- A US recession could be in the cards as markets resume sell-off. (Speed Round

- Zohr natural gas output triples to 11.3 bcm in 1H2019. (Speed Round)

- Yesterday’s earnings releases weren’t altogether positive. (Speed Round)

- Libya isn’t happy with our Foreign Ministry. (Diplomacy + Foreign Trade)

- The US-China trade deficit continues widening … in China’s favor. (Worth Watching)

- Stop bingeing your favorite TV shows. (Worth Reading)

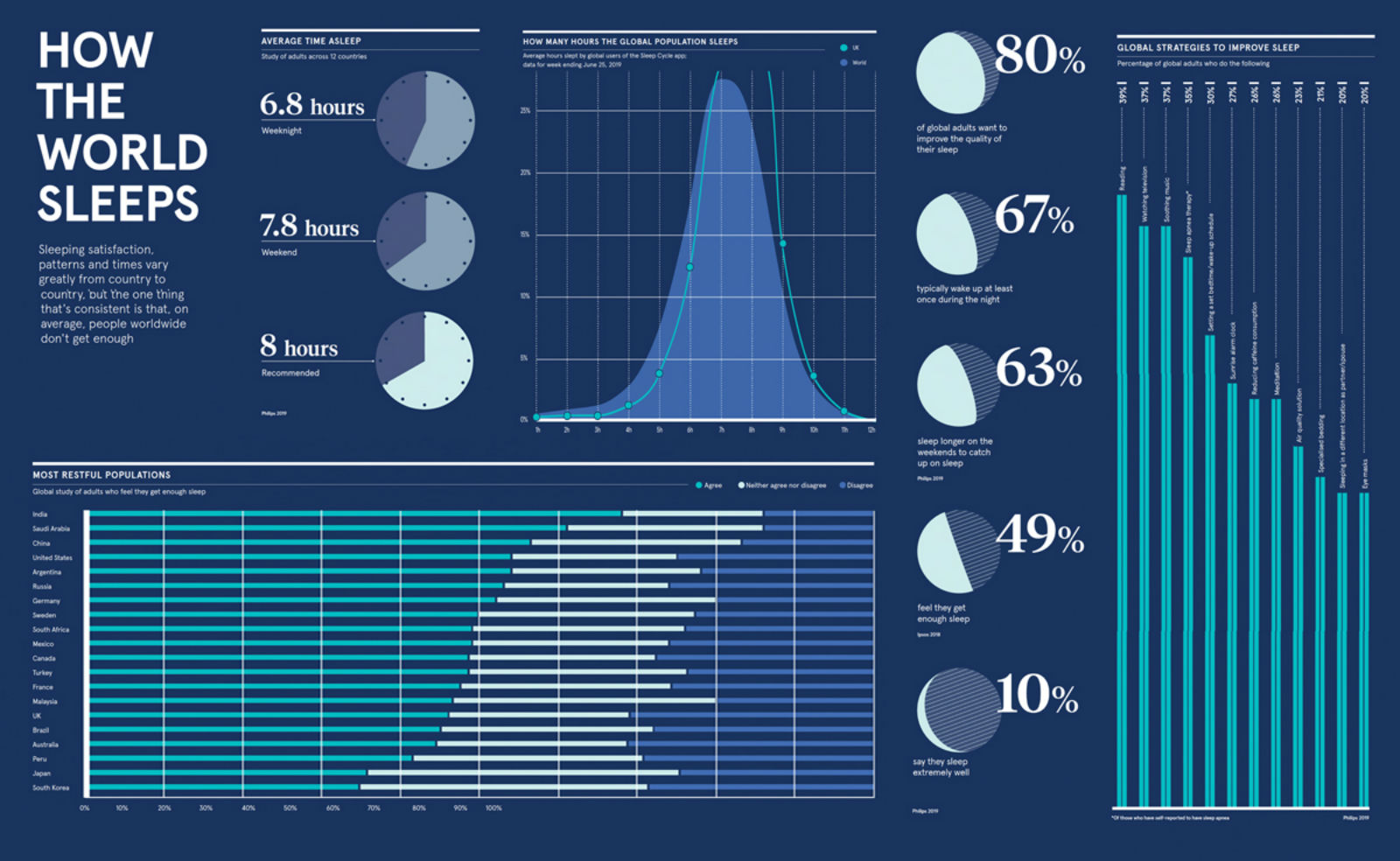

- The world isn’t getting enough sleep. (Image of the Day)

- Zahi Hawass gets big screen treatment at NYC’s Times Square. (On Your Way Out)

- The Market Yesterday

Thursday, 15 August 2019

Global stocks slide as US recession fears grow.

TL;DR

What We’re Tracking Today

Screenshot this morning’s tldr: You are looking at what is perhaps the slowest news day Enterprise has ever encountered. Luckily — or rather unluckily, depending on which way you look at it — international events are giving us a lot to talk about.

We’re exactly one week away from the Central Bank of Egypt’s next Monetary Policy Committee meeting. Whether or not the MPC decides to move ahead with a rate cut remains unclear: Last month’s inflation readings could give the central bank some breathing room to cut rates, but macro conditions — including Argentina’s historic stock market crash earlier this week — could push the CBE to hold off on resuming its easing cycle until the storm has passed.

And if yesterday’s anything to go by, the CBE might be wise to hold fire: The bond markets sounded the alarm for an oncoming US recession yesterday as poor data out of Germany and China heightened fears of a global slowdown. Global financial markets closed in the red, as the dreaded inverted yield curve in US treasuries reared its ugly head. We cover yesterday’s events in detail in this morning’s Speed Round, below.

Concerned about the whole ‘negative yield’ situation everyone is talking about in the financial press? So is Neil Macdonald, writing in Canada’s CBC. Macdonald reacts — as everyone watching the markets rightly should — with incredulity to the increasing numbers of investors paying to hold sovereign and corporate debt. And he asks an unnerving question to which very few people at the commanding heights of the global economy seem to have an answer: what, exactly, is the plan for when the next global downturn fully unfolds? The world’s systemic central banks have very little room to cut interest rates while remaining in positive territory. And if a move towards widespread negative rates is indeed the plan, just how low can they go before people begin pulling money out of the banking system? “We are in unknown territory, out past the “here be monsters” sign. None of us has any idea how this will turn out, economists included,” he writes ominously.

Putting negative rates in perspective: The FT is out with a series of charts illustrating the current state of play with central bank policy rates.

Deflation in Abu Dhabi accelerates in July: The deflationary trend in Abu Dhabi entered its second month in July after consumer prices fell 1.4% y-o-y, Bloomberg says. This is the biggest drop for at least four years, and the sixth in the past seven months. Falling housing, water and electricity prices were primarily responsible. “In the foreseeable future, it is hard to see the housing sector bottoming out, given current market conditions,” Mohamed Bardastani, senior economist at Oxford Economics, told Bloomberg. “A mismatch in the supply and demand curve and weak employment numbers have weighed down on housing prices, and that is the case in both Dubai and Abu Dhabi.”

Saudi Arabia will need to push for more substantial production cuts at the December Opec+ meeting amid a sustained slump in oil prices, David Sheppard writes in the FT. The stakes for the kingdom are high: prices need to exceed USD 60 a barrel if state oil giant Saudi Aramco is to come close to reaching USD 2 tn when its long-awaited IPO takes place. To do this another 1 mn barrels a day — approximately 1% of the global supply — will need to be removed from the market. And as 2020 is due to bring both a global oil surplus and a promise from Donald Trump to slash prices as part of his electoral campaign, the window for action is rapidly closing.

Silicon Valley VC meets traditional private equity: Japan’s SoftBank is preparing to host a meeting between its Vision Fund portfolio companies next month in the hopes of creating an “ecosystem” of tech companies, the FT says. The strategy — part Silicon Valley venture capital, part private equity — aims to increase collaboration between portfolio companies to boost growth and returns. The USD 100 bn Vision Fund, launched back in 2017, is comprised of various tech companies operating across seven different sectors.

Surprising to absolutely noone: Chinese tech giant Huawei is assisting African governments to spy on political rivals, a Wall Street Journal investigation has shown. The technology company, the most prominent in Africa, allegedly hacked into devices owned by political opponents of the Ugandan and Zambian governments, allowing them to intercept encrypted communications and track their movements. “The big question has been whether Chinese companies are just doing this for the money, or whether they’re pushing a specific kind of surveillance agenda,” digital surveillance expert Steven Feldstein said.

What are the chances of Huawei surveillance in Egypt? Egypt is one of the 13 African governments to purchase surveillance equipment from the company, in addition to hosting a Huawei office. Egypt also joins South Africa as the only two countries to be working with the company to install 5G infrastructure. Little is known about the extent of Chinese surveillance in the country, with the WSJ’s investigation shedding little light on countries outside Uganda and Zambia.

China ratchets up rhetoric on Hong Kong protests: Protests in Hong Kong have reached “near terrorism,” the Chinese government said yesterday after demonstrators attacked people they accused of being government sympathizers, Reuters reported. The US has warned travelers visiting the city after 10 weeks of violence have led to the country’s worst political crisis since 1997. A Chinese spokeswoman also accused US House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell of inciting further unrest, CNBC noted.

In international miscellany:

- Tunisia approves 26 candidates for September election: Tunisia’s electoral commission has whittled down a list of 71 applicants to stand in the 15 September presidential election to just 26, France24 reports. Prime Minister Youssef Chahed, former PM Mehdi Jomaa, and VP of Ennahda Abdel Fattah Mourou are among the approved candidates. The vote takes place after the death of the country’s first democratically-elected president Beji Caid Essebsi last month.

- Iran and the UK are close to resolving the tanker spat: Talks between Iran and the UK over the release of an Iranian tanker detained in Gibraltar last month are making progress, sources familiar with the talks told the Wall Street Journal. An agreement could pave the way for Iran to also release a UK tanker it seized in the Strait of Hormuz, and dial back tensions between the two countries.

- Kashmir crackdown: Indian prime minister Narendra Modi’s brazen crackdown in Kashmir is symptomatic of an increasingly anarchic international system whose rules are now routinely flouted by the world’s most powerful countries, David Gardner writes for the Financial Times.

Enterprise+: Last Night’s Talk Shows

Talk shows remain on hiatus as the talking heads enjoy the final days of the Eid vacation. Don’t worry though: we’ll be back with our regular coverage on Sunday.

Speed Round

Speed Round is presented in association with

US recession indicator flashes red as weak economic data triggers global stock sell-off: Financial markets recoiled yesterday as poor German and Chinese data provided further evidence of a global economic slowdown. US and European equities were slammed while a bond rally in the US pushed yields on 10-year treasuries below two-year rates for the first time since 2007, raising fears of a US recession.

Germany is on the cusp of a recession: The German economy contracted in the second quarter as domestic manufacturers struggled to cope with declining global conditions. Data released by the Federal Statistics Bureau yesterday showed that output fell by 0.1% quarter-on-quarter from 0.4% growth in the first quarter of the year. Poor data from the country’s export-dependent industrial and manufacturing sectors had raised fears of an oncoming recession in recent weeks as global trade disputes continued to escalate. Manufacturing PMI fell to seven-year lows last month, and industrial output contracted unexpectedly by 1.5% in June. “[Yesterday’s] GDP report definitely marks the end of a golden decade for the German economy, ING analyst Carsten Brzeski told Reuters. “Trade conflicts, global uncertainty and the struggling automotive sector have finally brought [it]… down on its knee.”

China industrial output hits 17-year low: Industrial growth in China fell to levels not seen since 2002 in July, official data showed yesterday. Figures published by the National Bureau of Statistics revealed that industrial growth fell to 4.8% y-o-y in July, down from 6.3% in June. Analysts said that the weak data points to falling demand across the broader Chinese economy, and some are now forecasting renewed stimulus measures. “The economy is going to continue to slow down. At a certain point, policymakers will have to step up stimulus to support infrastructure and property. I think it could happen by the end of this year,” Macquarie Group’s Larry Hu told Reuters.

US and European equities are in the red: Major US stock indices were down 3% at the close of play yesterday: both the Dow and the Nasdaq fell 3%, with the Dow shedding 800 points, and the S&P 500 fell 2.9%. European stocks fared slightly better — although that’s not exactly saying much: the German Dax lost 2.2%, and both the Euro Stoxx 50 and the French CAC 40 sank 2%. The sell off spread to Asia in the early hours of this morning, with all major indices down at least 1.3% as of 04:00 CLT. “Investors are increasingly selling first and asking questions later,” Alec Young, managing director for global markets research at FTSE Russell, told Bloomberg. “The only thing seemingly capable of reversing the volatility is credible evidence global growth is bottoming out. That seems too much to hope for right now.”

The bond market is now signalling a US recession: The US treasury yield curve inverted for the first time since 2007 yesterday as investors seeking safe haven assets caused the yield on US 10-year treasuries to fall below the two-year rate. The yield on 10-year notes fell to 1.623% early in the day, below the 1.634% rate on two-year bonds, before recovering later on, according to CNBC. The rate on 30-year bonds also fell to a record low of 2.02%. The curve between two-year and 10-year bonds has proven to be an accurate predictor of recessions in recent history, becoming inverted before almost every recession over the past 50 years.

But not this time, says Yellen: Former Fed chair Janet Yellen tried to calm market fears yesterday, telling Fox Business Network that an inverted yield curve does not guarantee a recession. “Historically, it has been a pretty good signal of recession, and I think that’s when markets pay attention to it, but I would urge that on this occasion it may be a less good signal,” she said. “The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields”

Global banks are being hit hard: MSCI’s total return index of developed market bank stocks plummeted to near-record lows against the wider benchmark yesterday as inverted yield curves in the US and UK raised investor fears that banks will begin restricting credit, Bloomberg reports. “Bond yields are pricing in Armageddon,” said Roelof Salomons, chief strategist at Kempen Capital Management NV. “The concern is that lower rates will keep economies and corporates afloat but such policy hurts banks’ profitability.”

And Trump has predictably weighed in on social media, once again aiming fire at US Fed chairman Jay Powell: “Our problem is not with China… Our problem is with the Fed. Raised too much & too fast. Now too slow to cut… Spread is way too much as other countries say THANK YOU to clueless Jay Powell and the Federal Reserve. Germany, and many others are playing the game! CRAZY INVERTED YIELD CURVE!”he haphazardly wrote on Twitter.

Zohr natgas output triples in 1H2019: The Zohr natural gas field produced some 11.3 bn cubic meters (bcm) in 1H2019 at the current rate of 68 mn cm/d or 2.4 bcf/d, Russian energy major Rosneft said yesterday. The field’s output has more than tripled during the first half of the year, from 3.1 bcm produced in 1H2018. Zohr is targeted to produce 76 mn cmd (at a rate of 2.7 bcf/d) by the end of 2019. Rosneft purchased a 30% stake in the field from operator Eni in 2017, and since then the state-owned company has increasing viewed it as a valuable resource in its expansion strategy and natgas production ambitions, says Reuters.

EARNINGS WATCH: Domty 2Q2019 net profits fall 35% y-o-y: Arabian Food Industries (Domty) reported 2Q2019 net income of EGP 37.5 mn, compared to EGP 57.7 mn a year earlier, the company said in a bourse filing (pdf). Revenues came in at EGP 646.8 mn, compared to EGP 693.4 mn during the same period last year.

Raya Holding for Financial Investments reported losses of EGP 24.7 mn during 2Q2019, compared to profits of EGP 1.3 mn a year earlier, the company said in a bourse filing (pdf). Revenues during the period were EGP 2.1 bn, compared to EGP 2.2 bn last year.

Cement producers Suez Cement and Tourah Cement make losses in 1H2019: Suez Cement reported a net loss of EGP 293.4 mn during 1H2019, compared to profits of EGP 238.3 mn during the same period a year earlier, the company said in a bourse filing (pdf). Revenues during the period fell 16% y-o-y to EGP 3.3 bn. Tourah Cement, which is 66.12%-owned by Suez Cement, reported a net loss of EGP 461.3 mn, compared to a loss of EGP 2.2 mn a year earlier, the company said in a bourse filing (pdf). Suez Cement suspended operations at Tourah Cement in May, citing “deteriorating financial results and the accumulated losses.”

B Investments reported net income of EGP 105.34 mn in 1H2019, down from EGP 112.08 mn during the same period last year, the company said in a bourse disclosure (pdf). B Investments is an active growth capital investor managed by BPE Partners.

Arabia Investment Holdings reported net income of EGP 31.62 mn in 1H2019, down from EGP 46.91 mn during 1H2018, according to the company’s earnings.

MOVES- Transport Minister Kamel El Wazir named Waleed Awad as head of the Damietta Port Authority, succeeding Tarek Shahin who will now head the Alexandria Port Authority, the ministry said in a statement.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

The world is getting fewer hours of sleep than it needs, according to this infographic by Raconteur based on the 2019 Philips Global Sleep Survey. People tend to sleep on average of 6.8 hours on weekdays and 7.8 on weekends, falling short of the recommended 8 daily hours. The world’s “most restful population,” according to survey respondents, is India, closely followed by Saudi Arabia, China, and the US. The Visual Capitalist has an interesting take on the graphic, which explores the importance of sleep, the science behind it, and ways to improve it.

Egypt in the News

There are no major stories dominating the conversation on Egypt in the foreign press this morning.

Stories worth a skim:

- Lingering effects of Rabaa: The 2013 Rabaa Al Adawiya dispersal continues to impact Egypt’s human rights situation six years after it took place, Amnesty International says. The Globe Post argues separately that the run-up to the dispersal opened the door for the “normalization of unprecedented levels of state violence and repression.”

- Crypto is coming? Launching an official cryptocurrency is one of the options on the table for the Central Bank of Egypt as it looks to respond to a wave of recent crypto innovations, David Awad writes for Al Monitor.

- All-in on the Orwell metaphor: Dissident journalist Osama Gaweesh provides an elaborate description of the current state of surveillance in Egypt for Newsweek.

Worth Reading

In the internet age of instant gratification, a return to pre-bingeing days could actually heighten our enjoyment of the TV shows we love: Recently released historical miniseries Chernobyl has drawn almost universal acclaim for the richness of its storytelling, but its depiction of the notorious 1986 nuclear meltdown is so vivid and gruesome as to make it impossible to binge, Tim Bradshaw writes in the FT. And although Netflix and other streaming platforms have built their business models on making viewer consumption as easy as possible, with the “bingeability” of a series being a sign of how good it is, watching Chernobyl in instalments actually enhanced Bradshaw’s appreciation of it, and his viewer experience as a whole, he continues.

What might this mean for streaming platforms? Psychological studies show that being able to delay gratification brings many long-term benefits, including a heightened appreciation of whatever it is you’re experiencing. As far as the battle for streaming primacy goes, Bradshaw advocates for an imaginative appraisal of the bingeing model, and how it could be altered — by adding a 24-hour time limit between episodes, for instance. “A new approach to scheduling could crank up anticipation for the next instalment or build the loyalty that comes with habit,” he says. Convenience may sell, but it seems there’s still room for a little innovation in how we satiate our appetite for entertainment.

Worth Watching

The US-China trade war: Not the story Trump wants to tell: Key data from the US-China trade war shows that, for all The Donald’s bluster about it being “a beautiful thing to watch,” the trade deficit continues widening … in China’s favor. China’s total surplus over the first seven months of 2019 alone was worth USD 168 bn, while in the first six months of the year, US exports to China slumped 21% (USD 33 bn), according to this FT video (watch, runtime: 2:08). Washington is preparing for a new round of negotiations in September, and this week delayed some of the new tariffs on Chinese goods by three months.

Diplomacy + Foreign Trade

Libyan High Council of State accuses Egypt of interference: Libya’s High Council of State issued a statement on Tuesday accusing Egypt of “blatant intervention” in Libyan affairs for supporting the rival House of Representatives based in the east of the country, according to the Libyan Express. The council said that this support violates UN resolutions that compel all countries to recognize the UN-backed Government of National Accord as Libya’s legitimate ruling body. Egypt’s Foreign Ministry issued a statement yesterday stating that the Tobruk-based House of Representatives “is the is the only elected institution in Libya, which is mandated to ratify any road map coming out of the Libyan crisis and to establish the constitutional rules for the organization of presidential and parliamentary elections.”

China looking to import dates from Egypt: China has finalized a protocol it hopes to sign with Egypt to begin importing dates from the country, China's economic and commercial counselor at the Chinese Embassy in Cairo Han Ping told Al Mal. The two countries are also in talks for Egypt to export pomegranate, honey and onions to China. The volume of trade between China and Egypt came in at around USD 13.8 bn in 2018, Ping said, adding that they’re looking to raise the number to USD 14-15 bn. Egyptian imports of Chinese goods accounts for the bulk of trade exchange between the two countries, with Egypt only exporting USD 1.8 bn-worth of goods to China last year.

Energy

Egypt plans to see some 50k cars converted to natgas-powered this year

The government is planning to have at least 50k car owners convert their vehicles to run on natural gas this year by installing dual-fuel natgas/gasoline engines, according to a ministry statement (pdf). The plan will see more refueling stations built across Egypt and new financial instruments to fund more conversions. State-owned Natural Gas Vehicles Company (Cargas) and Gastec, which will be providing the change service, will also make it easier for owners to cover the cost of the upgrade by requiring no down payments and offering flexible, simplified payment terms. Some 33k vehicles in Egypt converted to natural gas in 2018.

Infrastructure

Egypt’s ITDA to start building EGP 2 bn logistics zone in Qena next week

The Supply Ministry’s Internal Trade Development Authority (ITDA) is expected to break ground next week on a EGP 2 bn commercial and logistics zone in Qena, ITDA boss Ibrahim El Ashmawy said told Al Mal. The early phase of the zone will be developed by the United Company of Pharmacists, he said, without providing further details. We noted earlier this year that the zone will be the first in Upper Egypt, and is expected to be completed in three years.

Manufacturing

Talaat El Sagheer Steel to begin operations in its plant next july

Talaat El Sagheer Steel is planning to begin operations at its EGP 861 mn Upper Egypt factory next July with a production capacity of 300k tonnes per year, Chairman Talaat El Sagheer told the local press.

Banking + Finance

EGX restricts Medcap trading access as “preventive measure”

The EGX has restricted brokerage firm Medcap Securities’ access to the trading system and stock exchange services as “a preventive measure,” according to a statement. No further details were provided. Medcap was formerly known as Leaders Securities before changing its name in 2015. It is currently the 78th brokerage firm in Egypt in terms of market share, according to the EGX’s most recent brokerage league table (pdf).

Other Business News of Note

NUCA to conduct market studies before offering co-development land plots

The New Urban Communities Authority (NUCA) is conducting market studies before moving ahead with land tenders for the third phase of its PPP program, Housing Ministry officials tell the local press. The study will survey market players on plot sizes, locations and strategies to optimize returns, as well as decide the size of the offered plots. The third phase encompasses 20 land plots totalling 10k feddans in New Cairo, 6 October, New Alamein, and New Mansoura.

Sports

Egypt’s men youth handball team to play Iceland in quarterfinals after beating Slovenia

Egypt will play Iceland in the quarterfinals of the 2019 Men’s Youth Handball World Championship after beating Slovenia 30-23 yesterday, Youm7 reported.

On Your Way Out

Zahi Hawass comes to Times Square: A photograph of Egyptologist Zahi Hawass, replete in trademark blue jeans, shirt and Indiana Jones-style hat, will appear on the big screen of New York’s Times Square every two minutes for a month as part of a new tourism promotion campaign, Ahram Online reports. If Zahi’s charm isn’t bedazzling enough, the photo is accompanied by a message inviting Americans to visit Egypt.

The Market Yesterday

EGP / USD CBE market average: Buy 16.52 | Sell 16.64

EGP / USD at CIB: Buy 16.51 | Sell 16.61

EGP / USD at NBE: Buy 16.52 | Sell 16.62

EGX30 (Wednesday): 14,541 (+2.5%)

Turnover: EGP 1 bn (71% above the 90-day average)

EGX 30 year-to-date: +11.5%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 2.5%. CIB, the index’s heaviest constituent, ended up 2.5%. EGX30’s top performing constituents were Ezz Steel up 7.3%, Elsewedy Electric up 6.6%, and AMOC up 6.2%. Yesterday’s worst performing stocks were Cleopatra Hospital down 2.6%, Ibnsina Pharma down 1.0% and Egypt Kuwait Holding down 0.7%. The market turnover was EGP 1 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -99.3 mn

Regional: Net short | EGP -15.6 mn

Domestic: Net long | EGP +115.0 mn

Retail: 46.1% of total trades | 43.6% of buyers | 48.5% of sellers

Institutions: 53.9% of total trades | 56.4% of buyers | 51.5% of sellers

WTI: USD 54.80 (-0.78%)

Brent: USD 59.48 (-2.97%)

Natural Gas (Nymex, futures prices) USD 2.16 MMBtu, (+0.65%, September 2019 contract)

Gold: USD 1,529.40 / troy ounce (+0.10%)

TASI: 8,550.23 (+0.79%) (YTD: +9.24%)

ADX: 5,053.77 (-0.85%) (YTD: +2.82%)

DFM: 2,831.69 (-0.22%) (YTD: +11.94%)

KSE Premier Market: 6,742.10 (+0.35%)

QE: 9,675.54 (-1.62%) (YTD: -6.05%)

MSM: 3,861.51 (+0.60%) (YTD: -10.69%)

BB: 1,539.59 (-0.26%) (YTD: +15.13%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

17 August (Saturday): The High Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets. The hearing was postponed from 4 August.

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

1 September (Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule into the stock manipulation case, in which Gamal and Alaa Mubarak are involved in along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.