What we’re tracking on 14 May 2020

It’s big news morning to end the workweek week as we all prepare to (very gratefully) slide into the weekend:

- The Health Ministry has released a three-stage plan to re-open the economy at the same time as the government is lining up another USD 9 bn in foreign funding to shore up foreign reserves in the face of the pandemic.

- The Madbouly government is asking us all not to lay off staff.

- It’s interest rate day and the expectation is that rates will be left on hold.

- US Fed chairman Jay Powell spooked global markets by telling the truth: We’re looking at a long, slow, painful recovery.

- Europe and the UAE are looking to salvage something of the summer tourism season.

The plan to reopen the economy leads this morning’s Speed Round, followed by a rundown on how policymakers plan to shore up FX reserves.

Let’s get started?

The government has launched a campaign to discourage layoffs in the private sector, with our friends Ahmed El Sewedy (Elsewedy Electric) and Ahmed Heikal (Qalaa Holdings) out in front on this one, according to a statement (pdf). You can watch the campaign video here (runtime: 1:04).

It’s interest rate day: The Central Bank of Egypt’s Monetary Policy Committee meets today to review interest rates. Ten of the 12 analysts in our regular poll are predicting that rates will be left on hold.

***PLEASE LET US KNOW how covid-19 is impacting your business. We run an annual reader poll asking what you expect of business conditions and the economy in the year ahead. Covid-19 has us thinking that the results of this year’s survey need updating. Take a minute and tell us how covid-19 has impacted your business, whether it’s changed your outlook on the economy, and what you think of WFH. We’ll have the results for you immediately after the Eid.

So, when do we eat? Maghrib prayers are at 6:41pm and you’ll have until 3:22am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

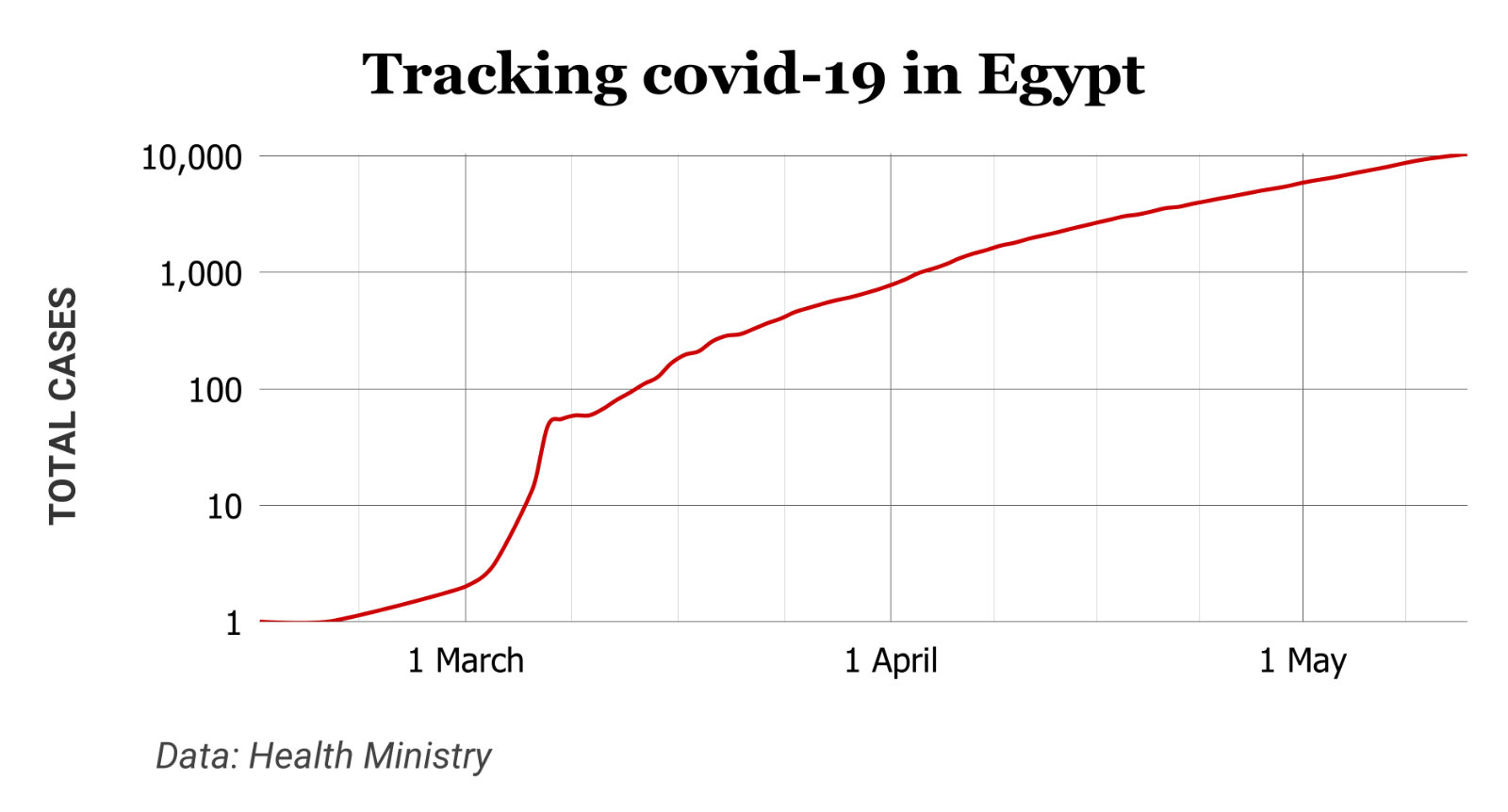

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 10,431 confirmed cases of covid-19 after the Health Ministry reported 338 new infections yesterday. The ministry also said that another 12 people had died from the virus, taking the death toll to 556. We now have a total of 2980 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 2486 have fully recovered.

Healthcare workers are feeling the stress, with the Medical Syndicate calling on authorities to repeal “dangerous” new guidelines that instruct health workers not to get tested for the virus unless they show symptoms. The call comes after reports that as many as 130 medical professionals at Al Azhar-associated hospitals are infected, Al Azhar University Vice President Mahmoud Sedik, according to Masrawy.

Separately, a university hospital in El Matareya also reported 19 new infections among its employees yesterday, Al Shorouk reports.

Hotels can choose to reopen starting tomorrow at a cap of 25% occupancy that could be raised to 50% in June if things go well. Operators face a laundry list of common sense protocols as a condition of reopening. Violators could have their licenses pulled and face a two-year closure order, Red Sea Governor Amr Hanafy told ‘Ala Mas’ouleety’s Ahmed Moussa on Tuesday (watch, runtime 6:05).

A “curfew” could be in place after Eid running from 11pm to 6am (also known as: When Normals should be sleeping, anyway) as part of the government’s package of measures to contain the spread of covid-19, says well-connected MP and former journalist Mostafa Bakry in a piece from Ahram Online’s Gamal Essam El Din that is very much worth a skim if you’re looking for insight into where parliamentarians’ heads are on the coronavirus.

The Finance Ministry is using covid-19 as cover to go after businesses selling online without charging and remitting VAT, a report in Al Mal suggests. The drive is specific to unlicensed businesses marketing themselves online, but readers should see this in the context of the state’s ongoing (and very sensible) push to ensure that ecommerce and online ad buys are subject to the same taxes as offline commerce.

Contractors will be able to apply for help under the central bank’s EGP 100 bn stimulus initiative for select industries to help them survive the fallout from covid-19, the CBE said yesterday. Companies need to have turnover of at least EGP 50 mn per year to qualify. Meanwhile, the unfortunately named FEDCOC continues to (sensibly) call for the CBE to expand its low-interest subsidized loan initiative to cover the retail and service sectors, Masrawy reports.

Meanwhile, construction at the new capital is moving forward at full steam, Reuters quoted officials as saying. Fewer workers are present on site, with work being stretched over two shifts. President Abdel Fattah El Sisi last month postponed to 2021 the inauguration of all national projects, including the new capital, due to the outbreak. Government employees were due to move in next month.

DONATIONS-

Our friends at GB Auto alongside TVD — its JV with El Ghalban Auto Market Group — have donated 20 pickup trucks to the Health Ministry, GB said yesterday.

Lafarge Egypt is contributing to repairing 460 ventilators at public hospitals, in addition to covering the expenses of 2k food boxes the Egyptian Food Bank is distributing to day laborers in Qalyubia, according to a press release (pdf).

Al Ahly Sabbour for Real Estate Developments has donated EGP 4.5 mn worth of ventilators and PPE, as well as 12k food boxes worth EGP 3 mn, to covid-19 front line workers, according to a cabinet statement.

ON THE GLOBAL FRONT-

The global tourism industry is desperate to reopen before it misses the northern hemisphere’s critical summer season.

Emirates Airlines is resuming service to Heathrow, Frankfurt, Paris, Milan, Madrid, Chicago, Toronto, Sydney and Melbourne, the company said in a statement yesterday. The news came as Dubai reopened public parks and private beaches for hotel guests while limiting gatherings to groups of five, the state news agency WAM reported.

The EU will try to reopen borders to avoid losing out on the lucrative summer season, but prospects are mixed over fears for health and safety, an EU commission deputy, Margrethe Vestager, said yesterday, according to Reuters. A proposal seen by Euractiv would ease travel restrictions in phases to reopen borders with “similar risk profiles.”

If this is nudging you to bring back the Eurotrip plans you shelved in March, here’s what you should know.

Canada and the US, meanwhile, look set to leave their border closed to all non-essential travel until 21 June, the Globe & Mail reports, citing unnamed government sources.

Air traffic won’t return to pre-covid levels until 2023 at the earliest, the International Air Transport Association (IATA) said yesterday, suggesting the 8k job cut at LSE-listed global travel operator TUI could just be the tip of the iceberg. TUI chief Fritz Joussen told reporters that the company plans to begin taking bookings for European holidays in July and that the industry might not make a full recovery until 2022.

GLOBAL MACRO-

The pages of the financial press were adorned with Jay Powell’s face for much of yesterday: In a webcast for the Peterson Institute yesterday the Fed chair had some choice words about where he sees the US economy going and what lawmakers should do to prevent the situation from getting any messier.

- Prepare for an “extended period” of weak growth: Contradicting the widespread optimism for a rapid economic recovery, Powell warned that immediate growth prospects were dire and it will take “some time” before the economy finds its feet. (Reuters)

- The US needs to get its act together and pass new fiscal measures: Congress and the White House need to agree on further fiscal support to prevent an extended recession. “Additional fiscal support could be costly but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery,” he said. (Washington Post)

- Negative rates are a no-go: The Fed chair pushed back on growing market speculation that the central bank could cut rates below zero if push came to shove. “The committee’s view on negative rates really has not changed. This is not something we’re looking at,” he said. (MarketWatch)

None of this went down too well with the markets: US stocks dipped to a three-week low on Powell’s comments. The S&P 500 closed 2.2% in the red and the Dow lost 1.75%.

Chinese officials are considering pulling out of the trade pact with the US: President Trump has rejected the prospect of reworking the first phase of the US-China trade agreement after Chinese state media reported that officials in Beijing are considering pulling out of the pact and renegotiating terms, Reuters reports. Unnamed Chinese trade officials told the Global Times that there is growing dissatisfaction over the terms of the agreement in Beijing, with some in the government calling for a complete renegotiation of the pact. The news comes as new figures revealed the two countries are pulling investments at a startling rate, the Financial Times notes.

AND THE REST OF THE WORLD-

It’s a fire sale at NMC Health: The UAE’s troubled healthcare provider has begun selling off assets as it tries to raise money to repay its creditors, Bloomberg reports. The company is planning to sell its distribution business, its fertility unit, and even its hospital business — the largest private healthcare provider in the region. The situation at NMC, once traded on the FTSE 100 with a USD 11 bn market cap, began to unwind in recent months after an internal investigation revealed evidence of fraudulent accounting.

It’s Making It day: Episode four of the second season of our podcast on building a great business in Egypt is out today. We will be taking a short break for the Eid weekend, and resuming on May 28th.

Sahar Salama, founder and CEO of TPay: As a software engineer who worked on consumer billing solutions for telecom companies, Sahar Salama has built the infrastructure that’s helping mns with cellphones — but no bank accounts — get online. Launched in 2014 in Egypt, Saudi Arabia and the UAE TPay helps consumers and businesses transact through direct operator billing. Before 2014, online payment options were sparse. Today, TPay is one of the region’s leading fintech companies specializing in enabling digital payments through mobile phones, operating in 18 markets across MENA covering almost 51 mn transactions a day.

Salama spoke to us on the importance of anticipating a business opening and getting a technological headstart to capitalize on it. Through her experience scaling her company from three to eighteen markets, she also discussed the importance of forming strategic partnerships that are right for scaling your business.

Tap or click here to listen to the episode on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.