- The results of our 2019 reader survey are out, and it’s the year of “less”: You’re a bit less optimistic, you’ve downscaled your investment plans, and you’ll probably hire a bit less, too.

- Egypt-China talks for USD 20 bn new capital project, monorail financing have reportedly fallen through. (Speed Round)

- Corporates will see the tax treatment of their income from gov’t debt change, too. (Speed Round)

- FinMin to tender for eurobond managers in January, plans to include Asian banks. (Speed Round)

- Swvl in market for USD 50-100 mn loan to fund Egypt, foreign expansion. (Speed Round)

- Santa rally? Fuggedaboutit. Volatility sees no one buying the dip. (What We’re Tracking Today)

- The Market Yesterday

Monday, 17 December 2018

The year of “less”? Our 2019 reader survey results.

TL;DR

What We’re Tracking Today

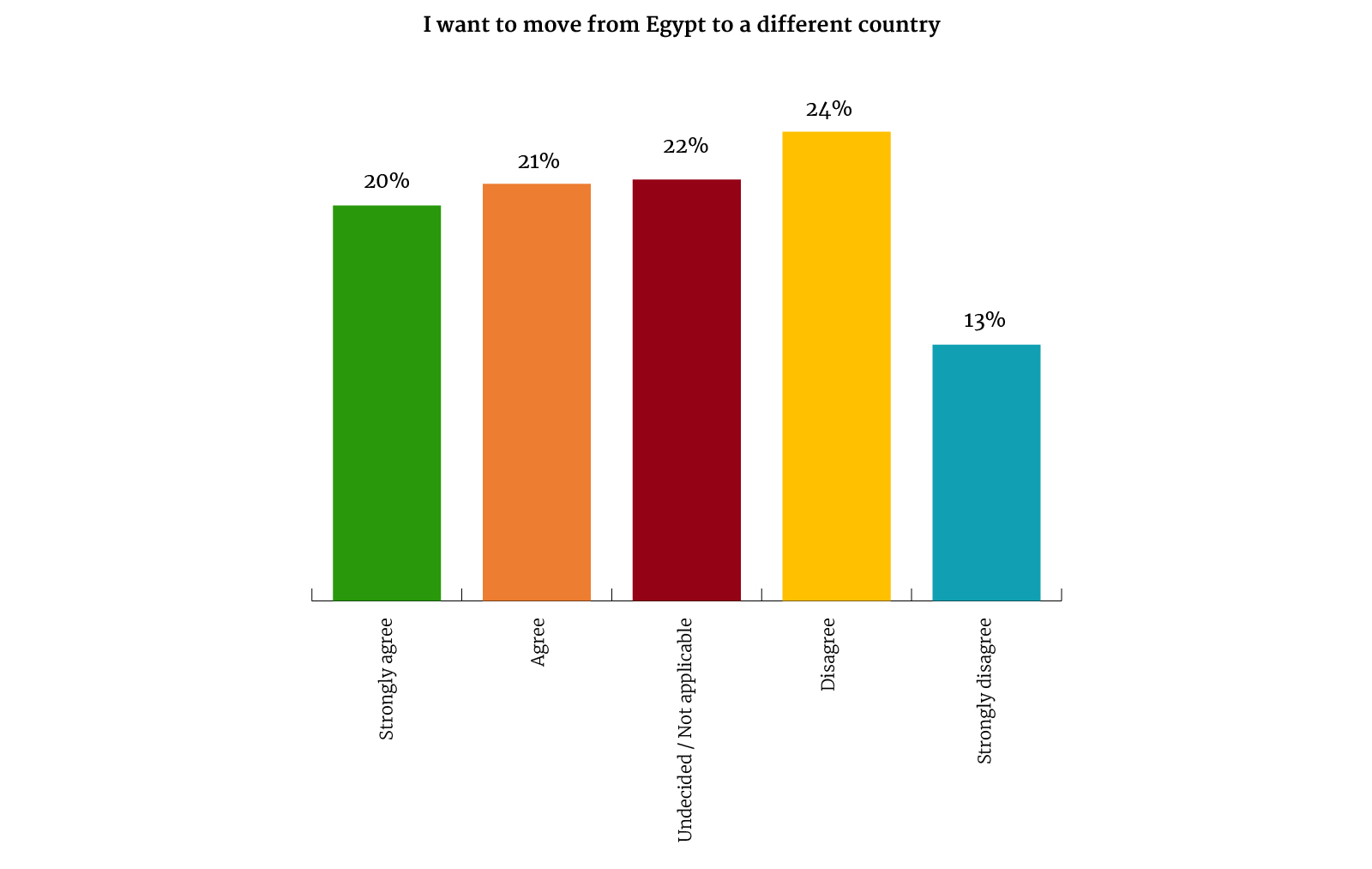

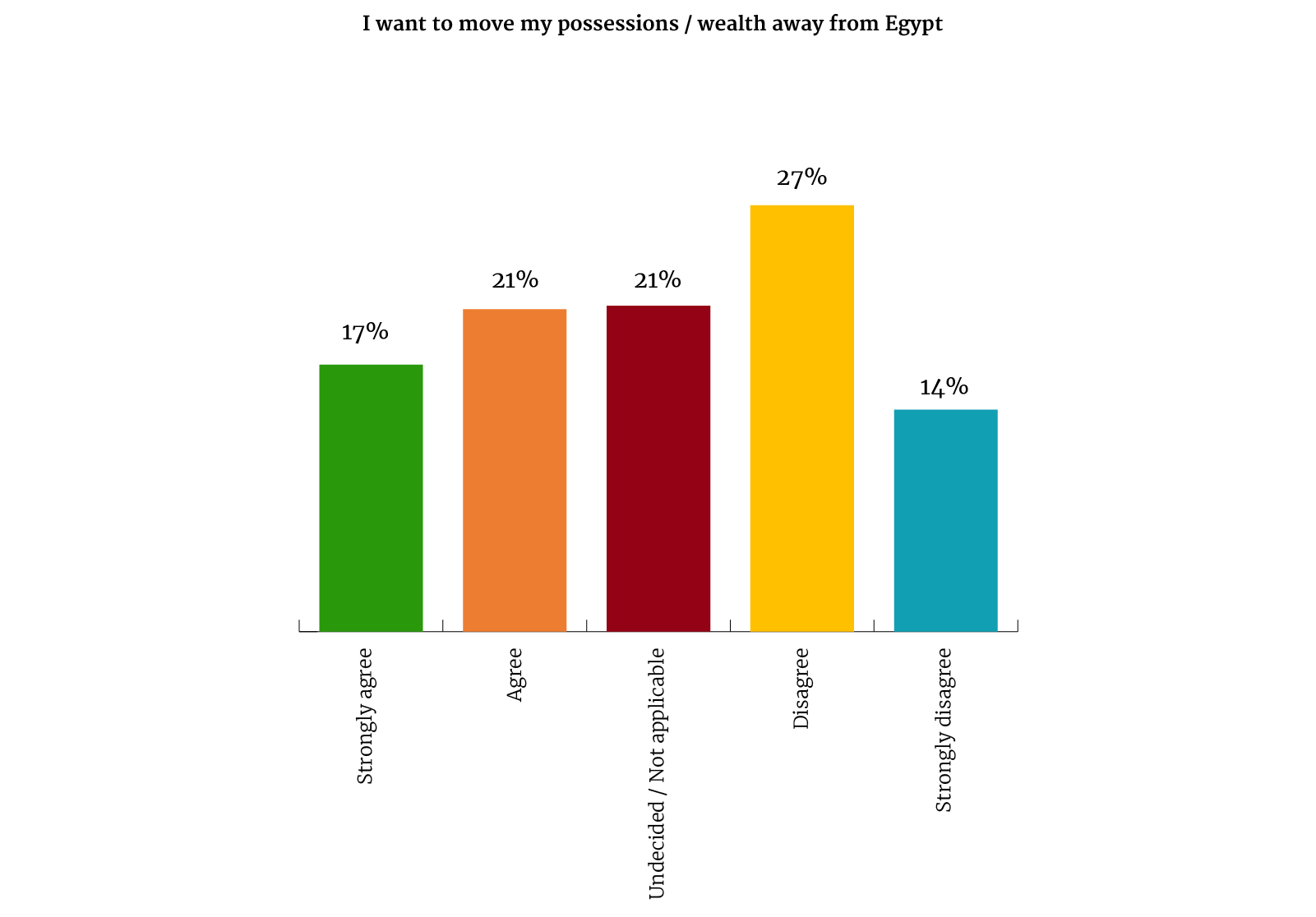

The 2019 Enterprise Reader Survey is out. Among the key takeaways from poll, which we immodestly consider the largest survey of executive sentiment in Egypt:

- More of you think 2018 was a good year to do business in Egypt than not;

- You are generally optimistic about 2019…

- …but you’re less confident about the outlook than you were at this time last year;

- Fewer of you expect to beat your competition in the new year than thought you would come out on top when we asked the same question a year ago;

- You’re being squeezed by inflation and high interest rates;

- You’re also less optimistic about prospects for FDI inflows into your specific sectors;

- And all of that is expressing itself in a sharp pullback on new investment: A year ago, the vast majority of you thought your companies would invest more in the following six months. Today, less than half of you are saying the same thing.

- Fewer of you expect to be hiring in 2019 than thought their headcount would grow when we last surveyed you a year ago;

- You’re hoping to keep wage growth under control in 2019 after two years of sharp pay hikes.

We have the full rundown on the results in this morning’s Speed Round, below. And taken on the whole, the results don’t feel horribly surprising this far into a long economic reform program — one that guarantees we have miles to go before we sleep.

Santa rally? Fuggedaboutit. Stocks in Asia are mixed this morning and US stock futures pointed to a slightly lower opening today after Friday’s sell-off. The EGX30, meanwhile, closed yesterday flat in light trading — about a third below the trailing 90-day average.

All signs point to more volatility as traders opt not to buy the dip, the global business press is warning. Bank of America Merrill Lynch found that traders pulled USD 27.6 bn out of US equities last week — a figure it’s calling the “second-biggest outflow of all time” — and a further USD 39 bn was “yanked from stocks worldwide,” Business Insider reports. At the same time, some USD 81 bn flowed into money-market mutual funds last week (the biggest inflow on record) and a steep USD 46 bn flowed out of equity mutual funds — “almost double the figure on any other week on record,” Felix Salmon writes for Axios.

Don’t take the word of the ink-stained wretches alone — the umbrella group of the world’s central banks agrees. The Bank for International Settlements warned in its quarterly review yesterday “that a normalization of monetary policy is likely to trigger a flurry of sharp sell-offs over the coming months,” CNBC writes. The BIS worries that rising US interest rates, America’s trade war with China and concerns about a possible global economic slowdown all mean we could be in for a bumpy 2019. You can read the full BIS report here (pdf) or start with the landing page, which includes links to remarks from BIS officials, stats and special features.

How worried should you be about 2019? Well, you loved Bloomberg’s Pessimist’s Guide to the year, which we noted yesterday. Go now and read the business information service’s The bulls versus bears guide to the world economy in 2019 for a “whistle-stop look at some of what could go wrong or right” in the trade war, oil, central banks, the US economy, a potential Euro crisis, Brexit and more.

Opportunity in the GCC? Nine state-owned energy companies in the Gulf have delayed IPO plans, but lower oil prices could rekindle the idea if stake sales in 2019, the Wall Street Journal suggests — if markets cooperate, that is.

Beltone hearing today: The Financial Regulatory Authority is scheduled to hear today an appeal by Beltone Financial of the six-month suspension handed its investment banking division over alleged irregularities in its handling of this fall’s Sarwa Capital IPO.

FOR YOUR MORNING COMMUTE: Choose between an exhaustive look at how global consultancy McKinsey “has helped raise the stature of authoritarian governments” and “When your new CEO is also your husband.” The latter explores the latest development in the Tory Burch business empire, of which we’re a fan in these parts.

Meanwhile, President Abdel Fattah El Sisi’s four-day visit to Vienna continues today. The president is in the Austrian capital for the high-level Africa-Europe Forum. The gathering comes as Egypt prepares to take over the African Union presidency in 2019. El Sisi will chair the group’s 31 January summit in Addis Ababa.

Other headlines worth a gander this morning include:

- US credit markets are drying up as volatility rattles investors, the Financial Times warns amid the suggestion that December could end without a single US company floating a junk bond.

- Qatar is putting on a push, buying three offshore oil blocks in Mexico from Eni, promising to invest at least USD 20 bn in the coming few years in the United States, and saying it won’t talk about ending its feud with its GCC neighbors until the embargo against it is lifted.

- Another Brexit referendum is among the options now being discussed to end the deadlock over how to move the debate forward, Bloomberg reports, but Prime Minister Theresa May thinks going to the polls again could shake citizens’ faith in the political system, Reuters adds.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s four-day trip to Austria, which kicked off yesterday, was in the limelight on the airwaves last night. Many of the talking heads fixated on the fact that this trip is the first to Austria by an Egyptian leader in 11 years.

El Sisi is set to sign several agreements with Austrian Chancellor Sebastian Kurz during his visit, Egypt’s ambassador in Vienna Omar Amer told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 03:29). El Sisi will focus during his trip on relaying to Austria’s leadership Egypt’s vision for developing Africa’s infrastructure during its time chairing the African Union, Masaa DMC ‘s Eman El Hosary said (watch, runtime: 02:24). Hona Al Asema, meanwhile, amped up the nostalgia factor by airing segments of El Sisi’s speech during Kurz’s trip to Egypt last year (watch, runtime: 03:24).

Also of considerable interest to the talking heads was El Sisi paying a visit to the Military Academy before setting off to Austria. The president warned students of the external challenges Egypt faces, Al Hayah Al Youm, Masaa DMC, and El Hekaya all noted (watch, runtime: 03:12 and runtime: 03:02 and runtime: 05:06).

The Administrative Control Authority, Egypt’s to corruption watchdog, has completed a thorough study of the problems investors face, Al Hayah Al Youm’s Lobna Assal said (watch, runtime: 02:27).

The government-sponsored “Egypt Can With Education” conference will feature discussions on the development of Egypt’s education system, Immigration Minister Nabila Makram said on Al Hayah Al Youm. The conference, which kicks off in Hurghada today, is one of many that will be held under the “Egypt Can” brand (watch, runtime: 04:35).

Also in miscellany last night:

- El Hekaya’s Amr Adib stressed on air about Egypt’s ballooning population and how the state will provide for newborns (watch, runtime: 10:52);

- Rep. Magdy Malak explained that potato prices (yes, we’re back to that) increased as a result of a decline in the number of imported potato seeds (watch, runtime: 07:19);

- Supreme Antiquities Council Secretary General Mostafa Wazery recapped the most significant archaeological discoveries made in Egypt this year (watch, runtime: 01:25) and the planned restoration of synagogues as historical sites (watch, runtime: 05:02);

- Sports critic Essam Shaltout gave his two cents on Al Ahly FC’s new Uruguayan head coach (watch, runtime: 06:52).

Speed Round

The results are in: 2018 was (mostly) a good year in which to do business in Egypt — and you’re cautiously optimistic that 2019 is going to be better, the results of our end of year 2019 survey showed. 46% of the hundreds of readers who participated earlier this month in our 2019 Enterprise Reader Survey said that 2018 was good for business. While the results found you are mostly positive 2018, they fell below last year’s survey results: 63% of respondents reported 2017 was good for business, and 83% poll takers at the time having said they expected business conditions would improve this year.

Half of all respondents think that business conditions will improve in 2019, while 16% on the other hand expect conditions to deteriorate — more than double the number of pessimists in last year’s survey.

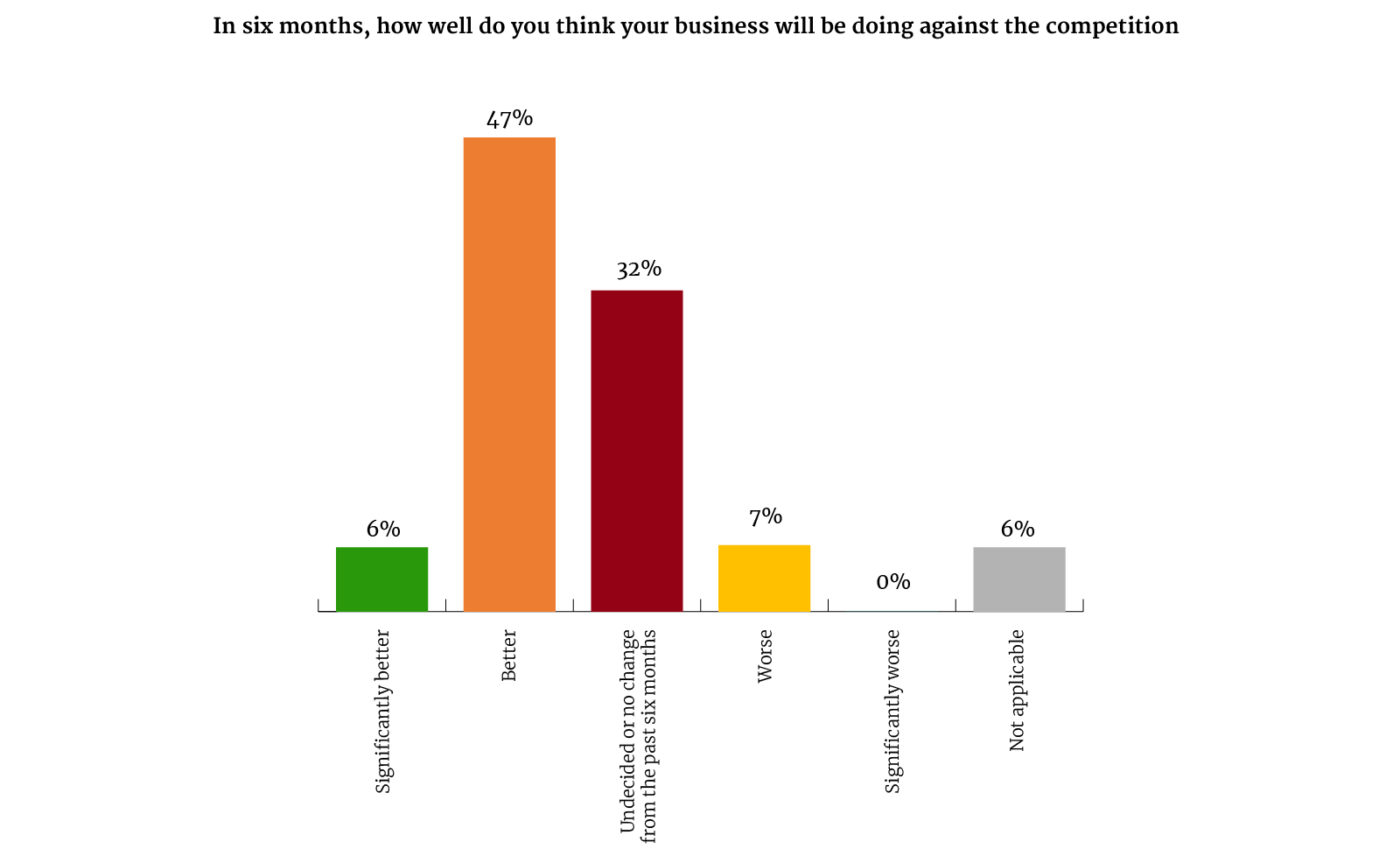

Fewer of you see yourselves beating the competition in 2019 than thought the same at the end of last year. About 54% of respondents see their businesses doing better than the competition in six months’ time, down from 68% in last year’s survey.

And fewer of you expect more foreign investment coming into your industry: 44% of you see fresh FDI in the cards for 2019, against the 65% of you who expected that foreigners would commit new capital in the year now ending.

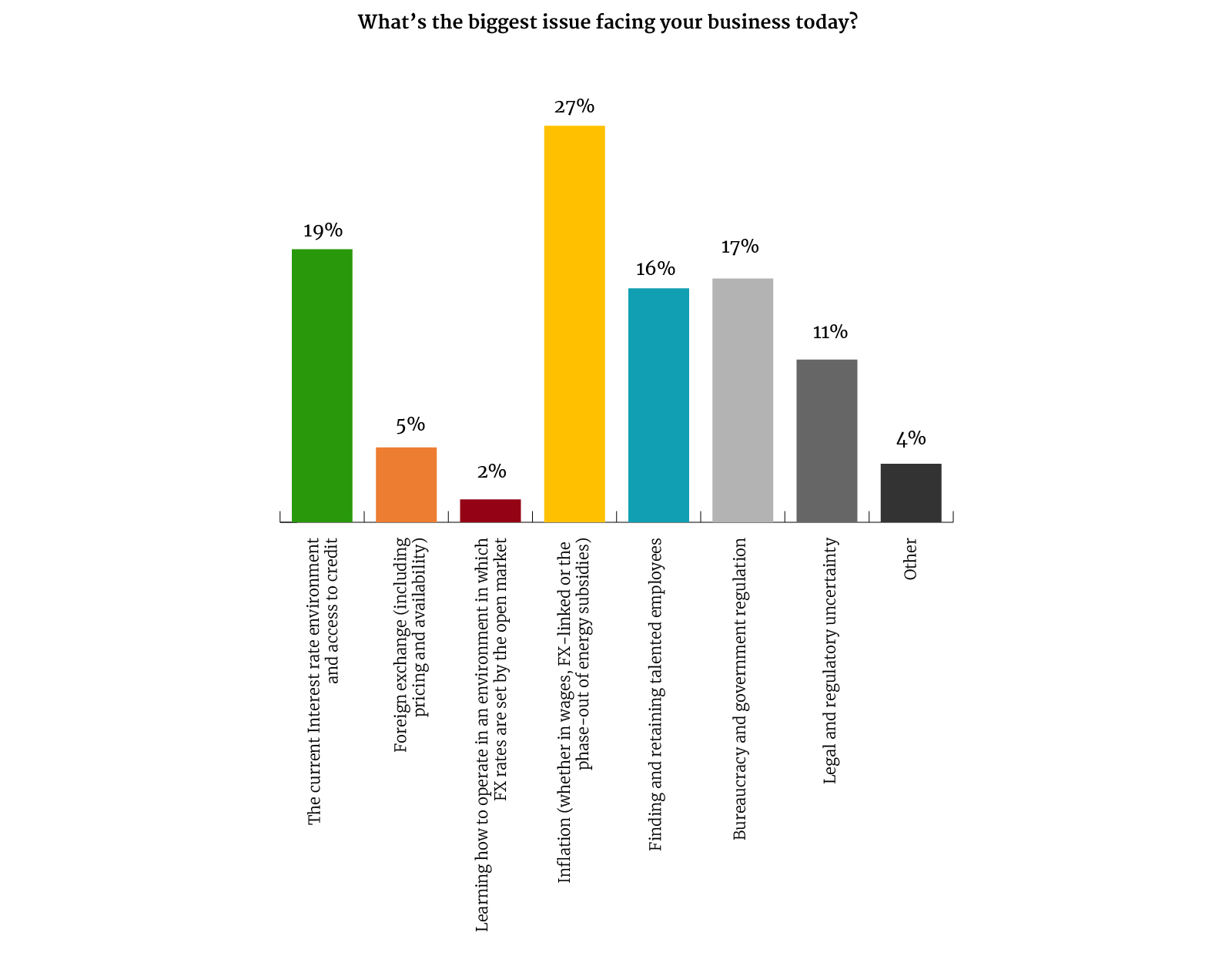

So what’s dampening the optimism that pervaded in 2017? All the usual suspects were high on our readers’ minds, from inflation to high interest rates, the challenge of finding top talent and government regulation. The two most pressing challenges were inflation (27%) and high interest rates (19%), effectively unchanged from their relative rankings in last year’s poll. And don’t expect much a reprieve: The CBE looks on track to cut interest rates very slowly indeed as it looks to stem outflows from state debt in the new year.

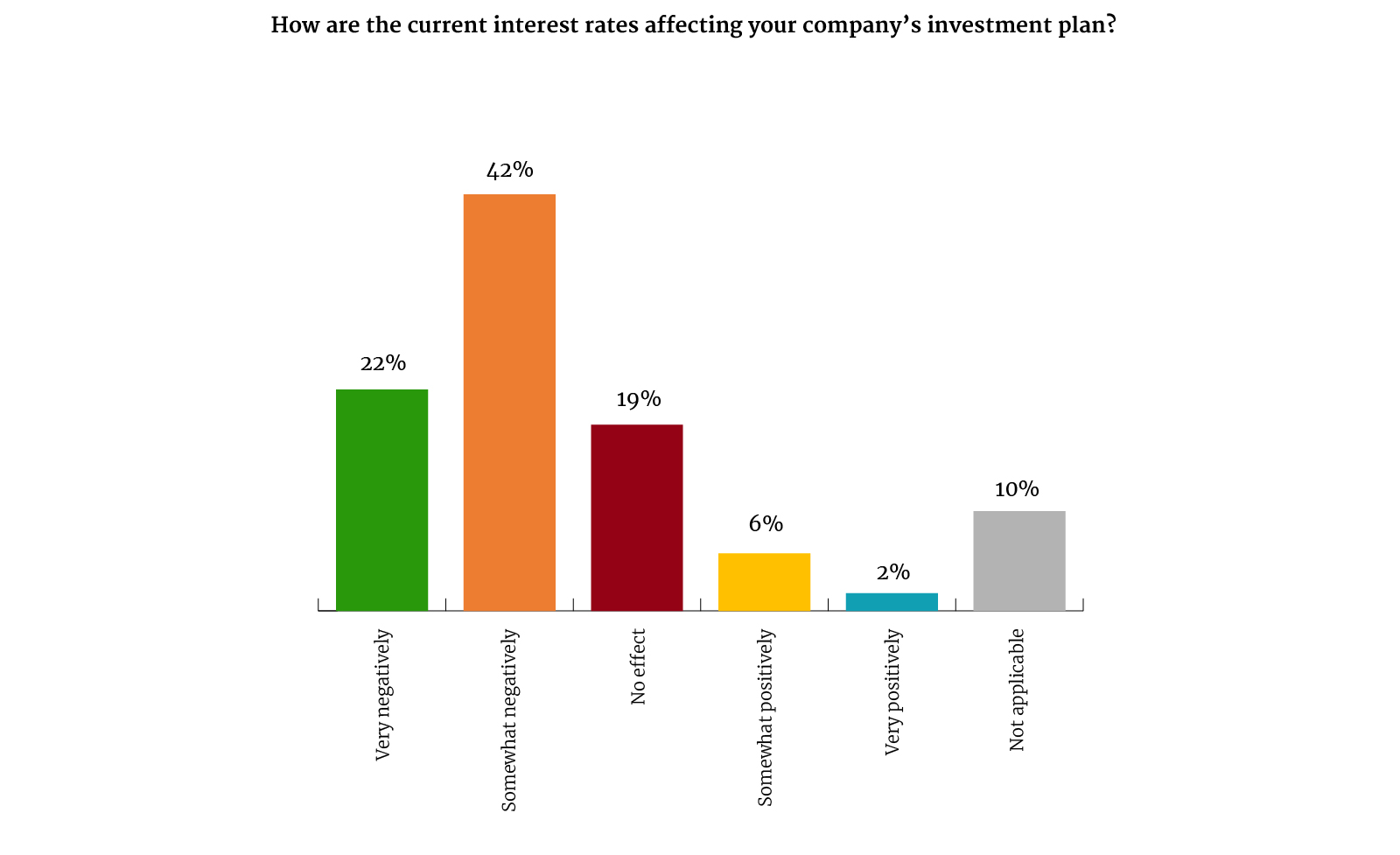

Interest rates are a major problem for business: 64% of readers see the current interest rate environment as either somewhat or very negatively affecting business, on par with last year. The overwhelming majority of you see interest rates coming down some time in 2019, but 29% of readers see no change in the cards. 48% see rates falling sometime in second or third quarter of next year.

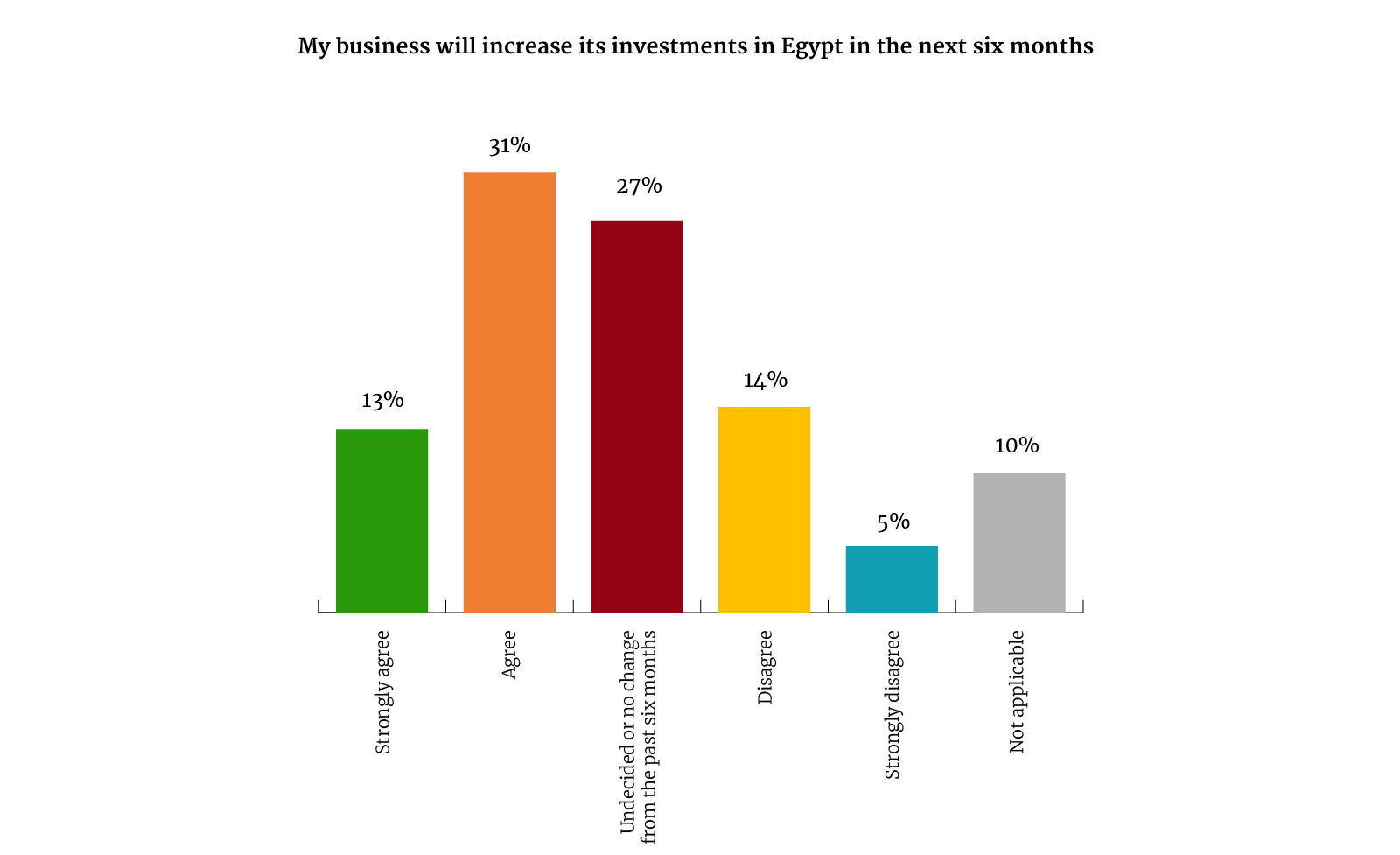

Add this all up, and you seem at risk of putting investment plans on hold: This time last year, 62% of you were certain your companies would increase their investments in Egypt over the following six months. Today, only 44% of you are saying the same.

One issue that appears to be going well is FX. Respondents who felt that access to FX was their biggest problem dropped to 5% in this year’s survey from 10% in last year’s survey. Learning how to operate in an environment where the open market sets the rate also fell marginally as the leading obstacle to business, with only 2% of readers this year saying that it was their most pressing problem.

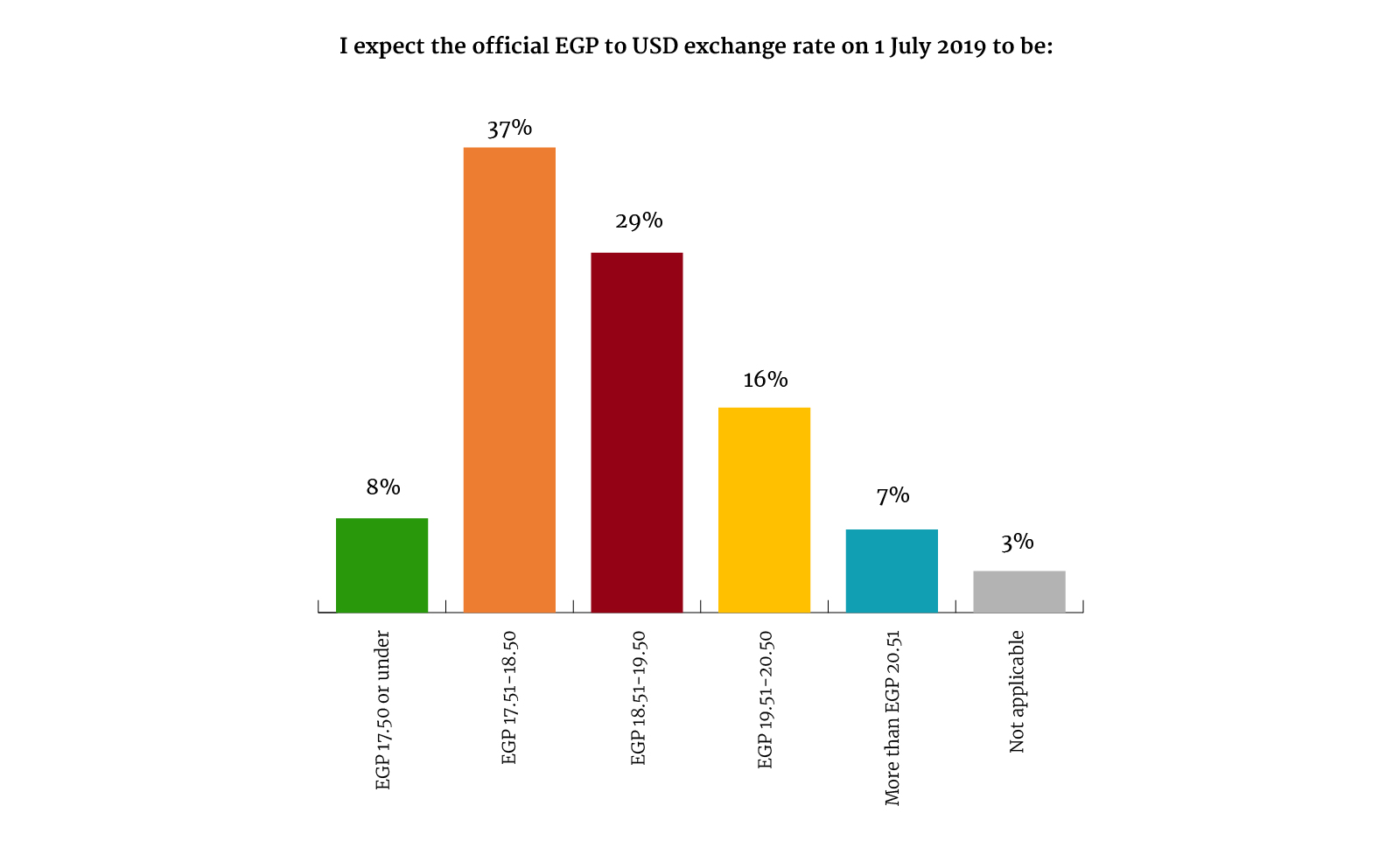

You expect the EGP to slide a little bit: The majority of respondents see the EGP losing ground against the greenback, but not much. Only 3% see the EGP as holding the same rate compared to the EGP or even appreciating, while 66% see the official exchange rate on 1 July 2019 to be between EGP 17.51 and EGP 19.50.

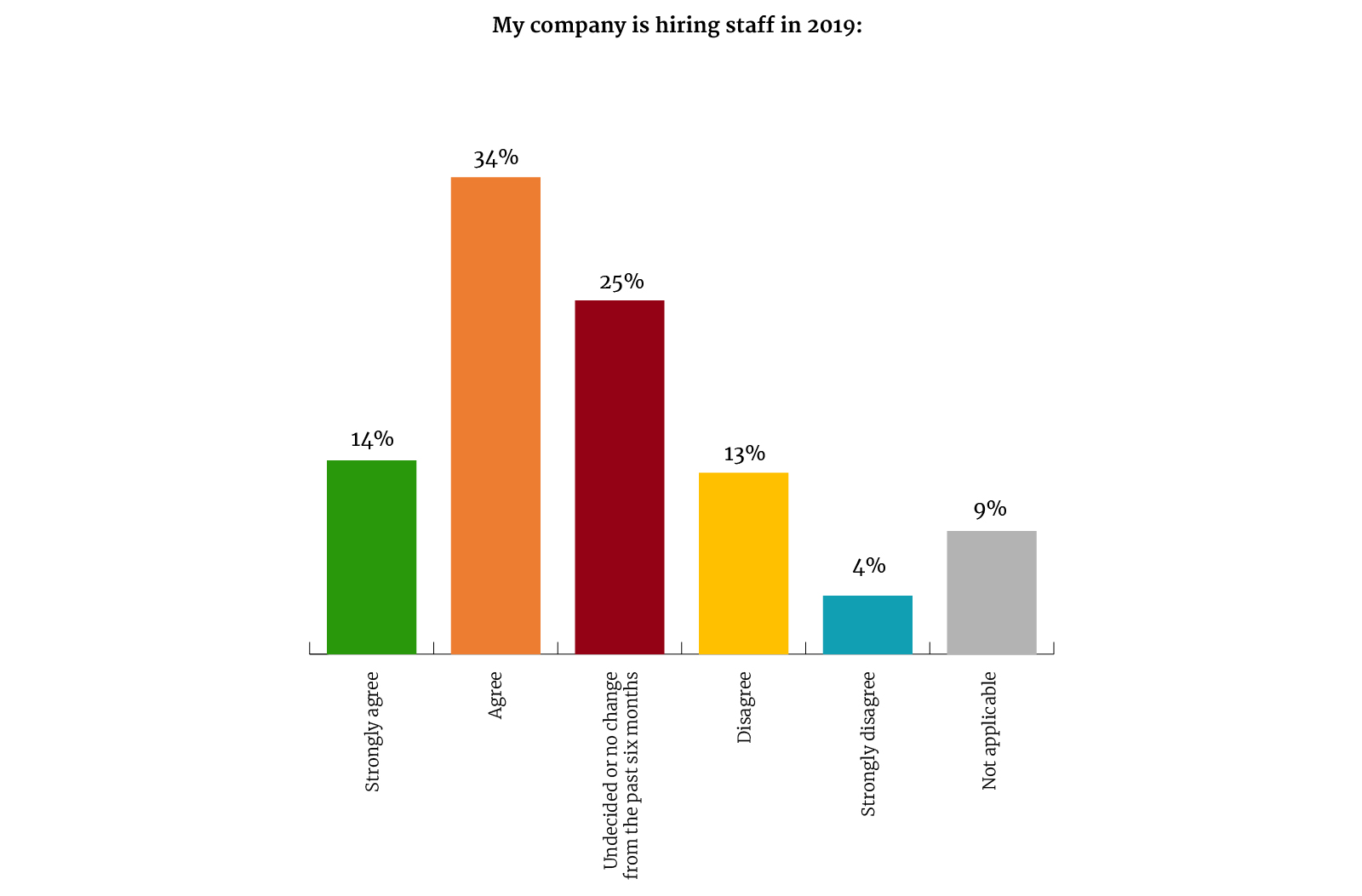

Fewer of you see your companies adding to their payrolls this year than thought the same a year ago. 48% agree or strongly agree that their companies will hire for new positions in 2019, down from 58% in last year’s poll.

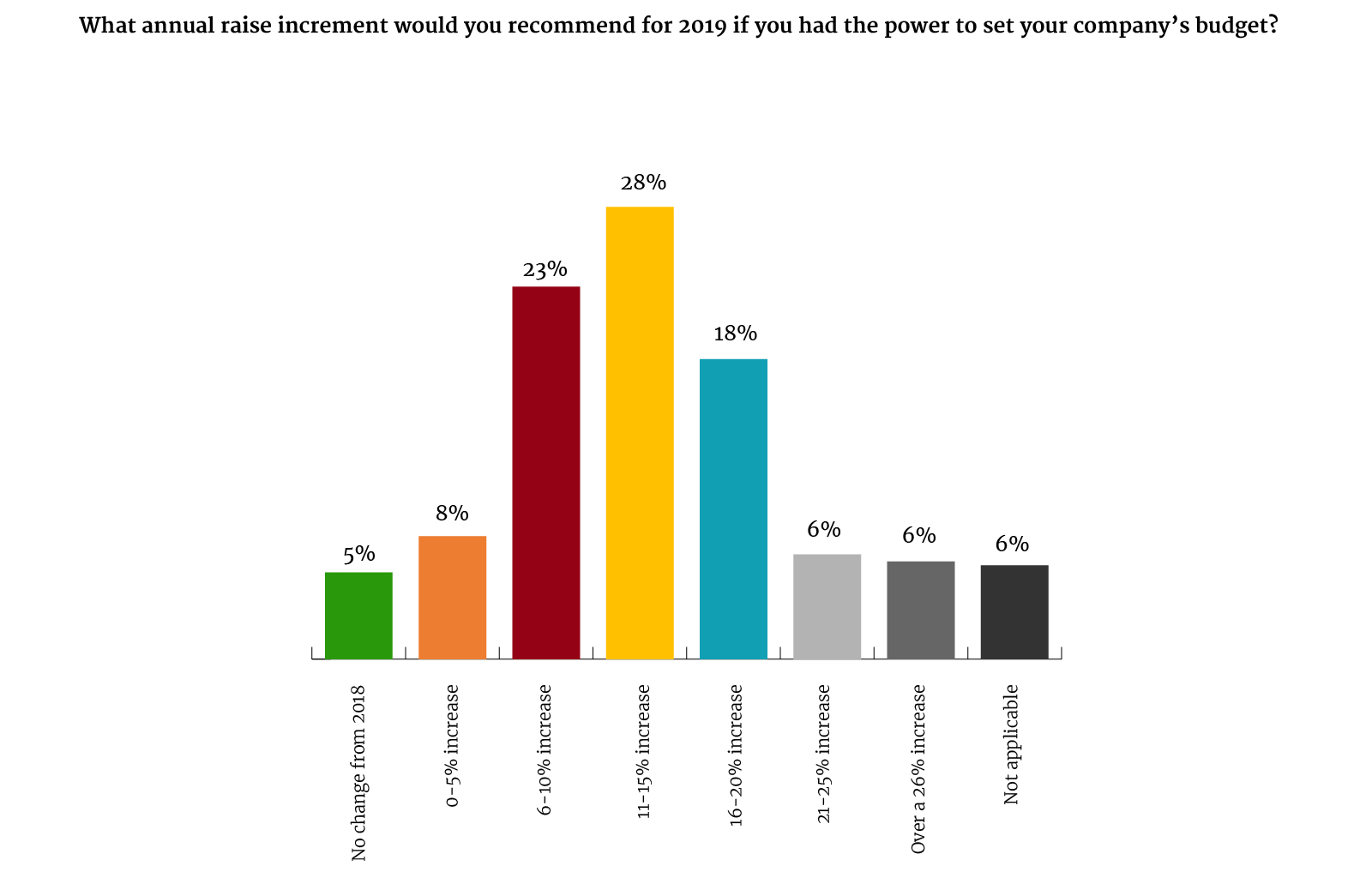

You’re really hoping to keep wage growth under control after two years of very hefty raises. Most companies are hoping to get away with salary increases of 15% of less, and of the companies that have already announced raises, the average wage rise has been around 15%.

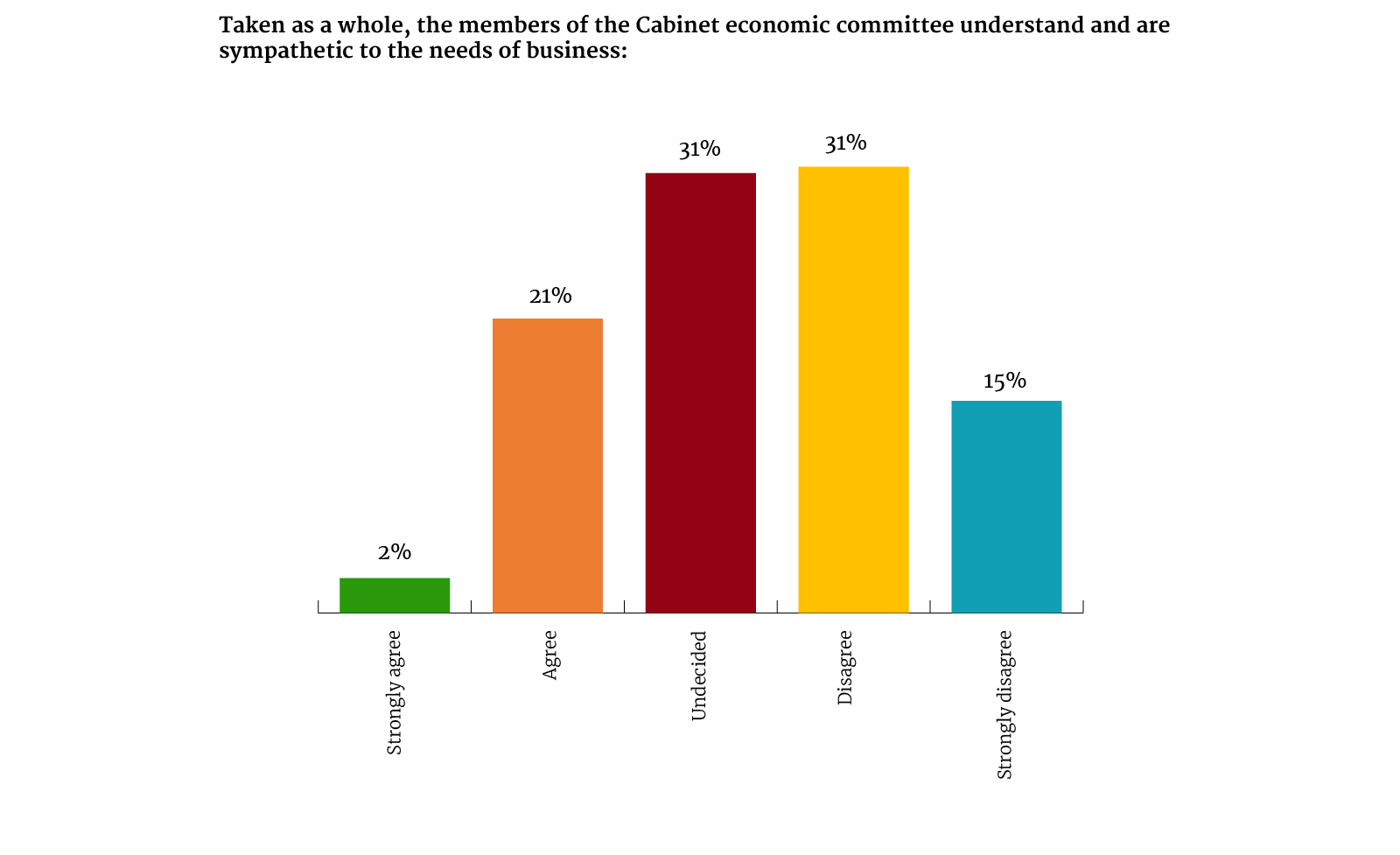

The cabinet economic group is getting a lower score this year than at the end of 2017. Some 46% of respondents do not think the group understands or is sympathetic to the needs of business — up from 37% of felt the same at this time last year. Our survey doesn’t get into the reasons why: The downturn in sentiment could have to do with ongoing friction at the regulatory level, it could be reform fatigue in the business community, or maybe y’all were cranky and undercaffeinated when you took the survey.

If you were going to start a new business this year, you’d make a play on our nation’s love of food. The overwhelming majority of polltakers said that if they were looking to start new businesses this year, it would likely be in the food sector, reflecting a general expectation that consumer goods will see an uptick in 2019. Export-oriented businesses were also high up there.

We were really humbled by all the kind messages of support so many of you left us in your comments. The really made our year. We really love you. We also enjoyed reading all of your expectations, concerns, and comments regarding the progress of the Egyptian economy as well as the suggestions on how to improve our service.

Egypt-China talks for a USD 20 bn project in the new capital have reached a deadlock amid a fight over revenue sharing, officials told Bloomberg. China Fortune Land Development (CFLD) had been in talks with Egypt for the past two years to develop the large-scale project over a 25-year period in the new administrative capital. The newswire notes that the disappointing end of the two-year negotiations could affect sentiment among foreign investors, but we’re not certain European and US investors will necessarily be put-off by the retreat of Chinese money. Local news had previously reported that talks were stalled after CFLD demanded a larger-than-initially-agreed stake in the project.

Other failed talks with China? Bloomberg notes that the breakdown in talks doesn’t mean Egypt will walk away from China (or even CFLD) on other projects. Still, it seems that talks with China’s Exim Bank on financing for a USD 1.2 bn monorail project have also fallen through, leading to its postponement, a transport ministry source told Al Shorouk. The official said the project, which will aim to link the new capital to 6 October, will be put on ice until the two sides reach consensus. He did not provide details on the disagreements. Egypt last month received three bids from international companies to construct two high-speed monorail lines.

Corporates will see the tax treatment of their income from state debt change, too: Corporations will join banks in seeing changes to how their income from holdings of government is taxed, minister Mohamed Maait told Al Mal. Large wheat milling companies, real estate players — such as Emaar (who holds some EGP 8.8 bn in treasury bills), and other EGX listed companies typically invest government debt. But unlike banks, corporates could invest surplus liquidity through other modes, such as interest paying time deposits, he suggested.

What proposed changes? Proposed amendments to the Income Tax Act, which were approved in principle last month, could see some banks looking at a double-digit increase in effective tax rate. Banks would be required to split their books, separately accounting for income earned from holdings of government debt. The new, higher effective tax rate will be a result of the aforementioned split — which will widen the bank’s taxable income — despite no change in income tax rates. The amendments were sent last week to the central bank for review, and are expected to make their way to the House of Representatives soon for a final vote.

EXCLUSIVE- FinMin to tender for eurobond managers in January, plans to include Asian banks: The Finance Ministry is expected to officially invite next month investment banks bid to act as joint lead managers of Egypt’s upcoming eurobond issuance, a senior government official tells Enterprise. According to the official, the ministry is looking to select at least one Asian bank to join the final lineup of bookrunners, since the government’s planned issuances will largely be concentrated in Asian markets. Separately, the government is working on predicting the future trajectory of yields on Egypt’s bonds following the US Federal Reserve’s expected interest rate decision this week, and the decision’s impact on the issuance plans.

Background: Egypt has been preparing to issue USD 4-7 bn worth of yen-, yuan-, USD-, and EUR-denominated denominated bonds in 1Q2019, we reported earlier this month. Egypt has also been waiting on global markets to stabilize before moving ahead with its issuances, government sources had previously told us. Finance Minister Mohamed Maait had also said earlier this month that the Madbouly government will release details on its 1Q2019 international bond issuances sometime next month.

Swvl in market for USD 50-100 mn loan to fund local, global expansion: Mass transit app Swvl is in talks with Asia-based investment funds to secure a USD 50-100 mn loan to finance its local and global expansion plans, CEO and co-founder Mostafa Kandil tells Al Mal. Kandil is hoping Swvl could sign the loan agreement in 1Q2019 as it works to grow presence in Egypt through new routes and new cities (beginning with Assiut) and expand into Southeast Asia (beginning with the Philippine capital of Manila). The CEO told Reuters last month that his company raised “tens of mns of USD” in series B funding, bringing its valuation close to the USD 100 mn mark.

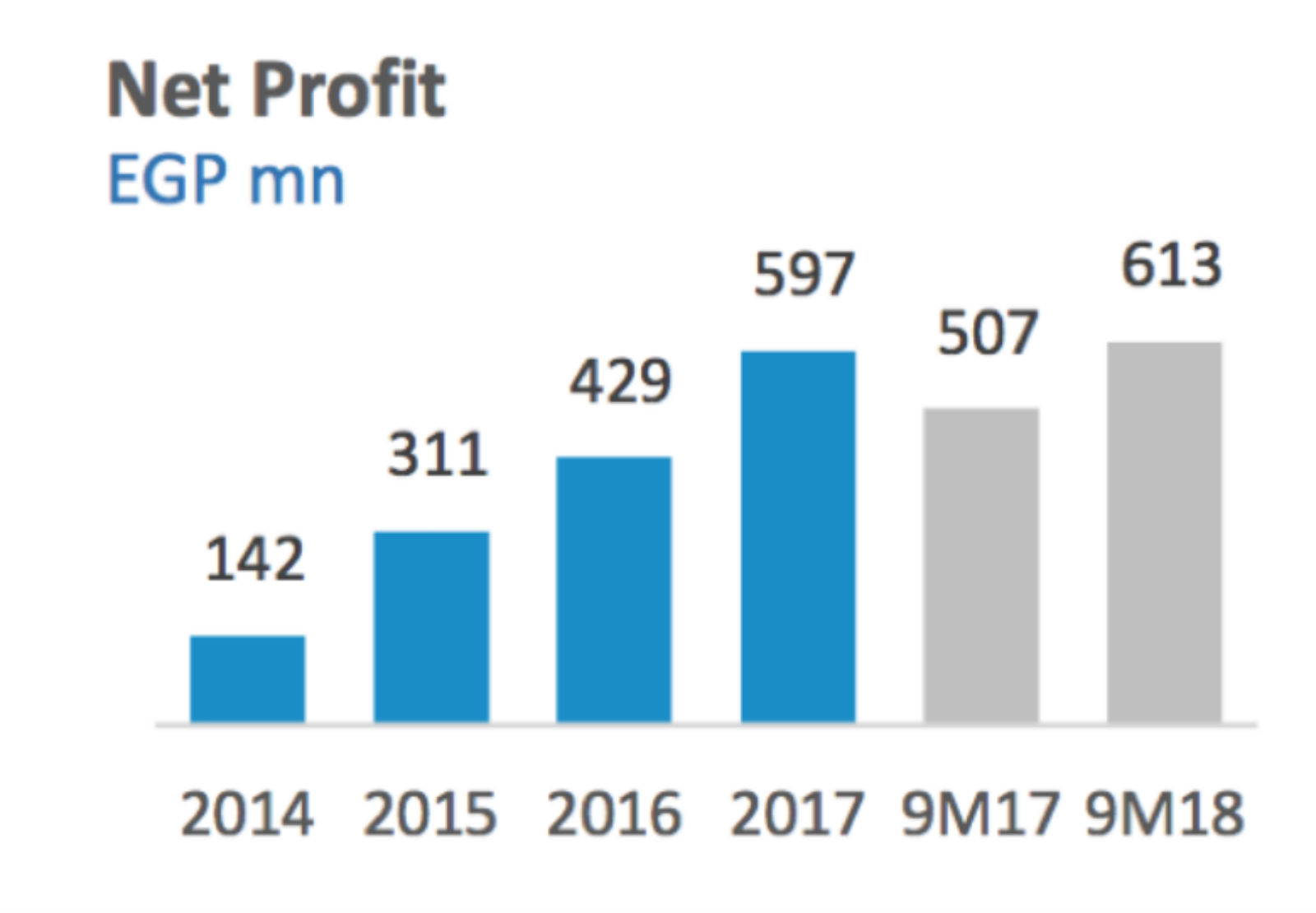

EARNINGS WATCH- SODIC reported 44% y-o-y growth in its bottom line to EGP 238 mn in 3Q2018 with a strong net profit margin of 26%, the company said in its earnings release (pdf). Revenues reached EGP 909 mn for the quarter, marking a 56% increase y-o-y, driven by “deliveries in Caesar and Villette that contributed to 42% of the delivered value during the quarter.” Net contracted sales were up 20% y-o-y, coming in at EGP 1.3 bn.

MOVES- EFG Hermes Finance CEO Walid Hassouna and market expert Nadia Ellozy have joined KarmSolar’s board of directors,the company said in a press release (pdf).

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

The Federation of Egyptian Chambers of Commerce (known by the unfortunate acronym FEDCOC) will meet with its Saudi counterpart in Aswan tomorrow and Wednesday to discuss jointly working to promote the development of SMEs, federation boss Ahmed El Wakeel had said.

The Cairo Economic Court is due to rule on an appeal by pharma distributors on Wednesday, 19 December. The distribution companies, including Ibnsina, Ramco, Multipharma and United Company for Distributions and Trade are appealing an Egyptian Competition Authority demand they pay as much as EGP 5.6 bn in fines for having allegedly colluded to cut credit periods and slash discounts to small pharmacies. The hearing comes amid speculation there could be an out-of-court settlement of the cases.

The Electricity Ministry expected to sign an MoU with Cypriot officials to begin construction on a USD 1.5 bn subsea power cable to link Egypt’s electricity grid with Cyprus’ sometime this month, Al Mal had reported.

FRA to look into an appeal by Raya’s Khalil on 23 December: The Financial Regulatory Authority (FRA) will hold a hearing on 23 December to review the conditions it set for Raya Holding founder Medhat Khalil’s mandatory tender offer (MTO) to take Raya private, local news reported.

The Central Bank’s Monetary Policy Committee will meet to decide on interest rates on Thursday, 27 December.

Egypt in the News

It’s a very quiet morning for Egypt in the international press. The latest discovery from ancient Egypt — a well-preserved 4,400-year-old tomb in Saqqara — still tops coverage, with CNN and Orlando Sentinel joining their peers in picking up the story from the wires.

On The Front Pages

Egypt’s engagement with Africa continues to shape the narrative in the country’s three main state-owned dailies. Dominating the front pages this morning is President Abdel Fattah El Sisi’s plans to discuss Egypt’s vision for the continent’s development strategy during his four-day visit to Austria (Al Ahram | Al Akhbar | Al Gomhuria). Al Ahram also has yet another story on its front page this morning about North Sinai’s return to normalcy and stability.

Worth Reading

Taking shots at China’s Belt and Road initiative. China is reassessing its Belt and Road Initiative (BRI) as mismanagement, accusations of corruption, and poor quality projects implemented under the initiative wreak political havoc across Asia, according to Bloomberg. Maldivian President Abdulla Yameen, for one, was voted out of office after the public learned that his borrowing from Beijing — which financed the construction of a new runway, housing developments, a hospital, and the 2.1 km-long “China-Maldives Friendship Bridge” — racked up almost 20% of the Maldives’ GDP in debt to China. Leaders in Malaysia and India are among those criticizing what they see as China’s “new version of colonialism” that has lured countries into debt traps.

Analysts say this pushback marks the end of the first phase of BRI. “A new model has not yet emerged, but it is clear that the old one, almost entirely focused on speed and scale, is no longer sustainable,” said German Marshall Fund Senior Fellow Andrew Small. Senior Chinese officials say they have noted examples of misconduct and are readjusting their global plans accordingly.

The US has (of course) swooped in to fill the gap, setting up an agency to lend as much USD 60 bn for infrastructure projects in several countries. This funding, however, pales in comparison to the estimated USD 1.3 tn BRI might hand out by 2027 and the USD 26tn worth of infrastructure the Asian Development Bank forecasts the region needs.

Worth Watching

A Taiwanese startup is using blockchain technology and the internet of things to change rice production, the FT reports. Sensors planted in the rice fields of isolated eastern Taiwan record weather patterns and chemical changes in soil, and then store that information through blockchain secure technology.

The amount of information and the transparency with which it is collected and stored is changing agricultural practices in the area. Farmers transitioning their crops to organic farming know they have data to back up their claims to consumers. But this trove of data is also a key tool for unraveling the impact of climate change on the rice crop.Though many families follow the traditional farming calendar, shifts in the climate mean the calendar does not match up with the ideal growing season. The sensors’ data will help farmers avoid weather-related risks to their harvest, which will eventually minimize the wild swings in agricultural commodity prices that follow natural disasters (watch, runtime: 3:20).

Apart from agriculture, blockchain is also making quiet gains in the world of cross-border currency transfers, the salmon-colored paper reports. JP Morgan’s Interbank Information Network (IIN) has been offering an efficient way for banks to transfer USD across borders and institutions through a system that eliminates the common two-day delays that plague problematic payments. Despite currently processing a fraction of the payments fintech startups do, IIN is growing swiftly.

Manufacturing

Egypt’s MPC, Malaysia’s Petronas to establish oil refining JV in 1Q2019

State-owned Misr Petroleum Company (MPC) and Malaysia’s Petronas will set up a JV to bring MPC’s underutilized oil refinery plant in Amreya to full capacity by 1Q2019, government sources said. The plan will bring the plant’s capacity to 30k tonnes per year. The JV will import crude from abroad and re-export the refined products under a shared brand name. MPC and Petronas signed the partnership agreement last July.

Elsewedy concludes studies for 2 mn sqm industrial zone in Egypt’s New Alamein

Elsewedy Electric’s industrial development arm has completed its financial and technical feasibility study for 2 mn sqm of industrial land it is developing in New Alamein, CEO Mohamed El Kammah tells Al Mal. El Kammah gave no further details.

Health + Education

Egypt extends nationwide crackdown on hepatitis C to schools

The government’s nationwide campaign to detect and treat hepatitis C will be extended to schools to screen 1.1 mn students in nine governorates in the first phase, according to Ahram Online. Diagnosed students will be prescribed medication under their health insurance.

Telecoms + ICT

Egypt loses mobile subscribers in September, penetration rate falls to 102.93%

The number of mobile service subscribers in Egypt declined 4.84% y-o-y in September to stand at 94.59 mn, down from 99.40 mn in September 2017, according to a CIT Ministry report. This brought Egypt’s mobile phone penetration rate to 102.93% by September-end, down 7.13% y-o-y from 110.06%.

Banking + Finance

Egypt Aluminum in talks with banks for USD 600 mn financing for new product line

State-owned Egypt Aluminum is in talks with five local and international banks to finance a portion of its planned USD 600 mn new product line, according to Al Mal. The company is looking to borrow 70% of the funds and will finance the remaining 30% through a capital increase. The banks include the National Bank of Egypt (NBE), CIB, the Arab African International Bank (AAIB), Qatar National Bank (QNB) and the European Investment Bank (EIB).

Central Bank of Egypt could raise ceiling for mobile lending

The CBE is studying raising the credit ceiling for mobile nano-lending to EGP 1000-1500, up from EGP 500 currently, banking sources familiar with the matter told Al Mal. The bank is now working to set the interest rate banks will charge for mobile lending services, which are set to be introduced by 1H2019 as part of the country’s drive toward financial inclusion.

Other Business News of Note

Eastern Company says counterfeit cigarettes have no impact on the company

State-owned tobacco maker Eastern Company said the counterfeit Cleopatra cigarettes manufactured in Montenegro have had no impact on the company’s growth, according to a statement to the EGX (pdf). The counterfeit production operation — which we delved into last week — took place in 2012, Eastern Co said.

Smart Lab, unnamed Egyptian company to set up USD 10 mn product testing labs

Saudi-based Smart Lab and an unnamed Egyptian private company are planning to build a USD 10 mn laboratory complex to certify mechanical products manufactured in Egypt, CEO Adel Al Ghamdi said. The complex will be built in proximity to major industrial areas and managed by the Saudi party, who will be working to certify products bound for export into its home country.

Sports

Egypt’s Ramadan Darwish wins bronze in judo at Guangzhou Masters 2018

Egyptian judoka Ramadan Darwish won the bronze medal at the Guangzhou Masters 2018 in China, after beating athletes from Portugal, Russia, and Holland but ultimately losing in the semi-finals stage, Al Masry Al Youm reports.

On Your Way Out

Egyptian clickfunding platform Bassita launched “VeryNile,” a new initiative to clean up the Nile by creating a sustainable ecosystem that recycles the plastic and waste collected from the river, Egyptian Streets reports. VeryNile aims to drive large-scale and environmentally sound removal of plastic pollution from Egypt’s aquatic ecosystems, partnering with local fishermen and leading volunteer cleaning crews to collect trash from the Nile River. On Saturday, 250 volunteers from VeryNile cleaned up 1.5 tonnes of garbage from the Nile.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 12,992 (0.0%)

Turnover: EGP 543 mn (32% below the 90-day average)

EGX 30 year-to-date: -13.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session flat at 0.0%. CIB, the index heaviest constituent ended down 1.1%. EGX30’s top performing constituents were Heliopolis Housing up 5.6%, and SODIC up 4.5%, and Telecom Egypt up 4.4%. Yesterday’s worst performing stocks were Abu Qir Fertilizers down 2.6%, Galaa Holding down 2.4% and Ibnsina Pharma down 1.9%. The market turnover was EGP 543 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +13.2 mn

Regional: Net Short | EGP -11.1 mn

Domestic: Net Short | EGP -2.1 mn

Retail: 74.4% of total trades | 76.2% of buyers | 72.5% of sellers

Institutions: 25.6% of total trades | 23.8% of buyers | 27.5% of sellers

WTI: USD 51.20 (-2.62%)

Brent: USD 60.28 (-1.90%)

Natural Gas (Nymex, futures prices) USD 3.83 MMBtu, (-7.20%, January 2019 contract)

Gold: USD 1,241.40 / troy ounce (-0.48%)

TASI: 7,908.07 (-0.08%) (YTD: +9.43%)

ADX: 4,831.15 (-0.63%) (YTD: +9.84%)

DFM: 2,556.68 (-1.63%) (YTD: -24.14%)

KSE Premier Market: 5,406.94 (+0.36%)

QE: 10,496.50 (+0.39%) (YTD: +23.15%)

MSM: 4,416.90 (-0.70%) (YTD: -13.38%)

BB: 1,319.32 (-0.07%) (YTD: -0.93%)

Calendar

December: The government will announce the second phase of its privatization program before year-end, Public Enterprises Minister Hisham Tawfik said. The committee overseeing the state privatization program is also scheduled to hold a meeting next month to look into how market conditions developed since the privatization program was put on ice.

11-17 December (Tuesday-Monday): Egypt-Russia business forum.

18 December: The Planning Ministry will be hosting an event at the Sonesta Cairo Hotel.

18-19 December (Tuesday-Wednesday): Federation of Egyptian Chambers of Commerce leaders are scheduled to meet with their Saudi counterparts in Aswan to launch a collaboration project to support SME development in Egypt and Saudi Arabia, head Ahmed El Wakeel said.

19 December (Wednesday): Cairo Economic Court to rule into an appeal by pharma companies

Mid-late December: The bylaws and articles governing Egypt’s upcoming, EGP 200 bn sovereign wealth fund will be completed, Planning Minister Hala El Said said. Cabinet is currently conducting its final review.

Mid-late December: The Electricity Ministry is set to sign an MoU with Cypriot officials to begin constructing the USD 1.5 bn subsea power cable to link Egypt’s electricity grid with Cyprus’, minister Mohamed Shaker said, according to Al Mal.

23 December: The Financial Regulatory Authority (FRA) will hold a hearing to review the conditions it set for Raya Holding founder Medhat Khalil’s mandatory tender offer (MTO) to take Raya private, local news reported.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

Early January 2010: Government to release details about its international bond issuance.

01 January 2019 (Tuesday): New Year’s Day.

01 January 2019 (Tuesday): Custom duties on EU-made car imports will fall to 0%, and we still have no automotive directive or any policy incentivizing local car manufacturing.

05 January 2019 (Saturday): An administrative court will hear Beltone Financial’s appeal against a six-month suspension the FRA handed to its investment banking arm, Youm7 reported.

07 January 2019 (Monday): Coptic Christmas, national holiday.

10-13 January 2019 (Thursday): International Property Show (IPS), Egypt International Exhibition Center

19 January 2019 (Saturday) Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case

21-22 January 2019 (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April 2019: The African Tripartite Trade Area (TFTA) agreement is set to take effect after a majority of the participating governments ratify it.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December 2019: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.