What we’re tracking on 16 June 2019

The nation has football on its collective mind this week as we head into Friday’s kickoff at the African Cup of Nations, hosted at stadiums across Egypt including Cairo, Alexandria, Suez and Ismailia. Egypt squares off against Zimbabwe in the opener on Friday. We have all you need to know in this morning’s Speed Round, below.

Just in time for Africa’s largest sporting event: We have three shiny new metro stations on line three: Haroun El Rashid, El Shams Club and Alf Maskan, Ahram Online reports.

It’s interest rate week in the US of A, with the US Federal Reserve widely seen as under pressure to get back on the easing train and cut rates when its Federal Open Markets Committee concludes its two-day meeting on Wednesday. Pundits see the Fed leaving rates on hold now, but signaling that a rate cut could take place in July. We take a deep dive into what this means for Egypt and emerging markets in this morning’s lead Speed Round piece, below.

The House general assembly is off this week, but will be back next week to debate the FY2019-20 budget.

Also this week:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada which kicks off on Wednesday;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs Tuesday through Friday;

- Middle East and Africa Rail Show will take place at the Egypt International Exhibition Center, Nasr City today;

- Seamless North Africa will be held at the Nile Ritz-Carlton tomorrow;

- Cairo Technology Week will run next week at the Hilton Heliopolis starting from tomorrow.

US expands probe into Abraaj: The US attorney’s office for the southern district of New York unveiled new charges on Thursday against three more former senior executives of Abraaj, the FT reports. The defunct private equity firm’s former CFO Ashish Dave, former VP responsible for day-to-day cash flow Rafique Lakhani, a former managing partner Waqar Siddique were added to the list of executives who have been charged with allegedly misappropriating USD 250 mn from its healthcare fund, including founder Arif Naqvi, who is under house arrest on GBP 15 mn bail.

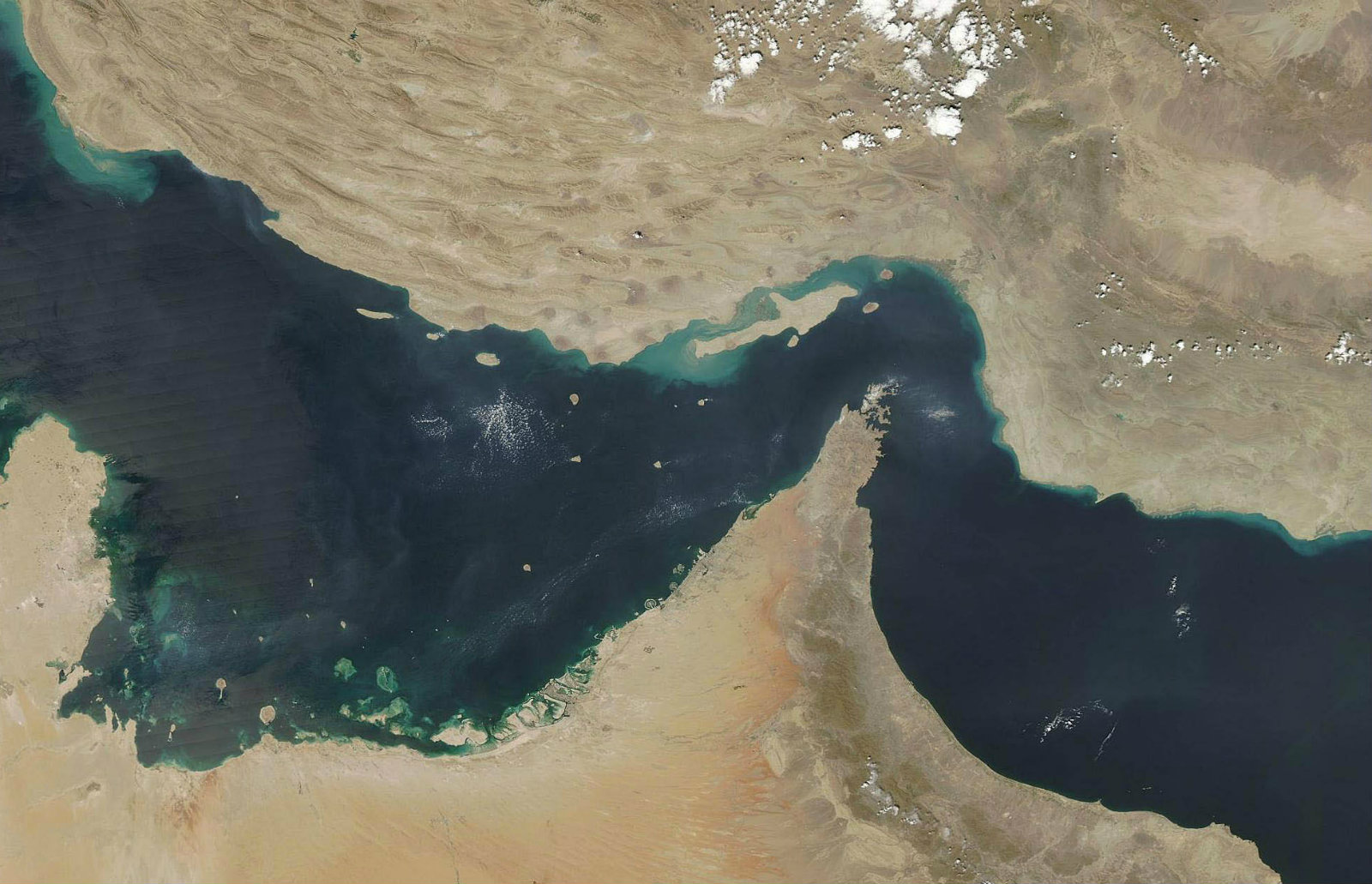

It’s looking more than a little tense in the GCC at the moment: Pundits are again speculating about the possibility of open conflict in the Gulf between the United States and Iran after two oil tankers were attacked in the Gulf of Oman on Thursday. The US and its Gulf allies immediately blamed Iran, producing a grainy video that they shey shows proof that Iranian forces had placed mines. The Japanese company operating one of the ships however disputed US claims, saying that its ship had instead been hit by a flying object. Iran has denied the accusations.

The attack drive oil prices up, MarketWatch reports, and western countries are now considering giving military protection to oil tankers navigating the Gulf in a callback to the “Tanker War” between Iran and Iraq in the 1980s.

In other international news you need to know about this morning:

- Putting lipstick on a… UBS has thrown its a top economist under the bus, putting him on leave after China freaked out over a bad translation of his remarks about pork prices. Bloomberg and the Financial Times have plenty of coverage.

- Stop us if you’ve heard this one before… Saudi Crown Prince Mohamed bin Salman reportedly sees the Aramco IPO going forward in 2020 or 2021. Oh, and the kingdom may be floating a trial balloon on legalizing booze.

- Hong Kong has suspended a controversial extradition bill after widespread protests roiled the city (and Asian markets) last week.

Our friends at CIB have released their 2018 sustainability report, chronicling an environmental, social and governance program that is generally held out as tops in the country. With an African theme to accompany Egypt’s leadership of the African Union in 2019 (and our hosting of the Afcon this week), CIB boss Hisham Ezz Al Arab uses his introduction to the report to drill into the concept of creating shared value. You can read the document here (pdf) and read the seminal Harvard Business Review piece (pdf) on creating shared valueby Michael Porter and Mark Kramer.

And in miscellany this morning:

- Just in time for Afcon: Uganda has disclosed a greater Ebola threat than was previously known, the New York Times reports, writing that the death toll has risen to two and that three others are hospitalized as the disease spread inward from Congo.

- Are you, like us, looking forward to getting lots of work done on your iPad Pro when iPadOS launches this fall? Federico Viticci is back with an overview, and it looks awesome. Read Initial thoughts on iPadOS: A new path forward.

Hey traders, it’s 2019 — no more drinking on the job, declares the Wall Street Journal as it looks at the London Metals Exchange’s decision to ban booze during the workday.

PSA- Call your Dad today. It’s Father’s Day in the US and Canada. And yes, we know: There really isn’t such a thing as Father’s Day here in Omm El Donia. In fact, plenty of countries don’t have Father’s Day. But with one of us here having recently lost his Dad, we tell you this: Call him today. Then go read Should I Call My Father?, a heart-wrenching opinion piece by Nana Asfour at the New York Times that will resonate with those of us who have aging parents.

I love you, Papa. Now and forever.