- Good news for Egyptian debt: Other emerging markets have lowered interest rates — and more should follow. (Speed Round)

- Traders can expect stamp tax refunds when the House approves scrapping the recent increase. (Speed Round)

- Greece’s Energean makes bid for Edison’s oil and gas business. (Speed Round)

- ADNOC, OCI NV said to be in talks to merge Middle East fertilizers businesses. (Speed Round)

- Gov’t to sign monorail contracts by end of month? (Speed Round)

- 96% of Egyptians are concerned about online privacy, survey finds. (Worth Reading)

- Afcon kicks off this Friday — here’s everything you need to know. (Speed Round)

- The Market Yesterday

Sunday, 16 June 2019

Good news for Egyptian debt amid global scrambling on interest rates

TL;DR

What We’re Tracking Today

The nation has football on its collective mind this week as we head into Friday’s kickoff at the African Cup of Nations, hosted at stadiums across Egypt including Cairo, Alexandria, Suez and Ismailia. Egypt squares off against Zimbabwe in the opener on Friday. We have all you need to know in this morning’s Speed Round, below.

Just in time for Africa’s largest sporting event: We have three shiny new metro stations on line three: Haroun El Rashid, El Shams Club and Alf Maskan, Ahram Online reports.

It’s interest rate week in the US of A, with the US Federal Reserve widely seen as under pressure to get back on the easing train and cut rates when its Federal Open Markets Committee concludes its two-day meeting on Wednesday. Pundits see the Fed leaving rates on hold now, but signaling that a rate cut could take place in July. We take a deep dive into what this means for Egypt and emerging markets in this morning’s lead Speed Round piece, below.

The House general assembly is off this week, but will be back next week to debate the FY2019-20 budget.

Also this week:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada which kicks off on Wednesday;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs Tuesday through Friday;

- Middle East and Africa Rail Show will take place at the Egypt International Exhibition Center, Nasr City today;

- Seamless North Africa will be held at the Nile Ritz-Carlton tomorrow;

- Cairo Technology Week will run next week at the Hilton Heliopolis starting from tomorrow.

US expands probe into Abraaj: The US attorney’s office for the southern district of New York unveiled new charges on Thursday against three more former senior executives of Abraaj, the FT reports. The defunct private equity firm’s former CFO Ashish Dave, former VP responsible for day-to-day cash flow Rafique Lakhani, a former managing partner Waqar Siddique were added to the list of executives who have been charged with allegedly misappropriating USD 250 mn from its healthcare fund, including founder Arif Naqvi, who is under house arrest on GBP 15 mn bail.

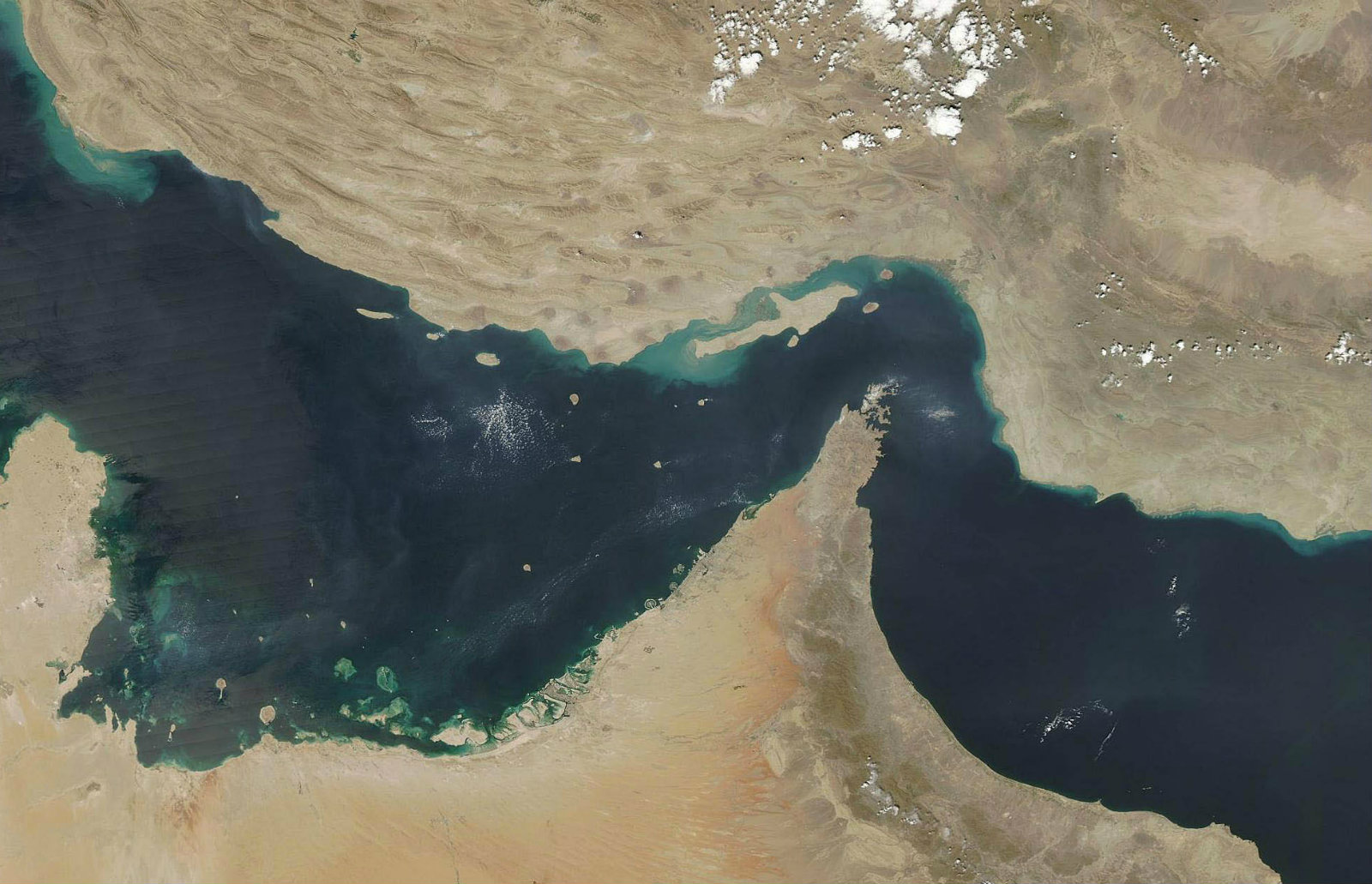

It’s looking more than a little tense in the GCC at the moment: Pundits are again speculating about the possibility of open conflict in the Gulf between the United States and Iran after two oil tankers were attacked in the Gulf of Oman on Thursday. The US and its Gulf allies immediately blamed Iran, producing a grainy video that they shey shows proof that Iranian forces had placed mines. The Japanese company operating one of the ships however disputed US claims, saying that its ship had instead been hit by a flying object. Iran has denied the accusations.

The attack drive oil prices up, MarketWatch reports, and western countries are now considering giving military protection to oil tankers navigating the Gulf in a callback to the “Tanker War” between Iran and Iraq in the 1980s.

In other international news you need to know about this morning:

- Putting lipstick on a… UBS has thrown its a top economist under the bus, putting him on leave after China freaked out over a bad translation of his remarks about pork prices. Bloomberg and the Financial Times have plenty of coverage.

- Stop us if you’ve heard this one before… Saudi Crown Prince Mohamed bin Salman reportedly sees the Aramco IPO going forward in 2020 or 2021. Oh, and the kingdom may be floating a trial balloon on legalizing booze.

- Hong Kong has suspended a controversial extradition bill after widespread protests roiled the city (and Asian markets) last week.

Our friends at CIB have released their 2018 sustainability report, chronicling an environmental, social and governance program that is generally held out as tops in the country. With an African theme to accompany Egypt’s leadership of the African Union in 2019 (and our hosting of the Afcon this week), CIB boss Hisham Ezz Al Arab uses his introduction to the report to drill into the concept of creating shared value. You can read the document here (pdf) and read the seminal Harvard Business Review piece (pdf) on creating shared valueby Michael Porter and Mark Kramer.

And in miscellany this morning:

- Just in time for Afcon: Uganda has disclosed a greater Ebola threat than was previously known, the New York Times reports, writing that the death toll has risen to two and that three others are hospitalized as the disease spread inward from Congo.

- Are you, like us, looking forward to getting lots of work done on your iPad Pro when iPadOS launches this fall? Federico Viticci is back with an overview, and it looks awesome. Read Initial thoughts on iPadOS: A new path forward.

Hey traders, it’s 2019 — no more drinking on the job, declares the Wall Street Journal as it looks at the London Metals Exchange’s decision to ban booze during the workday.

PSA- Call your Dad today. It’s Father’s Day in the US and Canada. And yes, we know: There really isn’t such a thing as Father’s Day here in Omm El Donia. In fact, plenty of countries don’t have Father’s Day. But with one of us here having recently lost his Dad, we tell you this: Call him today. Then go read Should I Call My Father?, a heart-wrenching opinion piece by Nana Asfour at the New York Times that will resonate with those of us who have aging parents.

I love you, Papa. Now and forever.

Enterprise+: Last Night’s Talk Shows

Rania Al Mashat is in Azerbaijan to participate in UN World Tourism Organization meetings which kick off today. The minister, whose attendance marks the first ministerial visit to Azerbaijan in years, will be a keynote speaker at a panel discussion headlined “Protecting Our Heritage: Social, Cultural and Environmental Sustainability.” Al Hayah Al Youm’s Lobna Assal dissects the visit (watch, runtime: 02:41).

Assal also highlighted (watch, runtime: 01:46) President Abdel Fattah El Sisi’s meeting with the Egyptian national football team yesterday during their preparations ahead of Afcon. The tournament will kick off this Friday, with a match between the Pharaohs and Zimbabwe.

Meanwhile, El Hekaya’s Amr Adib pointed to European economic reports that have praised the EuroAfrica electricity link between Egypt, Cyprus and Greece (watch, runtime: 05:48).

Speed Round

Speed Round is presented in association with

Good news for Egyptian debt: Other emerging markets have lowered interest rates — and more should follow. Russia, Chile and India have lowered their benchmark rates last week as emerging markets struggle with lower than expected growth and a turbulent macro climate. The hint from central bankers in other EMs is that they too will move to cut rates, Davidson Santana writes for Bloomberg in a piece that is surely good news for the continued competitiveness of Egyptian debt.

Who else is looking to make cuts? South Korea, Brazil and Turkey all seen as taking a move towards interest rate cuts in the short-term. In the medium-term, Santana expects Mexico and South Africa are likely to follow suit.

Which central bank isn’t likely to make rate cuts? Ours. Before the release last week of May inflation figures — which showed annual headline inflation rising unexpectedly to 14.1% from 13% in April — analysts we polled saw our central bank leaving interest rates on hold until nearer the end of the year. The May inflation figures and the inflationary impact of energy subsidy cuts due by July (to say nothing of turbulence in global markets) have analysts saying it is highly unlikely that the CBE’s Monetary Policy Committee will move to cut interest rates when it next meets on Thursday, 11 July.

That will likely make it another lost year for capex spending: With business paying credit-card levels of interest on facilities to fund new investment, don’t expect a rush to borrow anytime soon. Nine companies we spoke with last week tell us that rates should be in the 10-13% range (vs c. 20% on corporate borrowing now) before we can see sustained capex and consumer demand pick up. Most are waiting for rates to go down (and / or for factory utilization to pick up on the back of rising consumer demand) before they borrow.

EM analysts are looking to the Fed this Tuesday and Wednesday: As emerging markets look to stimulate their economies with rate cuts, their eyes will turn to the US Federal Open Market Committee, which will meet this Tuesday and Wednesday to review interest rates. The US Fed’s decision this week will have a critical impact on how carry traders see local EM currencies.

Which would mean what for the EGP? The carry trade has played a part in the appreciation seen by the EGP this year. A rate cut by the Fed could offset any strengthening of the USD against local currencies. This plays into projections by analysts we spoke with last week that see a gradual depreciation in the EGP towards the end of the year, depending on seasonal changes and inflows.

We’ll know more on inflows when the CBE releases the balance of payments report for 3Q2018-19, which we expect to later this month, especially as CAPMAS has already released trade figures for the quarter last week.

Traders can expect stamp tax refunds when the House approves scrapping the recent increase: The EGX and Misr for Central Clearing, Depository and Registry will refund investors who paid the newly increased stamp tax that came into effect this month when the House of Representatives approves a bill canceling the increase, Miar Clearing chairman Awni Abdel Aziz tells Al Shorouk. The stamp tax on stock market transactions was automatically increased to 0.175% on the 1 June from 0.15%, as per current legislation. The Finance Ministry had called off the stamp tax increase on EGX transactions last month in a move designed to ease the financial burden on traders and proposed amendments to keep the rate unchanged to the parliament. The Finance Ministry introduced the tax at 0.125% in 2017, and planned to increase it annually over a three-year period.

Now we just have to wait for the House: However, the House Planning and Budget Committee has postponed a decision on the proposed amendments saying it did not have enough information to make a decision and that it required more time to collect EGX data.

M&A WATCH- Greece’s Energean makes bid for Edison’s oil and gas business: Greek energy company Energean Oil & Gas has made an offer for oil and gas exploration and production assets held by Edison, including those in Egypt, Bloomberg reported, citing unidentified sources. Edison, an Italian arm of France’s EDF, is said to be selling the business as it seeks funds to finance its nuclear and renewable energy projects. EDF said it plans to sell as much as EUR 3 bn of assets by the end of next year to control debt.

Other bidders still in play? Neptune Energy, Warburg Pincus’s Apex International Energy and Wintershall Dea (an arm of Mikhail Fridman’s L1 Energy) had shown initial interest in Edison’s assets earlier. EDF was previously said to be seeking as much as USD 2 bn for the assets. We have background here and here.

M&A WATCH- ADNOC, OCI NV said to be in talks to merge Middle East fertilizers businesses: Abu Dhabi National Oil Company (ADNOC) is in talks with Nassef Sawiris’ OCI NV to explore the possibility of merging their Middle East fertilizers businesses, Bloomberg reports, citing unnamed sources. The assets include a plant in Egypt with capacity to produce about 1.65 mn metric tonnes of urea per year, a 60% stake in another Egyptian production complex that makes ammonia, and a fertilizer venture in Algeria. An agreement could be announced in the coming days, the sources told Bloomberg.

OCI confirms discussions: “OCI continually considers strategic initiatives regarding its portfolio, including possible partnerships,” OCI said in a statement. “In this context, OCI confirms that it is in discussions with ADNOC on a possible cooperation relating to each company’s MENA fertilizer assets. There can be no assurance that any transaction will ultimately take place.” OCI was in talks earlier to sell its methanol assets to Saudi Arabia’s SABIC, Bloomberg noted.

Gov’t to sign monorail contracts by end of month? The Transport Ministry is planning to sign this month the contracts awarding a consortium made up of Orascom Construction, Arab Contractors, and Bombardier Transportation to build the monorails linking 6 October City to Giza and Nasr City to the new administrative capital, according to a ministry statement. The contract’s parties are currently in the final negotiation stages, said the statements which follows a meeting between the Bombardier execs and the ministry. The meeting also discussed further cooperation in the sector with the company, including a potential agreement to upgrade 40 outdated locomotives.

Background: The consortium was tapped as the tender’s preferred bidder last month, after languishing without a winning bidder and contracts signed for four years. The USD 1.3 bn project would entail a 54-km-long monorail system connecting Nasr City with the new administrative capital, and a 42 km line that would connect 6 October to Giza.

Transportation Ministry raises ticket prices for Metro Line 3: The Transportation Ministry raised tickets prices for Metro Line 3 to a minimum of EGP 5 for trips of up to nine stations and to a maximum of EGP 10 for trips covering more than 16 stations, the ministry said in a statement. The hikes came into effect yesterday as the Sisi administration opened three new stations extending the reach of the Metro’s third line to El Shams Club.

Background: The Transport Ministry announced in May last year a new tariff scheme for the Cairo Metro that saw ticket prices more than triple in some instances and changed the pricing scheme to a tier system based on distance traveled instead of a standard fare. It’s a harbinger of things to come: Electricity prices will rise next month, and petrol prices are set to go up any day now, all as part of the administration’s IMF-backed economic reform program.

Gov’t looking at USD 65-70/bbl in fuel hedge contracts set to take effect in July: The finance and oil ministries have started renegotiating the USD 70/bbl price they had agreed on under fuel hedging contracts set to take effect next month, a government source told the local press. The government will be looking to lock the price of crude in at between USD 65-70/bbl in its contract with JP Morgan and Citibank.

Where are oil prices now? Crude has hovered below the USD 70 mark for the better part of the current fiscal year. Bloomberg’s Brent index averaged at USD 67.46 in the past 52 weeks, close to the USD 68 / bbl used in the government’s draft FY2019-2020 state budget (pdf).

Background: We noted earlier this year that the government was set to to hedge against volatility in the price of fuel, imported wheat and cooking oil, after OPEC production cuts caused prices to jump well above the budgeted estimates last year. The contracts take effect in FY2019-2020 to help ensure Egypt meets its budget deficit target.

Afcon kicks off this Friday: The biggest sporting event of the season (at least in this part of the world) is kicking off on Friday as the Pharaohs take on Zimbabwe in the opening match of the tournament at Cairo Stadium. Kick off time is at 10:00 PM CLT. The match is the first of Group A, which also includes the Democratic Republic of Congo and Uganda.

CAF’s official website has the full schedule of fixtures, list of teams, and group standings.

Are tickets still available? Word through the grapevine is that the EGP 150 third-class tickets are no longer available for Egypt’s matches, with Youm7 reporting that tickets to the opening game were sold out. Tickets for all matches appear to be available at online ticket-booking company Tazkarti.

Where can you watch the tournament? The National Media Council is launching a basic cable channel called Time Sports, which will broadcast the games without requiring a subscription package. Those who are looking to watch the channel in HD must purchase and install a “digital antenna,” which could run you from EGP 400-700, National Media Council member Shoukri Abu Emera told Ahmed Moussa (watch from 1:53:50, runtime: 2:14:30).

You can also subscribe to BeIN Sports Afcon 2019 package, which could cost you USD 20, or get the Afcon + Copa America 2019 package for USD 30. For those outside of the MENA region, Goal.com has a list of channels that are airing the tournament.

The Donald’s Mideast peace plan (you know, the one that allegedly has us giving up part of Sinai to the Palestinians) isn’t getting much traction. The White House’s effort to build support for the plan and the “Palestinian economic conference” due to kick it off next week in Bahrain isn’t going too well. Iraq and Lebanon are refusing to take part in the gathering, while Israel is yet to announce its attendance. Jordan, which had said last week that it would be attending, is reportedly still weighing its options. And Egypt and Morocco are coming under pressure from the Palestinians to boycott the event. The National has the rundown on who is and isn’t taking part.

UN chief Antonio Guterres also doesn’t approve, saying that there can be “no plan B” to the two-state solution.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Worth Reading

Internet security survey reveals Egypt’s online privacy and fake news fears: At least 96% of Egyptians are “concerned or somewhat concerned” about online privacy, according to a global internet survey published last week by the Centre for International Governance and Innovation (CIGI). Comprising interviews with 25,000 internet users in over two dozen countries, the study showed marked increase in distrust among internet users from a year ago, with 78% feeling concerned about their online privacy, and 53% stating that their concern had increased from a year ago.

We’ve probably seen fake news, and there’s a strong chance we believed it: 81% of the people surveyed in Egypt claim they have seen fake news and 60% say they initially believed it. While social media was regarded as the largest purveyor of fake news, 62% of Egyptians surveyed said they had also encountered it in mainstream media.

Egypt and other EMs would prefer their data to be stored overseas: 58% of Egyptians and majorities in Hong Kong, Indonesia, Brazil and Mexico wanted their data stored outside of their own countries, compared to only 23% in North America and 35% throughout Europe.

We are enthusiastic about cryptocurrencies: 56% of the Egyptians surveyed plan to use or purchase cryptocurrencies within the year, well above the global rate of 25%. Their long-term value as an investment is regarded as being much higher in EM than in developed markets.

And we are more knowledgeable than most about blockchain technology: While 22% of global citizens have some familiarity with blockchain, Egypt stands at 33% — behind China at 48% but above France and the UK at 15%.

Egypt in the News

It was a quiet weekend for Egypt in the foreign press: A Yemeni-American found himself on the sharp end of Cairo airport’s security team after he was detained for possessing a traditional Yemeni dagger, according to an AP report picked up by the NYT and the New York Post.

Other headlines worth a skim this morning:

- Anti-terror efforts get a bad review: Novelist Alaa Al Aswany argues that anti-terror laws have curtailed civil liberties in Egypt in The Washington Post.

- Pharaohs meets president: The Egyptian national football team met President Abdel Fattah El Sisi during their preparations for the upcoming African Cup of Nations tournament, The National reports. Ahram Online has the same story with lots of pics.

- Look on my works, ye Mighty: Fox News picks up on local press reports that archaeologists are uncovering new details about the behavior, traditions and customs of Egypt’s 19th Dynasty at a Ramses II-era fortress in Beheira.

On The Front Pages

El Sisi visits the Pharaohs ahead of Afcon: President Abdel Fattah El Sisi’s visit to the Pharaohs topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria). Afcon will kick off this coming Friday.

Diplomacy + Foreign Trade

Egypt, Tunisia, Algeria call for ceasefire in Libya: The Egyptian, Tunisian, and Algerian foreign ministers have called for an “unconditional ceasefire” in the Libyan conflict. News came following a meeting between Foreign Minister Sameh Shoukry and his Tunisian and Algerian counterparts held in Tunis on Wednesday. The three ministers have met several times before to discuss the situation in Libya and had put forward a political resolution in 2017. Ahram Online has the story in English.

Egypt has joined the Arab Charter on Human Rights, adopted at an Arab League summit in May 2004, Ahram Gate reports.

Energy

OPIC approves USD 87 mn for Lekela Egypt’s 250 MW power plant

The Overseas Private Investment Corporation (OPIC), the US government’s development finance institution, approved USD 87 mn in funding for Lekela Egypt’s 250 MW wind project in the Gulf of Suez last week, Saur Energy reports. It is expected that OPIC will provide over USD 250 mn in additional capital to finance the project.

Manufacturing

Court postpones challenge to increased duties on imported iron pellets

A court has postponed looking into a legal challenge filed by 22 factory owners against a decision to increase import duties on iron pellets to 15%, the local press reported. The Trade Ministry in April introduced 180-day import duties of 25% on finished steel rebar and 3-15% on iron pellets in a bid to protect local manufacturers. The World Trade Organization (WTO) had said last month it would meet with Egyptian officials to discuss the decision.

Health + Education

Govt to increase health insurance subsidies to EGP 252 mn in FY2019-2020

The government will increase subsidies for people unable to pay health insurance premiums to EGP 252 mn in the upcoming fiscal year, up from EGP 219 mn currently, Al Mal reports. The Universal Healthcare Act requires the government to pay the equivalent of 5% of the standard minimum wage to cover healthcare for each person who cannot afford to pay a premium.

Tourism

Azerbaijani national airlines to restore charter flights to Cairo, Sharm El Sheikh in July

Azerbaijan’s national carrier will resume charter flights between Baku and Cairo on 8 July and Sharm El Sheikh on 18 July, Al Mal reported. The decision came during Tourism Minister Rania El Mashat’s visit to the country for the UN World Tourism Organization’s governing council meeting.

Automotive + Transportation

Egypt’s all-female ride-hailing startup plans to come to Alexandria

Ride-hailing app Fyonka is planning to debut in Alexandria after having recently launched in Greater Cairo, co-founder Abdallah Hussein said. The ride-hailing startup has a staff of all-female drivers.

Banking + Finance

Orascom Development signs debt rescheduling agreement with Egyptian banks

Orascom Development Egypt (ODE) signed a CHF 228.1 mn (EGP 3.8 bn) debt rescheduling agreement with Egyptian banks that will see it pay CHF 38.9 mn (EGP 650 mn) by the end of June 2019, the company said in a statement. Lenders also agreed to reduce the interest rate margin on the foreign currency debt by 100 bps which will result in savings of CHF 4 mn (EGP 70 mn) in interest payments for 2019 and a total of CHF 19 mn (EGP 320 mn) over the six-year period ending in 2024. ODE has been exiting non-core assets to reduce debt liabilities.

On Your Way Out

Egypt’s Raneen El Welily and Karim Abdel Gawad were crowned champions of the 2018-19 CIB Professional Squash Association World Tour Finals, which ran from 9-14 June at Cairo’s Mall of Arabia. The tournament, held at Marakez’s Mall of Arabia, featured the world’s top eight male and female players, including women’s world no.1 El Welily and men’s world no.4 Ali Farag, who were crowned 2018-19 PSA Players of the Year before the tournament began.

The Market Yesterday

EGP / USD CBE market average: Buy 16.69 | Sell 16.79

EGP / USD at CIB: Buy 16.67 | Sell 16.77

EGP / USD at NBE: Buy 16.71 | Sell 16.81

EGX30 (Thursday): 14,181 (+0.2%)

Turnover: EGP 560 mn (28% below the 90-day average)

EGX 30 year-to-date: +8.8%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.2%. CIB, the index heaviest constituent ended up 0.01%. EGX30’s top performing constituents were SODIC up 5.0%, Arabia Investments Holding up 3.1%, and CIRA up 2.7%. Thursday’s worst performing stocks were Telecom Egypt down 1.9%, Juhayna down 1.7% and AMOC down 1.5%. The market turnover was EGP 560 mn, and foreigner investors were the sole net sellers.

Foreigners: Net short | EGP -46.8 mn

Regional: Net long | EGP +32.4 mn

Domestic: Net long | EGP +14.3 mn

Retail: 51.9% of total trades | 53.0% of buyers | 50.9% of sellers

Institutions: 48.1% of total trades | 47.0% of buyers | 49.1% of sellers

WTI: USD 52.51 (+0.44%)

Brent: USD 62.01 (+1.14%)

Natural Gas (Nymex, futures prices) USD 2.39 MMBtu, (+2.67%, Jul 2019 contract)

Gold: USD 1,344.50 / troy ounce (+0.06%)

TASI: 8,941.54 (-1.58%) (YTD: +14.24%)

ADX: 4,963.69 (-0.54%) (YTD: +0.99%)

DFM: 2,633.00 (-1.15%) (YTD: +4.08%)

KSE Premier Market: 6,390.70 (-1.0%)

QE: 10,515.88 (-1.00%) (YTD: +2.11%)

MSM: 3,918.49 (-1.10%) (YTD: -9.37%)

BB: 1,448.90 (-0.14%) (YTD: +8.35%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

Mid-June: A delegation of Egyptian businessmen will head to Estonia and Latvia to explore investment prospects in the two eastern European nations.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-21 June (Tuesday-Friday): President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

18 June (Tuesday): IDC CIO Summit, Marriott Hotel Zamalek, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, GrEEk Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.