- Saudi’s PIF snaps up USD 1.3 bn of minority stakes in four state-owned companies + Inflation accelerated in July. (The Big Stories Today)

- US inflation figures come in lower than expected. (The Big Story Abroad)

- Deforestation in the Amazon is fueling the (literal) fire. (For Your Commute)

- Food security is becoming more challenging with soaring global inflation. (Food Security)

- A dramatization of the original Renaissance man. (On the Tube Tonight)

- Introducing the CAF Africa Super League. (Sports)

- Azbakeya Wall Book Fair kicks off. (Out and About)

- Reasons to look forward to the future. (Under the Lamplight)

Wednesday, 10 August 2022

PM — It’s all about inflation

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. It’s a mostly good news kind of Wednesday, with the entry of Saudi sovereign wealth fund PIF getting the ball rolling on its pledged USD 10 bn of investments in Egypt, while inflation figures didn’t extend their brief cool-off last month.

THE BIG STORIES TODAY

KSA makes its grand entry into the state privatization program: The Saudi sovereign wealth fund acquired minority stakes in four EGX-listed companies for a total USD 1.3 bn, according to a Planning Ministry statement. The stake purchases are the first of some USD 10 bn-worth of investments that the Public Investment Fund pledged to Egypt earlier this year as part of KSA efforts to support Egypt’s external position, which has been under pressure from soaring commodity prices and capital outflows.

Inflation accelerates in July: Inflation picked up pace in July after a one-month cool-off in June, with the uptick triggered mostly by a recent hike in fuel prices. Consumer prices in urban areas rose 13.6% year-on-year in July, up from 13.2% in June, data from official statistics agency CAPMAS (pdf) showed. Overall, prices increased on a monthly basis by 1.3%, up from negative 0.1% a month earlier.

THE BIG STORY ABROAD

Inflation is also leading the conversation abroad, with the international business press focusing its attention on slightly lower-than-expected inflation figures coming out of the US. Inflation cooled slightly in the US in July to hit 8.5%, thanks to lower energy costs, according to Bureau of Labor Statistics figures (pdf). Although the cooling inflation is a welcome sign for the US economy, the US Federal Reserve has signaled that it needs several consecutive months of lower inflation figures before it dials back its aggressive interest rate hike plans. The story is on the front pages of the Financial Times, the Wall Street Journal, Reuters, and CNBC.

Meanwhile, China’s headline CPI in July also came in lower than expected, registering 2.7% (0.2 percentage points lower than analysts’ forecasts) despite pork prices recording their highest month-on-month increase, CNBC reports, citing data by Wind Information.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt will begin cutting back on electricity consumption nationwide from next week in a bid to redirect more natural gas towards exports, thus netting additional inflows of foreign currency.

- Another Gulf wealth fund wants a piece of Mopco: Saudi Arabia’s sovereign wealth fund will acquire a stake in the state-owned Misr Fertilizers Production Company (Mopco) through the EGX.

- Kuwaiti insurer wants AIG Egypt: A unit of Kuwait’s largest ins. group has submitted a takeover bid for AIG Egypt to acquire between 75% and 100% of the company at EGP 164.15 per share.

|

???? CIRCLE YOUR CALENDAR-

Ghazl El Mahalla IPO: The retail portion of Ghazl El Mahalla’s mini-IPO will wrap next Sunday, 14 August.

MNHD shareholders have the final word on SODIC takeover bid: Madinet Nasr Housing and Development will hold a general assembly meeting on Tuesday, 16 August, to decide whether to allow SODIC to conduct due diligence ahead of a potential takeover.

Interest rates: The Central Bank of Egypt will meet to discuss interest rates next Thursday, 18 August.

National Dialogue: The board of trustees overseeing the National Dialogue will hold its next meeting on 27 August. On the agenda: Choosing the rapporteurs for all of the committees and subcommittees of the social, political and economic tracks, and preparing the agenda and topics of discussion for the dialogue.

☀️ TOMORROW’S WEATHER- Temperatures in Cairo will hit 38°C tomorrow during the day before falling to 24°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Surprise, surprise, burning down trees in the world’s biggest rainforest is not great for the environment. Despite pledging to stop its deforestation drive by 2030, Brazil saw the number of fires recorded in June in its Amazon rainforest hit a 15-year high, before they even reach their annual peak, Reuters reports. Farmers start the fires by cutting down forests and burning the trees, with the burning season typically escalating in August and September when the dry season is at its height. Brazilian forests have gotten worse since 2019 when the country welcomed President Jair Bolsonaro into office, who came bearing weaker environmental protection. And all that comes worsening our climate crisis, with the rainforest destruction making up about 9% of human-caused CO2 emissions.

A (small) sigh of relief from supply chains: After the “perfect storm” of negative events, between covid-19 and the Suez Canal’s Evergreen saga, supply chains are finally recovering, economics reporter Valentina Romei writes for the Financial Times. Case in point: Shipping prices have almost halved, with the average cost of moving a 40-foot metal box dropping 45% from its peak last year. Supply chain issues have caused manufacturing delays, as well as significant increases in shipping costs, all of which have impacted the cost of production across various sectors. Now that supply chain bottlenecks are easing, “the system of international trade is dynamic and can recover.”

But don’t get too optimistic, just yet: With Christmas and the accompanying rush of orders fast approaching, there are worries that carriers will not be able to cope and we’ll go back to supply chain bottlenecks once again. “What we’ve seen so far is only a step in that direction, but [some] disruptions are likely to be with us, for months ahead, maybe years,” one economist said.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Up for a visual treat? Historical drama Da Vinci’s Demons promises to deliver, following the story of Leondaro da Vinci (Tom Riley) during the Renaissance in Italy in 1477. Da Vinci is portrayed as a genius battling his own ideas and imagination in a dramatic kindling, interlaced with inventing and solving crimes. There’s a lot of politics in the show too, as Da Vinci becomes involved in a political scheme to seize Florence while working for the House of Medici as he tries to track a spy providing information to the Catholic Church and the Pazzi family. While highly fictionalized, the series takes a dramatic swing at the original Renaissance man. You can stream the show’s three seasons on Disney+ or watch the trailer here (watch, runtime: 2:01)

⚽ All eyes on UEFA Super League: UEFA Champions League title holder Real Madrid goes head to head against Europa League title holder and Germany’s Eintracht de Frankfurt at 9pm.

And because anything is possible in football: Al Ahly fans are hanging on by a thread when the Red Devils face Port Said’s Al Masry at 9pm. Rivals Zamalek victored yesterday against Misr Lel Makassa, bringing the point difference with Al Ahly to 13 points. The White Knights now must come out on top in two games to be crowned holder of the Egyptian Premier League for a second consecutive season.

In other football-related news, say hello to the CAF Africa Super League: As it looks to “change the face and competitiveness of CAF and African football,” the Confederation of African Football (CAF) announced the continent’s Super League kick-off in August 2023, according to a press release. The tournament will run for 10 months until May 2023 with 197 games, and includes 24 teams from over 16 African countries, according to a video announcement (watch, runtime: 3:52). The total prize money of the CAF Africa Super League will be USD 100 mn, with the title holder receiving USD 11.5 mn.

Good news for all: CAF plans to pay each member association USD 1 mn annually from the new tournament’s funds. They also intend to allocate USD 50 mn from the funds for youth and women’s football development and other competitions.

Also in EPL tonight: Smouha v Future and Arab Contractors v Gouna at 6:30pm.

???? OUT AND ABOUT-

(all times CLT)

Zamalek’s Al Masar Gallery is hosting its annual Contemporary Views exhibition, showcasing the past and recent works by some of the gallery's most prominent artists including Mahmoud Said and Tahia Halim. The exhibition runs until 29 September.

SafarKhan Art Gallery is hosting its summer exhibition, Collage, bringing us the works of some of Egypt’s up and coming artists. The exhibition is running until 14 September.

It’s Karaoke Night at Room Art Space New Cairo: Grab a friend and sing the night away.

Calling all bookworms: The Azbakeya Wall Book Fair kicked off today and is set to run for 15 days. The annual open market sees books being sold for as little as EGP 2, with enough options to ensure there’s something for everyone.

???? UNDER THE LAMPLIGHT-

With bleak headlines seemingly becoming a fixture of our information consumption, an uplifting read is very much in order. Johan Norberg’s Progress: Ten Reasons to Look Forward to the Future, published in 2017, sheds light on how far humanity has come in tackling some of the greatest problems it has faced and argues that today, “we’re living in a golden age,” as we’ve reached the highest living standards in history. Each of Norberg’s ten reasons is outlined in chapter which include food, sanitation, life expectancy, poverty, and violence and are each backed up with research, facts and figures that back up his notion that people are wealthier and healthier than during any other time period in history.

???? GO WITH THE FLOW

The EGX30 was essentially flat at today’s close on turnover of EGP 1.01 bn (19.1% above the 90-day average). Regional investors were net buyers. The index is down 16.6% YTD.

In the green: Alexandria Container and Cargo Handling (+7.2%), CIRA (+4.7%) and Abu Qir Fertilizers (+1.4%).

In the red: e-Finance (-3.6%), Cleopatra Hospitals (-3.3%) and Palm Hills (-2.5%).

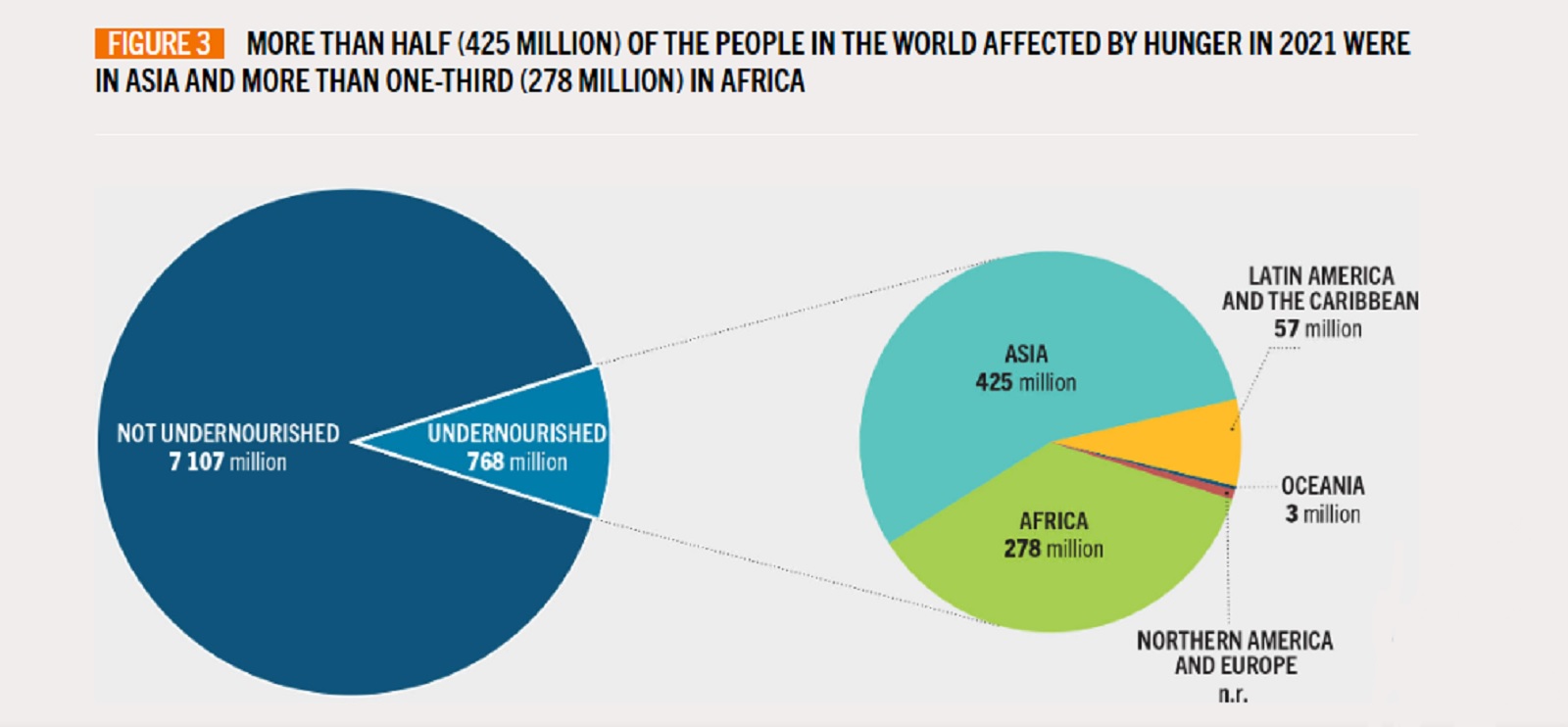

???? FOOD SECURITY

World hunger worsened in 2021 and we’re falling way behind on our goal to eliminate it by the end of the decade. The number of people affected by hunger globally rose to some 828 mn in 2021, clocking an increase of about 46 mn people since 2020 and 150 mn since the outbreak of covid-19, according to a report from the UN Food and Agriculture Organization (FAO) on the state of food security and nutrition. Worsening economic conditions around the globe and lost income resulting from the global disruptions caused by covid-19 and the war in Ukraine has made access to more nutritious food more difficult (and more expensive) than at any time in the previous seven years — for many middle and lower middle income countries around the world the situation is even worse.

Some 670 mn people will still be affected by hunger by 2030, the report predicts. By the end of the decade, some 8% of the global population will still be coping with some form of hunger, even if a global economic recovery gets underway, the report explains. “With eight years remaining to end hunger [before the UN Sustainable Development Goal deadline], food insecurity and all forms of malnutrition the world is moving in the wrong direction,” the report says.

The challenge of food security isn't equally shared and some countries will bear a much heavier burden than others: Despite a sharp rise in moderate to severe food insecurity globally in 2020, those same levels remained mostly stable throughout 2021. Severe food insecurity, however, grew 2.4 percentage points from 2019 to 2021 to 11.7% of the global population, indicating that those already struggling with food security face an increasingly worsening situation.

Much of that struggle is concentrated in Africa: The number of people affected by hunger in Africa is expected to substantially grow from almost 280 mn in 2021 to some 310.7 mn people by 2030, according to the report. In the year preceding the report’s publication last month, moderate or severe food insecurity increased most sharply in Africa, which was already the region home to the highest levels of moderate and severe food insecurity, reaching 34% in 2021 up from 30% in 2020. During this same period, the global average of moderate or severe food insecurity fell to 29.3% from 29.5%.

The pandemic and the war in Ukraine have had a particularly harsh effect on food security globally: The outbreak of covid-19 alone has already been estimated to be responsible for leaving 78 mn more people affected by hunger by 2030 than in a scenario where the pandemic hadn’t taken place, the report finds. The war in Ukraine, which hadn’t yet been accounted for in the FAO’s data for the 2022 edition of their report will likely “have multiple implications for global agricultural markets through the channels of trade, production and prices, casting a shadow over the state of food security and nutrition for many countries in the near future,” the report said.

But the bigger picture is that there are a bunch of reasons why we’re doing so terribly on eliminating hunger: The combination of extreme weather events stemming from climate change, armed conflict, economic crises and pre-existing inequalities are the main drivers of food insecurity globally, the report explains.

In low and middle income countries who rely on imports for a good chunk of their calories, the situation is tenuous: Net food importers like Egypt — which, for example, relied on Russia and Ukraine for over 80% of its imported wheat — have in the past several been feeling the bite of the war. The slowdown in grain shipments and skyrocketing prices have forced Egypt to find new import markets and rely more on local farming output to ensure our supplies of the staple commodity were not disrupted. The consequence of the disruption has been brutal for state budgets which saw an extra EGP 15 bn added to the country’s import bill in the last quarter of FY2021-2022 and could see an extra USD 10.2 bn in the next fiscal year. But still, despite the government’s attempts to shoulder a portion of these costs, people have been increasingly squeezed by the rising costs of food.

Even with a dip in food prices, inflation is still weighing on us: Although food prices fell for the fourth consecutive month in July as the costs of grains and vegetable oil dropped, food prices remain incredibly high by historical standards. July’s reading was the sixth highest since the FAO index began in 1990 and is 13% higher than a year earlier in July 2021.

There are still pathways to changing course on this trajectory: ”In low-income countries but also in some lower-middle-income countries where agriculture is key for the economy, jobs and livelihoods, governments need to increase and prioritize expenditure for the provision of services that support food and agriculture more collectively,” the report says. Part of that means adjusting fiscal subsidies so that they target consumers rather than producers, the report explains. Instituting border measures and market price controls as well as expanding public support for agriculture globally would also help make healthy diets more affordable worldwide.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

AUGUST

Late July-14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

August: Sharm El Sheikh will host the African Sumo Championship.

11 August (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

14 August (Sunday): Retail portion of Ghazl El Mahalla IPO ends.

14 August (Sunday): The government hosts public consultations on its state ownership policy document with finance and ins. players.

16 August (Tuesday): The government hosts public consultations on its state ownership policy document with wood manufacturers.

16 August (Tuesday): MNHD’s general assembly meeting to decide whether to allow SODIC to go ahead with due diligence on its takeover bid.

18 August (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

23 August (Tuesday): The government hosts public consultations on its state ownership policy document with chemical producers.

25 August (Thursday): Second Egypt and UN-led regional climate roundtable ahead of COP27, Bangkok, Thailand.

25 August (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

25-27 August (Thursday-Saturday): Jackson Hole Economic Symposium.

27 August (Saturday): The National Dialogue board of trustees holds its fifth meeting, which will set the agenda for the dialogue and choose rapporteurs for the involved committees.

28 August (Sunday): The government hosts public consultations on its state ownership policy document with mining and petroleum refining players.

30 August (Tuesday): The government hosts public consultations on its state ownership policy document with minerals players.

31 August (Wednesday): Late tax payment deadline.

31 August (Wednesday): Deadline for qualifying companies to submit offers to manage and operate a soon-to-be-established state company for EV charging stations.

31 August (Wednesday): Submission deadline for fall 2022 cycle of EGBank’s Mint Incubator.

31 August (Wednesday): Beltone convenes its general assembly to restructure the board following the change of ownership.

SEPTEMBER

September: Naval Power, Egypt’s first naval defense expo

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

September: Egypt will host the second edition of the Egypt-International Cooperation Forum (ICF).

1 September (Thursday): Credit hikes for ration card holders will come into effect.

1 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

1-2 September (Thursday-Friday): Third Egypt and UN-led regional climate roundtable ahead of COP27, Santiago, Chile.

4 September (Sunday): The government hosts public consultations on its state ownership policy document with electricity players.

6 September (Tuesday): The government hosts public consultations on its state ownership policy document with building and construction players.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Qubba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

8 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

11 September (Sunday): The government hosts public consultations on its state ownership policy document with accommodation and food services players.

13 September (Tuesday): The government hosts public consultations on its state ownership policy document with sports industry players.

11-13 September (Tuesday-Thursday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

15 September (Thursday): The government hosts public consultations on its state ownership policy document with water and sewage utilities players.

15 September (Thursday): Fourth Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20 September (Tuesday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.