What we’re tracking on 19 August 2019

The central bank’s Monetary Policy Committee (MPC) is set to meet this Thursday, 22 August to review key interest rates. Our poll on Sunday showed three-quarters of economists predicting that the central bank will cut rates for the first time since February.

Another case for a rate cut: Beltone’s Alia Mamdouh, who was absent from our Sunday poll, expects inflation to remain within the CBE’s target of 9% (+/-3%) for the remainder of the year, giving the MPC room for a 100 bps cut on Thursday. “We believe no further fuel price hikes will take place when prices are reviewed in September due to a strengthening EGP and falling global crude prices,” Mamdouh said, adding that the US Federal Reserve’s recent cut will also give the CBE more room to ease rates. She also downplayed the risk of outflows from Egyptian debt, suggesting that the strong EGP and higher real interest rates will continue to make treasuries attractive post-rate cut.

And Goldman is also predicting a 100 bps cut, according to Bloomberg.

President Abdel Fattah El Sisi will be in France next week to attend the G7 Summit, which will run from Sunday to Tuesday in Biarritz.

All eyes on Jackson Hole: Federal Reserve officials will gather in Jackson Hole later this week for the annual economic symposium — and marker watchers will be hanging on Chairman Jay Powell’s every word as he speaks for the first time since the bond market last week showed warning signs of a recession. His words will be closely scrutinized for indicators of whether the recent market volatility will persuade the Fed to embark on a full-scale easing cycle, and even restart its crisis-era bond-buying program. Powell’s captioning of last month’s 25 bps cut as a “mid-cycle adjustment” marked the start of a volatile August in the financial markets as hopes for a more aggressive easing cycle faded.

Economists think Powell will keep his cards close to his chest: Powell is likely to remain tight-lipped on the direction of US interest rate policy, economists tell MarketWatch.

That could be a risky strategy though: A failure to provide concrete signals will disappoint the markets and runs the risk of reigniting volatility, James Bianco, president of Bianco Research, told CNBC. “We could see another plunge in rates. We could see further movement down in yields and the yield curve and more volatility and problems in the markets. He should move aggressively,” he said.

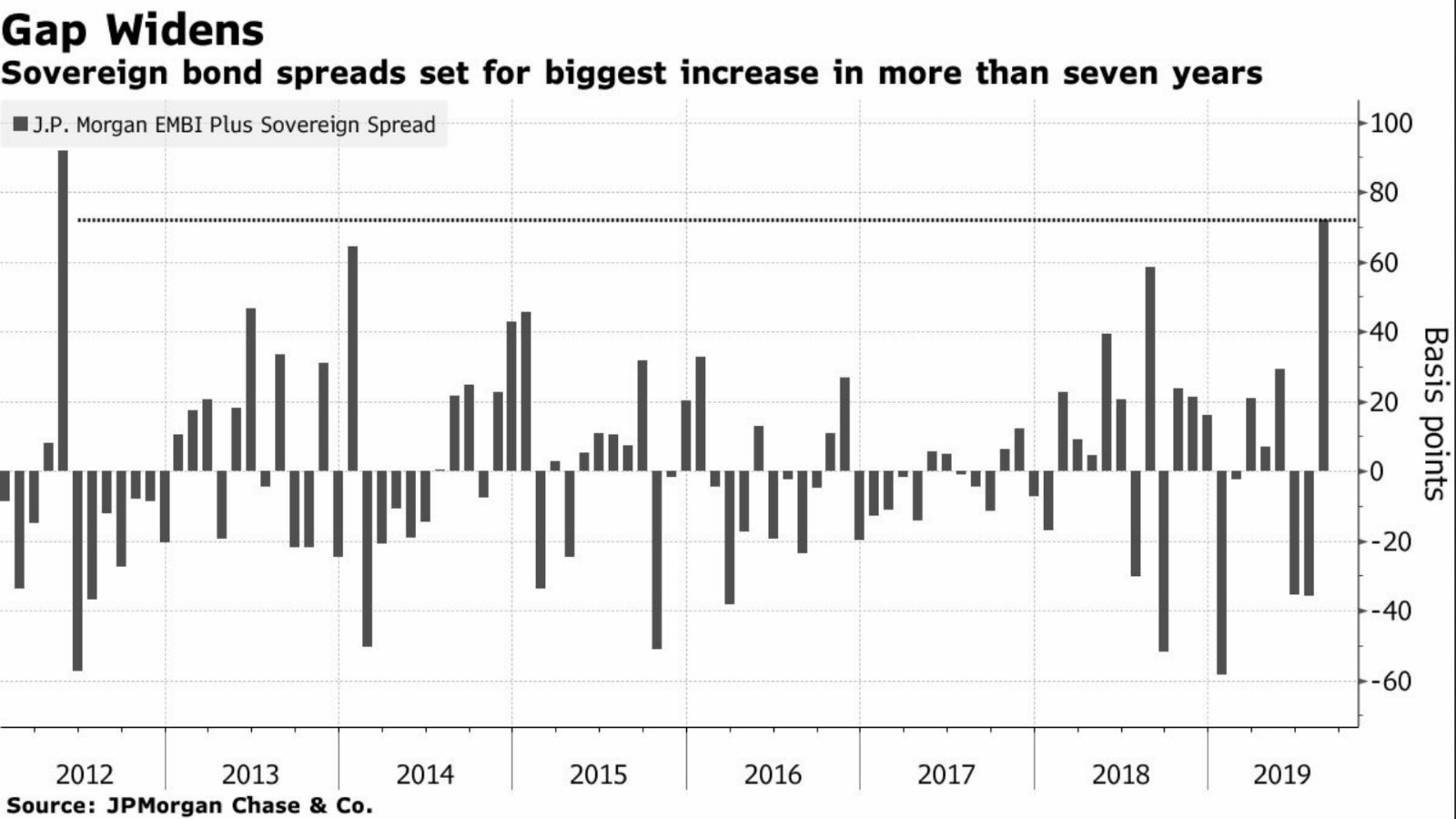

Any sign of easing could help EMs claw back losses: “Policy action, including from the Fed, and natural cyclical forces should eventually help activity to recover,” an emailed note from Morgan Stanley analysts seen by Bloomberg said. “EM risk assets tend to overshoot and undershoot fair value, with particularly large downside moves in the May-to-October time frame,” they said, adding that lower valuations and more time would be needed before inflows pick up.

Kudlow appears on Trump TV to quash economic fears: “I don’t see a recession at all,” Trump’s top economic official Larry Kudlow told Fox News yesterday (watch, runtime: 12:32), citing strong retail and unemployment figures. It’s probably worth bearing in mind, though, that this is Larry Kudlow: the guy who wrote “there’s no recession coming” six months before the biggest economic catastrophe this side of the Great Depression.

Tech IPOs are no longer as appealing and profitable as an investment prospect as they once were, the Wall Street Journal says. “Unlike during the dot-com era, when very young companies went public, many of today’s IPOs have been making losses for years. With age comes slowing growth.” These companies are also “more aggressively priced than their predecessors.” Part of the issue here is the delay in contemporary tech companies going to market versus in previous years, because they have access to VC funding and other private market sources, and shareholders tend to favor mergers or acquisitions to an IPO.

Softbank Group is lending some USD 20 bn to employees so they can buy stakes in its second giant venture-capital Vision Fund. The step is highly unusual and potentially risky, especially given the state of the global startup economy. With Softbank also contributing USD 38 bn to the fund itself, it could cumulatively make up more than half the money raised, the WSJ reports.

Suicide bomber targets wedding party in Kabul; At least 63 people died and 182 others were injured after a suicide bomber targeted a wedding party in Kabul on Saturday, BBC reports. The local branch of Daesh later claimed responsibility for the deadliest attack in the Afghan capital this year, which targeted an area with a significant Shia Hazara community. Afghan president Ashraf Ghani condemned the “inhumane attack” in a statement on social media, while the Taliban, which is currently in peace talks with the US, called the bombing “forbidden and unjustifiable.”

Egypt’s Foreign Ministry condemned the attack in a statement, offering condolences and solidarity to the victims’ families and to the country.

Iran tanker spat: Gibraltar has turned down a request by the US to detain an Iranian oil tanker seized by the UK in July, the BBC reports. Authorities said that they would not grant the request because US sanctions against Iran are not applicable in the EU. Gibraltar lifted the detention order on the Grace-1 vessel on Friday following negotiations with the UK, and allowed it to leave yesterday. UK authorities detained the tanker on 4 July over suspicions that it was transporting oil to Syria in breach of international sanctions.

Argentina’s economy minister Nicolas Dujovne handed in his resignation yesterday amid an economic crisis caused by President Mauricio Macri’s shock loss in a primary election last week, the BBC reports. The Argentinian peso lost a fifth of its value against the USD and the country’s main stock market crashed 48% in a single day, after the election increased the likelihood that the pro-market Macri will lose October’s presidential vote.

Is the European Union next in Trump’s sights? The Donald railed against EU trade policy at a rally in New Hampshire last Thursday, telling the crowd: “The European Union is worse than China, just smaller. It treats us horribly: barriers, tariffs, taxes, Bloomberg reports.

Here we were thinking this was a joke: It turns out Trump actually wants to buy Greenland. Trump told reporters yesterday that Greenland would be a “strategically interesting” purchase for the US and that White House officials “are looking at it,” according to the Washington Post (watch, runtime: 1:06). Greenlanders may have to wait a while for the privilege of becoming the 51st state of America though, after Trump said the issue “is not number one on the burner.”