- A nation under curfew. (Speed Round)

- Covid-19 cases up to 402 after 36 new cases reported. (What We’re Tracking Today)

- Gov’t covid measures could threaten 30% of Egypt’s nominal GDP -RenCap. (Speed Round)

- CBE offers two-year soft loans under tourism support initiative. (Speed Round)

- EGX slides after three days of gains. (Speed Round)

- Sovereign Fund of Egypt to prepare low-risk ventures for investors post-covid. (Speed Round)

- Dow has best day since 1933 on Fed bond buying and bailout hopes. (Speed Round)

- How the construction sector is responding to the covid crisis: Osama Bishai, CEO of Orascom Construction. (Hardhat)

- The Market Yesterday

Wednesday, 25 March 2020

Egypt placed under curfew as gov’t ramps up response to covid-19

TL;DR

What We’re Tracking Today

The biggest news of the day: A daily curfew from 7pm-6am goes into effect this evening for at least two weeks. The Madbouly government has also extended both the closure of schools and universities and the suspension of international flights, and has shut all but a handful of government services. We have chapter and verse on everything you need to know in this morning’s Speed Round, below.

PSA- You’re going to hear a lot about social distancing measures being “worse than the disease” in the days ahead, including from The Donald, who wants the US open for business by Easter. And there may prove to be smarter ways to do it. But in the meantime, it’s the best the world can muster. Doubt it? Read this thread by Tom Inglesby of Johns Hopkins.

COVID 19 IN EGYPT-

The Health Ministry yesterday reported thirty-six new cases of covid-19, all but one of them Egyptian citizens, taking the overall total to 402. A woman from Alexandria, aged 54, became the latest victim of the outbreak, bringing the country’s death toll to 20. Twelve people — nine Egyptians and three foreigners — were discharged from hospital, meaning 80 people have now made full recoveries.

Cleopatra Hospitals and medical diagnostics outfit IDH have laid out how they’re handling covid-19, as has snackmaker Edita. Give them a read to see how they’re protecting patients and consumers from the virus that’s preoccupying us all — they’re both reassuring to read as consumers and models of what to do if you’re in a critical industry. Read (pdf): Cleopatra Hospitals | IDH (which owns diagnostics chains Al Borg and Al Mokhtabar) | Edita.

“Okay, so my company needs to put out a covid-19 statement, right?” No, as we suggested recently in a note to friends and clients, unless you’re in a critical or regulated industry.

The other obvious exception: If you’re closing shop for the duration or otherwise have an, uhm, adverse outcome to report. Just make sure you aim your communication directly at your core audience, whether that’s investors or consumers, for example.

The German-Arab Chamber of Industry and Commerce did this when it told us that it has closed for an indefinite period due to ongoing events. The chamber’s staff members are accessible via email.

Air freight costs have more than doubled since the suspension of air traffic at Egypt’s airports, an industry official is quoted as saying by the local press reports. Both Emirates and EgyptAir have had to hike prices.

Farmers receive debt relief: The Central Bank of Egypt has agreed to postpone loan repayments for farmers and breeders for six months, the Agriculture Minister El Sayed El Qusair said yesterday. This after the central bank last week extended the tenor of all bank loans by six months to provide relief to businesses.

Afreximbank has announced a USD 3 bn package to assist member countries, including Egypt, manage the economic and health impacts of the covid-19 outbreak, Al Mal reports. It will support member states and other financial institutions in meeting their commercial loan obligations, as well as support foreign exchange reserves in the states’ central banks.

FOOD FOR THOUGHT- What the global pandemic means for Egypt’s informal economy: A side effect of the covid-19 pandemic is that it may push the government to reconsider its view of informal labor — be it seasonal labor, self-employed workers, or household enterprises that depend on daily transactions, Amr Adly writes for Bloomberg Opinion. Some 30% of labor in Egypt is informal, making it a major obstacle in imposing curfews or self-isolation given the lack of communication channels. It’s also a chance for the government to improve its regulation of the informal economy — and give incentives to the informal economy to go legit to capitalize on formal safety nets. The draft SMEs Act, which is currently making its way through the House of Representatives, will introduce tax and non-tax incentives to encourage informal businesses to join the formal economy.

ON THE GLOBAL FRONT-

G7 officials pledge to do whatever it takes to save the global economy: G7 finance minister and central bank governors yesterday vowed to ramp up emergency fiscal and monetary stimulus measures as long as the global economy is threatened by the covid-19 pandemic. “We will do whatever is necessary to restore confidence and economic growth and to protect jobs, businesses, and the resilience of the financial system. We also pledge to promote global trade and investment to underpin prosperity,” the group said in a statement.

Is the US the next epicenter of corona? The World Health Organization suggested yesterday that the US could become the next epicenter as the country sees a “very large acceleration” of cases, Reuters reports.

India has imposed a nationwide lockdown for 21 days to prevent the spread of covid-19, reports Reuters. It has reported 482 cases and 10 deaths so far, but the world’s second most populous country could see over a mn cases by May, health researchers warn.

The UAE is unblocking apps that use voice over IP, including Microsoft Teams, Skype for Business, Google Hangout, Zoom, and Blackboard to help employees work remotely, according to Bloomberg.

The 2020 Summer Olympics have been postponed until 2021, the International Olympic Committee confirmed, according to the Associated Press.

US presidential hopeful Joe Biden’s campaign is struggling to capture attention and funds amid the covid-19 crisis, pushing what would normally be a presidential campaign in full gear to relative obscurity, Reuters reports. Heightened restrictions and the economic fallout of the covid-19 outbreak are challenging the campaign’s fundraising effort and large public events are effectively off limits, meaning no campaign events. Meanwhile, big ticket donors are more focused on corona-related support — simply staying afloat.

Oh, and the rest of the world is getting a taste of Egyptian internet as Microsoft, Zoom, Google and other work-from-home tool providers struggle to keep up with demand — and as Youtube moves the whole world today to standard definition (480p) video by default. Google says the Youtube downshift will last a month. Regulators in Europe had already asked Netflix and Amazon Prime Video to do the same, Bloomberg notes. Use the time to watch Metallica in concert as the band releases a concert a week for the world to watch without charge.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: Our exclusive sitdown with Osama Bishai, CEO of Orascom Construction, the first in a two-part series on how the construction industry is managing the covid-19 crisis. Bishai spoke with us on the state of the sector during covid today, what can we expect on the long term, and what lessons or positive outcomes we can draw in a post-covid-19 world. Part two next week features a sit-down with Hassan Allam Holding co-CEOs Amr and Hassan Allam.

Enterprise+: Last Night’s Talk Shows

The government’s decision to introduce a nighttime curfew got top billing on the talk shows last night: Al Hayah Al Youm's Lobna Assal (watch, runtime: 3:00) and Masaa DMC’s Ramy Radwan (watch, runtime: 5:14) both covered Prime Minister Moustafa Madbouly's decision to impose a curfew from 7PM to 6AM. The move is the latest in a string of increasingly far-reaching decisions taken to halt the spread of the virus, which at the moment shows no sign of slowing down. Cabinet spokesman Nader Saad told Min Masr's Amr Khalil that people found to be violating the curfew will either be fined EGP 4k or imprisoned, and repeat offenders will receive both punishments (watch, runtime: 9:33). We have full coverage of the announcement in this morning’s Speed Round, below.

Targeted support for the private sector: The government will assist the private sector through sector-specific measures rather than a broader economic rescue program, Manpower Minister Mohamed Saafan told Al Hayah Al Youm’s Lobna Assal. He said assessments on support will be made based on the severity of impact on each sector. He called on irregular workers to record their information on the ministry’s website so that they can collect their exceptional EGP 500 stipend, adding that some 130k workers have registered so far and are being authenticated.

He said that he’s seen a marked difference in the private sector over the past week, with companies taking the pandemic more seriously and reducing capacity and shifts. He added that safety inspectors have been instructed to ensure that private companies are abiding by the state's precautionary measures (watch, runtime: 6:40).

Schools could be turned into hospitals if cases top 1k: The government may be forced to convert some schools into hospitals if the number of cases rises above 1k, Information Minister Osama Heikal told Yahduth Fi Misr’s Sherif Amer. He also implied that ministers wouldn’t move to impose a full curfew, suggesting that preventing people from buying their necessities would not be a logical policy choice (watch, runtime: 10:55).

The daily covid-19 update: Another person died and 36 new confirmed cases were discovered yesterday, taking the country’s covid-19 case total to 402 and the overall death toll to 20, the Health Ministry said in its daily statement yesterday. Twelve people made full recoveries and were discharged from hospital, and the number of cases to turn from positive to negative — indicating that they are on the road to recovery — reached 100. Masaa DMC’s Ramy Radwan (watch, runtime: 2:13) and Min Masr’s Reham Ibrahim (watch, runtime: 16:26:) covered the statement.

Speed Round

Speed Round is presented in association with

Egypt officially imposes 11-hour curfew, extends for two weeks the flight ban and suspension of schools and universities: A strict 7pm to 6am curfew goes into effect this evening for a period of two weeks, Prime Minister Moustafa Madbouly said at a press conference yesterday (watch, runtime: 20:31). Citizens will not be permitted to leave their homes during curfew hours and all forms of public and private mass transportation are prohibited. This includes taxis, rideshare services such as Uber and Careem, and tuk-tuks. While it will not be explicitly banned, Madbouly called on citizens to limit as much as possible traveling between governorates for the coming period.

Schools and universities will remain closed for an additional 15 days, after the initial two-week closure period announced earlier this month elapses. That means that, instead of resuming classes on 29 March, these institutions will now be closed until 13 April.

The suspension of all inbound and outbound international flights will be extended for an additional two weeks. Flights were suspended from last Thursday until the end of the month. The suspension will now be extended until mid-April. Cargo flights are still permitted.

Just about all public-facing government services will be suspended for the entirety of the two weeks. This includes civil registry offices, real estate registry offices, as well as the issuance of all official documents including (but not limited to) car and drivers licenses, passports, national ID cards, work permits, and construction permits. The only exception to this rule will be Health Ministry-affiliated services to allow for the registry of new births and deaths during this period.

What if your driver’s license / work permit / whatever is set to expire? Quite sensibly, the Interior Ministry will extend the validity of all licenses and official documents that are set to expire during the two-week period.

How is the curfew going to impact business? Read on:

Shops and retail stores, including malls, will be closed between 5pm and 6am on weekdays. They will be required to remain closed all day Friday and Saturday.

Cafes, bars, casinos, and nightclubs will be shut down completely for the two-week period. All gyms and sporting clubs are also to close.

Restaurants and other food services will only be allowed to run delivery service from 6am-7pm, but can’t open for table service.

Who’s exempt? Supermarkets, grocers, bakeries, and pharmacies (except for those inside malls).

Hospitals and all medical facilities will likewise be exempt from the curfew and will remain open around the clock. Journalists and media professionals will also be allowed to move freely during the curfew, Information Minister Osama Heikal said, according to the local press.

Petrol stations look like they’ll be allowed to continue operating during curfew to receive deliveries as tankers delivering petroleum products are exempt from the ban on movement.

Banks are moving to shorter hours starting today, the Central Bank of Egyp (CBE) said in a statement (pdf). Employee working hours will run between 9am and 2pm, and banks will open their doors to customers from 9:30am until 1:30pm. The FRA says the same work hours are in effect now for the insurance industry.

The EGX is also shortening the trading day to run from 10am until 1:30 pm, according to a statement (pdf). Price discovery will begin at 9:30am.

The government will also extend for 15 days its previous decision to cut down on the number of civil servants and employees at public sector companies and institutions. This extension will be applied as of 1 April, when the initial decision was set to expire.

The Customs Authority will operate from 8am-4:30pm, prioritizing the release of food, medical supplies and other strategic products, and running two shifts at airports.

Sporting clubs and facilities, youth centers, and gyms will be completely closed for the next two weeks. The Football Association will suspend matches and all other activities until 14 April.

Food manufacturers are allowed to continue operating at full capacity despite the curfew in order to make sure the demand for food commodities is met, said Ashraf El Gazayerly, chairman of the Federation of Egyptian Industries' food industries division, according to Youm7.

What happens if you break curfew? You’re goin’ to jail and will be slapped with an EGP 4k fine. At least if you’re a repeat offender. Cabinet spokesman Nader Saad said last night (watch, runtime: 9:33) that repeat offenders will face both fines and jails, while first-time offenders could get off with a fine alone.

You’re still allowed to leave the house for emergency medical treatment but need to head straight to a treatment facility.

The story is leading coverage of Egypt in the foreign press: Reuters | Associated Press | Bloomberg | AFP | The National | Gulf News

Gov’t covid-19 measures could threaten 30% of Egypt’s nominal GDP -RenCap: Around one third of private consumption in Egypt “could be hit hard” by the government’s measures to curb the spread of the covid-19 virus in the country, including the partial curfew, suspension of air travel, and closure of restaurants to in-house customers, Renaissance Capital said in a research note yesterday. Private consumption accounts for around 80% of Egypt’s nominal GDP, and non-food retailers are already hurting from these measures which has slowed down customer traffic, RenCap says. The investment bank points to travel receipts and Suez Canal revenues — which together account for 5% of nominal GDP — as also being vulnerable to a slowdown.

REGULATION WATCH- CBE extends its support to the tourism sector with two-year soft loans: The Central Bank of Egypt (CBE) will provide soft loans to tourism companies to pay wages, commitments to suppliers, and maintenance as part of the EGP 50 bn tourism initiative it launched last year, according to an official statement (pdf). Hotels, tour operators, restaurants, and tourism transport companies will be able to access loans with a tenor of two years and a six-month grace period at an interest rate of 8%.

Background: The CBE last year increased funding to support the tourism sector to EGP 50 bn, allowing more companies in the sector to access soft loans to renovate and upgrade tourism infrastructure then reduced the interest rate on this initiative along with two others earlier this month following its emergency 300 bps rate cut to help struggling businesses cope with the repercussions of the covid-19 outbreak.

In related news: The Hotels chamber is in negotiations with the Manpower Ministry to access the emergency fund to pay six months’ of salaries to hotel staff from April. A senior official in the sector said that some 500k employees are entitled to receive support from the fund but that there was disagreement with the ministry about whether it should cover the salaries of around 200k seasonal workers. The labor emergency fund was set up in 2002 to provide assistance to workers in businesses that have closed.

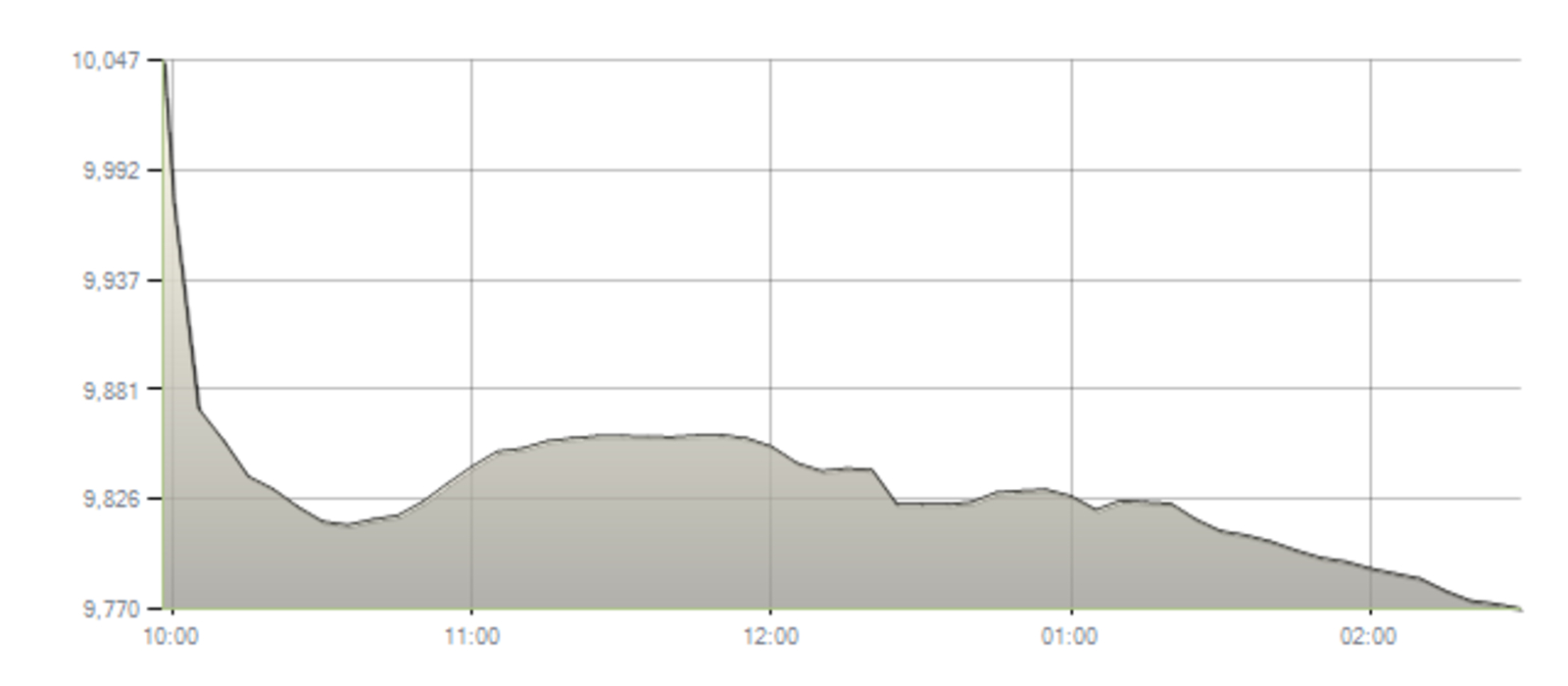

The EGX is back in the red again after three days of gains: The EGX30’s three-day bull run came to an end yesterday after investors exited shares on the government’s announcement of a partial curfew. The benchmark index finished 2.76% in the red having surged 14% during the three previous sessions. The market was down 2.23% by mid-day before stabilizing briefly, but eventually slid further during afternoon trading on news that a nighttime curfew would be going into immediate effect. The pressure was partially driven by index heavyweight CIB, which had shed 3.43% by the end of the day. Juhayna closed down 5.78% and GB Auto fell more than 5%.

Don’t forget that the CBE still has a EGP 20 bn bullet in its chamber — we just don’t know what the target is: Analysts are still largely uncertain about how the Central Bank of Egypt (CBE) will deploy the EGP 20 bn in EGX support announced earlier this week.

One potential scenario: New funds under the CBE’s purview: Prime Securities Managing Director Shawkat El Maraghy tells Al Mal the CBE could purchase equities through its newly established funds. Fund managers will likely do this over a medium- to long-term period, rather than all at once, he said.

The CBE could also go the traditional route and rely on the investment arms of state-owned banks like the National Bank of Egypt (NBE), the National Investment Bank, or NI Capital, HC Securities Managing Director Hassan Shoukry said. The National Investment Bank, in particular, is already deeply involved in the market and can easily raise its stakes in companies it is invested in or buy new shares from the market. NBE and Banque Misr already pumped EGP 3 bn into the market last week which has contributed to the recent recovery.

Dow has best day since 1933 as US, European markets soar on Fed bond buying and prospect of massive US bailout: Global stock markets soared yesterday as investors shrugged off dire economic data and regained confidence on a mammoth stimulus package from the Federal Reserve and hopes that US lawmakers would soon agree a USD 2 tn economic rescue plan. We have more on yesterday’s data releases in this morning’s Macro Picture, below.

US stocks collectively saw their biggest single-day gains since October 2008: The S&P 500 was up 9.38% at the closing bell yesterday while the Dow Jones surged at a rate not seen since 1933, finishing the day 11.37% in the green.

European stocks also posted big gains: Most of the region’s indices were at least 7% up at the close of play, with Germany’s DAX surging 11.5%, the Euro Stoxx 50 up 10% and the FTSE 100 gaining 9.35%.

So how does today look? Asian markets are soaring as we trudge toward dispatch time this morning, but futures now point to slightly lower opens for the Dow, S&P and Nasdaq, while Europe looks mixed.

One JPMorgan strategist is calling the return to a bull market already: Top JPMorgan strategist Marko Kolanovic has predicted that the US economy will rebound in a “number of weeks” causing stocks to surge 40% and return to record highs by the beginning of 2021, CNBC says. We want some of whatever Marko had with his breakfast / ingested before talking to CNBC. Make it a double.

Gains in the oil market were more muted: A rally Brent and WTI prices faltered in late trading after posting strong gains early in the session as the slump in demand continued to spook investors. Both crude benchmarks were up more than 5% before falling back, with WTI up 2.8% at USD 24.01/bbl and Brent 0.4% higher at USD 27.14/bbl. Reuters has more.

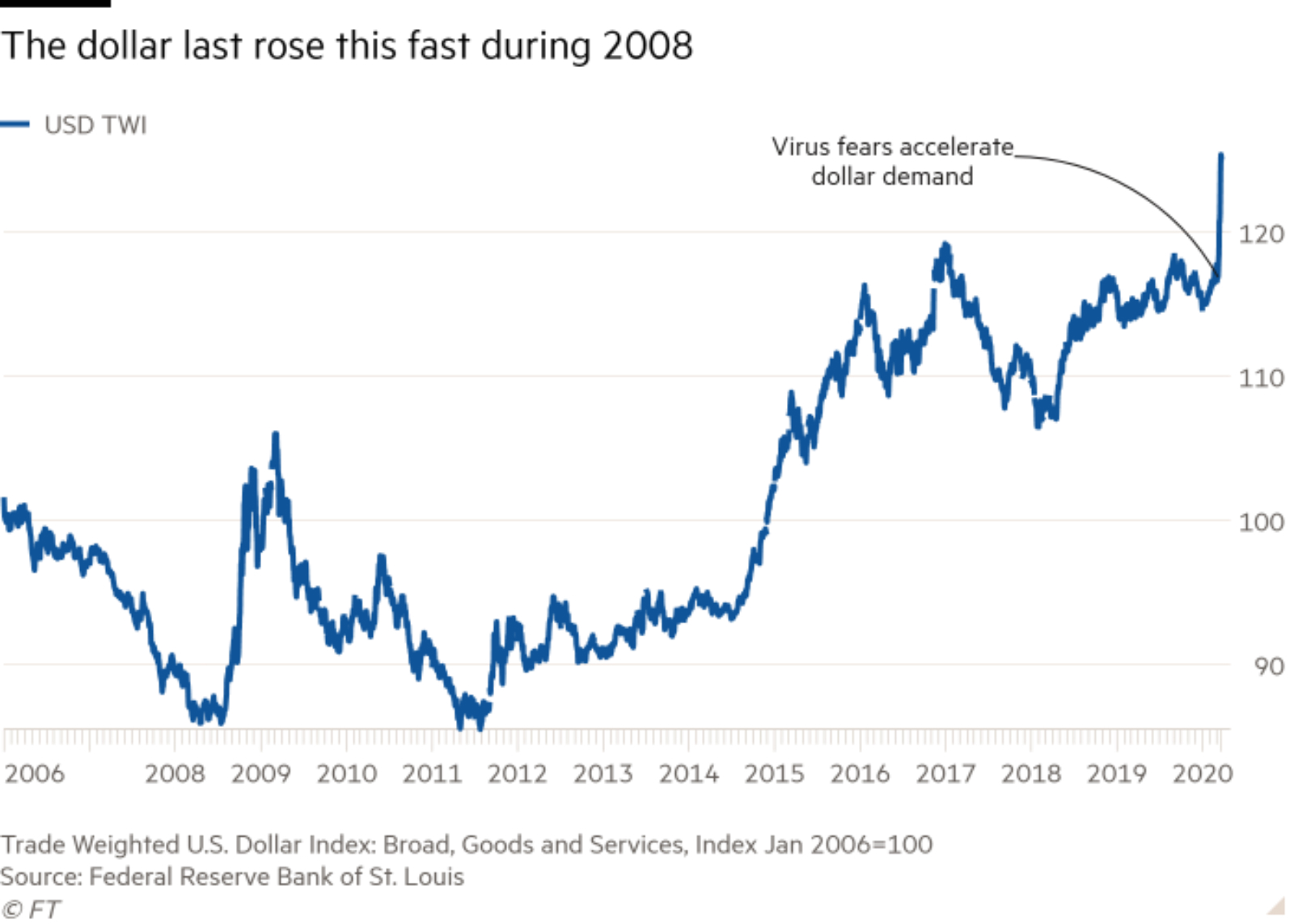

Pressure on the USD is easing after Fed’s ‘QE unlimited’: The massive shot of liquidity announced by the Federal Reserve two days ago seems, for the moment at least, to be doing the trick. A buying frenzy by fearful investors and businesses caused the greenback to surge almost 9% in 11 days, threatening to drain liquidity and freeze the funding markets. But the Fed’s pledge to buy unlimited amounts of government and mortgage-backed securities brought an end to the rally yesterday, which saw at one point the USD index fall back to its lowest point since 19 March, Reuters reports.

Goldman predicts direct intervention if the rally continues: “Should USD appreciation continue, we would see a reasonably strong case for targeted intervention, and think there is a rising probability that authorities will take this step,” Zach Pandl, currency analyst at Goldman Sachs, wrote in a note on Monday, according to the FT. “If swap lines and [bond purchases] prove insufficient, we think Fed and Treasury should and will consider traditional FX intervention to stabilise the USD.”

But the Fed hasn’t halted the corporate bond sell-off: Yields on corporate bonds are continuing to climb despite the Fed announcing that it would for the first time in history start buying investment-grade corporate debt, the FT reports. Corporate bond ETFs and derivatives have responded well to the measures but the prices of cash bonds have continued to fall — a trend that is now being caused more by poor trading conditions than fears over the economy, investors have said.

The Sovereign Fund of Egypt (SFE) is preparing a list of potential low-risk investments to present to investors after the covid-19 outbreak has been contained to restore confidence in the Egyptian economy, SFE CEO Ayman Soliman tells Al Mal. The negative impact of the pandemic on the economy will push investors towards low-risk ventures, Soliman said, without signaling what these potential investments could include.

Background: The SFE had offered to investors a 70% stake in the three Siemens-built combined-cycle power plants, and had said it expects to complete the acquisition of the first of the three plants this year. The fund will acquire the remaining 30%. The SFE also signed early last month an agreement with the military’s National Service Products Organization to market some of its subsidiaries to private investors.

DEBT WATCH- Market regulator expected to approve TMG’s planned EGP 2 bn corporate sukuk issuance this week: The Financial Regulatory Authority (FRA) is expected to approve this week Talaat Moustafa Group’s (TMG) planned EGP 2 bn corporate sukuk issuance, the head of the FRA’s central administration for finance department tells Hapi Journal. TMG announced plans earlier this year to launch a three-year EGP 4.5-5 bn sukuk program in April to finance the company’s real estate leasing projects. EFG Hermes is reportedly on board to lead the initial EGP 1 bn issuance after securing an FRA license.

EARNINGS WATCH- Dice profits grew 2.7% in 2019: Dice net profits rose to EGP 81.4 mn in 2019, up 2.7% from EGP 79.3 mn in 2018, the company said in a regulatory filing (pdf). Revenues increased 3.2% to EGP 1.35 bn, up from EGP 1.31 bn the previous year. Dice is looking to invest EGP 150 mn in the coming year, including its EGP 120 mn acquisition of Cairo Cotton which was agreed last month.

MOVES- CI Capital has appointed Tarek Tantawy (Linkedin) as co-CEO alongside Hazem Badran as of yesterday, according to a bourse filing (pdf). Tantawy will retain his position as managing director of the company, which he has held since 2017. Tantawy was CFO of IDJ-Beyti and CEO of Telecom Egypt prior to joining CI Capital in 2015.

Egypt in the News

The government’s decision to introduce a nightly curfew to slow the spread of covid-19 is dominating the conversation in the foreign press this morning: We have the full story in this morning’s Speed Round, above.

How the Egyptian construction sector is responding to the covid-19 crisis: Osama Bishai, CEO of Orascom Construction (PART 1 in a two-part series). Earlier this month our look at how infrastructure projects were faring in the early days of covid-19 had industry players tell us that projects have so far been largely unaffected. Fast forward three weeks and we’re looking at a very different world: Many businesses have instituted work-from-home policies, the government and the central bank have announced a raft of fiscal and monetary stimulus measures, flights have been grounded, and from today we will all be confined to our homes at night.

We spoke with two of the largest players in game to see how the industry is grappling with it all: Orascom Construction (our friends and associates on Hardhat) and Hassan Allam Holding. For part one this week, we spoke with Osama Bishai, CEO of Orascom Construction (OC) — part two, with Hassan and Amr Allam, runs next week.

Edited excerpts from our discussion with Osama:

The industry is looking at a slowdown as it imposes safeguards: Safety measures necessitated that OC temporarily slow work on some projects or suspend work on non-priority projects. These measures will be put in place for the next few weeks, after which we will assess the situation as new details emerge. Construction sites are potential hot zones for the spread of the disease, so these measures must be taken. I anticipate a substantial slowdown industry-wide as a result of these measures as all major contractors will have to adopt them. This is not altogether a bad thing as fighting this pandemic needs to be a coordinated effort.

We won’t know the real impact for another 6-12 weeks: It’s still too early to gauge how long this situation will last or what the full impact of it will be. I think we will get a clearer idea of the gravity of the crisis within 6-12 weeks. For now, the situation is very fluid, with circumstances changing every day. That said, I am an optimist. The world will survive.

The industry outlook for 2020: If the crisis continues, I anticipate that the industry slowdown will continue throughout 2020 as more valuable time of the infrastructure development cycle is lost. That will undoubtedly impact delivery on projects and deadlines. If the government or clients decide to accelerate the pace of work after the crisis, OC is ready to do it.

The industry is faces several risks at the moment. These range from rising unemployment and the likelihood of businesses going bust to the dynamics of global supply chains undergoing fundamental changes.

Smaller real estate projects and foreign companies are among the most vulnerable: Smaller scale building and real estate developments will likely be hit harder by the crisis than others. The slowdown is likely to be particularly acute for companies based out of the hardest hit countries. I can see delays down the road for projects that are Chinese-funded, as the likelihood of the disbursement of funds will slow down. I think the supply chain of the entire European Union (and not any one country in particular) will face increasing disruptions as factories shut down to slow the pace of infection. There’s also the human element, as foreign workers will need to go home to be with their families during these trying times.

Renewable energy offers hope: One way in which we see Egypt bucking a global trend is renewable energy. While globally, the oil price war between Saudi Arabia and Russia is expected to slow the development of renewable energy, this assessment isn’t really valid here. Egypt is slightly different because it has a solid pipeline of projects. Moving forward, I think Egypt’s gas needs to be used to create value-added products that can be then exported, while we rely more on renewables as our primary source of energy. That, coupled with improvements in technology that have lowered prices, renewables could end up being cheaper than fossil fuels, even at the rates they are today.

Through careful cash flow management, OC can weather the storm: We’re not too worried about the slowdown as we have a strong pipeline of projects. With our recent backlog, we are comfortable. Our focus now is maintaining our positive cashflow, because cash is key when weathering a crisis in our industry. We’re doing this by making our operations as efficient as possible while managing costs and avoiding unnecessary expenses, including avoiding renting or buying equipment we don’t absolutely need. This is being achieved by concentrating on essential operations and prioritizing essential projects. On the issue of unemployment, we have always retained our key people and talent during times of crises, and we do not expect to act differently this time.

OC has been working with its most vulnerable clients: In tandem with instituting safety measures for our workers, OC has made it a priority to communicate constantly with our clients and stakeholders. Not only to keep them informed, but to reach out to them in the event the covid-19 crisis has hit them hard. We don’t see an impact when it comes to projects that are funded through grants. But for clients that have been impacted, we’ve been working with them on their payment cycles. In general, there is a collaborative spirit all around and we don’t see contract disputes being a mainstay. On the contractor-side, I think force majeure can come into play in such unforeseen circumstances and on the client-side the industry has been very accommodating, with issues over payments being settled at the executive level. This type of collaboration is needed to help us all get by.

Gov’t stimulus has been supportive to clients: We’re also pleased with how the government has been reacting, as lower interest rates, increased liquidity and cuts to energy prices have helped our clients if not the construction industry directly. This goes to show how important government stimulus is in times of crisis.

The government must work with the construction sector to support employment: Because construction makes up a significant portion of the labor market, it is crucial that the government and construction industry players work together on initiatives that will help the sector and the economy as a whole.

There needs to be policies that prevent the industry from resorting to layoffs. These include deferring payment obligations on social insurance — which should help keep cash flow stable — and ensuring that arrears owed to contractors by the state be paid off as soon as possible. Accelerating payments to contractors will also help them meet their obligations to suppliers, some of whom are SMEs.

From crisis comes potential benefits: Moving forward, we need to take the lessons learned from the crisis and use it to our advantage. One prominent example would be to position Egypt as a key node in the global supply chain for construction materials and services. The crisis has impacted the supply chains from China to Europe. This will lead to a repositioning of distribution centers globally, and Egypt is in a great position to benefit from that.

Carving out a bigger place for the private sector: The government also needs to work more with the private sector on infrastructure. In the coming years we cannot continue without having the private sector investing alongside the government. Policymakers need to start thinking openly about how to do that while the crisis is going on, so that the private sector is primed for an upswing on infrastructure development when it eventually subsides.

A chance for dialogue and cooperation: The crisis could be a chance for the government and the industry to work on some of the wider issues that have been impacting construction, particularly when it comes to small and medium-sized operators. We feel that while some action has been taken on that front, there is still more to be done to make sure they can succeed and grow.

We also feel that the government can greatly benefit from our experience in crisis management, including on things such as converting civilian facilities to hospitals, and logistics and supply. We have experience and we can help.

And if there is one key takeaway I want it to be this: Dialogue and cooperation is what will help us get through it as an industry and as a country. We need to work together to address some of the issues we’ve experienced today while putting a plan in place for the post-corona world. If we do more of that, you can count on me to remain an optimist throughout the crisis and beyond.

Your top 5 infrastructure stories of the week:

- Gas prices: The government lowered the price of natural gas for industry to USD 4.50 / mmBtu. The new price will be reflected in bills for this month’s consumption.

- Metro work suspended: Arab Contractors temporarily suspended its work on phase 4B of Cairo Metro Line 3 for one week to deep clean workspaces for the project. Work is set to resume on Sunday, 29 March.

- World Banking funding: The World Bank is providing an additional USD 500 mn in funding for a program to develop low-income housing in Egypt.

- Desalination plants: Acwa Power said it will power its desalination plants in Egypt via solar power.

- Alexandria tram tender awarded: The National Tunnel Authority awarded the EGP 410 mn tender to design and restore the Raml tram in Alexandria to a consortium of French and Egyptian companies.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Tuesday): 9,770 (-2.8%)

Turnover: EGP 962 mn (59% above the 90-day average)

EGX 30 year-to-date: -30.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 2.8%. CIB, the index’s heaviest constituent, ended down 3.4%. EGX30’s top performing constituents were Egyptian Resorts up 6.0%, Ibnsina Pharma up 5.0%, and AMOC up 1.7%. Yesterday’s worst performing stocks were Juhayna down 5.8%, GB Auto down 5.0% and Egyptian Kuwait Holding down 5.0%. The market turnover was EGP 962 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -209.1 mn

Regional: Net short | EGP -13.2 mn

Domestic: Net long | EGP +222.3 mn

Retail: 43.8% of total trades | 45.3% of buyers | 42.3% of sellers

Institutions: 56.2% of total trades | 54.7% of buyers | 57.7% of sellers

WTI: USD 24.44 (+1.79%)

Brent: USD 27.15 (+0.44%)

Natural Gas (Nymex, futures prices) USD 1.68 MMBtu, (+1.51%, April 2020 contract)

Gold: USD 1,691 / troy ounce (+1.72%)

TASI: 6,193 (+3.4%) (YTD: -26.17%)

ADX: 3,651 (+6.08%) (YTD: -28.06%)

DFM: 1,713 (-0.08%) (YTD: -38.04%)

KSE Premier Market: 5,200 (+5.11%)

QE: 8,276 (+0.22%) (YTD: -20.61%)

MSM: 3,553 (-0.38%) (YTD: -10.73%)

BB: 1,360 (-2.09%) (YTD: -15.52%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist-sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

31 March (Tuesday): Houses of worship expected to be reopened to the public.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action,” new administrative capital, Egypt.

12 April (Sunday): House of Representatives covid-19 recess ends.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

13 April (Monday): Schools and universities expected to resume classes after covid-19 closure.

15 April (Wednesday): International flight suspension in Egypt expected to be lifted.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.