- FAB makes a play for EFG Hermes. (The Big Story Today)

- Regulators sound alarms over potential Russian cyberattacks against banks. (For Your Commute)

- The pandemic did not kill the cinema star. (Cinema)

- The EU really doesn’t want a repeat of covid-19. (For Your Commute)

- Start your Oscar nominees binge watching with beautifully-made CODA. (On the Tube Tonight)

- It’s a busy night in the football world. (Sports)

- The Girl With the Braided Hair: A tale of parallel love stories. (Under the Lamplight)

Wednesday, 9 February 2022

PM — Roaring ‘20s for cinema?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. It’s nearly the end of this workweek that has felt like an entire month on its own. Our almost-weekend reward: A healthy news cycle that’s keeping us on our toes.

FAB makes a play for EFG Hermes: The UAE’s First Abu Dhabi Bank (FAB) has presented a non-binding offer to buy a majority stake in Egypt’s largest investment bank, EFG Hermes, in a potential allcash acquisition, EFG said in a bourse disclosure (pdf). FAB is looking to acquire at least 51% of the leading financial services corporation in frontier emerging markets, preliminarily pricing EFG’s shares at EGP 19.00 apiece — marking a 21% premium on EFG’s closing price yesterday. FAB’s offer gives EFG a market value of around EGP 18.5 bn, the ADX-listed bank said in a regulatory disclosure (pdf).

EFG’s shares ended the day up 9.3%, closing at EGP 17.20. The investment bank’s shares had hit an intraday high of EGP 18.80 following the news of FAB’s acquisition offer.

^^We’ll have more on this story and others in tomorrow’s edition of EnterpriseAM.

HAPPENING NOW-

The House of Representatives is discussing amendments to the law governing non-residential rent in a plenary session. The bill would, if passed, allow landlords to eventually evict government agencies, public and private companies, embassies, clubs, associations and other entities leasing properties under the old rent system. The proposed amendments would do away with a system that currently protects non-residential renters from paying open-market rates on properties. The House Housing Committee had signed off on the bill last month.

The remaining amendments to the Real Estate Registry Act are also on the agenda for the House general assembly. Parliament had approved a portion of the proposed changes yesterday, including changes that place a 37-day time ceiling on the home registry process.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Please lend responsibly: The Financial Regulatory Authority set out responsible lending principles for non-bank SME financing products, offering guidance on how to act in borrowers’ best interests by making sure they are offered the most affordable and suitable options.

- WB sees growth underpinned by tourism rebound + gas exports: The World Bank expects a recovery in the tourism sector and rising gas exports will be the main drivers for its January prediction that our economy will grow 5.5% in FY2021-2022.

- Our first eco-friendly plastic alternatives factory? US environmental safety firm Okyanus Group and local infrastructure agent Income International unveiled a proposal to build a local plastics alternatives factory in a meeting with Prime Minister Moustafa Madbouly yesterday.

THE BIG STORY ABROAD- It’s a thoroughly mixed bag in the foreign press, which is (for once) not fixated on Ukraine tensions. The apparent shift towards living with covid-19 is getting ink on the front page of the New York Times and Reuters, which report on New York’s decision to drop mask mandates, while US medical chief Anthony Fauci tells the Financial Times that the worst of the pandemic is pretty much over in the US..

|

FOR TOMORROW-

Macro Group’s shares will begin trading on the EGX tomorrow under the ticker MCRO.CA at EGP 4.85 each. Macro raised EGP 1.3 bn in the IPO, which saw it sell 264.5 mn shares at EGP 4.85 apiece, valuing the company at around EGP 2.8 bn. The institutional offering — which was allocated 95% of the shares — was 1.8x oversubscribed, while the retail component saw stronger demand, closing on Monday 102x oversubscribed.

Inflation figures are due: The Central Bank of Egypt and state census bureau Capmas are set to release January inflation data tomorrow. Annual urban inflation rose to 5.9% in December from 5.6% in November. While analysts we spoke with expect prices to continue rising, they don’t see them going outside the central bank’s target range of 7% (±2%) by 4Q2022.

Keep an eye on the US, which will release its own CPI data just a few hours later. The data, which will be released at 3:30pm CLT (8:30am EET), is expected to show another jump in inflation figures last month, with the consumer price index expected to rise 7.3% in January after rising to a 40-year record 7% in December

???? CIRCLE YOUR CALENDAR-

German Foreign Minister Annalena Baerbock will be in town this Friday, 11 February for a two-day visit that will see her meet with Foreign Minister Sameh Shoukry and other officials for bilateral talks, the German Embassy in Cairo said in a statement. Baerbock is also expected to discuss potential collaboration between the two countries on the COP27 climate summit in Sharm El Sheikh this November.

Egypt will host the Arab League’s Arab Sustainable Development Week from Sunday, 13 February to Tuesday, 15 February. Held at Arab League headquarters in Tahrir Square and the Nile Ritz-Carlton, the forum will bring together ministers, senior officials, policymakers and private sector players from across the region to discuss ways to strengthen sustainable development. Arab League Secretary General Ahmed Aboul Gheit, Planning Minister Hala El Said, and IMF Executive Director Mahmoud Mohieldin are among those set to speak at the conference.

Catch an art exhibition for a good cause: The Sawiris Foundation for Social Development and AlexBank are organizing (pdf) the first art exhibition by marginalized children in partnership with Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery. The exhibition will showcase work from art workshops attended by 250 children from institutions such as Banati Foundation, Samusocial International, Association for the Protection of the Environment, Educate Me Foundation, the UNHCR, and Save the Children International. The opening of the exhibition is slated for 13 February before opening its doors to the public at Townhouse Gallery from 14-19 February.

⛅ TOMORROW’S WEATHER- We’re going to be winding down the week with weather similar to today’s, with a daytime high of 18°C and a nighttime low of 10°C. Tomorrow will be less sunny: Our favorite weather app tells us to expect a partly cloudy day.

???? FOR YOUR COMMUTE

Banks are bracing for possible Russian cyberattacks: The European Central Bank (ECB) has become the latest regulator warning banks of a possible cyber-attack from Russia as tensions continue to mount between Moscow and the west, Reuters reports, citing people it says have knowledge of the matter. The ECB, which oversees Europe’s biggest lenders, is questioning banks about their defenses in case of a cyberattack, mirroring a warning from the New York Department of Financial Services last month. European business leaders fear that a Russian invasion of Ukraine would have a ripple effect on financial markets across the region. Earlier this week, French President Emmanuel Macron shuttled between Moscow and Kiev in an effort to defuse tensions.

Can a universal vaccine protect against all covid strains? New research says it might, reports the Financial Times. Scientists are racing to develop a vaccine that could prove effective against all coronavirus strains, including SARS, MERS and covid, which, if the past 20 years are any indication, are likely here to stay. Some universal vaccines are targeting pieces of protein called epitopes in all coronaviruses or other structures on the sars group that don’t mutate to prompt an immune response, rather than targeting the spike protein, like current covid vaccines do. Scientists are also using computational predictive modeling to understand and predict how the structure of these viruses will respond.

Who is developing these vaccines? Variations of a universal vaccine are being developed by US military’s Walter Reed Army Institute of Research, Massachusetts’ VBI Vaccines and the Human Vaccine Institute at Duke University’s School of Medicine in the US and Cambridge University’s biotech spinout DIOSynVax in the UK. Although some research facilities have begun initial testing, it is unlikely that they will be rolled out anytime before 2023-2025, and they will likely require a booster every five to ten years.

Meanwhile, the EU is pushing for a global pandemic treaty that would ban wildlife markets and reward countries for reporting new viruses, an EU official tells Reuters. The talks, which will include international negotiators from six regions, among them Egypt representing the Middle East, will begin meetings this week with the aim of reaching a preliminary agreement by August of this year and signing a treaty in May 2024. Many major countries, including the US and Brazil, have requested that the treaty be non-binding. The EU has called for measures that include the gradual closure of wildlife markets and incentives for countries that report new viruses to avoid coverups. South Africa, among other southern African countries, was hit with severe travel restrictions after flagging the omicron variant last year. Incentives may include ensured access to medicines and vaccines as well as immediate support in the form of medical equipment for countries that detect and report new viruses.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Get started on binge-watching the Best Picture Oscar nominees with the beautifully-made CODA. Available on AppleTV, the comedy-drama film follows 17-year-old Ruby — a child of deaf adults (CODA) — as she navigates the coming-of-age challenges of choosing between her future and personal passion, and her obligations towards her family. As the only hearing person in her family, Ruby (played by Emilia Jones) is responsible for being her family’s interpreter and works on her family’s fishing boat. She joins her school’s choir club, where she discovers her “latent passion” for singing and is encouraged to pursue musical education. The film “offers few surprises, but strong representation and a terrific cast,” Rotten Tomatoes says.

⚽ It’s a busy night in the Premier League, where three separate matches kick off at 9:45pm: Manchester City v Brentford, Tottenham v Southampton, and Norwich City v. Crystal Palace. Aston Villa and Leeds United will also hit the field at 10pm.

The Egyptian Premier League also has a few matches today, with El Makassa going head to head against Enppi at 5:30pm, while El Gaish v El Gouna has an 8pm kickoff.

Chelsea and Saudi Arabia’s Al Hilal are battling it out at 6:30pm for a spot in the FIFA Club World Cup final match. The victor of tonight’s semi-final will meet Brazil’s Palmeiras, while the loser will be up against Al Ahly FC to determine the third and fourth spot finishers.

The Coppa Italia quarter-final match between Milan and Lazio kicks off at 10pm.

Over in the Coupe de France, Nice and Marseille will meet at 10:15pm in the championship’s quarter-final.

Last but not least, Spain’s Copa del Rey will see Rayo Vallecano and Real Betis meet in the semi-final at 10pm.

???? OUT AND ABOUT-

(all times CLT)

Gezira Art Center kicks off four art exhibitions today, including a retrospective exhibition of artwork by the late Elghoul Ahmed, Nagat Farouk’s When I Was Little, Legends from Beirut by Shayma Kamel, and Towards a New Primitivity by Emad Abuzeid. The exhibitions open at 7pm at the Zamalek center today and will wrap on Thursday, 24 February.

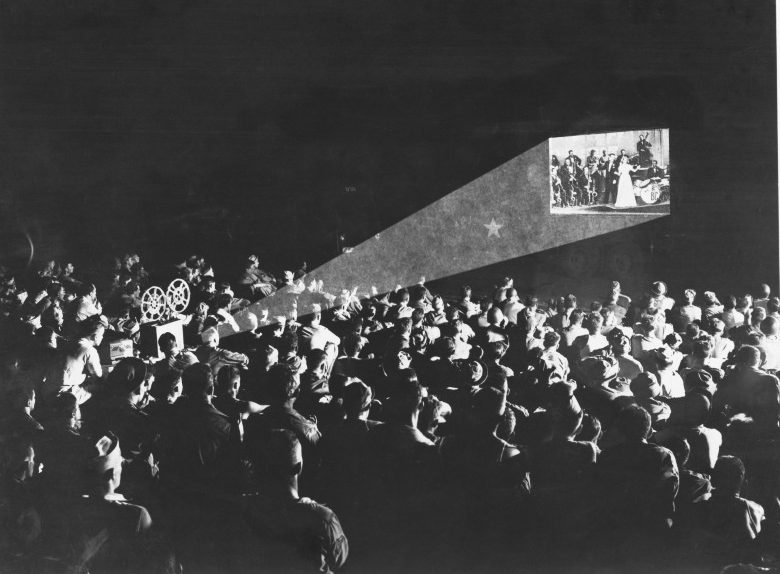

The Contemporary Image Collective in downtown is hosting Cairo University arts and culture professor Salma Mubarak for a talk about how Egyptian cinema transcended the country’s borders and played a political role as a form of soft diplomacy in the mid-1900s.

It’s shaaby night at Cairo Jazz Club 610 in Sheikh Zayed, with DJ Totti, 3enab, and Abo Sahar each set to take the stage from 7-10pm. Reservations are required.

???? UNDER THE LAMPLIGHT-

The Girl With the Braided Hair: A tale of parallel love stories in contemporary and Napoleonic era Egypt: Originally titled Shaghaf and penned in Arabic by Rasha Adly, the novel follows the lives of two women centuries apart. Yasmine, an art historian living in post-2011 Egypt, attempts to discover the identity of the subject of a painting from the French occupation. Her story becomes intertwined with that of Zeinab, who became the subject of a love triangle during the Napoleonic occupation. The novel’s translation by Sara Enany was awarded the Saif Ghobash Banipal Prize for Arabic Literary Translation.

???? GO WITH THE FLOW

The EGX30 rose 0.6% at today’s close on turnover of EGP 1.24 bn (14.8% above the 90-day average). Local investors were net buyers. The index is down 2.95% YTD.

In the green: EFG Hermes (+9.3%), GB Auto (+5.1%) and TMG Holding (+5.0%).

In the red: Fawry (-3.9%), MM Group (-2.8%) and Credit Agricole Egypt (-1.4%).

???? CINEMA

How cinema in Egypt is getting back on its feet: Against all odds and with omicron on the rise, Sony / Marvel Studios’ Spider-Man: No Way Home shattered box office records by scoring USD 587.2 mn globally in its opening weekend at the end of last year, making it the highest grossing film of 2021 and the third-highest opening of any film of all time. 12 days later, it raked in USD 1 bn globally, ensuring its spot with top earners Marvel’s Avengers: Endgame and Infinity War, the top two box office openers. This was following a year when the final installment of Daniel Craig’s James Bond: No Time to Die was postponed three times and blockbusters like The Batman, Black Widow and Eternals were pushed back to avoid bad box office runs.

The blockbuster opening only goes to confirm that going out is “in” again. Just as pandemic-induced lockdowns have increased our dependence on technology, they have also driven more people to attempt to reclaim the lost pandemic year, with some researchers (already) comparing post-pandemic life to the post-Spanish Influenza decade of the Roaring ‘20s. Cinema — the experience of watching a film with strangers in a dark room and sharing in the collective gasps, chuckles and annoyances — is certainly one of those experiences, although the current zeitgeist might not keep the ailing industry alive indefinitely.

And Egypt is no exception: Spidey made ripples in Egypt, achieving some EGP 57 mn (USD 3.6 mn) in box office sales. But so have Egyptian movies, as film buffs make their way back to theaters following almost two years of Netflix-and-chilling. Local films have been achieving good box office runs as well, with the past year seeing a renewed appetite for cinema-going in Egypt. This comes after a year when movie theaters racked up losses due to peak pandemic closures that saw them shutter their doors from March to June 2020 and then reopen with 25% caps to enforce social distancing. Cinema closures between March and May 2020 led to the loss of EGP 270 mn by the movie sector, according to figures published by The Egyptian Center for Economic Studies (ECES).

In Egypt, cinema revenues are split roughly 50/50 between Egyptian films and Hollywood, varying slightly from year to year, according to ECES, which charted ticket sales from 2015 to 2019. In 2019, cinemas generated EGP 1.2 bn in revenue, up from EGP 843 mn the previous year. However, the report attributes the leap to the increase in ticket costs, rather than an increase in ticket sales.

The local industry wasn’t exactly churning out dozens of films pre-pandemic. In 2019, 33 Egyptian films were made, raking in USD 72 mn (c. EGP 1.1 bn) — a modest number compared to say, 2k Bollywood films in 2018 and 660 Hollywood films in 2017). It is, however, still the highest in the Middle East, according to ECES. In 2020, that number plummeted to EGP 143 mn (USD 9.1 mn).

But it is getting some much-needed interest from investors. “We are at an intersection where we either build on the talent pool that we have or we become consumers of content that is created and controlled by other global and regional entities,” says Gamal Guemeih, Investment Manager at Ergo, Media Ventures, which entered into a definitive agreement with Film Clinic (Feathers, Netflix’s Paranormal and Perfect Strangers) in September of last year, giving Ergo a 49% stake in Film Clinic. “Today, the whole concept of content production is no longer just a cultural undertaking. Governments are looking at it as a driver of economic growth because it reflects on so many different aspects. It can be a source of employment, FDI, tourism, it helps in many different ways,” Guemeih tells Enterprise.

And we can see that from the effort being done with festivals: The Gouna Film Festival, (GFF), which has also jolted back to life the longstanding Cairo International Film Festival (CIFF), has brought pizazz back to the industry. GFF has served the dual role of building the organizational capabilities of event organizers and maintaining healthy competition with CIFF, with many Egyptian organizers working on last year’s Red Sea Film Festival in Jeddah.

There is a palate for Egyptian cinema in the Kingdom. As the “Hollywood of the Middle East,” Egypt exports cinema to other countries in the Arab world, making it dependent on cinema sales in the UAE, Lebanon, Tunisia, Morocco, Algeria and, recently, Saudi Arabia. The opening of Saudi Arabia’s movie theaters was lauded by film critics as good news for the Egyptian cinema industry given the kingdom’s preference for Egyptian films (mostly comedy). In fact, an Egyptian remake of American comedy Last Vegas — Wa2fet Regala which grossed EGP 25.8 mn in the domestic box office (USD 1.6 mn) and was later released on regional streaming platform Shahid — was the highest grossing film in Saudi Arabia in 2021.

Egypt needs to beware the sleeping Saudi giant: The Kingdom recently announced plans to invest USD 64 bn in its entertainment industry, positioning itself as a filming location for Hollywood blockbusters and signing an eight feature film agreement with Netflix to produce regional content. The launch of the Red Sea Film Festival in December of last year with 27 Saudi film screenings was a clear indication that it is looking to bring some glitz home as it invests in growing the local industry. Saudi Arabia has the potential to absorb as many as 2.6 k screens by 2030 and is expected to hit USD 180 mn in box office revenues by 2024, a report by PwC estimates.

…but Egypt has the potential to remain king: “Egypt still has an advantage because of its huge talent pool both on-screen and off-screen, and the rise of different platforms represents both an opportunity and a threat,” Guemeih tells us, adding that changing consumption habits are driving investment decisions in the industry.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

10 February (Thursday): Macro Group’s shares set to begin trading on the EGX.

11-12 February (Friday-Saturday): German Foreign Minister Annalena Baerbock will be in Cairo for a two-day visit.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

13-15 February (Sunday-Tuesday): Arab Sustainable Development Week. Arab League headquarters, Nile Ritz Carlton.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

14-19 February (Monday- Saturday): An art exhibition created by marginalized children will be held at Townhouse Gallery. The event is organized by the Sawiris Foundation for Social Development, AlexBank, Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourirsm Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff.

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

29 March (Tuesday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.