- How businesses are adapting their remote work policies as the economy reopens. (Speed Round)

- Annual inflation ticks up to 5.6% in June. (Speed Round)

- IMF mission chief praises Egypt’s reforms, crisis spending and post-covid recovery. (Speed Round)

- Mars Wrigley to increase investments in Egypt over the next two years. (Speed Round)

- Consumer watchdog to fine companies that fail to publicly list prices. (Speed Round)

- Egypt rejects Ethiopian proposal to stall GERD agreement. (Speed Round)

- Americana Egypt shareholders approve Adeptio offer price. (Speed Round)

- Stop worrying and love the deficit — YBG’s guide to surviving the pandemic. (The Macro Picture)

- The Market Yesterday

Sunday, 12 July 2020

How businesses are adapting their WFH policies

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to another workweek. Oddly enough, we love writing to you on Sundays, but that’s not why we’re so chipper this morning. So what gives?

#1- We have two short weeks coming up. We’re off a week from Thursday in observance of the anniversary of the 23 July Revolution. The month of July then ends with a long weekend marking Eid Al Adha. We expect to be off on Wednesday, 29 July for the waqfa, with the Eid running Thursday, 30 July through Monday, 3 August.

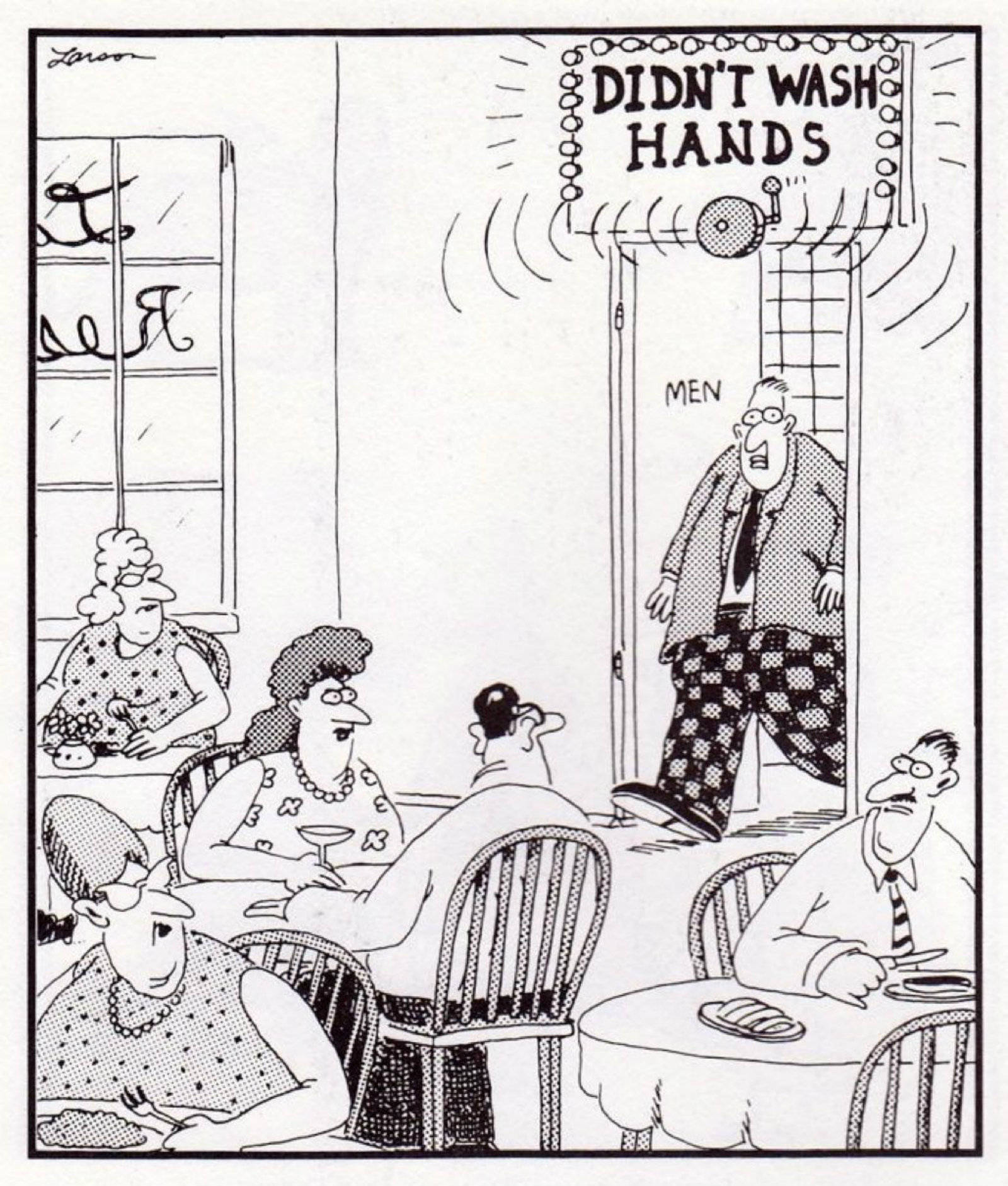

#2- Gary Larson is cartooning again. The creator of the Far Side was gifted a tablet and has three new pieces of work on his website under the heading “New Stuff.” Read his explanation and then tap the green “New Stuff” button for a smile this morning.

^^ Not new work, but exactly why we’re happy Larson is back.

SIGN OF THE TIMES- Traders in the GCC aren’t getting much of a summer vacation as locals stay home and expats put travel plans on ice thanks to covid-19, the gift that just keeps on giving.

REMINDER- It’s election season. Nominations for would-be senators opened yesterday as voters prepare to go to the polls on 11-12 August to elect the Senate, the nation’s newly reconstituted upper house of parliament. Egyptians abroad will cast ballots 9-10 August. Voters will elect 200 senators (half from a “list” system and half standing as individuals), while President Abdel Fattah El Sisi will appoint the remaining 100.

COVID-19 IN EGYPT-

The Health Ministry confirmed 67 new deaths from covid-19 yesterday, bringing the country’s total death toll to 3,769. Egypt has now disclosed a total of 81,158 confirmed cases of covid-19, after the ministry reported 923 new infections yesterday. We now have a total of 23,876 cases who have fully recovered.

EU travel restrictions do not prevent European tourists from travelling to Egypt, EU officials in Egypt said in a meeting with Tourism Minister Khaled El Anany last week. Egyptian nationals are still unable to travel to Europe after Egypt failed to make the EU’s ‘safe travel list’ which last month eased travel restrictions on 15 countries.

Sudan’s Khartoum International Airport has partially opened to flights from Egypt, Turkey and UAE, state news agency SUNA reported on Thursday.

ON THE GLOBAL FRONT-

India’s coronavirus epidemic continues to worsen, South Africa cases double in two weeks: The number of confirmed cases of coronavirus in South Africa have doubled to more than 250k in the past two weeks, while India reported a record single-day increase of 27,114 cases yesterday, the Associated Press reports.

US continues breaking records: US cases rose by a record 71,389 on Friday to take the country’s total to more than 3.2 mn. As if to mark the occasion, King Cheeto appeared in public wearing a mask for the first time.

More than 12.5 mn people around the world have now been infected by the virus, according to the Johns Hopkins University coronavirus tracker.

Concerns are mounting over a “silent pandemic” brewing in Africa as the gap between official data and the reality on the ground continues to widen in several countries, Reuters says. The issue is largely a result of inadequate testing, particularly as some countries do not have the resources to test widely enough or share their data. African governments will need to significantly ramp up testing and encourage mask-wearing to prevent local healthcare systems from being overwhelmed, head of the Africa Centers for Disease Control and Prevention John Nkengasong urged at a press conference.

Researchers are looking at different criteria in an attempt to more accurately gauge how far covid-19 has spread, such as death counts surpassing previous averages during this time of year, but information on these data points is also lacking. According to the UN, Egypt is among only eight countries in Africa that records more than 75% of its deaths. Nearly three quarters of the continent’s confirmed cases are in Egypt, South Africa, Nigeria, Ghana, and Algeria, according to Nkengasong.

Enjoy a memorable summer with Somabay’s exclusive dining experience built around family atmosphere and love to deliver exceptional service at every step of your journey.

Enjoy a memorable summer with Somabay’s exclusive dining experience built around family atmosphere and love to deliver exceptional service at every step of your journey.

Middle East banks are consolidating to weather the fallout from covid-19 and low oil prices with some USD 440 bn-worth of mergers and acquisitions currently in negotiation phases, Bloomberg reports. Saudi Arabia’s National Commercial Bank and Samba Financial Group are among the biggest players eyeing consolidation and are discussing a potential USD 15.6 bn merger. Some, however, have lost their appetite for big spending, leading some banks to put acquisition plans on ice. Among them: First Abu Dhabi Bank, which has shelved plans to buy Bank Audi’s Egypt unit.

Meanwhile: Dubai announced another USD 408 mn in stimulus to support the economy through the pandemic. United, the world’s third-largest airline, is considering laying off almost half of its workforce in what Axios is calling the opening salvo in the “second jobs apocalypse” across the pond.

AND THE REST OF THE WORLD-

Among the international headlines worth knowing about this morning:

- Elon Musk is now richer than Warren Buffet, Bloomberg reports.

- The US is dangling 25% retaliatory tariffs on a number of French goods in response to France’s digital services tax, which would collect a 3% duty from US tech companies with locally accessible services, Reuters reports.

- Hagia Sophia is once again being operated as a mosque in a move that’s being accorded a less-than-warm responses from Unesco and the EU, Bloomberg writes.

- Sudan has a new cabinet after a sweeping shuffle — and Christian citizens can toast new ministers with their ethanolic beverage of choice for the first time in more than 30 years.

Enterprise After Hours, Episode 1: Meet Rania Al-Mashat, who is leading Egypt’s program of economic diplomacy in a time of covid. Al-Mashat, a rock in a crisis, has helped shepherd the country through the global financial crisis (while a sub-governor at the CBE) and oversaw the recovery of the tourism industry before moving on to the international cooperation portfolio.

Tap or click here to listen to the episode on our website | Apple Podcasts | Google Podcasts | Omny. We’re also available on Spotify, but only for non-MENA accounts.

Enterprise+: Last Night’s Talk Shows

The nation’s talking heads continued to fret over the negotiations surrounding the Grand Ethiopian Renaissance Dam (GERD), which once again yielded no results over the weekend.

GERD or Libya: Which is the bigger crisis? Masaa DMC’s Eman El Hosary spoke with journalist Emad Adib, who argued that the threat to Egypt’s water security posed by the dam presents a threat to the country than the instability in Libya. The only way out of the quandary is via diplomatic means, he said, adding Egypt has two options: negotiations or international intervention. Ethiopia would prefer the international intervention option to buy time to fill the dam’s reservoir and present Egypt with a fait accompli, he suggested (watch, runtime: 19:29).

Ex-irrigation minister dismisses talks: Al Kahera Alaan’s Lamees El Hadidi spoke with former irrigation minister Nasr El-Din Allam, who described the GERD talks as “chats and conflicts, not negotiations.” He said that it’s hard to tell whether Ethiopia has started filling the dam’s reservoir, but Addis Ababa can't be trusted because they’ve broken promises before. He said he feared the African Union would pass on the dispute to another mediator, and called on the Egyptian government to raise the issue with the UN Security Council again (watch, runtime: 7:07).

Praise for law safeguarding victims: Al Kahera Alaan’s Lamees El Hadidi spoke with Nihad Abu El Qumsan, the head of the Egyptian Center for Women’s Rights, who praised the recent amendments to laws safeguarding the identity of crime victims, including in harassment cases. Abu El Qumsan said that they encouraged many women to come forward with their complaints against alleged serial [redacted] offender Ahmed Bassam Zaki and others (watch, runtime: 6:28).

11 drown in tragic incident off Alexandria beach: Al Kahera Alaan’s Lamees El Hadidi talked to Alexandria Governor Mohamed El Sherif about the drowning on Friday of 11 people at the Palm (El Nakheel) beach near Alexandria. Ala Mas’ouleety’s Ahmed Moussa also covered the story (watch, runtime: 13:19).

Face masks now included on ration cards: Ala Mas’ouleety’s Ahmed Moussa highlighted that the Supply Ministry has added face masks to the list of commodities distributed under the ration card system. Each cardholder is entitled to two masks (watch, runtime: 9:11).

Speed Round

Speed Round is presented in association with

SURVEY- How businesses are shaping their remote work policies as the economy reopens. We surveyed EGX-listed companies, multinationals, and small businesses to get a feel of how the private sector plans to reshape their work from home policies in the coming weeks and months.

The short answer: It’s more complicated than back in March, when businesses were uniformly gearing up to shift employees to working from home. Today, execs have the benefit nearly four months of experience with the pandemic and are tailoring WFH policies that try to strike a balance between business continuity and the health of their workforce.

Of the 16 companies we surveyed, 11 are still relying almost entirely on remote work for anyone whose job could possibly be done from home. The majority of these businesses — including Coca-Cola, Nestlé, Procter & Gamble, Unilever, UNDP, Orange, data analytics startup Arqam, and one of the country’s largest finance firms (which asked to remain unnamed) — have reopened their office space for employees who wish to work from there. These offices require a portion of their administrative and security staff to be present on-site. Some are also requiring top executives to work from the office, with the remainder of the staff permitted to work from home or on-site based on requests. Boutique business development firm Ahead of the Curve has not reopened its offices and its entire staff continues to work from home.

Another three have already moved to a rotating schedule, and two have fully returned to working from the office. Staff at Al Ismaelia Real Estate Development, for example, work three days per week in the office and the remaining two are used for remote work. Hassan Allam Properties has implemented a weekly rotation for its staff. Jude Benhalim — an upscale jewelry brand with a total of nine employees — returned to its office space two months ago with social distancing measures in place.

With the reopening of courts, law firms are taking a mixed approach. While Tamimi & Co fully reopened its offices with a slew of precautionary measures, Shahid Law currently has rotating shifts with a maximum capacity of 10% of employees. Youssef & Partners has reopened its offices but does not require its employees to work on-site. Adsero is flexible with where its employees work on a daily basis, but those who are required to attend court sessions are expected to comply with measures such as social distancing and wearing face masks.

None of the businesses we surveyed have clarity on when they’ll return to the office full time, but the majority of respondents have set a schedule to review their policies. Some said they review their policies as frequently as every two weeks, while others said that they will not be revisiting their remote work policy until September.

CORRECTION- 12 July 2020

An earlier version of this story incorrectly named Sharkawy & Sarhan among our survey respondents. The correct law firm is Shahid Law.

Annual urban inflation accelerated to 5.6% in June, edging up from a six-month low of 4.7% in May, according to central bank figures (pdf). Monthly figures remained subdued, with June’s figure coming in at 0.1%, compared to -0.8% during the same month last year, and to 0% in May, the central bank said.

Food prices under pressure: Food and drinks prices fell for the second consecutive month, dropping 1.6%, according to state statistics agency Capmas. All food items saw their prices drop, with the exception of fruits, where prices surged 18.8%. Food, which is the largest component of the basket of goods, was the main reason behind the subdued monthly figure, Naeem Brokerage said in a research note picked up by Reuters. The covid-19 pandemic has led to weak consumption patterns for much of this year, and government efforts to ensure supply are putting further downwards pressure on prices, the brokerage said.

Core inflation falls: Annual core inflation, which doesn’t account for volatile items such as food and fuel, fell to 1% in June from 1.5% in May. The price of core items fell by 0.3% during the month, compared to a 0.3% increase during May.

Unfavorable base effect responsible for annual uptick: The increase in the annual figure was in line with expectations and came due to an unfavorable base effect, Pharos’ head of research Radwa El Swaify and Mona Bedeir, senior economist at Prime Holding, told Enterprise. Both analysts projected a drop in the headline rate this month as the effect wears off.

“Weak consumer demand on the back of covid-19 is not to be ignored,” Bloomberg quoted EFG Hermes’ Mohamed Abu Basha as saying. Monthly inflation remains quite contained in spite of seasonality, reinforcing our view that demand pull factors are significantly low this year,” Naeem director of research Allen Sandeep told the business information service.

The central bank is scheduled to meet again on 13 August, after inflation figures for July are released. Analysts appear to expect rates will be left on hold at the meeting. Prime Holding said in a research note that while the CBE still has room for a cut without driving away foreign investors, policymakers will “opt to be cautious throughout the rest of 2020.” Capital Economics took a similar position, but expects some form of easing to be resumed later in the year. El Swaify is of the same mind, expecting rates to be kept on hold for the fourth consecutive meeting after the CBE made a historic 300-bps rate cut in March in response to the covid-19 pandemic.

IMF mission chief praises Egypt for resilience-enhancing reforms, plans for crisis spending and post-covid recovery: Egypt has taken a “proactive” approach to limiting the economic fallout from the covid-19 pandemic by seeking assistance from the multilateral lender through a two-part USD 8 bn financing package, IMF Egypt mission chief Uma Ramakrishnan said. The funding — which includes a USD 2.8 bn Rapid Financing Instrument and another USD 5.2 bn, 12-month standby loan — allowed the government to both address immediate spending needs to address the outbreak and avoid undoing progress made under its previous reform program, Ramakrishnan said. This approach will also help the country “further advance structural reforms to position Egypt for sustained recovery,” particularly as the program helped to increase Egypt’s resilience and weather the crisis.

“The government’s goal is to place Egypt on a strong footing for recovery,” she said. While state spending on healthcare and social safety nets has increased since the onset of the pandemic, the government is wary of becoming encumbered with debt down the line. The Finance Ministry is currently reworking its debt strategy — which it began implementing in March 2019 and entails moving towards longer-term debt and imposing a cap on eurobond issuances, among other things — according to Ramakrishnan.

Egypt is also committing to greater transparency in its crisis spending, Ramakrishnan said. To that end, the government will publish the details of its spending during the crisis on the Finance Ministry website and will also disclose procurement contract details.

INVESTMENT WATCH- Mars Wrigley is planning to increase its investments in Egypt over the next two years, Mars Egypt Director Dalia Salib said on Thursday, according to a cabinet statement. Salib did not specify how much the confectioner plans to invest during this time period, but noted that it has committed a total of USD 200 mn in Egypt. Mars is also planning to expand its production lines at its factory in Sixth of October City. The company had invested EGP 2 bn in 2018.

Meanwhile, Edita has put investment plans on hold until the pandemic subsides, Chairman Hani Berzi told Al Shorouk. The homegrown snackfood giant was planning to invest EGP 750 mn in its operations in Egypt and Morocco but plans have been largely frozen due to declining sales and falling exports, Berzi said. It will focus on existing products and its under-construction plant in Morocco, which is set to begin operations by the end of the year.

Companies face fines if they fail to publicly list the price of their products, including on their websites, Consumer Protection Authority Chairman Ahmed Samir told DMC’s “Al Youm” TV programme (watch: min 26:45). These include companies which advertise that they’ll send prices privately to consumers’ inboxes, he added. Fines will range from EGP 10k to EGP 1 mn, and will be determined by an economic court. Companies have until Thursday to abide by pricing regulations

Egypt bats away Ethiopia’s proposal to kick the can: Egypt has refused a proposal put forward by Ethiopia on Friday to delay decisions on crucial points of contention in the framework for filling and operating the Grand Ethiopian Renaissance Dam (GERD), the cabinet said in a statement. Egypt instead submitted a number of alternative solutions to address the outstanding differences, which remain unresolved despite months of intensive negotiations.

What Ethiopia is proposing: Addis Ababa’s proposal would see Egypt, Ethiopia, and Sudan sign a basic agreement with the points on which they already see eye-to-eye. Outstanding issues — including outlining a legal mechanism to resolve future disputes, and procedures for filling and operating the dam during periods of drought — would then be referred to a specialized technical committee that would be established under the preliminary agreement, which would then look into and settle these issues at a later time. The Egyptian delegation argued that this would essentially gloss over core disputes that need to be settled and put into a technical agreement.

Sudan is also getting uneasy as the threat to Nile river flow is fast approaching: There is now growing concern among Sudenese workers on the Nile over the changes GERD will likely bring to their livelihoods, Reuters reports. Pottery makers are worried they “will get less clay and less water” as the dam’s reservoir begins filling while farmers and fishermen further downstream also expect agriculture and fish stocks to be harmed. Some 20 mn people in Sudan are expected to be impacted in some form by the dam if not operated correctly.

Russia wants to get more involved as US mediation efforts fall flat: Bloomberg suggests that Donald Trump’s friendship with President Abdel Fattah El Sisi means the US was never going to be accepted as an impartial broker. The African Union (AU) has accused Washington of bias and questioned the Trump administration’s commitment to a fair resolution to the crisis. The AU has repeatedly said that GERD is an “African issue” that will be resolved with “African solutions.” That’s leaving room for Russia to come up the middle, is offering “technical assistance” to resolve the GERD dispute, Foreign Minister Sergei Lavrov said last week, according to Russia’s Tass.

The talks are getting attention in the foreign press: BBC | The Times | The National | Arab News.

M&A WATCH- Americana Egypt shareholders approve Adeptio offer price as market regulator approves share value methodology: Minority shareholders in Americana Egypt have approved Adeptio’s offer price of EGP 6.32 per share under a proposed mandatory tender offer (MTO), the local press reports, citing informed sources. This came after the Financial Regulatory Authority (FRA) approved the valuation methodology used by Adeptio’s financial advisor Ernst & Young but forced the Emirati outfit to up its offer price to account for the full value of the company.

What happened? The market regulator said in a statement (pdf) the offer price must account for the value of the company as a whole, rather than the minority shares targeted in the MTO. Adeptio is now required to remove or tone-down a figure used in the fair value study known as the discount for lack of control (DLOC). The change in the DLOC, which Adeptio has already agreed to, required the company to pay an average price of EGP 5.92 per share, or maximum price of EGP 6.32, up from the previous EGP 5.00 estimated by Ernst & Young using a DLOC.

Background: Ernst & Young was selected for the job last April after Fincorp, which was hired to determine a value for the MTO, was suspended by the FRA for understating the share price at EGP 3.90 apiece. Americana’s minority shareholders rejected the price, claiming that the value is somewhere in the region of EGP 24 per share. The story goes all the way back to when the FRA ordered the UAE’s Adeptio AD Investments to buy out minority shareholders in Americana Egypt after the former acquired the latter’s parent company Americana and gained indirect ownership of more than 90%.

STARTUP WATCH- Egyptian e-payments platform Fatura has raised north of USD 1 mn in its first funding round led by Disruptech and with participation from EFG Hermes and Cairo Angels, the local press reports. Fatura CEO Hossam Ali said the company is well positioned to provide transparent pricing and delivery data services for the wholesalers and retailers it connects and is seeking to shore up its tech infrastructure.

Background: Disruptech, a USD 25 mn fintech fund set up by former Fawry CEO Mohamed Okasha, made its first six-figure USD sum investment in two Egyptian startups, Khazna for mobile financial services and supplier distribution platform Brimore, earlier this year.

CORRECTION- 13 July 2020

An earlier version of this story incorrectly spelled Fatura as Fatora, and had linked to the incorrect website. Fatura does not currently have a website. The original version of the story also said Fatura raised USD 1 mn in the funding round; the startup raised more than USD 1 mn.

EARNINGS WATCH- Maridive & Oil Services’ net losses widened to USD 7.5 mn in 1Q2020, up 532% y-o-y from losses of USD 1.4 mn in 1Q2019, the company said in a regulatory filing (pdf). Revenues fell to USD 13 mn during the quarter from USD 18.1 mn in 1Q2019. The company, which is looking to divest a key subsidiary to Jeddah-based Khaled Abdullah Al Subaie Holding Company, opened talks with creditors in March as it grappled with the twin threats of covid-19 and the collapse in oil prices.

MOVES- Mohamed El Gamal (Linkedin) has been appointed as CEO of Maridive and Oil Services, a subsidiary of Maridive Group, according to an EGX disclosure (pdf).

MOVES- Haitham Hammad (Linkedin) has been appointed as deputy CEO of Mashreq Bank, according to Al Mal. Hammad was previously the head of retail banking at SAIB Bank and Arab Investment Bank, as well as senior director at CIB.

The Macro Picture

Stop worrying and love the deficit — YBG’s guide to surviving the pandemic: Governments are going to have to get used to deploying interventionist policy if economies are going to survive the current crisis. This was the key takeaway from an interview on Al Kahera Wal Nas with Mubarak-era finance minister Youssef Boutros Ghali — the man who at one time made it almost-fashionable to pay taxes — who argued that the “patient” that is the pandemic economy will be in serious trouble if governments don’t do more to support consumption, encourage lending and give companies incentives to invest. Even though every economy has a unique composition, governments should prioritize public spending and personal incomes as a general approach to keep their economies afloat, says Boutros Ghali, noting that emerging economies need to take cues from the developed world, something that is only just starting to happen.

Boutros Ghali uses an analogy that likens the covid economy to a crash survivor in need of a total body fix. Unlike during the global financial crisis, covid recovery efforts need to be multi-layered, he says, suggesting that governments should continue to use a mix of affordable lending, cash handouts, and “anything that keeps [the patient] alive.” The end goal of any recovery effort is to support consumption, a point he hammers home at several points in the interview. Expansionary monetary policy to reduce the cost of borrowing and measures to shore up social safety nets to protect the vulnerable should also be key to any recovery effort, he says.

The global financial crisis was caused by a heart attack at the center of the economy (the money markets). The prescribed treatment was coordinated and massive bond- and asset-purchasing programs by the world’s major central banks, a policy YBG played a key role pushing for as then-chair of the IMF’s policy-setting committee. Those programs involved, in no small part, loans to institutions at historically low interest rates. This, however, meant the money was paid back directly by the borrowers.

Now, governments need to step up and take the hit. Rather than passing debt on to already-burdened consumers, they should explore every avenue possible to increase disposable incomes, Boutros Ghali stresses. In the process of doing this, government deficits are widening dramatically, calling into question whether economies can afford such large-scale fiscal programs. Here, Boutros Ghali argues that governments are able to keep the printing presses running and dismisses arguments from the deficit hawks, claiming that since consumption will likely remain low in the coming months, governments need not worry about inflation.

Other takeaways from the interview:

- Globally, expat remittances to emerging economies are expected to drop by USD 100 bn this year;

- The crisis is also forcing policymakers to tap into unchartered waters with regards to testing out economic theory (see: the debate over the risks and pay-offs of Modern Monetary Theory);

- The pharma, consumer delivery and e-commerce sectors will emerged as the winners from the crisis;

- The US-China conflict is a war on all fronts but the military, affecting the ability of emerging economies to attract FDI and bring in foreign currency through trade.

Tap / click here to watch the full interview (runtime: 1:12:14).

Egypt in the News

The stalled talks over the future of the Grand Ethiopian Renaissance Dam are dominating the conversation on Egypt in the foreign press. We have the full story in this morning’s Speed Round, above.

Meanwhile: The New York Times looks at Cairo’s lockdown-enforced “detox” and carries an obit of famed Egyptian actress Ragaa El Gedawy. The Washington Post's editorial board is on again about a lawsuit against former PM Hazem El Beblawi by Mohamed Soltan. The Associated Press covered the drowning of 11 people in Alexandria’s Palm Beach in Alexandria, notorious for its dangerous currents, while AFP writes that Alex has banned kite-flying to “ensure the safety of citizens.”

Diplomacy + Foreign Trade

GERD aside (see Speed Round, above) It’s all about foreign funding for development and infrastructure projects this morning. The National Bank of Egypt and the International Finance Corporation signed an agreement to increase local funding for solar-powered water pumps in agriculture, according to a statement (pdf).

Help from the US, Canada: The International Cooperation Ministry signed six new agreements worth a total of USD 90 mn with USAID, according to a cabinet statement. The grants will be used to fund development projects in education, scientific research, science and technology, health, trade and investment, and agriculture. Separately, the ministry inked two agreements worth a combined CAD 14 mn with the Canadian embassy focused on the socio-economic empowerment of women, a cabinet statement said.

Energy

Egypt to contract Schneider, GE for EGP 8 bn-worth of electricity control centers

The Electricity Ministry is planning to sign in August some 15 contracts worth over EGP 8 bn on a turnkey basis to set up localized and regional energy control centers, Al Mal reports, quoting ministry officials. France-based Schneider Electric will reportedly be awarded 14 of the 15 contracts to build centers in Greater Cairo, Minya, Sharm El Sheikh, Hurghada Ismailia, Gharbia, Menoufia, and several of the El Sisi administration’s new urban developments. General Electric, meanwhile, will be building a single center in Alexandria.

Manufacturing

Cotton and Textile Industries Co. signs EGP 780 mn agreement with Misr Spinning and Weaving for cotton spinning factory

State-owned Cotton and Textile Industries Company has signed a EGP 780 mn agreement with Misr Spinning and Weaving Company after being awarded with the tender to develop a cotton spinning factory in Mahalla Al-Kubra, according to a cabinet statement. The factory is expected to manufacture some 30 tonnes of cotton per day once it is completed in 14 months’ time. The agreement comes as part of the Public Enterprises Ministry’s plans for consolidating and developing the cotton manufacturing industry.

Real Estate + Housing

NACCUD eases payment requirements for new capital developers

The New Administrative Capital Company for Urban Development (NACCUD) has cut the required downpayment for real estate developers on land in the new administrative capital to 10%, from an initial 20%, Hapi Journal reports, citing unnamed sources from the state-owned company. NACCUD will also be extending loan repayment schemes by one year as part of its incentive program. Investors willing to make 25% down payments in USD will also receive special privileges in land allotments.

Other Business News of Note

Spinneys amends Egypt expansion plans, will still inaugurate three branches

Spinneys is planning to open three new branches during the current fiscal year at a combined cost of EGP 150 mn, CEO Mohanad Adly said, according to Al Mal. He did not specify where the shops might open. The company had said in January it plans to set up six new branches before 2020 is out. The covid-19 outbreak has prompted some delays in the company’s investment plans but the company is still committed to Egypt in the longer term, Adly said.

On Your Way Out

Renowned choreographer and co-founder of the Reda dance troupe Mahmoud Reda has died aged 90, according to Youm7. Reda is widely known for helping to bring traditional folk dance from across Egypt to the limelight in the 1950s.

The Market Yesterday

EGP / USD CBE market average: Buy 15.94 | Sell 16.04

EGP / USD at CIB: Buy 15.93 | Sell 16.03

EGP / USD at NBE: Buy 15.96 | Sell 16.06

EGX30 (Thursday): 10,957 (-1.5%)

Turnover: EGP 1.2 bn (38% above the 90-day average)

EGX 30 year-to-date: -21.5%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 1.5%. CIB, the index’s heaviest constituent, ended down 1.2%. EGX30’s top performing constituents were Madinet Nasr Housing up 0.7%, Eastern Company up 0.7%, and Palm Hills up 0.4%. Thursday’s worst performing stocks were GB Auto down 4.7%, AMOC down 4.6% and Pioneers Holding down 4.2%. The market turnover was EGP 1.2 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -54.3 mn

Regional: Net long | EGP +53.8 mn

Domestic: Net long | EGP +0.5 mn

Retail: 64.5% of total trades | 64.2% of buyers | 64.8% of sellers

Institutions: 35.5% of total trades | 35.8% of buyers | 35.2% of sellers

WTI: USD 40.55 (+2.35%)

Brent: USD 43.24 (+2.10%)

Natural Gas (Nymex, futures prices) USD 1.81 MMBtu, (+1.46%, August contract)

Gold: USD 1,801.90 / troy ounce (-0.11%)

TASI: 7,416 (+0.30%) (YTD: -11.59%)

ADX: 4,295 (-0.38%) (YTD: -15.37%)

DFM: 2,082 (-0.05%) (YTD: -24.69%)

KSE Premier Market: 5,604 (-0.23%)

QE: 9,316 (+0.99%) (YTD: -10.64%)

MSM: 3,494 (+0.01%) (YTD: -12.24%)

BB: 1,286 (+0.23%) (YTD: -20.11%)

Calendar

12 July (Sunday): Postponed court session for the appeal filed by the Egyptian Resorts against the Tourism Development Authority

14 July (Tuesday): Egyptian Private Equity Association webinar on the post-corona economy.

15 July (Wednesday): STC will reportedly announce at 5pm Riyadh time whether it intends to go through with its offer to acquire a controlling stake in Vodafone Egypt.

23 July (Thursday): 23 July revolution anniversary, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

5 August (Wednesday): IHS Markit PMI for Egypt released.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.