- Cabinet approves the Ride-Hailing Apps Act’s exec regs, kicking off the law’s implementation. (Speed Round)

- Containing population growth could help drive down interest rates -RenCap’s Charlie Robertson. (Speed Round)

- Egypt is Africa’s number one investment destination for the third straight year -RMB. (Speed Round)

- Scatec Solar raises capacity target. Let’s hope Egypt is a recipient of any new investments. (Speed Round)

- Smart policy: The government wants to give plastic producers incentives to cut down single-use bag production. (Speed Round)

- Egypt’s Nile water flows could fall by 25% in 15 years, and that’s without GERD. (Speed Round)

- Weekend binge-watching material: Vox’s new Netflix show, The Mind. (Worth Watching)

- My Morning Routine: Aly El Shalakany, Senior Partner at Shalakany

- The Market Yesterday

Thursday, 19 September 2019

Egypt is Africa’s top investment destination for the third year in a row

TL;DR

What We’re Tracking Today

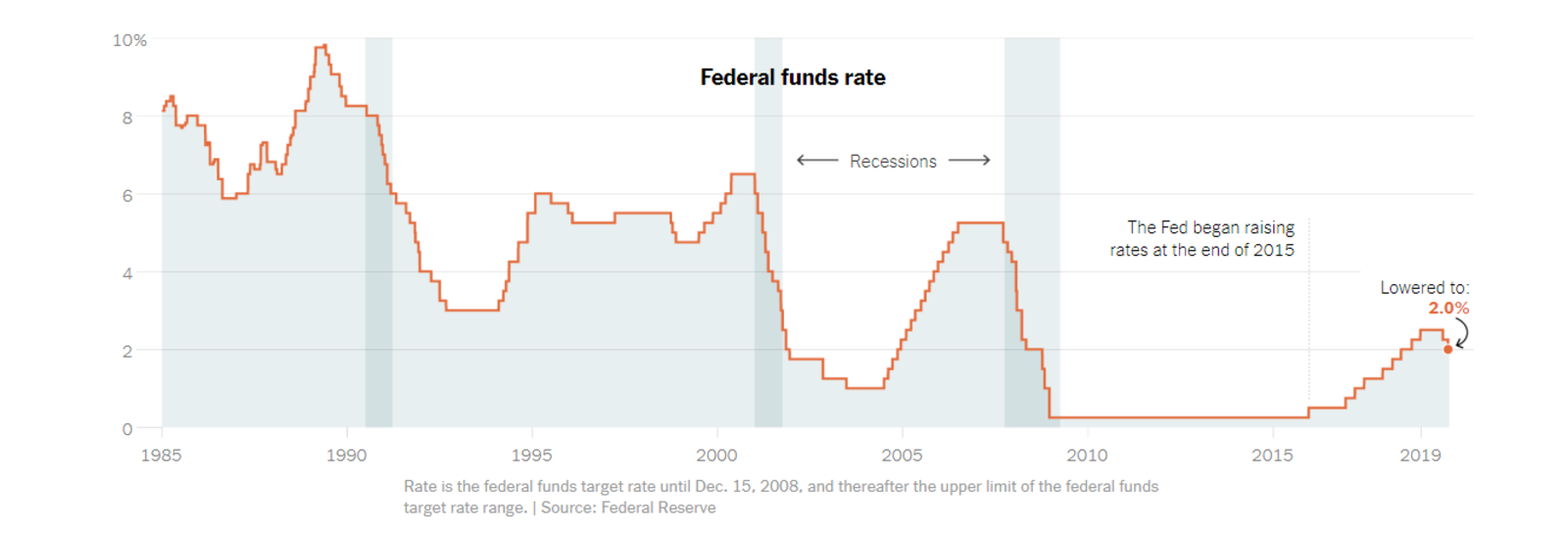

As expected, the Fed gave the market what it wanted: The US Federal Reserve Open Market Committee decided yesterday to enact its second interest rate cut of the year with a 25 bps reduction to 1.75-2%, citing “uncertainties” about the economic outlook, according to a statement. While the decision came in line with market expectations, it also highlighted growing dissent within the Fed on its monetary policy moving forward: One committee member wanted to push through a deeper cut, while two wanted to keep rates where they were. “Sometimes the path ahead is clear, and sometimes less so,” Fed Chair Jerome Powell said at a presser following the meeting, according to the Financial Times. “This is a time of difficult judgments, as you can see, disparate perspectives. I really do think that’s nothing but healthy.”

The decision is a reflection of the pessimism over the global economic growth outlook, of which the inverted yield curve is one of the symptoms, the New York Times explains. Manufacturing activity has been weakening, political tension is “creating uncertainty for business,” and sentiment among consumers — who have been driving the economy forward — “may be wavering.”

You can all but pencil in a rate cut here at home when the CBE’s Monetary Policy Committee meets a week from today. Analysts already saw low inflation figures for August providing the MPC with breathing room to move ahead with further monetary easing. Look for our comprehensive interest rate poll next week for an in-depth analysis of the factors at play.

Foreign Minister Sameh Shoukry is heading to New York today ahead of the United Nations General Assembly high-level meetings, which get underway on 24 September, according to a ministry statement. Shoukry is set to lay the groundwork for President Abdel Fattah El Sisi’s arrival in New York in a few days’ time.

Conference season continues here at home, with the Egyptian Private Equity Association having kicked off its venture capital event (pdf) yesterday at the Conrad Hotel. Events coming up this month, include:

- “The future of investment in Egypt” conference organized by the Egyptian Businessmen Association, will take place next Monday, 23 September at the Aida Ballroom, Cairo Marriott Hotel.

- The Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

- 24 September (Tuesday): A roundtable discussion titled “investing in renewable energy and sustainable development” organized by Media Avenue, Nile Ritz Carlton, Cairo.

- The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria.

The Gouna Film Festival also kicks off today, and is set to wrap next Friday, 27 September. The eight-day event will feature around 80 narrative films, documentaries, and short films from Egypt, Morocco, Lebanon, Poland, France, Bulgaria, Greece, Belgium, Algeria, Guatemala, and Sudan, among others, according to the festival guide (pdf).

Anwar El Sadat congressional gold medal design unveiled by US Mint: The US Mint unveiled yesterday the designs for the Anwar El Sadat Congressional Gold Medal, in a ceremony attended by members of Sadat’s family as well as representatives from Egypt and other nations held in the Department of the Treasury’s historic Cash Room, according to a US Treasury Department press release. “President Sadat took countless personal risks to achieve a society grounded in peace and diplomacy – an endeavor that ultimately cost him his life,” said Isaac Dabah, National Chairman of the Anwar Sadat Congressional Gold Medal Commission.

We aren’t competing in weightlifting events for two years: The Egyptian Weightlifting Federation has been barred from participating in all International Weightlifting Federation (IWF) events for two years as a result of the 2016 doping scandal involving seven Egyptian weightlifters, according to Ahram Online. The Egyptian federation has also been slapped with a USD 200k fine. The Independent Member Federation Sanctions Panel had earlier this week banned Egypt from the 2019 World Championships.

Egypt is participating in World Clean-Up Day on Saturday, 21 September, with four mega events to take place in Sharm El-Sheikh, Dahab, the Red Sea Governorate, and Minya in an attempt to clean bodies of water from plastics and other waste, according to Ahram Online.

US President Donald Trump named Robert C. O’Brien as his new national security advisor in a tweet yesterday. O’Brien is perhaps best known for being sent to Sweden by The Donald to negotiate the release of detained rapper ASAP Rocky (infer from that what you will about the current state of American politics), but is also a founding partner of an LA-based law firm, and was previously a representative to the UNGA. He succeeds John Bolton, who was fired by Trump last week.

Meanwhile, Saudi, Iran, and the US are still in a war of words over Aramco attack: The attacks on Saudi Aramco’s Abqaiq facility were “unquestionably sponsored by Iran,” Saudi Arabia’s Defense Ministry spokesman Turki al-Maliki said in a news conference yesterday. While he stopped short of directly accusing Tehran of launching the assault, al-Maliki said that evidence from drones and cruise missiles launched in the assault show they could not have come from inside Yemen. Iran continues to deny any involvement in the attack, and told the US it would retaliate immediately if Tehran was targeted in response. Houthi rebels, meanwhile, have reiterated their claim of responsibility. Before the Saudi news conference, US President Donald Trump said in a tweet that he had ordered tighter sanctions on Iran, but without giving any details about what the new measures would entail.

Meanwhile, 50% of the oil production cut by Saturday’s attacks has been restored, Saudi Energy Minister Prince Abdulaziz bin Salman said at a news conference in Jeddah on Tuesday evening. Finance minister Mohammed al-Jadaan later told Bloomberg that the attacks had zero impact on the kingdom’s revenues. But the impact of the attacks shines through elsewhere: Saudi has also joined the US-led International Maritime Security Construct coalition, designed to secure sea lines vital to oil shipping in the Middle East. And the country’s biggest customers in Asia have indicated that they are considering diversifying their supplies of oil.

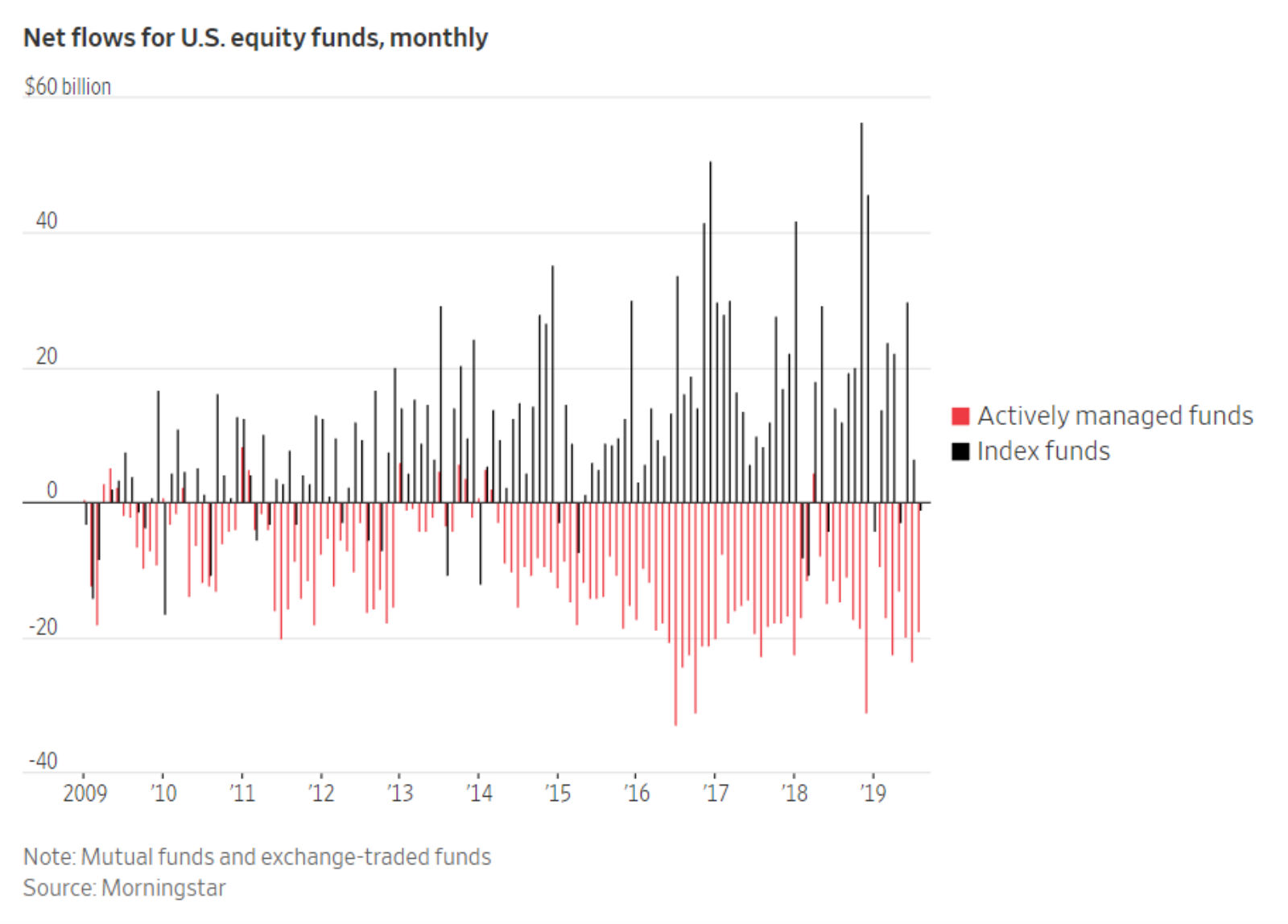

The robot takeover cometh for Wall Street: Index-tracking funds are beating their actively-managed rivals for the first time on Wall Street,according to the Mornigstar data, which nonetheless only “covers a slice of the mutual fund and ETF world,” says the WSJ. Broad US equity-tracking funds recorded USD 4.27 bn in assets on 31 August, surpassing the assets of funds “that try to beat the market,” which had USD 4.25, according to the data. This shift is turning the likes of BlackRock, Vanguard, and State Street Corp into power brokers and prompting concerns the “market-mimicking funds” could distort stock prices.

The case for central bank-backed digital currencies: Having central banks back digital currencies would be a very good step towards preventing outdated financial regulations to stifle financial innovations, writes Vikram Pandit in an opinion piece for the Financial Times. He argues that current financial regulations were drawn up in the 20th century, and are unsuited for new financial innovations, including digital and crypto-currencies. He posits that by putting central banks in the driver’s seat, regulations would follow that will allow these innovations to function as intended, without limiting their growth.

Cryptocurrencies have been moving up the priority list of central bankers. Regional central bankers met this week in Cairo for the Council of Arab Central Banks and Monetary Agencies Governors to discuss cryptocurrencies. Meanwhile, 26 other central banks, including the European Central Bank, have begun grilling representatives of Facebook over its planned Libra cryptocurrency project this week.

Enterprise+: Last Night’s Talk Shows

There was little by way of econ or business on the airwaves last night. Newly-elected Sudanese Prime Minister Abdalla Hamdok’s stop-by in Cairo earned some airtime, along with the weekly cabinet meeting — and a live rant about contraceptives.

Hamdok’s meeting with President Abdel Fattah El Sisi and Prime Minister Moustafa Madbouly was on Khaled Abu Bakr’s radar, with the Al Hayah Al Youm host speculating that Electricity Minister Mohamed Shaker’s presence at the meeting indicated “potential cooperation,” but stopped short of directly pointing to the Grand Ethiopian Renaissance Dam (watch, runtime: 2:11). We have more on this in this morning’s Speed Round, below.

Abu Bakr also picked up on the Madbouly cabinet approving a number of US and European grants yesterday during its weekly meeting (watch, runtime: 1:59). We have the story in our weekly roundup of the meeting in Speed Round, below.

Egypt witnessing a “birth control pill crisis”: Birth control pills have apparently been scarce for some time in pharmacies around the country, Yahduth Fi Misr’s Sherif Amer says. This shortage is a consequence of a recent Health Ministry decision to limit the distribution of subsidized pills to maternity care centers without notifying customers, head of the pharma division at the Federation of Egyptian Chambers of Commerce Ali Auf told Amer (watch, runtime: 5:44).

Speed Round

Speed Round is presented in association with

REGULATION WATCH- Gov’t kickstarts implementation of Ride-Hailing Apps Act: The Madbouly Cabinet approved in its weekly meeting yesterday the executive regulations of the Ride-Hailing Apps Act, it said in a statement. The regs cover a variety of regulatory procedures, including registration, licensing, taxes and social insurance — stipulating that all licensed ride-hailing companies must show their drivers are meeting their social insurance payments in accordance with the law. The decree also focuses on quality, supervision and inspection in addition to tariff regulations and data protection. The Official Gazette published the full text of the regs.

If ride-hailing companies haven’t hired white cabs, they better start now: The decree also stressed that companies need to comply with hiring white cabs as stipulated by the law, which was approved by the House of Representatives last year. Uber and Careem have both been incorporating white cab drivers into their fleets.

Background: We’d previously noted that companies will be required to pay up to EGP 30 mn to acquire the license to receive a five-year operating license. Meanwhile, ride-sharing drivers must pay up to EGP 2,000 (up from EGP 1,000) for an annual license to work through the companies, and will pay taxes 25% higher than those imposed on cab drivers. Companies will also be required to pay a one-off fee to legalize their status. The law stipulates that this fee must be lower than the cost of the operating license. Penalties will be imposed on companies and drivers that operate without the necessary licenses as well as companies that fail to share their databases as required by the state or incorporate white taxis in their fleets. These violations could also lead to companies’ licenses being revoked.

One way Egypt can get lower interest rates? Have fewer babies, suggests RenCap’s Charlie Robertson: It appears that there’s a correlation between Egypt’s high interest rates and its 100 mn population, according to analysis posed by Charles Robertson, chief economist at emerging markets-focused investment bank Renaissance Capital. Analysts at the bank have found a statistical relationship between fertility rates and bank deposits-to-GDP — a 53% correlation and one that has been holding up since the 1990s, Robertson tells the Financial Times (paywall). Higher deposit-to-GDP ratios leads to lower borrowing costs on the whole. Data appears to support this, as countries with deposit-to-GDP ratios of at least 60% in 2013 have had average one-year real interest rates of 0.9% between 2014 and 2018, compared with 2.1% for countries with deposit-to-GDP ratios of between 20-30%. He also suggests that states with higher deposit-to-GDP ratios have higher levels of investment.

The problem with high-population emerging markets is a tendency to not save. “People with lots of kids don’t save money,” he says. This is not only because they have more dependents to support and therefore less ability to save, but also because people with fewer children need to save for retirement because they are less able to rely on their offspring to provide for them in their dotage, he added.

Where does that leave us? With a very positive outlook going forward (if fertility rates decline): RenCap’s data suggests Egypt, alongside Ghana, Kenya and Pakistan, could see bank deposits double to at least 60% of GDP over the next 20 years. This is assuming that fertility rates continue to fall by about 0.4% a decade, as has happened in the past 10 years, potentially leading to a more than halving of real interest rates. “Egypt already looks well placed to fund its own investment, when lower government borrowing stops crowding out the private sector.” Robertson sees this trend happening for Morocco, Jordan and Vietnam as well.

Egypt is Africa’s number one investment destination for the third straight year, says RMB report: Egypt tops the list of most attractive African countries to invest in for the third year running, according to South Africa’s Rand Merchant Bank’s 2020 investment report, due to be released next January. “Egypt has made significant strides in changing their business environment, improving external investment into the market and growing their own industries,” said the bank’s Africa macroeconomic strategist Celeste Fauconnier in an interview with South Africa’s Biz News.

Reforms underpin the ranking: Egypt’s growth rate is expected to be approximately 5.3% for the next five years, which is well above the average of 4% expected for the rest of Africa, she says. Structural changes, including 2016’s currency devaluation, changes to the business environment, and steps taken to attract overseas investment and stimulate industry growth were all hailed as key to Egypt being an attractive investment destination. Our IMF agreement, increased trade policy agreements and pro-business reforms were also cited as concrete examples of positive steps taken.

M&A WATCH- Ebtikar acquires additional 9.1% stake in Masary for EGP 40 mn: Ebtikar for Financial Investment, a joint venture between BPE Partners and MM Group, has acquired an additional 9.1% stake in e-payments firm Masary in a transaction worth EGP 40 mn, MM Group said in a statement (pdf). The transaction brings Ebtikar’s stake in Masary to 54.9% and MM Group’s ownership in Masary to approximately 40%, up from 35%. B Investments holds a 20% stake in Ebtikar, while MM Group holds 52.9%. Ebtikar had acquired an additional 10% stake in the electronic payments firm in July.

(Potential) INVESTMENT WATCH- Scatec Solar raises capacity target. Let’s hope Egypt is a recipient of any new investments: Norwegian solar power plant company Scatec Solar plans to raise its capacity buildup target for solar power by 1 GW to 4.5 GW by the end of 2021, the company said yesterday. The company also set a new annual growth target of 1.5+ GW from 2022 onwards. “We are raising our growth ambitions, driven by a strong solar market and a steadily increasing pipeline of high quality projects,” Scatec Solar CEO Raymond Carlsen said. Egypt had been a significant investment for the company, which had embraced the Benban solar park and built solar power plants there. The company announced last month that it had begun commercial operations at its fifth 65 MW solar plant in Egypt, raising the Norwegian company’s total output in the country to 325 MW. It stands to reason that Egypt is a strong candidate for investment by the company when it looks to raise capacity. The company had grown its overall backlog to 5.6 GW from 3.9 GW since May 2018.

Jordan goes back to importing Egyptian natural gas after temporary halt: Egypt Gas has signed a one-year, USD 3.9 mn contract with the Jordanian–Egyptian Fajr for Natural Gas Transport and Supply Company to supply natural gas to Jordan Phosphate Mines, the company said in a statement (pdf). Jordan had stopped importing gas from Egypt in July due to low demand from its electricity producers. The kingdom had before then been reportedly importing only 75 mcf/d from Egypt.

Background: Jordan went back to importing 10% of its gas needs from Egypt in September last year, after a seven-year hiatus, as part of an agreement initially signed in 2014, but delayed due to Egypt’s inability to make available the agreed amount. Egypt supplied Jordan with 250 mcf/d of natural gas between 2004 and 2009, but imports completely stopped in 2011 due to attacks on the pipeline that linked the two countries.

CABINET WATCH- Madbouly Cabinet approves bundle of grants: The Madbouly Cabinet approved yesterday two USAID grants worth a combined USD 14 mn to support pre-natal care and science and technology funding, according to a cabinet statement on Wednesday. The ministers also approved a EUR 1.5 mn grant from the European Bank for Reconstruction and Development to establish a railway freight transport company and its purchase of 100 new railway cars. Cabinet also signed off on recommendations from a government committee allowing the government to use no-bid contracts for unspecified projects. The approval still requires the direct order agreements to comply with the Auctions and Tenders Act. Previous iterations of the routine decision has garnered flak in the foreign press, with Al Monitor suggesting on Wednesday that this could open the door to corruption.

An example of sound policy — gov’t to set incentives for plastic producers to curb production of single-use bags: The Environment Ministry is working on a strategy to curb the use of single-use plastic bags, whose local production has reached 2 mn tonnes per annum, Al Mal reported. The ministry is working with the Trade and Industry Ministry, the Federation of Egyptian Industries, and other entities to come up withincentives for producers, Environment Minister Yasmin Fouad said without giving details. The European Union has granted the ministry USD 2 mn to fund scientific studies for the initiative, Fouad said on the sidelines of a workshop on single-use bags in Spain. The ministry is also considering EUR 6 mn in subsidies to plastic producers to build new production lines of biodegradable bags. It has also inked agreements with 8 large retailers to use biodegradable bags, Fouad said.

THIRST WATCH- Flows from the Nile into Egypt could drop by as much as 25% in the next 15 years, a new study by Dartmouth College researchers suggests. The study, published in late August, throws into sharp relief the scale and impact of impending water shortages, driven by climate change and population growth. Egypt gets about 85% of its water from the Nile, and experts were already anticipating a nationwide shortage of fresh water by 2025. Climate change is set to make the river’s flow 50% more variable. By 2030, the flow of the Nile will regularly fail to meet demand, and the 20-40% of the region’s population that depends on it will face shortages, even during “normal years,” the Dartmouth study suggests. Meanwhile, hotter, drier years are set to become more commonplace, perhaps rising by a factor of 1.5 to 3 by the late 21st century, even if global warming is limited to an average of 2°C. Water reductions of 2% in Egypt would result in the loss of 200,000 acres of land and the effect of that would leave 1 mn people jobless, Irrigation Minister Mohamed Abdel Aty told the BBC last year.

Is it a wonder Egypt has been lashing out this week at stalled GERD talks? And this is without even taking into account the potential impact of the Grand Ethiopian Renaissance Dam (GERD), writes Zoë Schlanger for Quartz. She notes that all the problems Egypt is facing, while primarily the results of climate change, will only be exacerbated by GERD. It should come then as no surprise that the Foreign Ministry has been ratcheting up the rhetoric after Ethiopia rejected last month Egypt’s proposal for the timeline of filling the dam’s reservoir. This most recent dispute is being noted in the foreign press, including in Asharq Al-Awsat.

…Cue Sudan: Sudan’s newly appointed Prime Minister Abdalla Hamdok arrived in Egypt yesterday and met President Abdel Fattah El Sisi and Prime Minister Mostafa Madbouly, according to an Ittihadiya statement. While the statement focuses on strengthening bilateral ties, without providing specifics, we imagine that the meetings looked to the issue of GERD, as Egypt naturally wants an ally in coming trilateral talks. Hamdok and the accompanying Sudanese foreign affairs and finance ministers also discussed the Egypt-Sudan power interconnection project, and cooperation on national projects and medical aid in a separate sit down with Madbouly and Egypt’s finance, foreign, and electricity ministers, according to a cabinet statement. The statement doesn’t note that GERD was among the topics touched on during the meeting.

South African MNO Helios Towers is seeking a premium listing on the London Stock Exchange, with the IPO expected to reel in USD 125 mn in proceeds, according to the company’s ITF (pdf). The final share price for the telecoms firm’s resurrected IPO will be determined following the bookbuilding process next month. The company said it is targeting a freefloat percentage of at least 25% and “expects” it will be “eligible for inclusion in the FTSE UK indices.”

Advisors: BofA Merrill Lynch, Jefferies International Limited, and the Standard Bank of South Africa Limited are joint global coordinators and bookrunners. EFG Hermes and Renaissance Capital will also act as joint bookrunners if the IPO goes through.

MOVES- Prime Minister Moustafa Madbouly has appointed Osama El Gohary as head of cabinet’s Information and Decision and Support Center (ISDC), according to an official statement. Alongside retaining his post as an assistant to the prime minister, Gohary — an AUC grad who completed postgraduate studies in Scotland and the US — will be at the helm of the IDSC for a year.

Madbouly also tapped Zeyad Abdel Tawab Hassan as assistant to cabinet secretary general Atef Abd El Rahman for information systems and digital transformation.

Image of the Day

Ancient Egyptians could have invented the picket line: What you are seeing above could be the first recorded labor strike, which occurred in Ancient Egypt in 1159 BC under Ramesses III, according to Business Insider Singapore. Tomb-builders and artisans began complaining of month-long payment delays as they prepared for a festival to honor Ramesses III. After government officials ignored their demands, they stopped working and took to the city streets yelling “we are hungry” as they blocked access to the Valley of the Kings. Delayed payments, labor strikes, anger over no holidays. This so eerily familiar 3,000 years later.

Egypt in the News

It’s another quiet morning for Egypt in the foreign press. Perhaps the only story worth a skim this morning is a piece by the Guardian featuring Egyptian director Wael Shawky’s film trilogy, Cabaret Crusadesas number 7 of 25 in its list of Best Art of the 21st Century. Shawky was loosely inspired by Lebanese writer Amin Maalouf’s, “The Crusades Through Arab Eyes.”

Worth Watching

DOCUMENTARY OF THE WEEK — Vox’s new five-part Netflix series The Mind: The mind is so complex, sometimes it feels like we need a good old-fashioned Netflix documentary series to help us digest its intricacies. That’s why we highly recommend Vox’s new five-part series The Mind, Explained (watch trailer, runtime: 1:12). The series explores everything from how our memory and dreams work to psychedelics could be used to treat anxiety and other mental illnesses. Even if you’re not really interest, the scientific (but not boring) show will be sure to make good cocktail chatter at parties.

Energy

SDX Energy makes new oil discovery in West Gharib concession

SDX Energy has made an oil discovery in the West Gharib concession, the North Africa-focused company said in a statement. At 4,665 feet deep, the well has been “connected to the central processing facilities at Meseda” and brought online with an average gross capacity of 315 bbl/d. "We are pleased to announce a further drilling success with our MSD-19 well in the West Gharib Concession, which follows the positive result in the Rabul-7 well in June,” CFO and interim CEO Mark Reid said. The company is planning to dig other wells in the concession over the coming 18 months. “The well was brought online in a timely and cost efficient manner and will provide further support to our 2019 production guidance for this asset of gross 4,000-4,200 bbl/d.” SDX holds a 50% stake in the concession.

Egypt to issue tender for equipment for Sudan grid connection next month

The Electricity Ministry is planning to issue in mid-October an international tender for a Static VAR compensator for the grid connection project with Sudan, which is slated for completion by the beginning of 2020, sources told Al Mal. Siemens and ABB are expected to make offers in the tender, which Sudan will fund, the sources said. The winner of the tender is expected to be announced by mid-November.

Manufacturing

Egypt’s Nile Linen to inaugurate new EGP 200 mn textiles factory in February

Export-oriented Nile Linen Group is planning to inaugurate in late February a EGP 200 mn textiles factory in the Amreya customs-exempt industrial zone, Chairman Saeed Ahmed said. The new facility will produce 28k meters a day, and will be financed through equity, Ahmed said.

Health + Education

Egypt’s education ministry limits foreign ownership in int’l schools

Education Minister Tarek Shawki has issued a decision to implement a 20% cap on foreign investor ownership in international schools, according to a decree seen by the press. The cap applies to dual-passport holders, foreigners, and funds, “whether individually or as a group.” Sources tell the press that the decision could negatively impact M&A activities and foreign direct investment inflows in the sector. A number of education management companies are reportedly gearing up to meet with the minister to lobby against the decision.

Real Estate + Housing

AlHokair’s Marakez looking for land for a mall in Egypt’s Assiut

Marakez for Real Estate Investment is planning to develop a new shopping mall in Salam City on the Cairo-Ismailia road at a cost of EGP 250 mn, Chief Business Development Officer Ashraf Farid said, according to Al Shorouk. The mall will feature both open-air areas and retail stores. The Fawaz AlHokair Group subsidiary is also looking to acquire land in Assiut for its plans to bring more of its shopping malls outside Cairo, Farid said, according to a separate news report. Marakez, whose flagship project is Mall of Arabia in 6 October, is looking to invest over EGP 15 bn over the coming period for its expansion plans, we noted earlier this year. The plans include Mall of Tanta — which opened its doors this month — a planned Mall of Mansoura and a mall in Minya.

Automotive + Transportation

Egypt wants to supply 4-5% of Renault Morocco’s automotive component needs

The Egyptian-Moroccan Business Council is in talks to have Egyptian automotive component manufacturers supplying Renault’s Moroccan manufacturing facility with 4-5% of its component needs, council member Kamal El Dessouky tells the local press. According to El Dessouky, Egyptian companies are looking to supply the seats, windows, windshields, and isolation materials for the French car manufacturer. The arrangement currently under discussion would see the percentage of components Egypt supplies gradually increase.

Egypt’s transport authority raises private bus monthly fees

The Public Transport Authority issued a decision to raise the monthly fee paid by private bus route operators in Cairo five-fold to EGP 20k per bus, up from EGP 5k, reports Al Masry Al Youm. The decision was expectedly met with backlash from 12 companies affected by the decision, who said in a memo to the authority that the decision is not in line with the contract terms specified in the tender booklet issued seven years ago. The companies described decisions taken by the authority since 2015 as “arbitrary,” including previous decisions to raise the monthly fees by 83% and a separate 300% hike for violation penalties.

My Morning Routine

Aly El Shalakany, Senior Partner at Shalakany: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Aly El Shalakany, Senior Partner at Shalakany, one of Egypt’s largest and oldest corporate law firms.

I’m Aly El Shalakany, Senior Partner at Shalakany, Chairman of the Cairo Angels and President of the Middle East Angel Investment Network (MAIN). I’m married to my wonderful life partner and best friend Vanessa Lehmann, soon to be Frau Dr. Lehmann.

I’m a corporate lawyer specialized in finance, M&A, and projects with a particular sector focus on energy and infrastructure. I’m also a very active angel investor who invests in, mentors and coaches early stage startups and scaleups. And I’m on the board of several companies.

Mornings are important for setting my frame of mind for the rest of the day. I usually wake up around 6:30 am, crawl out of bed, brush my teeth, and then go for a run or go rowing on the Nile for about an hour. I used to find it impossible to even think about exercising in the morning, but now I find it so refreshing, and it really impacts my mood and energy levels for the entire day. When I’m back from my workout, I get showered and dressed, have breakfast and coffee with my wife and then walk to work. Due to the nature of my job, I usually can’t make it home for dinner, so our main meal and quality time together is over breakfast, which is fantastic.

Unless I have an early morning appointment, the very first thing I do is go through my emails and update my to-do list. I’m one of those annoying people who have zero emails in their inbox, with everything filed away neatly. Once that’s done, it’s time to read my favorite business publication, which is Enterprise of course.

I try to keep the more intellectually demanding work that requires strong focus for early in the day, and then schedule calls and meetings for later. I have lunch every day at 2 pm and, unless I’m with a client, I almost always eat with my lunch crew at our wonderful cafeteria at work. I think getting a mental break and a healthy lunch is crucial for me to go the distance in the second part of my day, so I find it hard to understand how some people skip this meal or just snack through it.

It’s impossible for me to pick a favorite movie or TV series. I recently saw “The Wife,” starring Glenn Close, and it was a gut-wrenching reminder of how women suffer because so many men are intimidated by strong women.

I read so much news and non-fiction for work that, in my leisure time, I try to stick to fiction. I made a promise to my wife to learn German and I’ve been true to my word, so I’ve only been reading detective novels — or Krimis — in German for the past few months. So weit, so gut.

Shalakany is one of the oldest law firms in Egypt and the Middle East, set up by my great-grandfather over a hundred years ago. Our real take-off point was in the 1970s, when the Egyptian economy opened up under Sadat and started welcoming investment and private sector participation. Our firm seized this chance, scaling up quickly to provide top-quality legal services to local and foreign investors setting up and running businesses in Egypt. This was challenging, and we had to build up the talent base from scratch, but we really believed in what we were doing, and stuck to it, and we haven’t looked back since.

Our strategy is to focus on providing effective legal solutions for complex transactions and disputes for our corporate clients, who are mostly multinationals or premium regional and local businesses. We’ll do the more commoditized legal work, but only if it’s something that our client needs to complement what we’re really good at, which is the work that requires in-depth knowledge and skill.

A recent example is the Veon Global Telecom Holding tax settlement and transaction. This took over three years, and we had our M&A, capital markets, disputes, tax and insolvency partners all working in parallel. Half the firm worked weekends at some point on this transaction alone, but in the end, we got the job done. We’re very proud of this kind of work, because we can really flex our muscles — and in our business, that’s the very best way to showcase what your firm is all about.

There’s so much that people don’t understand about the corporate legal sector. The image they often have from TV shows like “Suits” is very charming, but in reality, there’s a lot less drama and a lot more hard work. It’s also very surprising that people often think that all lawyers are ready to turn their hand to any legal problem. It’s an honor to be in a position of trust, so I don’t take it badly, but it does get tiring after a while. After all, you don’t ask a surgeon for advice every time you have a backache, do you?

Legal technology will be a game changer for the industry. I read a lot and attend many conferences about what the law firm of the future will look like. The legal market is already being disrupted by tech, and this will be more acute in the coming decade. Lawyers like to think that the industry is immune from this development, but it couldn’t be further from the truth. In 20 years, our business operations will, in many respects, be unrecognizable.

I strongly believe in the work-life balance, and try to spend as much time as possible with family and friends. My wife and I try to carve out enough quality time to do fun things together, like experiencing new food, shows, theater, and as much traveling as we can. We’re both big believers in the importance of family, and prioritize spending time with our parents and siblings. This mindset applies to our friends too, and we really try our best to invest in those relationships.

I also love sports, and do a mix of things three to four times a week. And I’m a massive Arsenal fan — which has been really tough over the past 10-15 years — but they’re my team and I will never abandon them, no matter how miserable they may make me on most weekends.

I’ve had many inspiring mentors in my life and throughout my career. Many of my co-investors and the founders I work with in my angel investing keep me sharp and are sources of inspiration and learning. But if I had to single out one important life lesson above all others, I would start with what I learned from my parents. My mother and father both taught me that if you want to be successful, you have to earn it the hard way through application and hard work. You can’t blame others if something doesn’t go your way. The hunger and desire to improve instilled in me has served me well in my life and in business.

For anyone looking for inspiration on time management, I recommend a talk by Randy Pausch, which is really more about the philosophy of staying organized. I personally am very organized — sometimes to a fault, because being spontaneous and carefree is also important in life (but I digress.) Structure and organization come naturally to me, but I’m also a big fan of technology and use lots of applications on my phone, desktop and laptop to ensure I stay on top of things.

The Market Yesterday

EGP / USD CBE market average: Buy 16.26 | Sell 16.38

EGP / USD at CIB: Buy 16.26 | Sell 16.36

EGP / USD at NBE: Buy 16.30 | Sell 16.40

EGX30 (Wednesday): 14,745 (-0.1%)

Turnover: EGP 613 mn (4% below the 90-day average)

EGX 30 year-to-date: +13.1%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.1%. CIB, the index’s heaviest constituent, ended up 0.5%. EGX30’s top performing constituents were Oriental Weavers up 2.1%, Eastern Co up 1.7%, and Orascom Construction up 1.1%. Yesterday’s worst performing stocks were Juhayna down 3.7%, AMOC down 3.2% and Palm Hills down 3.2%. The market turnover was EGP 613 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +65.3 mn

Regional: Net Long | EGP +11.0 mn

Domestic: Net Short | EGP -76.3 mn

Retail: 51.0% of total trades | 45.4% of buyers | 56.6% of sellers

Institutions: 49.0% of total trades | 54.6% of buyers | 43.4% of sellers

WTI: USD 58.15 (+0.07%)

Brent: USD 63.60 (-1.47%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, (-0.11%, Oct 2019 contract)

Gold: USD 1,500.80 / troy ounce (-0.99%)

TASI: 7,821.23 (+0.65%) (YTD: -0.07%)

ADX: 5,156.07 (-0.28%) (YTD: +4.90%)

DFM: 2,823.56 (-0.92%) (YTD: +11.61%)

KSE Premier Market: 5,934.59 (-2.23%)

QE: 10,539.59 (+0.66%) (YTD: +2.34%)

MSM: 4,015.99 (+0.36%) (YTD: -7.12%)

BB: 1,489.37 (-1.62%) (YTD: +11.37%)

Calendar

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

23 September (Monday): “The future of investment in Egypt,” a conference organized by the Egyptian Businessmen Association, Alexandria Businessmen Association, and the Egyptian Junior Business Association, Aida Ballroom, Cairo Marriott Hotel.

23-25 September (Monday-Wednesday): Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS), Kempinski Royal Maxim, Cairo

24 September (Tuesday): A roundtable discussion titled “investing in renewable energy and sustainable development” organized by Media Avenue, Nile Ritz Carlton, Cairo.

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

27 September (Friday): The Justice Ministry’s dispute resolution committee will hear a case filed by Raya Holding against the Financial Regulatory Authority (FRA).

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

28 September (Saturday): Smart Vision Egyptian Women’s Forum, venue TBA.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

8-10 October (Tuesday-Thursday): Korean business delegation visits Egypt

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, to be announced and Pitch by the Pyramids, Giza Pyramids

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.