- IMF down on emerging market and global growth in 2019, but really likes Egypt through 2023. (What We’re Tracking Today)

- EGX slides to lowest close in 12 months as EM Zombie Apocalypse, margin calls bite. (Speed Round)

- As Maait kicks off Asian roadshow for eurobond offering, Egypt sells t-bonds despite rise in yields. (Speed Round)

- Hassan Allam announces IPO with listing on EGX + GDR program, will use proceeds to grow solar portfolio and acquire specialty engineering outfit. (Speed Round)

- Eastern Company stake sale set for 21-25 October. (Speed Round)

- Global PE giant Blackstone launches company to invest in MENA energy opportunities. (Speed Round)

- First gas from Israel could begin flowing to Egypt by March. (Speed Round)

- Special forces vet turned terrorist captured in Libya. (Last Night’s Talk Shows, Egypt in the News)

- The Market Yesterday

Tuesday, 9 October 2018

EGX down to its lowest level in a year.

TL;DR

What We’re Tracking Today

It’s one of those good-news, bad-news mornings, folks.

On the good news side the ledger: One of the year’s most hotly anticipated IPOs is on as top construction and engineering group Hassan Allam Holding announced yesterday its intention to sell shares. That came as Egypt sold treasury bonds at auction yesterday, sign policymakers have the fortitude to make tough decisions. We have chapter and verse in Speed Round, below.

The benchmark EGX30 slid 3.6% yesterday to its lowest close in 12 months as “weakness in emerging markets and margin calls among local investors” bit hard on reasonably thin volumes. But we’re still not quite in bear territory: The EGX30 is down 15% since the end of August, so we have 5 ppt left to go before we hit the psychological 20% mark an can be said to be a bear market. The EGX30 is off nearly 9.5% year-to-date. We have more in Speed Round, below.

** #1 EM Zombie Apocalypse will bite heading into 2019: The IMF’s World Economic Outlook hit the streets a couple of hours ago, and it’s not looking wonderful for EM as a whole next year: The IMF sees emerging markets growth “flatlining” — unchanged at 4.7% this year and in 2019. That’s a substantial revision downward from the 4.9% for this year and 5.1% for next year that the IMF had predicted in July, and you have problems in Argentina, Turkey, South Africa and Iran (as well as a slowdown in China) to thank.

But on the good news side, the IMF is really bullish on Egypt: The fund writes that “Growth in Egypt is projected to rise to 5.5% in 2019 … reflecting a recovery in tourism, rising natural gas production, and continued improvements in confidence due to implementation of an ambitious reform program supported by the IMF’s Extended Fund Facility.” The IMF is also watching to make certain we stay the course on the reform agenda, writing that “healthy foreign reserves and a flexible exchange rate leave the economy well positioned to manage any acceleration in outflows,” but warning it will be “important” to maintain “sound macroeconomic frameworks and consistent policy implementation, which have led to a successful macroeconomic stabilization.”

What are the IMF’s projections on Egypt?

- Five years of very strong economic growth: The economy will grow 5.3% this year and 5.5% in 2019 — and still be growing at a very brisk 6% as far out as 2023;

- Unemployment will fall to 9.9% next year from 10.9% this year — down sharply from 12.2% in 2017.

- Inflation will cool to 14.0% in 2019, down from 20.9% in 2018 and a high north of 30% last year. (Remember, folks, that the peak in the 30s last year was the central bank’s measure of inflation — real inflation for middle-class and upper-middle-class wage earners was in the low 80% range last year.)

- The current account balance will improve to -2.4% of GDP next year from -2.6% this year and -6.3% in 2017.

We’re growing at more than 2x the pace of the MENA region, where the IMF sees average growth coming in at 2.0% this year and 2.5% in 2017. We’re also on track to outstrip growth in the wider “Middle East, North Africa, Afghanistan and Pakistan” region, where the fund is predicting 2.4% growth this year and 2.7% next year.

The global business press is having a field day with the notion of lower global growth as the IMF predicts the global economy advancing 3.7% this year and next, down from an original forecast of 3.9% for both years. Look to the Financial Times (great EM angle), Wall Street Journal, Reuters, Bloomberg or CNBC (drilling into the global impact of trade wars), depending on your preferences.

The release of the WEO comes as the Grand Wizards of High Finance convene in Bali for the fall meetings of the IMF and World Bank. Finance Minister Mohamed Maait and Vice Minister Ahmed Kouchouk are among those from Egypt attending. You can visit the World Economic Outlook landing page here or just download the full WEO (pdf). The landing page for the fall meetings is here. The gathering runs through Sunday, 14 October.

From the Department of Duh: The emerging market sell-off suggests that investors view EM as a homogenous “basket,” rather than accounting for individual merits and downsides, Bank Pekao CEO Michael Krupinski writes for the Financial Times’ Beyond BRICS blog. On the flipside, advanced economies are sometimes shrugged off as potential sources of financial instability, despite the 2008 financial crisis proving otherwise. “This flawed dichotomy between emerging and developed countries obscures the landscape and diverts investments away from healthy [ventures]. The recent pessimism regarding emerging markets is probably as unfounded as it is widespread, once we realize how diverse this group of economies really is.” Krupinski suggests setting up a different mechanism for assessing economic health, such as focusing more on the sustainability of each country’s economic policies.

Brent crude fell 1.3% to around USD 83/bbl yesterday as the Trump administration eyes waivers on Iran sanctions. The possible waivers have renewed hopes that the US may soften the blow on sanction on Iranian oil exports, Reuters reports. According to Bloomberg, the US was said to be in talks with countries that want to continue buying from Iran after the US imposes its sanctions on November 4.

In miscellany this morning to help get you through your commute (or that interminably long conference call you’re dreading):

- Google covered up a massive breach of user data to avoid controversy. An investigation by the Wall Street Journal has prompted Google to announce it is shutting down its Google+ social network.

- Big regional M&A: GE unit Baker Hughes is buying a 5% stake in Abu Dhabi National Oil Company’s (ADNOC) drilling unit for USD 550 mn

- Pakistan is starting bailout talks with the IMF for a package to help stabilize its finances as FX reserves plummet, the Financial Times reports.

Want to build a fintech business in Egypt? Pride Capital is running an event looking at how to build a successful monetization strategy for a fintech business today at 5:30pm on the Greek Campus. The event will be featuring our friend Martin Janzen, MD at Simon-Kucher Egypt, and MENA Startup Bootcamp’s Todd OBrien. Simon-Kucher works with global tech outfits including Paypal, Stripe, Uber and Evernote.

Back to basics, with an eye on global threats: The 2018 Nobel Prize in economics was awarded jointly to Yale’s William Nordhaus and NYU’s Paul Romer. The prize, official called the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, marries the work of Nordhaus and Romer and ties them back to the fundamental problem in economics: the management of scarce resources. The Royal Swedish Academy awarded Nordhaus the prize for “integrating climate change into long-run macroeconomic analysis” and Romer for “integrating technological innovations into long-run macroeconomic analysis.” We’re long this morning thank to a packed news day, so look in the coming days for a nice explainer on this year’s prize — and its relevance to Egypt.

Enterprise+: Last Night’s Talk Shows

**# 8 The capture of wanted special forces officer-turned-Daesh terrorist Hisham El Ashmawy in Libya blanketed the airwaves last night, with everyone, from Al Hayah fi Masr (watch, runtime: 1:40) to Hona Al Asema, weighing in on the case. Libyan military spokesperson Ahmed Al Mesmari told Amr Adib on El Hekaya that Ashmawy — who is believed to be behind the deadly Wahat attack on police last year —was captured during a raid on a known terrorist hub in Derna. He was wearing an explosive vest when he was arrested, Reuters said. The raid targeted Ashmawy due to his involvement in the deaths of hundreds in Libya and the training of operatives, and came as part of a wider effort to rid the city of extremists, said Al Mesmari, who also phoned into Masaa DMC. He said the former officer is likely to be extradited to Egypt (watch here, runtime: 4:51, here, runtime: 10:47 and here, runtime: 3:30).

Ashmawy is involved in 52 cases and implicated in the deaths of over 500 people, extremist groups scholar Sameh Eid told Hona Al Asema (watch, runtime: 14:36). His capture is an opportunity for security forces to gather more intel about Daesh’s operations in the area, Eid added on Masaa DMC (watch, runtime: 4:53). Adib referred to him as “Egypt’s Bin Laden” (watch, runtime: 1:55) and spoke to Islamic scholar Mokhtar Noah in detail about Ashmawy’s transformation from officer to operative (watch, runtime: 4:11)

The story topped coverage of Egypt in the foreign press this morning, with pickups from Al Arabiya and the Wall Street Journal. The National also lists Ashmawy’s “long charge sheet.”

Also on last night’s talk shows:

- Hona Al Asema drilled into the Trade Ministry’s new strategy for local industry development, about which we still know nothing other than it’s meant to help plug the trade deficit by boosting local manufacturing (watch, runtime: 14:63 and here, runtime: 15:45);

- Al Hayah fi Masr’s Kamal Mady talked to Sharqiya Governor Mamdouh Ghorab about development plans forthe governorate (watch, runtime: 25:41);

- Amr Adib interviewed Al Arabiya GM Turki Aldakhil about his opinion of Al Jazeera and its role in the ongoing spat between Qatar and its neighbors (watch, runtime: 35: 50).

Speed Round

** #3 Egypt sells t-bonds despite rise in yields: Egypt sold EGP 1.25 bn worth of five- and 10-year treasury bonds at auction yesterday despite a continued rise in yields, which averaged 18.41% on shorter-term offerings and 18.37% for the longer term, central bank data showed. Egypt had sold EGP 904 mn in T-bonds earlier this month after cancelling four auctions in September due to high yields, which the Finance Ministry said had crossed the “logical limit.” Minister Mohamed Maait had said sales would continue to be called off if yields remain high, pointing out that Egypt would look towards the global debt market — specifically Asia and Europe — to raise needed liquidity.

Maait meets with gov’t officials in South Korea as eurobond roadshow kicks off: On that note, Maait met yesterday with South Korean government officials and prospective investors in Seoul, where the ministry kicked off its nondeal roadshow in Asia ahead of Egypt’s planned USD 5 bn eurobond issuance, according to an emailed statement (pdf). The roadshow, which CI Capital is shepherding through its JV with Singapore’s Maybank Kim Eng, will also take Maait to Singapore, Hong Kong, China and Japan. The trip is meant to gauge the Asian market’s appetite for Egyptian debt, as the government works to broaden its investor base by exploring previously untapped markets.

Random note: Can we call Egyptian offerings in FCY “Hawawshi Bonds” and call LCY offerings “Molokheya Bonds?” Hardly seems fair the Japanese have Samurai bonds and the Chinese their Pandas and we have…no name.

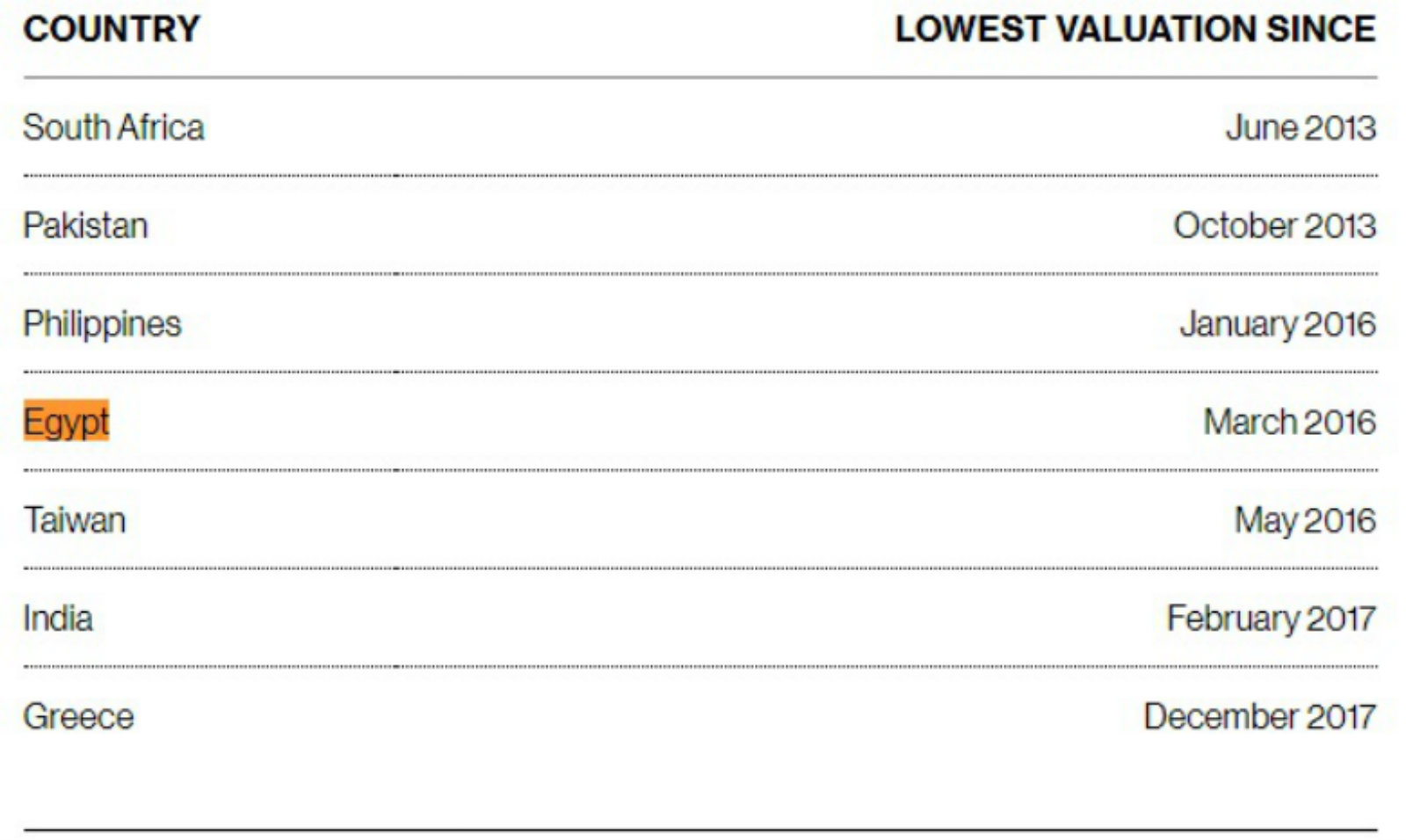

** #2 EGX drops to its lowest level in over a year: The EGX30 fell 3.6% yesterday to its lowest level in over a year as 29 of the index’s 30 constituents were “dragged down by weakness in emerging markets and margin calls among local investors,” according to Reuters, with shares including Juhayna, Emaar Misr, and Ibnsina Pharma losing between 8.0-8.5% at the end of yesterday’s trading session. Domty was down 7.8%, while Elsewedy Electric dropped 7.0%, and Palm Hills lost 6.2%, while index heavyweight CIB was also down 1.8% “It is a mixture of both emerging market weakness and margin trading, and the closure of some margin trades,” said Pharos Holdings’ Radwa El Swaify. The EGX30 has lost 15% since August and 9.4% y-t-d and is now underperforming on the MSCI EM Index, which also dropped 1% yesterday. The valuation of Egypt’s benchmark index is down to its lowest level since March 2016, Bloomberg says.

The slide won’t continue, one analyst suggests. London-based MENA Capital’s Khaled Abdel Majeed blamed the combination of the broader EM-selloff — which has been causing concerns about capital outflows from the Egyptian market — and some investors cashing in. He said he was positive, however, that “the slide would not continue, particularly with data showing that selling yesterday concentrated largely among locals ‘who were hit by margin calls,’ while net buyers were foreign investors.

Take heart: We’re not alone. Valuations of benchmark indexes in South Africa, Pakistan, and the Philippines have dropped to record lows, Bloomberg notes. South Africa appears to be taking the hardest blow, with the EM crisis “dragging the valuation of its benchmark index to the lowest level since the Taper Tantrum” in 2013.

What does all of this mean for IPO season? It’s really too early to say, particularly if you buy the argument of MENA Cap’s Abdel Majeed (above) that the downturn has almost run its course for Egypt. That hasn’t stopped Al Mal from citing market chatter about allegedly low retail appetite for consumer and structured finance player Sarwa’s IPO. Take that story with a cup of salt: It cites “sources.” Retail investors were grumpy AF yesterday. Institutional appetite for the offering was more than 10x the shares on offer. And the subscription period runs through close of play tomorrow. It’s not yet time to panic.

** #4 IPO WATCH- Hassan Allam announces plans to sell 44.3% stake on the EGX, offering to include GDR program: Leading construction and engineering group Hassan Allam announced yesterday its plans to sell 44.3% of the company in an initial public offering that will include both ordinary shares on the EGX and global depository receipts (GDRs) on the London Stock Exchange. The company expects to price the offering in early November, the company said in its intention to float (pdf).

Who’s selling? Per the ITF, the selling shareholders are “the Hassan Allam family which collectively owns an 86.2% stake in the Company, as well as the International Finance Corporation which owns a 13.8% stake.” The selling shareholders will re-inject USD 70 mn in proceeds from the transaction through subscription to a capital increase.

Use of proceeds: The company will use proceeds from the capital increase to “(a) develop a portfolio of solar assets under Lightsource BP powered by Hassan Allam Utilities, (b) fund its water platform by developing new assets and acquisitions, and (c) acquire a specialty engineering company and support continuing growth under the construction and building materials businesses.”

The equity story in a nutshell: If you’re long-Egypt, you want to be long-Hassan Allam. Alongside Orascom Construction, it’s the one outfit in Egypt that can (and is) building everything we need to build, from critical infrastructure including roads, bridges and tunnels to office parks and beyond. Renewable energy is a big sweetener. Says Co-CEO Amr Allam: “Our ultimate goal is to continue delivering steady growth and consistent returns to our shareholders generated by our legacy construction and building materials businesses, while simultaneously driving accelerated recurring revenue growth from utility plays in a nascent and fast-growing market.”

The financials: Hassan Allam reported revenues of EGP 11.5 bn last year, up 81.4% from 2016. Net profit in 2017 was EGP 339.7 mn, up 3% y-o-y. The group had a backlog worth EGP 55.8 bn as of 30 June.

Advisers: The company has tapped EFG Hermes and Renaissance Capital as joint global coordinators and bookrunners, and Arqaam Capital as bookrunner. Shearman & Sterling is acting as international counsel, while White & Case LLP is international counsel to the underwriters. Matouk Bassiouny has been appointed local counsel to the issuer. MHR & Partners, in association with White & Case LLP, is local counsel to the underwriters. Inktank Communications is investor relations advisor.

** #5 IPO WATCH- Eastern Company stake sale set for 21-25 October, timing not ideal: The sale of an additional 4.5% stake of cigarette maker Eastern Company on the EGX is scheduled to take place sometime between 21-25 October, Public Enterprises Minister Hisham Tawfik told the press yesterday, Youm7 reports. The government is committed to the schedule even though the timing of the transaction is less than ideal, according to Tawfik, who explained that the current drop in stock market volumes may cut into revenues from the sale (Eastern’s shares were down 4.0% at the end of yesterday’s trading session). State-owned investment bank NI Capital had said that the Eastern sale is expected to yield as much as EGP 2 bn in proceeds. EFG Hermes had signed contracts last week with the Chemical Industries Holding Company officially giving it the mandate to lead the transaction, which is expected to take the form of an accelerated bookbuild.

There could be up to 33 state companies selling stakes, not 23: The committee overseeing the privatization program has marked 10 public enterprises to add to its list of 23 companies, Tawfik also said, without naming the companies.

** #6 Blackstone launches company to invest in MENA energy opportunities: Global private equity giant Blackstone has set up a standalone company, Zarou, through which it will invest in energy opportunities in the Middle East and North Africa, the company announced yesterday. “Zarou will develop, finance, construct and operate energy-related projects in the Middle East and North Africa. Zarou’s focus is primarily on thermal and renewable power [investments] and also includes oil & gas midstream and water assets.” Through Zarou, Blackstone will invest “hundreds of mns of USD” in Egypt, Jordan, and Morocco, among other countries in the region, people familiar with the matter tell the Financial Times. Zarou will be led by Sameh Shenouda, former head of infrastructure equity investments at CDC Group.

Fuel subsidy bill for 1Q2018-19 to increase EGP 10 bn: Egypt spent EGP 10 bn more than budgeted for the fuel subsidy program in 1Q2018-19 thanks to the rising price of oil, an Oil Ministry source said on Monday. Last week, sources told us that the government is expecting its fuel subsidy bill for FY2018-19 to jump to EGP 100 bn, up from an initial projection of EGP 89 bn, after Brent crude prices surged beyond the USD 80/bbl mark to reach a four-year high. The development is pushing the government to pursue once again a fuel hedge. The government is currently tallying up the indicators for the first quarter of the fiscal year, and we should be hearing something on that soon.

** #7 First gas from Israel could begin flowing to Egypt by March: Egypt could begin importing gas from Israel as early as March 2019 under a USD 15 bn agreement Delek Drilling and Noble Energy signed with Alaa Arafa’s Dolphinus Holding if the East Mediterranean Gas pipeline is “found to be in good condition,” East Gas CEO Mohammed Shoeib tells Bloomberg. Noble, Delek, and East Gas signed a USD 518 mn agreement last month to acquire a 39% stake in East Mediterranean Gas. The agreement grants the three companies access to EMG’s 90 km pipeline connecting Israel’s grid to Egypt’s.

Procedures to test the pipeline and reverse its flow are expected to take around three to four months. “We expect the pipeline is in good condition. We aim to reach the pipeline’s full capacity or maximum flow rate within three years,” said Shoeib. If all else fails, a separate East Gas-owned pipeline that runs through Jordan could be used “as a backup.” Egypt will initially import 100 mn scf/d in 1Q2019, before gradually rising to 700 mn scf/d. By the end of 2019, 350 mcf/d is expected to be pumped to Egypt from the gas fields, supplying around 64 bn cbm of gas over a 10-year period, Delek previously said.

Egypt’s net foreign reserves rose marginally to USD 44.45 bn at the end of September, up from USD 44.42 bn a month earlier, the central bank said on Monday.

LEGISLATION WATCH- FRA completes amendments to law governing EIPF: The Financial Regulatory Authority (FRA) has completed amendments to the law governing the Egyptian Investor Protection Fund (EIPF) and sent them over to the Madbouly Cabinet for review, FRA boss Mohamed Omran said yesterday, Al Mal reports. The amendments are expected to expand the scope of the EIPF’s coverage, he added without elaborating. FRA Deputy Chairman Khaled el Nashar had said last month that the fund would be expanded to cover stock market losses resulting from fraud, and also the appointment of an independent financial advisor for companies facing mandatory or voluntary delisting, or conducting fair value assessments.

MOVES- Veteran investment banker Mohamed Younis (LInkedIn) is stepping down as CEO of Renaissance Capital’s Egypt operation by year’s end in the wake of the departure of our friend Ahmed Badr as RenCap’s MENA CEO. Badr is said to be leaving the emerging and frontier markets specialist to return to Credit Suisse after a four-year run. Younis, who joined RenCap in summer 2017 after a nearly four-year stint with CI Capital, worked closely with Badr to build the firm’s on-the-ground presence in Egypt and helped win RenCap a mandate as joint global coordinator and bookrunner on Hassan Allam, the firm’s first IPO in the region.

Badr, in moving back to Credit Suisse,has a mandate to rebuild the global firm’s MENA equities platform and is expected to focus sharply on both Saudi Arabia and Egypt in the first phase of the buildout, for which he is said to be putting together a best-in-class team to cover the markets.

MOVES- Nader Saad has been named the Madbouly Cabinet’s new spokesperson, succeeding Ashraf Sultan, Al Masry Al Youm reports. Saad is a diplomat who had previously worked in the Egyptian embassies in Ankara and Washington, DC.

Microsoft is said to be investing an unspecified sum in Southeast Asian ride-hailing app Grab, which is already on track to raise bns this year from investors including Toyota (USD 1 bn) and Softbank (USD 500 mn), according to Axios.

Image of the Day

Ancient Egyptian kids had colorful, striped socks, too: Scientists at the British Museum used a non-invasive imaging tool to show dyes and weaving techniques Ancient Egyptians by examining a child’s sock, the Guardian reports. The technique does not require samples to be taken. “The ancient Egyptians famously gave us paper and the pyramids, but were also early adopters of the stripy sock.”

Egypt in the News

The big news story of the day is the capture of special forces soldier turned terrorist Hisham El-Ashmawy in Libya. El-Ashmawy, already sentenced to death in absentia in Egypt, would by law face a mandatory retrial if he is extradited to Egypt as expected. The story is the lead piece on Egypt across platforms and countries this morning. El-Ashmawy was one of the most prominent figures in the regional terrorist ecosystem, but had fallen off the radar in the months prior to his arrest. Stories from Reuters and the Associated Press are getting the widest pickup.

Other headlines worth noting in brief include:

- Some love from China: “With Egypt’s strategic location and improved infrastructure, the North African country is becoming a regional hub for energy trade, said experts,” according to state-owned Chinese news agency Xinhua.

- Natural gas dreams, arrears to IOC nightmares: Egypt’s fulfillment of its long-awaited natural gas self-sufficiency dream is overshadowed by the never ending story of arrears owed to global oil majors — a problem not going anywhere, especially in light of rising global oil prices, MEED says.

- Australian Tribune’s Editorial Board condemned the arrest of journalists in Egypt amid accusations of fake news.

- Drones being used in the Yemen war are operating from bases in Sinai, according to satellite photos analyzed by the US-based Center for the Study of the Drone, the Associated Press reports.

- LGBT people face discrimination and harassment in Egypt when they look for real estate, a UN official tells the Thomson Reuters Foundation.

- Egypt will not impose tougher visa regulations on Tunisians, Xinhua says. This comes after reports alleged that Egyptian authorities plan to strengthen visitation procedures for tourists from Arab Maghreb states.

- Activist and artist Yassin Mohamed published a series of paintings chronicling his time in prison, the Associated Press reports.

On Deadline

Egypt’s healthcare system needs to be completely rewired if the country ever hopes to become a hub for medical tourism, Emad El Din Hussein writes for Al Shorouk. In addition to simplifying visa procedures for incoming tourists — which are often mired in red tape and requires security checks and clearances, Hussein writes — authorities need to implement a clear pricing structure for medical services that vary greatly from one place to the other. Improving the quality of nursing is also an important area of focus, Hussein suggests.

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry met on Monday with his Maltese counterpart, Carmelo Abela for talks that focused on illegal migration, among other issues Egypt’s Foreign Ministry said. Abela is expected to make a visit to Cairo soon, according to the statement.

Energy

Eni, Tharwa to finish drill first well in Noor by December

Eni and Tharwa Petroleum will reportedly complete in December drilling work on the Noor gas field’s first exploratory well, government sources tell Al Masry Al Youm. The two companies began work on the offshore North Sinai field late last month under a USD 105 mn concession agreement signed with the government in August. Eni had previously denied claims that Noor contains 90 tcf of natural gas reserves.

ASORC hires WorleyParsons as project manager for its mazut hydrocracking project

The state-owned Assiut Oil Refining Company (ASORC) signed a four-year agreement with Australia-based engineering services company WorleyParsons for management consultancy on ASORC’s USD 1.6 bn mazut hydrocracking facility in Upper Egypt, according to the Oil & Gas Journal. WorleyParsons will handle the project’s basic engineering phase, open-book estimate, detailed design, procurement, construction, and commissioning.”

Basic Materials + Commodities

PMI raises Merit and Marlboro cigarette prices by EGP 2

Philip Morris International (PMI) has increased the price of its red and gold Marlboro varieties and all Merit-branded cigarettes, according to Ahram Online. A pack of Merit cigarettes will retail at EGP 42, up from EGP 40, while the price for a pack of Marlboro was raised to EGP 39 from EGP 37. PMI’s Marlboro medium, L&M, and next cigarettes were unaffected by the hike, which is the company’s second since the government raised the sin tax in July by EGP 0.75.

Wheat reserves will last until February, sugar reserves until April

Egypt’s strategic wheat reserves are enough to last until the first week of February 2019 and sugar reserves will cover demand until April, the Supply Ministry said, according to Reuters’ Arabic Service.

Manufacturing

Hub Furniture plans to build EGP 150 mn factory in Sokhna

Furniture manufacturer Hub Furniture plans to build an EGP 150 mn factory in Ain El Sokhna, CEO Kareem Fouad said. Construction is set to start in 2H2019 and the facility is expected to go live by the end of 2020.

CCI, Ukrainian company sign USD 100 mn agreement to build coke-oven battery

A Ukrainian company has signed a c. USD 100 mn agreement with Chemical Industries Holding Company (CIHC) subsidiary Al-Nasr for Coke and Chemicals (CCI) to build a coke-oven battery, Al Mal reported. The agreement between CCI and the Ukrainian company entails supplying equipment, installation and technical supervision.

Health + Education

Egypt, Japan sign higher education cooperation framework agreements

Higher Education Minister Khaled Abdel Ghaffar inked yesterday three MoU with Japanese universities Waseda, Kokugakuin, and Kokushikan that could eventually see the institutions open campuses in Egypt, Al Masry Al Youm reports. The agreements will also see the universities train Egyptian faculty members and foster a greater number of student and staff exchange programs.

Real Estate + Housing

NUCA to issue first land tender to the private sector in New Alamein, New Mansoura tomorrow

The New Urban Communities Authority (NUCA) is planning to issue the first land tender for private sector real estate development in New Alamein and New Mansoura on Tuesday, NUCA Deputy Head Tarek El Sebai said.

Tourism

New overseas tourism promotional campaign to target 8 countries

Egypt’s new tourism promotion campaign will focus on eight main markets, including the UK, Germany, Italy, France, Russia, China, and India, Middle East Communications Network (MCN) CEO Sahar El Zoghby said yesterday, Al Mal reports. MCN is part of the consortium that was selected last month to run the promotional campaign.

China’s Sichuan Airlines to operate Chengdu-Cairo direct air route

Sichuan Airlines will begin operating a direct air route linking Chengdu and Cairo starting 23 October, the airline said, according to Al Shorouk. The service will be offered on Tuesday and Friday of every week.

Telecoms + ICT

Egypt loses mobile subscribers, gains landline subscribers in 2018

The number of mobile service subscribers in Egypt declined 4.6% y-o-y to reach 95.73 mn at the end of June 2018, down from 100.31 mn in June 2017, according to an ICT Ministry report picked up by Al Masry Al Youm. The number of landline subscribers, meanwhile, grew by 17.6% y-o-y to record 7.40 mn in June this year, compared to 6.29 mn in June 2017.

ICT Ministry looking to use Samsung’s production lines for educational tablets

The Education Ministry is in talks with Samsung to have the latter manufacture tablets for schools, ICT Minister Amr Talaat said, Amwal Al Ghad reports. The Education Ministry had contracted Samsung last month to supply 1 mn educational tables for the 2018-19 academic year for USD 240 mn. Education Minister Tarek Shawky had previously said that the ICT and military production ministries would locally produce the first batch of tablets for EGP 2.5-3 bn.

Banking + Finance

Egypt Post allows customers to accept transfers from all banks

Egypt Post has launched a new service that allows its customers to accept transfers from or send transfers to any bank across the nation, Al Shorouk reports.

Egypt Politics + Economics

Egypt to unify tax identification numbers by April

Every taxpayer in Egypt will have a tax identification number they will be required to use to file all their taxes as of April, Finance Minister Mohamed Maait said, Al Mal reports. The Tax Authority will start updating taxpayers’ information in November, to bring the new system — which is meant to eliminate errors — online at the beginning of May 2019.

Gov’t will reportedly stop hiring state workers for the next five years

The Egyptian government will reportedly institute a five-year freeze on hiring until the Planning Ministry completes a review of all current employees, Minister Hala El Said said last week, according to Arab News. The policy has sparked concerns about unemployment.

Supply Ministry adds 2 mn newborns to subsidy rolls

The Supply Ministry has added some 2 mn newborns to its subsidy rolls under 1.2 mn ration cards between August and the end of September, ministry spokesman Ahmed Kamal said. Kamal did not disclose how much the ministry expects to spend on the new beneficiaries, or how the government plans to finance the additional subsidies. The government had issued new regulations last year to govern new entrants to subsidy rolls, which cap the number of family members per card at four and introduce a EGP 1,500 monthly income threshold for eligibility for full-time workers, as well as a EGP 1,200 monthly threshold for pension earners.

Court sentences 4 to death and 17 to life over 2016 Giza killings

A court sentenced yesterday four to death and 17 others to life in prison over a case known as “Giza Province”, Ahram Online reports. The defendants allegedly joined a terrorist organization in Giza affiliated with Daesh that killed 20 police officers and a government employee in 2016 while attempting to bomb the Foreign Ministry building in Giza.

National Security

52 terrorists killed and seven hideouts destroyed in Central and North Sinai

Three Egyptian army personnel died during recent attacks on terrorists that killed 52 and destroyed seven hideouts in Central and North Sinai, according to an Armed Forces statement.

Egypt, Saudi begin joint wargames Tabuk 4

The joint Egypt-Saudi military exercises Tabuk 4 kicked off yesterday at a military base in Egypt, Asharq Al Awsat reports. The drills will focus on coordination between the two forces.

Sports

Egypt, Argentina 2-2 at the 2018 Summer Youth Olympics futsal event

Egypt secured a 2-2 draw against host nation Argentina in their first game at the futsal competition of the 2018 Summer Youth Olympics, which kicked off in Buenos Aires on Saturday, Egypt Independent reports. Egypt will face Panama tomorrow and Iraq on Wednesday in its upcoming group stage matches. You can watch the Argentina game highlights here (runtime: 2:20).

Salah among 30 shortlisted candidates for the 2018 Ballon d’Or trophy

Mohamed Salah is one of 30 top players shortlisted for the prestigious Ballon d’Or trophy, Reuters reports. A ceremony to announce the winner will take place in Paris on 3 December.

On Your Way Out

From Louis Vuitton handbags to Adidas kicks, Zeina Soliman can transform any article of clothing into a customized work of art. At just 16 years old, Cairo American College student Soliman is using her business — Reconstructed — to give brand name items a sense of uniqueness through pop art-inspired personalized designs. Drawing on her father’s business mindset and her mother’s artistic talent, Soliman brought Reconstructed to fruition after she piqued her friends’ interest with her splatter-painted white sneakers, which she had done herself. A custom-designed pair of shoes can set you back EGP 600-1,000, while bags cost anywhere between EGP 1,200 and 2,000. The young entrepreneur already has her eyes set on expanding Reconstructed beyond Egypt and taking on larger projects, such as customizing designs on buildings — and even planes.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 13,604 (-3.6%)

Turnover: EGP 709 mn (2% below the 90-day average)

EGX 30 year-to-date: -9.4%

THE MARKET ON MONDAY: The EGX30 index ended Monday’s session down 3.6%. CIB, the index heaviest constituent ended down 1.8%. Yesterday’s worst performing stocks were Emaar Misr down 8.5%, Juhayna down 8.3%, and Ibnsina Pharma down 8.0%. The market turnover was EGP 709 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +56.1 mn

Regional: Net Short | EGP -21.4 mn

Domestic: Net Short | EGP -34.7 mn

Retail: 54.8% of total trades | 54.4% of buyers | 55.1% of sellers

Institutions: 45.2% of total trades | 45.6% of buyers | 44.9% of sellers

Foreign: 25.1% of total | 29.1% of buyers | 21.2% of sellers

Regional: 8.2% of total | 6.7% of buyers | 9.7% of sellers

Domestic: 66.7% of total | 64.2% of buyers | 69.1% of sellers

WTI: USD 74.35 (+0.08%)

Brent: USD 83.96 (+0.06%)

Natural Gas (Nymex, futures prices) USD 3.28 MMBtu, (+0.49%, Nov 2018 contract)

Gold: USD 1,193.00/ troy ounce (+0.37%)

TASI: 7,939.17 (+0.58%) (YTD: +9.86%)

ADX: 5,003.38 (+0.26%) (YTD: +13.75%)

DFM: 2,774.62 (-0.56%) (YTD: -17.67%)

KSE Premier Market: 5,308.98 (+2.31)

QE: 9,819.74 (-0.28%) (YTD: +15.21%)

MSM: 4,505.35 (-0.24%) (YTD: -11.65%)

BB: 1,325.26 (+0.10%) (YTD: -0.48%)

Calendar

07-11 October (Sunday-Thursday): Egypt-Romania Business Council to meet in Bucharest.

08-14 October (Monday-Sunday): The IMF and World Bank annual meetings in Bali, Indonesia.

09 October (Tuesday): IMF to release World Economic Outlook report.

09 October ( Tuesday): Monetizing Innovation: How to build a smart fintech business model, The GREEK CAMPUS, Room 109, Cairo.

09-11 October (Tuesday-Thursday) Egypt Renewable Energy Conference, Cairo, Egypt.

10 October (Wednesday): Foreign ministers of Egypt, Cyprus, Greece to meet in Crete.

Second week of October: NI Capital expected to select winning bid in its tender for the management of Alexandria Containers & Cargo Handling’s stake sale.

12 October (Friday) Egypt plays its third 2019 Africa Cup of Nations qualifier against Swaziland

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

Mid-October: IMF delegation due in town for its fourth review of Egypt’s economic reform program.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

28 October (Sunday): 2018 Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

17-19 November (Saturday-Monday) ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.