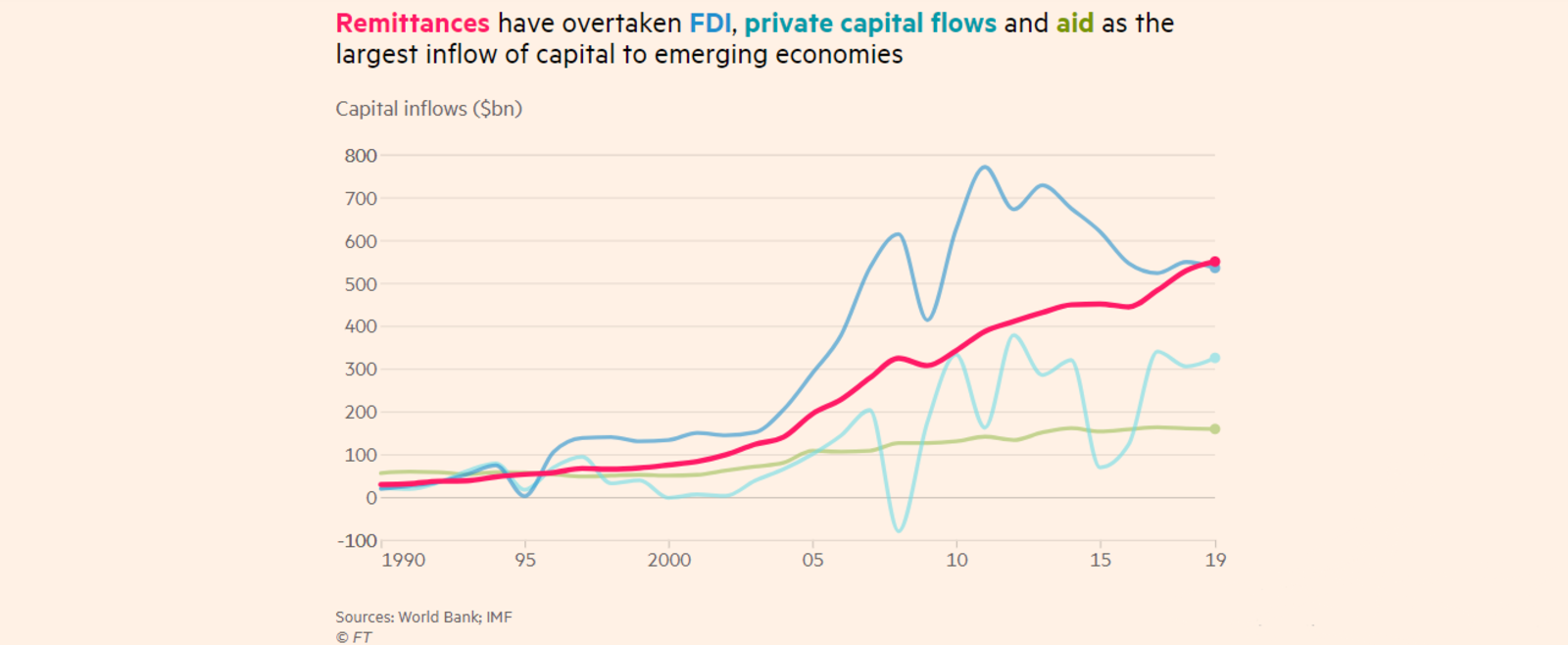

Remittances are outpacing FDI and foreign aid as developing countries’ biggest source of foreign capital

Remittances are officially set to outpace FDI, aid, and private capital flows as the biggest source of foreign capital in developing countries this year, the Financial Times says. As FDI levels from advanced economies is dipping, economists expect the reliance on remittances to remain strong, and continue serving as a “lifeline” for developing economies. “Remittances are ‘a relatively stable source of foreign currency in the current account, and that feeds directly into our sovereign ratings,’ says James McCormack of Fitch Ratings. ‘In the case of a country like the Philippines, Egypt or Nigeria, their current account positions would be much weaker in the absence of remittance flows.” In 2018, Egypt was one of the world’s top recipients of remittances, with inflows of Egyptians working abroad reaching USD 29 bn by the end of the year, according to World Bank figures. FDI in Egypt has also been in decline, with non-oil FDI in 1Q2019 falling to its lowest levels since 2014.

“No country is ever going to get rich from remittances”: The salmon-colored paper had noted last month that a number of emerging markets are trying to lure remittances into diaspora bonds for productive investment to offset low FDI, but these bonds remain “a niche part of financial markets.” Although remittances play a key role in developing economies, particularly when it comes to their balance of payments and credit ratings, they also provide a cushion for individuals’ incomes in the midst of slow economic growth. That, in turn, tends to give governments what can sometimes be too much breathing room in terms of policy reform to spur growth and raise standards of living. As long as the domestic job market fails to provide truly attractive alternatives, the push to emigrate to developed countries — and send home more remittances — will remain intact.