Heavy net outflows from EM bond funds continue, but could brighter days follow?

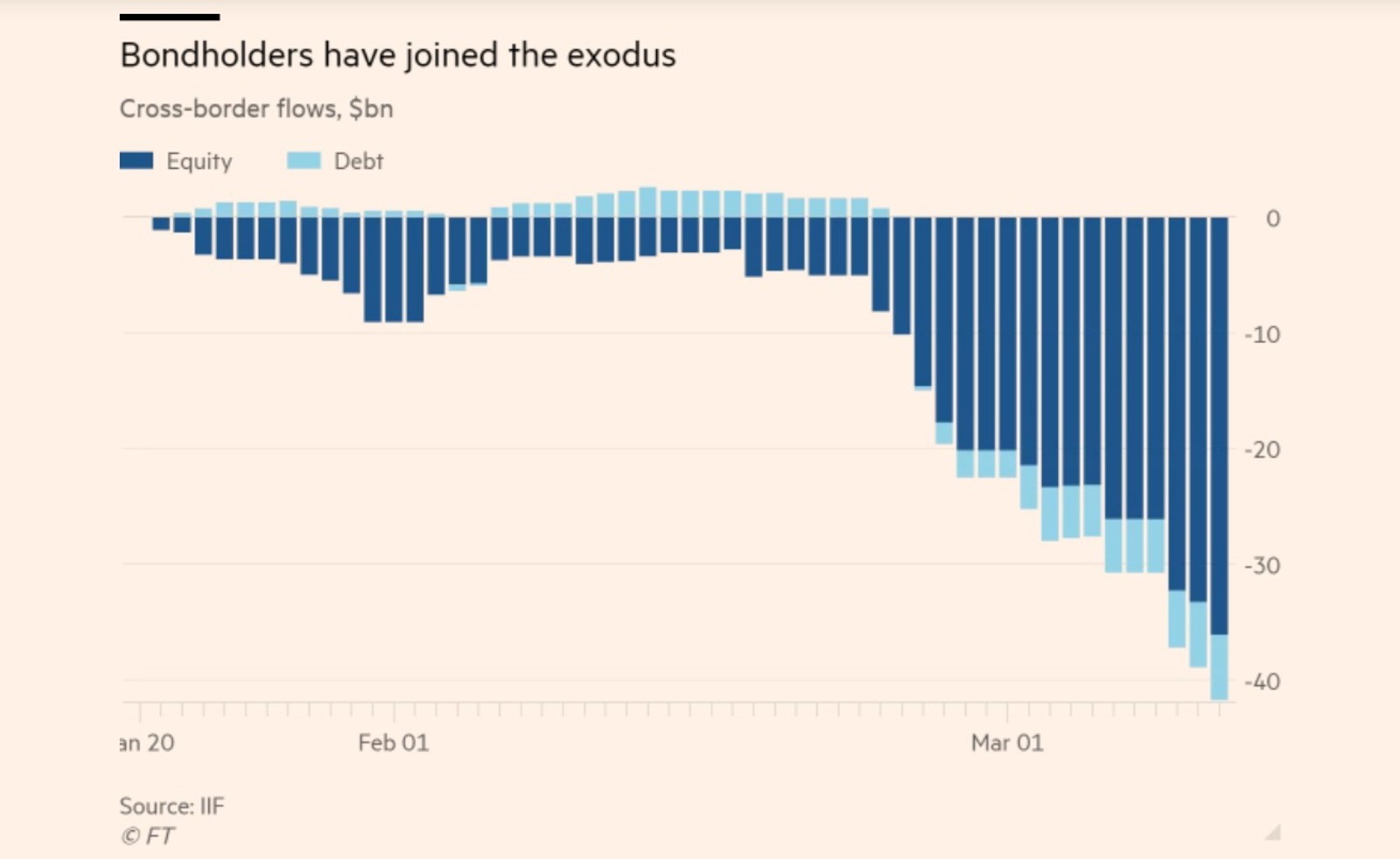

Emerging market bond funds are continuing to see heavy net outflows, as investors seek to dump debt amid the economic turmoil resulting from covid-19, the Financial Times reports. Data from EPFR Global shows that EM bond outflows hit USD 17 bn in the week leading up to 25 March, following a record USD 18.8 bn the week before. Outflows in the past four weeks hit USD 47.7 bn, the equivalent of 10.2% of all assets under management. Asset dumping has now erased a third of the USD 140 bn of net inflows to EM bonds that took place over the past four years, according to Bank of America, and for the first time since the start of the crisis, the outflow from local-currency EM bond funds exceeds that exiting hard-currency vehicles.

March has seen a rapid turnaround for EM bonds once termed “immune to coronavirus.” EM bonds were holding up well at the beginning of March, supported by investors’ continuing search for yield, according to Absolute Strategy Research economist Adam Wolfe. But amid the global slowdown, investors have been rushing to dump EM assets and seek the safety of cash. The sell-off — which far exceeds that seen at the beginning of the 2008 financial crisis — will see households, businesses and governments starved of credit, according to International Institute of Finance Chief Economist Robin Brooks.

What does this mean for Egypt? Just months ago, Egypt was considered a highly promising market, thanks to the real interest rate on our bonds, which in November last year stood at 9.42%, far exceeding the Turkish bond yields in second place at 5.14%. But the central bank’s emergency 300 bps rate cut two weeks ago is likely to accelerate outflows of foreign debt securities, according to EFG Hermes economist Mohamed Abu Basha. Despite this, EGP debt remains “relatively attractive,” according to HC Securities’ Monette Doss. Yields on Egyptian government debt will offer a 0.95% real interest rate (accounting for the 3% rate reduction and HC’s forecast for 9% inflation through 2020) compared to 0% for Turkey, she said.

It’s the worst 1Q on record for EM debt fund outflows, but there could be brighter days ahead. While JPMorgan’s core index of hard currency-denominated debt is down 10.9% this year, outflows for EM bonds still haven’t reached the levels seen in other periods of turmoil, according to Morgan Stanley. Total EM sovereign issuance for March 2020 is down to USD 4 bn from USD 31 bn in March 2019. But some EM governments, including Panama, Latvia and Israel, did sell new bonds this week, which analysts see as an encouraging sign. And while investors are waiting for a weakening USD and a clearer idea of how the covid-19 crisis will develop in the southern hemisphere before returning to the asset class, the US government’s USD 2.2 tn stimulus package and global central bank liquidity measures do seem to be bolstering confidence and supporting risk appetite.