Up to 6 private companies in IPO talks with the EGX, says El Dokany

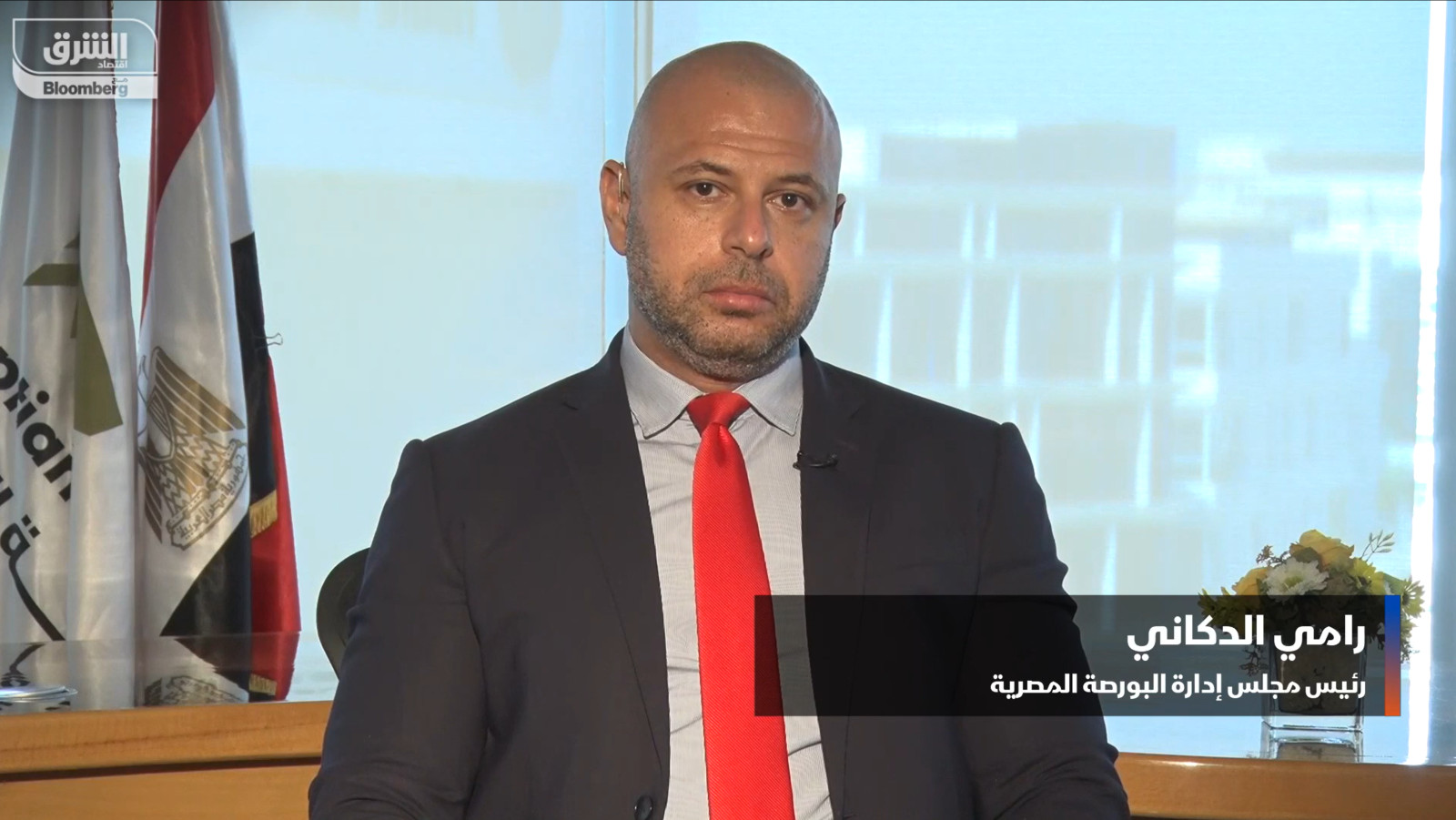

The EGX is in “serious talks” with five or six private sector companies to list on the bourse, new EGX boss Ramy El Dokany told Bloomberg Asharq. He said the negotiations are at an “advanced stage” and came on the back of the bourse’s moves to simplify listing procedures.

REMEMBER- Companies now have longer to meet the EGX’s listing requirements and are able to temporarily list shares before getting approval from the Financial Regulatory Authority under changes introduced last week to boost liquidity on the bourse.

What kind of companies can we expect? El Dokany said that petrochemical, energy, fuel, and fertilizer companies are best suited to IPO amid the current turmoil in the global economy.

Liquidity is key for foreign money: “To be able to attract foreign investments, we have to first bolster the confidence of the local investor and raise liquidity in the market … this will increase listing and IPOs in the bourse,” he said.

But so is a stable global economic environment: Trading volumes have been anemic for most of this year after foreign investors pulled back from Egypt and other emerging markets on the back of the war in Ukraine. The benchmark EGX30 index has fallen more than 18% this year, leading to the postponement of at least two IPOs and forcing the government to rethink its privatization plans, which at the beginning of the year envisaged as many as 10 state-owned companies selling shares on the bourse.

The bourse is turning to state-owned institutions: The EGX has held talks with a number of state-owned institutions about increasing their investments in listed-companies. Egypt Post, Misr Ins. Holding and other ins. companies have all been involved in meetings, which come as the bourse tries to find ways of boosting trading volumes.

The government is now trying to reboot its privatization program with the listing changes and a new pre-IPO fund set up by the Sovereign Fund of Egypt (SFE) earlier this month. The fund will offer stakes in state-owned companies to strategic investors and sovereign funds ahead of listing them on the bourse, and is expected to announce the first batch of companies within the next month.

SUEZ IPO COMING END OF 2022?

The Suez Canal Authority (SCA) will IPO the Canal Mooring & Lights Company on the EGX at the end of 2022, SCA Chairman Osama Rabie told CNBC Arabia yesterday. The authority plans to offer 10-15% of the company to investors, he said, without providing further details. Rabie said in August that the authority was planning to list three of its companies on the bourse before the end of the year.