- Eastern Company confirms ongoing tender that would (kind of) end its tobacco monopoly. (Speed Round)

- Egypt fuels 2020 MENA e-commerce boom. (Speed Round)

- It could be bad news for emerging markets when the IMF updates its World Economic Outlook next month. (Speed Round)

- Who are the foreign buyers in the EGX? Then vs now. (Go with the Flow)

- What to expect from the WTO’s new director-general. (What’s Next)

- Where to take Mom to eat tonight. (Eat this Tonight)

- Your face is not your own — why you’re right to be creeped out about unregulated facial recognition technology. (For Your Commute)

- Watch Otherhood on Netflix tonight in honor of Mother’s Day. (On the Tube)

Sunday, 21 March 2021

EnterprisePM — Egypt fuels 2020 MENA e-commerce boom

TL;DR

WHAT WE’RE TRACKING TONIGHT

Happy Mother’s Day to all of the moms out there. Y’all are amazing, and we hope all your loved ones — spawn and spouse alike — remembered to do something special for you today.

(North American readers: Don’t sweat it, you’re cool. It’s _Egyptian_ Mother’s Day. Moms in Canada and the United States will be celebrated on Sunday, 9 May.)

HAPPENING NOW- The Senate is discussing tougher penalties for female genital mutilation (FGM) in plenary sessions today and tomorrow. Lay persons caught performing the procedure could face up to seven years in prison if a victim is permanently disabled and a decade in the case of a death, according to Youm7. Medical professionals found guilty of FGM would face between 10-15 years in prison and will be stripped of their medical license. You’ll also face a term in prison if you’re caught promoting or encouraging the practice. The Senate will also be discussing a draft law that would set up a standards and accreditation body for the education industry as well as another bill that regulates the handling of cotton crops, according to Ahram Online.

CATCH UP QUICK on the top stories from this morning’s edition of EnterpriseAM:

- Eastern Company’s monopoly on cigarettes could go up in smoke, but industry players aren’t yet lining up to bid on a new license that would require them to give a 24% stake to the state-owned outfit. (We have a followup in this afternoon’s Speed Round, below.)

- It’s all vaccines, all the time: The first made-in-Egypt vaccine against covid-19 is about to enter clinical trials, some 250k people could be jabbed this week, and Europe has cleared AstraZeneca of accusations that it causes blood clots.

- The central bank left interest rates on hold as we stare down the possibility of a commodities supercycle. The MPC noted that “leading indicators are gradually recovering to their pre-pandemic levels.”

GLOBAL BUSINESS NEWS is quiet today, as is often the case on a Sunday afternoon. CNBC and Bloomberg are both leading with news that Saudi Aramco will push ahead with a USD 75 bn dividend despite an “earnings rout” that saw its bottom line slump 44%. The Wall Street Journal is leading with news that Blackstone is going to shift its posture to invest in companies with “big growth prospects” rather than its traditional focus on rooting out undervalued companies.

|

???? CIRCLE YOUR CALENDAR-

The CIB PSA Black Ball Open 2021 men’s squash is running until Thursday, following the completion of the women’s league last Thursday. Some 48 men will compete for a USD 350k purse, evenly split with the women in what is the PSA World Tour’s first event of 2021. You can stream the event live on SquashTV or the official Facebook page of the PSA World Tour (excluding Europe and Japan). You can also snag tickets online to attend in person at the Black Ball Sporting Club in New Cairo.

KUDOS- Egypt’s Nour El Sherbini won the women’s squash league, after beating USA’s Amanda Sobhy on Thursday.

Prime Minister Mostafa Madbouly will be visiting Amman this Tuesday to attend a meeting of the Joint Jordanian-Egyptian Higher Committee, Jordan’s news agency Petra reported.

The Real Gate real estate exhibition will kick off on Thursday and run until Saturday at the Egyptian International Exhibition Center.

The Spring Flowers Exhibit (Ma3rad El Zohoor) is currently taking place at Orman Botanical Garden in Giza. More than 200 exhibitors have set up shop to sell flowers, plants, agricultural products, and gardening equipment. The exhibit runs through 13 April.

The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo) is taking place from 17-20 June at the Cairo International Conference Center. The second edition of the expo will feature 48 exhibitors and 172 brands from across the region.

AUC Press’s Mad March book sale will be ongoing for the rest of the month. The sale is open to the general public every day from 10am–6pm CLT at AUC Tahrir Bookstore & Garden.

???? FOR YOUR COMMUTE-

Are you a watch nerd? Or want to dip your toes in that pool? Go check out The iconic watches that inspired Apple Watch faces. It’s a super-nerdy dive that’s still accessible to newbies who don’t know the difference between a Submariner, a Blancpain and a Speedmaster. Bonus: It has plenty of links if you want to go further down the rabbit hole.

Your face is not your own: Remember how the UAE is piloting a program that lets you land in the Emirates armed with nothing more than your face (provided you’re registered in a bunch of local databases? That’s just the tip of the iceberg — and at least it’s based on informed consent. Then there’s a company called Clearview, which has scraped the internet for images you’ve put on Facebook, LinkedIn Instagram, Twitter and elsewhere to create a massive database of human faces — including yours and your family’s. It’s already being used by US law enforcement and intelligence agencies. And it wins in a number of upcoming court battles, the stakes are nothing less than “giving companies the ability to track us as pervasively in the real world as they already do online.”

Yaphet Kotto has died. The iconic actor is known for his turn as bad guy Dr. Kananga / Mr. Big in the James Bond film Live and Let Die as well as for his turn in Alien. But if you’ve never seen him play Lt. Al Giardello on the crime drama Homicide: Life on the Street? You’re missing out on one of the best performances (alongside Andre Braugher) in one of the late 20th century’s best television shows of any genre. The New York Times’ obit is solid.

Supply chain woes are getting worse, with Samsung ringing the bell last week, Toyota and Honda saying they would halt production at plants in North America, and a fire at Japanese semiconductor giant Renesas Electronics stalling production for at least one month. Other than the global chip gap, the world is also experiencing shortages in petrochemicals and manufacturing, alongside pandemic-related problems and crippling weather in places like the US. The disruptions highlight how several forces are coming together to squeeze the world’s supply chains and ultimately cause cost increases and delays for numerous industries.

Fortune magazine agrees with us: Like it or not, vaccine passports are coming soon to an airport near you. Canada is mulling it, Europe could launch them as early as this summer, and China and Singapore are ahead of everyone else. Fortune talked with a consultant who’s advising Asian governments and businesses on “vaccine passports and other digital health solutions.”

???? ON THE TUBE TONIGHT-

(All times in CLT)

The ultimate Mother’s Day film for today: Otherhood on Netflix follows longtime friends Carol (Angela Bassett), Gillian (Patricia Arquette) and Helen (Felicity Huffman) who feel forgotten on Mother’s Day and embark on a roadtrip to reconnect with their adult sons. The film perfectly depicts a mother’s love and how they often have to redefine their relationships with their children, friends, spouses, and themselves as the years pass by.

Other classics you can watch on Netflix tonight: Make it a throwback movie night today with films including La La Land, Notting Hill, or Little Women.

The English Premier League’s gameweek 29 is coming to a close today, with West Ham set to play Arsenal at 5pm while Aston Villa will go head-to-head against the Spurs tonight at 9:30pm.

La Liga has a couple of reasonably anticipated matches on today, the most important of which are Atletico Madrid against Alaves at 7:30pm and Real Sociedad against Barcelona at 10pm. That last one is the pair’s fifth match against each other as they try to catch up to Atletico at the top.

Juventus will hit the field against Benevento soon in Serie A, with the match to start at 4pm. Meanwhile, you can also catch Fiorentina vs. Milan tonight at 7pm and Roma vs. Napoli at 9:45pm.

Chelsea and Sheffield United have just about started their match in the FA Cup and will be followed by Leicester City and Man United at 7pm.

???? EAT THIS TONIGHT-

Mother’s Day dinners you can take mama to today: If you hurry you can still catch Eish and Malh’s Mother’s Day Dinner with live music, starting at 5pm. Meanwhile, Piazzini in New Cairo is hosting a Mother’s Day dinner complete with classic Egyptian songs played live while you eat. Dinner service starts at 8pm today and we recommend you treat your mom to their lasagna. At the Hilton Zamalek, Mom eats tonight without charge at any of the hotel’s restaurants as long as she’s accompanied by three or more people. Kempinski Nile Hotel has a similar offer for two adult guests taking their mama out for lunch or dinner at the Blue Restaurant. Crave is also offering a photoshoot for mothers and their loved ones at City Centre Almaza, The Waterway, Arkan Plaza, Mall of Arabia, and The Park MOA today.

???? OUT AND ABOUT-

(All times in CLT)

The French Institute in Cairo has launched Micro-Folie, a gallery showing around 500 art pieces from major French and international institutions. Visitors to the gallery will be given tablets synchronized with the art displays to explain the details of the work — and allow visitors to interact with the work in the case of digital art. You can drop in for a visit on Fridays and Sundays from 2-4pm and Wednesdays from 4-6pm.

AUC theatre performance Msh Zanbek is hitting the stage starting tomorrow with the plays exploring the issue of [redacted] harassment from multiple perspectives: family and couple, bystander, victim and perpetrator, male and female, power and incapacity. Msh Zanbek will show at AUC New Cairo tomorrow, Tuesday, and Wednesday at 5pm as well as at AUC Tahrir next Tuesday and Wednesday (30-31 March) at 5pm. The play features over 50 AUC students and alumni working as directors, playwrights, actors, designers and managers.

???? TOMORROW’S WEATHER- You can expect dry, hot and dust-laden weather to stay with us until Tuesday, the national weather service says. We’re looking at daytime highs of 35°C and nighttime “lows” of 25°C tomorrow with a 30% chance of rain in the capital city, our favorite weather app forecasts.

SPEED ROUND: COMPETITION WATCH

Eastern Company confirms ongoing tender that would (kind of) end its tobacco monopoly

Tobacco monopoly Eastern Company has confirmed we’re about to see a new competitor: Several companies were invited to bid to become Egypt’s second major tobacco company in a tender issued by the Industrial Development Authority (IDA), state-owned cigarette manufacturer Eastern Company said in a filing to the EGX (pdf). The statement confirms local press reports over the weekend that the government is looking to potentially end Eastern’s decades-long grip over the industry by issuing a license to a competitor.

Terms and conditions of the tender protect Eastern’s market share by preventing the new player from producing cigarettes in the Cleopatra brand mass price category, which accounts for 98% of Eastern’s revenues, reads the EGX disclosure. “Accordingly, this will guarantee that there is no competitive threat,” it adds.

Under the terms of the tender, Eastern will also end up owning 24% of the planned company, and the new company would be forced to price its popular brands 50% higher than Eastern’s, the statement confirmed.

Giving their client-turned-competitor a chance to leap-frog into new products such as e-cigarettes appears to be what Eastern fears most, according to the statement. None of Eastern’s existing manufacturing agreements cover next-generation tobacco products, which the new license will cover, meaning its clients could opt to manufacture non-traditional products like e-cigarettes and the like at the competitor’s facility. Those manufacturing agreements are important, Eastern’s CEO Hany Aman told Enterprise, despite a series of “operational efficiency improvements” that have made it less dependent on contract manufacturers.

Eastern is touting the benefits of a duopoly. “Competition is always in the consumer's benefit, and at the international level it raises Egypt's rating [from investment rating agencies],” the company said. As we noted this morning, the tender’s conditions were criticized by major tobacco distributors who would like to get the chance to manufacture. They argue that, because only one license is up for grabs, the winning company would gain an unfair advantage.

SPEED ROUND: E-COMMERCE

Egypt fuels 2020 MENA e-commerce boom

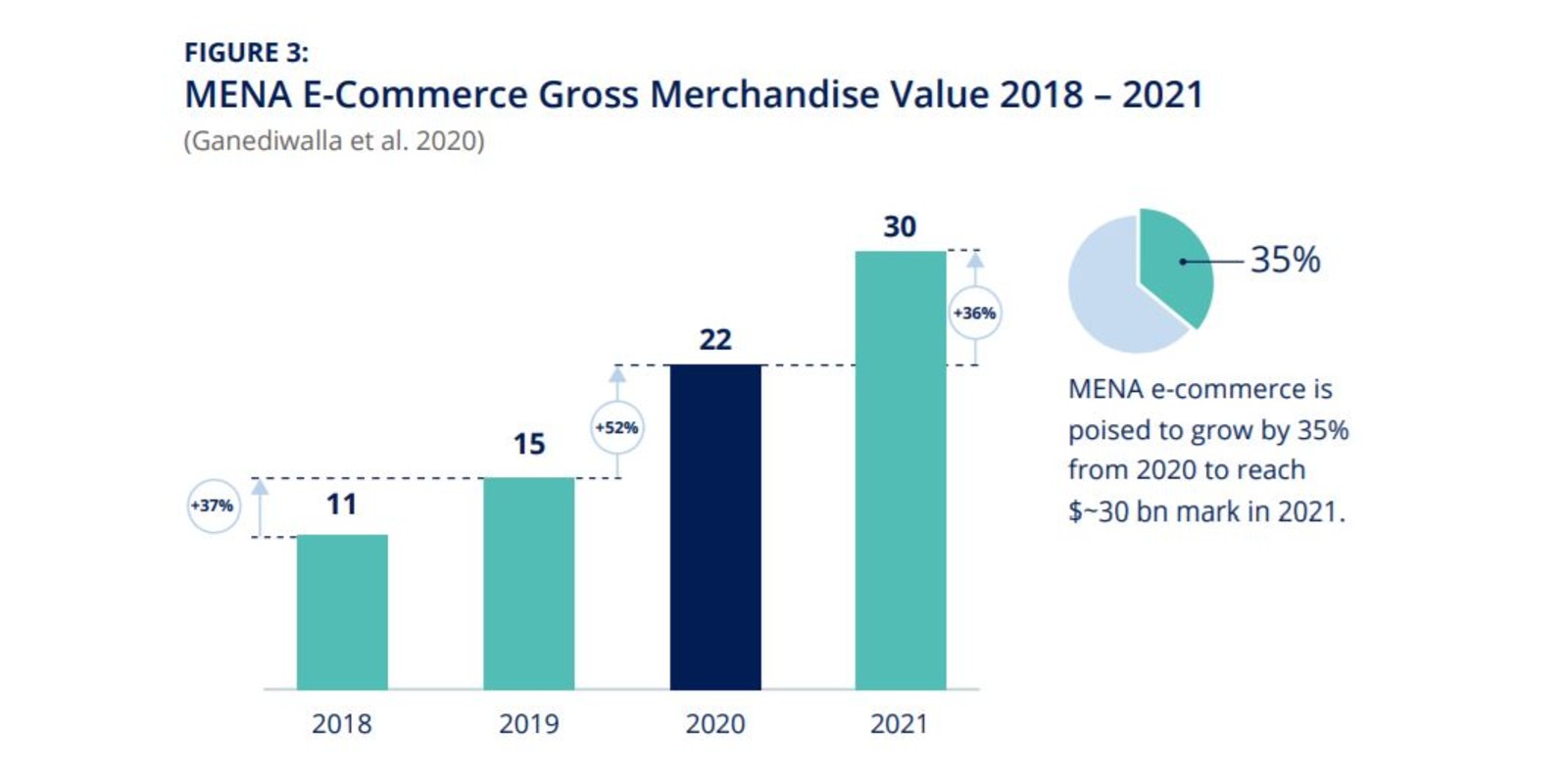

Egypt, Saudi Arabia and the UAE led a boom in e-commerce in the MENA region last year, as the covid-19 pandemic forced consumers online, according to a new study published last week. The value of the region’s e-commerce sector surged 52% to reach USD 22 bn by the end of 2020 — 80% of which came from Egypt, Saudi Arabia and the UAE, Wamda and MIT’s Legatum Center for Development and Entrepreneurship found.

Amazon’s Souq and online marketplace Noon dominated the sector, accounting for more than 50% of the market share in MENA. The two companies, alongside smaller operators such as Talabat (previously Otlob), built the digital and physical infrastructure necessary to operate in the region, boosting investor confidence in regional e-commerce and marketplace startups, the report said.

The e-commerce boom created a ripple effect across logistics and fintech: The increase in online shopping caused growth in the delivery and online payments sectors, with investments in fintech across the region more than doubling to USD 78 mn during the year. The spread of Egypt’s Fawry — which became the first Egyptian company to achieve a market cap of USD 1 bn last year — has enabled the unbanked population to more easily make online transactions, while the last-mile delivery sector grew in tandem to satisfy increased demand, accelerating the adoption of new technologies to improve logistical infrastructure.

The e-commerce space had already been on the rise pre-pandemic: Some USD 665 mn was invested in e-commerce startups in MENA from 2016-2019, accounting for almost 20% of the total amount invested in startups during this period.

Today, 80% of young Arabs shop online frequently, compared to 71% in 2019, with half of MENA’s youth population saying their online shopping became more frequent after the pandemic, the Wamda report said.

The trend is set to continue this year: MENA e-commerce is poised to grow by 35% y-o-y in 2021 to reach around USD 30 bn — double its value in 2019. Some 47% of consumers in the region expect to shop online more frequently in 2021, with almost 40% of Egyptian consumers saying the same.

A new normal: Accelerating e-commerce growth in the region should take place in a way that can “encourage and strengthen regional cooperation and further develop government policies for online purchases and supply,” the report said. Countries should implement policies that enable more digital payment solutions in cross-border transactions and reinforce trust between consumers and firms, as well as supporting startups through credit facilities and incentives. The region should also aim to set up a unified customs market that will provide startups with a larger capacity to scale while promoting investor confidence.

SPEED ROUND: MACRO

Recovery may not trickle down to EMs -IMF

The IMF may update its next World Economic Outlook to reflect signs of a stronger global economic recovery than the 5.5% GDP growth it forecast in January, IMF First Deputy Managing Director Geoffrey Okamoto said in a speech to the China Development Forum, according to Reuters. Okamoto appears to be co-signing on the Biden administration’s USD 1.9 tn covid-19 stimulus, hinting that the upgrade would in part happen because of the move.

What’s the WEO? The IMF’s World Economic Outlook is released in April and October with occasional updates in between. It’s the most closely watched barometer of what to expect from global growth and the macro trends that drive economies. The next WEO is due out in April.

But it’s not looking good for EMs, with Okamoto warning of “worrying signs” of a widening gap between advanced economies and emerging markets.The fund projects that cumulative income per capita will be 22% lower in developing countries (excluding China) between 2020 and 2022 compared to expected levels had there not been a pandemic due to these risks, Okamoto added.

A large part of it is vaccine diplomacy: Among the biggest risks Okamoto highlighted in his speech is the lack of access to vaccines in developing countries compared to advanced economies. “It was unclear how long the pandemic would last and access to vaccines remained very uneven, across both advanced and emerging economies,” he says.

Fiscal spending in 2021 would be constrained in these countries as a result, he warned, with some countries having little scope to boost spending to mitigate the pandemic’s economic impact, especially low-income countries with high debt levels. “Tighter financial conditions could exacerbate vulnerabilities in countries with high public and private debt,” he said, citing recent increases in bond yields garnered by market expectations of an earlier withdrawal of monetary stimulus.

GO WITH THE FLOW

Who are the foreign buyers in the EGX? Then vs now: In the great March selloff of 2020, the EGX saw the sharpest single-day decline since 2012, falling 9.3% to catch up with global equity markets, which tumbled the previous week as the covid-19 pandemic put travel bans and lockdowns into effect across the globe. Foreign institutional investors have largely been sitting on the sidelines of the market ever since, leaving the market to be dominated by retail investors.

IN THE HOT SEAT TODAY– Renaissance Capital’s head of MENA research Ahmed Hafez, Beltone Securities’ senior VP of institutional sales Mohammad A. Waked.

Historically, the biggest buyers of Egyptian equity stories are the frontier market funds, which “at one point in time had 10-11% invested in Egypt, which is sizable for an off-benchmark market,” says RenCap’s Hafez. This reflects the “squeeze” that’s happening to frontier markets as more are upgraded to emerging market status — and the limited investment opportunities for frontier fund managers, he adds.

But even the frontier market funds were among the biggest to exit in the March selloff, sending their exposure to Egypt down to lows of 7-8%, he says. It’s natural in a risk-off.

A pre-covid lull made worse: “Most foreign investors were not increasing their positions in 2019,” says Hafez. By the end of 2020, based on a trend indicator of the net international investment position number against the percentage of total market cap, “we were looking at 5-6 year lows of foreign ownership in the market.” But take this with a grain of salt, he says, “as it’s not a proxy of the actual overall ownership in the market, as it doesn’t take into account GDRs, and ownership past a certain threshold are calculated as foreign direct investment.”

“The foreigners who didn’t exit last March are not currently active,” says Beltone’s Waked. “When they take positions now, they hold them for shorter periods of time,” he adds. “We had captured decent inflows for Ibnsina Pharma, but they immediately cut their losses during the issues over 3elagi,” he adds, citing the Pharmacist Syndicate boycott of Ibnsina Pharma in November over its acquisition of a 75% stake in the pharma app.

Egypt is on the fringe of global emerging-market funds, says Hafez, by virtue of Egypt’s 0.1% weight in the MSCI EM index. And many investors who do take positions in Egypt are simply buying CIB as a proxy for the wider market, he adds.

Appetite for commodity-based names improved only relatively in 1Q2021, but primarily among local investors, and to a lesser extent in GCC institutions, says Waked. Foreign appetite for two of the sector’s biggest names has been muted: ElSewedy Electric could be bumped from the MSCI EMs index by Fawry, while Abu Qir Fertilizers isn’t about to offer another stake soon as it looks to get a new new fair value report.

“The consumer and traditional banking sectors are seeing less enthusiasm in favor of the penetration story,” says Hafez, citing fintech, education, and healthcare among the underserved industries.

That said, “early signs are positive” that the foreigners are coming back, based on the low level of ownership, the high valuation gap between MSCI EM and Egypt, and inflows early in the year, says Hafez, who argues this could spill over to regional investors as well.

African funds, even in most dire times, maintained “significant” exposure to Egypt, he adds, citing Egypt’s attractiveness relative to other African markets, despite any economic issues Egypt was facing pre-EGP float. What’s more, sizeable South African funds have a mandate to make minimum commitments to African equities outside South Africa, effectively channeling AUM to Cairo, Nairobi and Lagos.

Ultimately, only a wave of IPOs will change the stocks foreign investors are looking at, says Beltone’s Waked. “For the big players, the issue remains a lack of investment options that qualify for mandates from a liquidity perspective,” says RenCap’s Hafez.

The EGX30 fell 1.1% at today’s close on turnover of EGP 696 mn (52.8% below the 90-day average). Regional investors were net sellers. The index is down 0.4% YTD.

In the green: Eastern Co. (+2.0%), Orascom Investment (+1.6%) and Orascom Financial (+1.0%).

In the red: GB Auto (-5.2%), Ibnsina Pharma (-4.7%) and Heliopolis Housing (-4.2%).

ON THE HORIZON

What to expect from the WTO’s new director-general

Ngozi Okonjo-Iweala’s World Trade Organization: In a year of travel and trade disruptions, the World Trade Organization’s (WTO) role has been increasingly scrutinized. Many have questioned whether the organization can remain effective amid a rise in protectionism (most recently manifested in the vaccine protectionism hampering global rollouts) and the increasing weaponization of trade by the world’s two most powerful countries. Created in 1995 to oversee trade rules among nations, the WTO suffered a crisis of leadership after its director-general, Roberto Azavedo, stepped down last year, leaving the organization leaderless — until the election of Joe Biden to the US presidency paved the way for the appointment of Nigerian economist Ngozi Okonjo-Iweala in February.

New face, new life? Okonjo-Iweala is the first woman, and first African, to head the WTO, and her appointment was heralded by some as a chance to breathe new life into the organization. With all eyes on her as she takes the helm, key issues she is expected to move on include:

#1 – Getting the appellate body back on track: The WTO’s dispute settlement system has been paralyzed since the Trump administration vetoed the appointment of new members to its vacant seats, claiming that the seven-member body’s rulings are routinely harmful to US interests. “A refreshed WTO must find solutions to the stalemate on disputes settlement,” Okonjo-Iweala said during a speech at a conference before her appointment.

A key goal will be appointing new adjudicators so it can accept new appeals and issue legally binding decisions on international trade disputes. Though Trump’s is not the only US administration, historically speaking, to have blocked appointments to the appellate body, the Biden administration may prove more amenable to a compromise. Okonjo-Iweala has also referenced “updating the rulebook” for the body, which may imply that she intends to change the mechanism whereby one country can block the functioning of the dispute settlement process altogether.

#2- Holding China to account: China’s refusal to adhere to some requirements of the WTO (which it joined in 2001) has been a sore spot for members, particularly the US, whose representatives have claimed the WTO has let China get away with intellectual property theft when it comes to US tech. China’s high tariffs and other non-tariff barriers have meant that some sectors of the economy are still insulated from international trade and competition, contravening WTO rules.

Okonjo-Iweala has implied that she will be taking a softer approach than some would hope on China’s non-compliance, saying that she will ensure all members feel their balance of rights and obligations are fair, implying she doesn’t plan to push very hard on China to adhere to the WTO’s policies. On curbing sanctions between the US and China, Okonjo-Iweala said, “it is very clear that both the US and China have been helped by the multilateral trading system in the past,” and that her approach will involve reminding both sides of shared trade benefits and listening to China’s grievances.

#3- Ensuring the unhindered movement of vaccines and medicines: As the former chairperson of vaccine alliance Gavi, ensuring the movement of vaccines and medicines will be one of Okonjo-Iweala’s top priorities. “In the longer term we have to make sure we have an open, flexible trading system that allows imports or exports of these medicines and medical supplies and vaccines to countries that cannot manufacture them,” she said. In another sense, helping economies bounce back from the effects of covid-19 by using trade as an instrument of economic recovery is also on Okonjo-Iweala’s roster.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

23 March (Tuesday): AUC Women on Boards Observatory event to launch 2020 annual monitoring report.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

6 April (Tuesday): French Chamber of Commerce and Industry in Egypt working breakfast with Sovereign Fund of Egypt CEO Ayman Soliman.

7 April (Wednesday): British-Egyptian Business Association (BEBA) webinar on digital banking and fintech.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.