- Global economy in a “delicate moment,” as IMF cuts 2019 global growth forecast to 3.3%. (Speed Round)

- The government hopes to clear its overdraft by June. (Speed Round)

- Abu Kir is next in line for the state privatization program. (Speed Round)

- Medhat Khalil acquires 26.7% of Raya Holding shares during MTO. (Speed Round)

- El Sisi, Trump hold talks in Washington — and the US media isn’t happy. (Speed Round, Egypt in the News)

- Egypt is No.5 in the world for remittance receipts. (Speed Round)

- Can emerging markets benefit from modern monetary theory? (Worth Listening)

- The first rule of Fight Club: Entry fees are really [redacted] expensive. (Worth Reading)

- The Market Yesterday

Wednesday, 10 April 2019

IMF cuts global growth forecast to 3.3%

TL;DR

What We’re Tracking Today

It’s Wednesday, ladies and gentlemen — our second-favorite day of the working week (our favorite being tomorrow) — and we have a busy day ahead of us.

President Abdel Fattah El Sisi is due to meet today with IMF Director Christine Lagarde on the final day of his three-day visit to the US. El Sisi held talks yesterday with US President Donald Trump, as well as Sec. of State Pompeo and White House adviser Jared Kushner (more coverage on this in today’s Speed Round).

The House of Representatives will today finish its “two-day deliberation” of the proposed constitutional amendments, Ahram Online reports. House Speaker Ali Abdel Aal will then form a committee which will produce a final draft ahead of the parliamentary vote on Tuesday, 16 April.

Monthly inflation figures are due out today. Annual headline inflation accelerated to 14.4% in February, up from 12.7% the previous month. In a report earlier this week, the IMF urged Egypt to take it easy with the monetary policy easing to avoid another surge in inflation.

AmCham is holding its annual HR Day at the Cairo Marriott Hotel today. You can register here.

Other things to keep track of in the coming days:

- The IMF and World Bank are holding their spring meetings on 12-14 April in Washington, DC. Finance Minister Mohamed Maait and Investment and International Cooperation Minister Sahar Nasr are set to attend the meetings.

- The UK will, theoretically, leave the European Union on Friday, 12 April. Prime Minister Theresa May has asked for a three-month extension to 30 June.

- First quarter earnings season gets underway in the United States at week’s end as JPMorgan and Wells Fargo report results. The expectation, as we noted last week, is for corporate earnings in the US and Europe to fall in 1Q for the first time since 2016.

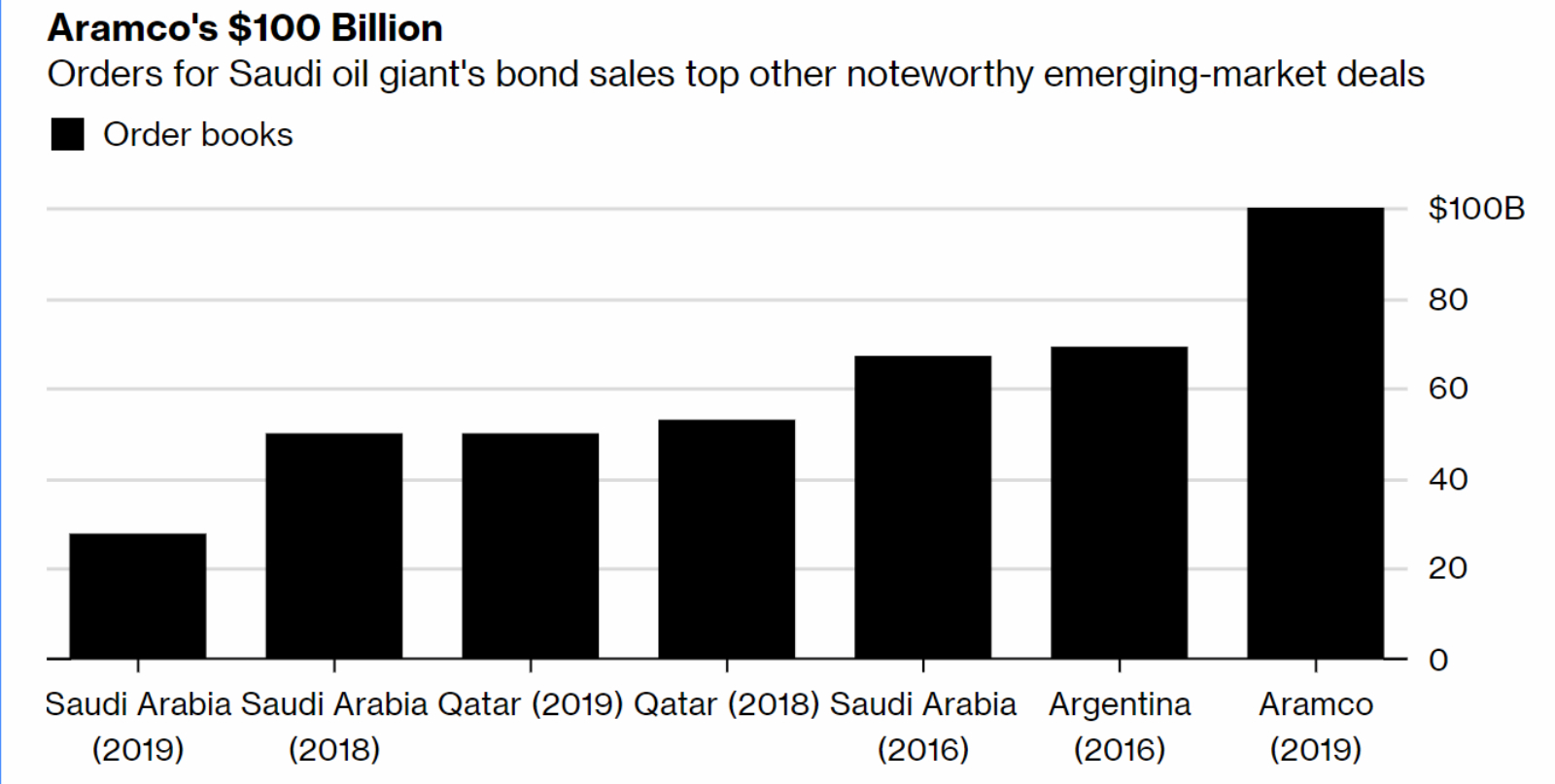

Orders on Aramco issuance break EM record: Demand for Aramco’s debut global bond issuance hit USD 100 bn yesterday, with fixed-income investors clamoring for yield at a time when rates on some sovereign and corporate bonds are low, reports Bloomberg. The bonds are being marketed as “in line” with Saudi government bonds, notes the FT, which could see Aramco’s final price fall further. The huge appetite for Aramco debt may mean that plans for an IPO may be placed on the shelf for a while yet, CNBC says.

The Israeli election was a nail-biter: Benjamin Netanyahu looks likely to emerge victorious in a closely-fought election battle with ex-general Benny Gantz. The winner was too close to call for much of the evening, but at the time of writing it seems that Netanyahu is set to enter a fifth term in office. Haaretz has live updates here.

Is there a new trade war afoot? The EU is threatening to escalate a trade dispute with Washington by introducing retaliatory tariffs on US goods, Bloomberg reports. The US on Monday announced USD 11 bn in new tariffs on EU products after the WTO found the bloc to have illegally subsidized Airbus. Although the EU has not yet provided details about the proposed tariffs, Airbus claimed that it would use “far larger countermeasures against the US.”

Uber’s IPO preparations could be going more smoothly: The ride-hailing company is coming under commercial and legal scrutiny as it prepares to IPO, the FT writes. The lawsuits and investigations, as well as questions over its business model, means that investors are going to be taking on more risk than is customary for IPOs, experts tell the salmon-colored paper.

Mind-blowing science story of the day: Today scientists will reveal for the first time ever pictures of an actual black hole. The images of Sagittarius A, taken by the aptly-named Event Horizon Telescope, will be unveiled during a press conference which will be live-streamed here.

*** QUESTION OF THE MORNING: We asked you the past couple of days and the answers have been inspiring. So we’re going to ask again every day until the end of the week: Does anyone out there know of homegrown Egyptian businesses that have successfully scaled up and expanded beyond our borders (not necessarily just to shiny Dubai)? We’re looking at great growth stories to feature in a new product we’re developing. Know someone? Drop us a line at editorial@enterprise.press.

Thank you to readers Christopher W., Mariam R., Aiman M., Ramez S. and Salma M. for your great suggestions.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s talks with US President Donald Trump dominated the nation’s airwaves last night. Trump showed the president “unprecedented, absolute support” during their second formal meeting yesterday in Washington, Al Hayah Al Youm’s Khaled Abu Bakr reported from the White House, adding that the two saw eye-to-eye on many topics. (watch, runtime: 5:35).

Trump also praised efforts by Egyptian authorities to promote religious freedom and tolerance during a press conference after the presidential meeting, Hona Al Asema’s Lama Gebreil reported from the US capital (watch, runtime: 8:43).

Egypt is the largest recipient of US FDI in Africa: Egypt is the largest single recipient of US FDI in Africa, and the second largest in the Middle East, according to an infographic published yesterday by the government and cited by Al Hayah Al Youm’s Lobna Assal (watch, runtime: 5:06).

Speed Round

Speed Round is presented in association with

The global economy is in a “delicate moment,” the IMF says: The global economy is in a “delicate moment”, IMF chief economist Gita Gopinath has said in the fund’s latest World Economic Outlook (pdf), which predicts growth to slow to 3.3% this year, down from 3.6% in 2018. Growth is expected to return to 3.6% in 2020 as conditions begin to improve in the second half of the year, fueled by Chinese stimulus, brighter market sentiment, and an end to temporary drags on growth in the euro area. Conditions in stressed emerging markets such as Turkey and Argentina will also begin to stabilize. Global growth is expected to plateau at 3.6% beyond 2020.

The problem is advanced economies: Slowing labour productivity and labor force growth will hinder growth in advanced economies, while the increasing weight of China and India props up global expansion rates, the IMF said. Growth in emerging and developing economies will stabilize below 5%.

A further escalation of trade tensions and the threat of a chaotic British exit from the EU continue to pose risks, the fund warned. This could lead to a sharp deterioration in market sentiment and tighter financial conditions. Uncertainty over Italy’s fiscal position and a reassessment of US monetary policy present additional dangers, it said. “If any of the major risks materialize, then the expected recoveries in stressed economies, export-dependent economies, and highly indebted economies may not occur,” Gopinath said.

What are the forecasts for Egypt? Growth is forecast at 5.5% in 2019 and 5.9% in 2020, the current account deficit is expected to drop to 2.4% in 2019 and 1.7% in 2020, while inflation will fall to 14.5% in 2019 and 12.3% in 2020.

EXCLUSIVE- FinMin, CBE look to clear government’s overdraft by June: The Finance Ministry and the Central Bank of Egypt (CBE) are in talks to clear the government’s overdraft, which had reached EGP 325 bn prior to Egypt signing for the IMF loan in 2016, a senior government official told Enterprise. The ministry will also issue a EGP 40-60 bn securitization bond for the CBE as part of the agreement. This would weigh on public debt and the budget deficit but will result in a more accurate reflection of the economy’s health. The Finance Ministry has been using the overdraft to repay the government’s debt and interest during the past period when the state’s financing gap was too wide.

Clearing overdraft accounts between the CBE and government agencies was part of Egypt’s agreement with the IMF, and the government is now looking at the overdraft owed by several bodies to the CBE, according to our source. Egypt’s improved FX reserves and overall liquidity levels have allowed the breathing room necessary for the move.

Abu Kir is next up in the privatization program: Abu Kir Fertilizers is next up in the state privatization program as the government prepares to sell a 20% stake on the EGX, sources close to the matter told the local press. The sale’s lead managers, private sector investment banks CI Capital and Renaissance Capital are currently working with the government to finalize the book building process. It was previously believed that the second company to take part in the program would be Alexandria Containers & Cargo Handling (ACCH), which plans to sell a 30% stake. The government is expected to raise up to EGP 8 bn in sale proceeds from the ACCH and Abu Kir offerings.

Background: The government successfully kicked off the program last month with Eastern Tobacco’s secondary offering of a 4.5% stake. Eastern, Abu Kir, and ACCH, along with Heliopolis Housing, are part of the first wave of companies piloting the program — which will only see share sales and not IPOs. Alexandria Mineral Oils Company (AMOC) was also part of the wave, but it got sidelined earlier this year for falling profitability. Public Enterprises Minister Hisham Tawfiq previously said all offerings in the first wave will wrap up before the Eid El Fitr break.

M&A WATCH- Medhat Khalil acquires 26.7% of Raya Holding shares in MTO: Raya Holding Chairman Medhat Khalil bought 26.7% (56.919 mn shares) of Raya Holding through his El Pharonia Real Estate Investment at a cost of EGP 314.76 mn in a mandatory tender offer (MTO) that ended on Sunday, the company said. The MTO kicked off on 11 March at EGP 5.53 per share, a slight premium to the EGP 5.35 at which it had last closed prior to the takeover bid.

This does not mean the company is being taken private: “We don’t have any intentions to delist from the stock market,” Raya Group CFO Hossam Hussein told Enterprise. “This was apparent in the proposal of the main shareholder in which he asked to buy 90% of the company’s shares — it was intentional to leave 10% of the company’s shares free-floating so that the company would continue to be on the exchange.”

What happens now? The group is expecting to push forward with its current plans, Hussein said. “Our future plans whether in Egypt or abroad will remain the same. Medhat Khalil is a main shareholder, but the board of directors comes up with companies’ plans and approves them.” Raya’s expansion plans will be focused on non-banking financial services, manufacturing and food production.

Background: The Financial Regulatory Authority (FRA) had ordered Khalil at the end of last year to submit an MTO for Raya or sell down his stake, arguing that he and related parties controlled a combined 42% of the company — a level of control that triggers the requirement for an MTO under securities regulations.

Trump calls El Sisi a “great president” during diplomatic talks: US President Donald Trump described President Abdel Fattah El Sisi as a “great president” and a “great friend” during diplomatic talks in Washington, DC yesterday. “We’ve never had a better relationship, Egypt and the United States, than we do right now,” Trump told reporters in the White House. The leaders reportedly discussed terrorism, regional security and the US-Egypt trade relationship during the meeting, which came just days before the House of Representatives votes on the proposed amendments to the constitution. The White House released a transcript of the press conference as well as a fact sheet following the talks.

The US press were less than impressed with the proceedings (more on this in today’s Egypt in the News).

El Sisi discussed events in Libya, Syria and Yemen, as well as terrorism and security with US Secretary of State Mike Pompeo ahead of his meeting with Trump, according to a SIS statement. He also held talks with White House adviser Jared Kushner during which he emphasized the need to restart the Israeli-Palestinian peace process, an Ittihadiya statement said.

A US official has expressed concern over growing Russian influence in the MENA region, urging Cairo to rely more on the West, Sputnik News reported. “We have long argued that Russia is not a reliable partner for weapons sales; that American equipment and American support is far superior,” the unnamed official reportedly said in a press briefing. Members of the US Congress have previously voiced unease about Egypt’s agreement last month to purchase 20 Russian fighter jets.

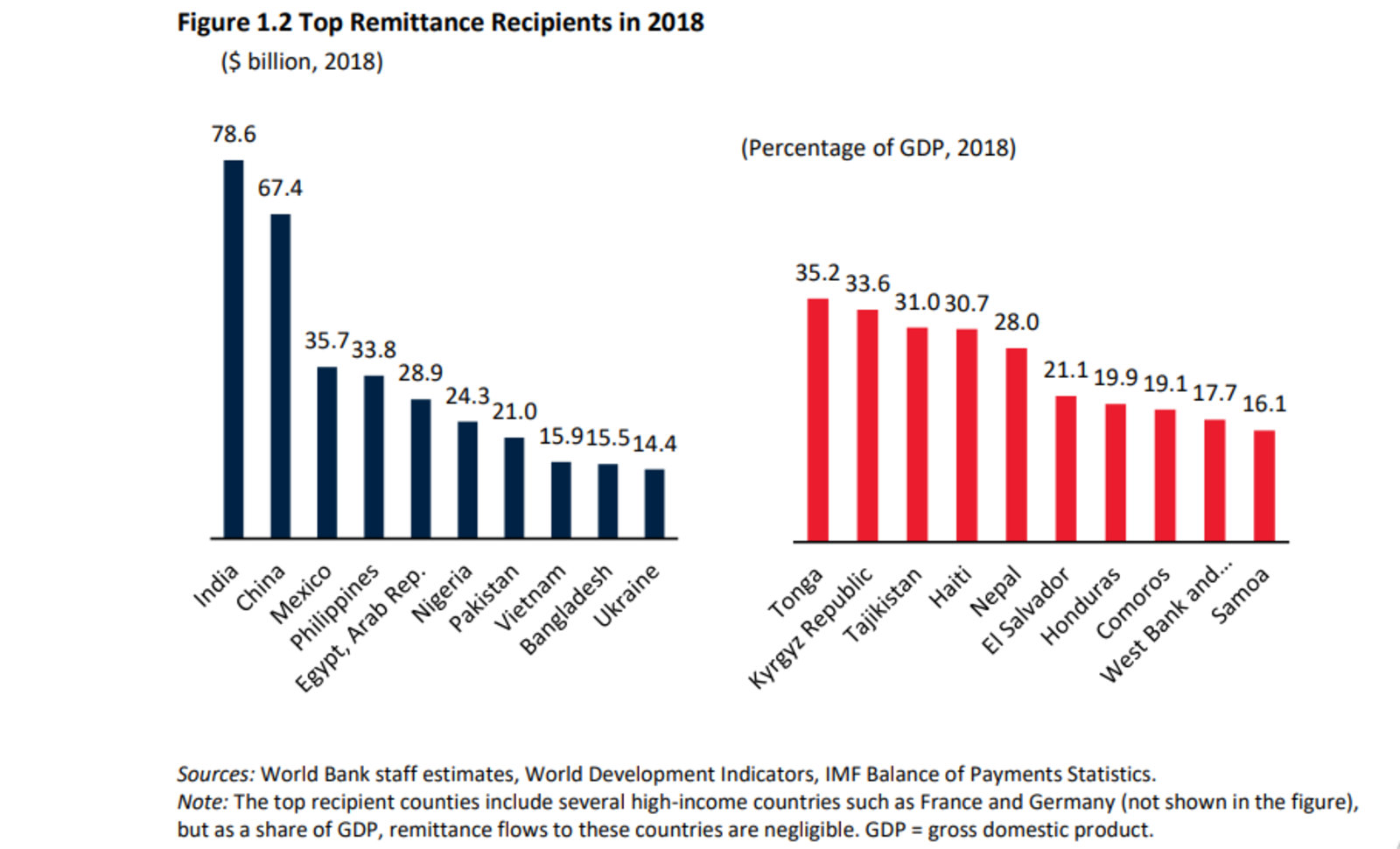

Egypt was the world’s fifth top recipient of remittances in 2018, with inflows from Egyptians working abroad reaching USD 29 bn by the end of the year, up 17% y-o-y from USD 18.2 bn last year, according to the World Bank’s Migration and Development Brief (pdf). The increase in flows to Egypt led MENA remittances to grow 9.1% y-o-y. “Beyond 2018, the growth of remittances to the MENA region is expected to continue, albeit at a slower pace of around 3% due to moderating growth in the [eurozone].”

The cost of sending home remittances in the MENA region is now lower than the global average, after declining slightly to 6.9% in 4Q2018 from 7.4% in 4Q2017, the report notes. The global average during the final quarter of last year was 7%. Costs are considerably lower when sending from GCC countries to Egypt and Jordan (sometimes falling below 5%) than when sending from high-income OECD countries to Lebanon, “which continues to be in the double digits.”

Ergot troubles could be making a comeback: Egypt rejected yesterday a 63k tonne shipment of French wheat, saying it contained higher levels of ergot than is legally allowed, sources close to the matter told Reuters. Egypt’s state tender rules and international standards allow for ergot levels of up to 0.05%, but the shipment was found to contain 0.1%, according to the sources. The shipment, which arrived at Safaga port last week, has not been offloaded but the supplier has filed a request to redo the test.

Background: Egypt had instituted a zero-tolerance policy for ergot in wheat shipments in 2016, throwing a wrench in the global wheat market and causing widespread headaches for industry players as traders were reluctant to participate in tenders by the General Authority for Supply Commodities (GASC). The disruptions also drove prices on Egypt’s wheat tenders higher. Following months of flip-flopping, the Higher Administrative Court decided last May to strike down the zero-tolerance policy, allowing imports with up to 0.05% ergot contamination.

MOVES- Transport Minister Kamal El Wazir appointed General Amr Ismail head of the General Authority for Ports and Dry Land following the retirement of Hosny Salman, reports Al Mal.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Why is 2019 a new story for EM assets, but the same old story for FX? The MSCI EM currency index hasn’t replicated the gains enjoyed so far this year by EM equities and bonds, says Bloomberg. The index has largely remained flat since January, and perspectives differ as to why — despite the US Federal Reserve’s pro-growth stance and signs of a US-China trade war truce — there hasn’t been an uptick.

Sensitivity to global slowdown, political volatility: Some analysts are pointing to the currency’s greater sensitivity to global growth risks. Those risks are coming primarily from weak growth data in Europe, which are further exacerbated by a strong USD and China’s weak output story. Others are saying political volatility in emerging markets is “squeezing funding for those who want to hedge.”

Fund managers might have had their share of EM currencies after a decade of easing in advanced economies — with perhaps more on the way. Foreign direct investment and current account balances also tend to uptick at a slower rate than stocks and bonds when central bank policies and global risk appetite shift favorably.

Looking forward, Chinese recovery and an easing of geopolitical risks coupled with policy support from major economies will put the index on the right track.

Image of the Day

Did you ever think a solar plant farm could look so pretty? Stretched over 1,679 acres in Nevada’s desert, the Crescent Dunes Solar Energy Facility supplies power to 75k homes, Wired says. The facility is comprised of massive mirrors that, according to renowned photographer Reuben Wu, make it resemble “a fake sun” from above — not to mention that the perfectly aligned rows are more aesthetically soothing than we ever thought solar plants could be.

Egypt in the News

El Sisi’s visit to Washington is unsurprisingly dominating the international press this morning — and we’re continuing to take a battering. The Washington Times is complaining that Trump failed to bring up the proposed constitutional amendments during the meeting, choosing instead choosing to tell El Sisi that he’s “doing a great job”. Slate and Voice of America are equally angry about this.

Human rights was also a phrase that found its way into much of the coverage: Bloomberg highlighted the detention of Americans in Egypt, treatment of religious minorities and the track record of human rights abuses. The deepening relationship with Russia also brought renewed scrutiny over US aid to Cairo, with Foreign Policy focusing on a letter sent from US lawmakers that urged Sisi to allow US diplomats to visit the Sinai Peninsula and track how Egypt is using US aid. The Washington Post has more.

Other headlines worth noting in brief:

- Posters encouraging people to approve the constitutional amendments in the upcoming referendum have flooded Cairo, the AP writes in a report picked up by Fox News.

- The daughter of a 60-year-old detained at Al Qanater prison has lobbied the US to assist in the release of her mother, according to Oregon Public Broadcasting.

- The inclusion of refugees in the “100 mn healthy lives” campaign has received praise from the WHO and the UN, as Egypt attempts to eliminate Hepatitis C by 2023, reports Relief Web.

- Seven people were killed in a suicide-bomber attack in North Sinai, per an interior ministry statement. Casualties included 4 police personnel and 3 citizens while 26 others were wounded, with Daesh claiming responsibility for the attack, Reuters reports.

On The Front Pages

President Abdel Fattah El Sisi’s trip to Washington topped the front pages of the state-owned press this morning for the second consecutive day (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Reading

Fight Club for finance’s top brass: The world of finance has a secret, exclusive, and unnamed club whose members are wealthy traders making high-risk (and high-reward) money moves, Alastair Marsh writes for Bloomberg. “It has no name and no board of directors but has a roster drawn from the world’s wealthiest and most successful traders. Members essentially become their own one-person firms, even firms within firms, by gaining a seal of approval to trade in the complex products typically reserved for institutions that manage hundreds of bns of USD. And all without drawing the attention of Wall Street’s everyday mn’aires.”

What does it take to get into the Finance Fight Club? Oh, you know, just a cool USD 25 mn “admission payment” to get what Marsh refers to as “the prize”: An International Swaps and Derivatives Association (ISDA) master agreement. “In the USD 542 tn market for over-the-counter derivatives, ISDA agreements set out the trading terms between two parties. In the vernacular of Adam McKay’s adaptation of The Big Short, they represent ‘a hunting license’ that lets an investor sit at the ‘big boy table and make high-level trades not available to stupid amateurs.’” A firm that hands out these agreements can get its hands on top-tier clients — and can charge a nice premium while they’re at it.

Worth Listening

Can modern monetary theory help emerging markets? In yesterday’s issue we gave a short explainer for modern monetary theory (MMT) — an alternative approach to monetary policy that is growing in popularity in the US. How applicable is it to emerging markets though? Its detractors would say that, even if developed countries with full control of their currencies were able to disregard their budget deficits, there is no way it would ever work in emerging markets where governments don’t have the same fiscal capacity. Wrong, says Fadhel Khaboub, associate professor of economics at Denison University, who explains in this Bloomberg podcast (runtime: 38:44) how the MMT perspective could benefit emerging markets. Here are the key takeaways:

Most developing economies lack monetary sovereignty because they issue debt denominated in foreign currencies and/or they peg their national currencies to foreign currencies.

What causes this? Reliance on food and fuel imports, as well as exporting high value-added content and importing low value-added content.

How can countries regain control over their currencies? By reducing fuel and food subsidies, and replacing them with domestic renewable energy and locally-produced food. Countries need a clear industrial investment strategy to develop a high value-added manufacturing base.

International trade between advanced and developing economies is unfairly weighted: Emerging markets will develop faster if they focused their efforts on building trade with other countries with similar-sized economies.

MMTers are not members of the IMF fanclub: Emergency IMF loans are akin to a “bandaid” which result in higher external debt levels and lower degrees of monetary sovereignty, Khaboub says.

Energy

Qalaa Holdings completes trial runs for two ERC units

Qalaa Holdings has successfully completed trial runs for the CCR and VDU units of its Egyptian Refining Company (ERC), the company said in an EGX disclosure (pdf). The company has supplied the Egyptian General Petroleum Corporation with about 100k tonnes of low-sulfur petroleum products (diesel, naphtha, octane and gasoline) since the trial run kicked off. ERC will complete trial runs for all of its units by the end of 2Q2019.

Basic Materials + Commodities

GASC orders new 60k tonne shipment of Romanian wheat

State grain purchaser GASC has re-ordered 60k tonnes of Romanian wheat from Ameropa after a previous shipment was rejected in March due to quality issues, reports Reuters Arabic service. The new shipment will cost USD 245.45 per tonne.

Telecoms + ICT

Egypt, Saudi agree tighter technological cooperation

Prime Minister Mostafa Madbouly and CIT Minister Amr Talaat met yesterday with Saudi CIT Minister Abdullah bin Amer Alswaha, and agreed to increase cooperation in digital transformation and information technology, according to Al Masry Al Youm. No further details were given.

Mobile subscriptions down 7.6mn at the end of last quarter 2018

Mobile subscriptions fell to 93.78 mn subscriptions by Q42018-end, down 7.4% y-o-y from 101.27 mn subscriptions by Q42017-end, according to a ministry report (pdf). There was also an uptick in the number of land-line subscriptions in the same quarter totaling 7.59 mn users in December compared to 6.60 in October.

Automotive + Transportation

Arab Organization for Industrialization signs MoUs for cargo train maintenance

The Arab Organization for Industrialization (AOI) signed MoUs with two Slovakian companies to maintain cargo trains, according to Al Shorouk. The agreement comes as part of AOI’s mandate to modernize Egypt’s railways.

Chemical Industries signs MoU with Malaysia’s Proton to develop El Nasr Automotive

The Chemical Industries Holding Company has signed an MoU with Malaysian automotive manufacturer Proton to examine cooperation over the development of El Nasr Automotive’s factory, sources told Al Mal. Proton expressed their interest in collaborating and agreed to conduct a feasibility study during a recent visit. El Nasr recently signed an MoU with Nissan to produce 100k cars a year in Egypt, following years of on-and-off talks with foreign companies to resurrect the Nasser-era car manufacturer.

Egypt Politics + Economics

Supreme Constitutional Court rules part of law on naturalization unconstitutional

The Supreme Constitutional Court ruled on Sunday that part of Egypt’s law on naturalizing citizens is unconstitutional, according to Al Masry Al Youm. The law had permitted minors of foreign fathers who acquire Egyptian citizenship to be naturalized, but did not grant the same right for minors whose mothers earned the citizenship. The court ruled that this difference was unconstitutional.

On Your Way Out

‘The Mountain’ pays a visit to the pyramids: Icelandic reigning World’s Strongest Man and actorHafþór Júlíus Björnssonl, better known as Gregor "The Mountain" Clegane from Game of Thrones, paid a visit to the pyramids, according to Cairo Scene. Björnssonl, of whom a selfie with the wife made headlines in the local press, got his one-way ticket to global fame when he appeared on GoT in the fourth season in April 2014. Need we remind you that the eighth and final season is scheduled to air on Sunday?

Nestlé Egypt plans to only be using recyclable packaging materials by 2025 as part of its commitment to protect the environment, it said in a statement (pdf). The company has begun coordinating with the Health Ministry for procedures to recycle its industrial waste. The company will also collaborate with civil society entities that are concerned with the issue and arrange campaigns to clean affected spots on the Nile and Red Sea coasts.

The Market Yesterday

EGP / USD CBE market average: Buy 17.27 | Sell 17.37

EGP / USD at CIB: Buy 17.26 | Sell 17.36

EGP / USD at NBE: Buy 17.26 | Sell 17.36

EGX30 (Tuesday): 15,089 (-0.2%)

Turnover: EGP 622 mn (31% below the 90-day average)

EGX 30 year-to-date: +15.8%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.2%. CIB, the index heaviest constituent ended up 0.4%. EGX30’s top performing constituents were Pioneers Holding up 3.4%, Qalaa Holdings up 0.8%, and Ezz Steel up 0.8%. Yesterday’s worst performing stocks were Palm Hills down 3.8%, Orascom Investment Holding down 3.5% and Heliopolis Housing down 1.8%. The market turnover was EGP 622 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -140.2 mn

Regional: Net Short | EGP -23.0 mn

Domestic: Net Long | EGP +163.1 mn

Retail: 36.1% of total trades | 34.4% of buyers | 37.9% of sellers

Institutions: 63.9% of total trades | 65.6% of buyers | 62.1% of sellers

WTI: USD 64.18 (+0.31%)

Brent: USD 70.61 (-0.69%)

Natural Gas (Nymex, futures prices) USD 2.71 MMBtu, (+0.37%, May 2019)

Gold: USD 1,308.60 / troy ounce (+0.02%)

TASI: 9,047.58 (+0.11%) (YTD: +15.60%)

ADX: 5,076.03 (+0.01%) (YTD: +3.27%)

DFM: 2,801.96 (+0.17%) (YTD: +10.76%)

KSE Premier Market: 6,104.82 (-1.56%)

QE: 10,217.92 (-0.09%) (YTD: -0.79%)

MSM: 3,971.72 (+0.00%) (YTD: -8.14%)

BB: 1,440.56 (-0.41%) (YTD: +7.72%)

Calendar

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

10 April (Wednesday): The Seamless Awards 2019, The Armani Hotel, Dubai.

10 April (Wednesday): Egyptian Retail Summit (ERS 2019), Nile Ritz Carlton, Garden City, Cairo, Egypt.

12-14 April (Friday-Sunday): IMF and World Bank spring meetings in Washington, DC.

16 April (Tuesday): The House of Representatives votes on the proposed constitutional amendments.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

23-24 April (Tuesday-Wednesday): SME Corporate Governance Workshop, Fairmont Nile City Hotel, Cairo, Egypt.

25 April (Thursday): Sinai Liberation Day, national holiday.

25 April (Thursday): Belt and Road Forum for International Cooperation, Beijing, China.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program.ahead of the disbursement of the fifth and final tranche of Egypt’s USD 12 bn IMF loan.

1 May (Wednesday): Labor Day, national holiday.

4 May (Saturday) An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

6 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.