- Central bank will leave interest rates on hold this Thursday -Enterprise poll. (Speed Round)

- We won’t be receiving the fifth tranche of our IMF facility this month — but reforms aren’t being delayed, either. (Speed Round)

- Breaking down the gov’t expected FX inflows in 2019. (Speed Round)

- Misr Capital Investments arm gets new team amid restructuring plans. (Speed Round)

- FRA rejects Beltone’s appeal of its six-month suspension. (Speed Round)

- EFG Hermes’ Egypt Education Fund is oversubscribed at first close. (Speed Round)

- Local governance act to take precedence over debate on SME bill. (Up Next)

- Die Hard and Trading Places — which one is the best Christmas movies ever?

- The Market Yesterday

Monday, 24 December 2018

We’re off tomorrow — go watch Die Hard or Trading Places, the best Xmas movies ever

TL;DR

What We’re Tracking Today

Good morning, friends, and a very happy Christmas Eve to all those among you who observe. It’s another oddly busy news morning here at home even as the holiday-season news slowdown becomes more pronounced abroad.

** We are off tomorrow and will be back in your inboxes on Wednesday morning at the usual time.

The question of the morning: What will global markets look like this week, when thin volumes and empty trading desks means it is anyone’s guess how things unfold. Asian shares opened down across the board this morning, with major indices in Japan, South Korea, mainland China, Hong Kong and Australia all in the red as we slid toward dispatch time. US stock futures also suggest weakness ahead of the opening bell today.

The Readers of Sheep’s Entrails weigh in: The chief equity technical strategist at Bank of America-Merrill Lynch tells CNBC, “We do think the equity markets are set up to continue this cyclical bear market or bear market, just call it what it is — and correct further, a deeper retracement.”

Fear not: Steve Mnuchin is on the case with his “Plunge Protection Team.” We kid you not: The treasury secretary called top US bankers yesterday and “made plans to convene a group of officials known as the ‘Plunge Protection Team,’” Reuters reports, sounding just a bit like The Onion. Mnuchin spoke individually to the CEOs of America’s six largest banks and “confirmed that they have ample liquidity available for lending,” Reuters quotes Treasury as saying. Treasury says the bank chiefs also told him they “have not experienced any clearance or margin issues and that the markets continue to function properly.” Ah, lovely: A reassuring statement that reads as if it was written by pols here in Omm El Donia. Nothing to see here, folks. Move along. Move along.

Remember: This is from the same guy who tweeted that he’s pretty certain that The Donald doesn’t think The Donald has the power to fire Fed boss Jay Powell. Bloomberg has the details.

When are western markets open? Funny you should ask:

London Stock Exchange:

Today (24 Dec): Early close (12:30pm London time)

Tuesday (25 Dec): Closed

Weds (26 Dec): Closed

Thurs-Fri (27-28 Dec): Normal hours

NYSE and Nasdaq:

Today (24 Dec): Early close (1pm New York time)

Tuesday (25 Dec): Closed

Weds-Fri (26-28 Dec): Normal hours

The next holiday for the EGX and most regional markets: Tuesday, 1 January 2019.

The latest from America: The Donald is apparently fine with his government shutdown running into January as he broods over the resignation of Defense Secretary Jim Mattis and sends him to the benches two months early.

Closer to home: Protests in Sudan entered their fifth day, Reuters reports, as police fired tear gas a “hundreds of protesters spilling out of a soccer match” in Khartoum. Protesters are condemning “price rises, shortages of basic commodities and a cash crisis,” the newswire adds. The Financial Times is positioning it as one of the “most significant challenges” Sudanese President Omar Al-Bashir has faced in nearly 30 years in office.

In miscellany this morning:

- Facebook is developing a cryptocurrency to allow users to transfer funds through WhatsApp, according to Bloomberg. The ‘stablecoin’ would be pegged to the USD.

- The father of Saudi bn’aire Alwaleed bin Talal has died at age 87 after a long illness, Reuters reports.

- More than 220 people are dead in Indonesia after a tsunami struck two islands, Reuters says.

Getting now into the holiday spirit: Can you hear the sound of crickets in your office this morning? Pilita Clark’s “Help wanted: a holiday roster that everyone can live with” struck a deep nerve with us this morning as we face day two of a relatively under-staffed week.

What’s the best Christmas movie ever made: Die Hard or Trading Places? That’s the burning question on our minds here this morning.

Tap / click the images to watch:

Die Hard: Bruce Willis at his sardonic best facing off against Alan Rickman before he became known to a generation as Severus Snape. So cool it set a template for a generation of movies and inspired an episode of Friends a decade after it was made. Unbelievably, the film turns 30 this year.

Trading Places: As if Eddie Murphy and Dan Aykroyd were not enough, the central premise here is a play that involves a short on frozen orange juice futures that gets the underlying bit about the commodities trade right. Don’t take our word for it: The inimitable Planet Money devoted a whole episode to this one.

More videos to distract you on your morning commute:

Macaulay Culkin (aka: The Kid from Home Alone) reprises his role as Kevin McAllister for a Google commercial that had us smiling.

Not quite as cool: Holiday greetings from the kids of Stranger Things, but our mania for the show had us watching anyway.

And for the finance nerds among us: Bns is back, baby. The coolest show ever written about finance (not a high bar, we know) is back in March. Catch the trailer:

Enterprise+: Last Night’s Talk Shows

No single topic drove the conversation on last night’s talk shows, leaving the talking heads to poke around a variety of stories and issues.

Egypt expects to sign the final agreement for the high-speed electric train that will link Cairo to the new administrative capital with the Chinese company that will construct the railway soon, Transport Minister Hisham Arafat told El Hekaya’s Amr Adib. The ministry is still working on locking down the necessary funding for the project, Arafat said (watch, runtime: 13:28).

MP threatens gov’t with vote of no confidence if ministers keep ignoring parliament: House Deputy Speaker Soliman Wahdan phoned in to Al Hayah Al Youm to whine about ministers failing to attend parliamentary sessions where their presence has been requested, saying that the House of Representatives has the right to withdraw its confidence in the government if this practice persists (watch, runtime: 11:17). If only Wahdan were equally disdainful of MPs missing sessions…

The Agriculture Ministry is planning to ramp up the cultivation of potato seeds to avoid being forced to import them at a higher cost, and thus keeping market prices in check next year, ministry spokesman Hamed Abdel Dayem said on Hona Al Asema. Cotton cultivation should also increase next year to better meet demand, he said (watch, runtime: 06:54).

The Electricity Ministry will announce the new breakdown of electricity prices two months ahead of the next increase in July, spokesman Ayman Hamza said on Masaa DMC, reaffirming that there are no scheduled price increases before then (watch, runtime: 07:02)

The Port Said governorate has cleared all of its illegally constructed slum areas and has provided alternative housing to these area’s residents, Hona Al Asema’s Reham Ibrahim noted (watch, runtime: 03:21).

Speed Round

EXCLUSIVE- Enterprise poll of economists sees CBE leaving interest rates unchanged on Thursday: The central bank will likely keep its key interest rates on hold when its monetary policy committee meets on Thursday, an Enterprise poll of 10 economists found. Citing a recent drop in inflation, the economists and analysts we surveyed said they expect the CBE to leave its overnight deposit and lending rates at 16.75% and 17.75%, respectively, at the 27 December meeting.

Weathering the (EM) storm: Nobody really expected an interest rate hike heading into Thursday. Instead, the question was whether the CBE might surprise the market with an early rate cut as inflation dropped to 15.7% in November from 17.7% the previous month, falling back into the government’s targeted range of 13% (+/- 3%). Don’t hold your breath: The CBE will hold off on a cut to help maintain foreign appetite for Egyptian treasuries, the economists said.

“The CBE will not be encouraged to resume its easing cycle given the ongoing turbulence of the emerging markets, which has dealt a hard blow to foreign holdings in Egypt’s treasuries,” said Pharos Holding’ Radwa El Swaify. Foreigners held Egyptian treasuries worth a total of USD 11.7 bn as of the end of October, down from a high of USD 21.5 bn in March — and off from the USD 13.1 bn recorded at the end of September, CBE data showed.

Let’s not forget that the US Federal Reserve raised its benchmark overnight lending rate last week, which could lead to more capital outflows from EM.

When will easing begin, then? Not before the dark cloud over emerging markets passes. “We generally see no interest rate cuts before 4Q2019, when the emerging markets are forecast to stabilize and Egypt’s inflation cools down after a new wave of price hikes follows the final round of subsidy cuts expected towards the end of the current fiscal year,” said EFG Hermes’ Mohamed Abu Basha. While both El Swaify and Abu Basha said they expect no rate cuts before 4Q2019, Capital Economics’ Jason Tuvey predicts the easing cycle could begin in early 2019.

Friendly reminder: Let’s not forget thatNovember inflation figures don’t reflect the impact of the government’s recent decision to scrap the discounted customs exchange rate for non-essential imports — a decision that economists told us could send inflation up by as much as 1 percentage point in the next reading.

EXCLUSIVE- Egypt won’t be receiving the fifth tranche of its IMF facility this month — but reforms aren’t being delayed, either: The Madbouly government is not in talks with the IMF to delay any part of its reform agenda, a senior government official tells Enterprise, denying a report in the domestic press over the weekend that Cabinet is looking to get some breathing room on the implementation of select reforms. According to our source, the government is planning to push ahead with all measures as previously announced. This includes the lifting of fuel subsidies in June 2019, particularly since global oil prices have declined significantly and are not expected to spike again in the coming months. Most forecasts we’ve seen suggest average oil prices will settle somewhere south of USD 70 next year.

So why hasn’t the IMF disbursed the fifth tranche of its facility? The IMF is currently coordinating with the Finance Ministry to verify its figures on the state’s budget deficit projections, particularly in light of the state privatization program being put on ice, our source says. Also under review is the ministry’s debt control strategy, which is expected to officially see the light at the end of this month. The IMF should have all the necessary information by the end of the week, and the fifth USD 2 bn tranche of the USD 12 bn extended fund facility should be disbursed by mid-January.

Shocker: Banks are looking for a way around higher taxes. The Federation of Egyptian Banks is in talks with the Finance Ministry to allow its members to deduct as an expense the EGP 2.5/1,000 healthcare levy on their top line, multiple sources told Al Mal. If the levy is not expense deductible, this would mean banks would pay an effective tax rate of 0.3%, higher than the 0.25% stipulated by the Universal Healthcare Act. The federation is also looking to know whether the levy will be calculated and paid on quarterly, semi-annual or annual basis.

Do banks have reason to act all fidgety? Bank profitability could take a hit from a recently proposed amendment to how they account for income from their investments in government debt. The change could result in a c.37% effective tax rate for a model bank, compared to a current 24%, in a scenario run by Shuaa Securities Egypt. The healthcare levy in question is calculated on gross revenues, making it substantial for banks.

Background: All companies will be subject to a new tax to support the government’s plan to make health insurance mandatory as part of the Universal Healthcare Act. The plan take 11-13 years to implement. The services under the scheme will debut next May in the Canal cities. Tap or click here for our exclusive primer breaking down all the taxes under the new legislation, which will range from nationwide corporate tax to industry specific levies.

Gov’t expects USD 86.7 bn in foreign currency inflows throughout 2019: The government is expecting 2019 to see USD 86.7 bn in foreign currency inflows, government sources told Youm7. The inflows include:

- Exports — USD 27 bn

- Remittances — USD 26 bn

- Tourism — USD 11 bn

- Foreign direct investment — USD 9 bn

- Suez Canal — USD 5.7 bn

- Foreign currency-denominated bonds — USD 4 bn

- IMF facility (fifth and sixth tranches) — USD 4 bn

Egypt’s net foreign reserves have doubled since the central bank floated the EGP in November 2016 but have more or less remained steady in recent months, standing at USD 44.513 bn by the end of November.

Banque Misr’s investment banking arm gets new team amid restructuring plans: Misr Capital Investments, the investment banking arm of state-owned Banque Misr, has hired a team (pdf) of veteran investment bankers and financial professionals, giving them a mandate to transform the outfit into a full-fledged investment bank.

Misr Capital Investments’ new co-CEO and MD is Khalil El Bawab (LinkedIn), who joins the bank after a more than 10-year run with EFG Hermes, where he was most recently head of fixed income at the firm’s asset management arm. Joining him are Omar Radwan (LinkedIn), a veteran of HC Securities and EFG Hermes, as chief operating officer, and Omar Ascar (LinkedIn) as senior investment manager. Staffing up in the first quarter is among the team’s first priorities, El Bawab said.

Restructuring + a wide service offering: The new team will aim to restructure the bank’s assets, create new value and put MCI’s existing licenses to work — all while keeping an eye on new opportunities. “We have very promising plans that will compliment Banque Misr’s activities. As an independent entity, we will be providing our bundle of services to public and private institutions,” El Bawab told us, adding that MCI is looking closely at the fintech space amid the Madbouly government’s drive to push for financial inclusion.

The Financial Regulatory Authority (FRA) rejected yesterday Beltone Financial’s appeal of a six-month suspension handed to its investment banking arm over alleged irregularities in the IPO of consumer- and structured-finance player Sarwa Capital, Al Mal reports. The FRA alleges that Beltone inflated subscription figures in the bookbuilding process and claims that the institutional offering was only covered once — not 10x oversubscribed as Beltone had announced at the time. The authority also alleges that Beltone failed to abide by a rule that bars the allocation of shares to investors who subscribe to 10% or more of the listing company’s shares, according to the newspaper.

Naguib Sawiris is “disappointed” in the ruling and in the FRA’s “failure” to address Beltone’s defense against the allegations, he said in a statement. The suspension has only served to shake investors’ confidence in the EGX and has called the authority’s impartiality into question, Naguib said, adding that Beltone will continue to pursue legal action against the decision. Sawiris is the chairman of Orascom Investment Holding, which owns Beltone Financial. Sawiris also suggested the FRA action was motivated by personal animosity.

Next move: An administrative court will hear an appeal by Beltone on Saturday, 5 January.

Background: The FRA had imposed the suspension after Sarwa Capital’s shares plunged on the first day of trading, prompting an investigation into the transaction. Beltone has denied the allegations with some backup coming from Misr for Central Clearing, Depository & Registry and the Egyptian Capital Markets Association.

EFG Hermes’ Egypt Education Fund is oversubscribed at first close: EFG Hermes’ private equity arm has hit first close on its Egypt Education Fund with total commitments of USD 119 mn, according to a company press release (pdf). The commitments, which are well above an initial target of USD 50-100 mn, were raised in just a little over six months amid a strong appetite from both domestic and foreign investors.

The fund is part of a larger USD 300 mn education platform with Dubai’s GEMS Education that aims to build a portfolio of 30 schools serving some 40k students within three years. The fund aims to reach final close in 2019, raising another USD 30 mn or so in capital. “We expect to make a strong impact in the industry and deliver attractive returns to our investors,” said EFG Hermes’ Head of Asset Management and PE Karim Moussa. The firm has also decided to seed USD 15 mn into the fund, as part of its wider strategy to enhance its PE operations.

First investment already on board: The EFG-GEMS platform acquired four schools in an EGP 1 bn transaction earlier this year and warehoused the assets on EFG Hermes’ balance sheet. The portfolio will now be transferred to the platform, which is 50-50 owned by the fund and GEMS.

Rep offices need to open full operations within three years under new decree: The General Authority for Freezones and Investments (GAFI) has recently issued a decree requiring foreign parent companies to open in Egypt within three years of opening representative offices here, according to law firm Riad & Riad newsletter. Foreign companies have the right to establish representative offices to conduct market research or feasibility studies in Egypt before taking part in commercial activities.

M&A Watch- Raya founder mulling two proposals to finance MTO: Raya Holding founder Medhat Khalil is considering two separate proposals from a local and international bank for an EGP 700-800 mn financing package to fund his take-Raya-private bid, Raya CFO Hossam Hussein said, according to Al Mal. We had reported last month that Khalil had approached at least four banks to execute a mandatory tender offer to acquire 58% of Raya’s shares, a stake he estimated is worth some EGP 500 mn. The Financial Regulatory Authority ordered Khalil to submit the MTO after it was revealed he and related parties control a stake in the company exceeding the 33% threshold which triggers MTOs.

LEGISLATION WATCH- House gives initial approval to draft laws on innovation, support for cops: The House of Representatives gave initial approval yesterday to a draft law that would create an innovation fund to support cutting-edge research, AMAY reports. The House also nodded to a draft law that would establish a fund to support members of the national police service and their families. The fund would be financed by raising to EGP 15 from EGP 5 all fees on Interior Ministry-related paperwork and processes, according to AMAY.

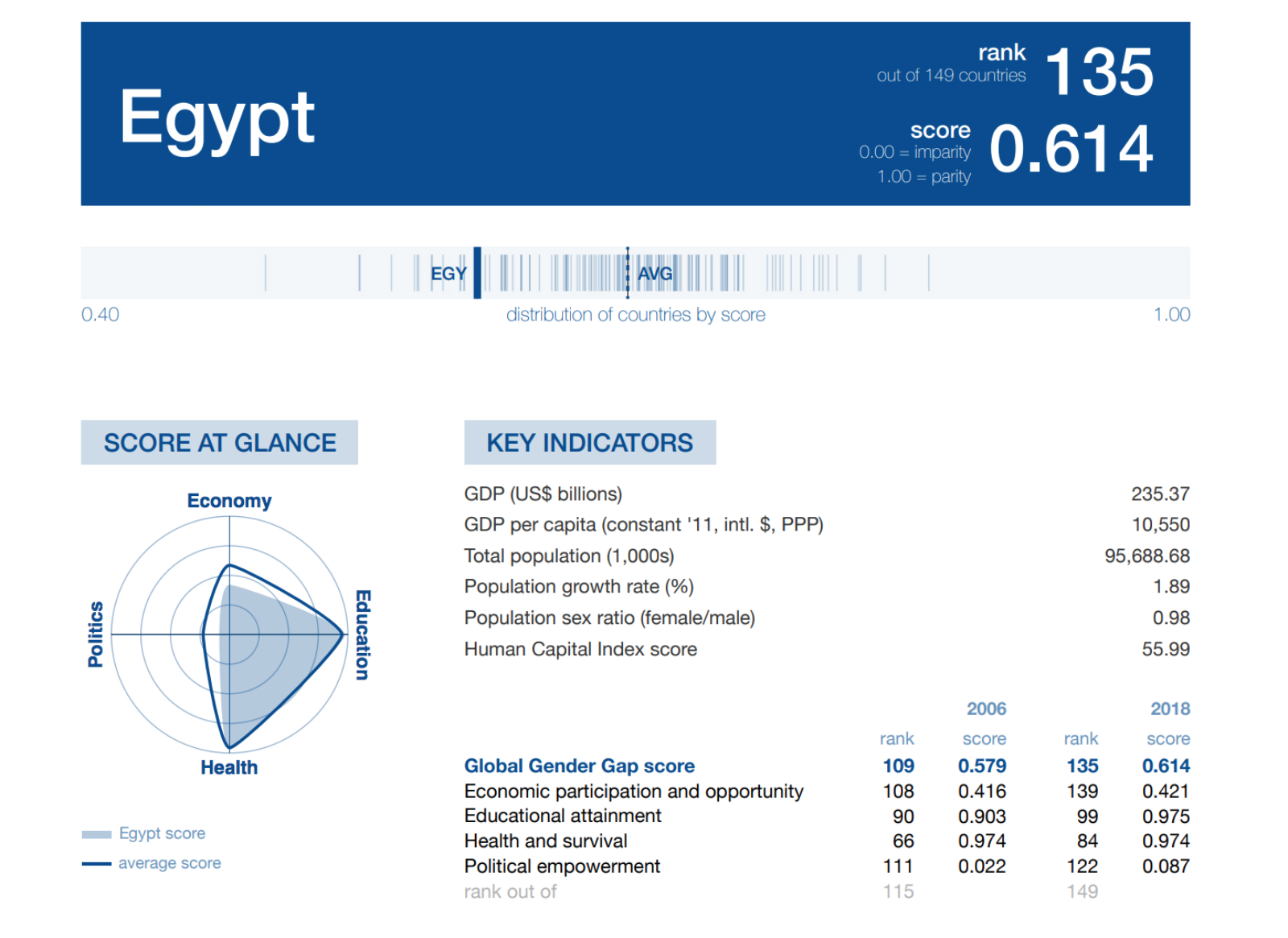

Egypt ranked 135 out of 149 countries in the World Economic Forum’s Global Gender Gap Report for 2018 (pdf), after having ranked 134 out of 144 countries in last year’s report. Iceland, Norway, Sweden, and Finland occupy the top four positions, while Syria, Iraq, Pakistan, and Yemen hold the bottom four. Egypt is one of the four lowest-performing countries in terms of political and economic leadership, and is one of six countries in the world where more than 90% of managerial positions are held by men. There also remains no legal framework in Egypt against gender-based discrimination in hiring or setting wages, the report notes. On the upside, Egypt’s ranking in the education subindex has improved “due to smaller gender gaps in literacy and tertiary education — as well as progress on gender parity in professional and technical workers.”

Globally, “the progress towards parity continues to be very slow,” the report notes. However, more countries have improved than have worsened — “out of the 144 covered both this year and last year, 89 countries have at least marginally closed their gender gap and 55 have regressed.”

MOVES- Sawari Ventures has tapped Tamer Azer to join its team as a principal, the company announced in a press release. An entrepreneur and business policymaker, Azer joins Sawari Ventures from A15. The appointment comes after Sawari reached first close on its USD 35 mn North Africa fund, which will target investment in knowledge- and tech-driven companies in Egypt, Tunisia and Morocco. LPs committing in the first round included the European Investment Bank, the UK’s CDC, France’s Proparco and the Dutch Good Growth Fund managed by Triple Jump.

MOVES- Egypt has appointed Khaled Megawer as the country’s new head of military intelligence, security sources told Reuters. Megawer, who previously served as deputy head, will replace Mohamed El-Shahat.

Careem strikes a partnership with Dubai to manage white taxis: Ride-hailing company Careem is launching a company with Dubai’s Road and Transport Authority (RTA) that will manage the e-hailing systems and online payment for all of the emirate’s 11,000 white taxis, FT reported. The agreement will be the world’s first partnership between a government regulator and a private ride-hailing app. Careem will have a 49 percent stake in the joint venture. The service is expected to launch in April 2019. White taxis will still be able to pick people off the streets, while Dubai’s ride-hailing apps will continue to operate as normal.

CORRECTION- We mistakenly said in yesterday’s issue that the Cairo Economic Court has postponed to 19 February the issuance of its verdict on an appeal by pharma distributors of an antitrust fine. The court actually met as scheduled on 19 December and set 19 February as the date on which it would hand down its verdict. We regret the error. The story has been updated on our website.

Up Next

NBE to roll out Meeza cards early next month: The National Bank of Egypt is expecting to roll out national “Meeza” debit cards to both banked and unbanked customers by early January, with an eye on issuing 1 mn cards throughout 2019, the bank’s head of retail Alaa Farouk said, according to Al Mal. The bank had previously said it plans to roll out some 500k cards this month. Amazon’s PayFort also announced it has partnered with CIB to allow Meeza holders to shop online through PayFort’s contracted retailers, PayFort Managing Director Omar Soudodi said, according to Al Mal.

House to discuss Local Governance Act “within days”: The House of Representatives is expected to discuss and vote on the long-awaited Local Governance Act in a plenary session within the next few days,Local Development Minister Mahmoud Shaarawy said, according to Al Shorouk. The law, if passed, would set the stage for local council and municipal elections in Egypt. The law also stipulates that governors and their deputies resign from their posts at the beginning of a new presidential term.

Parliament will only get around to discussing the SMEs Act once it gets through the Local Governance Act, but both pieces of legislation should see the light during the current legislative session, Rep. Hala Aboul Saad said, according to Masrawy. The SMEs Act sets out incentives — mainly in the form of services and subsidized access to financing — for owners of micro-, small-, and medium-sized enterprises to go legit and pay taxes.

The government will re-issue the tender to develop the Giza Plateau in the next three weeks, Public Enterprises Minister Hisham Tawfik said, according to Masrawy. The Sound and Light Cinema Company had scrapped its USD 10 mn contract with Orascom Investment Holding for failing to meet the terms of the agreement.

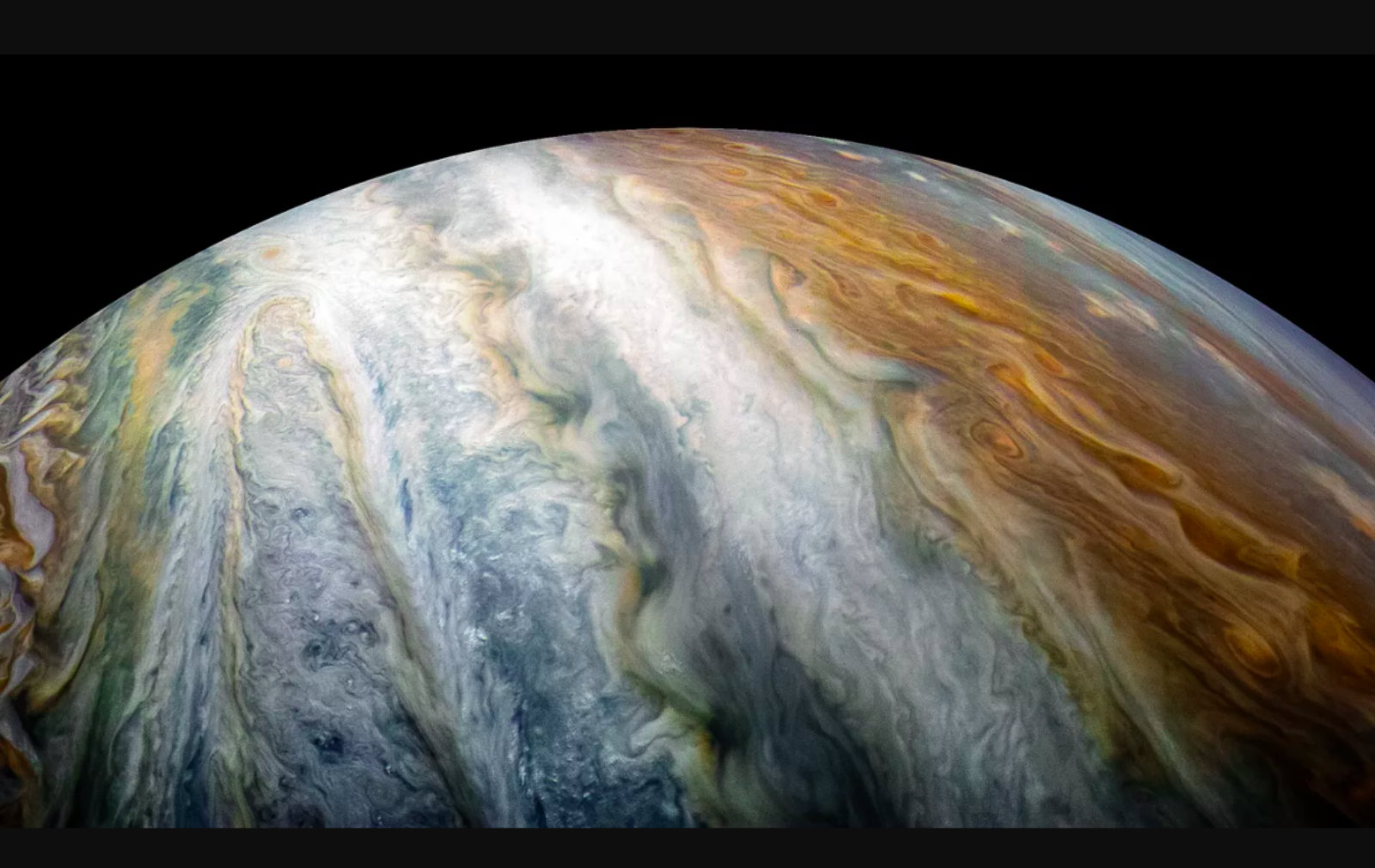

Image of the Day

NASA’s Juno spacecraft is sending home staggering pictures of Jupiter that we believe would make really nice wall art if printed. Orbiting the gas giant since June 2016, Juno has been instrumental in collecting data on the planet at the closest possible range, revealing cyclones swirling around the planet’s poles, variation in its magnetic field, and evidence that Jupiter’s core is not as dense as we once thought. That’s all well and good, but the pictures are something else: One part van Gogh, one part Pillars of Creation.

On The Front Pages

Driving the conversation in Egypt’s state-owned newspapers is President Abdel Fattah El Sisi’s statement yesterday on the importance of supporting the independence of the judiciary (Al Ahram | Al Akhbar | Al Gomhuria). Also featured on the front pages of Al Ahram and Al Akhbar: The government’s plans to incentivize investment in the Sinai Peninsula.

Worth Watching

Japan is not only a financial partner in the Grand Egyptian Museum (GEM) project, but has also been working with Egypt to preserve and restore Ancient Egyptian artifacts, Euronews says. The Japanese International Cooperation Agency (JICA) has played a key role in the transportation of precious and delicate artifacts from the Egyptian museum in Downtown Cairo to the GEM. Since 2008, the JICA has also trained over 2,000 Egyptians in artifact restoration. Expected to open in 2020, the GEM is planned to be the biggest museum dedicated to a single civilization in Africa (watch, runtime 05:00).

Diplomacy + Foreign Trade

Egypt, Germany sign EUR 150.5 mn-worth of financing agreements: Investment and International Cooperation Minister Sahar Nasr and German ambassador to Egypt Georg Luy signed yesterday EUR 150.5 mn-worth of agreements to finance development projects in Egypt, according to a ministry statement. The agreements include a EUR 48 mn grant to support education, and a EUR 102.5 financing package for clean energy projects and SMEs, and to support agricultural and energy efficiency.

Syria’s National Security chief and President Bashar Al Assad’s top aide Ali Mamlouk is in Egypt to meet with intelligence officials and discuss political and security issues, according to the Associated Press.

Infrastructure

ITDA to tender 8 retail and logistics centers in 6 governorates

The Supply Ministry’s Internal Trade Development Agency (ITDA) will launch tenders for eight commercial and logistics centers in six governorates across Egypt, ITDA head Ibrahim El Ashmawy announced. ITDA has set up an investment map to identify each governorate’s needs and issue tenders accordingly. Establishing logistics centers to cut down on spoilage of agricultural products is at the heart of the ministry’s internal trade strategy.

Basic Materials + Commodities

Egypt’s wheat reserves enough to last until April

Egypt’s strategic wheat reserves are enough to last until April, Supply Ministry spokesman Ahmed Kamal said, according to Reuters’ Arabic Service. The state buyer recently purchased 120,000 tonnes of wheat in an international tender for delivery between 11 and 20 February.

Health + Education

20.5 mn people examined so far under “100 mn Health” initiative

An estimated 20.5 mn people have been screened since the launch of the government’s nationwide campaign, “100 mn Healthy Lives,” in October, according to MENA. Approximately 7.8 mn examinations were conducted during the initiative’s second phase. The Health Ministry also plans to begin offering tests for breast cancer in clinics as of 15 January.

Automotive + Transportation

Nissan Egypt plans to increase production by 30% over five years

Nissan Motor Egypt is eyeing a 30% increase in production at its 6th of October plant over the next five years, Chairman Kohei Maeda told Al Mal. The Japanese auto manufacturer sees annual production capacity reaching 22k units by March 2019.

Egypt receives offers from int’l companies to invest in auto manufacturing

The Public Enterprises Ministry has received offers from 12 international companies to invest in two ailing state-owned automotive manufacturers, Minister Hisham Tawfik said, according to Masrawy. Tawfik did not mention any of the potential investors’ names, but added that four of them specialize in tire manufacturing. The plans to revive the state-owned companies come as part of the government’s strategy to step up vehicle manufacturing and pave the way for exporting.

Egypt Politics + Economics

Gov’t considering tax breaks and incentives for Sinai investors

The government is looking into potential incentives for investors in the Sinai Peninsula, including offering tax and customs exemptions for a limited period of time and offering land in North Sinai under a usufruct framework, Prime Minister Moustafa Madbouly said yesterday, according to Amwal El Ghad. The measures are meant to encourage development in the peninsula. The Suez Canal Authority is also reviewing proposals to facilitate access to financing for development projects in Sinai, Al Mal reports.

Court reviews case of presidential term limits

A Cairo court began hearing a case yesterday that aims to force the House of Representatives to amend term limits in the constitution, which would allow President Abdel Fattah El Sisi to stay in office longer, the Associated Press reports. The court has scheduled the next hearing for 20 January.

FRA studies proposal to establish Egypt’s first financial markets association

The Financial Regulatory Authority (FRA) is close to finalizing regulations to set up an association to represent employees in capital markets, head of the FRA’s committee on capital markets Soliman Nazmi said, according to Al Mal.

National Security

Army Chief of Staff meets US Secretary of the Navy Richard Spencer

Army Chief of Staff Mohamed Farid met yesterday the US Secretary of the Navy Richard Spencer to discuss continuing joint naval drills, according to an Armed Forces statement.

Sports

Egypt to play friendly against Nigeria in March

Egypt’s national football team is expected to play a friendly match against Nigeria sometime in March, Egypt’s Football Association said, according to the BBC. Egypt and Nigeria have both qualified for the 2019 African Cup of Nations.

On Your Way Out

An Egyptian documentary on Down syndrome, “My Name is Nour,” will participate in Morocco’s ninth Meknes International Youth Film Festival next February, according to Egypt Today. This is the 14-minute documentary film’s third participation in film festivals abroad, having won the Martine Filippi award and participated in the 14th Kazan Muslim Film Festival in Russia, and the 37th URTI festival in France. You can watch the trailer here (runtime 1:18).

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 12,958 (-1.5%)

Turnover: EGP 398 mn (50% below the 90-day average)

EGX 30 year-to-date: -13.8%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.5%. CIB, the index heaviest constituent ended down 2.0%. EGX30’s top performing constituents were Qalaa Holdings up 0.6%, and Juhayna up 0.1%. Yesterday’s worst performing stocks were SODIC down 5.1%, Telecom Egypt down 3.1% and Orascom Construction down 2.9%. The market turnover was EGP 398 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -3.3 mn

Regional: Net Long | EGP +2.2 mn

Domestic: Net Long | EGP +1.1 mn

Retail: 78.2% of total trades | 81.5% of buyers | 74.9% of sellers

Institutions: 21.8% of total trades | 18.5% of buyers | 25.1% of sellers

WTI: USD 45.48 (-0.24%)

Brent: USD 53.61 (-0.39%)

Natural Gas (Nymex, futures prices) USD 3.79 MMBtu, (-0.58%, January 2019 contract)

Gold: USD 1,263.60 / troy ounce (+0.44%)

TASI: 7,730.58 (-0.29%) (YTD: +6.98%)

ADX: 4,817.13 (-0.80%) (YTD: +9.52%)

DFM: 2,478.71 (-1.24%) (YTD: -26.45%)

KSE Premier Market: 5,300.43 (-0.16%)

QE: 10,332.77 (-0.77%) (YTD: +21.23%)

MSM: 4,336.18 (-0.02%) (YTD: -14.96%)

BB: 1,314.17 (+0.02%) (YTD: -1.32%)

Calendar

December: The government will announce the second phase of its privatization program before year-end, Public Enterprises Minister Hisham Tawfik said. The committee overseeing the state privatization program is also scheduled to hold a meeting next month to look into how market conditions developed since the privatization program was put on ice

Mid-late December: The bylaws and articles governing Egypt’s upcoming, EGP 200 bn sovereign wealth fund will be completed, Planning Minister Hala El Said said. Cabinet is currently conducting its final review.

Mid-late December: The Electricity Ministry is set to sign an MoU with Cypriot officials to begin constructing the USD 1.5 bn subsea power cable to link Egypt’s electricity grid with Cyprus’, Minister Mohamed Shaker said.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

27 December (Thursday): Deadline to settle overdue taxes and avoid 70% of the amount owed in late penalties, according to a Finance Ministry statement.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

Early January 2019: Government to release details about its international bond issuance.

Early January 2019: The National Bank of Egypt will roll out national “Meeza” debit cards to both banked and unbanked customers.

01 January 2019 (Tuesday): New Year’s Day.

01 January 2019 (Tuesday): Custom duties on EU-made car imports will fall to 0%, and we still have no automotive directive or any policy incentivizing local car manufacturing.

05 January 2019 (Saturday): An administrative court will hear Beltone Financial’s appeal against a six-month suspension the FRA handed to its investment banking arm, Youm7 reported.

07 January 2019 (Monday): Coptic Christmas, national holiday.

10-13 January 2019 (Thursday): International Property Show (IPS), Egypt International Exhibition Center

19 January 2019 (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January 2019 (Sunday): A Cairo court will hold its second hearing on a case to repeal presidential term limits.

21-22 January 2019 (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

10-12 February 2019 (Sunday-Tuesday): Third African Forum: “Building on Science, Technology and Innovation to Boost Private Sector and Socio-Economic Transformation in Africa”, Venue TBD, Cairo.

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April 2019: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

23 July (Tuesday): Revolution Day, national holiday.

12-14 August (Monday-Wednesday): Eid El Adha, national holiday (TBC).

06 October 2019 (Sunday): Armed Forces Day, national holiday.

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International.

December 2019: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.