- IPO phase of state privatization program on course to start in September, Tawfik says. (Speed Round)

- Dragon Oil acquires BP’s Gulf of Suez assets. (Speed Round)

- Russia once again dangles the idea of charter flights to Egypt resuming this year — provided we buy more stuff. (Speed Round)

- Egypt’s sovereign wealth fund joins global industry body. (Speed Round)

- Companies will have no choice but to file taxes online starting 2020. (Speed Round)

- Medhat Khalil seeks Justice Ministry intervention in dispute with FRA. (Speed Round)

- Foreign reserves inch up to USD 44.27 bn in May. (Speed Round)

- Why do most Egyptians quit their jobs? (Hint: It’s not the money). (Image of the Day)

- The Market Yesterday

Sunday, 9 June 2019

IPO phase of state privatization program on course to start in September, Tawfik says

TL;DR

What We’re Tracking Today

Not a lot happened over the Eid vacation, and it’s just as well: Plenty of us here at Enterprise are still grumbling over having been trolled on what conventional wisdom (and basic astronomy) had penciled in as the last day of Ramadan.

Get ready for a busy news cycle: We have barely three weeks left until schools let out and Sahel season begins.

The expected release tomorrow of inflation figures for May will be driving the conversation this week. May figures will be the last in the current fiscal year before the next round of electricity and fuel subsidy cuts next month, setting up the debate over whether the central bank will get back to cutting interest rates in the final quarter of the year. Annual headline inflation cooled unexpectedly in April to 13% from 14.2% in March.

Be on the lookout for the purchasing managers’ index for Egypt, Saudi Arabia, and the UAE, which are due out tomorrow at 6:15am CLT.

Wait, there’s more in what looks set to be a very busy June. Among the stories vying for your attention:

- The House of Representatives will wrap its debate of the FY2019-2020 budget this month. Expect more haggling over health and education funding from grandstanding MPs, which could push final approval of the budget into early July.

- The US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan — where he reportedly is presuming Egypt will give up part of Sinai — is expected to take place in Manama, Bahrain on 25-26 June.

- The US Federal will review interest rates 18-19 June under pressure to get back to cutting rates to mitigate the impact of Trump’s ongoing trade war with China. Egypt’s central bank won’t follow suit until 11 July.

It’s the final push for the first-half conference season at home and abroad. Among the highlights:

- Our friends at Pharos Holding are holding their annual investor conference in El Gouna on 19-20 June;

- Cairo Technology Week runs next week at the Hilton Heliopolis;

- OPEC and non-OPEC countries will hold a ministerial meeting in Vienna on 25-26 June;

- The G20 global economic summit will take place on 28-29 June in Osaka.

Oh, and then there’s the African Cup of Nations, which Egypt is hosting from 21 June through 19 July. We have all you need to know about the competition, including tickets, teams, matches, and nostalgia in this month’s edition of Your Wealth.

Peugeot and Arabia Investment Holding are set to face off in court today as AIH subsidiary CDCM seeks damages after Peugeot awarded franchise rights to a rival group. The case has already been postponed multiple times. The plaintiffs are seeking EUR 150 mn in damages.

Pension increases are back on the House’s agenda as MPs resume today debate of a proposal that could see minimum monthly pensions for civil servants rise to EGP 900 and payouts by 15%, Al Shorouk reports. The increases, which President Abdel Fattah El Sisi announced in March, are expected to take effect at the start of the fiscal year on 1 July.

Sign of the times #1: We’re looking at the worst year for M&A since before the global financial crisis, according to data provided to Axios by Dealogic, but there’s still a chance of a pickup in the second half of the year. Case in point: United Technologies is said to be nearing an agreement to merge its aerospace division with Raytheon, Reuters reports. News of the possible USD 100 mn transaction comes after Renault rebuffed Fiat Chrysler’s proposed merger.

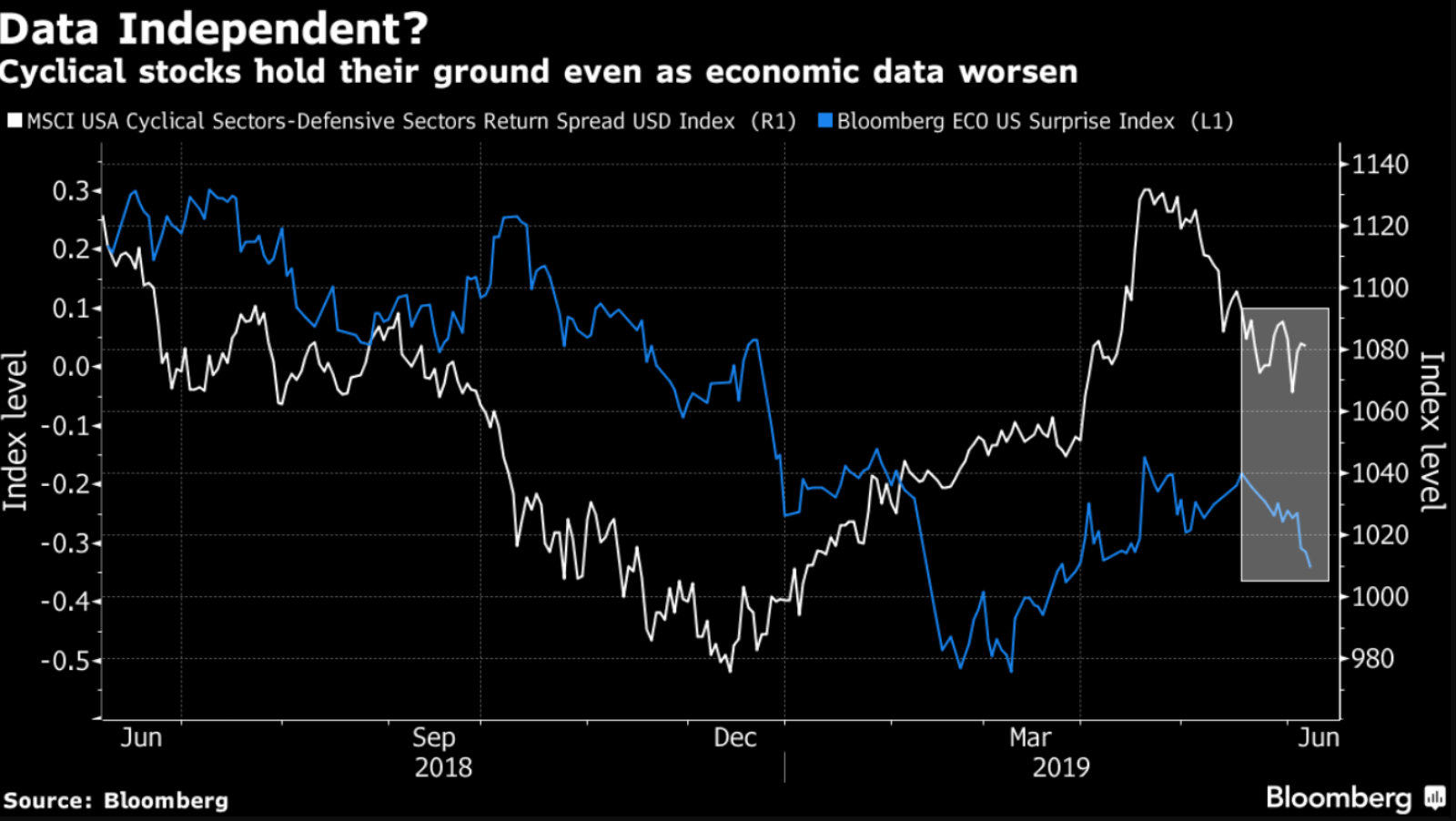

Sign of the times #2: What’s up with global markets? “Opposing signals from stocks and bonds are getting even more extreme, Bloomberg writes in the aptly headlined Two epic bull markets are dueling over the fate of global growth.

Sign of the times #3: The IMF is freaking out over Big Tech: The financial system faces “significant disruption” as the world’s biggest tech companies increase their influence on the financial sector, IMF head Christina Lagarde said during a seminar at the G20 meeting of finance ministers in Japan yesterday. Tech companies will in the future use data and AI to offer new financial products — and increase their control of global payment and settlement systems. Lagarde warned that the concentration of power within the hands of a few large businesses will present a “unique systemic challenge to financial stability.”

Sign of the times #4: Crypto startups are raising money again, this time with a twist, the Wall Street Journal writes. This time around, it’s not about “initial coin offerings” direct from startups, but “initial exchange offerings,” with crypto exchanges acting as investment banker, research house and bourse all in one by “researching currencies and deciding whether they are worthy of being listed” and offered to investors.

International headlines worth knowing about as your workweek gets underway:

- US President Donald Trump has taken the prospect of tariffs on Mexican goods off the table after Mexico agreed to clamp down on illegal immigration, Reuters reports. It’s the latest in the “unprecedented weaponization” of the US economy, Atlantic Council boss Fred Kempe says.

- Israel has the right to annex part of the West Bank, America’s ambassador to Israel said in an interview with the New York Times.

- Over 100 protestors were killed by military forces in Sudan during a week of violence, The Guardian reports. The African Union has since suspended Sudan until civilian rule is established.

- Oman will impose a 100% tax on cigarettes,alcohol, energy drinks and porc meat and products as of 15 June. Carbonated beverages will be hit by a 50% tax at the same time. (Bloomberg)

- Uber undergoes major reshuffle: Uber’s COO and chief marketing officer are on their way out of the company, allowing CEO Dara Khosrowshahi to increase his control over the day-to-day operations. (CNBC)

- Former US Vice-President Joe Biden still “leads the Democratic pack of presidential contenders” in a poll of Iowa voters. All jockeying for second place: Bernie Sanders, Elizabeth Warren and Pete Buttigieg. (Reuters)

PSA #1- Three stations in phase 4A of the Cairo Metro’s third line will open to passengers for trial runs on Saturday,Cabinet announced in a statement. Harun, Alf Maskan, and Shams Club stations have completed operational trials, and their soft opening is scheduled to come ahead of AFCON.

PSA #2- Holiday planning. We have a three-day weekend heading into Sunday, 30 June to mark the start of the summer holiday season. Then it’s a straight shot to Tuesday, 23 July and then Eid Al Adha, which will effectively blot out the week of 11 August.

Enterprise+: Last Night’s Talk Shows

The talking heads returned from their annual Ramadan hiatus last night. We’re still not sure whether we missed them. Maybe Lamees, but she’s been off-air for a while now, hasn’t she?

Eritrean President Isaias Afwerki began hais two-day visit to Egypt yesterday and sat down with President Abdel Fattah El Sisi, Hona Al Asema’s Riham Ibrahim said (watch, runtime: 1:17). We have more in this morning’s Diplomacy + Foreign Trade.

July could become ‘Egyptian heritage month’ in Canada’s largest province: Ontario, Canada’s largest province by population, has moved a step closer to dedicating the month of July to celebrations of Egyptian heritage after the province’s legislative assembly sent draft legislation to committee for review. The bill has now passed first and second reading. Al Hayah Youm’s Lobna Assal got her wires a bit crossed when she (like the Emigration Ministry and others in the domestic press) claimed that the bill had already been approved and / or would roll out nationwide. She spoke with the author of the bill, Egyptian-Canadian MPP Sherif Sabawy (website | twitter), who explained that the month would see the raising of the Egyptian flag, parliamentary meet-and-greets for members of the Egyptian diaspora, and various cultural events (watch, runtime: 8:44).

The upcoming two-day African Anti-Corruption Forum (ACCF), set to kick off on Wednesday in Sharm El Sheikh, also made it to Al Hayah Al Youm, brought to you by Assal’s co-host Khaled Abu Bakr (watch runtime: 1:43).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- IPOs by state-owned companies set for fall as planned, come what may: State-owned companies selected to make initial public offerings of their shares under the second phase of the state’s privatization program will move forward with transactions starting in September as scheduled, Public Enterprises Minister Hisham Tawfik told Enterprise over the weekend. The government is committed holdings its first IPO under the program in September even if there’s turbulence in the market, he added. The statement marks a shift in the government’s tone about how global markets could impact the program. While he would not name the first company due out of the gate, it is widely believed that oil and gas contractor Enppi is the frontrunner, as Oil Minister Tarek El Molla had suggested it would IPO in 1H2019. The ministry had planned to IPO four or five state companies at a rate of about one per month starting from September.

Share sales by already-listed companies will still hinge on market conditions, Tawfik said. Alexandria Containers & Cargo Holding and Abu Qir Fertilizers are both set to make offerings, and the timing will come down to recommendations from the investment banks quarterbacking the sales. No dates have been penciled, the minister added.

Abu Qir could sell shares any day now, according to a report in Al Mal that we picked up before the Eid break. Eastern Tobacco piloted the program of accelerated book builds with the sale of a 4.5% stake earlier this spring.

We may get clarity on share sales this week: A meeting with investment banks advising on the share sales will take place this week to decide on the next step in these share sales, Tawfik told us.

Advisors: Renaissance Capital and CI Capital are leading the accelerated book build on Abu Qir, while EFG Hermes and Citi are leading on Alexandria Containers. CI Capital, Jefferies International Limited, and Emirates NBD were said in late 2018 to be managing the IPO of Enppi, which could include both a domestic listing and a global depositary receipts program on the London Stock Exchange. State-owned investment bank NI Capital is presently soliciting pitches from houses interested in taking fintech player e-Finance public.

M&A WATCH- Dragon Oil agrees to acquire BP’s Gulf of Suez assets: BP reached an agreement to divest its interests in Gulf of Suez oil concessions in Egypt to Emirates National Oil Company’s (ENOC) subsidiary Dragon Oil, BP said in a statement. Under the terms of the agreement, which is subject to approval from the Oil Ministry, Dragon Oil would purchase producing and exploration concessions, including BP’s interest in the Gulf of Suez Petroleum Company (GUPCO). The sale is expected to be concluded in 2H2019. The value of the transaction hasn’t been disclosed, but Reuters suggested last month that it was in the USD 600 mn neighborhood.

BP to invest USD 3 bn in Egypt over the next two years, Dudley says: “Egypt is a core growth and investment region for BP,” BP CEO Bob Dudley said. “In the past four years we have invested around USD 12 bn in Egypt — more than anywhere else in our portfolio — and we plan another USD 3 bn investment over the next two years.”

Background: The plan to exit GUPCO — a JV between BP and the EGPC — is part of BP’s strategy to clear off more than USD 10 bn in global assets over two years. The company will in turn focus its work in Egypt on natural gas. In February, it began natgas production from its Giza and Fayoum fields, part of the second phase of the three-stage West Nile Delta concession development project. The final phase of the project is expected to kick into gear later this year when the Raven field goes online.

Russia could resume charter flights to Egypt this year, the country’s industry and trade minister, Denis Manturv, said on Friday, according to a report by Sputnik Arabic. Mantruv made his comments on the sidelines of the International Economic Forum in St. Petersburg following a meeting with Trade Minister Amr Nassar the previous day.

Typical Russian bureaucratic caginess (as a means to peddle us exports) ensues: “It is difficult to say when the charter flights could resume between Egypt and Russia,” the Russian minister said. He suggested that the talks included provisions for Russia to sell us airplanes and technology. Nassar said talks with Manturv also covered the latest developments on the Russian Industrial Zone in the Suez Canal Economic Zone, according to a Trade Ministry statement (pdf).

Background: Applying pressure on tourism to serve other state goals has worked out well for the Russians, who resumed flights to Egypt in April 2018 after a three-year suspension after we bought a USD 30 bn nuclear power plant. Russian Federation Council Foreign Affairs Committee Chairman Konstantin Kosachev told Egypt’s ambassador to Russia Ihab Nasr in February that direct flights from Russia to the Red Sea tourist destinations may “fully” resume in the near future.

Egypt Wealth Fund joins international industry body: Egypt’s sovereign wealth fund has joined the International Forum of Sovereign Wealth Funds (IFSWF) as an associate member, the IFSWF said in a statement. Associate membership is granted for three years and will require the Egyptian fund to implement the Santiago Principles, which consist of 24 principles that promote transparency, good governance, accountability and prudent investment practices for SWFs. The membership sends “a positive message” to potential investment partners and can become a full membership later, Planning Ministry Hala El Said said in a statement.

REGULATION WATCH- Companies to file taxes online starting 2020 — or else: The Finance Ministry amended the executive regulations of the Income Tax Act to make it mandatory for companies to file their taxes online starting from January 2020, the ministry said in a statement.

DISPUTE WATCH- Medhat Khalil seeks Justice Ministry intervention in dispute with FRA: Raya Holding’s Chairman Medhat Khalil filed a request with the Justice Ministry’s dispute resolution committee to mediate in ongoing disputes with the Financial Regulatory Authority (FRA). Khalil is looking to cut down or overturn fines (details below) in connection with a mandatory tender offer forced on him by the FRA, Al Mal reports. The FRA is also alleged to have blocked Raya’s bid to acquire a license to set up a firm that would specialize in securitized debt offerings. Separately, the Council of State (Maglis El Dawla) has postponed to July its next hearing in a separate case filed by Khalil to quash the fine.

Background: The FRA alleges Khalil failed to pay an EGP 11 mn fine handed out after he exceeded the maximum ownership limit in Raya without making a mandatory tender offer (MTO).The FRA had ordered Khalil at the end of last year to submit an MTO for Raya or sell down his stake, arguing that he and related parties controlled a combined 42% of the company — a level of control that triggers the requirement for an MTO under securities regulations. Khalil bought 26.7% (56.919 mn shares) of Raya Holding through his El Pharonia Real Estate Investment at a cost of EGP 314.76 mn in an MTO.

Foreign reserves inch up to USD 44.27 bn at end-May: Egypt added USD 112 mn to its reserves base in May to close the month at USD 44.274 bn compared to USD 44.218 bn at end-April, the central bank said. The central bank had made debt payment of USD 406 mn to African Export-Import Bank in May, according to Ahram Gate. Egypt is expecting the final USD 2 bn tranche of the IMF’s USD 12 bn extended fund facility this month after reaching a staff-level agreement in May, which should bolster reserves.

Egypt’s GDP will grow at a 5.5% clip in FY2019-2020 and FY2020-2021, according to forecasts from FocusEconomics. The company’s latest outlook predicts that growth will be driven by an uptick in consumption and fixed investment over the coming two years. However, “still-fragile government finances, an uncertain global trading environment and internal security problems” will continue to threaten the country’s growth outlook.

Looking back: Higher government spending in 9MFY2018-2019 resulted in a pick-up in economic growth during the third quarter, the report noted. Higher fixed investments and public wages, combined with lower unemployment and inflation, should have also supported growth during the period, it added.

A terrorist attack on a police checkpoint west of Al Arish killed eight members of the security force on duty early Wednesday, the Interior Ministry announced. Five terrorists were killed in the attack. Daesh later assumed responsibility via its Amaq outlet, according to Reuters. The ministry announced later in the day it had infiltrated a hideout in Arish’s Masaeed district, killing 14 suspects and capturing weapons and explosives. The story was widely picked up by foreign press outlets, including France’s AFP, Arab News, and the BBC.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

Why do Egyptians quit their jobs? You’d be surprised to know that money is not the primary factor: Bosses can sit there and gripe about “ungrateful employees” wanting more money. But according to a study (pdf) by our friends at Acumen Consulting, that is not the primary motivation for why professionals across various tiers and ranks are quitting their jobs.

The survey finds that issues with the boss was named as the biggest factor driving people away, particularly among managers and young professionals. Problems with the boss was also the biggest issue women survey-takers felt was pushing them to quit, with 30% of women citing it as the problem. Bosses were also driving away employees in startups, the public sector, NGOs, and multinationals.

No growth potential was cited as the second biggest reason for why people in Egypt quit their jobs, with 31% of men saying they quit for this reason. Entry level employees and employees of family-owned businesses say this is the primary factor for why they quit. An organization not having systems in place was named as the third highest reason for quitting. Note how little pay compared to the other reasons cited.

So what’s keeping them at their jobs? Having a high learning potential and pay were the two primary reasons why Egyptians stay in their jobs, according to the survey. This was followed by the organization’s culture and how appreciated they feel in their jobs.

Egypt in the News

A Foreign Policy hatchet job: Egypt’s economic reform program has so far only benefited the ruling elite — and done nothing for common Egyptians other than make their lives harder, writes Yehia Hamed in a hit job for that rag known as Foreign Policy. Does his name ring a bell? Hamed was the investment minister under the Islamist administration of Mohamed Morsi.

Other articles worth a skim this morning:

- Mo Salah can’t catch an Eid break: Mohamed Salah has complained on Twitter of “disrespect” from groups of fans and journalists who prevented him from leaving his family house in Nagrig to perform Eid prayers. The story is receiving coverage in the foreign press: The Times | RT | The National.

- Egypt’s female squash players in the spotlight: The National takes a look at how Raneem El Welily, Nour El Sherbini, Nouran Gohar and Nour El Tayeb (ranked #1, #2, #4 and #5 in the world respectively) are shaking up the Egyptian squash scene.

- The Arab Weekly is out with two articles examining Cairo’s struggles with pollution, and efforts to privatize the capital’s transportation system.

On The Front Pages

President Abdel Fattah El Sisi’s sit-down with Ethipian counterpart Isaias Afwerki topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria). We have more in Diplomacy + Foreign Trade below.

Worth Watching

DOCUMENTARY OF THE WEEK — Frontline strikes again with the definitive documentary on the US-China trade war: Having trouble keeping up with the US-China trade war? Or perhaps you are unsure of its origins or the political maneuvers behind it. Well, you’ll have PBS’ Frontline to thank for the most informative hour on the US-China trade war you’ll find out there. The documentary explores everything from the human impact of the trade war in China and the US, to the 5G competition that is shaping up to be the new “space race” in a 21st century Cold War.

Fun fact #1 (spoiler alert): Disadvantageous trade with Asia is probably Donald Trump’s most consistent policy point, as he’d been raving against the Japanese “taking advantage” of the US since the 1980s. His commitment to this issue supports one of the central theses of the film, which is that the trade war, like the very real war in Iraq, was primarily driven by ideologues in the Trump Administration — the “nationalists” — who won out against the “globalists”.

Fun fact #2: US companies basically made their own beds with this war. The film asserts that Trump’s stance is a reaction to decades of muddled US policy on the “unfair” trade policies of China. US companies are the primary culprits. Government officials from the Obama and Clinton administrations interviewed in the film say they would receive repeated complaints from US companies on intellectual property theft, and government subsidies to local companies. But when the government would move to act, the companies would lobby hard for them to back off as it would impact China revenue.

You can check out the full documentary here (watch, runtime: 54:47).

Diplomacy + Foreign Trade

Appointment of Israel’s ambassador to Egypt falls victim to Israeli political mess: The Israeli foreign minister has been urged by his staff to block PM Benjamin Netanyahu’s plan to appoint controversial Ayoub Kara as ambassador to Egypt, rather than veteran diplomat Amira Oron, The Times of Israel reports. Communications Minister Kara is a supporter of Netanyahu but has a history of “undiplomatic outbursts,” while Oron has previously served in Cairo and headed up the Israeli foreign ministry’s Egypt division.

El Sisi, Eritrea’s Afwerki discuss development projects: President Abdel Fattah El Sisi discussed with Eritrean counterpart Isaias Afwerki cooperating on infrastructure, electricity, healthcare, trade and investment, and agriculture projects, according to an Ittihadiya statement.

El Sisi ratifies KWD 70 mn loan for new sewage treatment facility: President Abdel Fattah El Sisi has ratified a KWD 70 mn loan agreement signed last year with the Arab Fund for Economic and Social Development to finance a new sewage treatment facility in Sharqia’s Bahr El Baqar. The decision has been published in the Official Gazette.

Egypt Politics + Economics

Finance Ministry to merge Mint and Public Treasury authorities

The Finance Ministry began procedures to merge the Mint Authority and the Public Treasury Authority in one entity under the name of the Mint Authority, the Finance Ministry said in a statement (pdf). The merger is part of administrative reform at the ministry and its affiliate authorities.

Nestle tips

On Your Way Out

Shou Ming making headlines as Thanaweya Amma kicks off: Abir Ahmed, founder of an Egyptian mothers’ association, has taken to the local press to send a message to the notorious exam-cheating Shou Ming Facebook group, which seems to be back in action as the Thanaweya Amma final exams begin. Authorities should closely monitor and shutdown pages which “create distress among students and parents and aim to embarrass the Education Ministry,” Ahmed said in a statement to journalists. The page has been leaking national exams since 2015, and has had at least two of its administrators arrested by the Interior Ministry since then. The problem of cheating on finals at Egyptian schools has become increasingly widespread in recent years — so much so that the Ismail Cabinet established in 2017 a committee dedicated to curbing the Shou Ming phenomenon.

The Market Yesterday

EGP / USD CBE market average: Buy 16.7114 | Sell 16.8114

EGP / USD at CIB: Buy 16.69 | Sell 16.79

EGP / USD at NBE: Buy 16.73 | Sell 16.83

EGX30 (Monday): 13,788 (+0.7%)

Turnover: EGP 303 mn (61% below the 90-day average)

EGX 30 year-to-date: +5.8%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.7%. CIB, the index’s heaviest constituent ended up 0.3%. EGX30’s top performing constituents were Madinet Nasr Housing up 3.9%, Telecom Egypt up 2.3%, and Global Telecom up 2.0%. Monday’s worst performing stocks were TMG Holding down 0,5%, Palm Hills down 0.4% and Pioneers Holding down 0.2%. The market turnover was EGP 303 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -14.1 mn

Regional: Net short| EGP -4.6 mn

Domestic: Net long| EGP +18.7 mn

Retail: 47.4% of total trades | 47.5% of buyers | 47.3% of sellers

Institutions: 52.6% of total trades | 52.5% of buyers | 52.7% of sellers

WTI: USD 53.99 (+2.66%)

Brent: USD 63.29 (+1.62%)

Natural Gas (Nymex, futures prices) USD 2.34 MMBtu, (+0.56%, July 2019 contract)

Gold: USD 1,346.10 / troy ounce (+0.25%)

TASI: 8,516.48 (+1.22%) (YTD: +8.81%)

ADX: 5,003.59 (+2.82%) (YTD: +1.80%)

DFM: 2,620.33 (+0.79%) (YTD: +3.58%)

KSE Premier Market: 6,276.36 (+0.76%)

QE: 10,319.33 (+1.49%) (YTD: +0.20%)

MSM: 3,941.82 (+0.13%) (YTD: -8.83%)

BB: 1,434.62 (-0.04%) (YTD: +7.28%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

10 June (Monday): Egypt’s Emirates NBD PMI for May released.

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

12-13 June (Wednesday-Thursday): The African Anti-Corruption Forum (AACF), Sharm El Sheikh

15 June (Saturday): An administrative court will look into an appeal by steel manufacturers to cancel the recently-imposed duties on imported steel rebars and pellets.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18 June (Tuesday): IDC CIO Summit, Marriott Hotel Zamalek, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, GrEEk Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.