- SolarizEgypt, Amarenco Group sign USD 255 mn acquisition, JV agreement + F&B logistics platform OneOrder raises USD 1 mn. (The Big Stories Today)

- Sanctions against Russia aren’t amounting to much. (The Big Story Abroad)

- Climate loss and damage compensation is at the forefront of the conversation on COP27 again. (Climate)

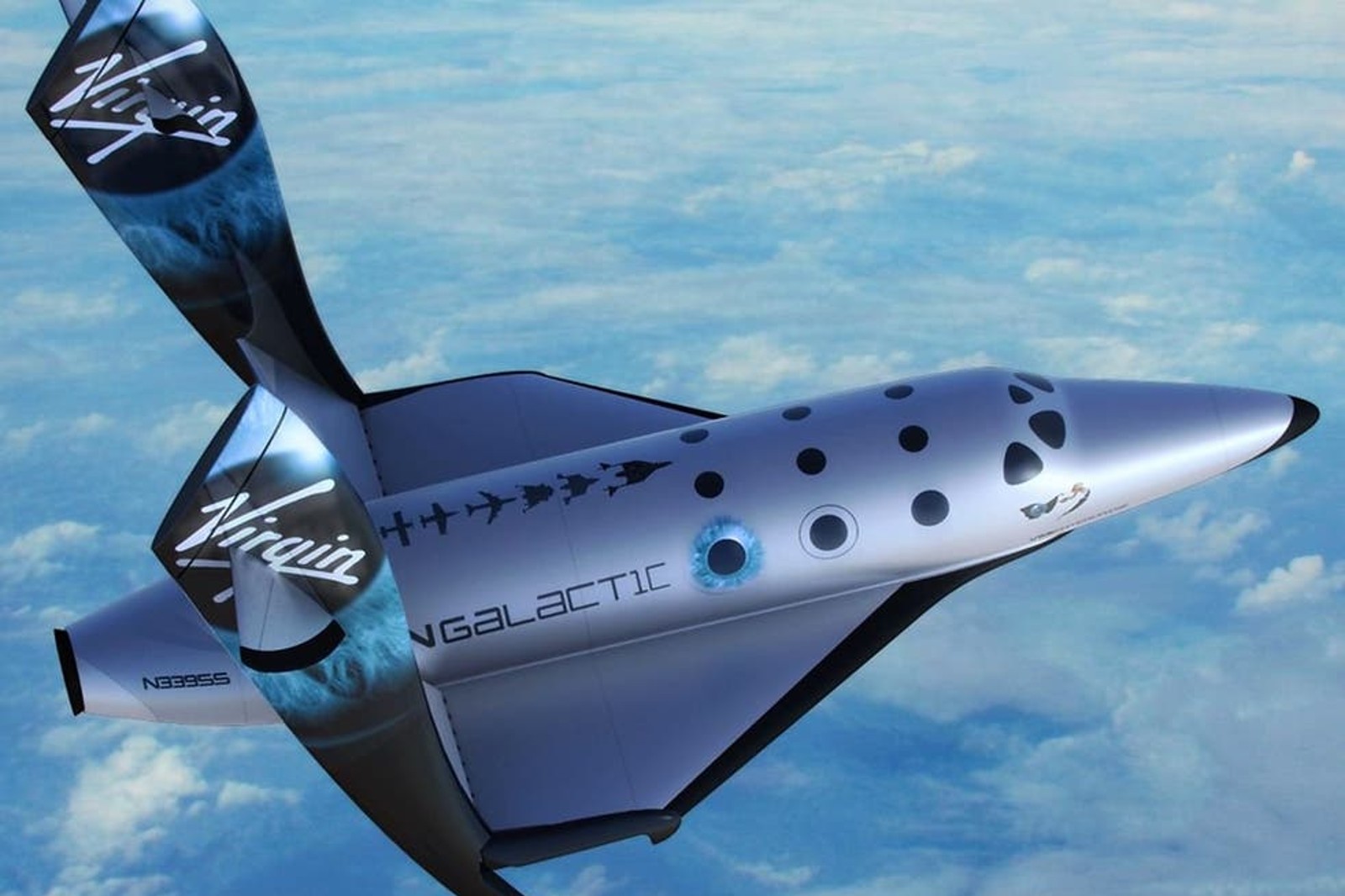

- Space tourism is here for the general (but rich) public. (For Your Commute)

- Crypto is slowly integrating itself into regulated markets, forging paths into the highly regulated US derivatives market. (For Your Commute)

- Space Force comes back with an out of this world second season. (On The Tube Tonight)

- The directors of Northwestern’s student entrepreneurship program create “The No B.S. Guide for Student Entrepreneurs.” (Under The Lamplight)

Wednesday, 23 February 2022

PM — Who’s picking up the bill for climate damage?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen, and welcome to almost-THURSDAY, as we like to call it here at Enterprise. It’s a bit of a mad rush to the weekend here at home and abroad (or, more specifically, in Ukraine), with a flurry of news on both fronts to keep you busy.

#1- SolarizEgypt, Amarenco Group sign USD 255 mn acquisition + JV agreement: French independent power producer Amarenco Group is acquiring 74% of SolarizEgypt’s portfolio in Egypt and the two companies will set up a joint venture to co-develop 300 MW of solar power projects over the next four years, as per an agreement the two sides signed, according to a statement (pdf).

#2- Newly launched tech-enabled F&B logistics platform OneOrder raised USD 1 mn in a round led by A15, according to a press release (pdf). The logistics company aims to solve inefficiencies and fragmentation Egypt’s restaurants face when sourcing supplies by creating a platform that consolidates suppliers and vendors for meat, vegetables, and equipment. Bringing these suppliers together on a single platform is hoped to yield more consistent and transparent prices, reliable quality, and regular delivery times, the release says.

^^We’ll have more on these stories and more in tomorrow’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- A busy day in the House gives us future flow securitization, new eviction rules: The House of Representatives’ general assembly approved yesterday amendments to the Capital Markets Act that will introduce future flow securitization, as well as amendments to the Old Rent Act that will allow landlords to eventually evict organizations from non-residential properties, and amendments to the Real Estate Registry Act to streamline the real estate registration process.

- The EGX launched four new sub-indices to track the performance of the most actively traded sovereign debt instruments yesterday in a move that paves the way for investment in index-tracking bond funds and other products linked to those gauges.

- More clarity from CBE on new import rules: The Central Bank of Egypt has responded in a document to queries from importers on its recently issued rules requiring them to get letters of credit (L/Cs) for their purchases instead of the common practice of documentary collection

HAPPENING NOW-

Two Egyptian startups are pitching their businesses to leading tech investors at the pan-African Africa Tech Summit in Nairobi, which kicks off today. Blockchain-based communications platform Pravica and agritech startup Visual and AI Solutions (VAIS) are among the nine startups that have been selected for the two-day event, which will bring together African startups, VC and private equity investors, lenders, and global tech leaders.

The conversation on Ukraine today is focused largely on the impact (or lack thereof) of the US and UK sanctions against Russia, which are being criticized for being limited in scope. Markets largely shrugged off the sanctions — billed as the “first tranche” of the West’s punitive measures against Moscow — as they broadly fell short of the swift and significant steps Washington and London have been vowing to take, Bloomberg reports. The sanctions are also under fire for not being directed at Russian President Vladimir Putin himself.

The EU could follow up with harsher measures, with ministers scheduled to sign off on the sanctions just minutes after we hit “send” on this afternoon’s edition, the Guardian reports.

On the other side of the equation, monetary support for Ukraine is being lined up: The UK rolled out a USD 500 mn loan program for Ukraine to “help mitigate economic impacts on Ukraine’s economy due to Russia’s aggression,” according to a Foreign, Commonwealth and Development Office statement. Meanwhile, the IMF is starting a new review of Ukraine’s USD 5 bn program, as Kyiv looks to unlock a fresh USD 700 mn tranche, according to Reuters.

This comes as Ukraine decided to impose a state of emergency for 30 days, which can be extended for another 30 days, Reuters reports. Kyiv also ordered its citizens in Russia to leave the country immediately, before the Ukrainian parliament agreed to impose sanctions on hundreds of Russian MPs, including those who had voted in favor of Russia’s decision to recognize the independence of separatist-held areas in Ukraine, according to CNBC.

Meanwhile, surprisingly not in a parallel universe: Former US President Donald Trump is siding with… Russia, calling Moscow’s decision to send troops into two separatist regions of Ukraine “genius,” according to this highly editorialized analysis piece from CNN.

Egypt is currently assessing just how much the unfolding crisis is going to affect us, with a meeting scheduled for later today to discuss the matter in depth, Prime Minister Moustafa Madbouly said, without providing further details.

It’s looking to us like a good news / bad news toss-up for Egypt: On the one hand, Ukraine and Russia are two of our main suppliers of wheat, leading state grain buyer GASC to lock in an April shipment of wheat from Romania despite it being pricier than Ukrainian wheat on offer. On the potentially good news side of things, Egypt could have a chance to export more natural gas to Europe, as Greece is looking for an alternative to Russia, which presently supplies nearly half of Greece’s natural gas needs, Reuters reports. Azerbaijan, Egypt, Algeria, and Nigeria are among the markets Greece is currently looking at as alternatives to Russia, the newswire reports, citing sources it says have knowledge of the matter.

The crisis is also having an impact on sports, as Russia could be stripped of hosting the UEFA Champions League final — club football’s most prestigious match — if UK Prime Minister Boris Johnson gets his way. In an address to UK Parliament yesterday, Johnson called on UEFA to take the final match elsewhere as part of a basket of punitive measures and sanctions against Russia for its recognition of two self-proclaimed republics in Ukraine, Bloomberg reports. The match is set to be played in St Petersburg’s Gazprom Arena on 28 May.

|

???? CIRCLE YOUR CALENDAR-

ARE YOU BUILDING A FINTECH STARTUP? You might want to apply for Visa’s global startup competition, the Visa Everywhere Initiative, the payments firm said in a statement (pdf) yesterday. In collaboration with the Central Bank of Egypt’s new Fintech Egypt project, the local contest will see Egyptian fintech players go head-to-head for a monetary award and the chance to advance to the regional and global finals. On offer: EGP 500k for the first-place finisher and a place in the Central and Eastern Europe, Middle East and Africa (CEMEA) regional finals in June.

What you need to know: A full breakdown on the entry criteria, the application process, and the schedule is available online here. The deadline for applications in Egypt is 20 March.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Our short-lived reprieve from the cold isn’t going to last very long, with the mercury set to reach 19°C during the day tomorrow and 11°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Space tourism is here for the general (but rich) public: Virgin Galactic has reopened online registration for its first commercial flights to space that will start in late 2022, reports AFAR. Following successful test flights last year, these 90-minute, four-passenger journeys mark the beginning of citizen space tourism. Bookings for these flights began back in 2014, when the rich and famous reserved seats, the magazine writes. Passengers will get to experience weightlessness in space all with the view of planet Earth to gaze at.

The price tag is hefty: The starting price for a seat on one of these trips is set at a cool USD 450k.

Crypto is slowly integrating itself into regulated markets: In efforts to increase its user base, the crypto industry is forging paths into the highly regulated US derivatives market, the Financial Times writes. Trading volumes of crypto-backed derivatives reached almost USD 3 tn in January, accounting for over 60% of total crypto trades — but most crypto trading is done via offshore, unregulated exchanges, putting the asset class in the crosshairs of US regulators. Now, crypto platforms are acquiring small companies with licenses to operate in the US in a bid to go mainstream and gain a bigger foothold in the market.

But there’s a problem brewing in BTC mining: BTC has lost nearly 45% of its value since a November peak of nearly USD 69k — and spiraling mining costs are partly to blame, Reuters reports. The total computational power (or hashrate) used by BTC miners globally has more than quadrupled as new miners rush to enter the market following last year’s rally. But all that power means miners are struggling to pay their costs, including electricity bills, prompting them to sell their coins and adding to the downward pressure on prices.

Want to know more about why crypto mining is becoming more energy intensive? We dove into the issue of crypto sustainability last week.

The iron dagger found in King Tut’s tomb gives us insight into how iron manufacturing technology first began, Japanese researchers say. The team of researchers from the Chiba Institute of Technology used chemical analysis to determine that the dagger could not have been forged in Egypt as at the time, Egyptians had no way of producing the iron, which required ultra-high temperatures. This suggests the iron dagger was a gift to Amenhotep III, the grandfather of Tutankhamun, from Mitanni, a kingdom in northern Mesopotamia. The metal was 80 times more valuable than gold during Ancient Egyptian times due to its rarity.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Steve Carell and Lisa Kudrow return in season two of Space Force: There’s general consensus that the second season of Space Force is even better than the first, with Hollywood Insider writing that it’s more “down to Earth” than season one. Steve Carell channels his inner Michael Scott (his character from The Office) as he plays General Mark Naird. The second season focuses more on the supporting characters, making sure to build their own plot lines within the main storyline. The workplace sitcom sees the stellar cast manage office politics and corruption among white-collar officials as they oversee the formation of the US Space Force. The force also faces the challenging task of handling the aftermath of a moon mission gone awry, speaking in front of an interrogation committee and working out how to navigate the consequences as a team.

⚽ The last leg of the round of 16 in the Champions League kicks off today: Atletico Madrid will host Manchester United, while Dutch side Ajax will face Benfica, both at 10pm.

Today will also see gameweek 26 of the English Premier League resume: At 9:30pm, Burnley will play against Tottenham and Watford against Crystal Palace, while Liverpool plays against Leeds at 10:30pm.

In the Egyptian League: El Ismaili meets El Gouna at 5:30pm, while the Eastern Company match with El Masry is ongoing as we dispatch.

???? OUT AND ABOUT-

(all times CLT)

Jordanian musical artist Aziz Maraka is performing tonight at Cairo Jazz Club 610 in Sheikh Zayed at 9pm. Meanwhile, local band Wust El Balad will be taking the stage at Agouza’s Cairo Jazz Club at 9pm.

In Potentia: An Exploration of Egypt's Audio/Visual Sphere combines electronic music and visual art scenes in a showcase at Malak Gabr Theater in AUC’s New Cairo Campus. The event will take place tomorrow at 7pm.

???? UNDER THE LAMPLIGHT-

“The No B.S. Guide for Student Entrepreneurs”: That’s how authors Melissa Kaufman and Mike Raab describe their new book, Founded. The duo are the directors of Northwestern University’s renowned student entrepreneurship program, The Garage, which helps university students learn and develop their business models. In the book, Kaufman and Raab channel their experience of guiding hundreds of early-stage startups to create a guide for young entrepreneurs to make good business decisions, avoid common mistakes, and take steps to get started on a new idea. Founded has issues that are often overlooked in the startup world, including a frank discussion on dividing up equity, warnings not to forget about sales, and the importance of good storytelling.

???? GO WITH THE FLOW

EARNINGS WATCH-

El Nasr Civil Works reported a net income of EGP 958k in 2021, reversing from net losses of EGP 27.02 mn in 2020, according to the company’s financials (pdf). Revenues saw a 24.5% annual drop for the year to record EGP 135.82 mn.

Oriental Weavers reported a net income of EGP 1.21 bn in 2021, up 8.8% y-o-y, according to its financial statement (pdf). Revenues for the year rose 20.2% y-o-y to EGP 11.40 bn.

The Egyptian International Pharma Industries (EIPICO) reported EGP 552.81 mn in net income in 2021, up 7.2% y-o-y, according to the pharma company’s financial statement (pdf). Revenues saw 19.1% y-o-y growth to record EGP 3.44 bn.

MARKET ROUNDUP-

The EGX30 fell less than 0.1% at today’s close on turnover of EGP 613 mn (39.7% below the 90-day average). Local investors were net buyers. The index is down 5.4% YTD.

In the green: GB Auto (+5.4%), Oriental Weavers (+3.2%) and Fawry (+1.8%).

In the red: CIRA (-1.7%), Heliopolis Housing (-1.6%) and Orascom Construction (-1.3%).

???? CLIMATE

Climate loss and damage compensation is at the forefront of the conversation on COP27 again, with climate groups criticizing US Presidential Climate Envoy John Kerry for failing to address the issue during his visit to Egypt this week, the Financial Times reports.

Damage compensation has been a contentious point in the conversation on climate change for decades. The push to address the loss and damages sustained by the global south as a result of climate change — much of which was caused by advanced economies’ rapid industrialization and ensuing mass emissions — first began in the 1990s. The Alliance of Small Island States proposed (pdf) setting up a fund that would see developed industrialized countries compensate “low-lying developing countries” for future damages caused by rising sea levels and allow these affected nations to rebuild their communities. It wasn’t until the 2007 Bali Action Plan, however, that the concept of loss and damages was formally included in a UN resolution, according to Carbon Brief.

In the years since, there has been little headway on providing financing through an institutionalized channel specifically for loss and damage compensation, with much of the conversation focused instead on future climate disaster mitigation and the general green transition, NPR notes. Last year’s COP26 in Glasgow saw a concerted effort from developing countries — representing the vast majority of the world’s nations — to create a financing mechanism to support the recovery from climate disasters, Reuters reported. The push ended up largely falling flat, with the proposal eventually being turned down by developed countries who would be required to pony up the funding.

Part of the problem: Assuming retroactive liability and responsibility for the damage that’s already been done. The 2013 Warsaw International Mechanism on Loss and Damage (pdf) was a significant step forward for the issue by acknowledging that “loss and damage associated with the adverse effects of climate change includes, and in some cases involves more than, that which can be reduced by adaptation,” but, critically, it fell short of determining who should be held responsible for these losses and damages.

It doesn’t look like this direction will change anytime soon: In a speech in Cairo earlier this week following the launch of the Egypt-US climate working group ahead of COP27, Kerry spoke of a necessity for national commitments to curb climate change, only mentioning briefly the issue of loss and damage. The climate envoy suggested that focusing on retroactive compensations “could delay our ability to do the most important thing of all, which is [to] achieve mitigation sufficient to reduce the level of adaptation.”

Climate advocates are not happy: “Loss and damage is beyond adaptation,” and is a critical component of the conversation about climate mitigation, as it’s a “climate justice issue, said Tasneem Essop, executive director of Climate Action Network, at a briefing on Africa’s agenda for COP27 on Monday.

But while the issue was not of much importance for Kerry, it was for President Abdel Fattah El Sisi, who said this week that Egypt will work to ensure developing countries get the funding they need from developed countries to fight climate change. El Sisi has been outspoken about prioritizing finance for Africa’s green transition, which Bloomberg says will be a key theme for this year’s summit.

Possibly lending a helping hand to Africa to fund climate mitigation: The continent’s first Green Exchange: Two fintech entrepreneurs are setting up the first exchange dedicated to green bonds in Africa, to address the continent’s need for financing climate change projects, Bloomberg reports. The Green Exchange — based in Ghana’s Accra — will provide the tools needed for companies to issue green bonds and will help investors trade them in a secondary market. The founders aim to raise USD 5 bn from African green bond sales over five years, to fund sustainable projects such as EV charging stations, solar panel installations, and sustainable housing. Global green bond investments are expected to reach USD 1 tn in 2022 alone; however, the African market contributes a mere 0.4% of the global market share by value.

Egypt pioneered the use of green bonds in MENA, taking the region’s first sovereign green bond issuance to market in 2020, raising USD 750 mn from investors to channel into green projects. CIB also issued Egypt’s first-ever corporate green bond last year, raising USD 100 mn in a five-year, fixed-rate offering.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

28 February-1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers’ playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers’ playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.