The Enterprise 2023 Reader Poll: More of you are feeling downbeat about our economic prospects as headwinds mount

The consensus among Enterprise readers: 2022 was not a great year for business — and there’s uncertainty on what the future holds. Towards the end of last year, some 70% of you agreed that 2022 hadn’t lived up to expectations, with the outbreak of war in Ukraine, the weakening EGP, spiraling inflation, and import restrictions all piling pressure on local businesses.

Four months on from our last survey, and the outlook is looking even less rosy. Times are getting tougher for businesses which are having to deal with the impact of the EGP devaluation, the FX shortage, and accelerating inflation. The economic headwinds mean that you are now more uncertain about what the year ahead will bring.

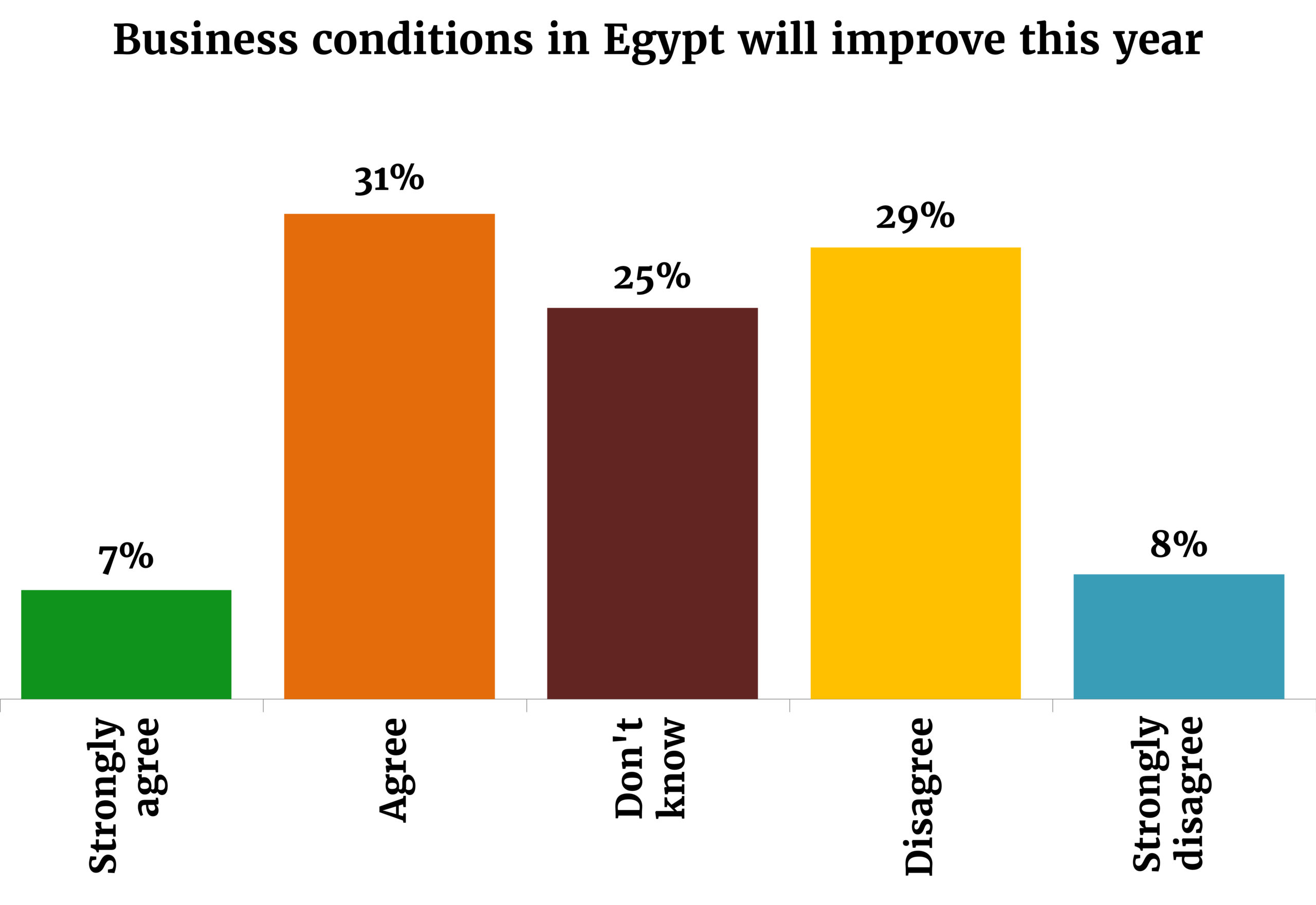

Your outlook on the year ahead is markedly less optimistic than it was just a few months ago. Back in September, 48% of respondents thought business conditions would improve in 2023. Today, you’re evenly split: 38% of respondents saying they see conditions improving over the course of 2023, while 37% don’t see that happening — and a quarter of you are uncertain about what the year holds in store.

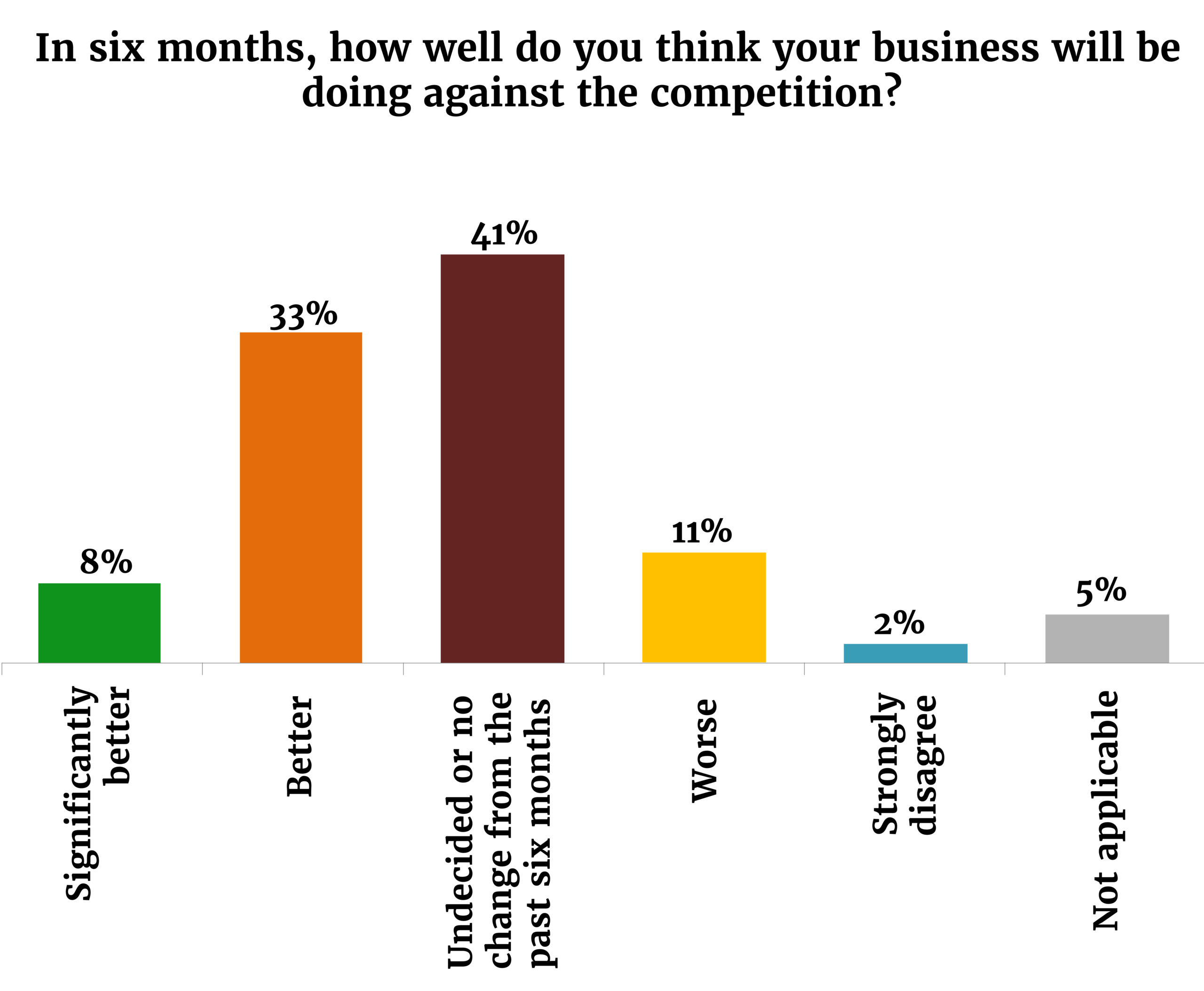

There’s also less certainty among our readers when it comes to their competitive advantage: Some 13% of respondents think their business will fare worse than the competition this year, while 41% think they’ll do better. Another 41% aren’t sure or think the status quo will be maintained for the year. That’s more mixed than how you all felt in September — today, a smaller percentage of respondents see the competitive landscape holding steady.

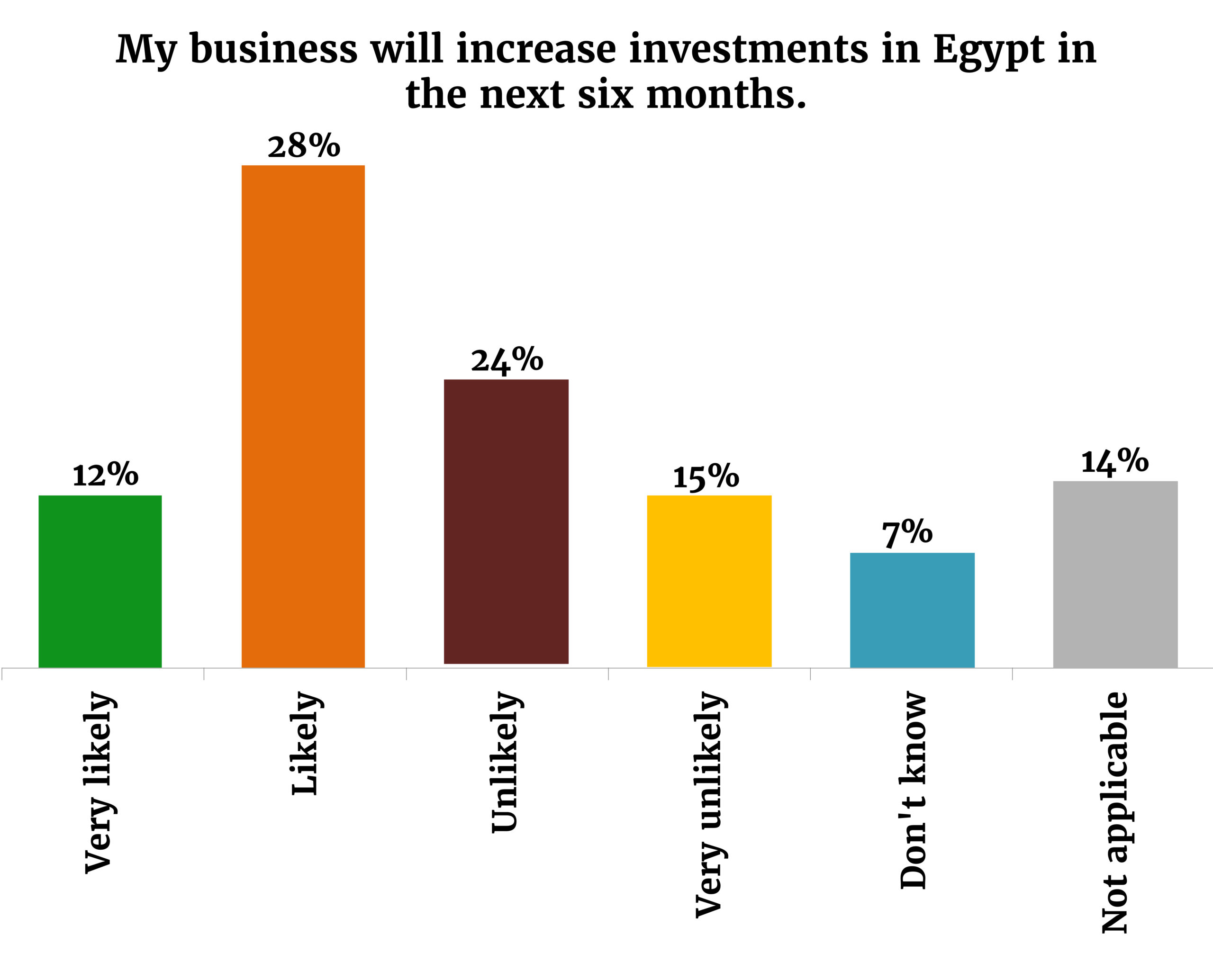

You’d think that all this uncertainty would translate into scaled back investment plans, but that doesn’t seem to be the case: Almost half (47%) of respondents said they’re planning to commit fresh investment in Egypt in 2023 (up from 40% in September), while 30% of you said that new investments are unlikely to be part of your 2023 plans. Last time we checked in, 39% of respondents said they probably wouldn’t be investing within six months’ time.

But: Borrowing costs need to fall to unlock that capex. One-fifth of you say the Central Bank of Egypt needs to cut interest rates by more than 600 bps to help you

increase capital spending, while 26% of you think that interest rate cuts anywhere between 300-500 bps would do the trick. Some 10% believe they can make do with less, saying that just 50-200 bps rate cuts could be enough.

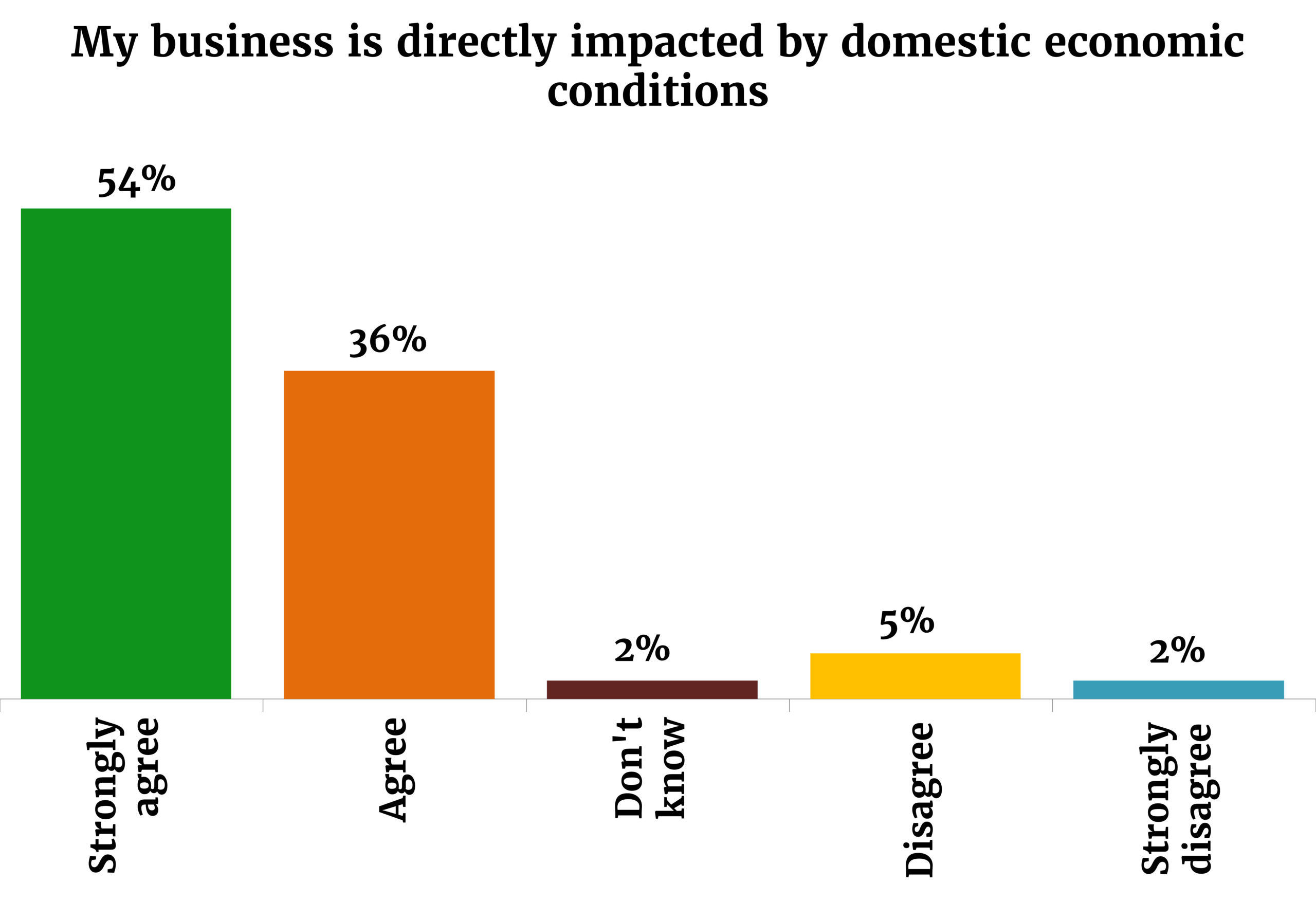

The vast majority of you (90%) said that your business is being directly impacted directly by the crisis here at home, while a mere 7% said there’s no direct effect. Inflation is taking its toll on almost everyone (88%) who responded to the survey, while more than two-thirds (68%) said the FX shortage is impacting their businesses.

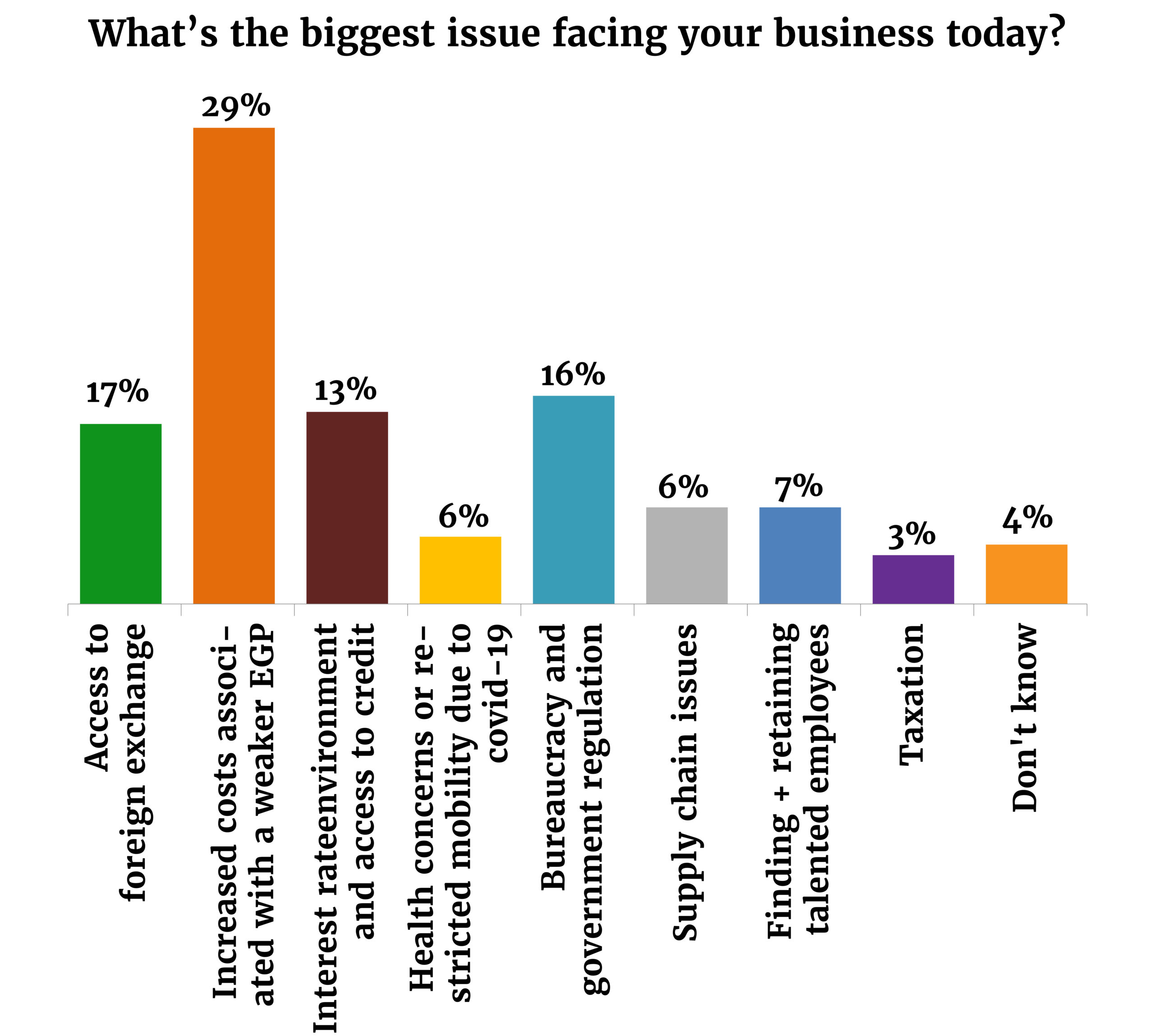

It’s no surprise that the weaker exchange rate and the FX shortage are the two single-biggest challenges facing businesses: Almost a third (30%) see the devaluation of the EGP — which has seen the local currency lose nearly half its value against the greenback over the past year — as posing the greatest challenge for their businesses, while 17% cited the inability to access FX as the biggest issue.

What’s your forecast for the exchange rate? Only 26% of you see the EGP returning to below 30.00 to the greenback by the end of 2023. More than two-thirds think the currency will weaken further from its current 30.62 level, with 41% expecting the currency to end the year between 30.01-35.00 and 27% forecasting a decline past 35.01. That more or less matches your budgeting plans for the year: the majority (52%) are budgeting for a USD rate of EGP 30.01-35.00 and 16% are on the more conservative side and planning for a rate above EGP 35.00.

Next up: Bureaucracy and government regulation, which 13% of respondents cited as their business’ biggest headache. That’s lower than the 19% of you who said the same in September, and it shows in your sentiment on the Madbouly Cabinet.

Sentiment on the council of ministers has improved: Five months ago, 62% of you saw the council of ministers as unsympathetic to the needs of business. In our most recent survey, that figure has dropped to 50%. Some 29% of all respondents think Cabinet is in tune with the needs of the business community.

Pushed to the back burner: Supply chain issues, finding and retaining talent, and taxation have been pushed off your worry list by the FX situation.

Click / tap here to read the full survey.