- Egypt is in line for USD 9 bn in investment under Trump’s Mideast peace plan, but will we want the strings some fear could come attached? (Speed Round)

- Gov’t to offer 10-15% stake in e-Finance IPO in 4Q2019. (Speed Round)

- Swvl raises USD 42 mn in largest-ever funding round for an Egyptian startup. (Speed Round)

- Cabinet agrees in principle on incentives for car manufacturers that use at least 45% local content. (Speed Round)

- Gov’t to allocate EGP 6 bn per year to export subsidies. (Speed Round)

- Investors pile into EGP as currency becomes “exotic” top performer. (What We’re Tracking Today)

- Egypt beat Zimbabwe 1-0 to open Afcon 2019. (Speed Round)

- The Market Yesterday

Sunday, 23 June 2019

Egypt to receive USD 9 bn investment under Trump’s Mideast peace plan

TL;DR

What We’re Tracking Today

It’s shaping up to be a rather busy week, ladies and gentlemen. The biggest news about Egypt will be made this week in … Bahrain. That’s where the Trump administration is set to unveil the first stage of what it is touting as the most “ambitious” Mideast peace plan in years. The idea behind the Bahrain “workshop on Palestinian economic development” is to get Gulf, European, and Asian powers to use economic incentives to nudge Palestine to “make political concessions” and secure peace with Israel.

The first stage of the Trump administration’s plan was released yesterday.

How does all of this involve Egypt? We could be in for around USD 9 bn worth of US investment and financing under the plan, which unconfirmed reports in the international press have also claimed could see Egypt cede land in Sinai to the Palestinians. A senior US official has flatly denied the Sinai angle, which was first reported by the international press.

Egypt’s delegation to the Tuesday-Wednesday gathering will be led by a vice-minister of finance, according to Reuters.

Ahead of the workshop: Arab finance ministers will meet in Cairo today to discuss the Palestinian Authority’s fiscal woes, Reuters reports. The PA has faced a cash shortage since February, when Israel reduced its monthly transfer of tax revenues by 5%. Arab ministers agreed in April to transfer USD 100 mn each month to the PA.

We have chapter and verse on the investment angle in this morning’s Speed Round, below.

It’s budget week in the House. Our elected representatives can practically taste the salt air of Sahel as they gaze longingly at the calendar like middle schoolers in the last week of class. The highlight of what could be the last week of the current legislative season will be discussion of the FY2019-2020 budget ahead of the 1 July start to the state’s new fiscal year.

Look for the budget debate to begin today, setting up a final vote by the House General Assembly as early as Tuesday, a senior government official tells us.

What if things run long? They won’t, but don’t fear: If MPs are still at it next week, all that’s required is for President Abdel Fattah El Sisi passing a decree that the current FY budget remains in effect until the new one is passed.

Also this week:

There will be football. So much football. The 2019 African Cup of Nations continues with the Pharaohs, who put Zimbabwe down 1-0 in the tournament opener this weekend, next playing on Wednesday at 10pm.

Amer Group and Antaradous Touristic Development face off in court today over a 2014 dispute brought to commercial arbitration by the Syria-based company over its partnership with Amer to develop the Porto Tartous tourist resort.

Prime Minister Moustafa Madbouly is heading to Germany this week with a delegation of 40-50 Egyptian companies, German-Arab Chamber of Industry and Commerce head Emad Ghaly told reporters on Thursday, according to Al Mal. The delegation will be pushing German companies to bring their business to Egypt, Ghaly said. Look in the days ahead for agreements with automotive manufacturers as well as resolutions to standing customs disputes involving German auto industry players.

Foreign Minister Sameh Shoukry and Defense Minister Mohamed Zaki will travel to Moscow tomorrow for talks with their Russian counterparts, according to a ministry statement.

The EGP is an “exotic” top performer — and investors are digging it: Global investors are piling into EGP- and Ukrainian UAH-denominated debt as the two “exotic” currencies have been “top performers” amid global volatility, according to the Wall Street Journal. The EGP and UAH have climbed 6% and 5%, respectively, against the greenback since the end of January and offer double-digit yields on local currency-denominated debt. “For many investors, however, the currencies’ main attraction is their steadiness in the face of worries that have whipsawed other assets this year … because these currencies have been moving for reasons that have little to do with global issues, buyers expect them to provide a haven during times of market stress.”

Global equity funds had their best week in over a year on the back of optimism that rate cuts across the world are coming, the Financial Times reports. Global equity mutual funds and ETFs snagged net inflows of USD 14.3 bn last week, the best showing since March 2018, thanks to growing appetite by investors who are banking on central banks adopting a looser monetary policy. US equity funds led their peers with USD 17.8 bn of inflows, the highest weekly total in three months. “The narrative of policy divergence among central banks ended with the Federal Reserve’s accommodative pivot,” said Ash Alankar, head of global asset allocation for Janus Henderson. “Looking ahead, conditions reflect a ‘goldilocks’ environment with dovish central banks, continued growth and muted inflation.”

Bitcoin has risen above USD 15k for the first time in 15 months, Bloomberg reports. The cryptocurrency has surged over the past three months, almost quadrupling in value since the beginning of April amid renewed interest in crypto after Facebook’s lunatic suggestion that it will enter and dominate the crypto space. The Wall Street Journal also has the story.

What’s all this “Libra” nonsense about, anyway? Check out this handy primer (pdf) from the Financial Times’ Alphaville.

It was a tense weekend in the Gulf: We came close to what could have been the opening shots of a full-fledged war in the Gulf at the end of last week after Iran downed an unmanned US drone flying in or near its airspace. Trump revealed later (via Twitter as he’s prone to do) that he had cancelled a retaliatory strike on Iranian military sites at the last minute because it was “not proportionate.”

This doesn’t mean his administration is done escalating: Trump announced last night that the US would introduce “major” new sanctions on the Islamic Republic on Monday. It isn’t clear immediately which sectors the latest round of sanctions will target.

In miscellany this morning to help you through your commute:

The final trailer for season three of Stranger Things is out (watch, runtime: 2:57) and it’s epic. The eight-episode season drops on 4 July.

Are you a nerd like us? If so, you may have dreamt of building your own clicky (or clear, if you prefer) mechanical keyboard. From scratch. With just the right keycaps and switches. And a layout that only a geek could love. If that’s the case: The Verge has got your back in Building my first mechanical keyboard (watch, runtime: 9:00).

Are mobile phones literally making us look like some cartoon representation of … Satan? That’s the contention of a couple of studies by researchers in Australia that went viral over the past few days thanks to a sensationalist story by the Washington Post headlined ‘Horns’ are growing on young people’s skulls. Phone use is to blame, research suggests. Except … maybe they’re not, argue the New York Times and CNET. Take a deep dive into both links and check out the original research (here and here) to judge for yourself.

Looking for some offline entertainment this summer? Have a look at the FT’s Summer books of 2019: critics’ picks, with suggestions from the salmon-colored paper’s staff and literary figures. Also on offer are recommendations on: economics | fiction | politics | crime | science fiction | travel | food and drink | and more. The landing page for the package is here.

PSA- We’re heading into a three-day long weekend, with next Sunday off in observance of the 30 June Revolution. If this doesn’t mark the start of peak summer, we don’t know what does.

Enterprise+: Last Night’s Talk Shows

The opening ceremony of Afcon 2019 dominated the airwaves on Saturday for the second night in a row (in case you haven’t heard yet, Egypt won 1-0 against Zimbabwe.)

President Abdel Fattah El Sisi met with his Mozambican counterpart President Filipe Nyusi in Cairo yesterday to discuss strengthening economic ties, Al Hayah Al Youm’s Lobna Assal said(watch, runtime: 03:59). The president offered his condolences on Mozambique’s losses due to recent hurricanes and expressed Egypt’s full support. The countries signed three MoUs, including one to exempt VIP passport holders from visa applications (watch, runtime: 01:38 and runtime: 01:52).

Enppi winning a USD 500 mn contract for a project in Saudi Arabia also earned some airtime with Hona Al Asema’s Reham Ibrahim (watch, runtime: 05:53). We have more in this morning’s Energy section, below.

El Hekaya’s Amr Adib explained that a technical issue was responsible for the delay in El Sisi’s speech at the opening ceremony (watch, runtime: 01:05).

Speed Round

Speed Round is presented in association with

Egypt to receive USD 9 bn under Trump administration’s Mideast ‘Peace to Prosperity’ economic plan: Egypt will receive as much as USD 9.1 bn worth of investment as part of the Trump Administration’s USD 50 bn Mideast economic plan, according to documents released by the White House (pdf) ahead of this week’s US-led workshop in Bahrain. The money would be invested across 12 projects in Egypt as follows:

- USD 5 bn earmarked for Egypt’s transport infrastructure;

- USD 1.5 bn to support Egypt emergence as a regional gas hub;

- USD 2 bn for development projects in Sinai (USD 500 mn each for power generation, water infrastructure, transport infrastructure and tourism projects);

- USD 500 mn to expand the Suez Canal Zone;

- An extra USD 125 mn will go to the US Overseas Private Investment Corporation (OPIC) program, which finances the growth of Egyptian SMEs;

- USD 30 mn will be used to upgrade the Egypt-Gaza power supply to 100 MW across two stages over three years;

- USD 12 mn will be allocated to refurbish existing Egyptian lines connected to Gaza;

- A commitment to explore ways to increase trade between Egypt’s Qualified Industrial Zones (QIZs), and Israel and Palestine.

What’s the quid pro quo for Egypt? In an interview with Reuters, White House advisor Jared Kushner referred to the economic plan as the “less controversial” part of the Trump Administration’s peace plan, raising eyebrows over what kind of political solution Kushner and Co. are intending to pursue. Trump’s Middle East envoy, Jason Greenblatt, has repeatedly denied reports that Egypt will be asked to surrender a chunk of the Sinai to create a sort of Greater Gaza area that stretches over the Rafah border to El Arish.

How the rest of the USD 50 bn will be allocated: The West Bank and Gaza will receive almost USD 28 bn, most of it earmarked for investment in transportation infrastructure, the power grid, water infrastructure, education, housing and agriculture. USD 5 bn will be spent on a transportation link connecting the West Bank and Gaza, and a further USD 1 bn has been earmarked to develop the Palestinian tourism sector. The rest of the fund will be divided between Jordan (which would receive USD 7.4 bn) and Lebanon (USD 6.3 bn).

The cash would be administered by a new investment fund under an “established multilateral development bank,” according to a second document (pdf).

Where’s the USD 50 bn coming from? According to the documents, USD 13.4 bn will be funded by grants and USD 25.7 bn will come from subsidized loans. Private capital, meanwhile, will stump up the remaining USD 11.6 bn.

There are serious doubts over whether the target figure is achievable. Reuters writes that there are “strong doubts” about whether governments will be willing to donate to the fund as long as a political solution remains out of sight. Foreign investors too are unlikely to see Palestine as an attractive investment destination given the poor security situation and the military occupation in the West Bank, which restricts the movement of people, goods and services.

Dream on, say the Palestinians: Hanan Ashrawi, a key figure in the Palestinian negotiating team over the past three decades, dismissed the plan as mere “intentions” and “abstract promises,” arguing that only a negotiated political settlement will bring the conflict to an end. Hamas unsurprisingly rejected the proposal, saying “Palestine isn’t for sale.” Palestinian businesses meanwhile have also come out in support of boycotting the Bahrain workshop, CNBC reports.

Egypt is definitely attending the Bahrain workshop: A delegation headed by a vice finance minister will travel to Manama on 25-26 June to attend the event, according to a Foreign Ministry statement picked up by Reuters. Egypt will reiterate its desire for a political solution to the conflict before economic development plans are put into place, a ministry spokesman said.

IPO WATCH- Gov’t to offer 10-15% stake in e-Finance in 4Q2019: The government is planning to sell 10-15% of its financial technology company e-Finance in an IPO during 4Q2019 as part of the second wave of the state privatization program, sources close to the matter tell the local press. The IPO will take place through a capital increase as no shareholders are presently looking to exit or sell down their stakes. NI Capital, the state-owned investment bank managing the Sisi administration’s IPO program, had invited several local investment banks last month to bid on quarterbacking the transaction.

Reminder on where we stand with the privatization program: Companies selected to IPO under the second wave of the program could begin listing as early as September, Public Enterprises Minister Hisham Tawfik said earlier this month. It is widely believed that Enppi will be the first company to go public. All timings remain contingent on market conditions.

STARTUP WATCH- Swvl raises USD 42 mn in the largest-ever funding round for an Egyptian startup: Egypt’s Swvl has raised USD 42 mn in Series B2 funding, the mass transportation startup said in a statement to Menabytes. The round was co-led by Swedish VC Vostok Ventures and Dubai-based BECO Capital, with Egypt’s Sawari Ventures, China’s MSA, US-based Endeavor Catalyst, Oman’s OTF Jasoor Ventures, Kuwait’s Arzan VC, Dubai-based Blustone, San Francisco-based Autotech, and Property Finder CEO Michael Lahyani all participating.

The funds are earmarked for Swvl’s expansion in Africa, with Swvl’s founder and CEO Mostafa Kandil telling Bloomberg that “the plan is to be in at least two or three more African cities by the end of the year.’’ Kandil confirmed that Nigeria is most likely the next market Swvl will tap, after the company had disclosed initial plans to launch 50 buses in Lagos by mid-July. Reports from earlier this year that the company would move into Uganda remain unconfirmed. Last year, Kandil said that Swvl would launch in Manila in 1Q2019 and then expand throughout Southeast Asia to reach seven megacities by the end of 2019, but the company appears to have since re-focused on Africa.

This is the second time Swvl has raised a record round after netting USD 8 mn in a series A in Egypt in April 2018. It then raised “tens of mns of USD” in series B funding in November last year, which apparently brought its valuation close to USD 100 mn. In its two years of operation, the company has raised almost USD 80 mn, making it one of the region’s best-funded startups.

EXCLUSIVE- Cabinet agrees in principle on incentives for car manufacturers that use at least 45% local content: The cabinet has agreed in principle to a proposal from the finance and trade ministers on incentives for car manufacturers that use at least 45% local content, two government sources told Enterprise. Cabinet will finalize the incentives and could announce them as early as the end of this month, they said. Sources told Enterprise last week that there would be a sliding scale based on how much local content manufacturers use, starting at 10%.

A raft of agreements on the horizon? Prime Minister Moustafa Madbouly will sign a number of cooperation agreements with car manufacturers Mercedes and BMW as well as component maker Bosch during an upcoming trip to Germany, one source said. One such trip begins this week, as we note this morning in What We’re Tracking Today (above).

Talks with four Japanese companies are also underway as are discussions with Korean, US and Chinese companies, the source added. Toyota, Suzuki, Nissan and Isuzu are all mulling options to become more deeply involved with the Egyptian market, the sources said, adding that the companies were “pleased to hear” about the proposed incentives.

Government to dedicate EGP 6 bn per year to export subsidies: The government will set aside EGP 6 bn annually in its budget for export subsidies as of FY2019-2020, Vice Minister of Finance Ahmed Kouchouk said, according to a Trade and Industry Ministry statement. The new program will allow increasing subsidies in tandem with increasing exports as of the second year of implementation, Kouchouk said. The finance and trade ministries have held meetings to discuss allowing exporters to net overdue subsidies off against their taxes, and Trade and Industry Minister Amr Nassar is set to meet with the heads of export councils.

Background: Exporters are waiting to hear more about potential tax breaks as part of a new framework that could see the government make good on overdue export subsidy payments. The program will effectively pay out what is claimed to be some EGP 12 bn in incentives owed to Egyptian exporters by the Export Subsidy Fund since last year.

Cabinet econ group green lights new central clearing company for debt: The Madbouly Cabinet’s economic group approved on Friday establishing a new central clearing and depository company, according to a statement. The new entity is expected to handle all the clearing and registry of government debt issuances, as well as collect taxes from these issuances. It will have capital of EGP 100 mn, 60% of which will be put up by the CBE, with the Finance Ministry and Misr for Central Clearing, Depository and Registry (MCDR) each contributing 20%. The company comes as the government looks to breathe lift into the nation’s debt market, the cabinet said.

LEGISLATION WATCH- House to vote on commercial rent law during next legislative session: The House of Representatives is expected to vote on proposed amendments to the commercial “old rent” law after the summer recess, parliamentary sources told the local press. A House committee approved earlier this month a proposed amendment that would see commercial tenants who signed long-term leases before 1996 pay significantly higher rents.

LEGISLATION WATCH- House committee okays draft Consumer Credit Act: The House Economic Committee has signed off on a draft of the government’s proposed Consumer Credit Act, which would regulate the nation’s fast-growing consumer credit industry, Al Shorouk reports. The government says the bill would improve transparency in the sector and protect consumers.

Who would be subject to the act? Approved by cabinet in February, the bill bill would require companies to obtain licenses from the Financial Regulatory Authority to sell goods on installment. All consumer finance players will be subject to the legislation if it passes, but retailers and manufacturers would only fall under the act if more than 25% of their annual sales are made on installment plans. The proposed law defines consumer finance as “any activity or operation aiming to fund purchases of consumer and durable goods and transportation vehicles.”

Marakez will open its Mall of Tanta this fall, the company said in a statement (pdf). The EGP 1 bn complex spans 33 acres and will house 140 shops, 30 restaurants and cafes, and a cinema. The mall is slated to be the biggest in the Delta, generating more than 10k jobs.

MOVES- Beltone Financial has appointed Maged Shawky (LinkedIn) as executive chairman and Ibrahim Karam as managing director, the company said in a statement (pdf). Shawky had previously served as vice-chairman for over seven years.

Afcon 2019 got off to a good start for Egypt as the Pharaohs secured a 1-0 victory over Zimbabwe on Friday thanks to a brilliant goal from Trézéguet.It wasn’t an especially dazzling performance from Egypt, which failed to build on the goal, but manager Javier Aguirre said he was confident that the team’s form will improve.

The story is receiving coverage in the local and international press, with Reuters offering a run-down of the opening match. Also earning attention is Egypt’s new electronic ticketing system, which will be rolled out for Egypt’s domestic league once the African championship comes to a close, according to the newswire. Meanwhile, sounding a less positive note, Reuters’ Amr Abdallah asks whether discrimination prevents Coptic Christian football players from rising through the ranks within predominantly Muslim teams.

M&A WATCH- NBK Capital Partners bows out of “advanced” talks to acquire Abraaj’s global credit fund: National Bank of Kuwait’s brokerage unit NBK Capital Partners has exited advanced-stage talks to acquire a global credit fund from defunct PE firm Abraaj, Reuters reported, citing two sources familiar with the matter. NBK Capital Partners, which was reportedly close to completing the transaction, is no longer engaging with the liquidators, one source said. Investors in the credit fund also failed to reach an agreement on the valuation for a potential transaction with NBK, another source said.

Background: Abraaj was widely seen as a standard-bearer for EM private equity before it collapsed last year amid concerns about the misuse of funds. The global credit fund, which had raised over USD 250 mn, was an EM fund offering private debt to medium-sized and growth-oriented companies.

Image of the Day

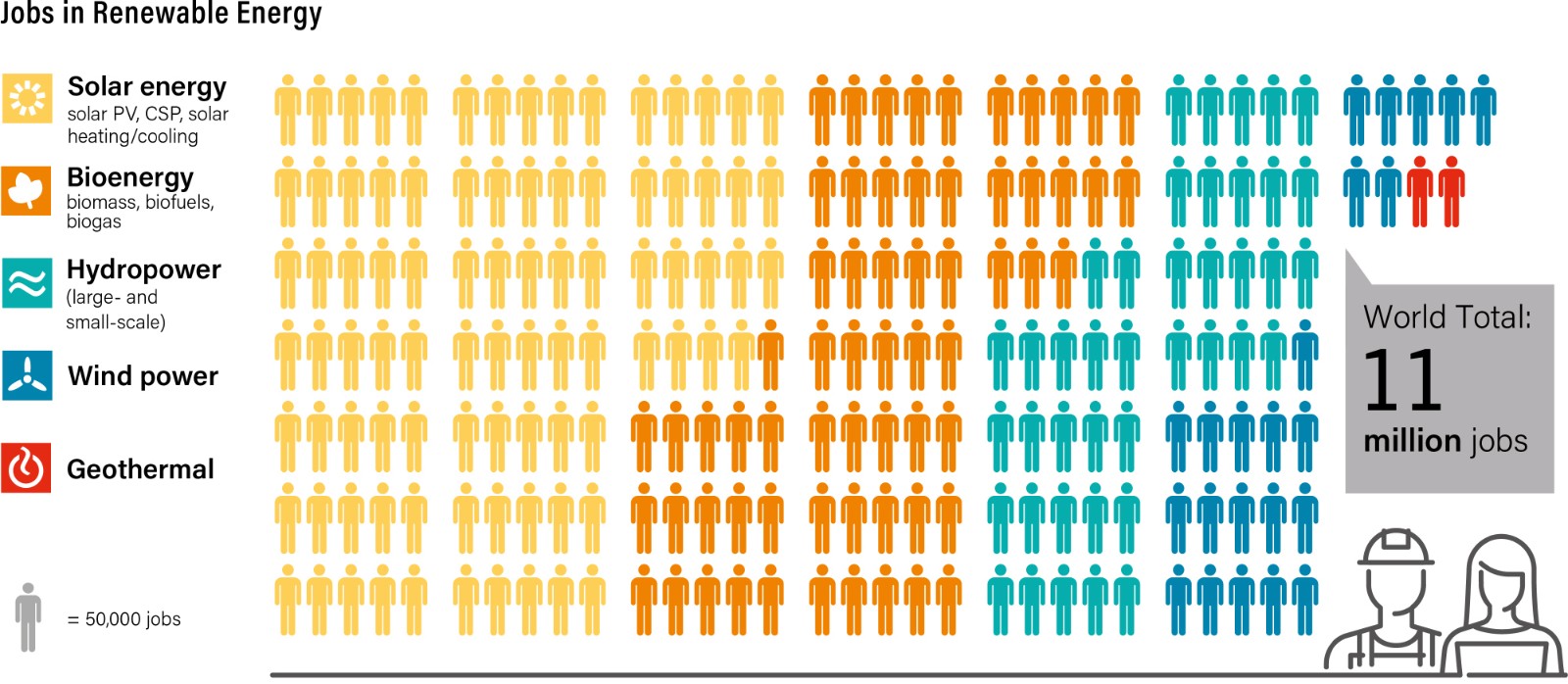

Twelve beautiful, but sad, charts and graphs tell the story of our global transition to clean energy: Using beautifully clear visuals that lay out all the essential science and economics behind green energy policy, Vox’s David Roberts digests 250 pages of the recently published Renewables Global Status Report (GSR) to demonstrate how our progress has been and what we need to be doing to have any chance of slowing climate change.

A few takeaways: Global carbon emissions were up 1.7% in 2018, while global fossil fuel subsidies were up 11% y-o-y in 2017 to USD 300 bn. Investment in renewable energy (excluding hydropower) last year was USD 288.9 bn — an 11% percent decrease from 2017. Renewables are pulling ahead in the power sector, with solar creating the most jobs.

Egypt in the News

The death of former president Mohamed Morsi continues to drive the conversation on Egypt in the foreign press, with the Washington Post once again questioning his health and medical care. Media coverage of Morsi’s passing, which the AP says was a “brief rallying point” for the Ikhwan, was muted by the government, Reporters Without Borders claims. Turkish president Erdogan meanwhile said he believes the UN will look into the circumstances of Morsi’s death, Reuters reports. The Independent’s Robert Fisk (yes, he’s still writing) launches a brief but damning attack on the hypocrisy of western governments, dripping sarcasm as he calls for “three cheers again for our parliamentary democracies, which always speak with one voice about tyranny.”

Egypt’s attempt to repatriate a 3,000-year-old bust of King Tut is giving new impetus to questions about cultural ownership of ancient artefacts, Heba Saleh writes for the Financial Times. French auction house Christie’s raised Egyptian eyebrows when it announced earlier this month it would auction the sculpture, which it maintains is legal under international treaties. Egypt and other countries have been arguing that many ancient pieces are circulating on the black market as a result of looting, “but some warn that the increase in acrimonious disputes over antiquity sales could drive the trade further into the private market,” Saleh says.

Other headlines worth a moment of your time:

- Amnesty International is calling on Egypt to decide against giving the death penalty to Karim Hemada, who was arrested as a minorfor being a member of a terrorist group. Sentencing was expected to take place yesterday, after his case was referred to the Grand Mufti on 6 June.

- Saidi folkloric music group Mazameer El Nil are getting some love from The Arab Weekly.

On The Front Pages

El Sisi meets Mozambican counterpart: A meeting between President Abdel Fattah El Sisi and Mozambican President Filipe Nyusi topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria).

Diplomacy + Foreign Trade

Shoukry urges Ethiopia, Sudan to speed up GERD talks: Foreign Minister Sameh Shoukry called on Ethiopia and Sudan to expedite negotiations over the Grand Ethiopian Renaissance Dam (GERD) during a meeting on Thursday with Ethiopian Foreign Minister Gedu Andaragachew, according to a ministry statement. Shoukry also said he intends to call a tripartite meeting soon between the three countries’ foreign and irrigation ministers to continue talks. The planned construction of the 6 GW GERD has been a source of tension between Egypt, Sudan, and Ethiopia for several years now, and the issue remains unresolved.

Nasr talks US-Africa trade, investment with US officials in Mozambique: Investment and International Cooperation Minister Sahar Nasr met with US Deputy Secretary of Commerce Karen Dunn Kelley last week to discuss working on infrastructure projects in Africa and US support of development financing tools, according to a ministry statement (pdf). The two sat down for talks on the sidelines of an American-African Business Council meeting in Mozambique.

Egypt’s conflict resolution center signs disarmament, anti-extremism agreement with UN: The Foreign Ministry’s Cairo International Center for Conflict Resolution, Peacekeeping and Peacebuilding (CCCPA) signed an agreement last week with the UN Peacekeeping Office of Rule of Law and Security Institutions to combat extremism, according to a ministry statement. The agreement is also intended to encourage disarmament and demobilization in Africa.

Energy

Enppi wins USD 500 mn-worth turnkey project in Saudi

Enppi has won in a bid for a turnkey project in Saudi Arabia worth over USD 500 mn, defeating a number of Saudi and international contractors, the cabinet according to a cabinet statement. The contract brings Enppi’s total size of activities in KSA to USD 1.25 bn. No further details were provided.

Basic Materials + Commodities

Egypt’s agricultural exports rise to 3.7 mn tonnes in 2019

Egypt’s agriculture exports since the beginning of 2019 have risen to 3.7 mn tonnes, compared to 3.47 mn tonnes during the same period last year, the Agriculture Ministry said in a statement. Citrus fruits comprised the biggest portion of the exports, followed by potatoes and onions.

Banking + Finance

CIB signs EGP 400 mn financing agreement with MUP

CIB has signed a EGP 400 mn medium-term financing contract with Medical Union Pharma (MUP), bringing the company’s total credit facilities to EGP 1 bn, AMAY reported. The financing aims to consolidate the company’s financial standing and allow it to boost its investments in the coming phase as well as set up new facilities.

Adib Capital seeks regulatory approval for USD 50 mn sukuk issuance

Abu Dhabi Islamic Bank’s investment banking unit Adib Capital Egypt is planning to request regulatory approval from the Financial Regulatory Authority (FRA) for a sukuk issuance it is managing for an unnamed local company, CEO and MD Hatem El Demerdash told Al Mal. The company’s shareholding is divided between public and private entities. The USD 50 mn sukuk issuance is the first to come out of the nation’s corporate sector. Adib Capital is also advising on two acquisition agreements in the education and health sectors, El Demerdash said, without providing further details.

Other Business News of Note

House approves EUR 225 mn loan from KFW development bank

The House of Representatives has approved a second, EUR 225 mn (c.USD 256 mn) tranche of a USD 450 mn facility from Germany’s KfW development bank to close the state budget’s financing gap, Mubasher reported. The tranche was approved by the government in March.

Icon signs EGP 60 mn housing facilities agreement with Petrojet

The Industrial Engineering Company for Construction and Development (Icon) signed a EGP 60 mn contract to provide and set up housing facilities for state-owned construction company Petrojet, the company said in a bourse filing (pdf).

Egypt Politics + Economics

El Sisi receives honorary doctorate from Romanian university

President Abdel Fattah El Sisi was granted an honorary doctorate from the Bucharest University of Economic Studies, Ittihadiya said in a statement. El Sisi received his honorary degree during his visit to Romania last week.

On Your Way Out

Mastercard expects Egypt’s e-banking market to double in size before 2022 as the Madbouly government and CBE push ahead with financial inclusion drives, MENA reported. Electronic transactions currently make up for only 2-3% of all transactions, but this is set to rise to up to 10%, said Country Manager Magdy Hassan.

Hot-air balloon flights over Luxor have been temporarily suspended after a balloon was driven off course by strong winds on Thursday, Ahram Online reports. The balloon managed to land safely in a mountainous area; all 11 tourists onboard and the pilot left the balloon safely before being picked up by a military search and rescue unit. Local authorities will investigate the matter to ensure that companies comply with all safety regulations, the Associated Press reports.

The Market Yesterday

EGP / USD CBE market average: Buy 16.6475 | Sell 16.7475

EGP / USD at CIB: Buy 16.64 | Sell 16.74

EGP / USD at NBE: Buy 16.65 | Sell 16.75

EGX30 (Thursday): 14,043.42 (-0.63%)

Turnover: EGP 685 mn (7% below the 90-day average)

EGX 30 year-to-date: +7.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.63%. CIB, the index heaviest constituent ended up 0.16%. EGX30’s top performing constituents were Arab Co. for Asset Management and Development up 3.45%, Oriental Weavers up 3.36%, and TMG Holding up 1.79%. Thursday’s worst performing stocks were Madinet Nasr Housing down 3.90%, Arabia Investment Holdings down 3.48% and Pioneers Holding down 2.61%. The market turnover was EGP 685 mn, and foreign investors were the sole net buyers.

Foreigners: Net long | EGP +81.7 mn

Regional: Net short | EGP -40.9 mn

Domestic: Net short | EGP -40.8 mn

Retail: 43.9% of total trades | 45.5% of buyers | 42.2% of sellers

Institutions: 56.1% of total trades | 54.5% of buyers | 57.8% of sellers

WTI: USD 57.43 (+0.63%)

Brent: USD 65.20 (+1.16%)

Natural Gas (Nymex, futures prices) USD 2.19 MMBtu, (+1.67%, July 2019 contract)

Gold: USD 1,400.10 / troy ounce (+0.23%)

TASI: 8,869.70 (-0.74%) (YTD: +13.33%)

ADX: 5,044.72 (+1.40%) (YTD: +2.64%)

DFM: 2,658.88 (+0.74%) (YTD: +5.10%)

KSE Premier Market: 6,367.00 (+1.01%)

QE: 10,688.67 (+1.73%) (YTD: +3.78%)

MSM: 3,928.26 (-0.39%) (YTD: -9.15%)

BB: 1,454.97 (+0.08%) (YTD: +8.80%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

Mid-June: A delegation of Egyptian businessmen will head to Estonia and Latvia to explore investment prospects in the two eastern European nations.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

7 July (Wednesday) The FRA will hear an appeal filed by Adeptio AD Investments, the lead shareholder of Egyptian International Tourism Projects Company’s (Americana Egypt), against an order to submit an MTO for Americana

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.