- Global oil rally threatens to derail budget deficit, change inflation outlook. (Speed Round)

- State unveils how it will price stake sales under privatization program. (Speed Round)

- El Sisi met Uber CEO Khosrowshahi as competition watchdog’s warning against potential Careem merger loom. (Speed Round)

- Algebra Ventures leads USD 600k Series A round for real estate platform iCommunity. (Speed Round)

- Trade Ministry unveils local industry development strategy. (Speed Round)

- More than half of the world’s population is now middle class. (What We’re Tracking Today)

- Egyptian surgeon pioneers a method to keep organs alive. (Worth Watching)

- The Market Yesterday

Wednesday, 3 October 2018

Oil rally threatens to derail budget deficit target

TL;DR

What We’re Tracking Today

It’s PMI day: The purchasing managers’ index for Egypt, Saudi, and the UAE is due out shortly after we hit “send” on today’s issue. You can find the report here once it lands at around 6:15am CLT.

The subscription period for retail investors who want a piece of Sarwa Capital’s IPO begins today and ends next Wednesday, 10 October. The consumer and structured finance firm has set aside 29.5 mn shares for it Egyptian retail offering. Sarwa announced earlier this week that it expects to price its IPO at EGP 7.04-8.00 per share, and will announce the final share price on 4 October, once the book building process is complete.

The Foreign Ministry has a new spokesman: Ahmed Hafez, who previously served in Washington and Tel Aviv and was most-recently co-head of Egypt’s mission in Ramallah, has taken the post.

And Egypt has a new ambassador to Ottawa: Outgoing spokesperson Ahmed Abu Zeid is heading to Canada’s capital city (watch, runtime: 1:46), where we wish him good luck with the mosquitos of August. Winter in Canada is a bear, Mr. Ambassador, but skating on the Rideau is nothing short of magical. And fall? There’s nothing like it.

** #6 More than half of the world’s population is now middle class, and five more people join the ranks of the comparatively well-off every second of the day. That’s the conclusion of the World Data Lab, a non-profit. Nearly 90% of the new members of the middle class are in Asia, while Africa is seeing comparatively little growth in the Middle Class. The middle class is the engine of modern economies, the Financial Times quotes World Data Lab as saying: “about half of global economic demand is generated by household consumption, with half of this coming from the middle class.” The outfit defines “middle class” as someone earning between USD 11 and USD 110 a day on a 2011 purchasing power parity basis.

It’s a good morning for: Women in business. California has become the first state in the US to require that companies headquartered in the state appoint women to their boards of directors. Corporations with at least five directors will need to ensure a minimum of two of them are women. CNBC and the Wall Street Journal have more. And following up on the appointment of Gita Gopinath as chief economist at the IMF (which we noted yesterday), the Financial Times has a gallery looking at how the dismal science, which has “long had a gender problem,” is slowly becoming more inclusive as “women follow the IMF’s Christine Lagarde into top jobs” in the field.

The resident 11-year-old doesn’t think much of economics, but she approves, saying, “anything a boy can do, a girl can do better.”

Ranking the managers: The New York Times gives a hint at where top US university endowments rank in a quick look at Harvard’s fund. The Harvard Management Company’s return of 10% “topped the 8.4% gain that a typical 60-40 portfolio of Standard & Poor’s 500-stock and aggregate bond index equities would have delivered” in HMC’s fiscal year ending 30 June, but the endowments at MIT (+13.5%) and the University of Pennsylvania (12.9%) did better, as did Notre Dame (12.2%).

Collusion of the very best kind: Egyptian business leaders need to ensure they pay a livable wage to all of their employees, and we’re suggesting folks start speaking amongst themselves about what that figure should be. Take inspiration from Jeff Bezos who, under attack from The Donald for everything under the sun, kept his mouth shut and then announced yesterday that Amazon is going to roll out a minimum wage of “USD 15 per hour in the US and GBP 9.50 in the UK, with a higher GBP 10.50 rate in London.” And guess what? It won’t be a disaster for Amazon’s books: “In terms of financials, it doesn’t move the needle all that much,” the Financial Times quotes on analyst as saying, “estimating it would at most amount to less than 1 per cent of the USD 235 bn in revenue Wall Street analysts are forecasting for this year.” Reuters and the Wall Street Journal also have the story, which is front-page news in the global business press today. Axios puts it all in perspective.

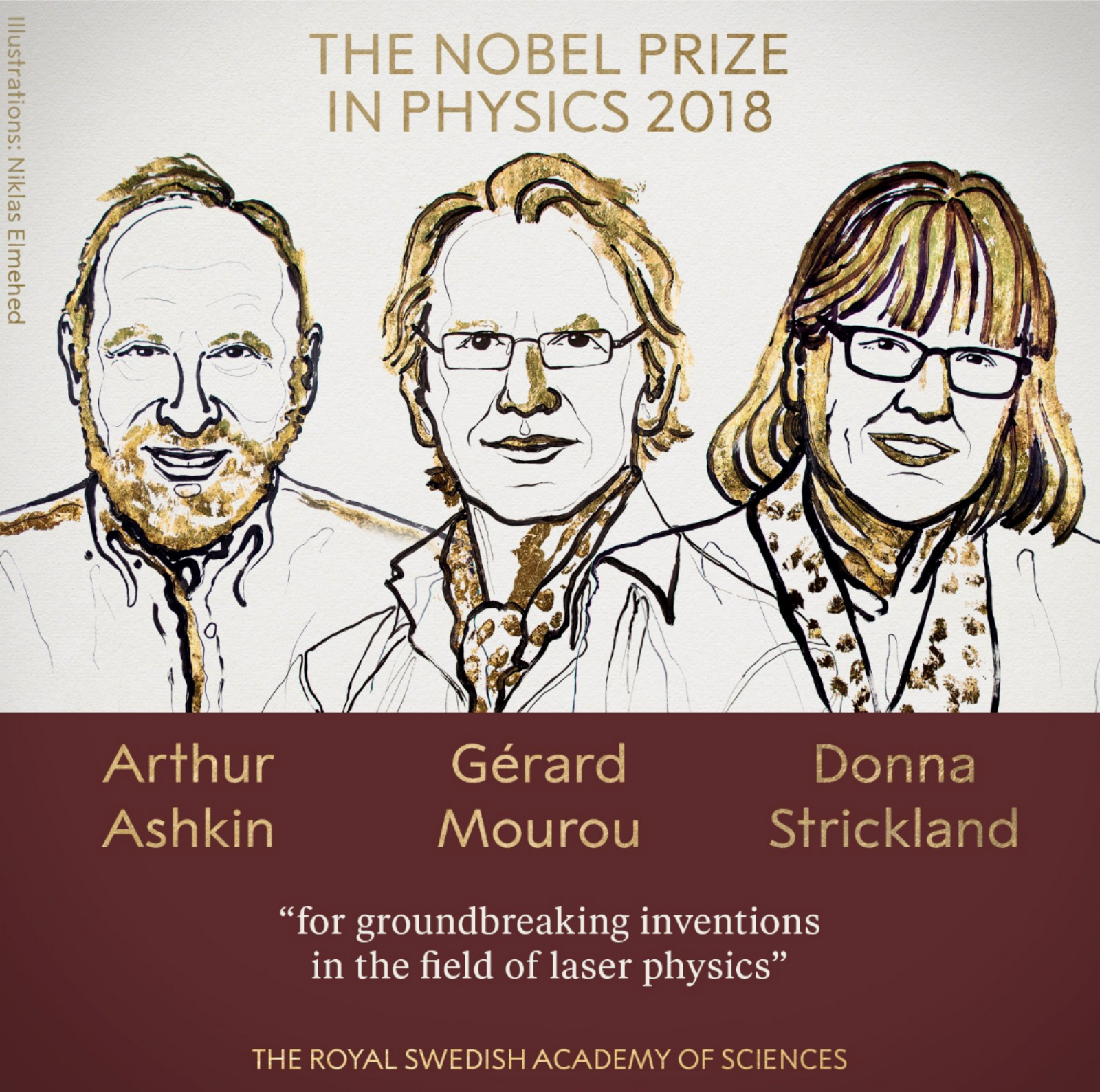

The Nobel Prize in Medicine went to researchers in the United States and Japan for their work on training the body’s immune system to attack cancer, in the process creating a new class of cancer drugs. And three researchers, including the first Canadian woman to win the prize, shared the Nobel Prize in Physicsfor work on lasers that has made possible everything from eye surgery to micro-machining. The Nobel for chemistry is due to be announced today, while the peace prize will be handed out on Friday and the prize for economics on Monday.

In miscellany this morning:

- Abraaj no longer has an office in DIFC after failing to pay rent, Bloomberg reports. Lost track of where the meltdown stands? The business information service has got your back here.

- Jamal Kashoggi when into a Saudi consulate, but hasn’t come out, the Wall Street Journal alleges. The Saudi journalist and political commentator’s disappearance “appears to be the latest effort by the kingdom to stifle dissent,” paper claims.

- Donald Trump allegedly engaged in tax schemes that included “outright fraud” in which he and his siblings helped their parents dodge mns in taxes, the New York Times reports in an investigation published late yesterday.

- Is China next in The Donald’s sights? That’s the contention over at CNBC, which sees the Trump White House “focusing all its ire on China” now that it has in place trade pacts with Canada, Mexico and South Korea.

- Don’t want to give the Kiwis your password when you land? That will be a >USD 3k fine. We let our membership in the tin-foil-hat brigade lapse years ago, but this is nearly enough to have us traveling with wiped devices…

One of us fried a beloved Macbook Pro earlier this week just before dispatch. Apparently the things don’t stand up particularly well to baths in hot coffee. That has sent us back to an iPad Pro-only lifestyle as we wait to see whether Apple will introduce something new at what some analysts think will be an October event — or whether we’re heading to the Apple reseller down the street to pick up another MacBook Pro. 9to5Mac expects we may see a significant refresh of the Mac lineup (including a new Macbook) later this month along with a redesigned iPad Pro.

** Enterprise One: By invitation only. Thank you very much to everyone who wrote in expressing interest in becoming one of the first 100 beta partners for Enterprise One, our forthcoming professional-grade business intelligence product for frontier and emerging markets. Your response was both overwhelming and humbling. We will be in touch over the coming week and, if you missed yesterday’s email, you can learn more here or register interest by emailing patrick@enterprisemea.com with “Enterprise One” in the subject line. Please note that as Enterprise One will become a paid service, we are asking our beta partners to be personally engaged and able to send constructive criticism and feedback as we build out the service.

Enterprise+: Last Night’s Talk Shows

The decision to liquidate the National Cement Company was the most exciting bit of news on what was an otherwise vapid night on the airwaves.

The 62 year-old company will be officially liquidated on 7 October, after the EGM nodded to the decision yesterday, Chairman Mohamed Radwan told Hona Al Asema. The Public Enterprises Ministry had made the decision last month after financial projections revealed that the company is unlikely to make a turnaround. Radwan blamed the losses — which amounted to some EGP 2.5 bn between 2013-18 — on a variety of factors, including rising fuel prices and higher operational costs, as well as neglect in the maintenance and upkeep of equipment, which kept the company’s output low. The company is also in debt to a number of government agencies and ministries.

Company faces probe: Prosecutors will launch an investigation to identify the reasons behind the company’s operational and financial failure, according to Radwan, who said that investigators would look into decisions by past management teams and board members (watch here, runtime: 11:12 and here, runtime: 5:52 ).

The company’s 2,057 workers and employees will received around EGP 300 mn in compensation, Radwan told Yahduth fi Masr’s Sherif Amer, adding that payments will be made within three months of the move (watch, runtime: 7:57).

Nasser Social Bank is offering one-year CDs with 17% interest for senior citizens, Deputy Head Sherif Farouk told Masaa DMC. The CD is currently available to anyone over the age of 70 through all bank branches, he added (watch, runtime: 6:40).

Speed Round

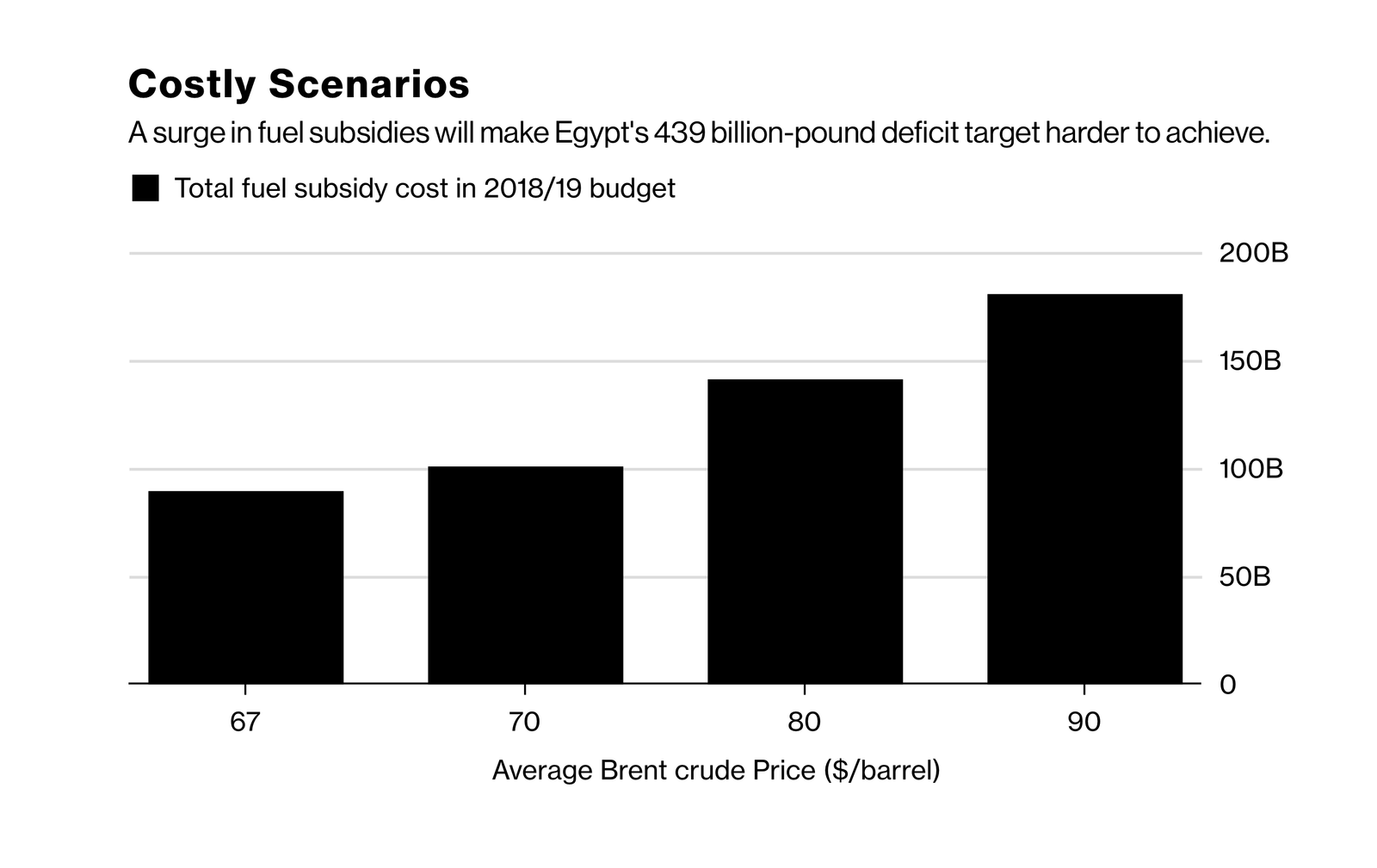

**# 1 Global oil rally threatens to derail deficit reduction plans, change inflation outlook: The rally in global oil prices threatens to derail Egypt’s budget deficit target of 8.4% this fiscal year, Ahmed Feteha writes for Bloomberg. Every USD 10 increase in oil prices over the USD 67/bbl set in the FY2018-19 budget adds USD 1-1.2 bn to Egypt’s current account deficit, according to calculations by EFG Hermes’ Mohamed Abu Basha. With Brent crude currently soaring above the USD 80/bbl mark (and some tipping it to cross the USD 100/bbl barrier), Egypt may find itself having to spend double the EGP 89 bn it had budgeted for fuel subsidies this year: Every USD 1 increase above the budgeted oil price adds EGP 4 bn (USD 222 mn) to the state’s annual outlay.

Whatever the country saves on liquefied natural gas imports will likely be eaten up. Oil Minister Tarek El Molla had said that Egypt would save an annual USD 1.5 bn after it pulled the plug on LNG imports last month. El Molla had also said that Egypt was due to start LNG exports by January 2019 as more output is pumped into the national grid from projects such as Zohr. “Although a revenue increase from Egypt’s own oil exports should partially mitigate some of the impact on the budget and the balance of payments from higher crude prices, the net effect will likely be negative,” according to Abu Basha.

Could oil prices change Egypt’s inflation and fiscal policy outlook? Oil Minister Tarek El Molla confirmed earlier this week that further subsidy cuts were still to come as Egypt works toward economic reform. The next hike in oil prices will be “more costly from an inflation perspective,” however, if the oil rally persists. A change in the inflationary outlook that sees it rising rather than dropping next year could prompt the central bank to continue to leave interest rates on hold, Abu Basha suggests.

The surging price of oil might not seem too bad in USD terms, but the situation is already as bad as 2008 in EM currency terms, David Fickling writes in a separate piece for Bloomberg. “With emerging market currencies falling against the greenback, the rising USD price of crude is compounded for consumers in less wealthy countries.” This gap helps explain the internal policies in many EM countries — including Brazil, Venezuela, and India — where governments have been doling out bns each year in oil subsidies to appease consumers, which further burdens state budgets and feeds into the “vicious cycle” when currencies slip.

**#2 State unveils how it will price stake sales under privatization program: Investment bankers hired to dispose of stakes in already-listed state-owned companies have guidance from cabinet on how to price their offerings. Ministers have approved an indicative pricing scheme that will see shares go to market within 10% of their average price on the EGX in the previous 30 days, Public Enterprise Minister Hisham Tawfik tells Al Mal. Cabinet agreed to the 10% up or down formula after the EGX was buffeted in recent weeks by fallout from the EM Zombie Apocalypse, Tawfik suggested.

Retail investors to get a piece of Eastern? The newspaper also claims that individual investor will be given the chance to subscribe to this month’s sale of a 4.5% stake in retail favorite Eastern Tobacco. Expectation had previously been that the offering would be to institutional investors as part of an accelerated book build, by which investment bankers place the full stake with institutions over a 24-48 hour period with no publicity. EFG Hermes, which has a proven reputation on accelerated book builds across GCC markets, is quarterbacking the transaction, which is expected to go to market in the second half of this month. We were told as recently as Monday that the sale is still on track for execution before the end of October.

In other news from the privatization program: Citi wants work. That’s the take-home from a news conference yesterday with Citi MEA CEO Atiq Ur Rehman, who said the bank is hoping to help the Madbouly government drum up interest in upcoming transactions. We said on Monday that Citibank was reportedly one of seven bidders vying to run the upcoming sale of an additional stake in state-owned Alexandria Containers & Cargo Handling on the EGX. Other bidders include Pharos Holding, HC Securities, and Arqaam Capital. State-owned investment bank NI Capital is expected to make a decision soon, sources said.

** #3 El Sisi met Uber CEO Khosrowshahi: Uber CEO Dara Khosrowshahi discussed the company’s operations in Egypt and investment plans going forward with President Abdel Fattah El Sisi last week on the sidelines of the 73rd UN General Assembly in New York, the company said in a statement (pdf) on Tuesday. Khosrowshahi reiterated plans to expand across 50% of Egypt’s governorates by year’s-end.

ECA objections to Uber, Careem mergers hangs in the air: The meeting came as Uber and its local rival Careem are being scrutinized by the Egyptian Competition Authority over alleged talks of a USD 2-2.5 bn merger between the two. While Uber and Careem initially denied the reports, the ECA issued a sharp warning against any merger. The watchdog had asked the two companies to seek clearance before signing any agreements, citing a similar case in Singapore where the US company and its Asian rival Grab were last week fined a combined USD 9.5 mn.

Landmark case for the ECA: The potential merger is increasingly being seen as a watershed case for the watchdog to increase its powers over the M&A landscape. Law firm Baker McKenzie’s Cairo office says the ECA’s flexing of muscles is a sign of the ECA’s newfound desire to regulate M&A, warning that “the development appears to signify a new enforcement policy of the ECA, under which parties to any merger or acquisition may be required to notify the transaction to the ECA and to obtain its prior approval before entering into the agreement,” the firm. As we have previously reported, the ECA wants to amend the Antitrust Act to require its approval over M&A transactions larger than EGP 100 mn.

** #4 Algebra Ventures leads USD 600k Series A round for iCommunity: Mobile real estate platform iCommunity raised USD 600k in Series A funding round led by our friends at Algebra Ventures, according to a statement on Tuesday. iCommunity will use the investment to grow locally and internationally, its CEO Karim Akram said. “The digitization of the real estate industry will create significant value in the MENA region and iCommunity is at the forefront of that transformation. We look forward to continuing to support the company as it further expands its reach and grows its customer base,” Algebra Ventures Managing Partner Tarek Assaad.

** #5 Trade Ministry unveils outline of local industry development strategy: Trade and Industry Minister Amr Nassar unveiled yesterday a strategy aimed at developing domestic industry and improving the competitiveness of locally manufactured goods, according to a ministry statement (pdf). The program, which hinges on promoting development across the supply chain, will focus on providing assistance to small-scale manufacturers and facilitating their access to funding and skilled labor. Under the strategy, the ministry will also help local connect with each other and with markets abroad.

“Buy Egyptian” figures into it: The recently passed Public Procurement Act — which gives products with at least 40% domestic content priority in government tenders over competing products with less domestic input — is another important tenet of the ministry’s strategy to put domestic production on the map, said Federation of Egyptian Industries head Mohamed El Sewedy.

Details TK: The statement does not flesh out the details of any incentives or other measures the government will take to nudge along domestic manufacturers.

Nassar discusses supporting private sector manufacturers with IFC: The unveiling of the strategy comes one day after Nassar discussed implementing programs to support private-sector industry with a delegation from the International Finance Corporation (IFC), according to a ministry statement. The two sides also looked into their ongoing work to improve the efficiency of electric motors used in industry. We previously noted that the IFC is committed to extend as much as USD 2 bn in funding to Egypt’s private sector until 2019 under the country’s cooperation framework with the World Bank Group, IFC CEO Philippe Le Houérou said.

CABINET WATCH- Cabinet signs off on E-payments Act: The Madbouly Cabinet signed off yesterday on the final draft of the E-payments Act, which is meant to guide Egypt’s transition to a cashless, paperless economy, according to an official statement. The bill — which the House of Representatives should receive during the current legislative term — is expected to serve as a prerequisite for enacting the Finance Ministry’s new billing and payments system that will see it roll out ATMs and point-of-sale (PoS) terminals at which people will be able to pay fees for various government services, as well as introduce a new national debit card. The CBE-drafted act will also grant incentives to anyone paying government service fees electronically, including discounts and possibly rebates, officials previously said.

The cabinet also approved amendments to laws regulating property registration, which make it mandatory for authorities to notify applicants within 30 days of application if their requests have been rejected. The amendments also update the framework for appeal proceedings.

Other items on the cabinet’s agenda yesterday included:

- Approving a USD 673.2 mn framework agreement between the National Authority for Tunnels and the Export Import Bank of China for the electric railway project that will connect Cairo the new capital; as well as another c. USD 50 mn agreement with the Chinese government for the same project;

- Approving a USD 1.2 bn agreement with the UN on sustainable development between 2018-2022, which covers economic development, social justice, female empowerment, and sustainable resource management;

- Signing off on amendments to aid agreements with the US that increase allocations for a judicial support package to USD 124.3 mn from USD 119.7 mn, and a healthcare support package to USD 11.36 mn from USD 6 mn;

- Approving loan agreements with the Arab Fund for Economic & Social Development worth KWD 70 mn and KWD 40 mn for the development of sewage treatment systems and upgrading the power transmission grid;

- A green light for a new JV between the Alexandria Port Authority and Suez Canal Authority to build and operate a new multipurpose platform at the Alex Port;

- Approving the establishment of a land port in the border city of Salloum to facilitate the exchange of goods across the Libyan border.

LEGISLATION WATCH- An uneventful first day back for House representatives: The House of Representatives’ first day back in session for a fourth legislative term yesterday was uneventful in the extreme as our elected representatives took time to wrap their heads around the idea that summer vacation is over. MPs face a busy agenda that includes changes to a basket of economic as well as political and social laws (You can catch up on that in our Enterprise One: Legislation Watch roundup here).

As a first order of business, House Speaker Ali Abdel Aal referred a law on the regulation of clinical trials and medical research back to the general assembly for review. President Abdel Fattah El Sisi refused to ratify the bill, citing a number of concerns. The President objected to a number of the bill’s clauses, including ones that prohibit and set harsh penalties for the transfer of human research samples outside of Egypt without obtaining approval from the government and intelligence authorities, Ahram Online reports. El Sisi said these provisions require reconsideration as they may prove problematic and could even hinder the scientific exchange between Egyptian universities and others abroad. The House had signed off on the law in May.

The issue got some air time last night on Al Hayah fi Misr (watch, runtime: 9:04). Hona Al Asema (watch, runtime: 5:12), and Masaa DMC (watch, runtime: 4:42).

Abdel Aal also referred a number of international agreements to the concerned committees to revise, including that on the development of a Russian Industrial Zone in the Suez Canal area and another on Egypt signing on to an Arab League human rights charter. A draft law that governs the management of the national archives was also sent to the Culture Committee, while another on property registration fees was recalled by the government, which intends to draft new legislation to that effect, according to Al Masry Al Youm.

UK’s Malicorp files new USD 500 mn arbitration suit against Egypt: UK construction firm Malicorp is planning to file another arbitration case against the Civil Aviation Ministry for USD 500 mn in compensation for terminating an 18-year-old contract to build, operate and manage an airport in Ras Sudr, sources close to the matter told a local newspaper.

Background: The concession agreement signed in 2000 was terminated a year later by the Egyptian side, which claimed Malicorp failed to comply with agreed terms. The company claimed the termination was related to national security concerns on the Egyptian side.

ICSID dismisses compensation claim for damages: Malicorp had previously taken the case to the International Centre for Settlement of Investment Disputes (ICSID) (pdf), seeking USD 500 mn in damages, but the international tribunal dismissed the company’s claim for compensation and ordered both parties to share the costs. Malicorp tried to reverse the ICSID’s decision, but failed.

CRCICA agrees modest compensation for expenses: Malicorp then filed for arbitration at the Cairo Regional Centre for International Commercial Arbitration (CRCICA), which ordered Egypt to reimburse the UK company for expenses in the amount of USD 14.8 mn.

Up Next

Melania Trump is coming to Egypt this week as part of a trip to Africa to “promote child welfare and education.” Melania will reportedly bring up tourism opportunities while in town, the Brookings Institute’s Landry Signé said. Her visit will also take her to Kenya, Ghana, and Malawi.

Want to build a fintech business in Egypt? Pride Capital is running an event featuring our friend Simon-Kucher Egypt MD Martin Janzen and MENA Startup Bootcamp’s Todd OBrien looking at how to build a successful monetization strategy for a fintech business. Simon-Kucher works with global tech outfits including Paypal, Stripe, Uber and Evernote. The event takes place on Tuesday, 9 October at 5:30pm on the Greek Campus.

The Egypt-Romania business council will meet in Bucharest from 7-11 October, according to Al Mal.

Expect more news on the energy-hub front when the foreign ministers of Egypt, Cyprus and Greece meet in Crete on Wednesday, 10 October.

Fourth IMF review scheduled for mid-October: An IMF delegation is due in town mid-October for a review of Egypt’s progress on its reform program ahead of the disbursal of the fifth USD 2 bn tranche of the country’s extended fund facility, Finance Minister Mohamed Maait said. The IMF should complete its review by the following month, Maait said.

President Abdel Fattah El Sisi will fly to Moscow sometime this month, Russian Presidential aide Yury Ushakov said yesterday, Youm7 reports. No further details were provided, but Russian Deputy Foreign Minister Mikhail Bogdanov had also said as much last month.

The 2018 Narrative PR Summit will take place at the Four Seasons Nile Plaza on Sunday, 28 October with participants including friends ranging from the World Bank’s Mahmoud Mohieldin to US embassy spokesman Sam Werberg. The event’s website is here and its Facebook page here.

An Egyptian-Sudanese presidential summit is set to take place in Khartoum this month. A ministerial committee was expected to meet at the end of September to prepare for the summit.

The Macro Picture

What copper can tell us about the EM crisis: It is no secret that the fate of many emerging markets is tied to the prices of commodities, including copper. But the correlation between copper prices and EM equities as measured by the MSCI index have risen to a six-year high in August, says Colby Smith for the FT who suggests that portfolio investors could need to take a look at the correlation when making decisions on EMs. And the key is China, as emerging markets copper producers, who dominate global supply, are heavily reliant on the state of the Chinese economy, and particularly, how it is impacted by monetary policy.

What is it telling us now? The prices appear to correlate with the emerging markets recovery, with prices climbing 5% since mid-September after a 14% drop in June. This happening concurrently with the People’s Bank of China apparent relaxing of monetary policy in response to the trade war with the Trump Administration. “New rules forcing banks to recognize non-performing loans and efforts to crackdown on local government lending have since given way to lower reserve requirement ratios for banks, tax cuts and billions in cash injections from the People’s Bank of China…These measures, plus the streamlined approval process for forthcoming infrastructure projects, should more than make up for the economic drag produced by the tariff tit-for-tat between the US and China.” Growth in China is expected to hold steady in 2018 by both JP Morgan and Barclays.

This is all looking good…for now: While this balance between fiscal and monetary policy in China are helping keep prices up, JP Morgan warns that should the renminbi weaken further from here, copper’s recent rebound could quickly unravel.” Looser Chinese monetary policy ensures that the US dollar will become an ever higher yielder versus the renminbi for the rest of the cycle, such that a cyclical negative from rate differentials aggravates a structural negative from China’s ongoing loss of a current account surplus,” J.P. Morgan’s John Normand says. This could mean bigger headaches to come for EMs.

Image of the Day

A woman won the Nobel Prize in physics for the first time in 55 years: Canadian physicist Donna Strickland was one of three recipients of the Nobel Prize in physics, marking the first time for a woman to receive the award in 55 years — and the third time in the history of the award, according to the Nobel Prize’s Twitter. Strickland and France’s Gérard Mourou were jointly awarded one half of the prize for their “method of generating high-intensity, ultra-short optical pulses,” while the other half was granted to the US’ Arthur Ashkin for developing optical tweezers that can grab molecules and living cells, the Royal Swedish Academy said in a release. Previous women laureates: Maria Goeppert-Mayer in 1963 and Marie Curie in 1903.

Egypt in the News

It was a blessedly slow news morning for Egypt in the foreign press, with only a couple of things that caught our eye:

Egypt’s stability is important for Israel’s security, especially as the two countries ready to begin trading natural gas at the start of next year, David Rosenberg writes for Haaretz.

Ousted president Mohamed Morsi’s youngest son waits outside the prison where Morsi is held every month in vain as he’s repeatedly denied access to visit his father, Brian Rohan writes for the AP.

Worth Reading

Are you taking full advantage of the tons of extensions Google Chrome has to offer? Ten-year old Google Chrome is now the world’s most widely-used internet browser — in no small part due to the extensive number of extensions and add-ons it offers. Wired compiled a list of their favorite browser extensions “that elevate it from good to great.” Among them: The Great Suspender, which pauses tabs after a certain amount of time so they don’t use processing power in the background. OneTab, which condenses all the tabs you’re keeping open “to read later” into one summary tab. And Clutter Free, which makes sure you don’t have duplicate tabs open.

Chrome has lots of tabs, but the browser is not without problems, particularly when it comes to privacy issues and battery consumption. The Wall Street Journal put out a primer last week encouraging you to think about whether you’re using the right browser — arguably the most important app you have — which points out that “you can’t easily use Chrome without at least Google knowing what you’re up to.”

Worth Watching

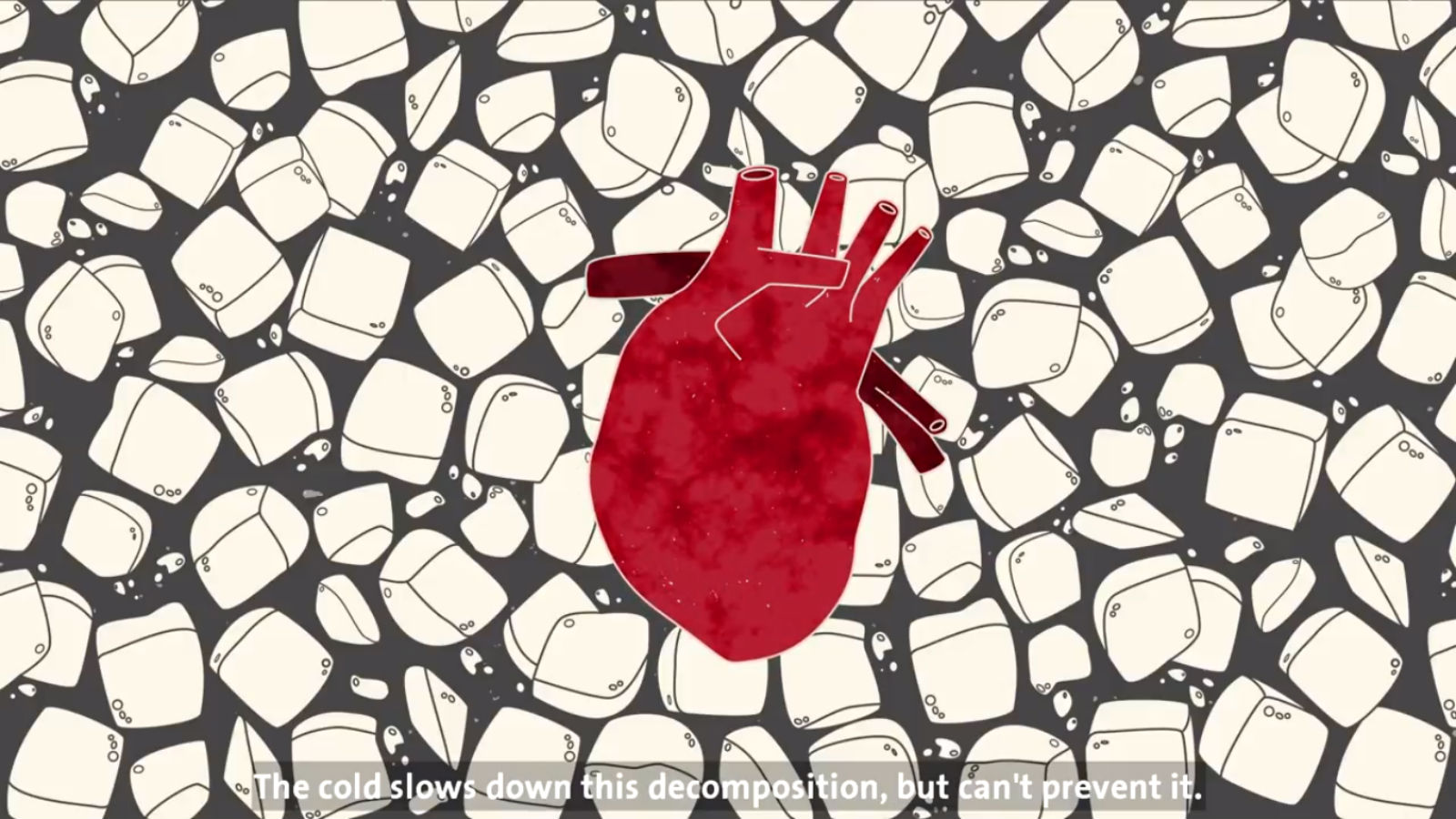

** #8 Egyptian cardiothoracic surgeon Waleed Hassanein pioneered a method to keep organs alive outside the body. His Organ Care System (OCS), a device that provides organs with conditions similar to those found inside the human body, allows donated organs to survive 3x longer than they would on ice, according to a video from the European Patent Office (watch, runtime: 1:56).

Diplomacy + Foreign Trade

Some 40 countries submitted requests to acquire land for new embassies at the new administrative capital, New Administrative Capital Company spokespersonKhaled El Hosseini tells Amwal Al Ghad. He did not name the countries but said that the Foreign Ministry is handling all the requests and organizing a visit to the new city for a number of diplomatic delegations on 16 October to view the embassies district.

Telecoms + ICT

TE and Airtel finalize agreement granting Airtel right to use TE’s cable systems

Telecom Egypt (TE) and Indian telecom company Bharti Airtel signed yesterday the final contracts for a partnership agreement that will grant Airtel permanent indefeasible right of use the TE North Cable and recently-acquired MENA subsea cable systems, according to a press release (pdf). TE is expecting to generate cash inflows of USD 90 mn from the agreement this year, and earn 4% more y-o-y over the contract’s 15-year term. The two sides signed the initial contracts last August.

Other Business News of Note

Saudi’s Sela terminates broadcasting rights with Presentation advertising agency

Saudi Arabian sports marketing firm Sela has unilaterally terminated its broadcasting rights agreement with advertising agency Presentation, which granted Pyramids TV the right to air Egyptian league matches, Presentation said in a press release carried by Yallakora. The decision comes a week after Sela had terminated its four-year sponsorship agreement with Al-Ahly Football Club after Al-Ahly fans reportedly insulted Saudi Sports Authority head Turki Al Sheikh.

Emaar-owned online fashion retailer Namshi eyes expansion to Egypt

Emaar-owned online fashion retailer Namshi is looking to enter the Egyptian market, Namshi CEO Hosam Arab told the press yesterday, the National reports. The UAE-based retailer intends to target the youth population, which Arab says is underserved. No further details were provided. The e-commerce market in Egypt is expected to grow by 33% by 2022 to be valued at USD 3 bn, up from USD 0.7 bn in 2017.

Egypt Politics + Economics

Egypt court overturns sentences for ‘Libya returnees’ case, orders retrial

The Court of Cassation overturned yesterday death and imprisonment sentences handed down in 2015 to 14 people who were arrested on terrorism-related charges in the “Libya returnees” case, according to Al Masry Al Youm. The defendants were arrested at Al-Salloum port on the Egypt-Libya border on charges of murder with premeditated intent and attacking public and private property. The court ordered a retrial.

Security forces kill senior Daesh member Maqdisi and two others

Daesh announced yesterday that Egyptian security forces killed senior member Abu Hamza Al Maqdisi and two others during an airstrike yesterday near Sheikh Zuweid in North Sinai, Reuters reports. Maqdisi was head of Daesh’s planning and training operations in Sinai. Egyptian authorities did not make an official comment on the incident, the newswire notes.

On Your Way Out

Egypt and the International Finance Corporation (IFC) launched the official website for The Next 100 African Startups competition that will take place from 8-9 December, according to an Investment Ministry statement. The competition will see the ministry and IFC select 100 promising startups from across the continent “and connect them with business leaders, international investors, financial institutions” at the Business for Africa Forum 2018 held in Sharm El Sheikh. You can apply for the competition here.

Mortada Mansour receives his third ban in less than a week: The Supreme Media Council decided yesterday to ban Zamalek Football Club chairman Mortada Mansour from making appearances on any and all media platforms, according to a decree picked up by Al Mal. The decision comes one day after Mansour was banned by the Egyptian Olympic Committee (EOC) from attending all Zamalek-related sporting events and two days following the Confederation of African Football’s (CAF) decision to ban him for one year and fine him USD 40k for making derogatory comments about CAF officials.

Armenian-French singer Charles Aznavour passed away on Monday at the age of 94. Nicknamed France’s Frank Sinatra, the late Aznavour “sold 180 mn records and recorded more than 1,200 songs over his eight-decade career,”according to Ahram Online. His signature song La Boheme was a favorite for mns over the years (watch, runtime: 4:04).

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 14,382 (-0.5%)

Turnover: EGP 744 mn (On par with the 90-day average)

EGX 30 year-to-date: -4.2%

THE MARKET ON TUESDAY: The EGX30 index ended Tuesday’s session down 0.5%. CIB, the index heaviest constituent ended down 0.9%. EGX30’s top performing constituents were Emaar Misr up 5.0%, Global Telecom up 4%, and Qalaa Holding up 3.2%. Yesterday’s worst performing stocks were Edita down 7.4%, Juhayna down 5.0%, and Ibnsina Pharma down 4.6%. The market turnover was EGP 744 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -53.2 mn

Regional: Net Long | EGP +41.2mn

Domestic: Net Long | EGP +12.0 mn

Retail: 49.6% of total trades | 48.9% of buyers | 50.3% of sellers

Institutions: 50.4% of total trades | 51.1% of buyers | 49.7% of sellers

Foreign: 29.1% of total | 25.5% of buyers | 32.7% of sellers

Regional: 10.8% of total | 13.5% of buyers | 8.0% of sellers

Domestic: 60.1% of total | 61.0% of buyers | 59.3% of sellers

WTI: USD 75.23 (-0.09%)

Brent: USD 84.52 (-0.54%)

Natural Gas (Nymex, futures prices) USD 3.17 MMBtu, (+2.33%, Nov 2018)

Gold: USD 1,207.00 / troy ounce (+1.28%)

TASI: 7,981.19 (-0.71%) (YTD: +10.45%)

ADX: 4,993.90 (+0.29%) (YTD: +13.54%)

DFM: 2,838.71 (-0.38%) (YTD: -15.77%)

KSE Premier Market: 5,323.54 (-0.11%)

QE: 9,817.07 (+0.27%) (YTD: +15.18%)

MSM: 4,535.34 (-0.06%) (YTD: -11.06%)

BB: 1,329.95 (-0.38%) (YTD: -0.13%)

Calendar

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

03-10 October (Wednesday-Wednesday): Subscription period for Sarwa Capital’s IPO.

06 October (Saturday): Armed Forces Day, national holiday.

09 October ( Tuesday): Monetizing Innovation: How to build a smart fintech business model, The GREEK CAMPUS, Room 109, Cairo

09-11 October (Tuesday-Thursday) Conference, Cairo, Egypt

Second week of October: NI Capital expected to select winning bid in its tender for the management of Alexandria Containers & Cargo Handling’s stake sale.

12 October (Friday) Egypt plays its third 2019 Africa Cup of Nations qualifier against Swaziland

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.