- Egypt was the top destination for FDI in the Arab world in the past half decade. (Speed Round)

- Egypt’s single-day covid case count + death toll continue to drop. (What We’re Tracking Today)

- Lekela Power is directing “most” of its investments in the near future to Egypt. (Speed Round)

- OIH is looking to exit its remaining telecoms investments. (Speed Round)

- Gov’t eyes 4.6% budget deficit, 82.5% debt-to-GDP ratio by 2023 -Maait. (Speed Round)

- El Sisi ratifies amendments barring retired army officers from standing for election without SCAF permission. (Speed Round)

- EM portfolio inflows fall m-o-m in July, but equity + debt flows are continuing to recover -IIF. (The Macro Picture)

- Egypt ranks #16 in the world for time spent on social media. (On Your Way Out)

- The Market Yesterday

Tuesday, 4 August 2020

Welcome to August: A month of elections and … lots of M&A news?

TL;DR

What We’re Tracking Today

Uhm, who am I? What do I do for a living? Forgive us, but we imagine this is what Will Smith must have felt like after Tommy Lee Jones zapped him at the end of Men in Black. Really long long weekends can do that to you.

So welcome, friends, to the month of August. Back to school month for some of us. The prelude to fall. The month before we all need to start thinking about our 2021 budget process. We hope those of you able to escape to Sahel are having a blast.

The big news of the day: We have the lowest single-day count of new covid-19 cases in Egypt since April. More on that below.

It’s shaping up to be a busy month punctuated not just by the start of the school year at some private institutions, but by a trip to the ballot box:

- PMI data for Egypt, Saudi Arabia and the UAE is due out on Wednesday, 5 August at around 6:15am CLT.

- Foreign reserves figures for July should be out early next week.

- Inflation data for July will land on or about, Monday, 10 August.

- We’re heading to the polls to elect a senate this month. Expats will vote 9-10 August, while voters in Egypt will cast their ballots 11-12 August. Runoffs take place in September. Expect to head to the voting booth yet again in October for House elections.

- The Central Bank of Egypt will meet to review interest rates on Thursday, 13 August.

- The House reconvenes on Sunday, 16 August after a brief recess.

- We have a holiday near the end of the month as we take Thursday, 20 August off in observance of Islamic New Year.

AU-sponsored GERD talks resume this week with technical teams from Egypt, Ethiopia, and Sudan set to meet today and tomorrow to discuss the Grand Ethiopian Renaissance Dam, cabinet said in a statement yesterday. Irrigation ministers from the three countries will then meet on Thursday. We have more in this morning’s Diplomacy + Foreign Trade, below.

COVID-19 IN EGYPT-

Daily cases reach lowest level since 21 April: The Health Ministry confirmed 157 new cases of covid-19 yesterday — the lowest single-day total since 21 April. This brings the nation’s total confirmed cases to 94,640. The ministry also reported 23 new deaths yesterday, which is the lowest figure reported since 22 May. Egypt’s overall death now stands at 4,888.

But be on your best behavior lest we be put back into lockdown: The government may need to once again impose stricter preventative measures if there is a resurgence of the virus, Prime Minister Moustafa Madbouly warned during a televised press statement following Wednesday’s cabinet meeting (watch, runtime: 24:46). Madbouly attributed falling rates of infection to public awareness — and stressed the importance of continued social distancing and wearing face masks in public.

Egypt’s churches opened their doors for the first time in more than four months yesterday, the Coptic Orthodox Church said in a statement. Worshippers will need to practice social distancing and wear masks, among other precautions outlined in a separate statement.

It remains unclear when mosques will re-open for Friday prayers.

Egypt is among 31 “high risk” countries subject to an indefinite flight ban by Kuwait introduced on Saturday by the country’s civil aviation authority. The decision was announced on the same day the country partially resumed commercial flights, with the Kuwait International Airport operating at 30% capacity.

It’s unclear when flights between the two countries might restart: A cabinet statement on Sunday said that the Kuwaiti Foreign Minister told Egypt’s Foreign Minister Sameh Shoukry that the ban will be reviewed “during the coming period.” The flight ban comes at a time of strained relations between the two countries as the Gulf nation looks to reduce the number of migrant workers who call it home.

ON THE GLOBAL FRONT-

The number of confirmed cases of covid-19 worldwide surpassed 18 mn on Sunday, according to data collected by Johns Hopkins University.

Russia is gearing up to administer a vaccine en masse by October: Clinical trials on a vaccine developed by a Russian state research institute have been completed, potentially allowing health authorities to start a mass vaccination campaign in October, Reuters reports, citing an unnamed source. The vaccine may receive regulatory approval by the end of August. Doctors and teachers would be first in line to receive the vaccine before it is made more widely accessible to the public.

There are growing concerns that politics is taking priority in the race for a vaccine: Skepticism has surrounded the speed at which Russia’s clinical trials have been rushed through, with leading US infectious disease expert Anthony Fauci expressing hopes that Russia is “actually testing the vaccine.” In the US, experts say they are worried that the Trump administration will push for a vaccine to be approved before Americans go to the polls on 3 November to give his reelection bid a boost.

Australia’s second-largest state is in lockdown with a nighttime curfew and the military rolling out to enforce isolation orders, according to Reuters.

GLOBAL MACRO-

Middle East bond binge to continue into 2021 -JPMorgan: The surge in sovereign bond issuances in the Middle East in the wake of the pandemic will continue into next year, JPMorgan Chase said, according to Bloomberg. Stability brought by USD pegs, solid sovereign credit ratings, and a lack of capital controls will continue to fuel investor interest in the region, which saw USD 72 bn of bond issuance during the first six months of the year. Governments have taken to the bond markets to plug gaping holes in their finances caused by lockdowns and the crash in oil prices.

And expect a wave of M&A: The US investment bank is forecasting a spate of takeovers in the region, particularly in the financial, retail, real estate, and tourism sectors. “All these sectors are ripe for consolidation,” said Karim Tannir, the bank’s joint-senior country officer for MENA. “Some of the [transactions] we will see may not have been driven by covid-19, but that is now going to accelerate consolidation.”

White House officials and US Congressional Democrats have “made some progress” in their talks on a third round of fiscal stimulus package, Reuters reports. Republicans remain opposed to renewing the crucial USD 600 per week unemployment benefits, which expired on Friday, saying the payouts are discouraging citizens to go back to work. US President Donald Trump is now “seriously considering” issuing executive orders to suspend or defer the collection of payroll taxes.

Manufacturing activity in China surged last month at its fastest pace in nine years in the latest sign that the world’s second-largest economy is mounting a strong recovery after its lockdown earlier this year, according to latest PMI figures.

LNG markets continued to contract for the third consecutive month in July, marking a record 9.4% y-o-y decrease in fuel exports — the steepest slump since 2017, Bloomberg reports. Weak global demand for liquified natural gas spells financing trouble for export projects that had set sights on the rapid expansion in LNG markets before covid took hold, the business information service notes.

HSBC profits fell 96% in 2Q2020 as losses from non-performing loans reached USD 3.8 bn, disappointing CEO Ewen Stevenson’s expectations of a “much sharper V-shaped” recovery, the Financial Times reports. The bank has readjusted its expectations for the year to account for anticipated weaker performance, setting aside some USD 8-13 bn for non-performing loans.

AND THE REST OF THE WORLD-

Under-fire Emirates REIT hires Houlihan Lokey ahead of regulatory probe: Nasdaq Dubai-listed Emirates REIT has tapped investment bank Houlihan Lokey to advise it on its “strategic options” and “operational structure,” the fund announced in a statement (pdf). The Dubai Financial Services Authority said last month that it would investigate the fund’s owner, Equitativa, on “matters connected to the management,” a week after shareholders accused it of misrepresenting its market value to investors.

The UAE inaugurated the Arab world’s first nuclear power plant on Saturday, making it one of the some 30 countries with nuclear capabilities, Bloomberg reports. The country plans to have four nuclear reactors online by 2023, producing a fifth of its electricity needs. The launch sees the New York Times with its knickers in a knot because, you know, only Westerners can be trusted with nuclear power programs: “The launch is raising concerns about the growing number of nuclear programs in the volatile Middle East,” the Grey Lady helpfully notes, wringing its hands.

Microsoft perseveres with talks to buy TikTok after Trump vows US ban: Microsoft is pushing ahead with talks that could see it acquire Chinese video-sharing app TikTok after talks between CEO Satya Nadella and President Donald Trump, the company said yesterday. The tech giant vowed to wrap up negotiations to buy the company’s US operations by the middle of September, and promised to conduct a security review and detail the “proper economic benefits” to the government.

What’s a little extortion between friends? The US government has been threatening to ban the app, citing security concerns, and King Cheeto wants a cut of the sale price if a transaction goes through.

ELSEWHERE ON PLANET TECH: A Chinese patent troll is trying to prevent Apple from selling in China anything that has Siri in it. Facebook smashed second-quarter earnings expectations despite an ongoing ad boycott over the platform’s role promoting hate speech. SpaceX returned two astronauts to Earth in a splashdown in the Gulf of Mexico on Sunday following a historic two-month mission to the International Space Station. Watch the landing here (runtime: 06:07:28).

Allow yourself the chance to recharge your inner batteries. Change your focus, energy, and take control. Reconnect with your inner self and let the renovation begin.

Allow yourself the chance to recharge your inner batteries. Change your focus, energy, and take control. Reconnect with your inner self and let the renovation begin.

Two Egyptian women named among Forbes’ 2020 most powerful women behind Mideast online brands: Abeer El Sisi, one of the co-founders of AI personal assistant startup Elves, and Ghada El Tannawi, who founded online gown rental platform La Reina, have been named by Forbes two of the most influential women behind online brands in the Middle East this year.

Enterprise+: Last Night’s Talk Shows

Nothing to see here, folks. The nation’s airwaves had absolutely nothing to offer us last night as the talking heads continued to enjoy their Eid holidays. Expect a relatively quiet month on the talk show front as Lamees El Hadidi and Amr Adib take their annual hiatus.

Speed Round

Egypt was the top destination for FDI in the Arab world in the past half decade, attracting USD 124.5 bn-worth of project commitments between January 2015 and December 2019, the Arab Investment and Export Credit Guarantee Corporation (Dhaman) said in a report (pdf). The country accounted for 35.2% of the USD 340 bn invested in the region throughout the period. In total, 476 new projects, or 10.9% of total foreign projects in the Arab world, were launched in Egypt during those five years.

Egypt, the UAE, and Saudi Arabia snatched up to 65.4% of total FDI inflows into the region in 1Q2020 with investments of USD 11.2 bn. FDI inflows during the quarter fell 27.2% y-o-y in value terms and 30% by the number of new projects, according to Dhaman. Japan, the US, France, Philippines, Belgium, Saudi, Germany, Bahrain, China, and India were the top 10 countries committing FDI to the Arab region.

Dhaman had previously put the 2019 figure for Egypt-bound FDI at USD 13.7 bn, also topping the charts in terms of value, we noted last month. The Kuwait-based agency said at the time that the UAE topped the 2019 charts in terms of the number of projects, followed by Egypt and Saudi Arabia. According to the more recent report, the three countries remained on top in terms of the number of projects between 2015 and 2020. Dhaman also recently said that Egypt led the pack, and by a significant margin, when it came to real estate FDI.

INVESTMENT WATCH- Lekela is directing “most” of its investments to Egypt: Actis-backed Lekela Power is planning to funnel “most” of its investments in the coming period to Egypt, Lekela Egypt General Director Faisal Essa said last week, according to a cabinet statement. The renewable energy company plans to implement projects with a combined capacity of 500 MW in the country, Essa said, without providing details on the cost or timeline of these projects. Lekela has invested some USD 350 mn in its 250 MW West Bakr wind farm, the statement notes.

INVESTMENT WATCH- EFG closes USD 50 mn sale of c.7% stake in Fawry: EFG Hermes closed last week the sale by existing shareholders of a combined c. 7% stake (50 mn shares) in EGX-listed e-payment company Fawry in a transaction worth USD 50 mn, according to a statement (pdf). The selling shareholders included the Egyptian American Enterprise Fund (EAEF), the International Finance Corporation (IFC), a vehicle of private equity investor Helios, asset manager ResponsAbility, the National Bank of Egypt, Banque Misr, and a number of Fawry employees, sources told us previously. The EAEF, IFC, and Helios vehicle Link were among 40 shareholders who earlier this year transferred the ownership of a 63.99% stake in Fawry previously held by PSI Netherlands Holding.

M&A WATCH- OIH looks to exit remaining telecoms investments: Orascom Investment Holding (OIH) is planning to sell off its submarine cable in Pakistan as the company moves to exit its legacy investments in the telecoms industry from when OIH was branded as Orascom Telecom Media and Technology, OIH Chairman Naguib Sawiris told Sky News Arabia (watch, runtime: 6:01). The divestment comes as OIH moves ahead with a horizontal demerger to split its operations in the financial services industry and other sectors.

M&A WATCH- Adeptio completes purchase of minority stake in Americana Egypt: Adeptio completed the purchase of a 9.6% stake in Americana Egypt on Wednesday following a two-year dispute with the Financial Regulatory Authority (FRA) and minority shareholders over the company’s valuation, Al Mal reports. The FRA finally approved the transaction earlier this month after the Emirati outfit raised its offer price to EGP 6.32 per share, having previously had an offer of EGP 3.90 rejected by the regulator.

M&A WATCH- Odin Investments eyes majority stake in El Nasr Civil Works: Odin Investments, along with other unidentified investors, are seeking a majority stake in El Nasr Civil Works, the investment bank said in a regulatory disclosure (pdf). Odin has asked real estate developer MNHD, which owns 52.5% of El Nasr, to be allowed to start due diligence, the company said in a disclosure (pdf). El Nasr’s board will discuss the request at an upcoming meeting, according to a separate disclosure (pdf).

M&A WATCH- DPI, Adwia end acquisition talks after failing to agree valuation: Acquisition talks between UK Africa-focused private equity firm Development Partners International (DPI) and pharma manufacturer Adwia have broken down after the two sides failed to agree on a valuation, Adwia Chairman Hossam Taher told Al Mal. Adwia rejected DPI’s USD 150 mn valuation on the basis that pharma manufacturers have seen strong growth during the covid-19 pandemic, and opted to cancel negotiations, he said.

The EGX30 swapped five companies in its regular rebalancing last week. The full rundown of the rebalancing is here (pdf).

Who’s out: Orascom Construction, Alexandria Mineral Oils Company, Egyptian Resorts Company, Kima, and Porto Group.

Who’s in: Edita, Egyptian Steel, Oriental Weavers, the Export Development Bank, and Beltone.

EFG Hermes topped the EGX’s brokerage league table in July with a market share of 23.3%, according to EGX figures (pdf). Pharos came second with a 8.3% share, while CI Capital (5.2%), Beltone (4.4%) and Pioneers (3.9%) rounded out the top five.

Gov’t eyes 4.6% budget deficit, 82.5% debt-to-GDP ratio by 2023 -Maait: Egypt is looking to narrow the budget deficit to 4.6% by FY2022-2023, down from 7.8% in FY2019-2020, Finance Minister Mohamed Maait said in an interview with Oxford Business Group. The government is also planning to maintain a 2% annual primary budget surplus, Maait said. On the debt front, the government is looking to continue reducing debt levels to hit 77.5-82.5% of GDP in the next two years. The government beat its 89% debt-to-GDP target in FY2019-2020, bringing it down to 86.1%.

How we’ll get there: The government is focusing on widening its tax base and improving tax collection efficiency, as well as encouraging informal businesses to go legit and join the formal economy as a key part of its strategy to reach these goals, the minister said. The strategy also includes “streamlining and reprioritising expenditure with a focus on productive spending” and pushing ahead with subsidy reforms. These economic structural reforms will give the government more room to spend on shoring up social security nets and investing in human capital, Maait said.

CABINET WATCH- Cabinet approves decision to appoint an executive to lead the Tourism Promotion Authority: The Tourism Promotion Authority will now be headed by a chief executive appointed by the prime minister after the Madbouly Cabinet approved in its weekly meeting on Wednesday changes to a 1981 presidential decree, according to a statement. The executive will hold the position for a renewable three-year term. The authority is currently led by ِAhmed Youssef, who was appointed chairman in 2019. Youssef saw his term renewed in June for another year.

Cabinet also approved during the meeting:

- A EUR 183 mn grant from the European Bank for Reconstruction and Development (EBRD) signed last November to improve Egypt’s electricity grid;

- A USD 30 mn education grant signed with USAID on 29 June to support graduate employment;

- A decree to set up a 64-feddan investment zone in Emaar’s Uptown Cairo;

LEGISLATION WATCH- El Sisi ratifies amendments barring retired army officers from standing for election without permission: President Abdel Fattah El Sisi signed off on legal changes that restrict retired military officers from running for presidential, parliamentary or local elections without permission from the Supreme Council of the Armed Forces, according to Youm7. Under the changes, the defense minister will also appoint a military adviser for each governorate and the army will be able to weigh in on proposed constitutional amendments and bills related to political rights, elections, and national security. Restrictions on entering politics or standing for election without permission from the army had previously only applied to serving officers. The government has said the changes aim to control the spread of confidential information entrusted to military personnel during their service.

The story is getting attention in the foreign press: Reuters | Associated Press | AFP.

Egypt’s arrears to international oil companies fell to USD 850 mn at the end of June, down from USD 900 mn a year earlier, despite the financial pressure caused by the covid-19 pandemic, Oil Minister Tarek El Molla told Reuters on Wednesday. Egypt’s arrears bill ballooned to USD 6.3 bn in the wake of the 2011 revolution but has steadily declined since FY2014-2015 as the government worked to pay down its debts and attract investors into its energy sector. Egypt was previously aiming to pay its arrears in full by the end of 2019.

EARNINGS WATCH- Pandemic lockdown weighed on Edita’s 2Q2020 performance: The covid-19 pandemic and the partial lockdown the government imposed weighed on Edita’s profitability during the second quarter of the year, leading the snack food maker to report a 90.3% y-o-y drop in net profit to EGP 3.1 mn in the second quarter. The company said in its earnings release (pdf) that it generated EGP 768.7 mn in revenues in 2Q2020, down 10.9% from the same period last year. On a six-month basis, Edita’s revenues slipped 6.1% y-o-y to EGP 1.73 bn. The company said the closure of schools and universities and the night-time curfew cut into the number of packs it sold.

Edita is focusing on driving sustainable revenue growth throughout 2020 and plans to “stimulate demand by leveraging its innovative abilities to introduce new offerings, while simultaneously migrating consumers to higher price-points.” Meanwhile, construction is proceeding according to schedule at Edita’s first-ever facility in Morocco, which is on track to begin operations early next year.

MM Group reported a 17.7% y-o-y decline in net profits in 1H2020 to EGP 209 mn, down from EGP 254 mn during the same period last year, the company said in a bourse disclosure (pdf). The company’s consolidated revenues also dropped 18.7% during the first six months of the year to EGP 4.3 bn, from EGP 5.3 bn last year.

MOVES- Orascom Development Egypt (ODE) has appointed ex-McKinsey & Company senior partner Omar El Hamamsy (LinkedIn) its new CEO, according to a statement (pdf). El Hamamsy spent 18 years at McKinsey advising multinationals in the Middle East and Europe on transformation, corporate strategy, M&A and marketing.

Mohamed Al Zallat has been appointed as the head of the Industrial Development Authority (IDA), according to a Trade and Industry Ministry statement. Al Zallat, who previously served as deputy head of projects at the Armed Forces Engineering Authority, will serve for a one-year term or until a new board of directors of the IDA is formed. Al Zallat succeeds Magdy Ghazi, who was appointed earlier this year as acting president.

The Macro Picture

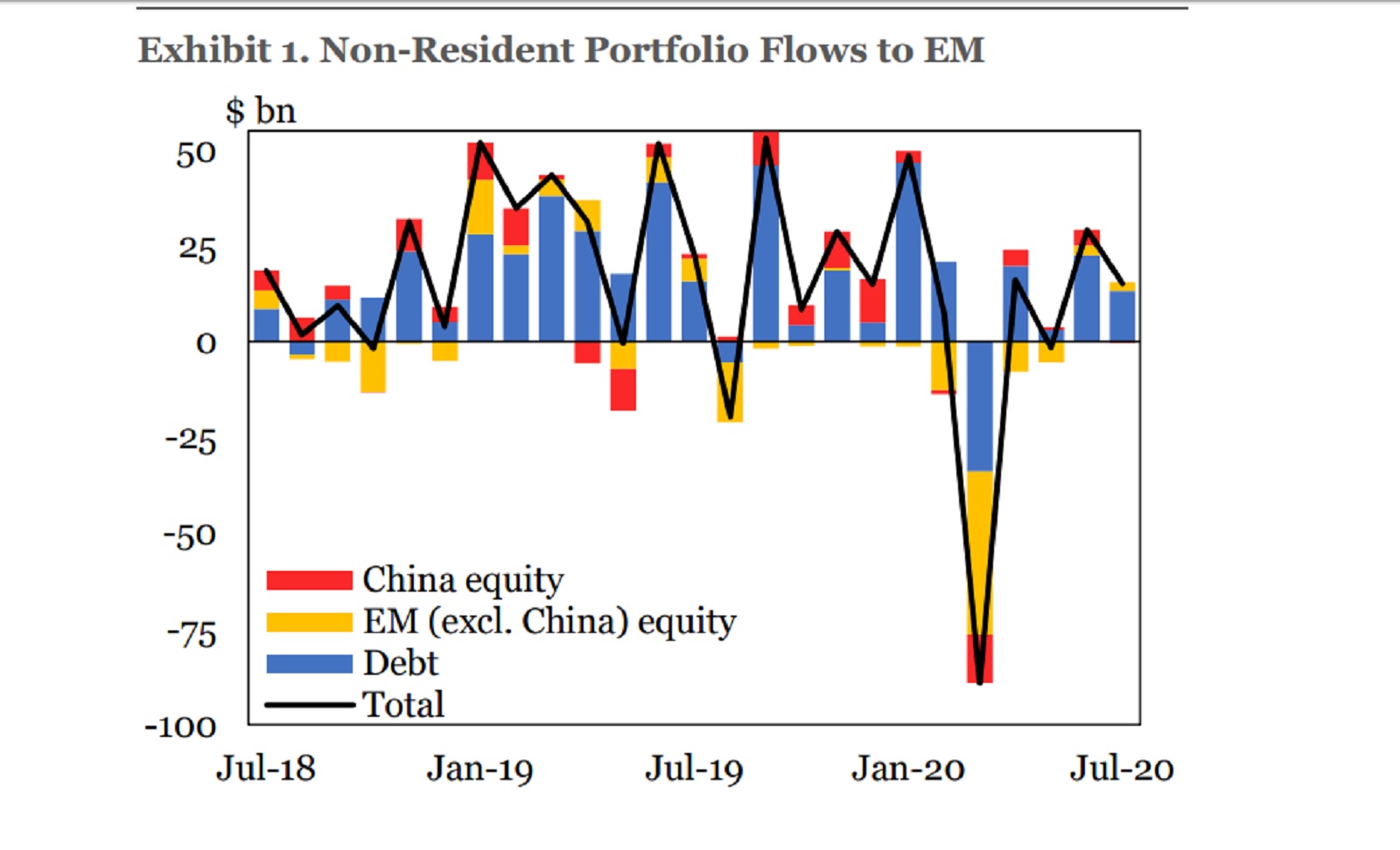

Net emerging markets portfolio inflows nearly halved in July to USD 15.1 bn from USD 29.2 bn in June, according to the Institute of International Finance’s (IIF) monthly capital flows tracker. The m-o-m decline comes as “hard data are still lagging behind” a recovery in investors’ sentiment on the outlook for EMs, the IIF says.

On the flipside, equity and debt flows continued to recover, posting a positive performance for the second consecutive month. Equity flows to EMs excluding China during July hit USD 2.3 bn, while debt flows were at USD 13.2 bn. According to the report, the positive performance came as “investor appetite [was] underpinned by a falling USD and an accommodative Federal Reserve” but the “dim” outlook for global economic growth and persistent concerns about fresh outbreaks of covid-19 weighed on performance.

Sovereign debt issuances are also showing a “shift in sentiment” as many EMs show “deeply discounted valuations” and attractive maturities. The IIF also says that “some of the more beaten down parts of the capital markets” are now picking themselves back up, and investors are keeping an eye on the sustainability of the upwards trend.

Egypt in the News

Elon Musk’s tweet claiming that Egypt’s pyramids were built by aliens is all over the foreign press this morning after International Cooperation Minister Rania Al Mashat invited Musk and SpaceX “to explore the writings about how the pyramids were built and also to check out the tombs of the pyramid builders.” Egyptian archaeologist Zahi Hawass also jumped on the anti-alien train, calling the argument a “complete hallucination” (watch, runtime: 01:08). Picking up the story: BBC | The Daily Mail | The Telegraph | The Independent | Evening Standard | Arab News | Sputnik News | VOA News.

Egypt’s so-called #MeToo movement is also still turning heads: The Washington Post asks whether victims from elite backgrounds are more able to press for accountability in a climate where [redacted] harassment is widespread and often goes unpunished. Meanwhile, the sentencing of five women to two years in prison for “inciting debauchery and immorality” on TikTok earned more digital ink in Deutsche Welle, the Independent and the New York Times.

The demolition of tombs in the City of the Dead to make room for two new highways has met with alarm by architects and conservationists. AP, AFP and Al Monitor all have the story.

Egypt authorizing military support for Libya’s Khalifa Haftar is meant to prevent our western neighbor from becoming a militant hotspot, particularly as the Armed Forces continue to battle Daeshbags in North Sinai, Mirette Mabrouk, the director of the Egypt Program at the Middle East Institute, told VOA.

Diplomacy + Foreign Trade

Egypt, Ethiopia, and Sudan have restarted technical talks to hash out the remaining sticking points during the second meeting of a new round of African Union-sponsored Grand Ethiopain Renaissance Dam (GERD) negotiations, cabinet said in a statement. Technical teams are due to meet today and tomorrow and present a report to the three countries’ irrigation ministers on Thursday with a focus on the immediate issues of the dam’s operation and an appropriate timeline to completely fill GERD’s reservoir, cabinet said while voicing objections on Ethiopia’s “unilateral” early filling and stressing the need for an expedited agreement. AFP, the BBC, and the Associated Press also took note of the talks.

The US State Department encouraged the three countries to engage in “constructive and fruitful” talks, saying in an emailed statement that Ethiopia is running out of time to reach an agreement, reports Bloomberg. Meanwhile, thousands of Ethiopians took to the streets to celebrate the dam’s construction after the country’s deputy prime minister called on the public to support the government ahead of the new round of talks, the Associated Press reports.

Egypt warns Turkey over Mediterranean seismic survey: Turkey’s planned seismic survey in the eastern Mediterranean would intrude into maritime territory claimed by Egypt, and would constitute “an assault” on Egypt’s sovereignty, the Foreign Ministry said in a statement on Saturday. Germany persuaded Ankara last week to suspend the survey on fears of an armed confrontation with Greece, with which it is locked in a dispute over maritime territory. Turkey has said it will halt its plans “for a while”, and promised to enter talks with Athens “without pre-condition.”

Health + Education

Egypt ranks 42 in US News education ranking

Egypt jumped nine places in US News’ global ranking for quality of education, coming in at 42 and cracking into the list of the 80 best education systems in the world, according to a cabinet statement. Six Egyptian universities were also ranked in the top 1k of the best global universities category with the first being Cairo University ranking at 434.

Automotive + Transportation

38 new trains begin operating

The Transport Ministry began operating 38 new trains last weekend as part of its ongoing plans to refurbish the country’s railway system, the cabinet said in a statement. Tickets for the new trains will be sold at a higher price than existing trains. The National Railways Authority is expecting a EGP 300 mn profit from the new lines by the end of 2020 that will increase to EGP 1 bn when Russia’s Transmashholding delivers all 1.3k trains, Al Mal reported, citing an unnamed source from the authority.

Other Business News of Note

Trade Ministry grants intellectual property rights unit greater oversight

Trade Minister Nevine Gamea issued a decision to restructure its intellectual property rights unit to allow for greater oversight and monitoring, as well as increased cooperation and information sharing with international bodies on matters of copyright infringement and intellectual property disputes, according to a statement. The decision will see the authority’s board composed of representatives of the ministries of higher education, scientific research, trade, culture, information technology, agriculture, industry, finance, and interior..

Environment Ministry to monitor emissions of 100 facilities by 2030

The Environment Ministry plans to monitor emissions from 100 major industrial facilities by 2030, said Mostafa Mourad, the head of the environmental quality division at the ministry, according to Mubasher. The ministry is currently monitoring 73 facilities including petrochemical, iron, steel, and petroleum refineries, as well as cement factories in an initiative that aims to improve Egypt’s air quality.

National Security

Egypt to receive five Russian fighters as part of USD 2 bn agreement

The Armed Forces are reportedly due to receive soon five Russian Su-35 air superiority fighters in the first such purchase for Egypt, RT Arabic reports, quoting unnamed military officials. Egypt ordered in March 2019 upward of 20 Su-35 Sukhoi-made aircraft under a USD 2 bn agreement, over which US officials threatened sanctions last November.

On Your Way Out

Egyptians’ social media addiction ranked: Egypt ranked #16 globally in the daily time spent on social media category in We Are Social’s Digital 2020 July Global Statshot report, with an average of two hours and thirty-eight minutes per day. Egypt also landed in the 42nd position in the ratio of social media users to the total population with 42% of Egyptians using the platforms.

The African Champions League final will be played on 16 or 17 October, the Confederation of African Football (CAF) said after ditching plans that would have seen Cameroon host the tournament’s semi-final and final games, Reuters reports. CAF said the semi-finals — which feature Al Ahly vs. Wydad Casablanca and Zamalek vs. Raja Casablanca — will be played over two legs and that the final could potentially be played at a neutral venue.

The Market Yesterday

EGP / USD CBE market average: Buy 15.93 | Sell 16.03

EGP / USD at CIB: Buy 15.93 | Sell 16.03

EGP / USD at NBE: Buy 15.92 | Sell 16.02

EGX30 (Wednesday): 10,599 (+0.3%)

Turnover: EGP 1.0 bn (6% above the 90-day average)

EGX 30 year-to-date: -24.1%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.3%. CIB, the index’s heaviest constituent, ended down 0.2%. EGX30’s top performing constituents were Orascom Investment holding up 6.6%, Orascom Development up 5.4%, and Kima up 5.2%. Wednesday’s worst performing stocks were EFG Hermes down 2.8%, CIB down 0.2% and Cleopatra Hospital down 0.2%. The market turnover was EGP 1.0 bn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -4.2 mn

Regional: Net Long | EGP +234.6 mn

Domestic: Net Short | EGP -230.4 mn

Retail: 38.3% of total trades | 30.6% of buyers | 46.1% of sellers

Institutions: 61.7% of total trades | 69.4% of buyers | 53.9% of sellers

WTI: USD 40.77 (+1.24%)

Brent: USD 43.88 (+0.83%)

Natural Gas (Nymex, futures prices) USD 2.10 MMBtu, (+16.62%, September 2020 contract)

Gold: USD 1,993.00 / troy ounce (+0.36%)

TASI: 7,459.21 (+0.05%) (YTD: -11.09%)

ADX: 4,324.14 (+0.45%) (YTD: -14.81%)

DFM: 2,065.32 (+0.71%) (YTD: -25.30%)

KSE Premier Market: 5,415.27 (-1.34%)

QE: 9,368.17 (-0.04%) (YTD: -10.14%)

MSM: 3,568.10 (+0.28%) (YTD: -10.38%)

BB: 1,290.57 (+0.11%) (YTD: -19.85%)

Calendar

5 August (Wednesday): IHS Markit PMI for Egypt released.

9-10 August (Sunday-Monday): Egyptian expats vote by post in Senate elections.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

16 August (Sunday): House of Representatives reconvenes after a brief recess.

20 August (Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.