Space tourism is here, but the price tag is hefty + Crypto is slowly integrating itself into the regulated derivatives market

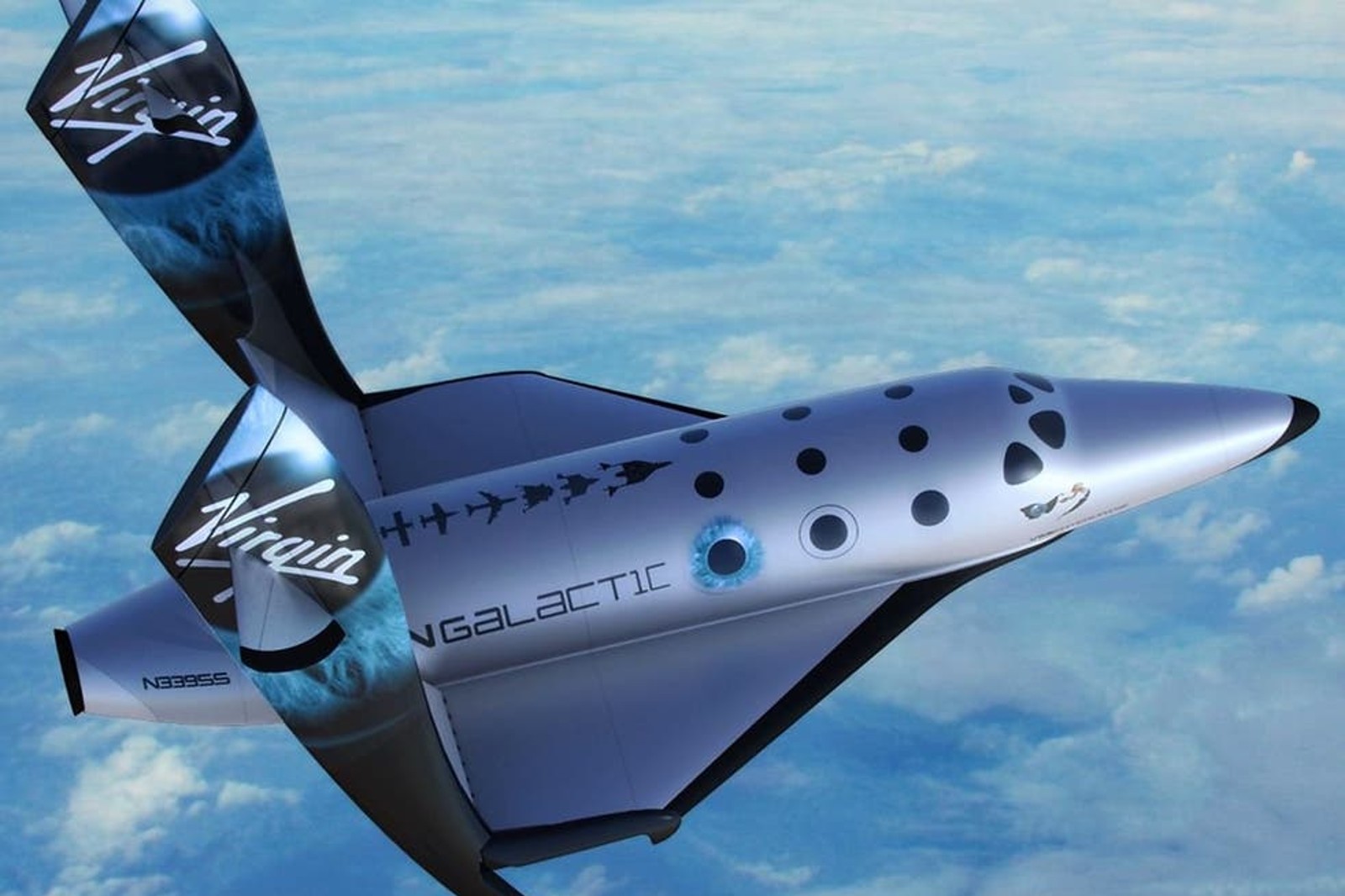

Space tourism is here for the general (but rich) public: Virgin Galactic has reopened online registration for its first commercial flights to space that will start in late 2022, reports AFAR. Following successful test flights last year, these 90-minute, four-passenger journeys mark the beginning of citizen space tourism. Bookings for these flights began back in 2014, when the rich and famous reserved seats, the magazine writes. Passengers will get to experience weightlessness in space all with the view of planet Earth to gaze at.

The price tag is hefty: The starting price for a seat on one of these trips is set at a cool USD 450k.

Crypto is slowly integrating itself into regulated markets: In efforts to increase its user base, the crypto industry is forging paths into the highly regulated US derivatives market, the Financial Times writes. Trading volumes of crypto-backed derivatives reached almost USD 3 tn in January, accounting for over 60% of total crypto trades — but most crypto trading is done via offshore, unregulated exchanges, putting the asset class in the crosshairs of US regulators. Now, crypto platforms are acquiring small companies with licenses to operate in the US in a bid to go mainstream and gain a bigger foothold in the market.

But there’s a problem brewing in BTC mining: BTC has lost nearly 45% of its value since a November peak of nearly USD 69k — and spiraling mining costs are partly to blame, Reuters reports. The total computational power (or hashrate) used by BTC miners globally has more than quadrupled as new miners rush to enter the market following last year’s rally. But all that power means miners are struggling to pay their costs, including electricity bills, prompting them to sell their coins and adding to the downward pressure on prices.

Want to know more about why crypto mining is becoming more energy intensive? We dove into the issue of crypto sustainability last week.

The iron dagger found in King Tut’s tomb gives us insight into how iron manufacturing technology first began, Japanese researchers say. The team of researchers from the Chiba Institute of Technology used chemical analysis to determine that the dagger could not have been forged in Egypt as at the time, Egyptians had no way of producing the iron, which required ultra-high temperatures. This suggests the iron dagger was a gift to Amenhotep III, the grandfather of Tutankhamun, from Mitanni, a kingdom in northern Mesopotamia. The metal was 80 times more valuable than gold during Ancient Egyptian times due to its rarity.