Egypt’s digital infrastructure: 2020 growth and key trends

Egypt’s digital infrastructure: 2020 growth and key trends: As we’ve been noting in recent months, 2020 was a year of rapid digitization. As the pandemic brought new restrictions for mns of people, Egypt saw a sharp rise in the use of digital services, social media, financial technology, and e-commerce platforms.

We have a clearer picture on these growth trends thanks to the Digital 2021: Egypt report by Data Reportal, which collects data from the UN, World Bank, Google and more to give us insight into where Egypt stands in its digital development.

2020 saw exciting new trends, but we have a long way to go: The report found that as of January 2021, Egypt had a mobile penetration rate of 92.7% and an internet penetration rate of 57.3%. In 2020, Egypt saw a 2.9% y-o-y increase in mobile connections and an 8.1% y-o-y increase in internet usage, not surprising, since the lockdown happened, and came in tandem with the CIT Ministry’s efforts to boost internet infrastructure at the start of the pandemic. We also see the emergence of things like the smart home devices, which grew in 2020. Other trends were already clearly visible (think e-commerce, social media usage, etc.). That said, the report notes that we still lag behind on key things, such as financial inclusion.

Surprisingly, fixed internet connection speed saw a much more muted increase in 2020, after shooting up 293% y-o-y in 2019. In 2020, the average download speed for fixed internet connections increased 31.5% y-o-y to 34.88 MPS MPS (megabits per second). This came after rising a massive 293% y-o-y in 2019 to 26.52 MPS. While the report was scant on what could have caused this, we can assume lockdown measures had hampered the installation of fiber optic cables, combined with the network overload and demand during the lockdown.

Looking ahead, we know fiber optic cables will remain key to the gov’t digitization strategy. Last year, the government announced plans to increase the average internet speed to 40 Mbps in 2021. This year, Telecom Egypt is establishing a new fiber optic connection between the Red Sea and the Mediterranean. As of April, fiber optic connectivity was set to become one of the public utilities required for new construction permits. And the rollout of more fiber optic cables nationwide is integral to recently-announced economic and social structural government reforms.

In 2020, the average download speed for mobile internet connections increased 20.9% to 20.42 MPS (megabits per second), Data Reportal tells us. By contrast, the average speed for mobile internet connections in 2019 decreased slightly y-o-y by 0.4% to 16.89 MPS.

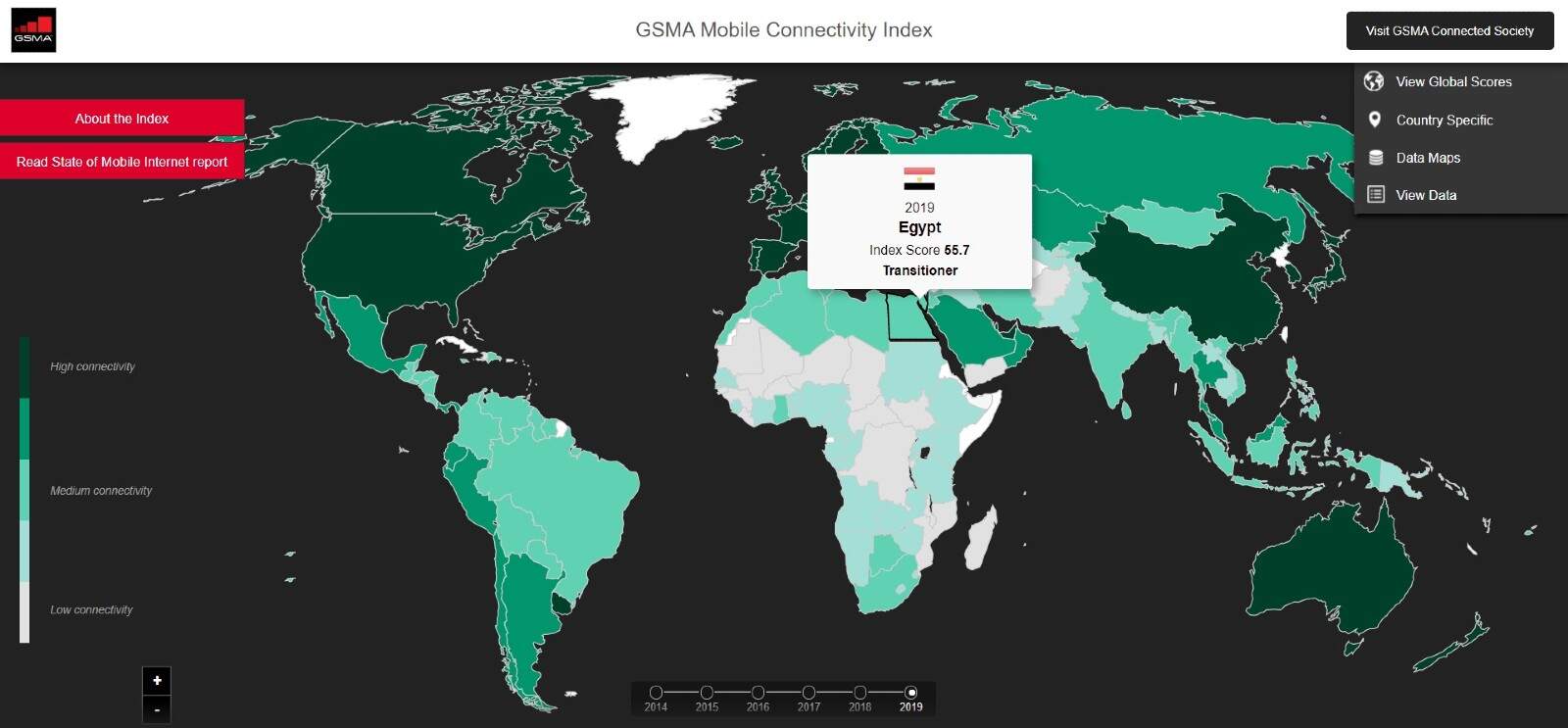

In 2020, Egypt’s overall score on GSMA Intelligence’s Mobile Connectivity Index rose to 55.71 out of 100, compared to 54.24 in 2019. The index measures the performance of 170 countries every year according to key metrics of mobile internet adoption.

Though Egypt still ranks in the bottom 50% of the Index, behind the UAE (78.2), Jordan (60.4), Tunisia (60), Morocco (59.9), and Lebanon (59.9), but ahead of Algeria (53.2), Libya (50.9), Iraq (45.5) and Sudan (35.1).

Social media usage in 2020 increased at double the rate of 2019: 2020 saw a 16.7% y-o-y increase in active social media users, compared to a 7.3% y-o-y increase in active social media usage in 2019. As of January 2021, Egypt had a social media penetration rate of 47.4%. The 40% y-t-d increase in internet traffic noted by Orange Egypt’s Chief Enterprise Line of Business Officer Hisham Mahran in April 2020 was largely driven by social media.

The consumer goods e-commerce market grew 63.5% y-o-y in 2020, to stand at USD 3.27 bn, with an estimated 41.36 mn people purchasing consumer goods on the internet as of January 2021. This ties in with Jumia Egypt’s reports of soaring pandemic-driven growth.

It’s further proof that e-commerce has become a key purchasing habit: Among 16-64 year old internet users, 20.6% make mobile payments, 56.9% pay for digital content, 33.7% pay online for ride-hailing apps, and 41.3% pay online for food delivery every month.

But overall, financial exclusion remains a challenge to the growth of the digital space. Though e-commerce, fintech and digital payments saw sharp growth during the pandemic, their adoption among most Egyptian citizens is low in an absolute sense, Data Reportal shows. Only 3.5% of the population aged 15+ reports paying bills or making purchases online — hardly surprising, given only 32.8% report having an account with a financial institution and only 3.3% have a credit card.

The food delivery market value was up: Food delivery transactions rose 44.1% y-o-y to USD 81.10 mn, with 3.59 mn people using online food delivery services as of January 2021. Market demand was clear when Jumia launched a dedicated food delivery service to fill the gap created by Uber Eats and Glovo’s exits.

While ride-hailing was understandably down: Meanwhile, Ride-hailing transactions fell 37.4% y-o-y in 2020 to USD 115.1 mn, with 1.88 mn people using ride-hailing services as of January 2021, according to Data Reportal. Decreased use of shared transport was clear at the start of the pandemic, with ride-hailing startups feeling the hit of the lockdown.

One surprising upshot: smart home device adoption soared in 2020: Egypt’s smart home penetration grew 11.1% y-o-y in 2020, compared to 86% y-o-y in 2019. As of January 2021, smart home devices were in 1.6 mn homes, up from 280k in January 2020.

But the market’s total value increase was only half of 2019’s: Smart home device purchases grew 49.4% y-o-y in 2020, compared to a 94% y-o-y increase in 2019. Market value rose to USD 133 mn in January 2021 from USD 94 mn in January 2020.

Your top infrastructure stories for the week:

- Transport projects: Part of the EUR 3.8 bn in agreements signed with France will go to the supply of 55 new trains for Cairo Metro Line 1, the rehabilitation of the Mansoura-Damietta railway, the construction of the Aswan-Toshka rail line, and the Abu Qir metro conversion project.

- Giza sound and light: Orascom Investment Holding subsidiary Orascom Pyramids and Holding Company for Tourism and Hotels signed an EGP 200 mn agreement for the Giza sound and light show revamp.

- Infrastructure financing: Egypt is close to getting a USD 400 mn World Bank loan that will in-part fund infrastructure.

- Tenth of Ramadan dry dock and logistics hub: The cabinet greelit a public-private partnership model under which the government will launch a tender to establish the Tenth of Ramadan City dry port and logistics hub.

- Bye bye microbuses: Microbuses will be banned from the ring road later this year to make way for the bus rapid transit system, which will see buses run regular routes with designated stops.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.