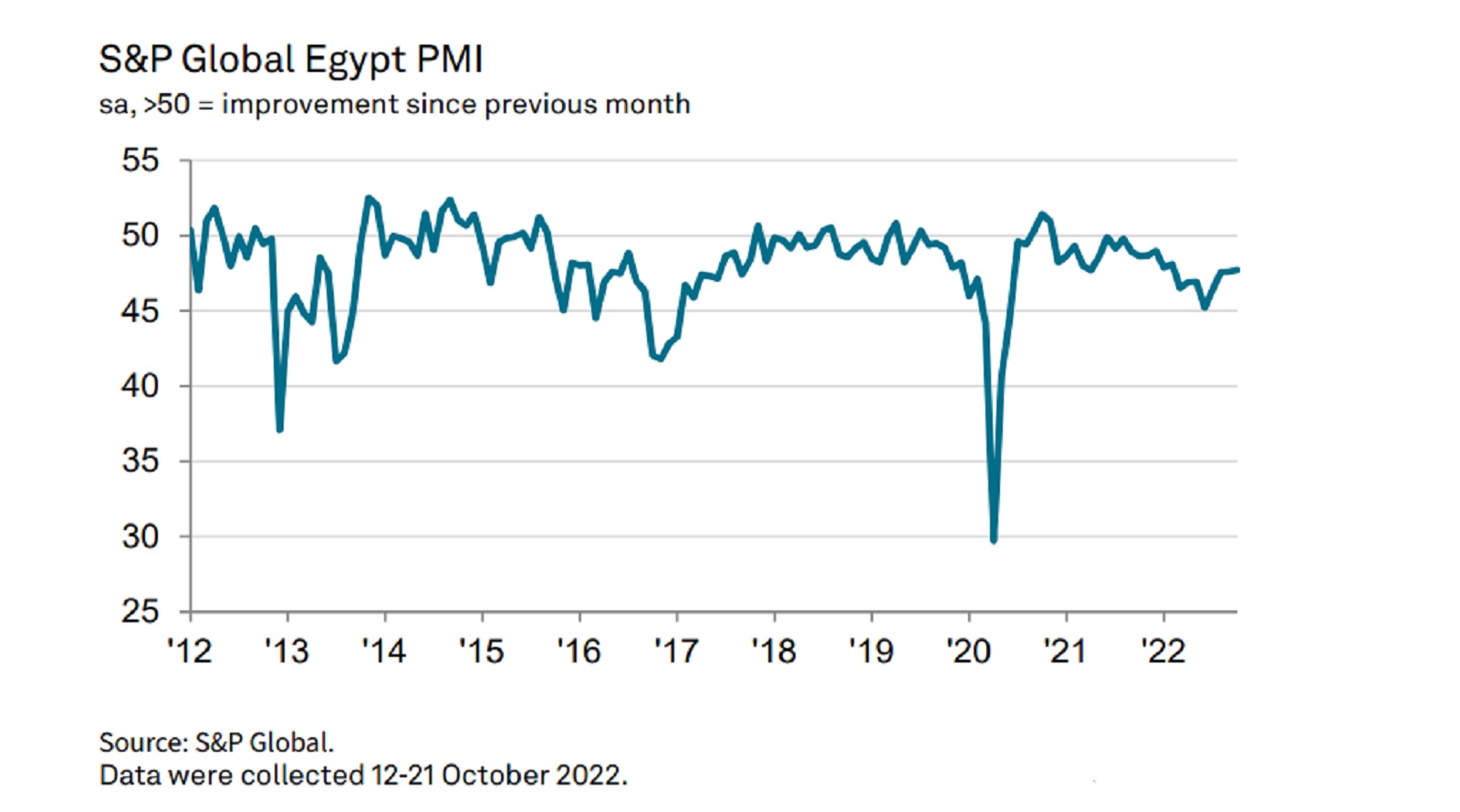

Private sector activity contracts for 23rd consecutive month

Activity in Egypt’s non-oil private sector continued to contract in October, remaining effectively unchanged from the month before as inflation, supply disruptions, and falling demand abroad continued to weigh on businesses, according to S&P Global’s purchasing managers’ index (pdf). The PMI index registered 47.7 last month, climbing just 0.1 points from September and remaining firmly below the 50.0 threshold that separates growth from contraction.

It has been a long time since we saw growth: This is the 23rd consecutive month that activity in the private sector has been in contraction.

October’s contraction was attributed primarily to inflation + supply issues: Inflationary pressures, fueled by import controls imposed by the Central Bank of Egypt earlier this year and a weakening EGP, “meant that a number of businesses again struggled to acquire relevant inputs.” The cost pressures eased somewhat last month, but “the rate of input cost inflation was still sharp and above the series trend.” These cost pressures led to lower output rates and weakening consumer demand, S&P Global notes.

Sentiment hits record low: Business optimism fell sharply to its lowest level since the series began more than a decade ago, with just 4% of those surveyed saying they are confident of growth over the next 12 months. That drop in confidence also led firms to make layoffs, according to the survey. That’s off the mark from our Fall 2022 Reader Survey, which showed almost half of respondents anticipating that 2023 will bring better conditions for the business community.

The release got coverage internationally: Reuters | Zawya | Arab News.

FROM THE REGION-

The UAE’s non-oil private sector saw “robust” growth in October, with the PMI (pdf) rising to 56.6 from 56.1 in September, which S&P Global notes is just shy of August’s three-year high of 56.7. A pickup in purchasing activity led firms to recruit at the fastest pace in more than six years, while reduced transport and fuel costs allowed businesses to lower their output prices.

Saudi Arabia’s non-oil private sector expanded at a quicker pace in October, with its PMI (pdf) recording 57.2 from 56.6 a month earlier. The growth came on the back of strong demand and output.