Credit Suisse singing our praises, but warns of a fourth wave

Credit Suisse seems optimistic about our post-covid recovery, as the economy shows signs of real growth, t-bills remaining attractive and muted risks from the Grand Ethiopian Renaissance Dam (GERD) conflict, Fahd Iqbal, Credit Suisse’s head of private bank Middle East research, told Bloomberg’s Middle East: Daybreak show this morning (watch, runtime: 09:06).

Good news for the wider Egyptian economy: Credit Suisse was upbeat on the chances for a strong post-covid recovery, Iqbal said. “It hasn’t just been a base effect. We are actually seeing genuine growth kicking in.” And while that growth has not been observed in the likes of Egypt’s PMI readings, “but we’re confident that it will improve further in each tune,” he noted.

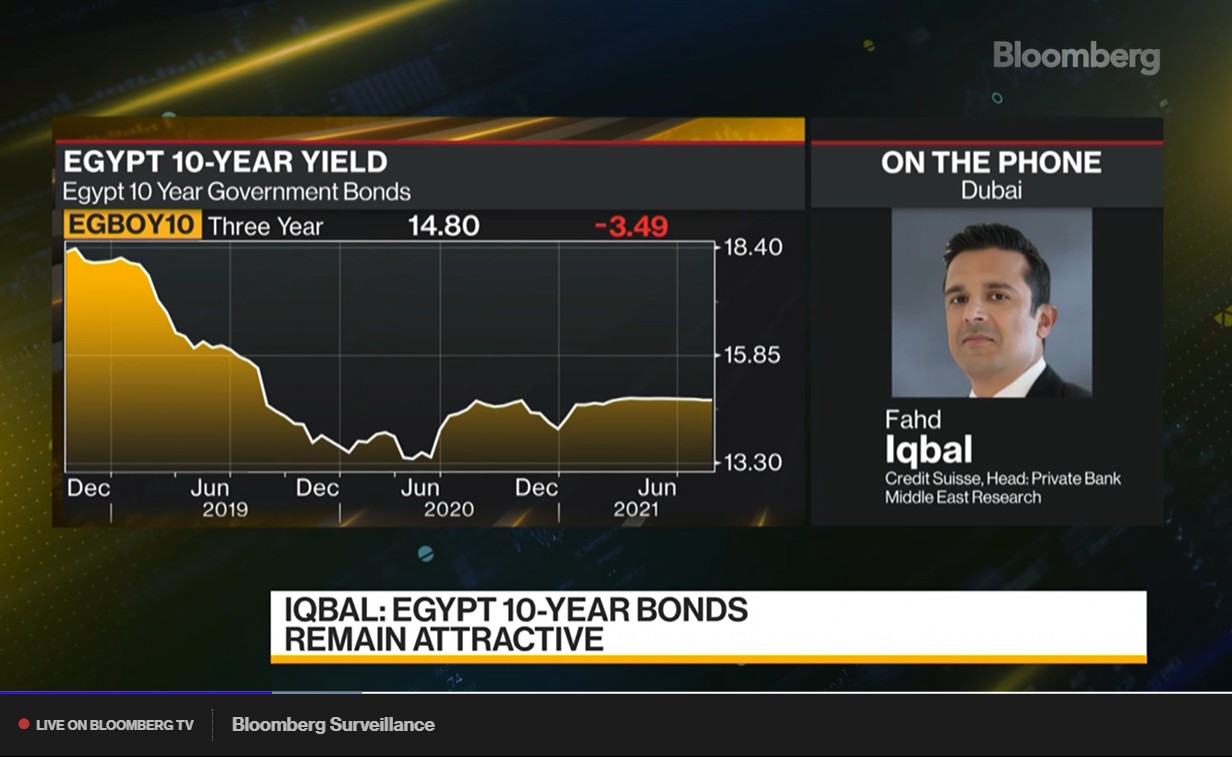

Bonds over shares: Government bonds are still attractive and the T-bill trade should remain comfortable for the rest of the year, he noted. The risk-reward tradeoff is much more attractive in government bonds than in equities, where valuations remain low. “What’s holding equities back is the low liquidity that you have, whereas the T-bill market really simply offers you better liquidity and certainly better payoff,” Iqbal said. Government debt instruments have seen strong inflows from abroad so far this year, with foreign holdings of bills and bonds standing at between USD 28-29 bn at the end of May, little changed from a record high of USD 28.5 bn in mid-February.

Are you just as confused about this as we are? It may not last into next year, as the risk of a government rate hike could impact payoffs in the T-bill trade, Iqbal says. Higher rates attract the carry trade who look for returns on higher bond yields. Egypt’s relatively high real interest rates have largely been responsible for the inflows.

Iqbal downplayed the impact of GERD in growth, saying that while there is a political risk stemming from the GERD, the conflict would likely be resolved.

He DID NOT downplay the risks of a fourth wave: A fourth wave of the coronavirus poses the greatest short-term risk to Egypt’s economy, Iqbal said—especially since the high population density in Cairo makes it difficult to enforce social distancing measures. “Morbidity has been pretty much the highest that you’d find anywhere else in the Middle East as a result, so it’s been a concern for us that you could see another wave coming in through.” Health Minister Hala Zayed this week warned that rising case numbers could herald a fourth wave incoming at the end of September.