Business activity contracts at a faster pace in January

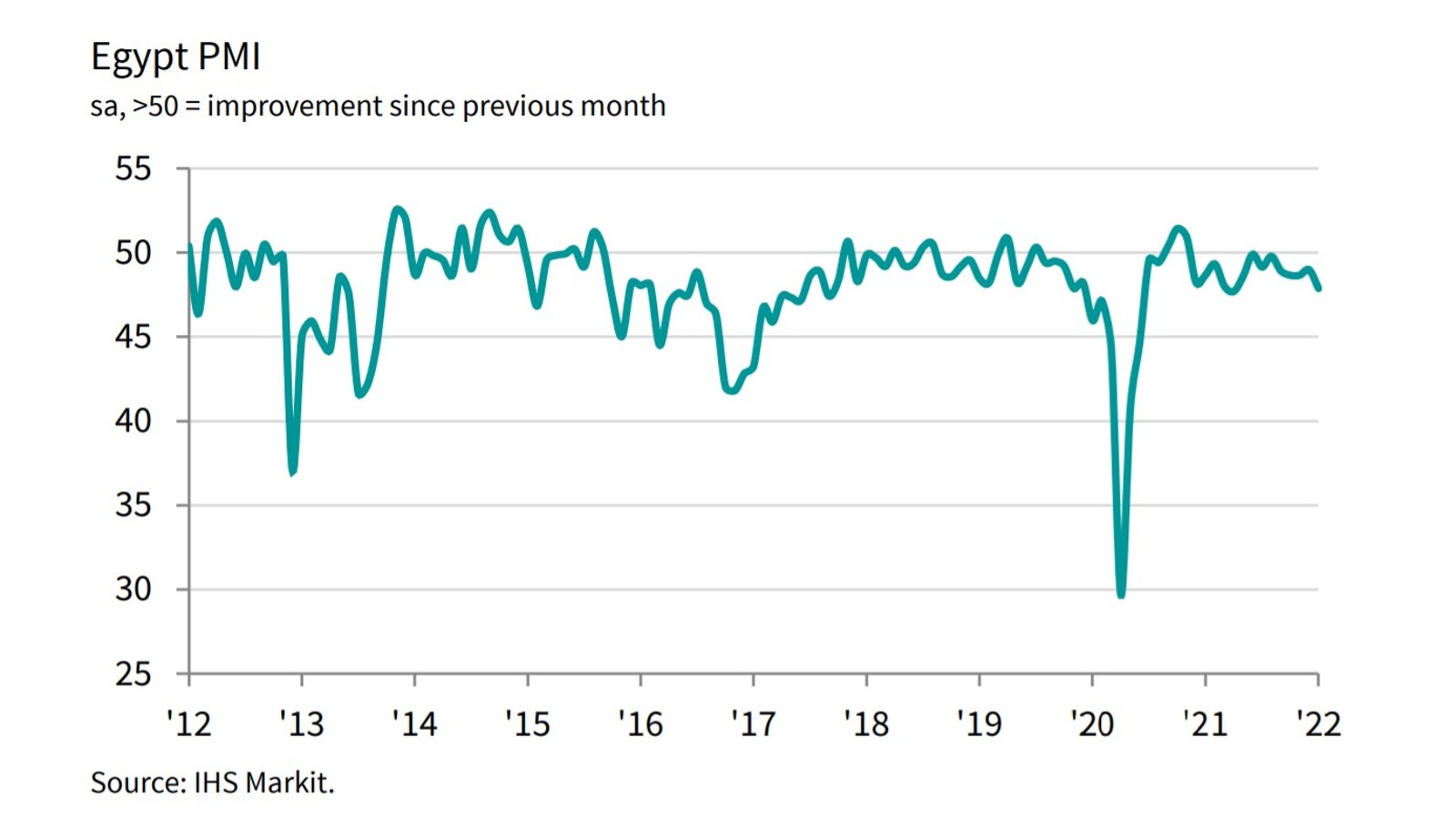

Non-oil business activity in Egypt contracted for the fourteenth consecutive month in January on the back of weaker demand and inflationary pressure, according to IHS Markit’s purchasing managers’ index survey (pdf). A “solid and faster deterioration in business conditions” pushed the gauge down to 47.9 in January from 49.0 in December, falling further below the 50.0 mark that separates expansion from contraction.

This is the lowest reading since April 2021, and below the series average of 48.2, which indicates “a solid decline in overall business conditions,” the report says. “Egypt’s non-oil economy had a disappointing start to the year, as weak demand conditions led to stronger declines in output and new business,” said David Owen, IHS Markit economist.

Construction, wholesale and retail have been hit particularly hard: January’s data points to “sharp falls in output” in construction, wholesale and retail, while the service and manufacturing sectors were “more stable” by comparison.

Weak demand driven by inflation: Inflationary pressures continued to weigh heavily on the non-oil sector throughout the month, with the prices of raw materials, components and transport all continuing to rise.

There’s been a continued decrease in purchasing activity, which fell at its fastest pace since April 2021, and businesses are trying to sustain sales by not fully passing on cost increases.

And we’re still seeing fewer jobs being created: Employment figures have fallen for the third consecutive month, with lower demand bringing stable backlogs and reduced workloads.

On the flipside, expectations for future growth are up: Hopes for strong growth in 2022 meant expectations for future output strengthened for the second consecutive month. But while “the degree of optimism picked up” in January, it still “remained lower than those seen through much of 2021,” said Owen.

REMEMBER- The Enterprise 2022 reader poll says you’re all quite optimistic about doing business in Egypt this year.

ELSEWHERE IN THE REGION- The UAE and Saudi Arabia’s non-oil private sector activity saw strong but slower growth in January, as a surge in covid-19 weakened demand. The UAE’s PMI (pdf) fell to 54.1 in January from 55.6 in December, off the back of rising covid cases, which led to increased uncertainty and stifled the rebound in tourism, said Owen. Meanwhile, the kingdom’s PMI (pdf) fell to 53.2 in January from 53.9 in December — its lowest level in 15 months.