What we’re tracking on 10 April 2019

It’s Wednesday, ladies and gentlemen — our second-favorite day of the working week (our favorite being tomorrow) — and we have a busy day ahead of us.

President Abdel Fattah El Sisi is due to meet today with IMF Director Christine Lagarde on the final day of his three-day visit to the US. El Sisi held talks yesterday with US President Donald Trump, as well as Sec. of State Pompeo and White House adviser Jared Kushner (more coverage on this in today’s Speed Round).

The House of Representatives will today finish its “two-day deliberation” of the proposed constitutional amendments, Ahram Online reports. House Speaker Ali Abdel Aal will then form a committee which will produce a final draft ahead of the parliamentary vote on Tuesday, 16 April.

Monthly inflation figures are due out today. Annual headline inflation accelerated to 14.4% in February, up from 12.7% the previous month. In a report earlier this week, the IMF urged Egypt to take it easy with the monetary policy easing to avoid another surge in inflation.

AmCham is holding its annual HR Day at the Cairo Marriott Hotel today. You can register here.

Other things to keep track of in the coming days:

- The IMF and World Bank are holding their spring meetings on 12-14 April in Washington, DC. Finance Minister Mohamed Maait and Investment and International Cooperation Minister Sahar Nasr are set to attend the meetings.

- The UK will, theoretically, leave the European Union on Friday, 12 April. Prime Minister Theresa May has asked for a three-month extension to 30 June.

- First quarter earnings season gets underway in the United States at week’s end as JPMorgan and Wells Fargo report results. The expectation, as we noted last week, is for corporate earnings in the US and Europe to fall in 1Q for the first time since 2016.

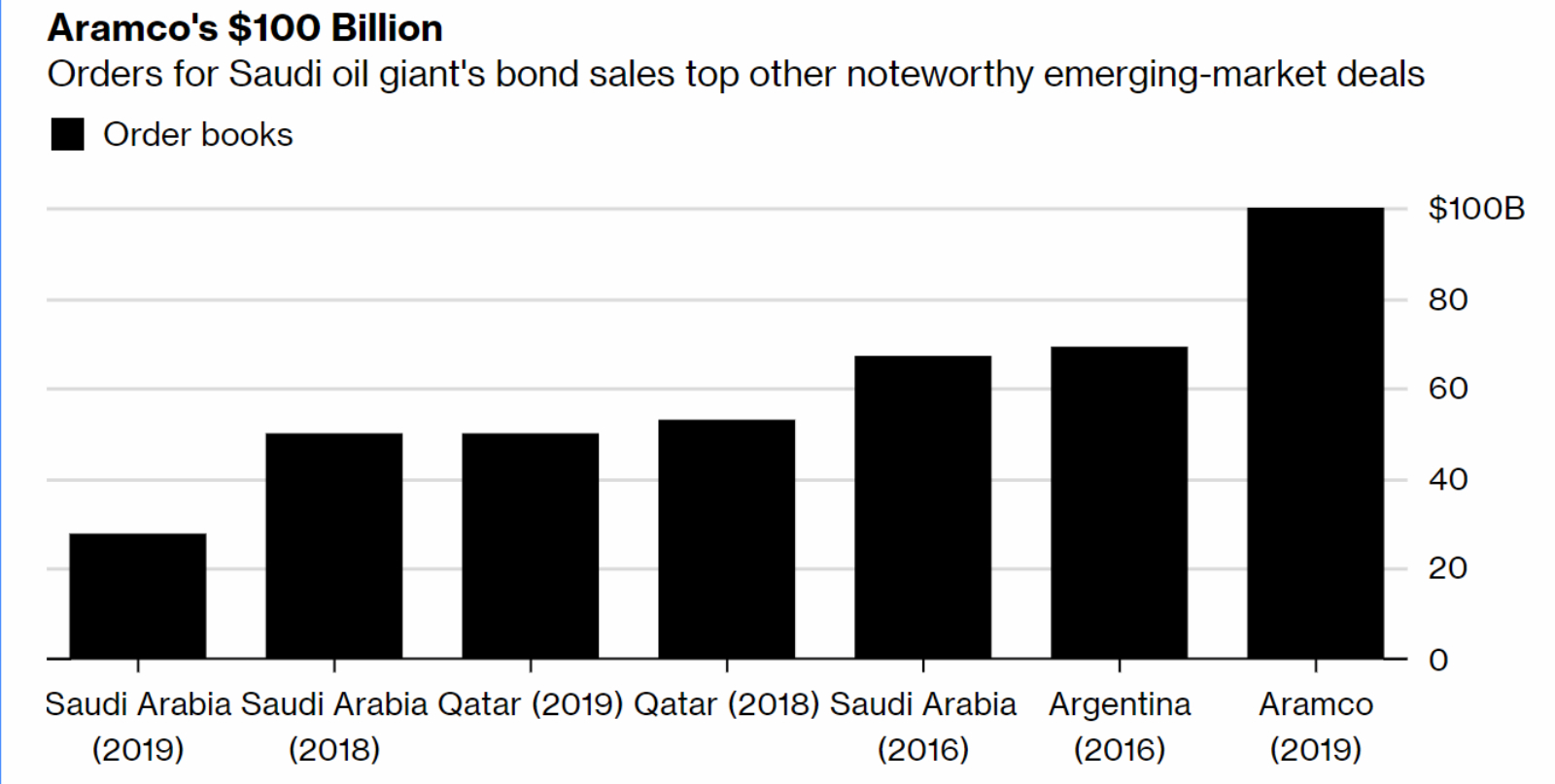

Orders on Aramco issuance break EM record: Demand for Aramco’s debut global bond issuance hit USD 100 bn yesterday, with fixed-income investors clamoring for yield at a time when rates on some sovereign and corporate bonds are low, reports Bloomberg. The bonds are being marketed as “in line” with Saudi government bonds, notes the FT, which could see Aramco’s final price fall further. The huge appetite for Aramco debt may mean that plans for an IPO may be placed on the shelf for a while yet, CNBC says.

The Israeli election was a nail-biter: Benjamin Netanyahu looks likely to emerge victorious in a closely-fought election battle with ex-general Benny Gantz. The winner was too close to call for much of the evening, but at the time of writing it seems that Netanyahu is set to enter a fifth term in office. Haaretz has live updates here.

Is there a new trade war afoot? The EU is threatening to escalate a trade dispute with Washington by introducing retaliatory tariffs on US goods, Bloomberg reports. The US on Monday announced USD 11 bn in new tariffs on EU products after the WTO found the bloc to have illegally subsidized Airbus. Although the EU has not yet provided details about the proposed tariffs, Airbus claimed that it would use “far larger countermeasures against the US.”

Uber’s IPO preparations could be going more smoothly: The ride-hailing company is coming under commercial and legal scrutiny as it prepares to IPO, the FT writes. The lawsuits and investigations, as well as questions over its business model, means that investors are going to be taking on more risk than is customary for IPOs, experts tell the salmon-colored paper.

Mind-blowing science story of the day: Today scientists will reveal for the first time ever pictures of an actual black hole. The images of Sagittarius A, taken by the aptly-named Event Horizon Telescope, will be unveiled during a press conference which will be live-streamed here.

*** QUESTION OF THE MORNING: We asked you the past couple of days and the answers have been inspiring. So we’re going to ask again every day until the end of the week: Does anyone out there know of homegrown Egyptian businesses that have successfully scaled up and expanded beyond our borders (not necessarily just to shiny Dubai)? We’re looking at great growth stories to feature in a new product we’re developing. Know someone? Drop us a line at editorial@enterprise.press.

Thank you to readers Christopher W., Mariam R., Aiman M., Ramez S. and Salma M. for your great suggestions.