We’re happy when EMs score USD 53.5 bn in a month

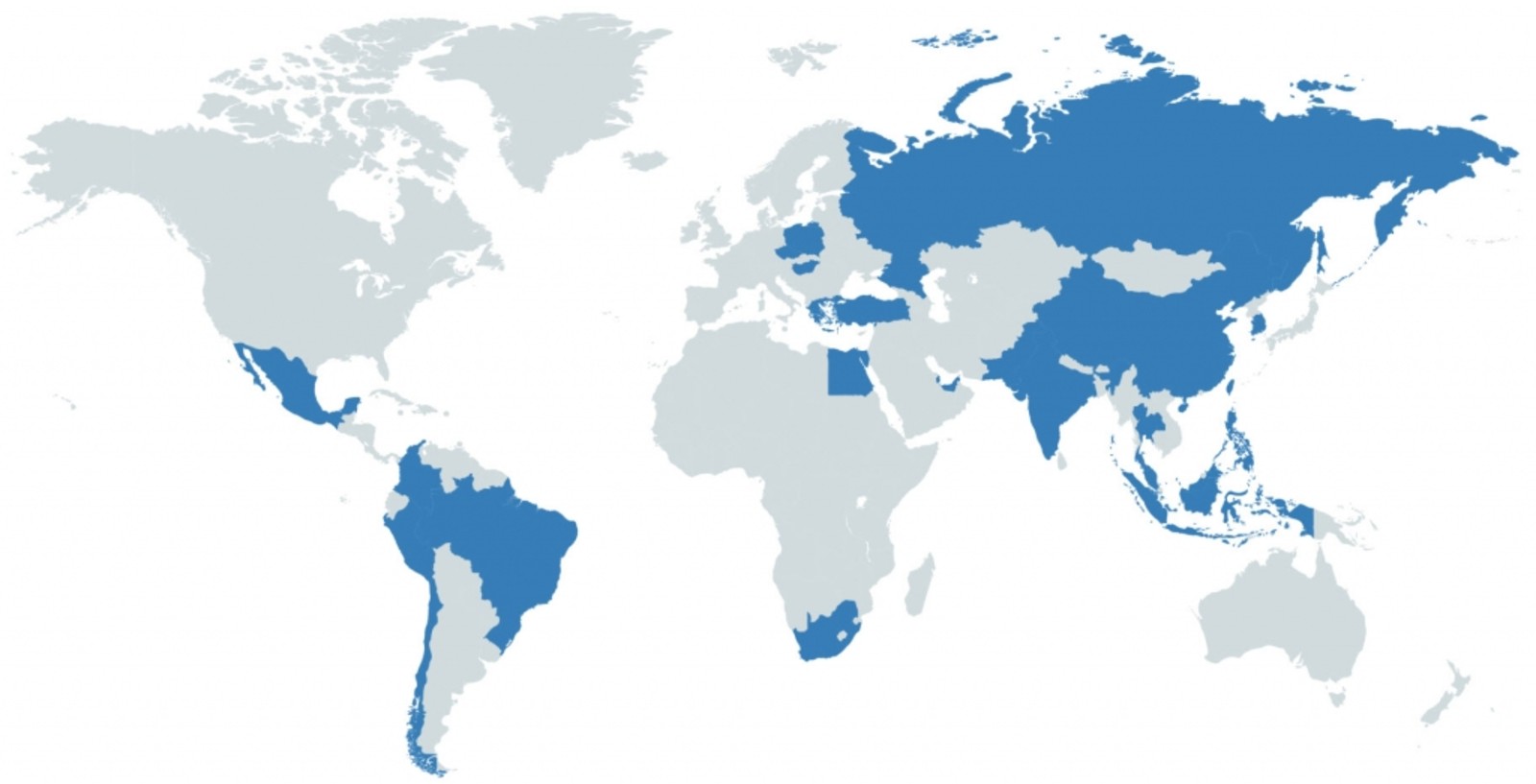

Emerging markets posted their tenth consecutive month of positive net portfolio inflows, a sign that EMs are in favor with global investors, according to the Institute of International Finance’s (IIF) monthly capital flows tracker picked up by Reuters. EM stocks and bonds attracted some USD 53.5 bn of net inflows in January, with USD 44.2 bn going towards debt instruments, and USD 9.4 bn going to EM equities.

China (which the IIF still thinks is an EM) was at the top of the leaderboard: The world’s second-largest economy brought in some USD 15.4 bn in debt inflows and USD 2.7 bn into equity, the IIF’s tracker showed. This came despite an “important outflow episode” from Asian stocks and bonds in the last week of January, highlighting “lingering weaknesses across EM in a post-covid-19 scenario.”

February could be a good month for EM equities, says Barron’s: EM equities saw net inflows of USD 5.7 bn in the first week of February, marking 19 out 20 weeks of “large inflows” in recent months, strategists at Bank of America said, according to Barron's (paywall). Investors prefered the EM stocks over those of the US, which witnessed USD 7.3 bn in net outflows (their largest in the past six weeks). While the S&P 500 was up just over 4% for the week, the iShares MSCI EMs exchange-trade fund gained more than 5%.

Looking ahead, the IIF is “relatively constructive” on its outlook for EMs. The global association expects inflows into the EM asset-class to continue generating momentum, citing heightened liquidity in markets and the vaccine rollout. EM equities will continue doing well, and a so-called “reinflation” in global trade will lead to more inflows coming their way, Citizens Bank head of global markets Tony Bedikian tells Barron’s.

Also, equity valuations across EMs are quite reasonable, Citi strategists said recently.

One thing to keep in mind, though: The performance of EM assets is a cyclical trend, rather a structural change we can expect to last long, says US-based portfolio manager Brandywine Global macro strategist Anujeet Sareen.

How are we doing in Egypt on the foreign inflows front? Foreign investment in EGP bonds has continued to rebound through the beginning of 2021 after a covid-inspired sell-off that swept emerging markets. Total holdings stood at USD 26 bn in mid-January, up from USD 23 bn at the end of November and is less than USD 2 bn shy of pre-pandemic levels. In terms of inflows into equities, the strong EM rally could spill over to Egypt, potentially reversing the 2020 trend that saw foreign institutional investors firmly positioned as net sellers every month on the EGX, Renaissance Capital’s head of MENA research Ahmed Hafez said in a note last month.