- Gov’t dusts off plans for EGP-denominated int’l bond issuance. (Speed Round)

- Egypt construction sector best in Africa last year: Deloitte. (Speed Round

- Is Damietta LNG plant finally going to reopen this quarter? (Speed Round)

- Cairo-based delivery startup Trolley raises USD 200k in seed funding. (Speed Round)

- Gov’t issues exemption guidelines for those unable to pay for universal healthcare. (Speed Round)

- The ‘R’ word is back in the headlines. (What We’re Tracking Today)

- Is the developed world getting ‘Japanified’? (The Macro Picture)

- The birth of modern Egypt: A history from below. (Worth Listening)

- The Market Yesterday

Wednesday, 28 August 2019

Gov’t plans EGP-denominated int’l bond issuance.

TL;DR

What We’re Tracking Today

Will we get an extra day’s holiday this weekend? Maybe. The cabinet said yesterday that whether the government takes the day off on Sunday will depend on where the Islamic New Year falls. Sunday? We enjoy a nice three-day weekend. Saturday? No dice.

President Abdel Fattah El Sisi is in Yokohama, Japan today to take part in the Tokyo International Conference on African Development (TICAD), which runs until Saturday, 31 August. Foreign Minister Sameh Shoukry yesterday held a preparatory meeting with his Japanese counterpart Taro Kono ahead of the conference, Ahram Online reports.

Investors impressed by Egypt’s economic turnaround: Egypt has become increasingly attractive to investors on the back of the government’s commitment to tough and politically sensitive economic reforms, Heba Saleh writes in the Financial Times, noting Morgan Stanley’s recent kind words. With the economy growing at a 5.6% clip in FY2018-2019 and that figure expected to hit 6% in the coming years, inflation figures cooling to a four-year low, a narrowing budget deficit, and healthy bond yields, the macroeconomic data is highly encouraging for investors, she says.

Of course, macro data is only one metric of success: Capmas data released last month showed that the rate of poverty surged to 32.5% last year, from 27.8% in 2015. The key thing for the government now is to ensure that positive macro data translates into prosperity for wider society.

The inverted yield curve cometh again: The US yield curve between 2-year and 10-year bonds inverted once again last night, placing the dreaded ‘R’ word firmly back in the headlines of the financial press. Yields on 10-year treasuries closed 5.3 bps below the 2-year — the lowest level since 2007, the FT notes.

This seems like an appropriate place to plug an interesting article in Columbia Journalism Review that asks: does anyone in financial media actually understand what they’re talking about when it comes to recessions? Based on this evidence, the answer seems to range between “sort of” and “no.” A particularly telling quote from Simon Kennedy, executive editor of Bloomberg Economics: “If I could predict the start of a recession, then I probably wouldn’t be a journalist.”

Ratings agency Moody’s has downgraded its outlook for global investment banks (GIB) to ‘stable’ from ‘positive’ due to slower economic growth. Moody’s said in a report yesterday that it expects banks’ profitability to be hit by falling client activity and lower interest rates if conditions continue to decline. "The stable outlook for the GIBs reflects our expectations that profitability for the GIBs may have peaked for this economic cycle," Ana Arsov, managing director of Moody’s Investors Service, said. "Greater revenue headwinds will make further profitability gains more elusive, despite a continued focus on business reengineering and technology investments to boost efficiency."

US-China trade war escalation turns UBS bearish: UBS Wealth Management, which has around USD 2.5 tn in AUM, “has trimmed its core equity recommendation to an ‘underweight’ position” for the first time since 2012, according to the Financial Times. In a note to clients earlier this week, Global Chief Investment Officer Mark Haefele said the trade tensions are unlikely to wind down before the year is out, ramping up the risk of slowing global and manufacturing growth.

Big tech shares plateau as investors factor in slowing growth: Facebook, Apple, Amazon, Netflix, and Google (aka FAANG) stocks are struggling to give investors a strong upside, leading funds to trim their exposure to the one-time “darlings of the technology sector,” according to The Wall Street Journal. “For several years, investors reliably bought the shares for the companies’ massive growth potential and dominance over their respective industries,” but are now “increasingly pricing in slowing growth, rising costs and the potential for greater government oversight.”

But Norway might have stronger appetite for some FAANG: Norway’s USD 1 tn wealth fund could potentially shift some of its global holdings away from Europe and toward the US, where it could increase its investments by as much as USD 100 bn, according to Bloomberg. And where would these investments go, you ask? The very same tech giants that US-based investors think are losing their luster.

Airbus, Boeing and Softbank are working to send drones where no drones have gone before: Up into the stratosphere, where they could fly unaided for months, running on solar power, taking photos and providing internet services, the Wall Street Journal reports. And while the companies have not yet hit on the perfect balance of lightness, size and ability to withstand inclement weather needed for the drones to be functional, it seems likely they will soon. A study by research firm NSR estimates that there are 40 development programs underway and that the industry could bring in USD 1.7 bn in revenue in the next decade.

Enterprise+: Last Night’s Talk Shows

Business news dominated the airwaves last night:

Gold prices have soared to unprecedented levels in recent weeks: 21 carat gold prices have reached EGP 705 per gram and are expected to go up to EGP 800 per gram by the end of next month, Amir Rizk, member of the Gold Division at the Chamber of Commerce, told Yahduth Fi Misr’s Sherif Amer (watch, runtime: 04:06). Rizk expects the trend to continue until the end of the year, surpassing EGP 900 per gram. He attributed the rise in prices to the US-China trade war.

Baltim South West is expected to start production of natural gas within days, three

months ahead of time, Hona Al Asema’s Lama Gebril quoted the Oil Ministry as saying (watch, runtime: 01:24). Five other wells will be drilled during the current fiscal year, raising the total production capacity of the field to 500 mcf/d (watch, runtime: 04:41).

A report by the Financial Times hailing Egypt’s economic performance also caught the attention of a number of talking heads, including Masaa DMC’s Ramy Radwan (watch, runtime: 06:20).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- EGP-denominated int’l bond issuance could be back on the table: The Finance Ministry is revisiting previously shelved plans to take an EGP-denominated bond issuance to the international market, two government sources tell Enterprise. According to our sources, the ministry has yet to determine the exact size and timing of the potential issuance, but will likely aim to pull the trigger early next year, depending on market conditions and investor appetite. Investors would purchase the bonds in USD, while the government would pay the principal and interest in EGP.

Background: A Bloomberg report back in October claimed that an EGP-denominated bond issuance on the international markets was in the cards, and said the transactions would be cleared through Belgium-based settlement company Euroclear instead of local banks. Our sources in the government later said that the Madbouly Cabinet was not planning on moving ahead with the issuance for two fiscal years.

It’s all about the EGP appreciation and post-Zombie Apocalypse recovery: The plan had initially been put on hold during the EM sell-off of April-December 2018. The decision to revisit the issuance comes following the EGP’s resilience to global headwinds, and its appreciation over the last several months, our sources tell us. The EGP has risen significantly against the USD this year on the back of increased inflows from portfolio investors, a reduced imports bill, and increased tourism receipts — and potential intervention from the Central Bank of Egypt. However, analysts we spoke with earlier this year anticipate the EGP to reverse some of its gains later in the year, with most expecting the EGP / USD rate to return to the 17.50-18 range before the year is out. HC Securities also told us that monetary easing by the CBE would “spark profit-taking by investors.”

In related news: The Central Bank of Egypt repaid USD 3 bn in foreign currency debt during 1Q FY2019/2020, including USD 946.6 mn of debt service payments, according to Al Mal. The growth of Egypt’s external debt pile accelerated in 3Q FY2018/2019, rising 10% to USD 106.2 bn during the quarter, CBE data showed yesterday.

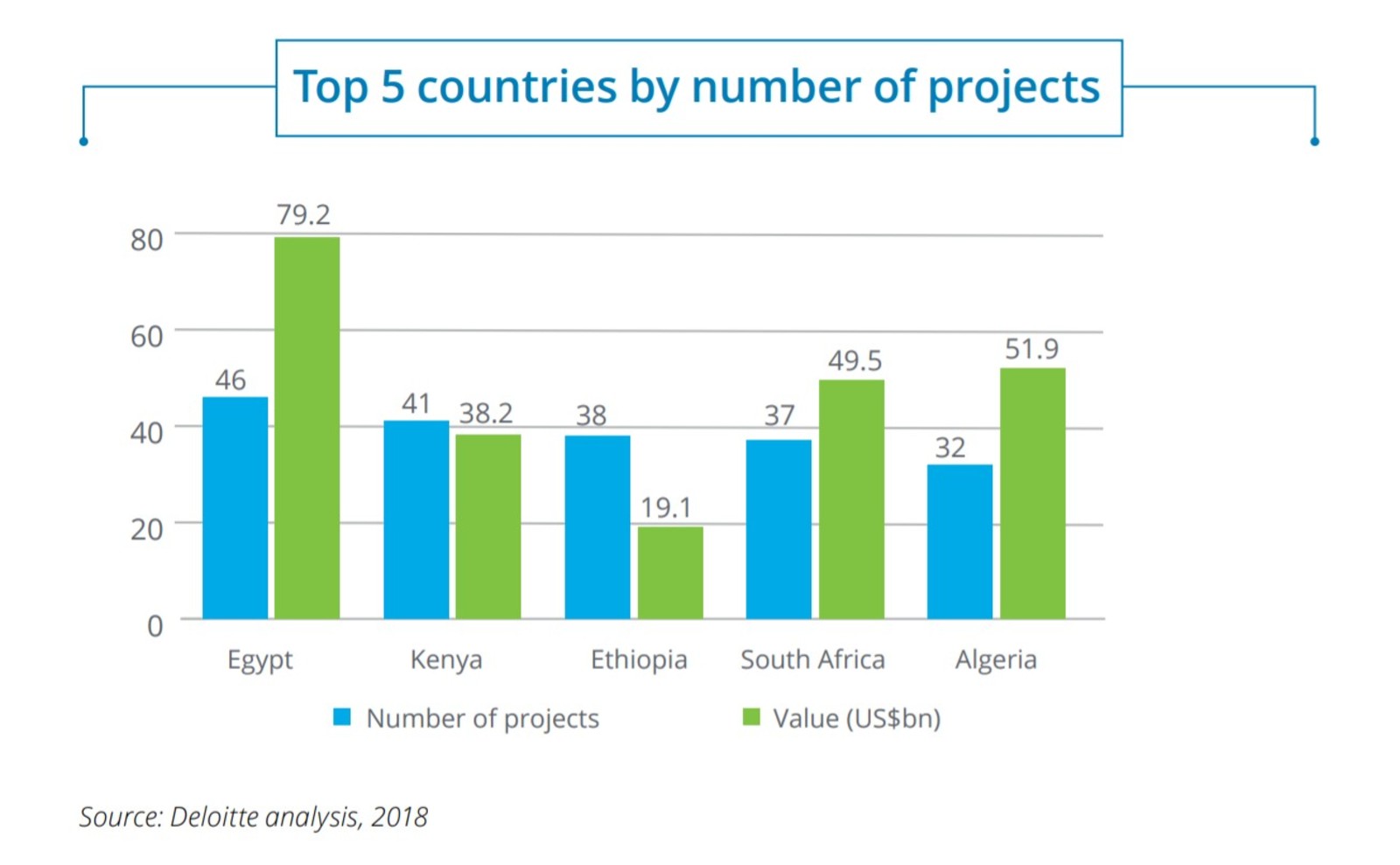

Egypt topped Africa in the number and value of construction projects within a single country in 2018,according to Deloitte’s Africa Construction Trends Report (pdf), which looks at industry trends at the levels of continent, region and country. The report says Egypt saw a total of 46 projects, comprising 9.5% of the total number of projects in Africa during the year, at a total value of USD 79.2 bn (17% of the total value of projects on the continent).

Egypt’s projects are among the driving forces of sectoral growth in North Africa: The Tahrir Petrochemical Complex — expected to be the largest petrochemical complex in the Middle East — and the Dabaa nuclear plant are two of the most prominent projects in North Africa. Both are driving growth, the report says, with Dabaa being the largest project on the entire continent. North Africa in fact saw the greatest change in the number and value of projects of any region in Africa in 2018, with a 172.5% increase in projects, and a 92.3% increase in their total USD value.

Throughout Africa, China is playing a greater role: The economic relationship between China and North Africa in particular continues to grow as part of Beijing’s Belt and Road Initiative, with Egypt “leading Sino-North Africa bilateral relations,” the report says. Chinese investors are showing particular interest in the Suez Canal Economic Zone, the TEDA industrial zone in Ain Sokhna, and the port of Alexandria. Although governments continue to fund the largest share of projects across the continent, China funds almost one in every five and is also the most prolific state builder of projects.

Deja vu: Damietta LNG plant to reopen in 3Q2019? The Damietta liquefaction plant will reopen by the end of 3Q2019 after being offline for the past six years, an unnamed oil industry source tells Youm7. The facility, which produces around 5 mn tonnes of liquefied natural gas per year when operational, has been closed amid a long-running dispute between the Egyptian government and operator Union Fenosa Gas (UFG).

We’ve heard this one before: An oil ministry source said back in February that the plant would reopen in April following an agreement with UFG. This was proved wrong just two days later when UFG publicly denied reaching a settlement. Then last month Eni (a joint partner in UFG with Union Fenosa) said that the facility should open “soon this year”, and another source claimed that the facility would be operating at full capacity by 4Q2019. For the latest claim to be realistic, there needs to be a resolution to the five-year UFG dispute within the next four weeks. Forgive us if we keep our eyebrows raised on this one.

STARTUP WATCH- Cairo-based startup Trolley has raised USD 200k in seed funding from a Kuwaiti investor, Menabytes reports. Founder and CEO Mohamed Abbas said that the seed funding will be put towards marketing efforts, developing the company’s website and app, and expanding the team. The company, which sells and delivers groceries in Cairo and Giza through a web platform and mobile app, was launched in January this year. It is now looking at expanding its operations to three more governorates by mid-2020, starting with Alexandria.

REGULATION WATCH- Gov’t issues exemption guidelines for those who are unable to pay for universal healthcare: The government has issued guidelines to determine who will not have to pay insurance premiums under the Universal Healthcare Act, Al Shorouk reported. Under the legislation, employees have to pay premiums equivalent to 1% of their salary, increasing to 3% to cover an unemployed spouse and a further 1% for each child. Citizens who receive aid from the Takaful and Karama social welfare programs will be exempt from paying premiums, as will families where the breadwinner is unemployed, disabled or has no other sources of income. Also included are citizens suffering as a result of natural or man-made disasters as well as individuals whose income does not meet their needs or their families.

EARNINGS WATCH- Orascom Construction profits drop 38% y-o-y in 2Q2019 to USD 31.3 mn, compared to USD 50.6 mn a year earlier, the company said in its earnings release (pdf). While net income was hit mostly by higher financing costs in Egypt during 1H2019, the company managed to reduce its debt at the end of 2Q, returning to a net cash position of USD 69.2 mn, compared to a net debt position of USD 78.6 mn at the end of 1Q.Revenues increased 5.3% y-o-y to USD 790.1 mn in 2Q2019, while consolidated EBITDA for 1H2019 rose 26.8% y-o-y. The MENA region comprised 73% of revenue in 2Q2019. Revenues from US operations declined compared to last year due to the completion of the large methanol plant in Texas in 2018.

OC’s consolidated backlog excluding BESIX increased 9.4% y-o-y to USD 4.6 bn as of 30 June 2019. Consolidated new awards increased 40.5% y-o-y to USD 934.7 mn in 2Q2019. Including the group’s 50% share in BESIX, pro forma backlog as of 30 June increased 19.3% y-o-y to USD 7.3 bn. Pro forma new awards increased 49.4% y-o-y to USD 1.5 bn in 2Q2019. “This current backlog level comfortably provides us with sufficient revenue and profitability as we continue to pursue an exciting project pipeline across existing and new markets,” said CEO Osama Bishai.

MOVES- Hany Farahat (LinkedIn) has left his position as CI Capital’s chief economist and has been appointed as general manager and head of market intelligence at Banque Misr. Farahat joined CI Capital back in 2014, following a five-year spell as the head of client portfolio management at Beltone Financial. He also previously worked as an economist at the Investment Ministry, where he was part of the team driving investment, capital market, and financial reforms since 2004.

Administrative Control Authority gets new deputy: President Abdel Fattah El Sisi has appointed Amr Adel as deputy chairman of the Administrative Control Authority starting 24 August, AMAY reported.

CORRECTION- We picked up a MENA article yesterday that incorrectly said Ahmed El Bassiouny was appointed as the head of the Central Bank of Egypt’s economic research division, and that he would maintain his position of assistant sub-governor of the monetary policy division. El Bassiouny is sub-governor of both divisions. The story has been amended on our website.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

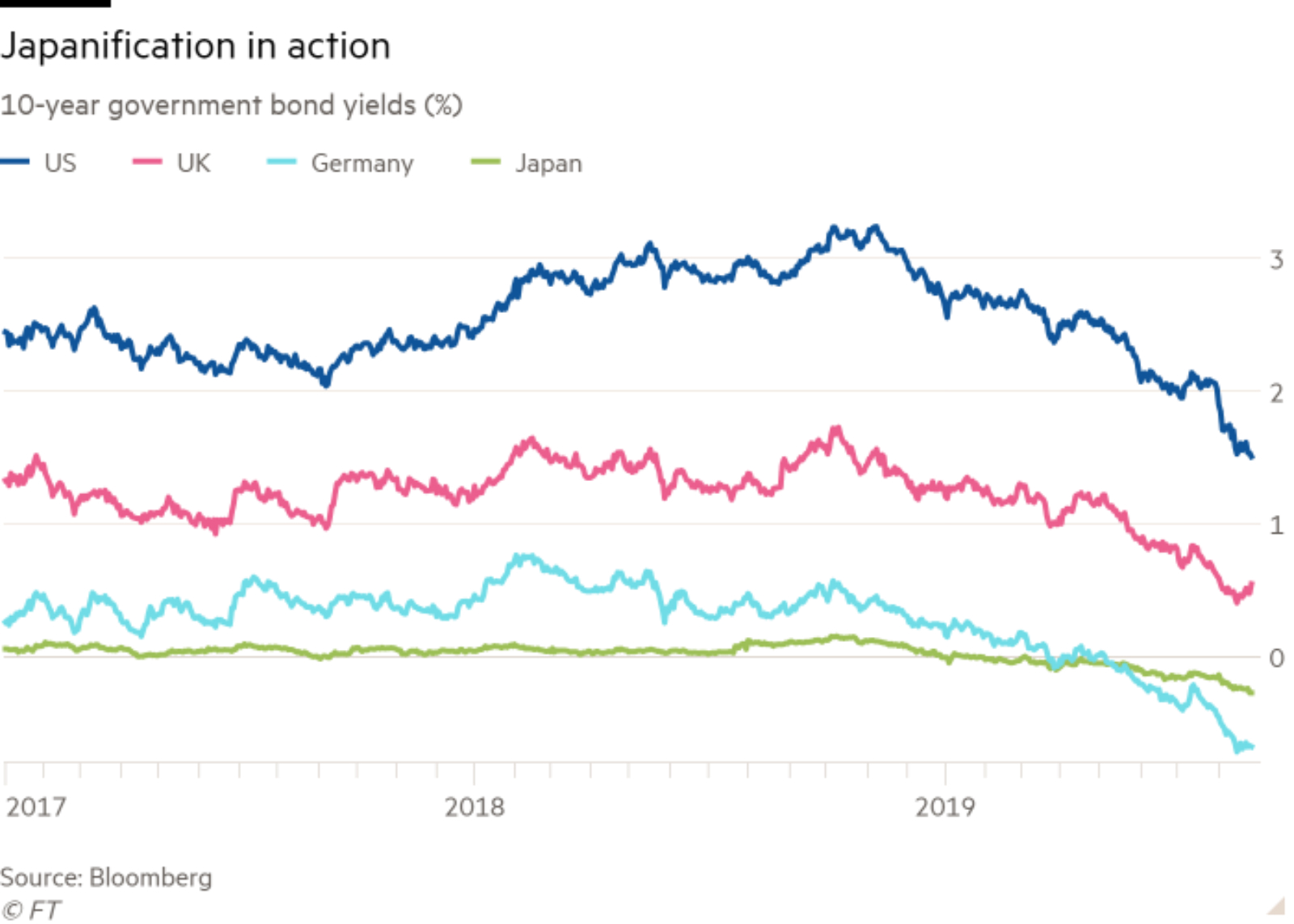

Is ‘Japanification’ going global? Economists are becoming increasingly concerned that the hallmarks of so-called ‘Japanification’ are spreading around the world, Robin Wigglesworth writes in the FT. Japanification refers to problems that have plagued the Japanese economy for the past three decades — negative interest rates, low inflation and weak growth — for which monetary policymakers are yet to find a solution. Now, other parts of the developed world are showing signs of undergoing a similar, perhaps irreversible transformation. Lisa Shalett, CIO of Morgan Stanley Wealth Management, frames the problem in terms of addiction. “You can get addicted to low or negative rates,” she said. “It’s very scary. Japan still hasn’t gotten away from it… The world is in a very precarious spot.”

Europe is increasingly resembling Japan. Negative yielding debt has soared in recent months, helped by the European Central Bank’s (ECB) deposit rate, which has been in sub-zero territory since 2014. The entire German and Dutch sovereign bond markets carry negative yields, while large parts of Spanish, Portuguese and Irish markets — countries, lest we forget, were embroiled in sovereign debt crises just a few years ago — are negative yielding. Inflation has remained stubbornly below the ECB’s target rate of just under 2% over much of the past six years, and fell to 1% for the first time since 2016 in July. And none of the central bank’s stimulus measures have made much of an impact either on inflation or GDP, which has continued to languish below 1% since the 2008 financial crisis.

Will “black-hole economics” cross the Pacific? Although the US has shown less symptoms of Japanification than the Eurozone — GDP has remained robust over the past two years, and sovereign yields are still above 1% across the market — there are signs that this may be beginning to change. Inflation is low, and the Federal Reserve may be about to embark on an extended easing cycle with the Federal Funds rate at only 2.25%. The threat of what former Treasury Secretary Larry Summers calls “black-hole monetary economics” in the US is now real. “Black-hole monetary economics is now the confident market expectation in Europe and Japan, with essentially zero or negative yields over a generation,” he said last weekend. “The United States is only one recession away from joining them.”

Egypt in the News

It’s another relatively quiet morning for Egypt in the foreign press, with no single story driving the conversation:

- Clerics are being dispatched to Sahel of all places to speak to young people on holiday as part of a government-mandated plan to “rejuvenate religious discourse,” Al Monitor reports.

- There are more than 3 mn tuktuks operating in Egypt, driven mostly by either children or young men who were unable to find other sources of income. VOA tackles the issue in a photo essay.

- Secret submarines: Israeli PM Benjamin Netanyahu secretly allowed Germany to sell Egypt two submarines in order to get a USD 500 mn discount on a German sub, Haaretz reports.

Worth Listening

Modern-day Egypt: Not purely the product of the literate elite. Historians often credit Egypt’s educated, literate upper class for molding the modern-day nation state between 1870 and 1930, and the common historical narrative tends to make a binary division between the literate elites and the uneducated majority. The reality was much more nuanced, argues Dr. Hoda Yousef in this episode of the Ottoman History Podcast (listen, runtime: 42:00). Various activities — what she terms “public literacies,” ranging from the use of scribes, to public newspaper readings, to the utilitarian use of reading and writing — fundamentally altered the social fabric and allowed topical issues, including protests and the status of women, to be a more visible part of Egyptian society at large.

Universal literacy as a force for good? It wasn’t always seen that way. Yousef draws on rarely accessed data, including handwritten scribal petitions, records of domestic mail and anecdotes of the period, as evidence that a much more diverse group was involved in nation building than merely the fully literate elite. Meanwhile, the legacy of this time period — a perennial preoccupation with literacy in the modern-day, universal, sense of the word — has since had a bearing on a huge number of social issues. These include Arabic’s instatement as the official language, the way it is taught in schools, the remnants of colonialism, and the degree to which the illiterate may now be denied agency within their own communities in a way they were not in the past.

Diplomacy + Foreign Trade

A Hamas delegation is in Cairo to discuss with Egyptian officials a ceasefire with Israel following a series of rocket attacks in the Gaza strip, according to the Times of Israel. A delegation from the Palestinian Islamic Jihad group is expected to attend the talks in the coming days as well.

Energy

Gupco to increase investments in Ras Shuqair

The Gulf of Suez Petroleum Company (Gupco) is planning to invest USD 1.2 bn over the next two years on exploration and development, according to the local press. This includes a USD 503 mn investment in Ras Shukeir, where the company plans to drill 13 new wells. Gupco was initially established as a joint venture between BP and the Egyptian General Petroleum Company. BP reached an agreement earlier this year to sell its shares in the company to Dragon Oil.

Egas issues tender for LNG cargoes

The Egyptian Natural Gas Holding Co (Egas) has issued a tender for three LNG cargoes for loading from the Idku gas liquefaction plant near Alexandria, two industry officials said, according to Reuters. The officials did not disclose the size of the cargoes. The tender closes on 28 August.

Vodafone Egypt looking to invest in renewable energy

Vodafone Egypt is looking to invest in renewable energy projects and smart technology in Egypt, CEO Alexandre Froment-Curtil said yesterday in a meeting with Electricity Minister Mohamed Shaker. The meeting comes in light of government efforts to push for renewable energy to cover 20% of the country’s needs by 2022 and over 42% by 2035.

Basic Materials + Commodities

Egypt mulls imposing anti-dumping tariffs on sugar imports

The government is considering imposing a 20% anti-dumping tariff on sugar imports for 180 days after receiving complaints from local producers of large stockpiles and slow sales, unnamed sources tell the local press. The government would impose the tariff in return for raising the procurement price of sugar cane and beet as requested by farmers.

Manufacturing

Industrial Complex to be built near Port Said

The Chemical and Fertilizers Exports Council is building a 250k sqm industrial complex in the Suez Canal Economic Zone, according to Masrawy. The council plans to earmark the entirety of the complex’s production output for exports. No further details were provided on the expected investments or timeline for the complex.

Health + Education

Africa Crest Education plans to invest EGP 800 mn to build two schools in Egypt

Dubai-based Africa Crest Education Holdings (ACE) is planning to invest EGP 800 mn to build two schools in Egypt, Al Mal reported. The schools include one in the new administrative capital that will open its doors to 2k students at the start of the 2020/2021 academic year, and another in Capital Group’s Al Burouj project east of Cairo, which will open in 2H2020.

Health startup Hospitalia looking to expand beyond Cairo

On-demand home healthcare service platform Hospitalia aims to expand to Giza this year and to the Alexandria and Delta regions by 2021, said founder Mohamed Maamon. The company also plans to release an app on Android at the beginning of 2020, he said. Hospatalia will be competing at seed-stage startup competition Seedstars Summit in Switzerland next year, after winning the Cairo round of the global competition. Hospitalia could land USD 500k in equity investments and other awards at the competition.

Automotive + Transportation

White taxis are launching their own ride-hailing app

White-taxi drivers are launching their own ride-hailing app, developed by an Egyptian company, in October, Taxi Drivers’ Union head Mahmoud Abdelhamid tells the local press. White-taxi drivers were supposedly launching this very same app back in 2016 at the height of their complaints over the growth of ride-hailing apps Uber and Careem. The Ride-Hailing Apps Act, which was passed in 2018, required ride-hailing companies to incorporate white taxis into their fleets.

Revolta to invest EGP 60 mn in EV charging stations in Upper Egypt

Revolta is planning to invest EGP 60 mn to install electric vehicle (EV) charging stations in Upper Egypt, chief of business development Ezz El-Din Ibrahim said at a presser on Monday, according to local news. Revolta CEO Mohamed Badawy had said earlier this year that the company is planning to install EGP 100 mn-worth of EV charging docks by the end of 2020.

Belarus’ MAZ to assemble natgas, diesel-run buses in Egypt

Belarusian state-run automotive manufacturer Minsk Automobile Plant (MAZ) has signed an agreement with the Egyptian Automotive Manufacturing Company (EAMCO) to locally assemble natural gas and diesel-fuelled buses, according to Masrawy. MAZ is expected to source 60% or more of the components for the buses from Egypt.

Banking + Finance

Middle East Glass Company may receive loan of USD 100 mn from IFC

The Middle East Glass Manufacturing Company (MEG) is in talks with the International Finance Corporation (IFC) over a USD 100 mn loan to refinance some of its debts and finance its capex plans, the IFC said in a disclosure. MEG is also expected to contribute USD 26 mn from internal cash generation, bringing the total amount of financing to USD 126 mn. The company will then use USD 67 mn to refinance its debt and USD 59 mn for capex, which includes “three major furnace rebuilds, resource efficiency improvements and the operational streamlining of the cullet processing operation.”

Other Business News of Note

Global Telecom shareholders approve voluntary delisting from Egypt’s bourse

Global Telecom Holding (GTH) shareholders approved the company’s voluntary delisting during an extraordinary general assembly meeting on Monday, GTH said in a statement to the EGX (pdf). The company will buy back shareholders’ shares at EGP 5.08 apiece.

Egypt Politics + Economics

Egypt blocks two news websites after Huawei complains of attempted extortion

News websites Al Akhbariya and Al Sabah News have been blocked by the Supreme Council for Media Regulation following a complaint from Huawei, Al Masry Al Youm reports. Huawei accused the editor-in-chief Marwa Abu Zaher of extorting the company by threatening to publish false news unless they paid money. The council has claimed that the allegations have been substantiated, something that Abu Zaher has denied.

On Your Way Out

Doctors start social media campaign for better wages: Egyptian doctors and researchers have created a Twitter hashtag to protest against “deteriorated living and working standards” and call for salary increases, BBC Arabic reports. Participants are urging the government to amend regulations to increase their salaries in a way that fits their educational role and social status.

Authorities are looking into equipping Giza Zoo with waste-to-energy plants, according to Afrik21. The plants would produce 100 cbm of biogas per day from animal waste, and cost around EGP 300-400k.

The Market Yesterday

EGP / USD CBE market average: Buy 16.49 | Sell 16.61

EGP / USD at CIB: Buy 16.50 | Sell 16.60

EGP / USD at NBE: Buy 16.50 | Sell 16.60

EGX30 (Tuesday): 14,283 (-0.1%)

Turnover: EGP 1.1 bn (83% above the 90-day average)

EGX 30 year-to-date: +9.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.1%. CIB, the index’s heaviest constituent, ended down 0.4%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 2.7%, Orascom Development Egypt up 2.5%, and Madinet Nasr Housing up 2.2%. Yesterday’s worst performing stocks were Egyptian Resorts down 4.6%, KIMA down 2.3% and CIRA down 2.2%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -154.9 mn

Regional: Net long | EGP +72.8 mn

Domestic: Net long | EGP +82.1 mn

Retail: 37.7% of total trades | 39.1% of buyers | 36.3% of sellers

Institutions: 62.3% of total trades | 60.9% of buyers | 63.7% of sellers

WTI: USD 55.56 (+1.15%)

Brent: USD 59.51 (+1.38%)

Natural Gas (Nymex, futures prices) USD 2.20 MMBtu, (+0.05%, September 2019 contract)

Gold: USD 1,553.40 / troy ounce (0.10%)

TASI: 8,285.54 (+0.34%) (YTD: +5.86%)

ADX: 5,130.75 (+2.67%) (YTD: +4.39%)

DFM: 2,751.29 (+0.82%) (YTD: +8.76%)

KSE Premier Market: 6,527.00 (-0.01%)

QE: 10,008.80 (+2.26%) (YTD: -2.82%)

MSM: 3,954.46 (+0.70%) (YTD: -8.54%)

BB: 1,536.99 (+0.41) (YTD: +14.94%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

30 August / 1 September (Saturday or Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8 September (Sunday): The Supreme Administrative Court has postponed appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets after two judges resigned from the panel, Mubasher reported

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9 September (Monday): Japan Arab Economic Forum, Nile Ritz Carlton, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.