Why can’t we stick to resolutions? Before we answer this question, we first need to take a long, hard look at why we continue to make New Year’s resolutions year in and year out, completely undeterred from the slew of failed resolutions in years past. Oftentimes, the amped up pressure during this time of the year from friends, colleagues, social media and TV, is what ends up driving the need for us to follow suit and make our own pledges, not our having a genuine willingness — or readiness — to make a change.

The reason behind a resolution matters: The impetus for setting resolutions includes social pressure, a desire to reinvent oneself, and feelings of guilt or shame about one’s habits, according to psychologists. But what’s often lacking is actually the most important ingredient: The real desire to make a change that is specific to your own needs and wishes, and not those of friends, family, or society at large.

First of all, let’s ditch the word “should”: In her book How to Get Sh*t Done, lifestyle coach Erin Falconer says using the word "should" — whether it’s “I should start dieting,” or “I should quit smoking,” or “I should start exercising — as part of the rationale behind your resolution will likely doom it to failure. This is because “should” is often tied to feelings of guilt and shame, and reflects people or society’s expectations of you, and an “absence of a decision,” Falconer writes. It does not reflect an actual commitment to the resolution, but rather a feeling that you’re obligated to do something.

But of course, it’s all in the mindset: Changing up your vocabulary when inking your resolution into your planner isn’t the secret ingredient for success. The word itself is attached to a mindset with a history of baggage for each individual, based on years of being convinced you’re slacking off from things you really should be doing. “Right from the getgo [a resolution] has failure and procrastination built into it,” says one psychology professor. Framing your resolution negatively from the start as something that must be done will not help you move forward with it; it will keep your head churning thoughts about the very thing you’re trying to avoid, psychologists say.

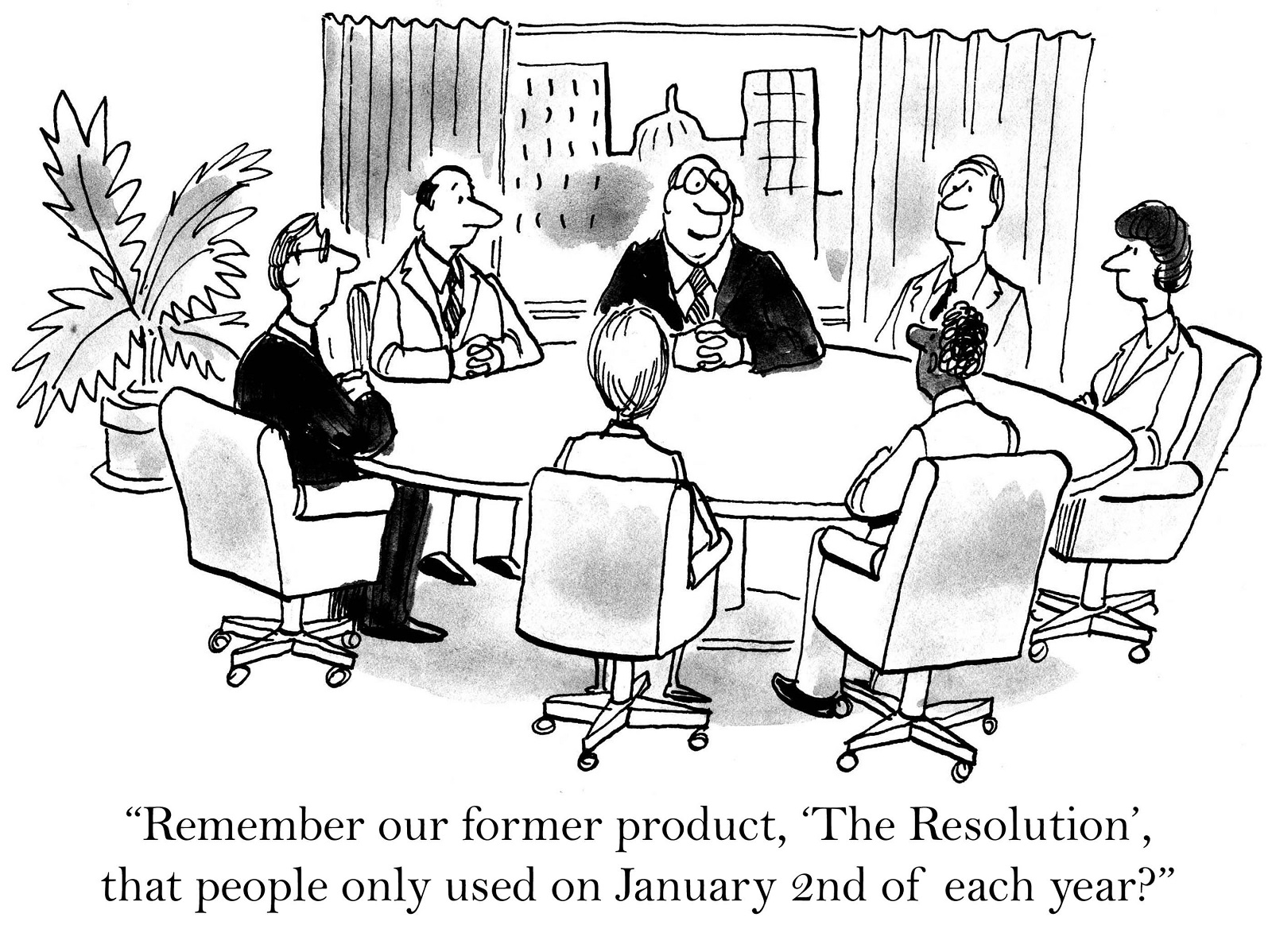

And if you’re not committed, the very foundation of your resolution is wobbly: Most resolutions made for the wrong reasons — and rushed through without too much thought — end up being vague and unrealistic, dissolving either into abstract resolutions that are difficult to measure, or incomplete resolutions that don’t factor in the concrete repercussions of making a change.

People need to prepare: This is where preparation comes in, one psychologist says. Preparation is an essential step in any process of lasting change, without which no change of habit can come about. Spending time in the preparation stage, ensuring your mental, physical, and financial state are ready for this new change, and that you are ready for what will come with it, is the only way you can really let it stick. January 1st resolutions — which often have an implied timeline of a year in order for it to count as a “success” — are too time restricted to allow you to make sure you’re ready to take on the challenge.

Don’t set goals based on a calendar date: The process of making a change is a long and active one, and it shouldn’t be dictated by the flip of a calendar page. Rather than making a resolution on the first day of the new year, decide you'll change your habits when you’re actually ready to commit. That could take days, weeks, or even months, but being prepared — whether mentally, physically or just because the place you’re in right now allows it — is essential if you plan to stick to your new change.