Is this UN facility a silver bullet for African indebtedness?

Egypt could have access to a proposed UN facility that would boost liquidity in African sovereign bond markets through a special type of rich-help-poor model. The model for the so-called Liquidity and Sustainability Facility (LSF) put forward (pdf) by the UN and fixed-income asset manager Pimco in September proposes a new mechanism to provide short-term liquidity to developing countries in Africa that have come under severe fiscal and economic pressure because of the pandemic.

The goal? To make African sovereign bonds less risky for investors, to lower borrowing costs and to provide debt relief for poor and middle-income nations.

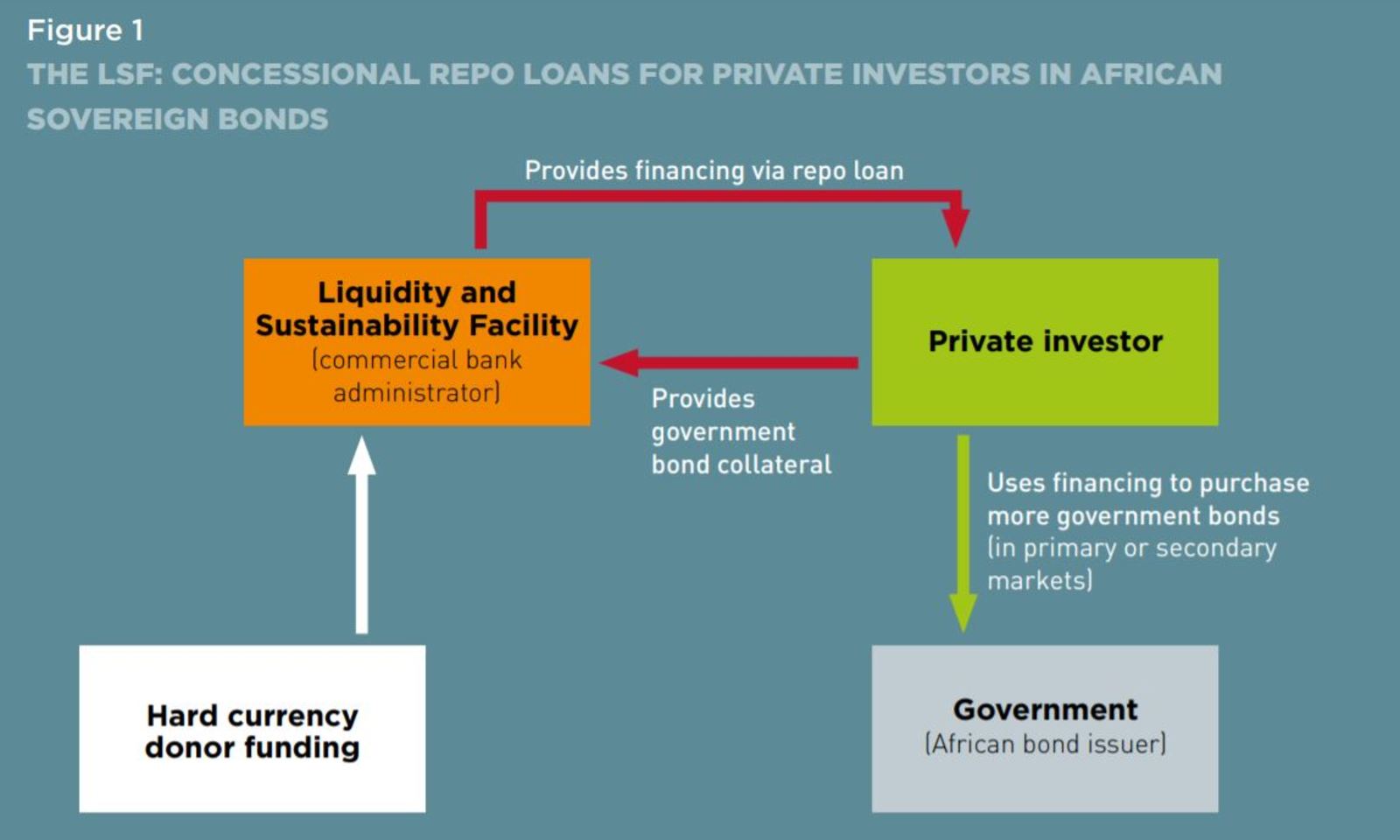

How would it work? Rather than convince bondholders to take losses on their investments, the LSF would subsidize their holdings via repurchase agreements (if you don’t know what these are, check out our explainer here). Investors would effectively borrow cash from the facility in exchange for their sovereign debt portfolio, incentivized by the interest rates and potential haircuts on short-term repo transactions, which are lower than in the private debt markets. This would, in theory at least, increase liquidity and demand for African sovereign debt and lower borrowing costs for distressed governments.

There’s a problem though — where to get the money: The obvious place to turn is the developed world. The UN and Pimco propose persuading central banks in OECD countries to lend out USD 50-100 bn to the facility, but given the damaging effects of the virus on their economies, the political will to sanction bns more in overseas lending is lacking.

Enter the IMF: A recent statement by US Treasury Secretary Janet Yellen backing more firepower for the IMF to lend poorer countries is a signal the Washington-based lender could have an alternative plan in mind. In particular, it could use SDRs — which are its way of giving member countries claims over the hard currency of other members — to fill in the gap and provide the needed lending capacity to the LSF. The IMF’s recent approval to issue USD 500 mn more SDRs already aims to help emerging-markets ease through the covid recovery.

Why this is crucial for Africa: The African Development Bank (AfDB) forecasts that average debt-to-GDP in African countries will grow 10-15% this year due to the fiscal shock of the pandemic. Debt relief efforts were made, including an initiative by G20 Debt Service Suspension Initiative to get rich country lenders to suspend repayments. Even then, already indebted African countries continued to tap debt markets as their financing needs grew. They were reluctant to ask for debt relief in fear of losing access to capital markets.

Sounds cool, right? Well, the idea doesn’t come without risks, neatly rounded up by the Financial Times:

#1 Will the facility be around in hard times? The LSF would use sovereign bonds as collateral as a way of boosting liquidity, meaning it will adopt margin calls, or ask for more securities from repo borrowers when bonds drop in value. As a result of better ratings in good times and worse ratings when conditions worsen, the LSF could create only “cyclical improvements in liquidity,” or access to it only when African borrowers need it least.

#2 Will it accept local bonds as collateral? If it doesn’t, sovereign borrowers could start disproportionately borrowing in foreign currencies, making them more vulnerable to foreign debt outflows, the report says.

#3 Can it undermine monetary policy? The LSF could undermine its efforts to raise liquidity in the markets should it increase haircuts on investors if and when the bonds it holds as collateral become riskier. This threatens to make it more difficult for African monetary policymakers to keep a lid on bond market volatility during stressful times.

Does Egypt really need it? Egypt isn’t on the list of EMs most vulnerable to a debt crisis. The government continued to be able to issue debt during the pandemic and was able to negotiate up to USD 8 bn in emergency funding from the IMF under favorable conditions. The country was also not on the list of nations eligible for G20 debt service relief. At the moment, our policy priority is to reduce short-term refinancing needs by issuing more long-term debt. Still, the potential existence of the LSF will give access to short-term financing that can be used to refinance longer-term obligations.

DIG DEEPER-