- Central bank leaves interest rates unchanged. (Speed Round)

- The Finance Ministry sees the economy growing at a blistering 6.5% in the state’s 2019-20 fiscal year. (Speed Round)

- Egypt’s unemployment rate rose fractionally to 10% in 3Q2018. (Speed Round)

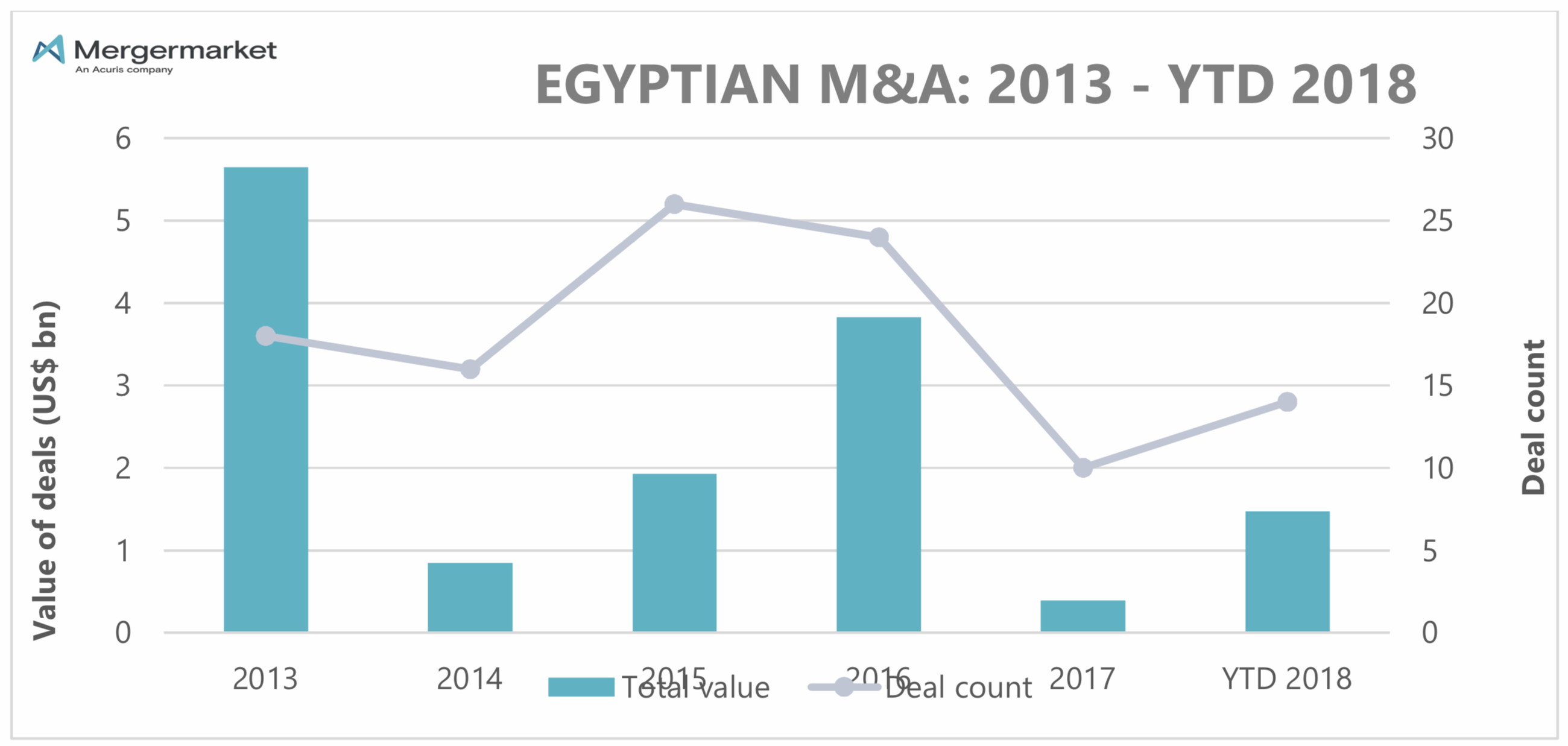

- Egypt M&A activity up almost 4x to USD 1.5 bn so far this year, but still pales compared to recent high water mark in 2013. (Speed Round)

- EAEF will invest an additional USD 165 mn in Egypt by end-2019. (Speed Round)

- Court rejects Beltone’s request to stay FRA-imposed suspension on investment banking arm; next hearing 1 December. (Speed Round)

- Exporters clamor for release of export subsidy payments. (Speed Round)

- Egyptian launches world’s first crypto ETP in Switzerland. (What We’re Tracking Today)

- Want a 70% discount on the interest and penalties you owe the taxman? (What We’re Tracking Today)

- The Market Yesterday

Sunday, 18 November 2018

Central bank leaves interest rates on hold

TL;DR

What We’re Tracking Today

Even with a mid-week holiday, it’s shaping up to be a busy week. Don’t let the end of earnings season fool you: Have you finalized your 2019 budget yet? Among the nuggets worth keeping your eye on in the coming days:

Want a 70% discount on the interest and penalties you owe the taxman? A window granting a discount of up to 90% on penalties and accumulated interest in tax disputes ended last week. More than 50k files worth an aggregate EGP 12.5 bn were closed, the Tax Authority says. Missed the deadline? You have until 27 December to settle at a 70% discount under the same program. The break on interest and penalties drops to 50% on 28 December 2018 and runs until 9 February 2019. Companies and individuals alike can settle under the program.

Want a road or a bridge? Prime Minister Moustafa Madbouly and other cabinet officials will meet tomorrow with a delegation from the China-backed Asian Infrastructure Investment Bank to discuss financing for infrastructure projects here. The delegation will be in town until Friday, 23 November.

A delegation of French healthcare companies will be in town tomorrow for the French-Egyptian Healthcare Forum.

The Egyptian Competition Authority will inaugurate tomorrow a regional center for competition policy headquartered in Smart Village, according to a press release. The new center will act as a Middle East and North Africa hub for consumer protection law, regulations and policies. The Consumer Protection Agency recently inaugurated a similar training facility as part of the same UNCTAD-backed program.

The central bank will auction USD 1.675 bn-worth of one-year USD-denominated treasury bills tomorrow, according to a statement cited by Reuters. The offering will be settled on Tuesday.

Egyptian launches world’s first crypto ETP in Switzerland: We introduced you almost two years ago to Hany Rashwan (Linkedin), the Egyptian tech entrepreneur who had made Forbes’ 30 Under 30 Enterprise Tech List for 2017. The Cairo native won recognition for his second startup, whose payouts, disbursements and compliance API was used by top online lenders. Rashwan is now back in the headlines with Amun, a London-based startup that just won permission to launch the world’s first exchange-traded product tracking multiple cryptocurrencies, according to the Financial Times. The Amun Crypto ETP will have half of its assets invested in bitcoin. Amun says it aims to make buying crypto assets “as easy as buying a stock.”

How accurate are sell-side analysts? “Sell-side analysts have been caught a little flat-footed as companies have reported far better results than expected” as 3Q earnings season ended, the Financial Times’ Alphaville blog writes. “These results beg the question of just how much weight we should give analysts’ earnings forecasts. It turns out, not much, especially in the long run.” The exceptions: “Analysts add value when it comes to small caps” and other shares that are outside the spotlight, and they can also “make a difference when they reassess their outlooks.”

The CIA has concluded that Crown Prince Mohammed Bin Salman ordered the killing of Saudi journalist Jamal Khashoggi, according to the Washington Post, citing unnamed sources. US President Donald Trump called the alleged report “very premature,” but admitted it was possible, noting that he was waiting for a complete report by tomorrow (Monday, 19 November). Further complicating relations between the two countries, Saudi Arabia is reportedly slashing oil shipments to the US, a tactic that “boosts prices and may rile Trump,” CNBC reports.

Game of Thrones will be back in April for its eighth and final six-episode season, HBO has announced. A promo for the season is out here (watch, 1:15). Or you can say a silent prayer that George R.R. Martin finishes writing the sixth and final installment of the series of novels that inspired the HBO show. He tells the WSJ that he’s hard at work on The Winds of Winter. He has a prequel, Fire & Blood, due out on Tuesday, 20 November. It takes place 300 years before the events seen in Game of Thrones and is written in the style of a history book.

PSA #1- Tuesday is a national holiday in observance of the Prophet’s Birthday. The stock exchange and banks will be closed.

PSA #2- Thursday is Thanksgiving in the United States. The holiday has a measure of global appeal, so look more than a handful of your friends and colleagues to celebrate with a turkey. Many schools following a US curriculum will be off.

Enterprise+: Last Night’s Talk Shows

Our talkshows report is on hiatus today. We hope to have it back tomorrow.

Speed Round

The central bank of Egypt (CBE) kept key interest rates on hold on Thursday, citing higher-than-expected headline inflation rates in September and October. The bank’s monetary policy committee left the overnight deposit and lending rates at 16.75% and 17.75%, respectively, and also left on hold its main operation and discount rates at 17.25%, the CBE said in a statement (pdf). Economists in our inaugural Enterprise poll had suggested that the MPC would leave rates on hold to preserve Egypt’s competitiveness in the battle for hot money fleeing emerging markets amid turmoil, a strong USD and rising US interest rates.

“Slight deviation” from inflation target: Annual headline inflation rose to 17.5% in October, up from 16% the previous month. “As headline inflation for October 2018 has been affected by a higher-than-forecasted increase in the prices of fresh vegetables, there is an upside risk of a slight deviation from the inflation target announced in May 2017, which records 13 percent (±3 percent) on average during 2018 Q4,” the CBE said.

The CBE said annual real GDP growth was unchanged at 5.4% in 2Q2018, stalling after six consecutive quarters on an uptrend. “The positive contribution of private domestic demand and net exports declined, while that of public domestic demand increased,” the bank said.

The Finance Ministry sees the economy growing at a blistering 6.5% in the state’s 2019-20 fiscal year, up from a projected 5.*% this fiscal year. That’s perhaps the most interesting take away from the ministry’s 2019-20 budget guidelines (pdf). The ministry sees GDP growth accelerating to 6.9% in 2020-21 and 7.3% in 2021-22. The budget guidelines set the framework on which the FinMin and other ministries and agencies will build next year’s budget. Policy makers are starting the process with an edge on the expense side as global oil prices have come down 20% from their high earlier this fall. The ministry is hoping to maintain its 2% primary budget surplus during the next fiscal year.

Budget deficit, unemployment seen falling: Egypt’s budget deficit is expected to fall to 7% of GDP by FY2019-20, down from 8.4% of GDP in the current fiscal year, the document shows. The Finance Ministry aims to see the deficit then shrink to 5.6% of GDP in 2020-21 and 3.9% in 2021-22.

It also sees unemployment falling to 8% by 2021-22 and the poverty level falling to below 25%.

Cutting fuel subsidies and widening tax base: Sources had previously told us that a substantial reduction in the budget deficit will come as a result of eliminating fuel subsidies by next fiscal year, as agreed under the IMF_backed reform program. The government is also hoping to widen the tax base by passing the SMEs Act and bringing in smaller enterprises into the formal economy, according to the documents.

Tax efficiency to play a hand in raising revenues: The government is also planning to increase tax revenues by implementing an electronic billing and tax payment platform. Finance Minister Mohamed Maait had said that the electronic platform, which will set a single tax ID number for companies to pay all their taxes, will be implemented in 1 May 2019. The ministry is expecting additional revenues from reforming the customs system (though amendments to the Customs Act) and amendments to the Real Estate Tax Act. Notably, Maait has promised not to raise tax rates during this process.

Gov’t to issue c. USD 4 bn in international bonds next year: The government plans to issue EGP 75 bn (or around USD 4.2 bn) in foreign-currency-denominated bonds in FY2019-20, we’re told, alongside some EGP 539 bn in local treasuries next fiscal year. The budget document is clear, though, that the ministry plans to reduce Egypt’s public debt to 79.3% of GDP by 2021-22 from 98% today.

How much has the zombie apocalypse bit? Yields on Egyptian debt soared to an average of 19% this fiscal year year, the document suggests, significantly above the 14.9% in the current budget as Egypt pays a premium to keep hot money investors here.

Egypt’s unemployment rate rose fractionally to 10% in 3Q2018, up from 9.9% the previous quarter, according to data from state statistics agency CAPMAS. Unemployment stood at 11.9% a year ago.

Egypt M&A activity up almost 4x to USD 1.5 bn so far this year: Some 14 transactions have seen total M&A activity in Egypt of USD 1.5 bn year-to-date in 2018 according to Mergermarket (pdf). Last year, companies closed some 10 transactions worth just USD 389 mn. Energy, mining and utilities made up the bulk of the transactions by value, with Mergermarket highlighting Mubadala’s acquisition of a 10% in the Zohr gas field from Eni, and SOCO International’s acquisition of Merlon Petroleum El Fayum Company. This is still a really anemic year compared to the recent high of more than USD 5.5 bn worth of activity in 2013.

Egypt’s market share of MENA M&A activity also grew to 6.3% so far in 2018, from 2.5% in 2017. The region’s M&A transaction value rose to USD 23.4 bn so far in 2018, from USD 15.9 bn in 2017. We’ll have more from last week’s M&A conference in tomorrow’s edition.

M&A WATCH- Medhat Khalil requests a deadline extension for Raya MTO: Raya Holding for Financial Investments founder Medhat Khalil has asked the Financial Regulatory Authority (FRA) to extend the 27 November deadline for him to make a mandatory tender offer for 100% of his company to January or February, he told Al Mal. Khalil, who has been in talks with potential lenders to finance the acquisition, had estimated that he would have to secure up to EGP 800 mn to acquire the outstanding 58% of Raya — which he said would be impossible to achieve before the deadline.

Background: The FRA had ordered that Khalil launch an MTO or sell off shares in Raya after declaring he had triggered the MTO requirement with an effective stake of more than 33%. Khalil says he and his family members control 32% of shares, but the FRA is counting the 10% stake owned separately by his brother-in-law as a related party, bringing the Khalil group’s total stake to 42%.

INVESTMENT WATCH- EAEF is looking to invest as much as USD 165 mn in Egypt by the end of next year: The Egyptian American Enterprise Fund (EAEF) plans to invest some USD 165 mn in Egyptian businesses by the end of 2019, Executive Director Amal Enan said. According to Enan, the EAEF had previously set a target of investing a total of USD 300 mn by end-2019, of which it has invested USD 135 mn “in the past few years.” The EAEF announced last Monday it is investing USD 3 mn for a minority stake in primary care clinic chain Dawi Clinics. US Embassy Chargé d’Affaires Thomas Goldberger had said last month that the fund would invest USD 30 mn in Egyptian SMEs this year, bringing its total investments in Egypt to date to USD 200 mn.

Court rejects Beltone’s request to stay FRA-imposed suspension on investment banking arm: An administrative court rejected yesterday Beltone Financial’s request to stay proceedings on a six-month suspension handed to its investment banking division by the Financial Regulatory Authority (FRA), sources tell Al Mal. According to the sources, the court requested that Beltone and the FRA each present the documents pertaining to the suspension; it will hold an ‘urgent hearing’ on 1 December. The FRA is accusing at Beltone of several overlapping charges pertaining to the firm’s alleged conduct during the IPO of structured and consumer finance player Sarwa Capital.

Did the FRA vote on the suspension without having quorum? Beltone has also requested to see the original record of the meeting during which the FRA’s board of directors decided to impose the suspension to confirm that the board had quorum while voting on the move, Matouk Bassiouny’s head of litigation, Osman Mowafy, said, according to the newspaper.

What’s happening with the promised release of export subsidy payments, ask Egypt’s exporters: Egyptian exporters frustrated by what they feel is a lack of action from the government on releasing long-overdue export subsidies are urging Prime Minister Moustafa Madbouly to take action. Egypt’s export councils, along with the Egyptian Businessmen’s Association (EBA), sent letters (pdf) highlighting the struggles faced by exporters after a two-year delay in the release of export subsidy payments. They argue that the delay in payment is also making it difficult to plan after what they see as having fulfilled their end of the bargain as Egypt’s non-oil exports rose 7% in 9M2018.

What’s at stake? A separate letter (pdf) by the EBA last week suggests as much as EGP 9 bn in export subsidies have yet to be disbursed. But that figure could be as high as EGP 12 bn, according to Food Export Council member Karim Abou Ghaly. His Pasta Regina is alone owed around EGP 105 mn in export subsidies, with EGP 75 mn in export funds having been acknowledged by the government, he added.

How many companies are affected? Abu Ghaly tells us that as many as 400 food importers alone are suffering, saying the sector is owed about EGP 3 bn of the EGP 12 bn he believes the state owes exporters.

What’s an export subsidy, anyway? The state-run Export Subsidy Fund is supposed to pay out 8-12% of the value of exports to companies, depending on how much local content is used and the export destination.

Maait has promised a solution: The Madbouly Cabinet will meet this month to finalize a solution to pay out late subsidies to exporters, Finance Minister Mohamed Maait said last week, adding that his ministry will work with the Trade Ministry to set up a new framework to ensure payments are made on a regular basis. Separately, Youm7 quotes Maait as saying first payments could be made as early as this week. Maait delivered the same message in a recent meeting with the heads of Egypt’s export councils. Official figures suggest government has budgeted EGP 4 bn in export subsidies for FY2018-19.

LEGISLATION WATCH- FRA says Consumer Credit Act is in its final stages: The Financial Regulatory Authority (FRA) is in the final stages of drafting the Consumer Credit Act, FRA boss Mohamed Omran said on Thursday, according to Al Mal. The legislation would bring companies selling consumer goods on installments under FRA-imposed regulations, including requiring companies to acquire special licenses to offer installment plans. Omran said the FRA is currently mulling whether or not the bill would require companies to establish separate vehicles for cash and installment sales. The FRA has also resolved a discrepancy between the recently approved Leasing and Factoring Act and the Egyptian Accounting Standards, which would have been a hurdle for the companies subject to the proposed legislation, Omran added. We had noted on Thursday that the FRA is planning to have the act finalized by next year.

Also in the pipeline for the FRA in 2019 is the Insurance Act, which would make the FRA the primary regulator of the sector. It will contain provisions for private insurance funds and would, if passed, allow establishing separate health insurance companies, and raise insurance company capital floors to EGP 120 mn from EGP 60 mn. We had noted in September that compulsory insurance for SMEs and new freelance and seasonal job insurance regulations will also be key components of the draft.

LEGISLATION WATCH- Parliament changes-up proposed amendments to Real Estate Tax Act: The House Housing Committee has completed drafting a revised version of proposed amendments to the Real Estate Tax Act and has returned the bill to the Madbouly Cabinet for review, according to Al Masry Al Youm. The proposed changes appear to significantly water-down the original bill, which covered everything from the new real estate tax formula to how rented properties will be taxed and avenues for appeal. Housing Committee chair Rep. Alaa Waly had said last month that President Abdel Fattah El Sisi had called for the amendments to be “revisited” to be more considerate of low-income citizens.

Revised real estate tax formula: The revised amendments would set the annual real estate tax formula at 10% of its annual rental value, after excluding maintenance expenses from the total — which are set at 20% for residential properties and 15% for non-residential properties. The original version had set the maintenance expenses at 30% and 32% for residential and non-residential properties, respectively. The tax formula for industrial and tourism properties, as well as mines, quarries, airports, and ports, would be based on the size and land value of the property. The amendments would also see the real estate tax increase 10% each year for all properties.

Unused land would be subject to half of the annual tax as long as it remains unused. The original amendments had revised Article 9B of the law to say that only land in use will be subject to a real estate tax.

A number of articles are also on the cutting board: The original amendments would have seen a government property census, which would be used to determine the market value of assets on which their annual rental value would be calculated, take place once every seven years, instead of five. The new amendments would scrap that article altogether. The revised amendments would also scrap an article stipulating that the rental value of a property is equal to 1.8% of a property’s market value, which will be determined by the Tax Authority during appraisals.

EARNINGS WATCH- Regional financial services corporation EFG Hermes reported a net profit after tax and minority interest of EGP 279 mn in 3Q2018, up 18% y-o-y, the company said in a statement on Thursday. The group’s net revenues reached EGP 1.03 bn for the quarter, up 24% y-o-y over the same period last year, the firm said, noting that this came despite the traditionally slow summer season and Eid Al Adha holidays. “Furthermore, revenues would be up 64% y-o-y in 3Q18, if we exclude non-recurring items in the comparable quarter,” the firm added. “EFG Hermes is approaching the end of 2018 with strong momentum. The Firm has delivered excellent top-line gains and these have translated into a flourishing bottom-line,” said EFG Hermes Group CEO Karim Awad.

Results came despite EM turbulence: “Our investment banking team has managed to close a record number of [transactions] across multiple geographies in the quarter, despite the challenging markets,” Awad added. “EFG Hermes has now maintained its top position in MENA equity capital markets as ranked by transaction fees for the seventh consecutive quarter , an unprecedented success.”

Cement producer Arabian Cement Company (ACC) reported a net profit after tax and minority interest of EGP 2.1 mn in 3Q2018, down from EGP 95.9 mn in 3Q2017, according to the company’s consolidated financial statements (pdf). Sales revenues for the quarter reached EGP 807.7 mn, up from EGP 674.5 mn in 3Q2017.

MOVES- Hatem El Demerdash (Linkedin) has been appointed the CEO and managing director at ADIB Capital, according to Al Mal. The finance industry veteran had previously served at ADIB Capital Investment Banking, Naeem Holding, Citi, and CIB.

CORRECTION- We had noted a story from Al Mal last Thursday that smart card supplier Masria Cards is considering an IPO on the EGX within the next two years. A top company exec tells us that Masria Cards is not planning an IPO in the medium term. The story has been removed from our website.

The Macro Picture

Five years after its launch, China’s Belt and Road Initiative is still “popular” in target countries despite issues that have infected an estimated 14% of the projects in the 88 mostly developing countries that are being invested in, Raffaello Pantucci writes in a guest post for the Financial Times. Pantucci points out that the most significant issues were seen in Pakistan, Malaysia and Myanmar, all due to local government pushing to renegotiate project terms. The article doesn’t mention Egypt, but it reminds us that last month the Suez Canal Authority rejected an offer from a state-owned Chinese company for a reason that remains unclear.

Image of the Day

Overlapping Ottoman, Bedouin, and Islamic motifs with cultural, political figures from Egypt’s Golden Age: From Om Kolthoum to Farid Al Atrash to Gamal Abdel Nasser, Egyptian-Armenian artist Chant Avedissian produced many iconic pieces that brought together pop culture with Egyptian folk culture. The artist, who passed away late last month at the age of 67 after a years-long struggle with cancer, was educated in Montreal and Paris before working for the Aga Khan Foundation with exemplary Egyptian architect Hassan Fathy, who is said to have inspired Avedissian’s lasting interest in traditional art and local materials.

Egypt in the News

Topping coverage of Egypt in the foreign press is Mo Salah leading the national football team to victory in our AfCON qualifier against Tunisia on Friday. Salah brought the final sore to 3-2 with a finesse shot in the 89th minute (watch, runtime: 1:37). The win brought Egypt on par with Tunisia in group points at 12 each, with the latter maintaining the lead with a better head-to-head record. Over the past week, Morocco, Nigeria, Mali and Uganda also booked their places at next year’s final round of qualifiers, according to Reuters. Egypt is due to face Niger on 22 March next year.

In other football news, Salah is on the list of nominees for the 2018 BBC African Footballer of the Year award, according to BBC. The award’s winner will be announced on 14 December. Salah was crowned BBC African Footballer in 2017.

Egypt’s human rights were back in the foreign headlines on Thursday, with Human Rights Watch alleging that Sudanese opposition activist Mohamed Boshi had been abducted in Cairo and taken to Sudan. Sudanese authorities have reportedly admitted that they have Boshi, the Associated Press reports. Meanwhile, Amnesty International welcomed President Abdel Fattah El Sisi’s statement on the need for a more “balanced NGO law,” calling on him to repeal the law altogether. Yesterday, Prime Minister Madbouly announced that a committee led by the Social Solidarity Ministry will be tasked with amending the NGO law. However, El Sisi was criticized elsewhere over a recounted story by The Conversation of activist Amal Fathy who was arrested for her controversial Facebook video earlier this year.

Other headlines worth noting in brief:

- The construction of the new capital has many Egyptians wondering if the government will ever develop Cairo, but some experts believe the current capital will be “left to die a slow death,” the AP’S Hamza Hendawi says.

- Tariq Ramadan, grandson of Ikhwan founder Hassan Al Banna, was released on bail from a French prison after being held in custody since February on [redacted] assault accusations, France’s AFP reports.

- An Egyptian court handed down a death sentence yesterday to an alleged Daesh supporter for stabbing a Christian doctor to death in September 2017, according to the Associated Press.

- Egyptian band Takh is gaining popularity for its sarcastic lyrics that touch on everyday issues, according to The Arab Weekly.

On Deadline

To effectively reform the contentious NGOs Act, the prevailing conception of NGOs as a thorn in authorities’ side must be done away with, Ziad Bahaa El Din writes for Al Shorouk. Bahaa El Din notes that this change in perception is the first stepping stone in creating a new version of the law that will no longer act as a chokehold for civil society. He also stresses the importance of allowing civil society to actually engage in the national dialogue on the proposed amendments, which he says may seem like a given but was not a priority when the law was originally drafted.

Diplomacy + Foreign Trade

The US sees significant potential in the Eastern Mediterranean energy project and “will continue advancing energy development in the region as a priority,” Assistant Secretary of State Francis Fannon said, according to the AP. Fannon, who is in charge of energy-related affairs, made his remarks on the sidelines of Nicosia meetings between Cyprus, Israel and Egypt to discuss their Eastern Med energy cooperation. Egypt has been working to establish itself as the region’s premier energy hub. To that end, the government signed an agreement with Cyprus in September to jointly build a USD 1 bn pipeline connecting Cyprus’ Aphrodite natural gas field to liquefaction plants in Egypt, which will use it to meet local demand and export the rest to Europe. Egypt has also agreed to import natural gas from Israel under a USD 15 bn pact.

Energy

Electricity Ministry has concerns on implementation cost of Cyprus power linkage project

The Electricity Ministry reportedly has concerns over the implementation cost and landing point of the 2,000 MW subsea power cable to connect the electricity grids of Egypt, Cyprus, and Greece, unnamed government sources said. The ministry sent comments to EuroAfrica Interconnector on its prepared feasibility studies for the USD 4 bn project, citing security and environmental regulations concerns. Last we heard, Egypt and Cyprus had reportedly reached an agreement in principle with an unnamed European company to link the two countries’ power grids for an estimated USD 1.5 bn. The interconnection project with Cyprus and Greece is part of a larger plan to link to power grids in Africa and Europe.

RGS Egypt eyes new USD 20 mn factory with China’s Sako Power

Egypt’s RGS is in talks with China’s Sako to build a USD 20 mn plant to manufacture solar inverters, with plans to produce solar panels, heaters and energy-saving LED lamps at an integrated industrial complex, RGS CEO Mohamed Ali Ismail told Al Shorouk. Production will meet the needs of the local market in Egypt, and surplus will be exported to African and Middle Eastern markets. Ismail will meet Sako’s CEO this week to continue talks over establishing the industrial complex.

Infrastructure

ASORC in talks with local, Gulf banks for USD 500 mn loan in financing for refinery

The Assiut Oil Refining Company (ASORC) is in talks with local and Gulf banks for a USD 500 mn loan as part of the financing package for its USD 1.9 bn hydrocracking facility, unnamed banking sources said, according to Al Shorouk. ANOPC had previously approached the National Bank of Egypt, Banque Misr, CIB, Arab African Bank, QNB Egypt, HSBC, Credit Agricole, and Egyptian Gulf Bank for a EGP 1.2 bn loan (c. USD 67 mn).

Real Estate + Housing

OUD, El Mostakbal to co-develop 200 feddans in Mostakbal City

Orientals for Urban Development (OUD) is set to sign an agreement with El Mostakbal for Urban Development to co-develop 200 feddans in Mostakbal City, according to Al Shorouk. No details were provided on when the two companies expect to sign the contracts.

Tourism

EGOTH to sell 51% stake in Grand Continental Hotel

The state-owned Egyptian General Company for Tourism and Hotels (EGOTH) plans to sell a 51% stake in the Grand Continental hotel project, EGOTH Chairperson Mervat Hataba tells Al Mal. EGOTH plans to form a JV with the private sector to manage the site of the hotel — one of downtown Cairo’s historic grand hotels, whose demolition was ordered in February. A tender to the private sector in a manner similar to the Shepheard Hotel will be held, she added. The government plans to build a new hotel at the site of the original, while maintaining similar periodic architectural design. The demolition order was met with opposition, due to it being considered a landmark in downtown Cairo.

Banking + Finance

National Bank of Egypt to roll out 500k “Meeza” debit cards in December

The National Bank of Egypt (NBE) is planning to roll out 500k national “Meeza” debit cards next month, through which it will target both banked and unbanked customers, NBE’s head of retail Alaa Farouk tells Al Mal. The card — which pensioners, civil servants, and subsidy recipients will be the among the first to access — is part of the government’s bid for financial inclusion and transition towards a cashless economy.

HSBC to manage USD 150 mn loan for PICO Group

HSBC is managing and marketing a USD 150 mn loan for PICO that will allow the company to restructure its existing loans, sources tell Al Shorouk. The sources did not disclose further details on the financing package.

United Bank looks to exit three companies by start of 2019

The United Bank of Egypt is looking to exit three companies by January 2019, sources said on Saturday, as the bank looks to restructure its investment portfolio. United Bank is looking to sell its shares in El Amal for Paints company, El Nasr for Castings, and El Nile Development. The divestments are valued at a total of EGP 350 mn. The bank also plans to invest in an e-payment company, the sources said, without providing further details.

AfreximBank in talks over USD 800 mn loan for Arab Contractors, Elsewedy Electric

The African Bank for Import and Export (AfreximBank) is considering arranging and managing an USD 800 mn loan for Arab Contractors and Elsewedy Electric to build a USD 2 bn, 2.1 GW hydroelectric dam over Tanzania’s Rufiji River, according to Al Shorouk. Arab Contractors was awarded the tender for the dam last month.

Other Business News of Note

Qalaa promotes its Egyptian Refining Company at African forum

Qalaa Holdings showcased its USD 4.3 bn petroleum refinery Egyptian Refining Company (ERC) as a case study for increasing the attractiveness of private investment through policy reform at the African Investment Forum in Johannesburg earlier this month, according to a press release (pdf). “This ability to access financing from development finance institutions (DFIs), export credit agencies (ECAs) from Europe, Asia and North America as well as sovereign wealth funds from the Gulf is what made ERC possible,” Founder and Chairman Ahmed Heikal said. Initiated 12 years ago, ERC is currently in its final stages and is due to produce up to 4.7 mn tonnes of refined oil when it is fully operational in May 2019.

National Security

41 countries to participate in EDEX 2018

41 countries are expected to participate in Egypt’s first Defense Expo, "EDEX 2018," which is scheduled to kick off on 3 December in Cairo, according to Ahram Online. Over 316 local and international companies are set to showcase military and security equipment at the expo.

Sports

Egypt’s Hedaya Malak wins gold at French Open 2018

Egyptian taekwondo champion Hedaya Malak was awarded the gold medal in the 67 kg women’s competition during the French Open 2018 in Paris, after her opponent withdrew from the final match, Al Ahram reports.

On Your Way Out

Egyptian pharmacist Ahmed Taha was stabbed to death by a Saudi customer in his place of work in the Saudi city of Jazan. Youm7 and Egypt Independent, among others, took note.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 13,682 (+1.4%)

Turnover: EGP 882 mn (18% above the 90-day average)

EGX 30 year-to-date: -8.9%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.4%. CIB, the index heaviest constituent ended up 1.1%. EGX30’s top performing constituents were Palm Hills up 5.9%, and Eastern Co up 4.6%, and Telecom Egypt up 4.5%. Thursday’s worst performing stocks were Pioneers Holding down 4.0%, Juhayna down 2.3% and Sidi Kerir Petrochemicals down 0.8%. The market turnover was EGP 882 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +78.0 mn

Regional: Net Short | EGP -101.0 mn

Domestic: Net Long | EGP +23.1 mn

Retail: 64.8% of total trades | 63.5% of buyers | 66.1% of sellers

Institutions: 35.2% of total trades | 36.5% of buyers | 33.9% of sellers

WTI: USD 56.46 (0.00%)

Brent: USD 66.76 (+0.21%)

Natural Gas (Nymex, futures prices) USD 4.27 MMBtu, (+5.79%, December 2018 contract)

Gold: USD 1,223.00/ troy ounce (+0.66%)

TASI: 7,662.17 (+0.03%) (YTD: +6.03%)

ADX: 5,055.46 (+0.68%) (YTD: +14.94%)

DFM: 2,778.76 (+0.09%) (YTD: -17.55%)

KSE Premier Market: 5,297.04 (+0.13%)

QE: 10,214.19 (+0.15%) (YTD: +19.84%)

MSM: 4,450.56 (-0.20%) (YTD: -12.72%)

BB: 1,309.16 (-0.10%) (YTD: -1.69%)

Calendar

17-19 November (Saturday-Monday): ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

09-10 December (Sunday-Monday): Cairo Regional Centre for International Commercial Arbitration’s Sharm El Sheikh VII conference, Egypt Hall, SOHO Square, Sharm El Sheikh

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheikh, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.