- Uber CEO on why the company chose to roll out its microbus service in Egypt + plans to invest USD 100 mn here over five years. (Speed Round)

- The EGX and US shares slumped yesterday and the “yield curve” is flattening. Here’s what you need to know. (What We’re Tracking Today)

- World Bank pledges USD 1 bn loan to support Egypt’s reform program, private sector development. (Speed Round)

- Cleopatra Hospitals shareholders approve M&A options as Tarek Kabil joins board, company releases 3Q18 earnings. (Speed Round)

- Transmar looks to capture market share in citrus export season, rolls out new reefers. (Speed Round)

- Gov’t to investors: We’re staying the course on the IPO program; the tax treatment of banks is in line with international norms. (Speed Round)

- Lots of interest in electric vehicles, but don’t expect subsidized electricity at charging stations. (Speed Round)

- Cairo retained its spot as the 50th most-visited city worldwide in 2018. (Worth Watching)

- For companies, it can be hard to think long term. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 5 December 2018

EGX and US equities slump — December isn’t going out with a whimper

TL;DR

What We’re Tracking Today

We had the pleasure of sitting down with Uber CEO Dara Khosrowshahi, who was in Cairo yesterday to launch Uber Bus. He shared with us his views on Egypt as an investment and innovation hub and why the company chose to pilot its bus service here. The company is committed to investing USD 100 mn in Egypt over the next five years, he said. Khosrowshahi also praised the Ride-Hailing Apps Act, which he described as a model for the rest of the world. We have the full interview in this morning’s Speed Round, below.

The EGX30 dropped 2.4% to an 18-month low yesterday, as CIB shares slipped amid concerns over proposed amendments to the tax code that could see banks pay more into state coffers, Reuters reported.

US shares tumbled more than 3% yesterday and Asian shares are down this morning “as sharp declines in long-term U.S. Treasury yields and resurgent trade concerns stoked investor worries about global economic growth,” Reuters reports. The story is getting heavy coverage in the global business press, including the Financial Times and the Wall Street Journal.

What they’re all going to be talking about today: Whether the flattening (or perhaps even inversion) of the yield curve (which the FT nicely calls a “widely followed bond market barometer of economic sentiment”) suggests that US economic growth is slowing — and whether a recession is in the cards. Read: Flattening yield curve stirs US recession fears, which comes as Bloomberg Opinion notes that a section of the yield curve just inverted for the first time in more than a decade.

Wait, what does any of that gibberish mean? First, you have to know that “yield” on a bond is nothing more than the return on investment someone gets from buying it. A 13% yield, for example, means you get 13% return on whatever amount you sunk into the bond. And the yield curve? It’s nothing more than the difference in yields between two bonds of the same quality, but with different maturity dates.

Okay, so…? Well, as the nice people at The Week tell us: “Usually, yields on long-term bonds are higher than yields on short-term bonds. In that case, the difference between the two is positive. But every so often, short-term yields will overtake long-term yields, which produces a negative spread. That’s when the yield curve ‘inverts.’”

So why should I care if it “inverts”? Because in the US at least, every time the yield curve has inverted, a recession has followed. The problem: The recession may have followed, but there’s the inversion of the yield curve does nothing to tell you when, exactly, an economy may start to contract.

I am Tariff Man: From The Donald yesterday, on Tweeter, of course: “….I am a Tariff Man. When people or countries come in to raid the great wealth of our Nation, I want them to pay for the privilege of doing so. It will always be the best way to max out our economic power. We are right now taking in $billions in Tariffs. MAKE AMERICA RICH AGAIN.”

Irish business delegation in town: A 12-company Irish business delegation is in town. Civil Aviation Minister Younes El Masry met with the visitors yesterday to discuss, among other things, the possible launch of charter flights between Cairo and Dublin, Al Mal reports.

Egypt’s first defense expo wraps up today. President Abdel Fattah El Sisi inaugurated EDEX 2018 on Monday. We have more in Diplomacy + Foreign Trade, below.

The IFC has selected several Egyptian startups to join its Africa’s Next Start-Ups initiative, according to a press release. The program, a joint effort with Egypt’s Investment Ministry, selects 100 startups and entrepreneurs from across Africa to join the Africa 2018 Forum in Sharm El Sheikh next week, as well as get access to funding and support from the IFC. Among the Egyptian startups selected were Vezeeta and Avidbeam.

A handful of international headlines worth knowing this morning as we brace for the onslaught of the day:

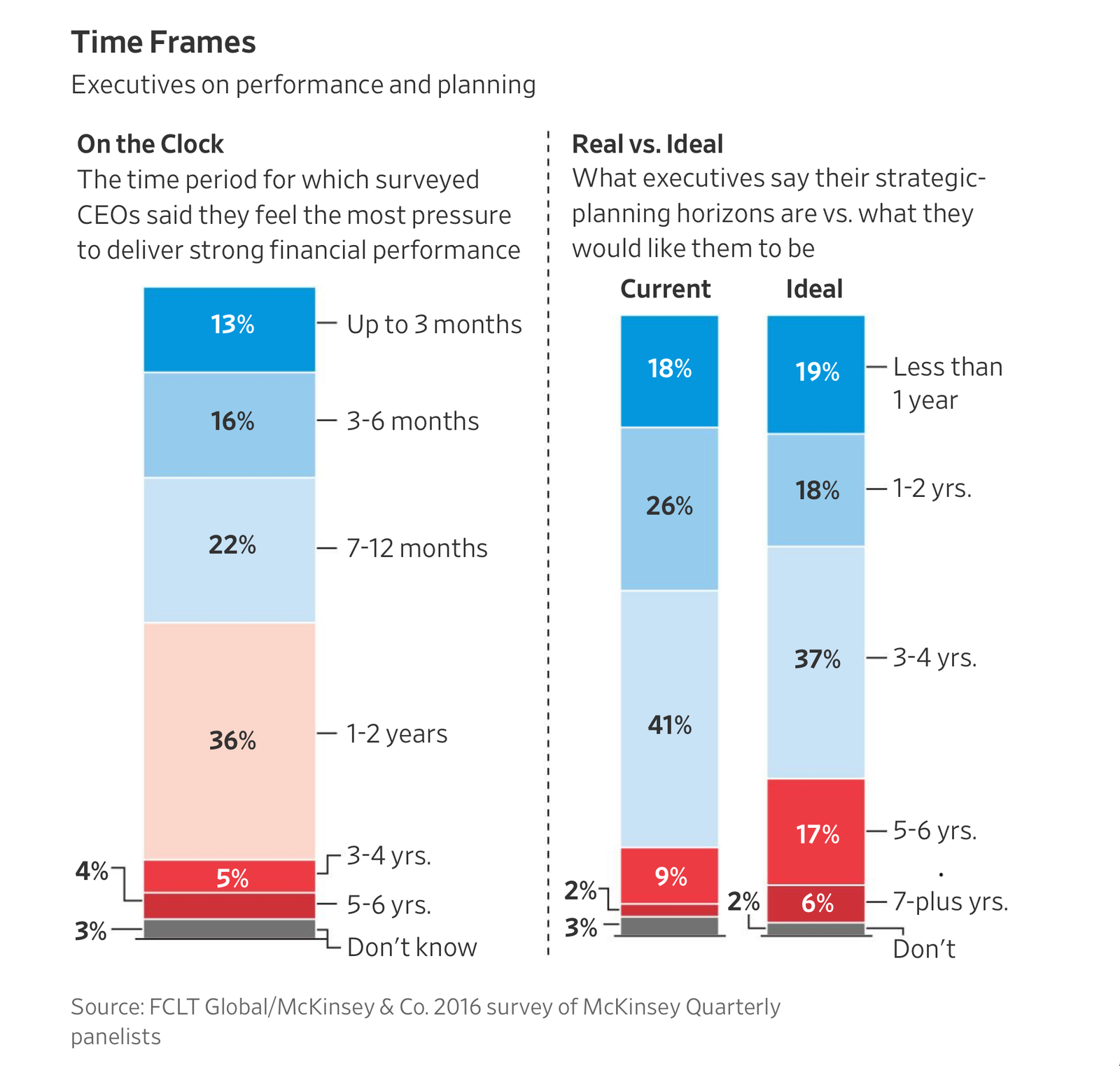

MUST READ- For companies, it can be hard to think long term: Business leaders want to run with strategies that take years to pay off, but equity investors don’t always react kindly, the Wall Street Journal writes. Witness the furor over Apple’s recent decision to stop releasing quarterly sales figures for everything from iPhones to Macs. “The debate is a key concern for chief executives trying to justify major capital investments that can take years to pay off. Long-range strategies can be hard to pull off in an era when Wall Street is fixated on three-month reporting periods,” the WSJ writes.

The bottom line: Almost no CEO is thinking more than 2 years down the road, according to a McKinsey survey the journal quotes.

Need some inspiration on the whys and how-tos of thinking long term about the business you lead? We’ve got your back:

- The McKinsey Podcast’s episode on Leading for the long term is worth a listen, and if reading is more your thing, that link also includes a full transcript of the episode (runtime: 32:41).

- BlackRock boss Larry Fink wants CEOs everywhere to think more long-term about how they’re growing and running their businesses. Business Insider ran a full copy of his 2016 letter to CEOs across the US and Europe.

- The Harvard Business Review wrote in September on “Why CEOs should share their long-term plans with investors.” (Our only quibble: This assumes they’ve had the time to create something long-term…)

- There are plenty of tools, tips and ideas in this slide deck from CECP titled Long-Term Plans: CEO Presentation Toolkit (pdf) that incorporates a bunch of ESG principles to boot.

PSA- There’s a strong possibility of light to moderate reaching Cairo this afternoon as Alexandria and our northern coastlines receive heavy rainfall today and tomorrow. Rain could last well into the evening in the capital city, according to our favorite weather app.

Enterprise+: Last Night’s Talk Shows

EDEX 2018 continued to top the talking heads’ agendas on last night’s talk shows. The latest developments in France were also a topic of discussion on Al Hayah Al Youm (watch, runtime: 2:54) and Hona Al Asema (watch, runtime: 8:15).

The Arab Organization for Industrialization (AOI) signed a preliminary agreement with a US company to manufacture armored vehicles in Egypt at the defense expo, AOI Chairman Abdel Moneim El Teras said in a phone-in to Al Hayah Al Youm (watch, runtime: 9:46). Armed Forces Spokesman Tamer El Refai also gave Yahduth fi Masr’s Sherif Amer a rundown of the officials who met at the expo (watch, runtime: 4:32).

Praise for the event flowed in from several people, including Ahmed Al Shehhi, an official from a UAE arms company (watch, runtime: 2:54), retired major-general Yousry Farag (watch, runtime: 3:21), and former military intelligence official Nasr Salem (watch, runtime: 20:02).

Providing a progress report on the new administrative capital was the spokesman of the New Administrative Capital Company for Urban Development, Khaled El Hosseini, who told Al Hayah Al Youm that the presidency, House of Representatives and all ministries are on track to move to the new capital in 2020 (watch, runtime: 6:38).

A decision from Al Azhar University prohibit faculty members from talking to the press without prior permission did not sit well with former Culture Minister Gaber Asfour, who said they should be allowed to share their knowledge freely (watch, runtime: 4:55). University spokesman Ahmed Zarea stressed that the move is meant to clamp down on wrong fatwas (religious edicts) (watch, runtime: 6:54).

The amended customs FX rate will push up the prices of non-European cars by 4-10%, depending on their engine size, Alaa El Saba, who runs an automotive distributor and is a member of the Federation of Egyptian Chambers of Commerce’s automotive division, told Hona Al Asema’s Lama Gebril (watch, runtime: 2:38)

Speed Round

Uber pilots bus service in Cairo: Uber CEO Dara Khosrowshahi was in Cairo yesterday to launch Uber Bus, the ride-hailing company’s mass transit service. Cairo is the first city to pilot the service globally.

How does it work? The service is essentially an upscaled, tech-enabled version of a microbus route (though the bus we saw was certainly more decked out). Cairo residents hail a bus ride through the standard app, which will find other passengers traveling in the same direction. “The initial rollout will start by covering the areas of Nasr City, Heliopolis, Greater Downtown, and Mohandeseen, and will expand across Cairo in upcoming months,” the company said (pdf). The story has also made it to the Financial Times

Stiff competition in the Egyptian mass transit apps space: The move comes just one day after Careem announced that it was piloting its new bus service in Downtown Cairo, Maadi, 6 October and the Fifth Settlement. The services are similarly priced, with Uber Bus fares being around 70% cheaper than a regular Uber ride, while Careem’s are fixed at 60-70% less than a regular hop with Careem. With the launch of their respective services, the MENA ride-hailing rivals are stepping onto the turf of local startup Swvl, which previously broke the Egypt record for a series ‘A’ investment round and whose CEO said the company was valued at USD 100 mn thanks to a successful series ‘B’ last month.

Have the ride-hailing giants been competing for a bite of Swvl? Uber representatives with whom we spoke said they were unaware of market chatter suggesting that the company had acquired or was in talks to acquire a stake in Swvl, possible the stake that Careem is believed to have sold before launching its rival service. Careem had earlier invested USD 500k in Swvl, which did not respond to requests for comment.

Keep an eye on the microbus drivers of Cairo. Taxi drivers haven’t taken Uber and Careem sitting down. Their colleagues plying the city’s microbus routes are typically less, uh, inhibited about expressing their displeasure.

Uber Lite to be rolled out in Egypt in the coming few months: Under the mantra of expanding the accessibility of Uber’s service, the company has developed a smaller-sized version of its regular app that could work with poor signal quality. The 5 MB version will launch in the coming few months.

Our sitdown with Dara Khosrowshahi: We had the opportunity to speak with the Uber CEO on his first visit to Cairo since taking over the company. The discussion ranged from the launch of Uber Bus to the company’s love of Egypt as an investment destination, how Egypt fits into its global strategy and where he sees the future of ride-hailing and transportation. Edited excerpts:

Why the company’s bus service made its global debut in Cairo: We started in Egypt because it is an important market for us. It’s our largest market in the Middle East, it’s one of the fastest growing markets and a top 10 market in terms of trips on a global basis. We’re big believers in the Egyptian economy and what President Abdel Fattah El Sisi is doing. So it is a market we are going to continue to invest in. What’s important for us in investing in Egypt (or any market) is making sure we increase the accessibility of our service to a broad range of Egyptians. Minibuses are a popular mode of transport in Cairo and a lot of big cities, and what we want to do is to take bus services to the next generation. So what you will see with the Uber Bus service are very exciting new features such as dynamic routing, and a deep integration into our product, which we are starting in Egypt and from where we will expand to the rest of the globe.

Uber will invest USD 100 mn here over the next five years: The growth is all over our Egypt services, honestly. The Egyptian market is an incredibly healthy market and that has led us to invest over USD 100 mn in the next five years. We are also building a center of excellence here. Uber Scooter is off to a terrific start here, and we hope Uber bus will have the same sort of start.

How much is Uber investing in the product launch? If the service grows like we expect it to, the investment will be significant. Right now the investment is in the technology that is integrated in the mainline. I can’t share investment numbers just yet, as the numbers will depend on how big the business gets. But my expectation is that the investment will get very significant.

Ride-hailing Apps Act is a “model regulation” for the rest of the world: We believe that the law is a very constructive law. We’ve always wanted to work with authorities to make sure are services are ones that fit in with the vision of the government, and is also able to help the local economy grow. We over 90,000 monthly active Uber drivers now. So we’re waiting for the executive regulations to come out, and we’re looking for a constructive dialogue with the government here. But I think that this regulation has a potential of being not only a strong regulation here in Egypt, but a model regulation for the world.

Where does Egypt fit in to Uber’s global strategy of becoming “the Amazon of transportation”? When I talk about becoming the Amazon of transportation, I’m really talking about moving beyond just cars and into whatever form of transportation. And Egypt for us is going to be an innovation front. I think Uber Bus is going to be an incredibly important part of the various types of transportation that we offer, and if we are going to achieve this vision, Egypt is going to be very crucial to that.

How is Uber adapting to younger (Taxify) and at times homegrown competitors (Swvl), which the Wall Street Journal has described as more nimble? These competitors are certainly younger, but I take issue with them being nimbler. I think competition is good for any industry, makes us smarter and sustainable, and makes us continue to be at the bleeding edge of innovation.

Was there an acquisition involved in Uber Bus? The Uber Bus technology and service was really built from the ground up, and in a very integrated way with Uber’s other lines of business. So this will not be a service on the side and will be part of the mainline.

How does the business of Uber Bus work? We’re essentially working with local providers to supply the buses. We don’t buy the buses, as you know there are a lot of local providers. And we want to partner with local businesses to build the Uber Bus service.

Uber Bus is part of the company’s drive to cater to a wide cross-section of society: Our mission is to essentially be the mobility on demand for service for cities all around the world. And we want to make mobility available in many forms, including UberX. Options like Uber Bus and Uber Scooter increase accessibility by making mobility on demand essentially more affordable for everybody. We’re combining that with the launch of Uber Lite, so if you have Android phones that are less powerful or don’t have the broadband access as someone in the US, you have accessibility.

Sorting out Cairo’s traffic problem: We consider it a challenge. And with a service like Uber Bus and our ability to dynamically route, we believe we can be a solution for Cairo’s traffic problems. This is going to take a lot of experimentation and partnership with the city and government as well. We’re certainly up for it, and we believe this is going to be a multi-year investment for us in partnership with the government.

What’s next? Maybe an Uber Tuk-tuk? Never say never. With the launch of Uber Scooter and Uber Bus, there’s going to be a lot of experimentation and investment in that format. But we’re constantly looking at different ideas. We’re looking at an auto rickshaw product in India and if it works there, we’ll expand it as well. We really look at the particular needs to every city and based on the success of a rollout in a city, we’ll expand. If the potential for Uber Bus proves out, it will be a product we will launch globally.

Electric cars are also on the menu: We’re certainly interested in reducing congestion and helping the environment, so electric is definitely a part of that. And we’re open to dialogue with the government on electric transportation.

Driverless here in Egypt? Way, way, waay down the road? Based on my experience getting from the airport to here, we would really have to optimize our driverless hours to make it work here. With driverless, you have to start some place, but I wouldn’t go to Cairo tomorrow.

Egypt’s net foreign reserves were flat at USD 44.513 bn as of the end of November compared to USD 44.501 bn the previous month, the central bank reported on Tuesday.

World Bank pledges USD 1 bn in fresh funding to support Egypt’s reform program, private sector development: The World Bank has pledged to provide Egypt with a new USD 1 bn loan to help finance the next phase of the government’s economic reform program, which focuses on spurring private sector growth, the bank said in a statement yesterday. “The program is designed to support three of the government’s key objectives of job creation, improving government performance and raising living standards. The [development policy financing] is focused on reforms to improve the business environment, with an emphasis on ensuring small businesses have access to finance and new financial technology such as digital payments, along with [chances] to bid for government contracts; while empowering local governorates and districts for local investment planning.”

Final agreement on Sinai facility: The bank had also reached a final agreement with Investment Minister Sahar Nasr in October over a USD 3 bn loan for infrastructure projects and the government’s development drive in the Sinai Peninsula.

M&A WATCH- AMOC in talks to purchase Sasol’s stake in Alexandria Wax Products Co: The Alexandria Mineral Oils Co. (AMOC) is in talks to acquire a portion of Sasol Germany GmBH’s stake in Alexandria Wax Products Co at EGP 100 per share, according to an EGX disclosure (pdf). AMOC, which currently holds 40% of Alexandria Wax Products, is seeking a majority stake in the company, but has yet to say how much of Sasol’s 51% stake it is looking to acquire.

M&A WATCH- GAFI signs off on sale of Helwan Cement plant to Emaar: The General Authority for Freezones and Investment has approved Helwan Cement’s decision to sell its white cement plant in Minya to Emaar Industries, which Helwan’s extraordinary general assembly had approved last month, according to an EGX disclosure (pdf).

M&A WATCH- MM Group for Industry and International Trade increased its stake in Kanawat Distribution to 62.7% up from 37.5% in a transaction worth EGP 73.9 mn. The acquisition of 21.67% has been completed, while the remaining 3.53% is pending approval from the EGX. We had previously reported that MM Group was going to increase its stake to just north of 59%.

EARNINGS WATCH- Cleopatra Hospitals Group reported a 186% y-o-y increase in net profit to EGP 91.6 mn in 3Q2018 from EGP 32 mn in 3Q2017, according to the company’s earnings release (pdf). Revenues for the quarter stood at EGP 388.3 mn, up 32% y-o-y from EGP 293.2 mn in the same period last year. Profit growth was driven by an internal integration program and increased efficiency across its operations. The top-line growth “is an encouraging indication that the Group is heading in the right direction, and is testament to the effectiveness of our comprehensive, long-term rationalization program,” CEO Ahmed Ezzeldin said.

New board members: Former Trade and Industry Minister and longtime PepsiCo executive Tarek Kabil has joined Cleo’s board as an independent director. Also joining the board is our friend Samia El Baroudy, who will represent shareholder Care Healthcare Ltd.

Cleopatra shareholders also moved approved moving ahead with two inorganic growth options, approving management’s plan to take over El Katib Hospital and to take a long-term lease agreement for a 50-bed specialist hospital in East Cairo.

Speaking on the M&A piece, Cleopatra Corporate Strategy and Investor Relations Director Hassan Fikry said, "The news on El Katib and the 50-bed East Cairo hospital are the opening moves of a six-stream inorganic growth strategy we’re rolling out in 2019 and beyond. This will include a mix of greenfields, brownfields and acquisitions, the pillars of which are the launch of our polyclinics franchise in the first quarter of the new year, additional acquisitions of both operating and brownfield hospitals, capacity expansions (including at Shorouk Hospital) and expanding into new services such as home care and home visits. We also plan to make further investments in our centers of excellence initiative.”

EXPORT WATCH- Home-grown shipping giant Transmar is looking to capture new market share as Egypt’s citrus export season gets underway, the company said in a statement yesterday. Transmar is looking to capture new market share in the export of lemons, limes, tangerines and grapefruits and singled out oranges as a particularly promising category as it invests in the growth of its reefer fleet over the coming months, CEO Mohamed El Ahwal said. The company serves citrus exporters out of Adabiya Port into Saudi Arabia and Port of Sudan. El Ahwal said Transmar is working with exporters seeking “wider and newer markets in the Gulf” and noted the company is also growing its share of “the export of dry foods, with increasing exports of confectionery and snacks from Egypt.”

Gov’t to investors: We’re staying the course on the IPO program; the tax treatment of banks is in line with international norms. Finance Minister Mohamed Maait and Public Enterprise Minister Hisham Tawfik briefed investors yesterday at a Beltone investor access event. Among the highlights, according to a research note circulated after the event (pdf):

- The government is holding the line on the sale of state-owned companies via IPO and accelerated book builds, Tawfik said. The core issue is the intersection of timing and price. Expect the state’s plans for the second phase of the IPO program to be made clear by year’s end;

- A parallel restructuring drive continues as the Tawfik’s ministry looks not just to bring loss-making companies to profitability (or liquidate them, as we’ve previously reported), but also to help profit-making companies in insurance and maritime transport “realize their full potential”;

- Dormant state assets, mostly land, will be transferred to the sovereign wealth fund;

- Finance Minister Mohamed Maait recapped current macro indicators with a focus on GDP growth (5.8% this fiscal year) and deficit reduction. This is helping fund social security measures and comes as the state is making progress on debt reduction.

- The tax treatment of bank holdings of bills and bonds is simply fair, Maait suggested: “The current tax rate on the proceeds of government securities is set at 20%, while the tax on commercial and industrial profits at 22.5%. He added that the move ensures tax equality with regards to financial institutions investment in government securities and also the fair collection of taxes due on profits earned from the rest of their activities.”

No subsidies for electric car charging stations? The Electricity Ministry will not subsidize electricity sold to recharge electric vehicles, Electricity Minister Mohamed Shaker is quoted as saying by the domestic press. To do so would only inflate the nation’s subsidy bill. The remarks come amid increasing industry interest in electric vehicles. The Trade Ministry’s Egyptian Organization for Quality and Standardization (EOS) is due to set the specification standards for the market before year-end as it is expecting more cars to hit the road in the coming period, EOS head Ashraf Afifi said. Electric vehicles may presently be imported to Egypt at 0% customs duties.

More companies seeing potential: Luxury automotive distributor MM Group for Industry and International Trade (MTI) is planning to start importing electric cars from Jaguar in 2Q2019, CEO Khaled Mahmoud said. Jaguar’s only electric vehicles are the models of its new I-PACE series. This makes company the latest to join a wave of manufacturers and distributors involved in the sub-sector. The local distributor of China’s Dongfeng cars, Dershal, says it aims to be the first to assemble the cars locally, while SMG Engineering Automotive and Revolta Egypt are both importing completely built-up units.

LEGISLATION WATCH- Expect executive regs for Consumer Protection Act next week: The executive regulations for the Consumer Protection Act will be issued next week, Consumer Protection Agency (CPA) head Rady Abdel Moaty said. The law gives the CPA authority to impose price controls, censor advertisements and regulate the e-commerce, automotive and real estate markets. Don’t expect businesses to welcome the new law, which was approved by the House in April, with open arms. You can learn more about the act here.

LEGISLATION WATCH- FinMin looks to speed-up tenders for PPP projects: The Finance Ministry is preparing amendments that will cut the time to issue tenders for public-private partnership (PPP) projects and introduce new mechanisms for private sector contracting, minister Mohamed Maait said, according to Youm7. The amendments would allow private sector bidders to submit unsolicited proposals to the government. They could also allow the government to negotiate directly with a sole bidder without needing to take the project through the competitive bidding process. The government is looking to encourage private sector involvement in infrastructure, public services, and utility developments, particularly in the new cities.

MOVES- Prime Minister Moustafa Madbouly has appointed Ahmed El Sheikh as deputy chairman of the EGX, according to a Cabinet statement. El Sheikh, who has held several positions in the EGX since 1993, will hold the new position for four years.

Egypt in the News

Italy places five Egyptian security forces members under investigation for kidnapping Regeni: Italy’s prosecution to investigate five members of Egypt’s National Security Agency for their suspected involvement in the disappearance of Italian PhD student Giulio Regeni, Reuters reports. The suspects are not being looked at for Regeni’s murder, however; Italy has yet to accuse anybody of the student’s killing. The story is leading the conversation on Egypt in the foreign press this morning, with the UK’s Telegraph, Germany’s DW, and the New York Times all taking note. Egypt had rejected Italy’s request to add the names of Egyptian policemen to Rome’s “suspect registry” in connection with the crime, as we noted yesterday.

Egypt’s “leading role in the Arab world” is “something very important for Greece,” Greek Defense Minister Panos Kammenos said on Tuesday, according to Greek Reporter. Kammenos referred to Cairo and Athens as “an axis of stability” in the southeastern Mediterranean, and said the two countries are cooperating closely to safeguard the region’s stability.

Other news worth noting:

- An increase in forcible evictions and arrests in Egypt was decried by UN Special Rapporteur Leilani Farha, AFP reported.

- Egyptian-Austrian director Abu Bakr Shawky talks about his casting choices for “Yomeddine,” Egypt’s contender for the foreign-language Oscar award, in an interview with Variety.

On The Front Pages

It’s another day of EDEX 2018 leading the conversation in Egypt’s three main state-owned newspapers. Al Ahram, Al Akhbar, and Al Gomhuria all focus largely on the defense expo and President Abdel Fattah El Sisi’s meetings with various officials who are in town for the event.

Worth Watching

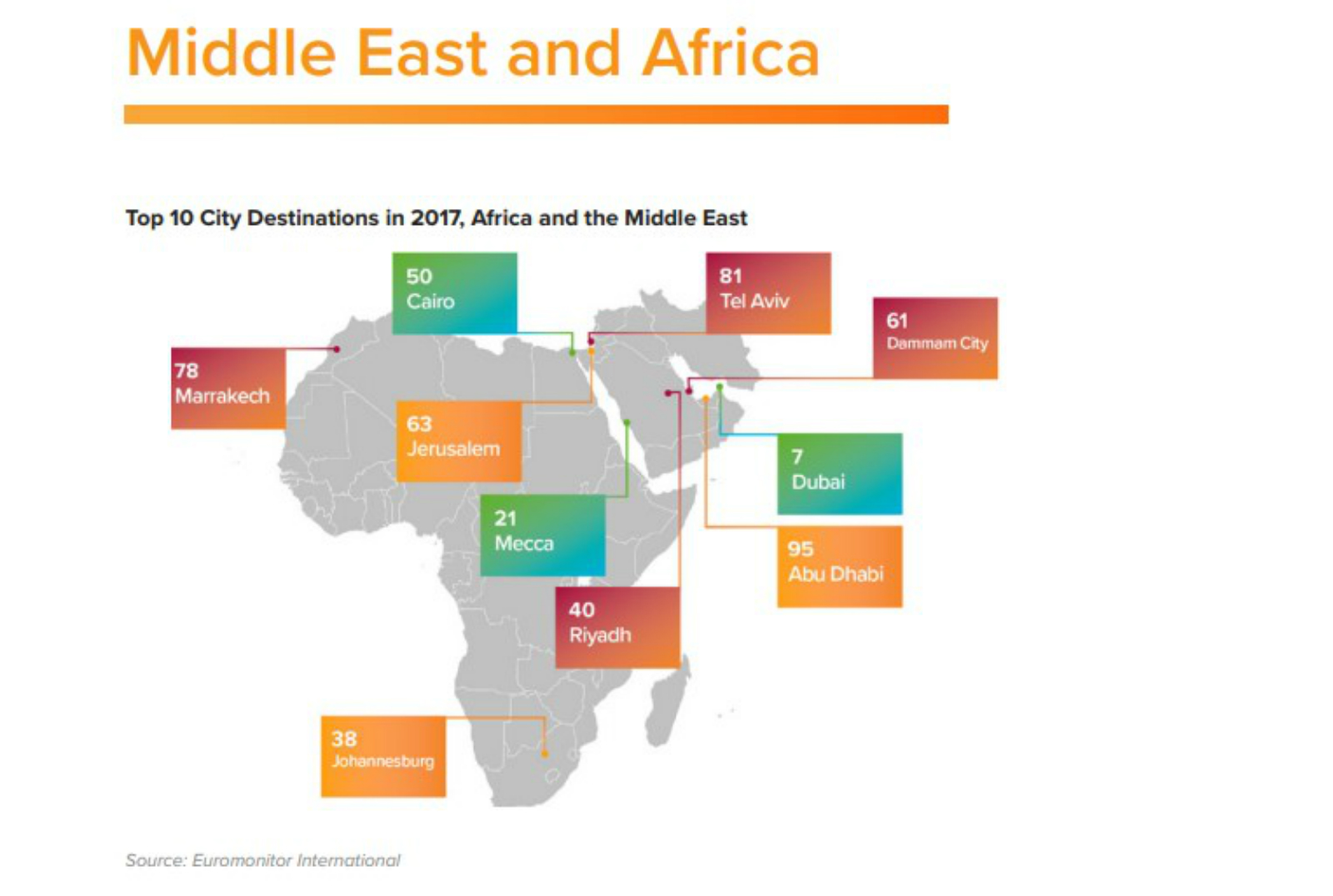

Cairo retained its spot as the 50th most-visited city worldwide in 2018, according to a report by Euromonitor International . International arrivals to Egypt’s capital city rose to 4.9 mn in 2018 from 3 mn in 2016. Hong Kong topped the chart, followed by Bangkok, London, Singapore and Macau while Dubai came in 7th place, Bloomberg notes (watch, runtime: 1:00).

Sadly, however, the report says the Middle East and Africa region is “the biggest loser … with cities such as Jerba and Sousse in Tunisia, or Sharm el Sheikh in Egypt dropping out of the ranking in past years, mainly due to terrorist attacks and subsequent slumping” demand.

Diplomacy + Foreign Trade

El Sisi meets defense, business officials at EDEX 2018: President Abdel Fattah El Sisi discussed national security and military cooperation with US Director of National Intelligence Daniel Coats and Sudanese Defense Minister Awad bin Ouf on the sidelines of EDEX 2018, Ittihadiya said yesterday. El Sisi also met with Dassault Aviation CEO Eric Trappier to talk potential purchase agreements for Egypt’s armed forces.

Defense Minister Mohamed Zaki and Army Chief of Staff Mohamed Farid also held talks with the French, Greek, Cypriot, and South Korean defense ministers, as well as Jordan and Saudi Arabia’s military chiefs of staff.

Meanwhile, Military Production Minister Mohamed El Assar and Russian tank manufacturer UralVagonZavod CEO Alexander Potapov looked into potentially establishing a waste-recycling plant, Al Shorouk reported.

Egypt and Kuwait signed several cooperation agreements on security, sports, labor, arts and culture, and education during the 12th session of the Egyptian-Kuwaiti joint committee, according to a Foreign Ministry statement.

Real Estate + Housing

Mountain View aims to increase investments in Egypt by as much as 20% in 2019

Mountain View plans to increase its investments in Egypt by 20% during 2019, CEO Ayman Ismail said, according to Al Mal. The company intends to invest some EGP 50 bn in its PPP project with the New Urban Communities Authority, Ismail said, without adding further details

Tourism

Albatross Holding to build two new Hotels at Red Sea destinations

Albatross Holding plans to break ground on two new hotels in Soma Bay and Hurghada early next year, and open their doors as early as the following year, Chairman Kamel Abu Ali said. The company is in talks with local banks for loans to cover 30% of the projects’ financing, and will self-finance the remaining costs.

Automotive + Transportation

China’s CRRC to supply Egypt with 22 trains for new capital-10 Ramadan line

Egypt has contracted China’s CRCC to manufacture and supply 22 trains for Egypt’s 10 Ramadan-new capital railway line, according to Xinhua. The trains will include a total of 132 train cars, and will each have a maximum capacity of 2,222 passengers. The Chinese company will also provide maintenance services for 12 years.

Banking + Finance

ACC to restructure outstanding loans through new syndicated loan

Cement supplier Arabian Cement Company (ACC) is receiving a syndicated loan from the European Bank for Reconstruction and Development and CIB to restructure its USD 23 mn and EGP 499.3 mn outstanding debt to a local bank, according to a press release (pdf). The facility will give ACC more room to fulfill its long-term strategy to become more competitive through higher energy and cost efficiency, the company said.

EBRD extends USD 50 mn to AAIB for Egypt exporters, importers

The European Bank for Reconstruction and Development (EBRD) has extended a USD 50 mn facility to the Arab African International Bank (AAIB) to drive export and import growth, according to a press release. The facility will see the EBRD “issue guarantees in favour of international commercial banks covering the … risk of the transactions undertaken by AIIB.” The EBRD will also support the training of the bank’s trade finance staff.

Central Bank of Egypt plans to launch polymer banknotes by 2020

The CBE will launch plastic or polymer banknotes by 2020, which are more durable than their paper counterparts, CBE Governor Tarek Amer told state news agency MENA, according to Al Shorouk. Amer said polymer banknotes are already being used in major economies and that the move would be positive for Egypt’s currency market as it would help reduce printing costs and improve quality.

Other Business News of Note

AIIB, SCA and Investment Minister meet to discuss Asian-Egyptian cooperation

Suez Canal Authority Chief Mohab Mamish and Investment and International Cooperation Minister Sahar Nasr met with a delegation from the Asian Infrastructure Investment Bank in Ismailia yesterday to discuss potential avenues for cooperation to develop infrastructure in the Suez Canal Economic Zone, according to Al Mal.

Alaa El Saba to consolidate, list his businesses within three years

Alaa El Saba (not Alaa Saba the investment banker turned private equity investor) is looking to roll investments including car distributor El Saba Automotive and a tourism company into a new holding company structure that could be listed on the EGX within three years, he said yesterday. El Saba plans to retain advisors for the restructuring in the first quarter of next year.

Sports

Egypt’s Essam, Hammamy win first-day matches in PSA tournament

Egyptian squash players Shehab Essam and Karim El Hammamy each won a match on the opening day of the CIB Black Ball Squash Open, leading them to enter the second round of a PSA Platinum event for the first time in their careers, according to PSA World Tour. Essam beat Scotland’s Greg Lobban, while El Hammamy won his first-round match against fellow Egyptian Mazen Hesham.

Mo Salah comes in sixth place in Ballon d’Or awards

Liverpool forward Mohamed Salah came in sixth place in the Ballon d’Or awards, coming in behind Croatian midfielder Luka Modric, Cristiano Ronaldo, Antoine Griezmann, Kylian Mbappé and Lionel Messi, according to BBC. Salah is the first Egyptian to ever be nominated for a Ballon d’Or — one of the most prestigious individual awards in football.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 12,625 (-2.4%)

Turnover: EGP 628 mn (21% below the 90-day average)

EGX 30 year-to-date: -15.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 2.4%. CIB, the index heaviest constituent ended down 2.7%. EGX30’s top performing constituents were Global Telecom up 1.0%, and Juhayna up 0.1%. Yesterday’s worst performing stocks were Porto Group down 5.6%, AMOC down 5.1% and Elsewedy Electric down 4.9%. The market turnover was EGP 628 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +49.5 mn

Regional: Net Short | EGP -20.7 mn

Domestic: Net Short | EGP -28.8 mn

Retail: 62.2% of total trades | 63.5% of buyers | 60.9% of sellers

Institutions: 37.8% of total trades | 36.5% of buyers | 39.1% of sellers

WTI: USD 52.68 (-1.07%)

Brent: USD 62.08 (+0.63%)

Natural Gas (Nymex, futures prices) USD 4.52 MMBtu, (+1.39%, January 2019 contract)

Gold: USD 1,241.70 / troy ounce (-0.39%)

TASI: 7,905.12 (-0.15%) (YTD: +11.36%)

ADX: 4,898.15 (+2.68%) (YTD: +11.36%)

DFM: 2,675.87 (+0.27%) (YTD: -20.6%)

KSE Premier Market: 5,369.04 (+0.79%)

QE: 10,602.84 (+1.45%) (YTD: +24.40%)

MSM: 4,534.63 (+1.90%) (YTD: -11.07%)

BB: 1,325.43 (0%) (YTD: -0.43%)

Calendar

03-05 December (Monday-Wednesday): First Egypt Defense Expo “EDEX 2018”, Egypt International Exhibition Center, Nasr City Cairo.

04-05 December (Tuesday-Wednesday) Irish Minister of State for Trade, Employment, Business, EU Digital Single Market and Data Protection Pat Breen in town heading a delegation of 12 companies to explore investment prospects, according to an Irish Embassy in Cairo statement (pdf).

06 December (Thursday): Egypt’s Emirates NBD PMI for November released.

07-09 December (Friday-Sunday): RiseUp Summit, The Greek Campus, Downtown Cairo (location).

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

08-10 December (Saturday-Monday): Fourth Food Africa 2018 expo, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

09-10 December (Sunday-Monday): Cairo Regional Centre for International Commercial Arbitration’s Sharm El Sheikh VII conference, Egypt Hall, SOHO Square, Sharm El Sheikh

10 December (Monday): The Financial Regulatory Authority will hear a grievance appeal by Beltone against a six-month suspension handed to its investment banking arm over “irregularities” the authority says it found in Sarwa’s IPO, Al Mal reported.

11 December (Tuesday): The EFG Hermes CEOs Dinner. Cairo

11-13 December (Tuesday-Thursday): The EFG Hermes Egypt Day Summit. Cairo.

11 December (Tuesday): TVET Future Chef Competition – Season II, Cairo, venue TBD.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheikh, venue TBD.

14-16 December (Friday-Sunday): AutoTech 2018, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

18-19 December (Tuesday-Wednesday): Federation of Egyptian Chambers of Commerce leaders are scheduled to meet with their Saudi counterparts in Aswan to launch a collaboration project to support SME development in Egypt and Saudi Arabia, head Ahmed El Wakeel said.

19 December (Wednesday): Cairo Economic Court to rule on an appeal by pharma companies.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

10-13 January 2019 (Thursday): International Property Show (IPS), Egypt International Exhibition Center

19 January 2019 (Saturday) Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.