Egypt fuels 2020 MENA e-commerce boom

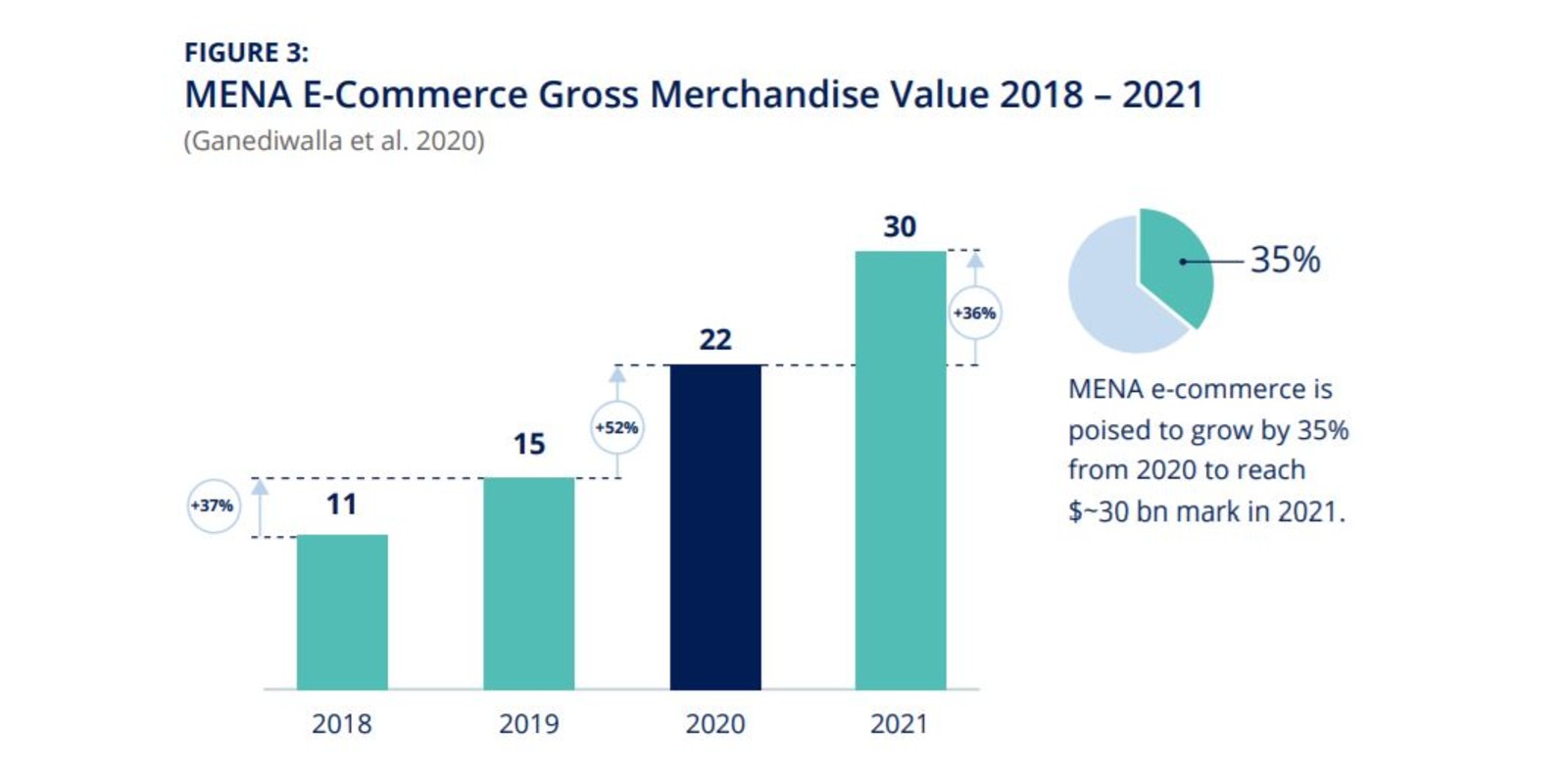

Egypt, Saudi Arabia and the UAE led a boom in e-commerce in the MENA region last year, as the covid-19 pandemic forced consumers online, according to a new study published last week. The value of the region’s e-commerce sector surged 52% to reach USD 22 bn by the end of 2020 — 80% of which came from Egypt, Saudi Arabia and the UAE, Wamda and MIT’s Legatum Center for Development and Entrepreneurship found.

Amazon’s Souq and online marketplace Noon dominated the sector, accounting for more than 50% of the market share in MENA. The two companies, alongside smaller operators such as Talabat (previously Otlob), built the digital and physical infrastructure necessary to operate in the region, boosting investor confidence in regional e-commerce and marketplace startups, the report said.

The e-commerce boom created a ripple effect across logistics and fintech: The increase in online shopping caused growth in the delivery and online payments sectors, with investments in fintech across the region more than doubling to USD 78 mn during the year. The spread of Egypt’s Fawry — which became the first Egyptian company to achieve a market cap of USD 1 bn last year — has enabled the unbanked population to more easily make online transactions, while the last-mile delivery sector grew in tandem to satisfy increased demand, accelerating the adoption of new technologies to improve logistical infrastructure.

The e-commerce space had already been on the rise pre-pandemic: Some USD 665 mn was invested in e-commerce startups in MENA from 2016-2019, accounting for almost 20% of the total amount invested in startups during this period.

Today, 80% of young Arabs shop online frequently, compared to 71% in 2019, with half of MENA’s youth population saying their online shopping became more frequent after the pandemic, the Wamda report said.

The trend is set to continue this year: MENA e-commerce is poised to grow by 35% y-o-y in 2021 to reach around USD 30 bn — double its value in 2019. Some 47% of consumers in the region expect to shop online more frequently in 2021, with almost 40% of Egyptian consumers saying the same.

A new normal: Accelerating e-commerce growth in the region should take place in a way that can “encourage and strengthen regional cooperation and further develop government policies for online purchases and supply,” the report said. Countries should implement policies that enable more digital payment solutions in cross-border transactions and reinforce trust between consumers and firms, as well as supporting startups through credit facilities and incentives. The region should also aim to set up a unified customs market that will provide startups with a larger capacity to scale while promoting investor confidence.