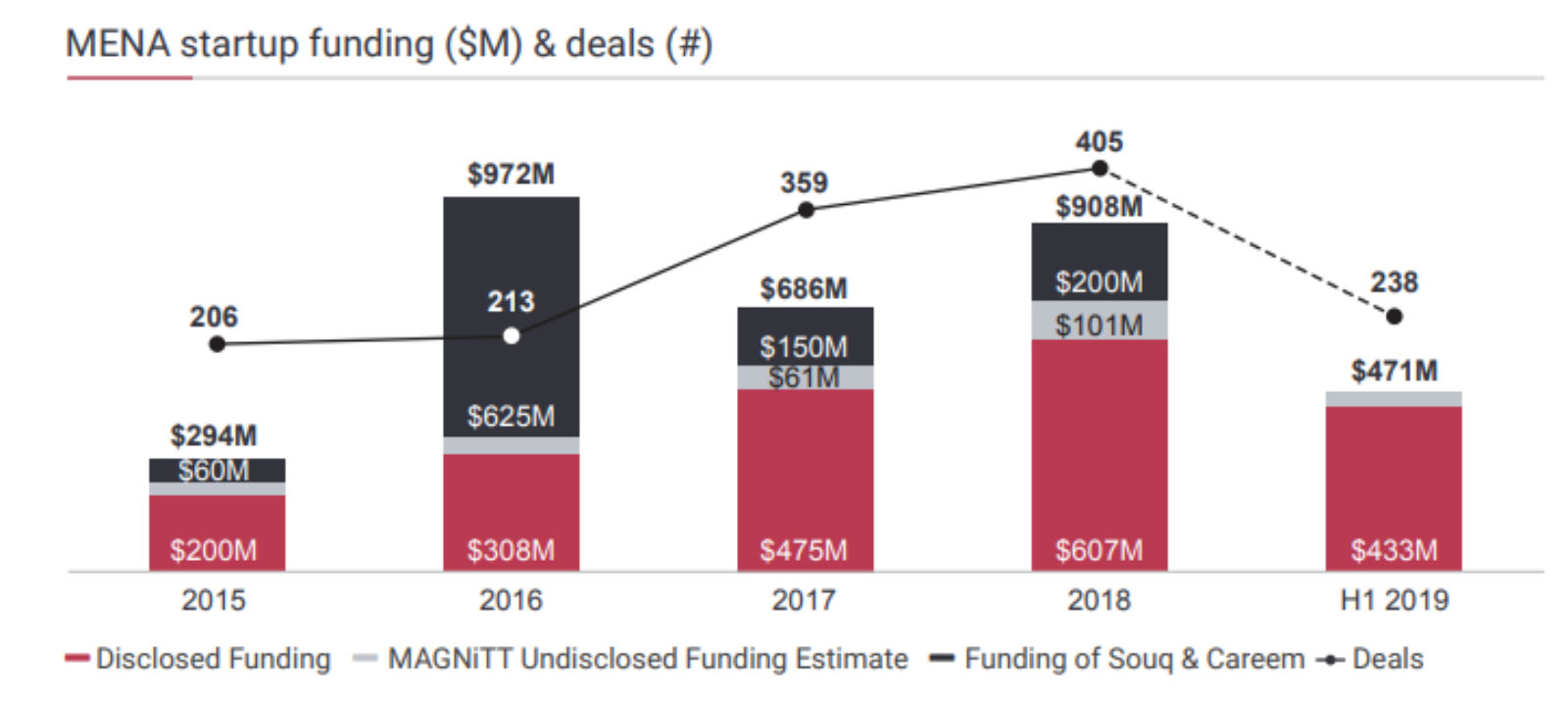

MENA startups raised USD 471 mn in 1H2019, Egypt second largest recipient

MENA startups have raised USD 471 mn during the first half of the year, surging 66% y-o-y, according to Magnitt’s MENA Venture Investment Report 1H2019 update. A record of 238 funding agreements were inked, up 28% from 1H2018. The top two funding rounds were UAE-based Emerging Markets Property Group (EMPG) and Yellow Door Energy, which attracted USD 100 mn in series D and USD 65 mn in series A funding, respectively. You can check out the summary (pdf) or the full report (paywall)

Egypt’s SWVL raised the third-largest sum during the period with its USD 42 mn series C round. The landmark USD 3.1 bn Uber-Careem merger was also a highlight during the first half of the year, making Careem the region’s “first unicorn exit” since the USD 580 mn Amazon acquisition of Souq in 2017.

Egypt came in as the region’s second largest funding recipient, accounting for 21% of the number of agreements signed. The UAE retained the top position at 26%, and Lebanon and Saudi Arabia came in third and fourth, at 13% and 11%, respectively. “In relative terms, Egypt, Saudi Arabia and Jordan have witnessed the greatest funding growth, while Lebanon and Kuwait have witnessed the biggest decline,” Magnitt founder Philip Bahoshy said in a live webinar yesterday, according to Zawya.

Fintech remained the most attractive industry, after overtaking e-commerce as the most active in the 2018 Magnitt coverage. The industry accounted for 17% of the total agreements, up 9% y-o-y and ahead of e-commerce, which covered 12%.