- British Airways, Lufthansa abruptly suspend flights to Cairo, citing “security concerns.” (Speed Round)

- The government unveiled the details of the long-awaited EGP 6 bn per year export subsidy framework. (Speed Round)

- Misr Italia is revisiting its IPO plans, suggesting Egypt’s IPO dry spell might be coming to an end. (Speed Round)

- In a world where investors are bucking African stocks for African debt, Egypt shines at both. (Speed Round)

- The European Union wants us to strengthen our natgas sector to help wean it off Russian gas. (Speed Round)

- An unexpected rate cut in South Korea set the tone for other EM central banks last week. (What We’re Tracking Today)

- The race to name the new administrative capital has officially begun. (What We’re Tracking Today)

- The entire Red Sea governorate could be a no-plastic zone soon. (On Your Way Out)

- The Market Yesterday

Sunday, 21 July 2019

British Airways and Lufthansa suspend Cairo flights

TL;DR

What We’re Tracking Today

We hate to open on a down note, but today’s news cycle will likely be dominated by British Airways and Lufthansa’s suspension of flights to Cairo due to what they described as “security concerns.” British Airways, whose lead was followed by the German airline, has so far remained tight-lipped on the nature of these concerns. We have chapter and verse in this morning’s Speed Round, below.

Tuesday will be off in observance of Revolution Day, blessing us with a mid-week break. The EGX and banks will be off, CBE sources tell MENA.

We also finally know when Eid Al-Adha will be: The waqfa falls on Saturday, 10 August and the first day of Eid will be Sunday, 11 August, sources from the National Astronomy Institute tell Masrawy. The vacation should run through Tuesday, but we’re expecting a fair number of people to bridge for a nine-day holiday.

The new administrative capital is finally getting a better name: The New Administrative Capital Company for Urban Development (NACCUD) has launched a competition for naming and designing a logo for the new capital. A cash prize of EGP 75k will be handed out to the winner, while the runner-up and third place will receive EGP 50k and EGP 25k respectively. The competition closes on 17 August, meaning that we may not be far away from finally naming the new capital. Check out the terms and conditions here.

Speaking of the new capital, that’s where the next youth conference on 30-31 July, Al Masry Al Youm reports. The last youth conference was held in July 2018.

In case you’ve been under a rock all weekend, Algeria took home the Afcon title on Friday evening after defeating Senegal 1-0 in a tense game at the Cairo International Stadium, Reuters reports. This is the second time Algeria have won the competition. You can watch the highlights here (watch, runtime: 3:05).

CAF crisis escalates: Under-fire Confederation of African Football (CAF) President Ahmad Ahmad has dismissed his deputy Amaju Pinnick as FIFA released its plans for reforming the trouble organization, Reuters reports. Ahmad, who is currently under investigation by the global body’s ethics committee for corruption, removed Pinnick because he was challenging him on multiple issues, sources said.

Shock South Korea rate cut caps week of emerging market easing: The South Korean central bank set the trend for other emerging market banks last Thursday after it made a surprise 0.25% cut to its benchmark interest rate, Reuters says. The Bank of Korea signaled that it may make further cuts if economic conditions do not improve. South Korea’s trade-dependent economy is currently being hit by a trade dispute with Japan and the continued uncertainty surrounding the US-China trade war. Indonesia, South Africa and Ukraine all made 25-50 bps cuts when their respective governing boards met last Thursday.

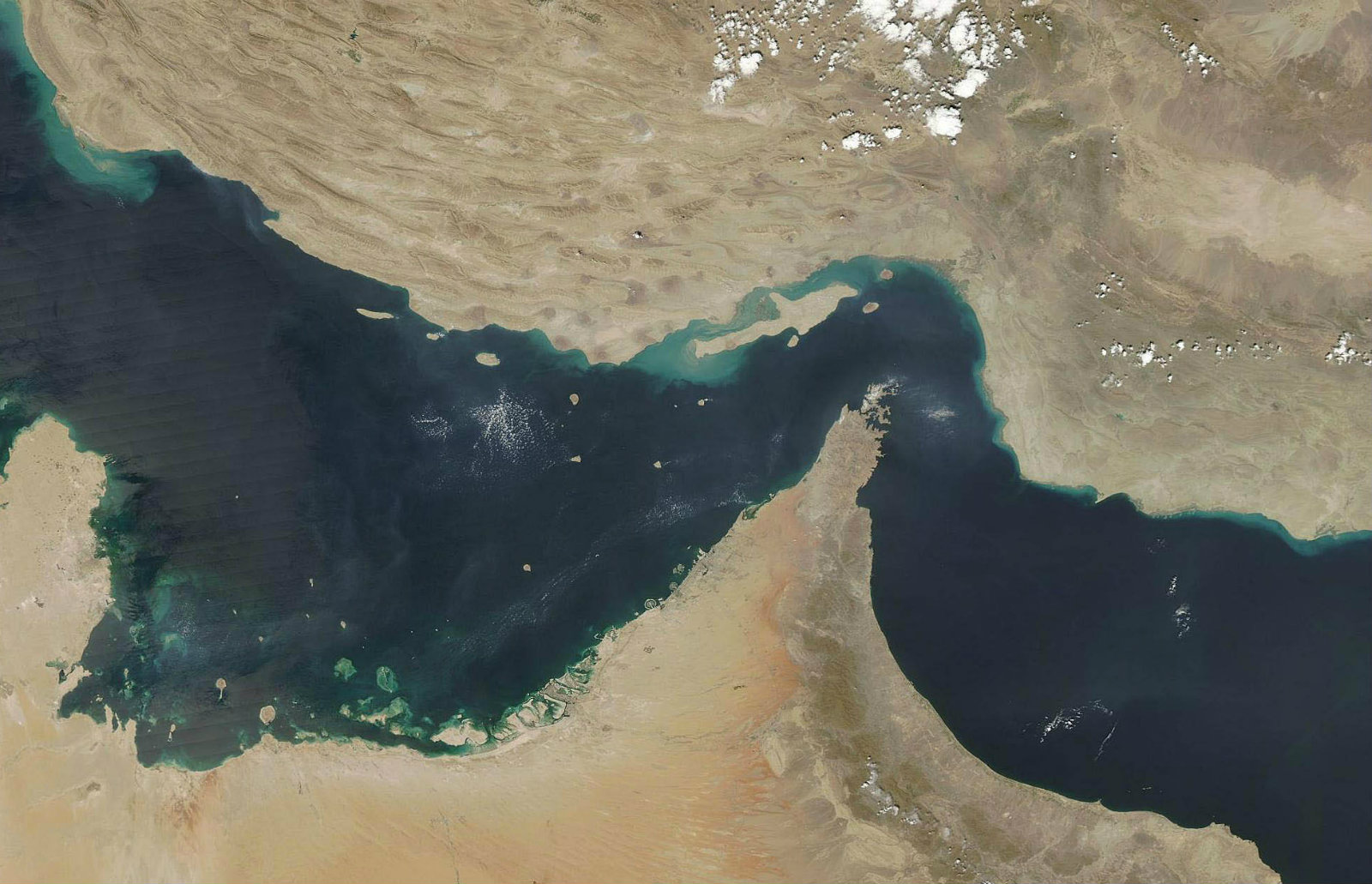

Another day, another provocation in the Arabian Gulf: Iranian forces have detained a UK-flagged tanker as it was passing through the Strait of Hormuz, Bloomberg reports. The seizure of the ship comes in response to the capture of an Iranian ship by British forces in the Mediterranean a few weeks ago. The UK foreign office has demanded that Iran release the ship immediately, threatening “serious consequences” if it does not comply.

Make it a double: The US claimed that it shot down an unmanned Iranian drone in the Gulf on Thursday, the New York Times reports. Iran denied the accusation, and released footage that it says proves that the US did not destroy the drone, the BBC says. All of this came just a few hours after Iranian Foreign Minister Mohamed Javad Zarif offered to permanently allow inspections of its nuclear facilities in return for a lifting of US sanctions, the Guardian reports.

Could the conflict trigger a global recession? It’s a no-brainer that all this tension can’t be good for commodity prices, but Bloomberg says a prolonged conflict “could help tip the U.S. and global economies into recession and even accelerate the worldwide move away from fossil fuels.” Oil prices could also jump to USD 100 a barrel in the immediate wake of a full-out war, but “some resilience of exports from the region” would help adjust prices to USD 80 per barrel, says Ken Medlock, a senior director at Rice University’s Center for Energy Studies in Houston.

Enterprise+: Last Night’s Talk Shows

The airwaves didn’t offer us any significant business-related stories last night, but the talking heads had plenty to keep them busy throughout the evening.

Are Schengen countries getting stricter about which country issues our visas? Not really: Everyone is required to get their Schengen visa from the country they plan to enter first, Foreign Ministry spokesperson Ahmed Hafez explained to a panicked Amr Adib. The host apparently received phone calls from several Egyptians who were denied entry into some European countries for trying to enter with a visa for a different country (watch, runtime: 07:36). The ministry had also issued a statement earlier yesterday reiterating these rules (which, as far as we know, have always been in place).

We can’t believe this is even a debate in 2019: El Hekaya and Masaa DMC both had the story of a 15-year-old girl who is currently behind bars pending an investigation into her stabbing of a man she said was trying to [redacted] assault her (watch, runtime: 15:27 and runtime: 01:51).

We know we lost the Afcon tournament … but let’s appreciate the good organization: Hona Al Asema focused on the success of Tazkarty, an online platform that fans used to buy their tickets, while Al Hayah Al Youm’s Lobna Assal praised the organization of the championship in such little time, paying special attention to how safe the matches were (watch, runtime: 38:22 and runtime: 34:58).

It’s been 20 days since the universal healthcare system was launched in Port Said, and Hona Al Asema aired a report on how that’s turning out so far (watch, runtime: 12:37).

Speed Round

Speed Round is presented in association with

British Airways, Lufthansa abruptly suspend flights to Cairo, citing “security concerns”: British Airways decided yesterday to suspend for seven days its flights to Cairo “as a precaution to allow for further assessment” of security arrangements, the airline said in a statement, according to Reuters. Three sources from Egypt’s airport security told the newswire that “British staff had been checking security at Cairo airport on Wednesday and Thursday,” but did not provide further details. Lufthansa followed suit with a one-day suspension of its flights to Cairo from Munich and Frankfurt yesterday, saying it would resume flights again today, according to the newswire.

British gov’t didn’t order the suspension, but did raise threat level in Egypt travel advisory: Egypt’s Civil Aviation Ministry said in a statement yesterday that the British airliner’s decision to suspend flights was not ordered from the British foreign or transport ministries. However, the Foreign & Commonwealth Office updated its travel advice on Egypt to say that there is “a heightened risk of terrorism against aviation.” The Civil Aviation Ministry also said it would arrange additional flights from Cairo to Heathrow airport in London to accommodate travelers’ plans.

Lest you need a reminder, the UK’s ban on flights to Sharm El Sheikh is still in place since it was imposed in 2015 following the Russian Metrojet crash. Last we heard on the matter, British Prime Minister Theresa May said in February that the ban was still “under review.”

The story is picking up steam in the foreign press, with the Financial Times, Bloomberg, the Associated Press, Huffington Post, Sky News, BBC, and of course British tabloids including the Daily Star and Metro all taking note.

Maybe not related, but probably also not helping matters: Public Health England issued a statement last week warning travelers heading to Hurghada about E. coli infections, which has reportedly affected “a number of people, including children” who traveled to the Red Sea town.

Gov’t unveils new EGP 6 bn per year export subsidy framework: The government unveiled the details of the long-awaited new framework for disbursing export subsidies. The new framework would disburse EGP 6 bn per year in export subsidies through the Export Subsidies Fund starting from FY2019-20, according to a statement by the fund released on Thursday (pdf). Some EGP 2.4 bn (or 40%) of the EGP 6 bn will be disbursed as a cash payment to exporters, the Export Subsidy Fund’s board said upon ratifying the framework. 30% of the annual disbursement, or EGP 1.8 bn, will be doled out through tax breaks and cuts to payments owed to the Finance Ministry. The remaining EGP 1.8 bn will be spent by the fund to “build up Egypt’s export capacities.” This would mean funding to developing facilities as well as promoting Egypt’s exports abroad, the statement goes on to explain.

You get bonus points if you raise exports, export to Africa, or are an SME: Corporations and medium-sized companies that raise their exports by 20-30% y-o-y will see their export subsidies raised by 15-30%. Small enterprises that have managed to increase their exports 20-30% can expect a 20-30% increase their annual allocation of export subsidies. The fund will continue to set aside an additional EGP 40 mn in subsidies to those exporting to Africa, the statement says.

Conditions: To benefit from these incentives, exporters need to source 40% of their production inputs domestically, the ministry said.

The program has the endorsement of a number of Egypt’s business associations, including the Federation of Egyptian Industries, the statement assured.

Mechanism for payment of overdue subsidies yet to be clarified: While the statements give us clarity on how the fund will run moving forward, it provides very little detail on the mechanisms for how outdated and overdue export subsidies are to be paid. Here’s what we know: The government is currently making the determination on how much export subsidies are due on a sector-by-sector basis, said Trade and Industry Minister Amr Nassar. The Finance Ministry is planning to publish a detailed accounting of what is owed by the government before settling up with the Export Subsidies Fund, Minister Mohamed Maait said. The statement also implied that the fund will set up an electronic platform to facilitate the red tape in applying for overdue export subsidies. We had noted reports on Thursday that the Madbouly Cabinet had approved a mechanism for repayment, whereby exporters could receive discounts on their obligations to the electricity, oil, and investment ministries and claim redeemable IOUs from the Finance Ministry.

IPO WATCH- Misr Italia to complete procedures to list 25% on EGX in six months: Property developer Misr Italia is once again considering an initial public offering of up to 25% of its shares on the EGX, and is expecting to finalize all necessary procedures within six months, Chairman Hany El Assal told Al Mal on Wednesday. The company will soon begin the selection process for which investment bank will lead the offering. Misr Italia originally said that it would list 20-25% of its shares in April 2017, but the offering has been delayed for more than two years for unknown reasons.

Misr Italia expects to raise EGP 2 bn from the IPO: The company will use the proceeds to finance ongoing projects, including the EGP 20 bn Il Busco and EGP 10 bn Vinci compounds in the new capital. The company is also developing two “Kai” resorts in the North Coast and Ain Sokhna.

The company has been reluctant to finance its work through bank loans due to high interest rates, but has started probing this possibility to fund the commercial and service portion of its development in the new capital, El Assal told the newspaper yesterday. We noted earlier this year that the developer was in talks with unnamed local banks to arrange a EGP 1.5 bn loan, EGP 550 mn of which will be earmarked for the company’s Cairo Business Park in New Cairo.

In a world where investors are bucking African stocks for African debt, Egypt shines at both: With Egypt’s GDP growing at 5.6% in FY2018-19, the country is bucking the “anemic” economic growth witnessed by African peers, giving it a clear advantage as far as equity traders are concerned. South Africa’s output contracted the most in a decade in 1Q2019, and its key index dropped 1.4% since April, Bloomberg says, while Nigeria is struggling to recover since the collapse of oil prices five years ago. Excluding South Africa, African stocks trade at a forward price-to-earnings ratio of barely 9 based on estimates for the next 12 months, far below the emerging and frontier market average ratio of 12. By contrast, the EGX30 has risen 4.6% YtD.

Egypt remains the star in a burgeoning African debt market: Even when looking at an African bull debt market, Egypt remains the most attractive carry trade there is. “EGP bonds, which yield 16%, have made total returns of almost 8% over that period, extending their gain this year to 25%,” Bloomberg notes. Foreign holdings in Egyptian treasuries stood at USD 19.2 bn mid-June, Vice Finance Minister Ahmed Kouchouk said at a presser on Wednesday. South Africa’s debt is up 6.9% since the end of April and Nigeria’s 4.7%, the news information service says.

INVESTMENT WATCH- ‘Mystery’ UAE fund to invest up to USD 90 mn in Suez Canal logistics project: An as of yet unnamed UAE-based fund is planning to invest USD 70-90 mn on a logistics project in the Suez Canal, said Walid Hegazy, founding partner at Hegazy and Partners, which were hired to advise on the transaction. He told the local press on Thursday the investors have conducted the feasibility study on the project and are awaiting regulatory approvals. The project will look to service ships docking along the Suez Canal’s ports, he noted.

EU to provide Egypt with EUR 20 mn in funding to wean itself off Russian gas: The EU is planning to provide Egypt with EUR 20 mn in funding for its natural gas sector, according to statements by the EU delegation’s head in Egypt Ivan Surkos picked up by Al Mal. The funding would be weaved into a series of loans from the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), and a number of other financial institutions to the gas sector, Surkos said at the signing of a fuel bunkering agreement between the Oil Ministry and the port of Antwerp on Tuesday. “The new project, called EU for Energy, is a five-year project for capacity building, passing experience, and strengthening the expertise of Egypt in the gas sector,” Surkos told the local press.

The motive — EU sees East Mediterranean gas (and our prime position in it) as an alternative to Russian gas: Surkos revealed that the grand vision for the aid is to help the EU wean itself off of Russian gas, with the East Mediterranean gas reserves and Egypt’s position in it as an export hub being the most viable alternative. Establishing the East Mediterranean Gas Forum (EMGF) — founded in Cairo back in January to bringing together the gas markets of Egypt, Cyprus, Israel, Greece, and Italy — is crucial for the EU to lower its dependence on Russian gas, and the East Mediterranean gas will be a convenient alternative source of energy for Europe, Surkos said. “We will announce a certain financial support for the EMGF next week as a symbolic amount of funding to support the regional cooperation in gas and energy,” he added.

Protecting its investment — EU is planning measures to counter Turkey’s interloping: It looks like the EU will push through with measures designed to dissuade Turkey from drilling illegally off the coast of Cyprus. “It has been announced that the EU is going to suspend negotiations with Turkey about Comprehensive Air Transport Agreement,” said Surkos. “The European commission will request the EIB to review all projects which the bank is implementing in Turkey, as part of other decisions, to make Turkey stop its drilling activities off the coast of Cyprus,” he noted.

New EU funding also coming for electricity: The EU will announce new funds to strengthen Egypt’s electricity grid through connecting it with the renewable sources’ produced energy, Surkos is reported to have said.

ITFC to provide USD 50 mn in SME loans in 2020: The Islamic Trade Finance Corporation (ITFC) will channel a USD 50 mn facility through local banks to finance SMEs in January 2020, CEO Hani Sonbol told Masrawy, without revealing which banks the ITFC will be working with. This will be the first time the institution provides funding to Egyptian private sector businesses. Egypt signed two agreement with the ITFC last year to unlock a total of USD 3 bn in financing to purchase foodstuffs and petroleum products. State grain buyer GASC then secured a USD 1 bn tranche in January.

MOVES- Oil Minister Tarek El Molla has tapped Mohamed Radwan (LinkedIn) as co-head of the Egyptian General Petroleum Corporation (EGPC), according to Al Masry Al Youm. Radwan was formerly assistant general manager at Apache and EGPC JV Khalda Petroleum Company.

Image of the Day

We’re no fans of colonialism, but there’s no denying the grandeur, beauty, and sense of history offered by Egypt’s oldest hotels, originally designed as “virtual palaces that catered to the whims and fancies of Victorian-era travelers.” Pictured here is the beautiful indoor swimming pool of the Old Cataract in Aswan, one of Egypt’s most opulent establishments. This CNN feature gives a rundown of this and eight other hotels that still carry the traces of Egypt’s singular past.

Egypt in the News

The foreign press is squarely focused on British Airways and Lufthansa’s suspension of flights to Cairo. We have the full story in this morning’s Speed Round, above.

Other headlines worth noting in brief include:

- Pharaoh Tutankhamun’s coffin is set to be renovated for the first time its discovery in the 1920s, CNN notes.

- The Trump administration’s Mideast ‘Peace to Prosperity’ economic plan has been “foiled” by Egypt, Jordan and Saudi Arabia, said Palestinian Information Minister Nabil Abu Rudeineh last week, according to Asharq Al Awsat.

- Egyptian authorities intend to question eight men deported from Kuwait last week, believed to be members of the Ikhwan, who are reportedly set to stand trial in Egypt for the second time, the National reports.

- Egypt failed to capitalize on the financial and “soft power” opportunities afforded by Afcon, argue Ruth Michaelson and Nick Ames in the Guardian.

Diplomacy + Foreign Trade

Egypt, Jordan to set up logistics center in Mafraq: The Egyptian and Jordanian chambers of commerce will establish a logistics center in Jordan’s Mafraq Governorate bordering Iraq and Syria, Federation of Egyptian Chambers of Commerce head Ahmed El Wakeel said. The center will comprise storage facilities and a zone for customs clearance and will be run by a holding company in which the federations will partner directly with industry players and an international company specializing in managing logistics centers. This public-private shareholding structure will allow for revenue sharing. The move comes as part of an Egypt-Jordan-Iraq plan to cooperate on manufacturing, energy, infrastructure, and the post-war reconstruction of Iraq and Syria.

Rome conference to showcase Egyptian investment landscape: Rome will host an investment conference on Egypt soon to introduce Italian companies to prospects in the country, Al Masry Al Youm reported. The announcement came following a meeting between Internal Trade Development Authority head Ibrahim Ashmawy and a delegation from the Italian Confederation for Economic Development, headed by its president, Jose Romano.

President Abdel Fattah El Sisi met with Algeria’s interim President Abdul Qadir bin Saleh in Cairo on Thursday to talk trade and economic ties, according to an Ittihadiya statement.

Energy

Egypt’s NUCA, Saudi’s Fas Energy sign MoU to set up waste-to-energy facility in 10th of Ramadan

The New Urban Communities Authority (NUCA) has signed an MoU with Saudi-based Fas Energy to set up a waste-to-energy facility in 10th of Ramadan City, according to a Housing Ministry statement. No details were provided on the cost or capacity of the facility. NUCA will allocate a land plot to the Saudi company under a 25-year usufruct or leasing framework. We noted last October that the Fas has plans to invest USD 420 mn in solar and waste projects in Egypt, USD 325 mn of which were said to be earmarked for “waste recycling projects.”

Schneider Electric, General Electric awarded power transmission control center contracts

Schneider Electric and General Electric were awarded contracts to build four power transmission control centers under a tender issued by the Egyptian Electricity Holding Company (EEHC), sources told the local press. Schneider Electric will build three power transmission control centers in Cairo, while General Electric will build one in Alexandria, the sources said without disclosing details on the value of the contracts. The EEHC had issued a limited tender for three international companies to build five power transmission control centers across Cairo, Alexandria and the Suez at the end of last year.

Basic Materials + Commodities

Centamin raises Sukari gold mine output to 234k ounces in 1H2019

Centamin’s Sukari gold mine produced 117,913 ounces of gold in 2Q2019, bringing production in 1H2019 up to 234,096 ounces, the company said in its quarterly report (pdf) on Thursday. Centamin projects that it will hit its 2019 production target of 490,000 – 520,000 ounces at a cash cost of USD 675-725 per ounce.

Sugar imports down 10.2% in 1H2019, frozen meat imports up 11.5%

Egypt’s sugar imports declined by 10.2% y-o-y in 1H2019 to 116.4k tonnes, compared to 129.5k tonnes during the same period last year, the General Organization For Export & Import Control (GOEIC) said. Meanwhile, frozen meat imports grew 11.5% y-o-y in 1H2019 to 116k tonnes from 104k tonnes last year, GOEIC said.

Health + Education

Egypt’s first AI college opens in Kafr El Sheikh

Egypt’s first artificial intelligence (AI) college has opened at Kafr El Sheikh University and is accepting the first class of students this school year, Egypt Today reports. Admission will only be granted to students with strong academic performance in math.

Banking + Finance

Your Commercial Registry records will be made available to banks through iScore

The Supply Ministry has signed an agreement with the Federation of Egyptian Banks and credit ratings agency iScore that will open up the records of the Commercial Registry to banks through iScore, Supply Minister Ali El Moselhy said on Thursday, according to a ministry statement. The move was designed to strengthen customer measures by banks, Moselhy said. In other iScore news, three local and international companies have offered to set up a special system to digitally evaluate nano lending via phones, iScore boss Mohamed Kafafi told Al Mal.

Other Business News of Note

Cabinet looks to resolve Simo privatization dispute under dispute resolution committee

The Madbouly Cabinet’s dispute resolution committee began last week looking into the six-year dispute over the unwinding of the privatization of the Middle East Paper Company (Simo), Al Mal reports. Investors, the largest of whom is Al Ahly Financial Investment Management, are looking for EGP 500 mn in damages from a decision to reverse the privatization of Simo in 2013. The committee’s role in resolving such cases comes after the House of Representatives approved a law last month bringing these cases under its purview.

EFG Hermes to set up real estate private equity fund in 2020

EFG Hermes is planning to set up a real estate private equity fund next year with a number of unnamed real estate developers, EFG Hermes Group CEO Karim Awad said, according to the local press. The fund is part of the firm’s expansion plans over the coming few years, which will also see EFG begin to offer insurance services set up one or two non-banking financial services.

Ernst & Young wins tender in ABE technology upgrade project

Ernst & Young has won a tender to act as financial advisor to the Agricultural Bank of Egypt (ABE) in the bank’s development of its technology infrastructure, ABE Chairman El Sayed El Qasir told Masrawy. The bank is still in the market for a company to carry out the upgrade, and is currently working on the booklet of conditions for that tender, El Qasir said.

Egypt Politics + Economics

Registering newborns into the commodity subsidy system could see budget allocation swell by EGP 2 bn

Including newborns into the commodity subsidies system could see the government spending EGP 91 bn in FY2019-2020, a government source told Al Mal. The FY2019-2020 state budget had allocated EGP 89 bn for commodity subsidies. Supply Minister Ali El Moselhy had delayed registering newborns to September from June, likely as the ministry has yet to complete purging the commodity subsidy system from Kramers (fraudulent beneficiaries of the subsidy system).

Misr Holding in talks with state-run banks for coverage to exporters

Misr Insurance Holding Company (MIHC) is in talks with two state-run banks to cooperate with them to provide insurance coverage for exporters targeting African markets, Chairman and Managing Director Basel El Hini told Amwal Al Ghad. The move comes as a number of countries require insurance and many countries are also not granting Egyptian exporters letters of credit easily, El Hini said.

National Security

20 Daesh terrorists killed in retaliatory gov’t airstrikes in North Sinai

At least 20 Daesh terrorists were killed over the weekend as the government launched retaliatory airstrikes in North Sinai province following a suicide bombing on Thursday, AP reports. Daesh claimed responsibility for the death of two people in the bombing in North Sinai, security and medical sources told Reuters on Thursday. This happened one day after four people were reportedly beheaded.

Sports

UK’s Aston Villa to buy Trezeguet for GBP 8.75 mn

Premier League football club Aston Villa seems to have edged out a number of European clubs in a bidding war to buy Egyptian winger Mahmoud Trezeguet in a GBP 8.75 mn agreement with Turkish sporting club Kasimpasa, where he plays now, KingFut reports. Trezeguet has been with the Turkish team for two seasons.

On Your Way Out

Marsa Alam will soon become a no-plastic zone as Red Sea Governor Ahmed Abdullah is extending his policy of banning single-use plastics across the governorate, Abdullah recently said, according to Egyptian Streets. A ban on plastic came into force in Hurghada last month. The city’s officials have since been seeking to provide alternatives to help enforce the ban. The ban currently applies to 90% of Hurghada, and is expected to cover the entire city by the end of July, Abdullah said.

University students will have to complete a course to educate them on marital life as a prerequisite to graduation starting the coming academic year, reports Ahram Online. The course will provide tips on choosing partners and handling conflict. Its introduction is meant to curb Egypt’s rising divorce rate.

The remains of an enormous residential settlement, including a well-preserved multicolored mosaic floor, were recently uncovered at Alexandria’s Kom El-Dikka archaeological site by an Egyptian-Polish archaeological mission, Egypt Today reports. The settlement reportedly dates back to between the 4th and 7th centuries AD, and also contains a small theater, a grand royal bath and a group of 22 lecture halls from an ancient university.

The Market Yesterday

EGP / USD CBE market average: Buy 16.55 | Sell 16.67

EGP / USD at CIB: Buy 16.56 | Sell 16.66

EGP / USD at NBE: Buy 16.56 | Sell 16.66

EGX30 (Thursday): 13,670 (+0.2%)

Turnover: EGP 492 mn (23% below the 90-day average)

EGX 30 year-to-date: +4.9%

THE MARKET ON Thursday: The EGX30 ended Thursday’s session up 0.2%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were CIRA up 7.2%, Orascom Investment Holding up 1.8%, and Egyptian Iron & Steel up 1.4%. Thursday’s worst performing stocks were GB Auto down 4.0%, Kima down 1.0% and Egypt Kuwait Holding down 0.7%. The market turnover was EGP 492 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -14.4 mn

Regional: Net Short | EGP -3.3 mn

Domestic: Net Long | EGP +17.7 mn

Retail: 38.7% of total trades | 42.7% of buyers | 34.6% of sellers

Institutions: 61.3% of total trades | 57.3% of buyers | 65.4% of sellers

WTI: USD 55.63 (+0.60%)

Brent: USD 62.47 (+0.87%)

Natural Gas (Nymex, futures prices) USD 2.25 MMBtu, (-1.57%, August 2019 contract)

Gold: USD 1,426.70 / troy ounce (-0.10%)

TASI: 9,033.83 (-0.46%) (YTD: +15.42%)

ADX: 5,218.13 (+2.70%) (YTD: +6.17%)

DFM: 2,762.98 (+1.73%) (YTD: +9.22%)

KSE Premier Market: 6,746.74 (-0.33%)

QE: 10,503.10 (-1.04%) (YTD: +1.98%)

MSM: 3,747.69 (-0.01%) (YTD: -13.32%)

BB: 1,537.78 (-0.06%) (YTD: +15.00%)

Calendar

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

25 July (Thursday): US Secretary of Energy visiting Cairo.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): Egypt will hold its seventh youth conference at the New Administrative Capital.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

3 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

3-4 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

4 August (Sunday): The High Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.