EGX slides after three days of gains

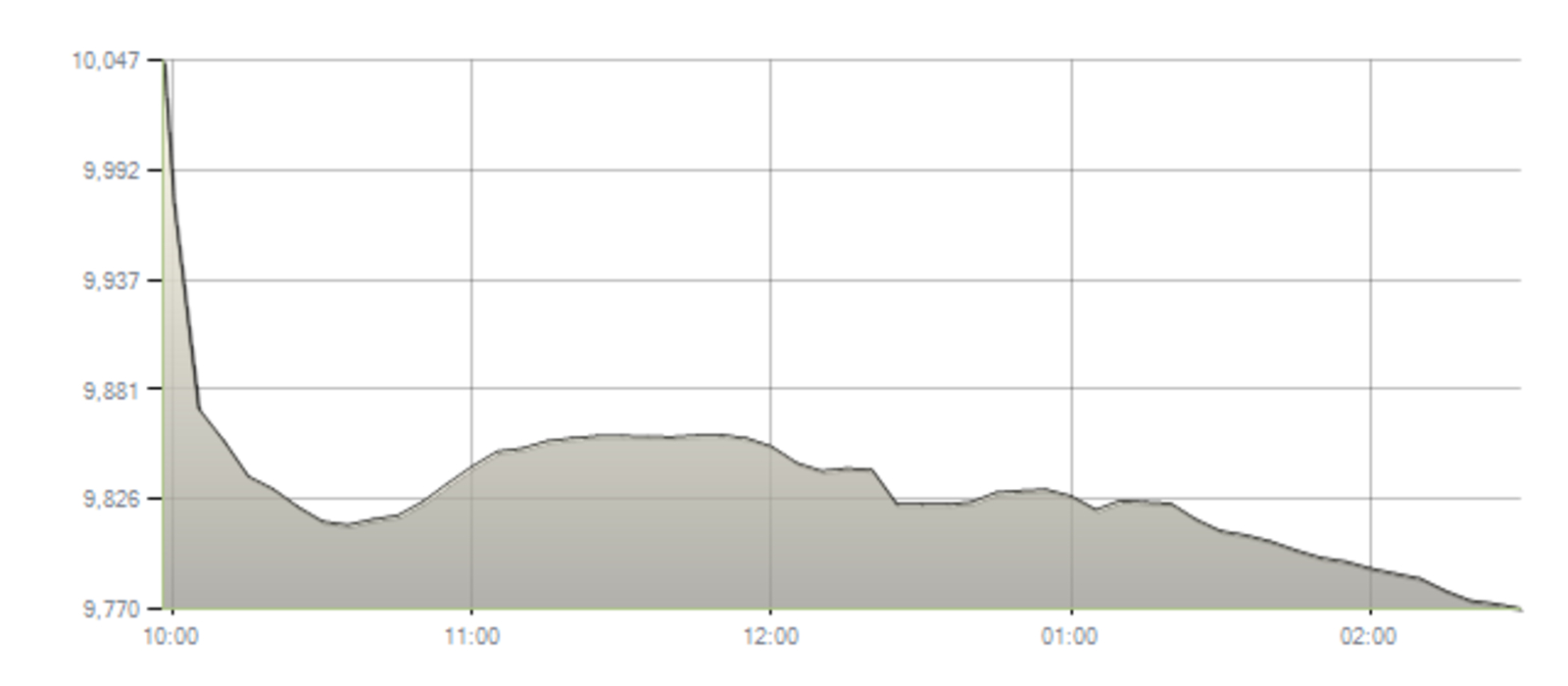

The EGX is back in the red again after three days of gains: The EGX30’s three-day bull run came to an end yesterday after investors exited shares on the government’s announcement of a partial curfew. The benchmark index finished 2.76% in the red having surged 14% during the three previous sessions. The market was down 2.23% by mid-day before stabilizing briefly, but eventually slid further during afternoon trading on news that a nighttime curfew would be going into immediate effect. The pressure was partially driven by index heavyweight CIB, which had shed 3.43% by the end of the day. Juhayna closed down 5.78% and GB Auto fell more than 5%.

Don’t forget that the CBE still has a EGP 20 bn bullet in its chamber — we just don’t know what the target is: Analysts are still largely uncertain about how the Central Bank of Egypt (CBE) will deploy the EGP 20 bn in EGX support announced earlier this week.

One potential scenario: New funds under the CBE’s purview: Prime Securities Managing Director Shawkat El Maraghy tells Al Mal the CBE could purchase equities through its newly established funds. Fund managers will likely do this over a medium- to long-term period, rather than all at once, he said.

The CBE could also go the traditional route and rely on the investment arms of state-owned banks like the National Bank of Egypt (NBE), the National Investment Bank, or NI Capital, HC Securities Managing Director Hassan Shoukry said. The National Investment Bank, in particular, is already deeply involved in the market and can easily raise its stakes in companies it is invested in or buy new shares from the market. NBE and Banque Misr already pumped EGP 3 bn into the market last week which has contributed to the recent recovery.