- Is Egypt seeking a standby facility from the IMF? (Speed Round)

- Egypt’s private sector activity expected to recover in 2020 amid “favorable” economic environment -EFG. (Speed Round)

- Returns on Egyptian gov’t bonds to remain “robust” -Credit Suisse. (Speed Round)

- Take note, finance nerds: The market for corporate paper may soon be resurrected. (What We’re Tracking Today)

- Aton secures CAD 300k bridge loan for work in its Abu Marawat concession in Egypt. (Speed Round)

- Papermaker Fine plans to invest USD 35 mn next year. (Speed Round)

- Flu season is here early this year. (What We're Tracking Today)

- The Market Yesterday

Wednesday, 18 December 2019

Flu season is here early this year

TL;DR

What We’re Tracking Today

Talking point of the morning: The flu. At least one Cairo-area private school has closed early for the Christmas holiday and two others have sent updates to parents amid warnings that this year’s flu season could be particularly nasty. New Cairo British International School (NCBIS) said it was sending students and staff on holiday early “on advice from the Ministry” and would re-open as planned on 12 January 2020. The decision was made for “the health and safety of everyone,” the note said. The American International School in Egypt (AIS) reportedly told parents earlier this week that it had found its first “reported case that tested positive for H1N1 virus” (that’s the so-called “swine flu”). Cairo American College (CAC) said last night that it doesn’t currently see the need to close early, but urged everyone to “take everyday preventive actions to help stop the spread of the flu virus.”

Have more than a couple of people in your workplace? Take basic precautions, folks. Remind staff to cover their mouth and nose when they cough, to wash their hands often, and to stay home if they have flu-like symptoms.

Should you be freaked out? Not yet. But you need to pay attention. The US Center for Disease Control warns that flu season could peak earlier this year, with the apex of the annual outbreak possibly coming this month. Kids and the elderly are particularly vulnerable to complications. WebMD has lots more about the flu and Ars Technica has a good rundown on CDC’s warnings as well as on reports that this year’s flu includes an “unusual type” that’s dominating the early start to the season.

Look for the EGP’s rally this week against the greenback to continue getting attention in the press as analysts line up to explain what the currency’s improved performance means for the future. There are diverging opinions on where the EGP will be next year, with Naeem Brokerage’s Allen Sandeep telling Reuters the FX rate could hit EGP 15.75 / USD 1 in 1Q2020, while Renaissance Capital’s Ahmed Hafez tells the newswire the currency could weaken in 2020. RenCap sees lower inflows from fixed income portfolios and reduced Egyptian treasury purchases, and expects the current account deficit to push a depreciation in the EGP, “which is already trading at a premium to its long-term average REER [real effective exchange rate].”

*** Tell us what you think will happen in 2020 and maybe we’ll send you an Enterprise mug and our very own coffee: Your view on where the EGP will be next year is one of the key questions in our 2020 Enterprise Reader Poll, which also asks you if your company is hiring, how optimistic you are about the economy in the new year, and other questions designed to take the pulse of our community. Tell us, and we’ll share the results with the entire community in early January to help you shape your view of the year. The survey is quick, we promise.

You can take the Enterprise Reader Poll here.

As a token of our thanks, we’re going to send 40 readers their very own Enterprise mug and a bag of our special coffee blend, produced in association with our friends at 30 North. Want a chance to get a mug of your own? Make sure you give us your name and complete contact information at the bottom of the survey.

Finance nerds should keep their ear to the ground today: The market for corporate paper looks like it’s about to get a shot in the arm. Word on the street is that EFG Hermes is about to take to market a short-term bond issuance for a high-profile real estate outfit in what could be the first offering of its kind under a new regulatory framework introduced by the Financial Regulatory Authority (FRA) last year. The FRA said yesterday that it had greenlit an offering, but did not name the issuer, saying only that EGP 2 bn-worth of short-term bonds would be issued, with the proceeds earmarked to finance working capital. If it goes through, it would be the first issuance of corporate paper in Egypt (other than securitized bonds) in almost a decade.

Sound smart: The new FRA rules allow joint-stock and limited liability companies, banks, financial institutions and SMEs to sell short-term debt instruments with maturities of less than two years to retail and institutional investors. Issuers must have two years’ worth of financial statements audited by an FRA-approved auditor, be investment grade themselves (at least a BBB- credit rating), and appoint a FRA-approved lead manager.

Assistant secretary for the US State Department’s Bureau of Near Eastern Affairs David Schenker arrived in Egypt yesterday for a trip that will see him meet unnamed “senior Egyptian officials” and officials from the Arab League, according to a State Department statement. Schenker, who is in town until Friday, will also visit Sinai to visit the multinational force and observers in the peninsula.

Oil prices eased from a three-month high on the back of a report that showed “surprise builds” in the US’ crude inventories, Bloomberg reports. “Oil futures ended Tuesday’s session just 6 cents shy of the USD 61 mark, buoyed by rebounding U.S. factory production and progress between [the] world’s two largest economies on trade,” the business information services says.

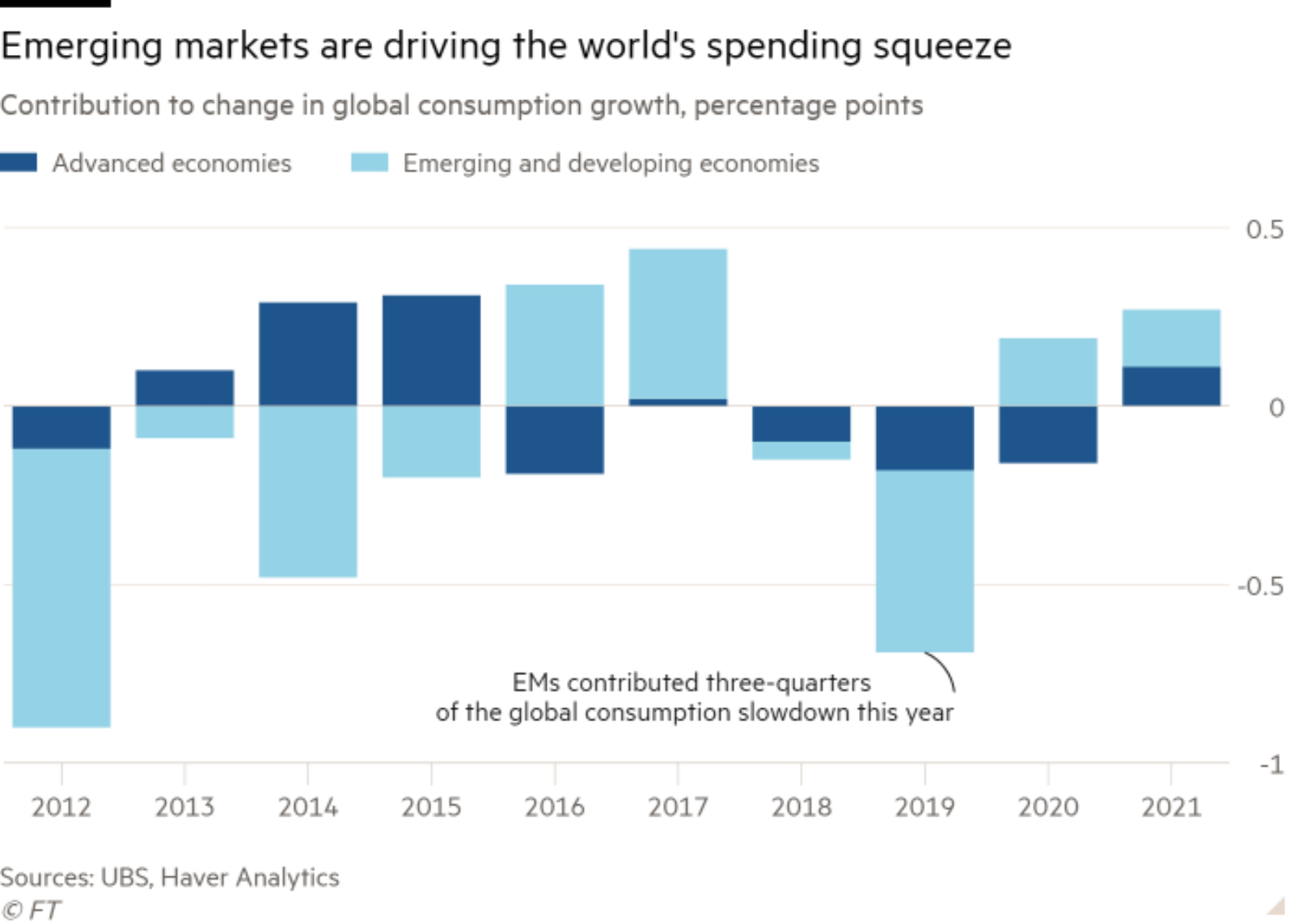

Fingers pointed at emerging markets as global consumption slows: UBS economists say that falling spending in emerging markets has been largely responsible for a slowdown in global consumption this year, the Financial Times says. Growth of global consumer spending and GDP are on course to hit decade lows this year, with EMs accounting for around 80% of the slowdown.

It has been a tough year to be a fintech unicorn: Amid the record equity prices and plunging bond yields, 2019 has seen many a fintech unicorn fall on its face. The Wall Street Journal looks at the headwinds fintech companies face, including unreliable technology, small consumer bases and business models that focus more on finance and less on tech.

Mideast-focused healthcare chain under fire from short seller: Shares of UAE-based NMC Health tumbled 27%, the London-listed company’s sharpest-ever decline, on the back of a report by short seller Muddy Waters alleging that the company’s “financial statements hint at potential overpayment for assets, inflated cash balances and understated debt,” according to Bloomberg. Shares of LSE-listed Finablr, which shares a founder with NMC and which went public this year, fell yesterday on the NMC news, Bloomberg reports.

Other business and international news you should know:

- Boeing will suspend production of its 737 MAX passenger jet in January in the wake of crashes in Indonesia and Ethiopia that claimed 346 lives, according to the Wall Street Journal.

- Saudi Aramco’s shares dipped slightly yesterday for the first time since their debut on the Tadawul, shedding 0.7% to reach SAR 37.75 apiece, according to Bloomberg.

- Trump impeachment gathers momentum as vote nears: Several Democratic lawmakers have come out in support of impeaching President Trump days before the House votes on whether to take him to trial, Agence France-Presse reports.

- The GBP fell 1.4% against the EUR yesterday on fears that Boris Johnson will push the country towards a hard exit from the EU, according to the Financial Times.

- Algerians elected former prime minister Abdelmadjid Tebboune as their new president, according to the Financial Times.

Enterprise+: Last Night’s Talk Shows

World Youth Forum coverage reached a fever pitch on last night’s talk shows as the gathering came to an end in Sharm El Sheikh yesterday.

Talking point of the day: The forum closed with a handful of recommendations, including launching an African initiative to promote digital development with the African Union, creating an Arab-African digital platform to publish women-led research, and launching an initiative to support fintech and blockchain apps. Masaa DMC’s Ramy Radwan (watch, runtime:9:50) and Yahduth Fi Misr’s Sherif Amer (watch, runtime: 5:12) both took note of the recommendations.

Also at the forum, President Abdel Fattah El Sisi told foreign media reps that Egypt’s only challenge at the moment is maintaining stability in the midst of regional turbulence, Al Hayah Al Youm’s Lobna Assal noted. Assal also had a chat with political analyst Moataz Bellah Abdel Fattah on how Egypt has been handling its image in the foreign press over the past few years (watch, runtime: 4:18).

Elsewhere, Masaa DMC’s Ramy Radwan happily reported on Egypt’s improved ranking on the Global Terrorism Index, which we cover in this morning’s Speed Round, below (watch, runtime: 1:53).

Speed Round

Speed Round is presented in association with

Is Egypt seeking a standby credit facility from the IMF? Egypt’s post-loan agreement with the IMF is could take the form of a standby credit facility, which “provides financial assistance to low-income countries … with short-term balance of payments needs,” unnamed government sources tell the local press. The facility’s duration is expected to be two years, which the fund says should be the maximum amount of time needed to resolve a country’s financing needs in order to be eligible for the facility. According to the sources, the government is hoping to have the agreement signed by 1Q2020, which is consistent with recent statements that the agreement could be finalized as early as March.

Background: The Finance Ministry had previously said that Egypt is eyeing a non-loan agreement with the IMF following the expiry of the USD 12 bn Extended Fund Facility, and initially said we could sign said agreement by October. IMF officials had initially poured cold water on the prospect of a cooperation framework, saying that Egypt would have to complete its three-year program with the fund before trying to get a second helping. The IMF’s Middle East and Central Asia Director Jihad Azour said in October that any renewed engagement between Egypt and the fund would likely focus on developing the private sector, strengthening welfare provisions, and increasing the transparency of state organizations.

Egypt’s private sector activity expected to recover in 2020 amid “favorable” economic environment -EFG: As Egypt’s economy enters 2020 with fiscal consolidation coming to an end and without macro tightening on the horizon, private sector activity is set to begin gradually recovering next year, EFG Hermes’ research team says in its 2020 yearbook. “We do expect, though, this recovery to be gradual as the economy slowly pushes away the dust of austerity. Egypt is a domestic demand-based economy, so it will take time for investment to recover until consumer demand also picks up.” Consumer demand has remained muted, growing at less than 1% while population growth is at around 2.5%.

CBE to put the pedal to the metal on monetary easing next year: With inflation expected to stabilize in the 6-7% range, EFG sees the Central Bank of Egypt (CBE) having ample room to cut interest rates by 150-200 bps in 2020. These cuts would bring rates to below pre-float levels “while still offering foreign portfolio investors a lucrative real yield.” The CBE will likely want to keep Egypt’s carry trade attractive to investors with a positive real rate margin of 2-3%, according to EFG.

Weak liquidity, muted private consumption growth threaten to drag down Egypt’s equities: The investment bank points to a “slower-than-expected drop in CDs rates leading to a continuation of weak local liquidity” coupled with private consumption growth remaining weaker than anticipated as the key risks for Egyptian equities next year. EFG notes that the EGP has appreciated around 10% YTD (breaking the EGP 16 / USD 1 barrier earlier this week) and the real effective rate exchange (REER) “is now at the LT average.” The FX rate is expected to see limited volatility next year, with EFG expecting less than 5% change.

Corporate earnings growth in Egypt is expected to be among the fastest across the countries EFG covers, with the investment bank penciling in earnings growth of 15% or more next year. Pakistan, Kenya, and Sri Lanka are also expected to have equally high earnings growth rates. “Macro headwinds remain strong in a number of our markets, and the likelihood of a truly cyclical earnings recovery seems to be highest in Egypt and Saudi Arabia.” Bloomberg had said last month that corporate earnings have now bounced back to pre-float levels in USD terms, three years after the EGP float, which initially dragged down earnings with inflation soaring to highs of 33%.

How Egypt’s 2019 performance compares to its peers: At 36%, the MSCI Egypt Index has seen returns sixfold that of MENA (6%) and more than three times that of EM (11%). “With rates getting close to pre-2016 levels and EPS growth still on track, we see no reason why Egypt should be trading at a 25% discount to Frontier-x-GCC markets.”

How EMs are expected to fare next year: Emerging and frontier markets should see strong performance early next year against a “favorable” backdrop, including successive rate cuts across EMs and a brief period of monetary easing in the US. EFG also expects oil prices to remain stable in 2020. The detente in the US-China trade war and a weaker USD will also give EMs a chance to breathe, and should start to see inflows pick up again after weakening since 2Q2019.

ETF inflows to EMs have historically been at their strongest during the first quarter of the year, EFG notes, suggesting that 1Q2020 will see a sustained uptick in inflows that will likely taper off around the middle of the year. While this is the historic trend, EM inflows are expected to be undermined by next year’s US presidential elections, which also tend to drag down EM performance. With elections set for November, “any 1Q rallies may fade as we enter 2H20e,” the investment bank says.

Returns on Egyptian gov’t bonds to dip but remain “robust” -Credit Suisse: Egyptian government bonds will pay lower returns to foreign investors in 2020 but will remain “robust,” Fadh Iqbal, head of Middle East research at Credit Suisse, told Bloomberg TV yesterday (watch, runtime: 4:07). “It’s still a very attract trade to be had. I don’t think that the returns are going to be as attractive as we saw previously but we still that there’s good value to be had,” he said.

Long-term issuances a sign of optimism: The recent trend towards longer term issuances “is testimony towards the increased confidence and the still attractive returns,” Iqbal said. Egypt last month held a three-tranche eurobond issuance of four-year, 12-year, and 40-year notes, a notable increase in maturity from previous FX-denominated offerings and local currency issuances.

Meanwhile, foreign holdings of Egyptian treasuries rose to USD 14.96 bn in October, up from USD 11.7 bn during the same month last year, according to central bank data.

Remittances rise 13.6% in 1Q2019-2020: Remittances from Egyptians living abroad rose to USD 6.7 bn in 1Q2019-2020, up 13.6% y-o-y from USD 5.9 bn in the same period last year, according to Central Bank of Egypt figures (pdf). Remittances rose 33.2% to USD 2.3 bn in the month of September.

Canadian mining firm Aton Resources has lined up a CAD 300k bridge loan from Ou Moonrider to finance its work in the Abu Marawat concession in Egypt, according to an emailed statement (pdf). The loan carries a 10% annual interest rate. Aton had said in June it discovered two new gold mine prospects in the eastern desert concession, with preliminary sampling returning positive results. The mining company said in the statement it is also still waiting on an exploitation license for the West Hamama concession, where Aton is looking to secure 20-year exploitation rights. If the Egyptian Mineral Resources Authority grants the license, Aton would become the second major gold producer in Egypt after Centamin.

INVESTMENT WATCH- Papermaker Fine to invest USD 35 mn in 2020: Fine Hygienic Holding will invest USD 35 mn in 2020 to expand production, add new products, and expand its truck fleet in Egypt, CEO James Michael Lafferty told Reuters’ Arabic service. Fine had announced plans last year to invest EGP 120 mn to add new tissue and diaper production lines, bringing its investments in the last two years to roughly EGP 2.25 bn. The company exports 25% of its production in Egypt to Europe and Africa, Lafferty said.

MOVES- FRA approves Prime Holdings’ removal of Khaled Rashed as CEO: The Financial Regulatory Authority (FRA) has ratified Prime Holdings’ board of directors’ decision to appoint vice chairman Mohamed Maher as CEO after removing Khaled Rashed, according to the local press. Rashed, who is the CEO of Sameem Capital, which holds a 27% stake in Prime Holdings, lodged a legal complaint with the FRA over Prime’s board meeting that saw his removal. The regulator rejected the complaint.

IPO WATCH- Emerald to offer 28% stake in January IPO: Real estate investment firm Emerald is planning to sell 28% of its shares on the EGْْX in the middle of January 2020, CEO of Egyptians Real Estate Fund Hashem El Sayed said, according to Al Mal. The company will offer as much as 95% of the stake to institutional investors that have already been approached by the lead manager, Odin Investments. The IPO will see existing shareholders exiting the company rather than new Emerald shares listing on the bourse. The company has not said how much it is expecting to raise from the sale.

Background: Odin Investments — which holds a 16% indirect stake in Emerald through its stake in the Egyptians Real Estate Fund, which in turn controls 50% of Emerald — announced plans to offer an undisclosed stake on the EGX last month and that a fair value report had been submitted. The company is seeking regulatory approval to list on the EGX ahead of the offering.

BUDGET WATCH- Gov’t to beat fuel subsidy spending targets in 2Q -gov’t source: The government will not spend more than EGP 10 bn on fuel subsidies in 2Q2019-2020, beating the EGP 13.23 bn quarterly allocations included in the state budget, an unnamed government source told Al Mal. Fuel subsidies spending fell 69% y-o-y to EGP 7.25 bn in the first quarter of the fiscal year. The government allocated EGP 52.96 bn to fuel subsidies for FY2019-2020, down from EGP 89.75 bn last fiscal year. Egypt has moved to gradually reduce fuel subsidy spending over the past three years under the USD 12 bn IMF-backed economic reform program.

One top 10 list we’re more than happy to fall out of: Egypt ranked 11th in the Institute for Economics and Peace’s 2019 Global Terrorism Index, taking us out of the top 10 countries affected by terrorism, the report issued in November said (pdf). Egypt ranked 9th in last year’s edition of the index. Deaths from terrorist attacks fell by 90% this year, which the report attributed to reduced activity from Daesh in Sinai following Egyptian military operations in the peninsula.

Finance nerds, this is your time to shine: Our next guest on Making It is all about finance and insurance. You think you know securitized bonds inside-out? He pioneered them in Egypt. Sitting in one of the coolest offices in Egypt, our next guest talks to us about gaining capital, pioneering products no one has heard of, and the hardships of trying not to be a micromanager.

Our last episode with Azza Fahmy Managing Director Fatma Ghaly is already out. Listen on our website | Apple Podcast | Google Podcast.

Egypt in the News

On yet another relatively muted morning for Egypt in the foreign press, President Abdel Fattah El Sisi’s latest statement warning against foreign intervention in Libya is making the rounds. Agence-France Presse and Russia’s RT are among those taking note.

Reuters’ Aidan Lewis takes a look at the recently inaugurated Benban solar power park, where 30 companies from 12 countries are developing facilities producing nearly 1.5 GW of clean electricity. The piece outlines the massive project that helped turn Egypt away from rolling blackouts in 2013 to 50 GW of installed power capacity. Lewis also points to the government’s plan to increase Egypt’s reliance on renewables to 20% of its energy mix by 2022 and 42% by 2035.

Manufacturers call for tariffs alongside government’s subsidized loan initiative: Factory owners tell Al Monitor that the EGP 100 bn program will help to stimulate industrial investment but call on the government to do more to protect local industry against imported products and dumping.

Worth Reading

How the pyramids influenced Nikola Tesla: Famed Serbian-American inventor Nikola Tesla is best known for being the brains behind the modern AC electrical supply system, but it turns out that behind part of his mad-scientist facade was an obsession with the Egyptian pyramids, according to BigThink. He believed the pyramids contained a power to send energy wirelessly due to their shape and location, which provided the inspiration for his experimental Wardenclyffe Tower and his designs for generators that could theoretically use the Earth’s ionosphere as a source of energy.

Diplomacy + Foreign Trade

El Sisi refuses to budge on Qatar demands: President Abdel Fattah El Sisi restated his demand for Qatar to meet 13 conditions put forward by the Arab Quartet back in 2017 before reinstating diplomatic ties, according to the National. “There are ongoing efforts that we hope will succeed. Doha’s position has not changed and there are 13 conditions that have not been met,” he said at the World Youth Forum yesterday. Talks between the island state and Saudi Arabia produced somewhat of a breakthrough earlier this week when the two sides agreed to resume dialogue.

Egypt receives EGP 2.5 mn World Bank grant for statistical research: Egypt will receive a EGP 2.5 mn grant from the World Bank to increase the capacity of the Central Agency for Public Mobilization and Statistics (Capmas), according to a cabinet statement. The grant will allow Capmas to collect statistics on economic sectors and monitor the country’s progress towards its sustainable development goals..

Egypt, Saudi Arabia sign tech cooperation agreement: CIT Minister Amr Talaat yesterday signed a three-year MoU with his Saudi counterpart that will see the two countries cooperate in a number of fields including fintech, AI, entrepreneurship and digital literacy, according to the local press.

Energy

Empower scraps plans to generate energy from sewage

Renewable energy group Empower has decided to scrap its plans to set up wastewater power plants in Egypt and reorient its investment to establish power plants fueled by municipal solid waste, CEO Hatem El Gamal told the local press. According to El Gamal, the feed-in tariff for sewage-to-energy electricity, which the government set at EGP 1.03 / kWh, is low and would not justify investing EGP 2.4 bn. The company would therefore rather direct its investments to more profitable projects, including solid waste, the tariff for which is EGP 1.40 / kWh.

Egypt raises natgas exports to Jordan to about 350 mcfd

Egypt has increased its exports of natural gas to Jordan to 350 mcf/d in December, up from 300 mcf/d last month to meet increased demand, according to the local press.

Infrastructure

Legrand plans to expand its presence in Egypt

French industrial group Legrand is looking to expand its operations in Egypt through acquisitions in the new administrative capital and establishing a new showroom in East Cairo in 2020, Legrand Egypt Group Managing Director Nicolas Hobeilah said in a press conference this week (pdf).

Real Estate + Housing

Porto Assuit to break ground in coming days

Porto Group intends to start construction work on the EGP 4.5 bn Porto Assiut project in the coming days, said Chairman and Managing Director Mohamed El Sayed, according to Hapi Journal. The development will include 1.9k residential and hotel apartments and 525 villas.

Tourism

Pyramisa to open its Dubai hotel in 1Q2020

Pyramisa Hotels to open its EGP 250 mn Dubai hotel in the first quarter of 2020, Chairman Magdi Azab said, according to Al Mal.

Abu Dhabi Development Holding Company to invest EUR 100 mn in FTI Group

Abu Dhabi Development Holding Company is seeking to invest EUR 100 mn in tour operator FTI Group, almost a third of which is owned by Egyptian businessman Samih Sawiris, according to Al Mal. The two companies will sign a partnership agreement to attract European tourists to Abu Dhabi.

Automotive + Transportation

Egypt launches three-month electric bus pilot between Tahrir and AUC New Cairo

Egypt’s first electric bus has begun a three-month testing period before the government begins rolling out more of the vehicles across Cairo, according to the local press. The EGP 4 mn bus is running between Tahrir Square and AUC New Cairo.

Banking + Finance

Bank Audi could invest alongside Egypt’s SWF

Bank Audi yesterday discussed potential investments with the Sovereign Fund of Egypt, Al Mal reports, without providing further details. The EGP 1 tn fund was officially launched last month by CEO Ayman Soliman. It has agreed to set up a USD 20 bn investment fund with the UAE, and is expected to finalize talks with the Oman Investment Fund over a similar venture in the coming weeks.

On Your Way Out

For people who know a thing or two about Ancient Egypt, perhaps the name Merit Ptah rings a bell: Merit Ptah is credited as being the "first woman known by name in the history of science," but it turns out the famous female physician was a myth, according to Science Alert. University of Colorado medical historian Jakub Kwiecinski claims that there is no actual proof that she ever existed, and claims to her existence are likely down to a mix-up of facts and dates over the 80 years since her name became recognized.

The Market Yesterday

EGP / USD CBE market average: Buy 15.97 | Sell 16.09

EGP / USD at CIB: Buy 15.98 | Sell 16.08

EGP / USD at NBE: Buy 15.99 | Sell 16.09

EGX30 (Tuesday): 13,627 (+1.7%)

Turnover: EGP 1.1 bn (50% above the 90-day average)

EGX 30 year-to-date: +4.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.7%. CIB, the index’s heaviest constituent, ended up 1.5%. EGX30’s top performing constituents were CIRA up 7.0%, Qalaa Holding up 4.6%, and Cleopatra Hospitals up 3.9%. Yesterday’s worst performing stocks were Egypt Kuwait Holding down 0.6%, Juhayna down 0.1% and Credit Agricole down 0.1%. The market turnover was EGP 1.1 bn, and domestic investors were the sole net sellers.

Foreigners: Net Long | EGP +35.4 mn

Regional: Net Long | EGP +11.2 mn

Domestic: Net Short | EGP -46.6 mn

Retail: 50.1% of total trades | 36.7% of buyers | 63.6% of sellers

Institutions: 49.9% of total trades | 63.3% of buyers | 36.4% of sellers

WTI: USD 60.60 (-0.56%)

Brent: USD 66.10 (+1.16%)

Natural Gas (Nymex, futures prices) USD 2.32 MMBtu (-0.04%, January 2020 contract)

Gold: USD 1,480.30 / troy ounce (-0.02%)

TASI: 8,197.39 (+0.72%) (YTD: +4.74%)

ADX: 5,058.61 (+0.39%) (YTD: +2.92%)

DFM: 2,758.39 (+0.80%) (YTD: +9.04%)

KSE Premier Market: 6,796.55 (-0.27%)

QE: 10,340.37 (+1.16%) (YTD: +0.40%)

MSM: 3,948.86 (-0.05%) (YTD: -8.67%)

BB: 1,583.65 (+1.03%) (YTD: +18.42%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: Indian automotive delegation to visit Egypt.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

23 December (Monday): The Cairo Economic Court decided to adjourn the lawsuit filed by Americana Egypt minority against the independent financial advisor to Monday 23 December.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June 2020 (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.