- Non-oil business activity contraction slows down despite inflation concerns + CBE issues updates to its L/Cs FAQ sheet. (The Big Story Today)

- Some 20,000 Ukrainian tourists are stranded in Egypt, mostly in the Red Sea area. (What We’re Tracking Tonight)

- Could Egypt’s Loutfy Mansour be Chelsea FC’s next owner? (For Your Commute)

- Day 8 of the Russian invasion of Ukraine sees the conflict shift to the key Ukrainian port city Mariupol. ((What We’re Tracking Tonight)

- Russian stocks will be cut from emerging markets indexes such as the MSCI and FTSE Russell. (What We’re Tracking Tonight)

- Sittat Bayt El Maadi: Three women, their cheating husbands, and murder. (On The Tube Tonight)

- Al Ahly will play against Sudan’s Al-Merrikh on Saturday at 9:00 pm in the CAF Champions League. (On The Tube Tonight)

- How innovation got some businesses through the pandemic — and why it could be key to weathering the next crisis. (Entrepreneurship)

Thursday, 3 March 2022

PM — Could Man Capital’s Loutfy Mansour be Chelsea FC’s next owner?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

We’ve got a pretty hefty day of news to close out a very busy week, ladies and gentlemen. And while Ukraine continues to dominate headlines globally (more on that below), here at home, our tourism sector is beginning to feel the direct impact of the conflict…

Some 20,000 Ukrainian tourists are stranded in Egypt, with arrangements currently underway to fly them to Europe, Reuters reported, quoting Ukrainian embassy officials in Cairo. Most of the tourists are staying at three-star hotels at no charge at Red Sea resorts Sharm El Sheikh and Hurghada, while a few others are in Marsa Alam, embassy deputy chief Yevhen Zhupeyev said. The embassy is working with authorities in Egypt and tourism companies for returns to third countries in Europe, he said.

#1- Non-oil business activity contraction slows down despite inflation concerns: Egypt’s non-oil business activity continued to decline for the fifteenth consecutive month in February but at a slower pace than the previous month, according to IHS Markit’s purchasing managers’ index (PMI) survey (pdf). The gauge inched up to 48.1 in February from 47.9 in January but remained below the 50.0 mark that separates expansion from contraction. Putting a damper on the slowdown was inflation, with price pressures weighing on business confidence and consumer demand and spending. This drove output sentiment down to its weakest in the guage’s history, IHS Markit says.

#2- CBE issues updates to its L/Cs FAQ sheet: The central bank issued this morning updates (pdf) to its response to importers’ inquiries on its rules requiring them to get letters of credit (L/Cs) for their purchases. The updates appear to allow banks to transfer down payments for imported goods to foreign sellers while the importer awaits their L/Cs. The updates also clarify rules regarding buying and transacting from freezones and special economic zones.

^^We’ll have more on these stories and others in Sunday’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Diplo settings on neutral: Egypt was among 141 nations who called for a Russian withdrawal from Ukraine at a UN General Assembly meeting yesterday, but released a statement rejecting some forms of economic sanctions.

- Gulf Capital knows how to make an entrance: UAE’s Gulf Capital plans to invest some USD 250 mn in Egypt over the next five years, targeting companies in the tech, fintech, e-commerce and healthcare sectors.

- Homzmart ups its design game: Homzmart has acquired Berlin-based MockUp Studio, a tech-enabled interior design startup, for an undisclosed sum as the Egyptian company aims to add core technology to its business.

THE BIG STORY ABROAD- Day 8 of the Russian invasion of Ukraine sees the conflict shift to the key Ukrainian port city Mariupol after Russian forces seized the southern city of Khreston yesterday amid a slow progress to Kyiv. Shelling against Mariupol stretched overnight in what the city’s deputy mayor told BBC was "near to a humanitarian catastrophe". The city located on the Azov Sea coast might see more attacks, as pro-Russian forces said “targeted strikes'' were possible, Russian Interfax news agency reported, quoting Donetsk separatist commander Eduard Basurin.

Next stop for the Russians appears to be Odessa: Russia was sending four amphibious assault ships to land troops near the Southern port city of Odessa, Ukraine’s military headquarters said on Thursday, according to Bloomberg.

Meanwhile, a large Russian military convoy advancing on capital Kyiv appears to still be stalled, the British defense ministry said in an intelligence update, adding that the column “has made little discernible progress in over three days” as it remains over 30km from the center of the city. It credits Ukrainian resistance for slowing it down.

THE CASUALTIES- At least 34 citizens were killed and 285 injured in eastern Kharkiv in the past 24 hours, Ukraine’s emergency services said in a statement on Facebook. Officials have put its civilian death toll at around 2k yesterday since the beginning of the invasion. The UN Human rights office confirms a death toll of 227 and injuries of 525 since the start of the crisis, yet acknowledging that the the “real toll is higher”

More people are fleeing Ukraine, with the tally topping 1 mn since the beginning of the invasion, the UN High Commissioner for Refugees Filippo Grandi said, according to a press release by the UN Refugee Agency.

On military casualties, Ukrainian President Volodymyr Zelensky said in a video address (watch, runtime: 1:41) on Thursday that 9,000 Russian soldiers were killed as he warned them that “wherever they go, they will be destroyed”. The same number is reported too by the Ukrainian General Staff of the Armed Forces in a statement on Facebook. But Russia downplays the casualties, despite acknowledging losses for the first time with 498 of its paratroopers killed and around 1.6k injured since the start of the war. Moscow claims it killed 2.9k Ukrainian soldiers, with Ukraine remaining tight-lipped on its military casualties.

ON THE DIPLO FRONT- Russia remains defiant: Russia will continue with the operation until “the end,” Russian foreign minister Sergei Lavrov said, according to Reuters, accusing the West of preparing for war against his country. Lavrov compared the US to Hitler and Napoleon, accusing the US of “trying to impose their own view of the future of Europe on us”, Sky News reported.

Lavrov downplays nuclear fears: He further lashed on statements by US President Joe Biden and British foreign minister Liz Truss, who he said echoed statements on nuclear war, which “are not in the heads of Russians” despite President Vladimir Putin ordering nuclear deterrence forces on high alert.

…And sees a path for diplomacy: Lavrov also said that there was no doubt that a solution of the crisis would be found, saying that a second round of talks were to begin between his country and Ukrainian officials, without specifying a time.

Meanwhile, Georgia and Moldova joined Ukraine in pressing for European Union membership, Reuters reported, quoting an EU official that said that the bloc is set to receive membership applications from the two countries. The applications were due “imminently”, the official said.

Moscow was slapped by more sanctions from the UK, which announced in a press release that Russian aviation and space industry firms will be barred from access with any UK-based insurance services. The additional sanctions “will limit the benefits Russian entities receive from their access to the global insurance and reinsurance market,” the government said.

THE MARKETS- Russian stocks will be cut from emerging markets indexes, with the MSCI and FTSE Russell removing Russians stocks from widely-tracked emerging markets indexes effective March 9. The MSCI ruled that the Russian equity market was currently “uninvestable and that Russian securities should be removed from the MSCI Emerging Markets Indexes”, according to a press release. FTSE Russell will remove Russia constituents listed on the Moscow Exchange at a zero value on March 7, Bloomberg reported. Meanwhile, the London Stock Exchange (LSE) suspended trading in 28 depositary receipts for Russian companies, the stock exchange’s CEO David Schwimmer told Bloomberg Television on Thursday.

Oil prices continued to surge as Russia sanctions bite, with Brent crude futures rising 2.3% to USD 115.5/bbl as of dispatch. This comes after prices jumped over 5% towards USD 120/bbl earlier in the day, Reuters reports. The price is up nearly 20% over the week, while U.S. West Texas Intermediate crude soared to a high of USD 116.57, the highest since September 2008.

Commodities are on course for their biggest jump over the Russian-Ukrainian crisis since the mid-1970s, Bloomberg reported, with its gauge of raw materials, which have so far escaped Western sanctions, growing 8.6% as of Wednesday.

|

FOR TOMORROW-

Contemporary art and culture center Darb1718 is hosting its 3031 Art Festival from tomorrow until next Saturday, 12 March on its premises in Fustat, Old Cairo. Unique collections of multidisciplinary art will be on display along with live music, dance, theater performances, and interactive workshops. Guest speakers Adsum Art Consultancy will be on hand to discuss investing in art. Catch a full day of activities from 1:00pm–9:30pm on weekends and weekdays from 4:00pm–10:00pm

???? CIRCLE YOUR CALENDAR-

Key news triggers to keep your eye on over the next few weeks:

- Foreign reserves: February’s foreign reserves figures will most likely be announced today or next week.

- Inflation: Inflation figures for February will be released a week from today, on Thursday, 10 March.

- Interest rates: The Central Bank of Egypt (CBE) will hold its next monetary policy meeting on Thursday, 24 March.

The Diarna Handicrafts Fair kicked off last Thursday and runs through 7 March at Cairo Festival City from 10am until 10pm daily.

PodFest Cairo kicks off on Saturday at AUC’s Tahrir campus. The half-day podcasting conference runs from 2pm to 6pm. Admission is without charge and there’s no need to register, but you’ll need to show proof of vaccination.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Friday will be a bit more of the same, with a daytime high of 20°C and nighttime low of 10°C, our favorite weather app tells us. Saturday will be warmer as the mercury rises to 24°C during the day and drops to 15°C at night.

???? FOR YOUR COMMUTE

Could Egypt’s Loutfy Mansour be Chelsea FC’s next owner? The CEO of Mantrac Group and Man Capital Loutfy Mansour is reportedly making a bid to buy Chelsea, according to The Telegraph. The English Premier League club’s owner, Russian b’naire Roman Abramovich confirmed he would be selling the club amid Western sanctions imposed on Russia in the wake of its invasion of Ukraine. Abramovich is reportedly asking for GBP 3 bn for Chelsea, a price tag he’ll struggle to achieve, writes The Daily Mail. Mansour might need to go up against Swiss bn’aire Hansjorg Wyss who is also considering making an offer as part of a consortium which includes co-owner of the LA Dodgers Todd Boehly. If Mansour acquires Chelsea, he will be the second Egyptian club owner in the Premier League, following Nassef Sawiris’s purchase of Aston Villa. We are currently reaching out to Mansour’s team for comment on the move and have yet to receive a response as of dispatch.

Russians now have to make do with furniture they don’t have to build themselves (the horror): Ikea will shut down all of its stores in Russia and suspend all of its exports and imports of Russia and Belarus, the company said in a press release read. “[The war]…is also resulting in serious disruptions to supply chain and trading conditions. For all of these reasons, the company groups have decided to temporarily pause IKEA operations in Russia,” the statement read.

In non-Russia news, AWS wants to be the greenest of them all, but is a bit late to the party: Amazon Web Services (AWS) launched a tool that helps users estimate their carbon emissions before and after using the giant’s cloud services. The move comes amid a lack of transparency on the carbon footprint of cloud providers like Google Cloud and Microsoft’s Azure, the Wall Street Journal says. Google and Azure already introduced carbon-tracking tools for their customers in the past two years, and higher customer demands for such a tool. Data centers accounted for about 1% of global electricity use in 2020, excluding crypto mining, the WSJ cites the International Energy Agency as saying.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Hawanem Garden City fans should definitely check out its knock off Sittat Bayt El Maadi. The show follows three couples who lived in the same house across different times: Mariam (played by Kinda Aloush) in the sixties, Sharihan (Injy El Mokkaddem) in the eighties, and Radwa (Tara Emad) who represents the modern-day character. Based on the US series Why Women Kill, the three women all have marriage problems and try to fix them in different ways — but ultimately all three storylines end up with a murder (or two). The Egyptian version of the show is more toned down, but still displays scandalous events. We really enjoyed the acting and the intro scenes before the show gets underway. It’s a great show to binge watch this weekend if you’re feeling the couch potato bug.

⚽ It’s a quiet day for football lovers, with very limited games to be excited about. In the FA Cup, Everton will play against Boreham Wood at 10:15 pm.

Spain’s Copa Del Rey will see Real Betis vs Rayo Vallecano in the second leg of the tournament’s semi final at 10 pm with Betis being victorious in their first clash with a score of 2-1.

In the Egyptian League, Al Masry will clash with Enppi at 5:30 pm.

But look forward to the weekend, with games on Friday featuring Sevilla and Deportivo Alavés at 10:00 pm in the La Liga, Intermilan v Salernitana at 9:45 pm in Serie A, and Pyramids vs Al Moqawloon at 5:30 pm in the Egyptian Premier League.

Saturday will see seven Premier League matches: Leicester City v Leeds United at 2:30 pm, Aston Villa v Southampton, Burnley v Chelsea, Newcastle United v Brighton, Norwich City vs Brentford, and Wolverhampton v Crystal Palace at 5:00 pm. Liverpool will clash with West Ham United later in the night at 7:30 pm.

In La Liga, Osasuna will play against Villarreal at 3:00 pm, while Espanyonl will clash with Getafe at 5:15 pm, Valencia vs Granada at 7:30 pm and Real Madrid vs Real Sociedad at 10:00 pm.

Italy’s Serie A will see Udinese vs Sampdoria at 4:00 pm, Roma v Atalanta at 7:00 pm and Cagliari vs Lazio at 9:45 pm.

Moving on to the CAF Champions League, Al Ahly will play against Sudan’s Al-Merrikh on Saturday at 9:00 pm in a clash after a disappointing result last week which saw the Red Devils losing 1-0 against Mamelodi Sundowns in the stage games.

???? EAT THIS TONIGHT-

The Sandwich Room — The incognito mode for comfort food: With literally no digital footprint on social media, The Sandwich Room in Palm Hills’ Street 88 wants only to reach out to your taste buds. The menu is pretty simple, all day sandwiches in their delicacy bread made from scratch and the freshest ingredients to help you push throughout the day. Our in-house favorites are the Chicken Punch, and the Chicken Rosaline whose dill ranch and roasted red pepper are to die for. When craving seafood, we definitely go for Shrimp Punch, which is similar to fried Chicken Punch but with panko shrimps. For our vegetarian friends, we recommend the Eggplant Rosaline. While we’re at it, their Breakfast & Brunch sandwiches are not to miss, with their cheese melt on top of the list. You can wash these down with their delicious homemade peach, blackberry or raspberry ice tea.

???? OUT AND ABOUT-

(all times CLT)

Photopia’s Beyond Borders film screening series is showcasing “3eshreen” by Menna Ahmed. The film explores the Palestinian diaspora from the perspective of 20-year-old Zeina. The showing will take place today at 6pm.

New Cairo’s The Park Mall is hosting LA Market’s March Queens Bazar tomorrow from 11am to 11pm.

A swing dance introductory class will be held tomorrow at Dawar Arts at 5:30pm. The class features live jazz music performed by Rami Attallah, Caitlin Alais Callahan, Mina Nashaat and Amir Attalah. The event page also suggests putting on “your finest 20s or 50s garments”.

Catch Sara Abayazied’s flamenco concert at The Room Garden City, including tangos, bulerías and rumba sung in both Spanish and Arabic. The concert will take place tomorrow at 8:30pm.

???? EARS TO THE GROUND-

Maz Jobrani decides to be the class clown in his new educational podcast: The comedian — known for being part of the Axis of Evil comedy troupe — has launched a podcast called Back to School with Maz Jobrani. The show was inspired by Maz’s 10 year old son who asked him a question he didn’t have an answer for. Instead of turning to Google, he pulled in two of his friends, Tehran and Kaitlan, to together co-host a podcast that brings on experts from all walks of life. It’s a hard combination to implement: both comedy and important knowledge, but the professors are all lively and know how to enjoy a joke from Maz and his co-hosts while still communicating ideas. The episodes include one on the supply chain crisis, Western media’s negative depiction of Muslims, and how to become a pro wrestler.

???? UNDER THE LAMPLIGHT-

“In Love: A Memoir of Love and Loss” is a heart-breaking memoir by New York Times bestselling author Amy Bloom, where she shares the story of her and her husband’s decision to end his life following his Alzheimer’s diagnosis. The couple travel to Switzerland to go to Dignitas, an organization which provides assisted suicide to those suffering from terminal or several physical and mental illness. Bloom shares their last journey together and her struggle to find a way amid the tragic loss.

???? GO WITH THE FLOW

EARNINGS WATCH-

Telecom Egypt recorded a net income of EGP 8.4 bn in FY2021, up 75% y-o-y, according to the company’s financials (pdf) out today. Revenues also rose 16% y-o-y to EGP 37.1 bn in FY2021.

Ezz Steel’s bottom line turned positive in FY2021 reaching EGP 5.4 bn, compared to a net loss of EGP 4.7 bn during the previous year, according to the company’s financial statements (pdf). Sales revenues in 2021 reached EGP 67.8 bn from EGP 38.6 bn in 2020.

MARKET ROUNDUP-

The EGX30 rose 1.0% at today’s close on turnover of EGP 865 mn (13% below the 90-day average). Foreign investors were net sellers. The index is down 5.4% YTD.

In the green: AMOC (+6.0%), Sidi Kerir Petrochem (+5.0%) and Ezz Steel (+4.7%).

In the red: Oriental Weavers (-1.2%), TMG Holding (-1.1%) and Fawry (-1.0%).

???? ENTREPRENEURSHIP

What key lessons has the pandemic taught us on innovation? Companies that have thrived since the outbreak of covid-19 prioritized innovation, rather than simply continuing with business as usual, putting their heads down and hoping to survive, argues a recent Financial Times op-ed. Amid pandemic-fueled disruption, these businesses saw a chance to grow by creating new products and services. We’ve seen multiple examples of this in Egypt, in everything from digital payment facilitation to the explosion of fintech, from a boom in healthtech and infrastructure startups to co-working spaces diversifying their services. And while these companies went about it in their own ways, the FT argues that there are three common lessons that could be learned.

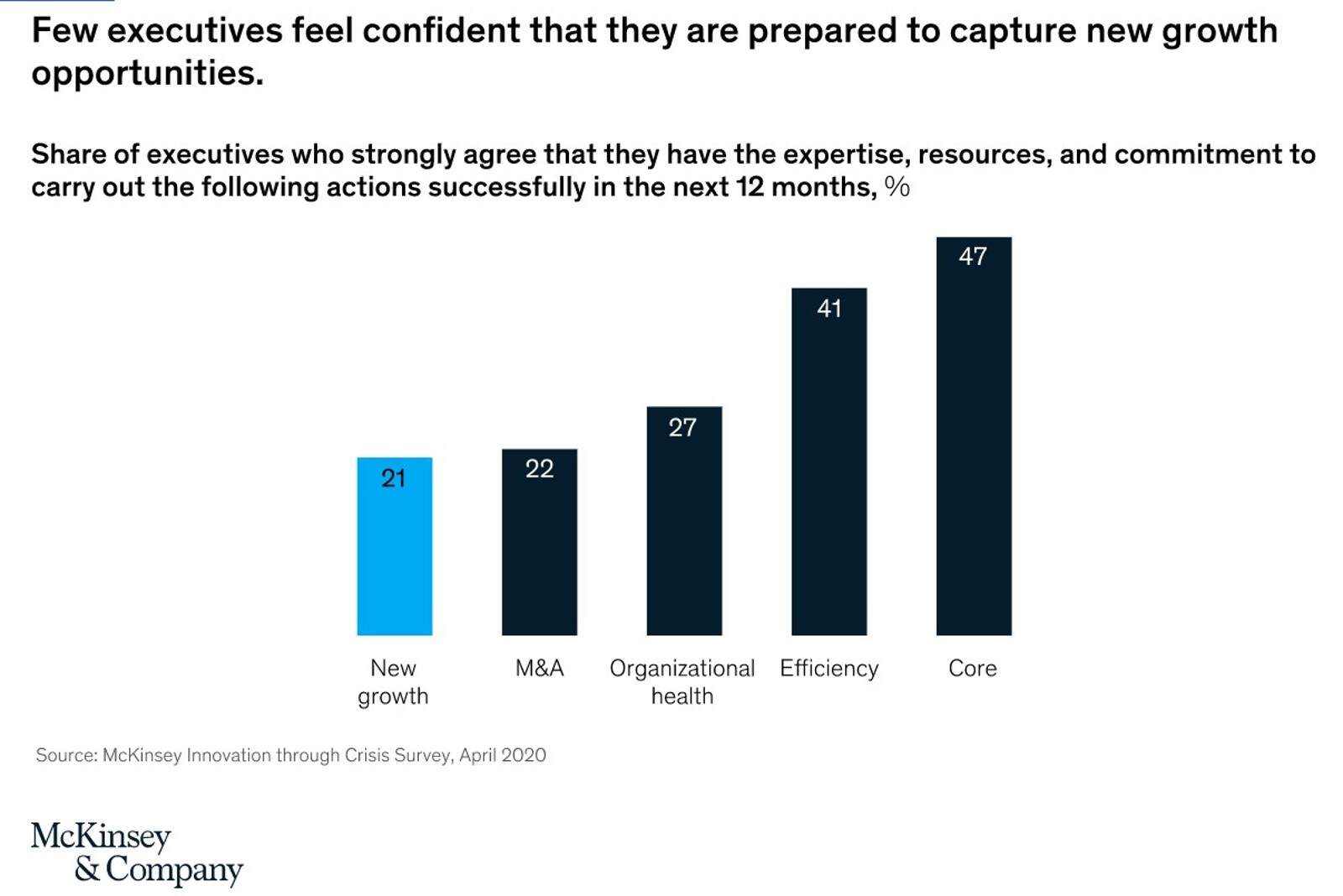

The first key lesson: When crises hit, competitive advantages shift. There’s a strong case for focusing on innovation in a crisis, because competitive advantages change quickly in response to shifting market conditions, notes McKinsey’s Innovation Through Crisis survey. The report surveyed more than 200 organizations across different sectors on their responses to the pandemic.

Innovating out of a tight spot is great — but it isn’t the norm: Of the companies interviewed by McKinsey, even ones that prioritized innovation pre-covid were generally ready to eschew it when the pandemic hit, favoring risk aversion. Only 23% of participants named innovation as a top priority in the midst of covid, compared to 55% pre-crisis.

And execs aren’t confident about getting out of their comfort zone: McKinsey found only 21% of executives interviewed felt prepared to execute new growth strategies in the 12 months following the survey, compared to 47% who felt able to execute their core business.

Forward-looking actions should be prioritized ahead of minimizing risk and shoring up the core business, McKinsey said. These include adapting the core business to meet changing customer needs, identifying and seizing new areas of potential growth, reallocating resources to areas for innovation, and building a strong foundation for post-crisis growth.

A second key lesson: Innovate pre-crisis, not just in the thick of it. Innovation works best when it’s a long-term approach, the FT argues. Companies that innovate before a crisis are more likely to have the organizational structure and talent in place to innovate during one, it adds.

Is this a case of adapt or perish? “Many companies did not innovate in response to the pandemic and have not survived as a result,” noted UPenn professor Serguei Netessine in a Financial Times op-ed last year. The businesses that survived tended to be those where management was “more resourceful in finding new sources of revenues, or reinventing their businesses,” the World Bank noted.

A third key lesson: Innovation doesn’t mean abandoning your existing model: For a business to emerge strong from a recession requires a combination of defensive and offensive moves, noted Harvard Business Review in a recent study. That often means trimming fat in some places in order to make significant investments elsewhere. The purpose isn’t to completely change or reinvent your business, but to look for new avenues of growth. Some business leaders describe this process as “pivoting,” because the businesses “kept one foot on the ground and rotated with the other to twist what they were doing,” the FT says.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

24 February-7 March (Thursday-Monday): Diarna Handicrafts Fair. Cairo Festival City, Cairo.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will

replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.