- Egypt is one of the countries most vulnerable should the EM Zombie Apocalypse bite again. (Speed Round)

- How much longer can the banking system support FX outflows without the central bank releasing some reserves? (Speed Round)

- Economy grew 5.3% in 1Q18-19, according to preliminary gov’t figures. (Speed Round)

- Cabinet approves amendments to Mineral Resources Act. (Speed Round)

- New York-based Modus Capital launches in Egypt. (Speed Round)

- Germany’s BSH to set up home appliances factory in Egypt. (Speed Round)

- Workers are driven by “meaning,” not paychecks, Harvard Business Review claims. (Worth Reading)

- My Morning Routine: Nadine El Alaily, founder and CEO, BodyBlocks

- The Market Yesterday

Thursday, 8 November 2018

Can banks keep forking over USD to cover outflows without an injection from the CBE?

TL;DR

What We’re Tracking Today

We end the news week on a relatively quiet note, friends: Wednesday was slow in Egypt and there was no overnight pickup in news. Meanwhile, the international business press is squarely focused on the Democrats’ victory in the US midterm elections (they took back the House, but not the Senate) and the fact that The Donald demanded the resignation of Attorney General Jeff Sessions and appointed a loyalist in his place. Investors were certainly relieved the midterms were over: The CBOE’s volatility index fell as much as 16% to its lowest in almost a month. The European gauge also fell.

Also worth noting this morning:

Brent crude recovered to USD 73 a barrel yesterday following a report that Moscow and Riyadh are in talks to cut oil production in 2019. The news comes just days after the US reimposed sanctions on Iran.

King USD will not be toppled anytime soon as the world’s reserve currency, Megan Greene writes for the Financial Times.

No elections in Libya as rival faction reconciliation still in the works: Western powers and the United Nations have given up hope that Libya will hold elections in the immediate future, sources told the New York Times.

In miscellany this morning:

- October was the worst month for hedge funds in seven years (Financial Times)

- A husband and wife just made the inner circle at Goldman Sachs as the investment bank names this year’s class of partners. (Bloomberg)

- The new MacBook Air is awesome, but high-profile reviewer Joanna Stern says PC makers have caught up on design, battery life and ergonomics. (Wall Street Journal)

- Samsung teased a phone that folds out into a mini tablet. It says it will mass-produce the device in the new year. (Android Central | CNET)

The most-clicked stories in Enterprise over the past week:

- The World Bank’s Doing Business 2019 report, which shows Egypt among the most-improved countries (World Bank, pdf)

- Questions we need to be asking about the suspension of Beltone’s investment banking arm (Enterprise)

- 9 hours of ‘Executive Time’: Trump’s unstructured days define his presidency. (Politico)

- Ocean Shock: A package of climate change stories by Reuters looking at what’s happening under the sea. (Reuters)

- Markit / Emirates NBD purchasing managers’ index for Egypt (Markit, pdf)

- Why do we destroy what makes us? (New York Times opinion piece on the Maspero Triangle)

- The office of the future? No desks, no chairs. (Fast Company)

Enterprise+: Last Night’s Talk Shows

The airwaves were as slow as the rest of the news last night, leaving the talking heads with little to discuss.

Prime Minister Moustafa Madbouly has formed a committee to amend the controversial NGOs Act, as per President Abdel Fattah El Sisi’s order earlier this month, Masaa DMC’s Osama Kamal and Yahduth fi Masr’s Sherif Amer noted (watch, runtime: 1:31 and runtime: 1:12). The committee includes representatives from the foreign, justice, and social solidarity ministries, as well as NGOs, Cabinet spokesman Nader Saad told Al Hayah Al Youm (watch, runtime: 10:16). Al Shorouk’s Editor-in-Chief Emad El Din Hussein was full of praise for the decision to amend the law, saying it was the most important outcome from the World Youth Forum. He also stressed that the amended law must strike a balance between security concerns and allowing for flexibility with developmental NGOs (watch, runtime: 8:07).

Hussein seemed to be suffering from World Youth Forum withdrawal, which he remedied by discussing the forum’s pros and cons (spoiler alert: there were no cons) (watch, runtime: 8:07).

El Sisi and Prime Minister Moustafa Madbouly will be meeting with individual governors this month to follow up on provincial-level plans, Cabinet’s Nader Saad said on Al Hayah Al Youm. Cabinet is also looking into potentially arranging regular meetings with media personnel, he said (watch, runtime: 10:16).

Egypt securing a seat in the International Telecommunication Union (ITU) was ICT Minister Amr Talaat’s main talking point on Masaa DMC, where he discussed with host Osama Kamal his ministry’s efforts to develop Egypt’s ICT industry. Egypt is also set to host an ITU conference in Sharm El Sheikh next year, in what will be the union’s first outside its Geneva headquarters (watch, runtime: 8:22).

A produce vendor whose confrontation with police went viral was also a topic of interest for Yahduth fi Masr’s Sherif Amer, who had a chat with the vendor about the incident. According to Karima Hemedan, police confiscated her vegetable cart following a verbal head-to-head. Damietta Governor Manal Awad has since ordered the policemen involved be investigated (watch, runtime: 2:58).

Speed Round

Egypt is one of the countries most vulnerable should the EM Zombie Apocalypse bite again,according to study by Bloomberg Economics. Turkey was the most vulnerable, followed by Argentina and South Africa. Thailand and Saudi Arabia are the least vulnerable of the 20 nations included in the study.

What’s the methodology? Bloomberg Economics cobbled together a ‘vulnerability index’ that takes into account the current account balance and short-term external debt (both as a percentage of GDP), reserve coverage, government effectiveness and CPI inflation. Data is primarily from the World Bank and IMF as well as from the national stats agencies of each of the 20 countries.

The bad news for Egypt: We were given the lowest score for government effectiveness in our peer group, suggesting we have a “less-than-optimal” ability to deal with long-term external shocks. Foreign currency reserves, although now adequate after being rebuilt by the central bank, are also fairly low in comparison to the peer group.

The good news for Omm El Donia: Our short-term external debt position is the strongest among the 20 economies in the group: Egypt’s ratio of short-term external debt, by residual maturity, to GDP stands at 5.0% so far into the year. Another good sign is that, although inflation has overshot the central bank’s target in the third quarter, the miss was likely transient and we’re doing far better on that front than Turkey and Argentina.

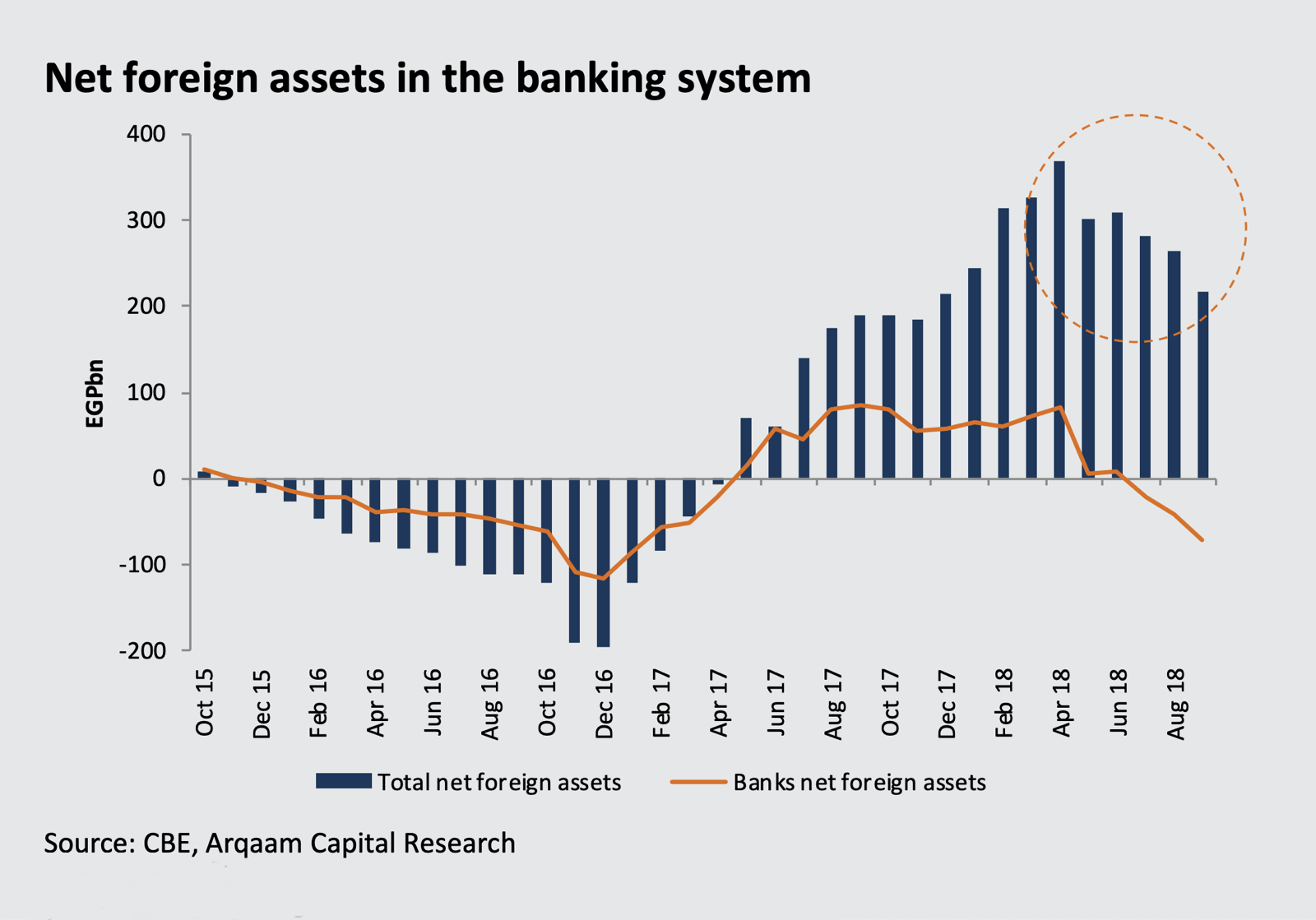

How much longer can the banking system support FX outflows without the central bank releasing some reserves? We all know that FX has been leaving Egypt has hot money has pulled out of Egypt as the EM Zombie Apocalypse has unfolded. So why have reserves at the Central Bank of Egypt not declined? (For those keeping track at home: Net foreign reserves have steadily inched up from USD 44.1 bn in May 2018 to USD 44.5 bn in September and October.) The answer, Arqaam Capital says, is that the money has come from the nation’s commercial banks.

The facts: Foreign holdings of T-bills fell in September to 18% of the total buys, a steep decline from a high of 32% in February 2018, according to a recent report from Arqaam Capital. “These USD outflows have mostly been financed by Egypt’s commercial banks that now have a net foreign liability position of USD 4 bn, equal to 1.4% of total assets and 19.5% of consolidated shareholders’ equity,” said the report.

The implication: Banks need some FX if they’re to act as shock absorbers in the future. Banks are now “less shock absorbent for a future devaluation” (which Arqaam says is unlikely at this stage, at any rate.) “The gap between foreign assets and liabilities at the commercial banks still widening,” Jaap Meijer, Michael Malkoun and Aliya El Husseini write. “Net foreign assets stood at EGP -70.7bn in September, down from EGP -41.6bn in August and EGP -21.5bn in July, the first month the number turned negative. This is a significant drop from the EGP 82.5bn net asset position recorded in April 2018. This is merely 1.4% of total assets but has widened to almost 20% of combined shareholders’ equity.” By Arqaam’s calculations, FX reserves would only fall by USD 4bn if the CBE dips in to make the banks whole for the outflows.

What does this mean for interest rates? If inflation didn’t rise in October, Arqaam expects interest rates to remain on hold until August of next year. If inflation ticked up, the CBE could go for a rate hike of around 100 bps when it meets a week from today. This in turn would help slow down outflows by keeping Egyptian debt attractive to carry traders and “keep real interest rates in positive territory and protect the EGP / USD exchange rate.”

Economy grew 5.3% in 1Q18-19, according to preliminary gov’t figures: Egypt’s GDP grew 5.3% y-o-y during the first quarter of FY2018-19, according to preliminary figures made public yesterday by Planning Minister Hala El Said told cabinet. Growth was driven by the gas, ICT, and construction sectors, as well as Suez Canal revenues. The government is targeting GDP growth of 5.5% for the current fiscal year. Projections for GDP growth in FY2018-19 from HSBC, the European Bank for Reconstruction and Development, Capital Economics, Fitch Group’s BMI Research, and economists polled by Reuters have ranged between 3.8% and 5.5%. Reuters has also picked up the story.

CABINET WATCH- Madbouly Cabinet approves amendments to Mineral Resources Act: The Madbouly Cabinet approved on Wednesday long-awaited amendments to the Mineral Resources Act that aim to attract significant foreign interest in the nation’s mining sector, according to a statement from the Madbouly Cabinet. While the statement includes no details on the amendments, previous reports indicate that the reforms will see Egypt scrap its oil-and-gas-style production sharing agreement and move to a tax, rent and royalty model — and eliminate the requirement that miners enter into 50:50 JVs with the sector’s regulator. The bill is also expected to allow exploration companies to acquire exploration ground without first obtaining exploration licenses. Oil Minister Tarek El Molla had said last month that the amendments to the act would be presented to the House of Representatives in three months.

Stakeholders to be consulted on the amendments: Prime Minister Moustafa Madbouly ordered a survey of local officials whose governorates are home to potential mining activity. Business associations such as the Federation of Egyptian Industries and the Federation of Egyptian Chambers of Commerce will also be included in the public consultations.

Industry approves: The amendments have received the overwhelming support of the industry, with top execs at Aton Resources, Thani Stratex Resources and Resolute Egypt signing an exclusive op-ed for Enterprise praising the reforms.

All buildings will soon be paying waste management fees: All municipalities are to enforce a monthly fee for all buildings and businesses that would go towards garbage collection and waste management. The cabinet also mandated that 25% of real estate taxes collected from a governorate would go towards waste management.

Other decisions around the cabinet table yesterday:

- Approving a USD 64.6 mn grant from the US to fund water infrastructure development;

- Approving a c. USD 330,000 grant from the Arab Fund for Economic and Social Development;

- Approving a dual taxation agreement with Kazakhstan.

INVESTMENT WATCH- New York-based Modus Capital launches in Egypt: Entrepreneurial venture capital firm Modus Capital, established in 2015, announced on Wednesday the official launch of its operations in Egypt. “We intend to work closely with our local partners to build the ecosystem, drive positive social change, whilst generating profits for investors,” Modus’ Managing Partner and founder Kareem Elsirafy said in a statement. Elsirafy, who did a stint in the US Marine Corps, is a Columbia grad who did a year abroad at AUC. The outfit is reportedly targeting a 60:40 split between SMEs and startups.

What Modus likes: Fintech, marketing technology, blockchain protocol applications, enterprise and consumer Saas, health IT and direct-to-consumer

Ticket sizes: As little as USD 50k in seed rounds, up to USD 5 mn invested opportunistically. The firm says it’s looking for “10-40% as a large minority” shareholder.

Tap here to learn more about their portfolio companies (including current holdings and exits) or here to see who else is on their team.

INVESTMENT WATCH- Germany’s BSH to set up home appliances factory in Egypt: New Urban Communities Authority (NUCA)’s board of directors has agreed to allocate 10 acres in the Tenth of Ramadan industrial city to Germany’s Bosch und Siemens Hausgeräte (BSH) to set up a home appliances factory, a local news outlet reported. No further details on the facility were provided, but we had noted earlier this year that BSH had plans to establish a EUR 80 mn home appliances factory with a production capacity of 400k units per year.

EARNINGS WATCH- CIB posts record third quarter earnings: Our friends at CIB delivered a 24% y-o-y rise in net income of EGP 2.6 bn in 3Q2018 on revenues of EGP 6.01 bn (up 45% y-o-y). Commenting in the bank’s earnings release overnight, management said CIB’s strong performance underscores the bank’s resilience amid an uncertain macroeconomic environment, particularly with the emerging markets sell-off. Management also noted that topline growth was backed “by an impressive growth in local currency deposits, which added EGP 29 bn from 2017 year-end and EGP 14 bn over the quarter, alongside a recovery in foreign currency lending activity by the start of 2018.” CIB’s capital adequacy ratio rose to 19.1%, up 13% y-o-y, which is “comfortably above the current minimum regulatory requirement, and with a buffer sufficient enough to accommodate the higher requisites which will accompany the onset of 2019 as well as keeping an open eye to market dynamics that may pose pressure on capital adequacy levels.” You can read CIB’s full earnings release here (pdf).

Up Next

LEGISLATION WATCH- The House could vote as early as Saturday to impose tougher penalties for the possession of unlicensed firearms and ammunition,according to Al Mal. The news comes as the House Constitutional and Legislative Committee is expected to finalize on Sunday its review of proposed amendments to the Criminal Procedures Act, MP Abla El Hawary said, according to Al Shorouk.

The UN Biodiversity Conference headlined “investing in biodiversity for people and the planet” will run Thursday, 13 November through to Thursday, 29 November in Sharm El Sheikh.

The government will announce by mid-November the date of its first auction of ‘unused’ state land, Public Enterprise Minister Hisham Tawfik has said. As many as 10 mn sqm of state-owned land in 10 governorates will be up for sale to developers.

The Egypt M&A and Private Equity Forum will take place on Wednesday, 14 November at the Nile Ritz Carlton in Cairo.

Interest rate watch: The central bank’s monetary policy committee meets on Thursday, 15 November to review interest rates. The emerging consensus is that the bank will leave rates on hold.

The Cairo Regional Centre for International Commercial Arbitration-sponsored Sharm El Sheikh VII conference will take place between 9-10 December in Egypt Hall, SOHO Square, Sharm El Sheikh.

Egypt in the News

Wire pickups of an Egyptian military court sentencing eight Daesh members to death for their involvement in terrorist attacks on security forces is topping coverage of Egypt on an otherwise quiet morning in the foreign press. Another 32 defendants were handed life sentences and two were sentenced to 15 years in prison. Two others were acquitted, according to the Associated Press. The verdict can be appealed.

Speaking of terrorist attacks: The Egyptian military’s anti-terror offensive in Sinai has significantly reduced the number of attacks in Egypt, but has otherwise failed to provide effective protection for Coptic Christians, Youssef Hamza writes for The National.

Elsewhere, President Abdel Fattah El Sisi’s comments on the recent “potato crisis” has been met with sharp criticism on social media, according to Reuters. Speaking at the World Youth Forum this week, the president had posed the (metaphorical) question of whether people want to build a worthwhile state or focus on eating potatoes. El Sisi’s comment “hit a nerve with Egyptians” who are struggling to cope with inflation, the newswire says.

Worth Reading

Workers are driven by “meaning” not paychecks: Studies show that 9 out of 10 workers would choose meaningful jobs over a bigger paycheck. “Work is about a search for daily meaning as well as daily bread, for recognition as well as cash, for astonishment rather than torpor,” wrote Pulitzer Prize-winner Studs Terkel over 40 years ago. Even though the search for meaningfulness in jobs has only climbed since then, businesses have failed to evolve to meet the demand, a group of researchers argue in a piece for the Harvard Business Review. Most employers are failing to create “meaningfulness” at work or translate it into monetary value, an HBR survey of over 2k American professionals has revealed.

How much is “meaning” worth to workers? American workers would give up 23% on average of their “entire future lifetime earnings” to have a job that provides them with meaning on a consistent basis, the researchers found. The finding supports a previous study that had revealed that 80% of workers would rather have a caring boss who helps them find meaning than a 20% salary increase.

How much is it worth to businesses? Workers with meaningful jobs are not just more satisfied, data shows they spend more time working and even take fewer days off. “Based on established job satisfaction-to-productivity ratios, we estimate that highly meaningful work will generate an additional USD 9,078 per worker, per year.”

Worth Watching

Bill Gates wants to reinvent the toilet, saying a different design could save 500k lives and USD 233 bn a year, according to Bloomberg. The Bill & Melinda Gates Foundation has funded USD 200 mn-worth of sanitation research and presented some 20 new toilet models that are healthier, more advanced, and much more economical in a recent exposition in Beijing. The models could prevent up to half a mn infant deaths and curb USD 233bn in costs linked to diarrhea, cholera, and other diseases. This new market could potentially generate USD 6 bn annually and had already attracted leading companies including Japan’s LIXIL Group (watch, runtime: 0:57).

Diplomacy + Foreign Trade

Lebanon’s Tourism Minister Avedis Guidanian has formally apologized for calling Egypt dirty, Lebanon’s state-run National News Agency said. Guidanian referred to Egypt in an interview on Monday with The Daily Star as dirtier, louder, and more crowded, saying it nevertheless manages to bring in more tourists than his country.

Foreign Minister Sameh Shoukry met yesterday with a delegation from the Egyptian-British parliamentary friendship group prior to their visit to London to discuss ways to strengthen bilateral relations with the UK, according to a Foreign Ministry statement.

Energy

ExxonMobil to expand oil and gas activities in Egypt

ExxonMobil is looking to shore up its oil and gas activities in Egypt, company President Bryan Milton said during a meeting with Oil Minister Tarek El Molla, according to an Oil Ministry statement (pdf). No further details were provided, but the company said earlier this year it is planning to invest 60 mn in Egypt and is particularly interested in opportunities in the gas-rich East Mediterranean.

Real Estate + Housing

Mariout Hills launches EGP 500 mn eco-friendly compound in New Alamein

Real estate developer Mariout Hills has launched a EGP 500 mn environmentally-friendly residential compound in New Alamein, chairman Ahmed Hassan tells Al Mal. The project’s first phase will be complete by 2021 and offer 250 reduced-cost eco-friendly. We had noted earlier this week that the company is looking to invest a total of EGP 8 bn in the city.

Tourism

Al Mashat meets WTTC CEO, tourism ministers at London WTM

Tourism Minister Rania Al Mashat met yesterday with the UK’s Minister of Arts, Heritage and Tourism, Michael Ellis, and World Travel & Tourism Council (WTTC) president and CEO Gloria Guevara Manzo during the London World Travel Market (WTM) to discuss her plans to reform Egypt’s tourism industry. Al Mashat also participated in a panel discussion on sustainable tourism with her Greek and Bulgarian counterparts.

Banking + Finance

Investor Protection Fund coverage to expand to EGP 1 mn

The Egyptian Investor Protection Fund (EIPF) is considering expanding its investment portfolio coverage limit to EGP 1 mn from EGP 500k to cover stock market losses resulting from fraud, its chairman Mamdouh Abu Elazem told Youm7. We had previously reported that FRA had completed amendments to expand the scope of the EIPF’s coverage and sent them to the Madbouly cabinet for review.

Fawry Plus signs with 13 major Egyptian banks to offer banking services

E-payments outlet Fawry Plus signed contracts with 13 local banks, including CIB and the National Bank of Egypt, to start offering limited banking services to the banks’ customers before year-end, a source from the company told Al Mal. The service will initially allow bill payment and access to smart wallets, but will not cover direct withdrawals and deposits. Fawry Plus had recently acquired a license from the CBE to launch the service as the latter moves to expand mobile banking services as part of the government’s transition towards a “cashless economy.”

Lincom Investments hires Grand Investment to manage IPO before year-end

Red Sea-focused real estate investment firm Lincom Investments has hired Grand Investment to manage the IPO of 25% of its shares on the EGX in December, Chairman and Managing Director Ehab El Hattawy told Al Mal. The company has commissioned a fair value report and expects to shortly file it with the Financial Regulatory Authority (FRA).

Other Business News of Note

Qalaa to sell its stake in Zahana to Algeria’s CIGA by 1Q2019

Qalaa Holdings has signed an MoU to sell its stake in Algerian cement company Zahana to Algeria’s state-owned Groupe Industriel des Ciments (GICA), according to an EGX disclosure (pdf). The transaction should be complete in 1H2019, Qalaa said. Qalaa had announced plans to exit Zahana last September as part of its bid to divest in impaired assets.

Legislation + Policy

Housing Ministry in talks to push forward Real Estate Investment Law

The Housing Ministry is currently in talks with real estate representatives about a proposed law to regulate investments in the sector, ministry sources said. The ministry is working to expedite the issuance of the law, which is meant to resolve issues the New Urban Communities Authority (NUCA) faces in its dealings with developers, including an inability to evaluate competing companies before receiving tender bids, the sources said. The bill is expected to be completed within six months, said Deputy Housing Minister Khaled Abbas. It was first proposed in 2015 but has yet to see the light of day.

Egypt Politics + Economics

Supreme Media Council extends deadline for news website licenses

The Supreme Media Council announced yesterday it has extended the deadline for submitting applications for news website permits an additional two weeks, according to Al Masry Al Youm. Some news websites were not able to submit their applications in time, council undersecretary Abdel Fattah El Gebaly said. The licenses apply to news websites whose capital exceeds EGP 100k a year under temporary licensing regs the council has issued last month. The regs are only in effect until the second part of the Press and Media Act is passed.

My Morning Routine

Nadine El Alaily, founder and CEO, BodyBlocks

My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions because we simply can’t help ourselves.

Who are you?

I’m Nadine El Alaily, founder and CEO of BodyBlocks. We deliver healthy, tailored meals to about 3,000 clients in the capital city, including breakfast items, salads, sandwiches and ready-to-head soups and dinners as well as smoothies and treats. We offer paleo, sports, pre- and post-natal and vegan options, among others. All our products are sold online and delivered to our client’s doorstep. We use local ingredients and all our products are free of preservatives and added sugar.

What’s your morning routine?

I wake up at 4:00 am daily. My black Americano is a must before anything. The whole house is asleep, and I start by reading my email — it’s the quiet before the storm. Then I start making to-do lists: A list for pending work, the office, the factory, the kids, the groceries, the house — plenty of to do lists. I find that they help me brainstorm, reflect and keep me focused so I don’t miss anything or anyone.

Then I get ready and go to the factory for 5:00 am because our first orders leave the kitchen at 5:30 am daily. Then, and again later in the day, I conduct audits by randomly selecting orders on the list to check. I also keep a close eye on cleanliness in the factory — that everyone is wearing their gloves and hair nets and that everything has been sterilized after cleaning and use. I also have on-site cameras and an app on my phone, so I’m usually checking all of this on my way to the factory, too. I make sure all the drivers are wearing their BB t-shirts and have their delivery sheets and that everyone is on time.

I’m usually back home by 6:00 am. I wake my kids up and get their clothes ready for school, organize their lunch boxes, make sure their bags are packed, and then we have a healthy breakfast together. I drop them off to the bus at 7:00 am and once they’re off to school, I go back home for another coffee. That’s when I read Enterprise, check out Instagram and Facebook. After a 30-minute workout, I take my vitamins and have a green juice before I get ready and start the next phase of my day at the office by 8:00 am.

At the office, I start with a meeting every morning with the team to discuss plans, issues and to-do lists before we all start. Then I’m working on my own lists ‘til the kids get home from school.

What time do you sleep at night?

I go to bed when my kids sleep, around 8-9:00 pm.

How big is your team right now?

We have 15-20 people at the factory at any given time and then another five in the office.

What do people not understand about your business?

How much we’ve had to build this from the ground up. We handle our logistics in-house and we run our own fleet of delivery vans, allowing us to deliver next-day in two slots — 6am to 9am for working clients and 11am to 2pm for those who want lunch packages.

The level of customization and tailoring of all our options can be tricky, so to make sure we get it right, we created our own software to keep things on track. The idea is to make the whole process as automated as possible, and this starts from the moment you hit our website. Clients can buy off-the-shelf, but our nutritionists generally tailor programs specifically for each person — they need to be able to take into consideration work schedules, eating requirements, illnesses, etc.

What’s your origin story?

We started off as a nutrition consulting company three years ago, when we specialized in chronic illnesses. But the real market opportunity became clear when I noticed that most of our clients didn’t have time to shop or cook and wanted easy, healthy options to incorporate in their diet. I started outsourcing to different food suppliers — getting them to deliver meals to my clients — and I then decided I wanted to create my own recipes so I found a kitchen that would work as a contract manufacturer. Our clients were happier and getting better results because we could measure portions ourselves and use healthier ingredients. That’s when I decided to open my own factory and bring it all in-house.

How does your turnover split in between online sales to individuals vs. wholesale to supermarket?

About 90% of our turnover is from online sales to individuals, with the rest coming from supermarkets and gyms.

What’s your best-selling SKU?

Our best-selling line is our set of weight-loss programs, followed by our salads.

So far you’ve grown by…

…word of mouth. But we’re hiring a company now to handle our digital marketing to grow our reach.

Do you consider yourself a small business or a medium-sized business?

We are a medium-sized business.

What’s the best part of running a mid-sized company?

The best part of running a medium-sized business is seeing your hard work turn into reality and watching your company grow. I’m lucky my passion is my work and I’m fortunate that my work can have a positive effect on people.

What’s the biggest obstacle to growth?

Competing with unhealthy products in the market — and creating meals that are both healthy and delicious at the same time. Selling chocolate cake to people is much easier than convincing them to have beetroot and cabbage, that’s for sure.

What’s your big business goal for 2019?

My big business goal for 2019 is to be literally closer to our clients — we want our clients to be able to make an order and have it delivered in 20-30 minutes. We’re rolling out hot meals next month and are partnering with Uber Eats to start offering same-day delivery to our clients. We’ll start out in Zamalek and then expand to Kattameya and Six October at the start of 2019. We’re also looking to get more of our products into supermarkets, gyms and cafes.

We also have a new range of granola products, including bars and granola bombs, coming soon. We call it “Yola” — named for and by my children Youssef and Layla. My goal is to export this range eventually. We’re price-competitive with Dubai and the UK because of our currency.

What’s the best piece of business advice you’ve ever been given?

My dad always tells me the best opportunity to learn and improve is by making mistakes and failing.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 13,616 (+1.3%)

Turnover: EGP 1.2 bn (%67 above the 90-day average)

EGX 30 year-to-date: -9.3%

THE MARKET ON WEDNESDAY: The EGX30 index ended Wednesday’s session up 1.3%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were Global Telecom up 6.4%, and SODIC up 5.5%, and Ezz Steel up 5.4%. Yesterday’s worst performing stocks were Abu Qir Fertilizers down 2.9%, Arab Cotton Ginning down 0.9% and Palm Hills down 0.8%. The market turnover was EGP 1.2 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -1.3 mn

Regional: Net Short | EGP -0.6 mn

Domestic: Net Long | EGP +1.9 mn

Retail: 66.0% of total trades | 62.7% of buyers | 69.4% of sellers

Institutions: 34.0% of total trades | 37.3% of buyers | 30.6% of sellers

Foreign: 11.7% of total | 11.7% of buyers | 11.8% of sellers

Regional: 11.6% of total | 11.6% of buyers | 11.7% of sellers

Domestic: 76.7% of total | 76.7% of buyers | 76.5% of sellers

WTI: USD 61.67 (+0.05%)

Brent: USD 72.07 (-0.08%)

Natural Gas (Nymex, futures prices) USD 3.53 MMBtu, (-0.65%, December 2018 contract)

Gold: USD 1,228.00/ troy ounce (-0.06%)

TASI: 7,792.56 (-0.25%) (YTD: +7.84%)

ADX: 5,016.07 (+0.25%) (YTD: +14.04%)

DFM: 2,829.23 (+0.48%) (YTD: -16.05%)

KSE Premier Market: 5,292.80 (+0.55%)

QE: 10,252.50 (-1.20%) (YTD: +20.29%)

MSM: 4,446.06 (+0.56%) (YTD: -12.81%)

BB: 1,316.27 (+0.18%) (YTD: -1.16%)

Calendar

13-29 November (Tuesday-Thursday): UN Biodiversity Conference, Sharm El Sheikh, Egypt.

14 November (Wednesday): Egypt M&A and Private Equity Forum, Nile Ritz Carlton Hotel, Cairo, Egypt.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.15 November (Thursday) The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

15 November (Thursday): The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

17-19 November (Saturday-Monday): ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

09-10 December (Sunday-Monday): Cairo Regional Centre for International Commercial Arbitration’s Sharm El Sheikh VII conference, Egypt Hall, SOHO Square, Sharm El Sheikh

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.