- It’s confirmed: Trading of e-Finance shares on the EGX is set to begin this Wednesday. (What We’re Tracking Tonight)

- The ECA isn’t happy that M&A agreements are happening without its knowledge. (What We’re Tracking Tonight)

- Former US SecState Colin Powell dies aged 84. (What We’re Tracking Tonight)

- Is “Judgment Day” approaching for emerging markets? (What We’re Tracking Tonight)

- El Sisi is in Athens tomorrow for a trilateral summit with Greek + Cypriot leaders. (What We’re Tracking Tonight)

- Is the West planning on offsetting one of the most important global trade routes? (Global Trade)

- Succession season 3 is here + read these two thrillers out in time for spooky season. (Enterprise Recommends)

- That hypersonic missile is really just a very, very fast Jetsons car, says China. (For Your Commute)

Monday, 18 October 2021

EnterprisePM — It’s confirmed: e-Finance begins trading on the EGX on Wednesday

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen. The foreign business press today is warning of a potential EM selloff on the back of rising energy prices. It’s been an uncharacteristically slow Monday in the local press today, where the talk is still over the anticipated e-Finance’s IPO.

Trading of e-Finance shares on the EGX is set to begin this Wednesday, the state-owned fintech platform and payments infrastructure provider’s Chairman and CEO Ibrahim Sarhan and the EGX confirmed. The retail component of the IPO officially closed yesterday 61.4x oversubscribed.

The EGX has continued its streak in the green for a tenth consecutive session, with the bourse up 1.1% today.

It’s the Prophet Muhammed’s birthday today and public and private sector workers and the business community at large take this Thursday off in observance. Banks and the EGX will be closed, the Central Bank of Egypt and the bourse have confirmed. Remember — it’s our final long weekend of the year, so put the time to good use.

THE BIG STORIES TODAY (so far)-

#1- The Egyptian Competition Authority (ECA) is not happy that a number of M&A had taken place without it being notified. In a statement today, the ECA warned businesses making EGP 100 mn in annual revenues looking to merge that they must inform the ECA of these transactions or they could be potentially in violation of the ECA Act. The statement did not specifically name the companies alleged to be in violation.

#2- Aspire Capital Holding (formerly Pioneers Holding) has set up its microfinance arm, Kheir Microfinance, the holding company announced in a bourse filing (pdf). The company is currently awaiting the Financial Regulatory Authority to issue the needed licenses to begin operations.

HAPPENING NOW-

EBRD Vice President of Banking Alain Pilloux is in town through Wednesday for a series of high-level meetings (pdf).

CORRECTION- The government is keeping electricity prices for industry fixed for the next few years as part of a package of incentives for the private sector. We incorrectly said in this morning’s EnterpriseAM that natural gas prices would be fixed for four years.

Read more about how the Finance Ministry is lining up new business incentives in Part II of our one on one with Vice Minister of Finance Ahmed Kouchouk, including help for the automotive industry and new export subsidies.

** CATCH UP QUICK on the other top stories from today’s EnterpriseAM:

- Foreing investors had heavy appetite for shares of e-Finance, whose shares will officially begin trading on the EGX on Wednesday.

- No vaccine? No entry into government institutions for you, as of 1 December.

- Fintech law + PPP Act amendments making their way through parliament: The House of Representatives’ CIT Committee yesterday gave final approval to a draft law to regulate Egypt’s fintech sector, while the House general assembly gave a preliminary nod to proposed amendments to the PPP Act.

THE BIG STORY ABROAD- Former Sec. of State Colin Powell dies: Former US Secretary of State Colin Powell passed away this morning aged 84 “due to complications from covid-19,” despite being fully vaccinated, his family said in a statement. Powell became Secretary of State in 2000, serving under George W. Bush, but resigned in 2004 after acknowledging that evidence he provided to justify the US’ invasion of Iraq in 2003 was false. The story is on the front pages of the Wall Street Journal, the New York Times, and Reuters, among others.

Elsewhere, analysts are wondering if “Judgment Day” for EMs is approaching: Emerging markets are attractive to investors as long as they post strong growth to outweigh higher risk, but EMs excluding China are expected to grow more slowly than the US for a third year next year, Jonathan Wheatley writes for the Financial Times. China’s slowdown, meanwhile, may see growth fall to match that of the US, says Bank of America David Hauner. If energy prices cool off to ease global inflationary pressures and China can manage its property-market crisis, the global recovery can push ahead. But if fuel continues to spiral and the Chinese economy plummets, we could see a mass exodus from EM stocks and bonds as investors offload risky assets.

What does that mean for Egypt’s borrowing plans? Egypt’s fiscal position is solid enough to withstand emerging market shocks and selloffs, particularly ones that could result from the US Federal Reserve tapering off its stimulus, Vice Minister of Finance Ahmed Kouchouk told Enterprise last week. And our successful bond issuances have garnered plenty of interest from investors and drawn enough inflows to cushion us from these shocks, Kouchouk says.

Also joining the chorus warning of vulnerability in developing economies is markets sage Mohamed El Erian. The Allianz chief economist and Queen’s College Cambridge president followed up yesterday’s appearance on Fox News with an op-ed in the FT, arguing that current macro challenges threaten to derail long-term development ambitions among low-income, commodity-importing countries. The solution? More vaccines and a restructuring of crushing debt obligations would be a start, El Erian says, echoing the IMF’s most recent World Economic Outlook.

Even with a mounting energy crisis, Europe is apparently still hesitant about accepting a helping hand from Moscow. Russia’s Nord Stream 2 gas pipeline could be Europe’s lifeline amid its energy crisis, but EU officials “want a break” from the bloc’s energy dependence on Russia. “We want to break out from this [Russian energy] dependence,” Morten Petersen, a Danish lawmaker at the European Parliament, told CNBC. The 1.2k km-long pipeline is finished and currently awaiting regulatory approval to start exporting 55 bcm of natural gas to the energy-starved continent — and it’s only “a matter of time” before approval is granted and the gas starts flowing. Last year, almost half of Europe’s natgas imports came from Russia, and the International Energy Agency (IEA) said last month that Russia should increase its supply of natural gas to Europe, as skyrocketing prices threaten a winter energy crisis across the continent.

|

FOR TOMORROW-

President Abdel Fattah El Sisi will be in Athens tomorrow for a summit alongside Cypriot President Nicos Anastasiades and Greek Prime Minister Kyriakos Mitsotakis. The three officials will review trilateral cooperation, according to a statement from the Cypriot government. This meeting comes shortly after Egypt signed MoUs with Greece and Cyprus to link electricity grids.

???? CIRCLE YOUR CALENDAR-

Three days to go until the Cairo International Furniture Show, Le Marche. The four-day event runs from this Thursday, 21 October until next Sunday, 24 October. It is the first and largest furniture, material and home accessories exhibition in the region.

Fall conference season is still going strong. Among the exhibitions and business events here and throughout the region:

- The GITEX Global at the Dubai World Trade Center kicked off yesterday and runs through this Thursday. The event brings together players in Big Tech to discuss what’s next in areas such as AI, cloud, 5G, cybersecurity, blockchain, and more.

- Cairo Water Week begins next Sunday, 24 October. The annual event will wrap next Thursday, 28 October.

- The two-day Intelligent Cities Exhibition & Conference takes place next Wednesday and Thursday, 27 and 28 October.

- Later this month: The Middle East Angel Investment Network is hosting its Angel Oasis in El Gouna on 27-29 October, with separate pricing for in-person and virtual attendance.

☀️ TOMORROW’S WEATHER- A balmy high of 29°C is forecast for tomorrow, while the mercury will drop to a low of 18°C come nightfall. Ditto for Wednesday, with some added cloudy skies, according to our favorite weather app.

???? FOR YOUR COMMUTE

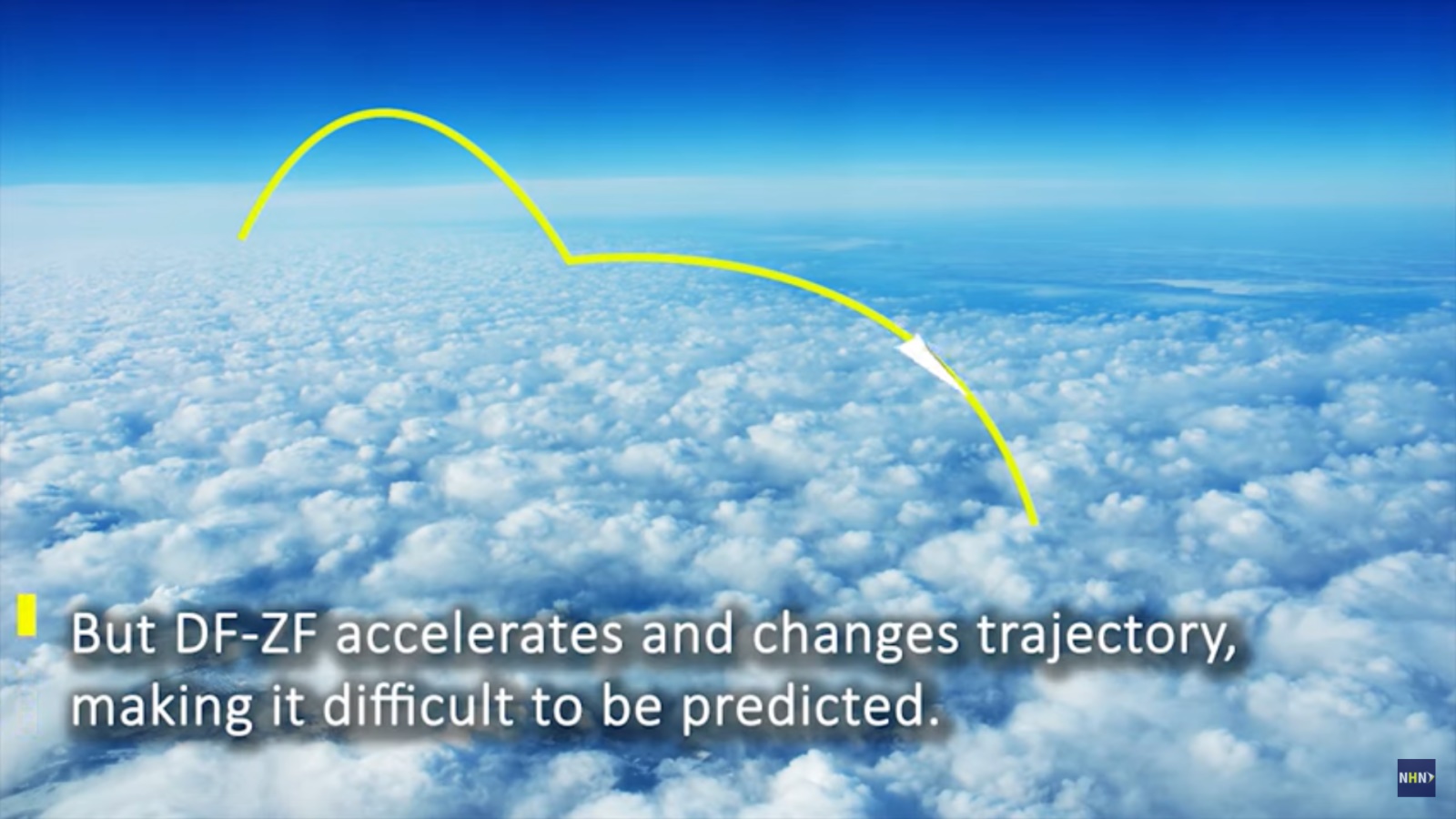

It’s a bird. It’s a plane. It’s … not a hypersonic missile? The “nuclear-capable hypersonic missile” that the Financial Times claimed China was testing back in August was no more than a space vehicle, according to the Chinese Foreign Ministry. The vehicle was on a “routine test” ahead of potentially reusing the vehicle, ministry spokesman Zhao Lijian said during a press briefing, according to Reuters. The test — which Lijian says happened in July, not August — was carried out with the aim of proving “a cheap and convenient method for humans to peacefully travel to and from space.”

Privacy changes turbocharge Apple ad revenues: New privacy rules for iPhones have seen Apple triple its advertising market share in six months, mobile marketing firm Branch told the Financial Times. Apple’s Search Ads business now accounts for 58% of all App Store downloads generated through ads, up from 17% a year ago, after rivals including Facebook were blocked from targeting consumers through the App Store under the new rules introduced in April. Apple, until recently a bit-player in the app advertising game, is now on track to generate USD 5 bn in ad revenues this fiscal year and USD 20 bn yearly within three years, according to researchers.

Data protection, but for (and from) whom? The rules put a 72-hour delay on information to third parties and only allow them to see aggregate data, limiting their ability to track and tailor content to individual consumers. But Apple’s Search Ads clients get detailed info, including the ability to follow users for “retargeting” down the road — which one ad exec says is just the latest example of Apple bending the rules on privacy. The company has already faced an anti-competitive conduct charge from a US judge in September over its decision to force app developers to use its payment platform exclusively.

???? ENTERPRISE RECOMMENDS

Succession season 3 is here + read these two thrillers out in time for spooky season

???? ON THE TUBE TONIGHT-

(all times CLT)

Succession season 3 is out today. Fans of the show in Egypt and the Middle East can watch the first episode courtesy of OSN. In case you’ve literally just started reading EnterprisePM, we’re all big fans of the show that twists the rich wish-fulfillment trope by portraying the worst family of bn’aires on television right now — not surprising, as they are inspired by the Murdochs. The new season picks up at last season’s cliffhanger finale, so we definitely recommend you start from the top on this one before jumping in. You can catch a glimpse of the snarky dialogue in this exclusive clip from the new season put out by HBO Max (watch, runtime: 1:48).

⚽ Arsenal will face Crystal Palace (managed by former Arsenal legend Patrick Vierra) at 9pm in the only English Premier League match on today.

There are two fixtures this evening in the Spanish league: Deportivo Alaves v Real Betis at 7pm, and RCD Espanyol v Cadiz CF at 9pm. The Italian league will see Venezia play ACF Fiorentina at 8:45pm.

???? OUT AND ABOUT-

(all times CLT)

The Sinatras are back at Room Art Space and Cafe in New Cairo at 9pm tonight with their tribute to Frank, and joining them is first-time guest vocalist Youssef Gabriel.

???? UNDER THE LAMPLIGHT-

Spooky season brings us two buzzy new thrillers perhaps more anticipated for their authors than their content — but strong reviews have us willing to give them a try.

One-time presidential hopeful and former US secretary of state Hillary Rodham Clinton has launched a new career as a novelist, enlisting acclaimed Canadian murder-mystery writer Louise Penny to co-author State of Terror. The thriller follows Ellen Adams, the woman secretary of state who must save the US when an incompetent and self-regarding president puts the country in harm’s way (stop us if this sounds familiar). Eye-rolling is encouraged, but all good thrillers have a touch of the ridiculous, and Penny’s skill for narrative has critics responding well.

Meanwhile, fans are excited about spy-novel titan John le Carré’s final work, Silverview, completed before the author’s death last December and published in the week of what would have been his 90th birthday. The last novel from the former British spy serves up the same combo of twisty plot and complex characterization that made earlier books like The Spy Who Came In from the Cold and Tinker Tailor Soldier Spy so well-loved.

???? GO WITH THE FLOW

Market roundup on 18 October

The EGX30 rose 1.1% at today’s close on turnover of EGP 1.4 bn (7% below the 90-day average). Local investors were net sellers. The index is down 4.0% YTD.

In the green: GB Auto (+7.8%), CIRA (+6.6%) and Pioneers Properties (+4.4%).

In the red: Abu Kir Fertilizers (-4.3%), AMOC (-2.4%) and MM Group (-2.0%).

???? GLOBAL TRADE

Is the West planning on offsetting one of the most important global trade routes? An undersea fiber optic data cable known as EllaLink, linking Europe to Latin America, came online in May. Backed by the European Investment Bank and major public lenders, the EUR 150 mn project is seen to rival China’s Belt and Road Initiative and meddle with global trade, which is heavily reliant on the Chinese route, according to the Financial Times.

The EU is pushing for the project to enhance collaboration with partners — namely the US, Japan, and India — under the umbrella of supporting high quality projects and channeling investments into developing countries. This comes under an even wider scheme where the EU aims to launch an ambitious global infrastructure plan by 2022 connecting the EU with the rest of the world, Reuters reported.

The plan was even given a nod last month by the Group of Seven during the G-7’s first face-to-face meeting in two years under a so-called “Build Back Better for the World” plan. The plan is designed to enhance global infrastructure — from railways in Africa to wind farms in Asia, CNBC reported. The EU strategy, dubbed as "A Globally Connected Europe", doesn’t even mention China at all, but an EU diplomat who contributed to drafting the strategy said the eight-page document had "China written all over it,” Reuters further said.

Why is China’s Belt and Road initiative important? Launched in 2013, the Belt and Road Initiative quickly became a strategic tool for more than 150 cities and international organizations from the Middle East, Africa, Asia and Europe, and is being considered a landmark foreign policy by Chinese President Xi Jinping to expand his country’s global influence.

But over the years (and global crises) funding for the plan had been decreasing. During 1H2021, the Belt and Road initiative received USD 19.3 bn of funding, which is already a 29% y-o-y decrease, according to Bloomberg.

Egypt had been considered a crucial part of the plan as a gateway for Chinese investments into Africa. The two countries had been actively engaged in talks over Egypt’s participation in the global initiative since at least 2015, with Egypt even hosting a Belt and Road conference back in 2017 that saw Chinese companies awarded projects. Talks for further Chinese infrastructure investments had gotten underway last year after China provided Egypt with deliveries of the Sinopharm vaccine.

The Belt and Road initiative has also been criticized to be in favor of Chinese companies, particularly state-owned ones, while burdening other involved parties with debt. The Group of Seven said that China’s non-market practices prompt unfair competition, according to CNBC.

With projects abroad being marred by mismanagement: China was reassessing its Belt and Road Initiative (BRI) as mismanagement, accusations of corruption, and poor quality projects implemented under the initiative wreak political havoc across Asia, Bloomberg reported back in 2018.

And for harming the environment: “While Chinese president Xi Jinping has pledged to make the BRI greener, there have still not been any concrete actions to limit outbound investment in such environmentally damaging industries,” Economist Intelligence Uitl Imogen Page-Jarrett told CNBC. A World Bank report in 2019 estimated that transport infrastructure under the program could increase global carbon emissions by 0.3% and by 7% more in some countries. However, for the first time since the project was launched, China didn’t finance any coal projects during 1H2021 amid increased scrutiny from environmentalists, Bloomberg reported. But the country didn’t commit to its renewables promises either, and slashed green energy funding by 90% in 1H2021.

Is the US too late to counter with its own infrastructure diplomacy? The US passed the USD 60 bn Build Act in 2018 with the aim to increase private sector investment in developing countries. Experts say it’s too late as the world is already heavily dependent on the Chinese infrastructure projects. Nonetheless, while the US has been vocal in taking on China, others such as the EU still didn’t explicitly express their desire to join an anti-China alliance. According to the New York Times, US President Joe Biden urged European countries last month to provide hundreds of bns to build an alternative for China’s Belt and Road initiative, and bring China’s growing economic power down.

That ship has certainly sailed, diplomats say: “So far we are trying to counter Belt and Road mostly with buzzwords and lofty policy papers,” a senior EU diplomat told the Financial Times. “But unfortunately there is no real geopolitical strategy or plan which is consistent and coherent. There’s a real need to work together on infrastructure projects and avoid countries becoming over-reliant on China.”

???? CALENDAR

October: Romanian President Klaus Iohannis could visit Egypt mid this month to discuss ways to boost tourism cooperation between the two countries.

14-22 October (Thursday- Friday): El Gouna Film Festival.

Mid-October: The Egyptian Banking Institute, the Financial Services Institute, and I-Score will begin airing in mid-October the Digital Credit Scoring Webinar Series, a line-up of webinars on the banking sector and banking regulations.

18 October (Monday): Prophet’s Birthday.

20 October (ًWednesday): E-Finance begins trading on EGX.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday): Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28 October (Thursday): Second tranche of overdue subsidy payouts will be handed to eligible exporters.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

30-31 October (Saturday-Sunday): G20 Leaders’ Summit, Rome, Italy.

31 October (Saturday): World Cities Day, Luxor, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

7-10 November (Sunday-Wednesday): Cairo ICT 2021, Egypt International Exhibition Center, New Cairo.

15-21 November (Monday-Sunday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

25-27 November (Thursday-Saturday): RiseUp Summit, Cairo, Egypt.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.