- Will the US Fed give the market what it wants with a rate cut today? (What We’re Tracking Today)

- Farm Frites brings online a new USD 40 mn potato chip production line. (Speed Round)

- Is Rameda Pharma the mysterious pharma company planning a USD 61 mn IPO? (Speed Round)

- FRA targeting a total of EGP 16 bn in securitized bond issuances in 2019 (Speed Round)

- Dawi Clinics’ Magda Habib on scaling up a healthcare startup in Egypt. (Speed Round)

- Season 2 of how a remote-controlled plane disrupted the global oil supply. (Speed Round)

- What’s coming after Facebook? (Worth Watching)

- The Market Yesterday

Wednesday, 18 September 2019

It’s Fed day: Will the market get what it wants?

TL;DR

What We’re Tracking Today

Today we find out if the US Federal Reserve will decide to give markets the rate cut it so desperately needs. An announcement will come in the wee hours of Thursday morning CLT, so look for the results in Thursday morning’s issue. The decision comes during a very tough week for markets following heightened tensions in Saudi Arabia, when 5% of the global oil supply was temporarily taken out of commission following a Houthi attack. The resulting spike in oil prices and the prospect of rising inflation is adding confidence to those assuming the Fed will cut rates, according to CNBC. That said, markets are pricing a 34% chance that the Fed will stay put on rates.

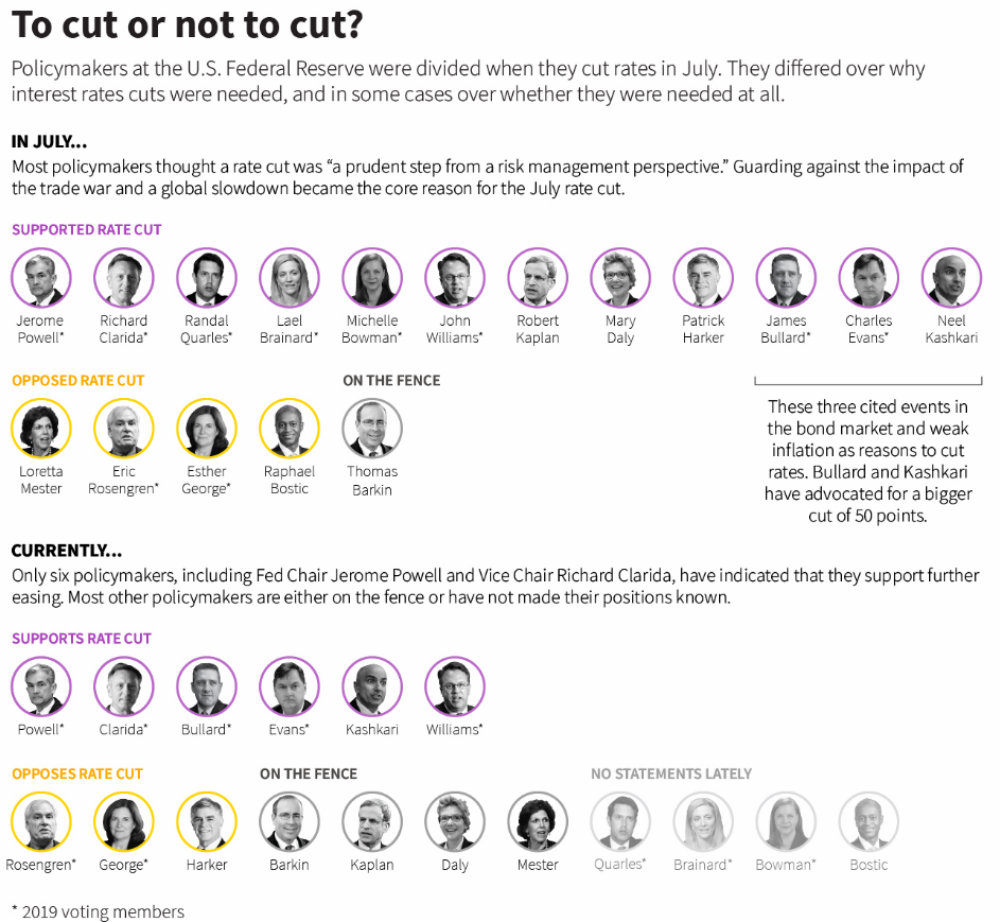

But not all of the Fed sees eye to eye on rate cuts. Reuters draws a very interesting picture of where Fed board members stand now versus where they stood when the Fed first started cutting rates in July. We see a much more divided Fed with more people on the fence and fewer board members seeing the need for a cut.

EMs want it: As we noted yesterday, the appetite for monetary easing has been prevalent across emerging markets. Bank of America expects Russia, Brazil, China and the Czech Republic, will likely cut rates further this year.

This is all making it likely that the central bank will move to cut rates when its Monetary Policy Committee meets next Thursday, 26 September. The primary driver given by analysts we’ve been speaking with is the low inflation. “We see inflationary pressures largely subsiding following the July subsidy cuts,” said HC Securities’ Monette Doss. “Yearly inflation dropped below 9% y-o-y, well within the CBE target of 9% (± 3%) in 4Q20, providing room for the CBE to proceed with monetary easing to stimulate economic growth and stock market activity,” she added. HC expects the CBE to cut rates by 100 bps.

One thing we haven’t seen discussion on is the impact of higher global oil prices on the CBE’s inflation targets. Brent crude crossed the USD 70/bbl market earlier this week following the attack on the Aramco facility, and reached a high of USD 68/bbl yesterday.

Conference season continues, with tech summits and competitions gaining the most traction in the local press.

Hala El Gohary, CEO of ITIDA, inaugurated the E-commerce Summit, focusing her opening speech on the growth of the e-commerce market in Egypt, and the country’s emergence as a regional leader in the field, according to a press release. She made note of the authority’s initiatives to stimulate the e-commerce sector such as an additional 5% subsidy for outsourcing firms.

On the competition side of things, cybersecurity solutions firm Trend Micro held the Egypt National Cybersecurity Competition (pdf). Three Egyptian teams were selected for the regional competition, which will be held in Cairo this month, before a winner goes off to compete in the global challenge in Tokyo in November.

Elsewhere, this year’s RiseUp Summit (which runs from 5-7 December) features the “Pitch by the Pyramids” competition, a multi-stage regional startup pitch contest involving countries from around the MENA region with the grand final event at the Great Pyramids of Giza. Local and international media heavyweights, renowned investors, and industry leaders will be present to see what the startups have to offer. More details on the competition’s format and the prizes offered are still to be announced.

Coming up on the events calendar are:

- The Egyptian Private Equity Association will host their venture capital event (pdf) later today at the Conrad Hotel.

- The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria.

- The Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

WeWork shelved its IPO on Monday after investors were seemingly unenthusiastic about the multi-bn USD listing, according to the Financial Times. The company had planned to launch a roadshow marketing the IPO as early as Monday morning, and to price and list its shares next week. This was not an unprovoked decision as SoftBank, WeWork’s biggest shareholder, has been opposing the IPO as of last week due to the slashing of the company’s valuation.

The end of founder worship? Investors had turned cold after concerns were raised about co-founder and CEO Adam Neumann’s outsized sway over the company as well as the increasing operating losses. The listing was expected to raise between USD 3-4 bn. WeWork has also lost out on a USD 6 bn loan from a consortium of banks, contingent on a successful IPO this year.

Israel’s national elections closed last night, and Netanyahu’s Likud party isn’t certain to come out on top. Exit polls following the election say “the result is too close to call,” according to the BBC. Incumbent Prime Minister Benjamin Netanyahu’s right-wing Likud had secured 28.42% of the ballots counted around an hour before dispatch time, while 25.40% were cast in favor of centrist former army chief Benny Gantz’s Blue and White Party, the Jerusalem Post reported.

Hong Kong leader Carrie Lam said she will begin an open dialogue with the community next week, but that suppressing the violence that has been taking place in three months of protests was still her priority, Reuters reports.

Enterprise+: Last Night’s Talk Shows

Surprise, folks: It was another rather uneventful on the country’s airwaves. The talking heads were occupied with the Baltim natural gas field going online,recent regulatory amendments, and the latest meeting of top government officials.

Eni’s Baltim goes online: Egypt’s Baltim South West natural gas field at a rate of 100 mcf/d, Al Hayah Al Youm’s Khaled Abu Bakr noted (watch, runtime: 3:14). We have the full story in this morning’s Speed Round.

El Sisi looks at FY2019-2020 economic indicators: President Abdel Fattah El Sisi, Prime Minister Moustafa Madbouly, CBE Governor Tarek Amer, and Finance Minister Mohamed Maait sat down yesterday to review macroeconomic and fiscal indicators so far into the fiscal year, reports Al Hayah Al Youm’s Khaled Abu Bakr (watch, runtime: 2:21).

FRA amends listing regs to ensure women representation: The boards of listed companies will now be required to have a woman member, according to one of two recent Financial Regulatory Authority decisions cited by Yahduth Fi Misr’s Sherif Amer (watch, runtime: 0:32).

Speed Round

Speed Round is presented in association with

INVESTMENT WATCH- Dutch food manufacturer Farm Frites has launched a new, USD 40 mn production line for producing potato chips in 10 Ramadan City, the Investment Ministry said in a statement. “We aim to export 65% of the products manufactured here, and raise our export markets to 20 countries,” Managing Director of Farm Frites Egypt Ahmed Seddik was quoted as saying at the opening. The company is also looking to add around five new products to its lineup of 18 products, he added.

IPO WATCH- Is Rameda Pharma the mysterious pharma company planning a USD 61mn IPO? Remember that unnamed pharma company that Financial Regulatory Authority official Sayed Abdel Fadeel said is planning a USD 61 mn initial public offering on the EGX this year? Well, Al Mal is speculating that the company in question is actually Rameda Pharma. Rameda had been looking to list sometime in 2018, but had suspended plans to list — along with Giza Spinning and Weaving and Hassan Allam Holdings — over the emerging markets zombie apocalypse.

M&A WATCH- Ugandan central bank gives BdC green light to buy out Cairo International Bank: The Ugandan central bank has signed off on Banque du Caire’s (BdC) full acquisition of Cairo International Bank in Kampala, Uganda, Chairman Tarek Fayed told Amwal Al Ghad. BdC previously owned 60% of the bank, and is now acquiring the remaining 40% that were jointly held by the National Bank of Egypt and Banque Misr. The Central Bank of Egypt had also given BdC the green light for the acquisition back in May.

The Financial Regulatory Authority (FRA) is targeting a total of EGP 16 bn in securitized bond issuances in 2019, of which EGP 10 bn have already been issued, Sayed Abdel Fadeel, head of the FRA’s corporate finance department, told Al Mal. Consumer and structured-finance player Sarwa Capital said last week it’s issuing EGP 4 bn in securitized bonds for the New Urban Communities Authority (NUCA) before the end of this month.

FRA grants GB Auto’s Drive Finance preliminary approval for securitized bond issuance: Meanwhile, the has given GB Auto’s Drive Finance preliminary approval from the FRA to undertake a securitized bond issuance, a company source told Enterprise. Al Mal had reported on Tuesday that the companys had requested approval for a EGP 400 mn securitized bond issuance. A company source, however, told us that a decision on the size of the issuance has yet to be made. The newspaper also reported that CIB and the Arab African International Bank (AAIB) will manage the issuance. The two banks will cover the issuance alongside the National Bank of Egypt, while El Derini and Partners will act as legal advisor.

Sukuk issuances also in the books for this year? CIAF Leasing, a company under the Civil Aviation Ministry, is seeking the FRA’s approval for a USD 50 mn-worth sukuk issuance that it hopes to execute this year after MERIS Ratings finishes its evaluation, Abdel Fadeel said.

CORRECTED on 18 September 2019

Drive Finance only received a preliminary approval to make the securitized bond issuance. The size of the issuance had yet to be decided.

Could the return of German direct flights to Taba see ODH turn a profit from Taba Heights? Orascom Development Holding (ODH) aims for its Taba Heights project in south Sinai to turn in a profit in the coming year, during which it plans to launch four new hotels in four different countries, CEO Khalid Bishara told Reuters. The company hopes that within 3-4 years Taba Heights would be making 2010-level profits, which had reached USD 20 mn. Earlier this year, Germany removed flight restrictions to Taba, allowing direct flights to the Sinai city. Taba Heights is ODH’s second largest hotel and largest tourist destination in south Sinai. ODH will also launch the third phase of its O West project west of Cairo in September. Bishara said the company is not considering projects in the new capital at the moment, but that it aims for its planned projects in the North Coast to be livable all year, not only for a couple of months per year.

The first of six wells in BP and Eni’s Baltim South West natural gas field has begun producing 100 mcf/d, the Oil Ministry said in a statement. The field’s total production is expected to reach 500 mcf/d once the other five wells are completed by 2Q2020. Eni, which shares production on the field with BP and the EGPC, had estimated the field to hold 1 tcf of natural gas when it was discovered in 2016. “Baltim South West development is yet another example of the joint efforts of BP and its partners to accelerate gas production commitments to Egypt,” BP North Africa Regional President Hesham Mekawi said, according to Energy Voice. “It demonstrates BP’s ongoing commitment to help meet Egypt’s growth in local energy demand with the Ministry of Petroleum and our partners.” Reuters also has the story.

STARTUP WATCH- Can a healthcare startup in Egypt manage to scale up and not lose its way? Our good friend Magda Habib seems to think so, and she believes her startup Dawi can do it. In an interview with the Financial Times, she says that the primary healthcare clinic chain Dawi Clinics is currently operating at about 15% of capacity, and has significant room for growth. Although not yet turning a profit, Dawi recently turned down a takeover offer from an undisclosed party, feeling the offer to exit was too early and that the buyer was not the right fit. Dawi secured instead a USD 3 mn investment from the Egyptian American Enterprise Fund last November.

The key is in waiting it out: Dawi’s focus on providing an ethical, affordable service puts pressure on revenue, but Habib believes that the long-term investment in patient trust will ultimately put the company in a stronger position for growth. “We’re trying to make the branches profitable, but this is a business based on volume, so I need 10-15 busy branches to start making a profit. We want branches to start to be profitable by the end of next year,” Habib said. She believes Dawi is an eminently scalable business, and says that it is her dream to have 100 branches one day, although the current plan is to set up between 25 and 30. With seven branches in Cairo currently, the intention is to expand outside of the capital, and open at least one branch in the Nile Delta next year.

Magda Habib’s interview is part of a Financial Times series on startups in the Middle East. You can access the full series of FT Future 25: Middle East here.

Careem’s application of tech infrastructure to create regional solutions led to its USD 3.1 bn acquisition by Uber, a second piece in the Financial Times series says. This challenge posed by Careem to its US-based rival has led to the region’s largest tech buyout, due to close in January, which will see Careem become an Uber subsidiary while continuing to operate under its own brand. Careem will continue to be led by co-founder and CEO Mudassir Sheikha,who intends for it to become a one-stop shop for diverse services, pursuing a growing customer base as it continues regional expansion, and moving into mass transportation and deliveries.

The idea is to continue following Uber’s original model, while maintaining its track record of localizing more effectively. In addition to launching its bus service in Egypt, the company has set up a Jeddah-Mecca route in Saudi Arabia for Hajj pilgrims, is diversifying beyond ride-hailing with the acquisition of a bike sharing company in Abu Dhabi this year, and an entry in the food delivery space. Careem also intends to add groceries and pharmaceutical products to the goods it delivers towards the end of this year and in early 2020.

The series continues with a look at how to avoid the mistakes of investing in MENA startups. Trying to apply Silicon Valley investment techniques in MENA is a mistake, writes entrepreneur and investor Sabah Al Binali. The region is not homogenous, and communication is often less direct than in the west, while regulatory structures are more complicated and investment returns often won’t come quickly. Building a successful startup means investing in regional expertise, he says.

Among the other stories in the FT series:

And now, Season 2 of how a remote-controlled plane disrupted the global oil supply: US President Donald Trump dialed back his rhetoric about Iran’s responsibility for Saturday’s attack on Saudi Aramco’s Abqaiq facility, which has disrupted 5.7 mn barrels of oil a day, or roughly 5% of global supply. Using more muted language than Monday’s “locked and loaded” tweet, Trump said that while the US was more prepared for military conflict than at any other time in history, it was something he would like to avoid. Iran’s supreme leader Ayatollah Ali Khamenei said on state television that there will be no talks between Iran and the US at any level,following reports circulating about a possible meeting between Trump and his Iranian counterpart, Hassan Rouhani, at next week’s UN General Assembly meeting. Khamenei said that all negotiations are off the table unless the US returns to the 2015 nuclear deal which it left in May 2018.

Mixed reports are emerging about when Aramco could resume full production: Top Saudi officials said yesterday that output was recovering more quickly than initially forecast, and that the kingdom was close to restoring 70% of the 5.7 mn barrels per day lost, according to an unconfirmed report from Reuters. Aramco’s output could be fully back in two to three weeks, they reportedly said. This directly contradicts earlier reports, however, which suggested that it could be months before full resumption was possible. A former corporate planning adviser to Aramco said that Abqaiq’s stabilization towers, of which five out of 18 were taken out, require specialized parts that could take weeks or months to procure. “Damage to the Abqaiq facility is more severe than previously thought,” said a chief oil analyst at Energy Aspects.

A delay to Aramco’s IPO is looking possible: Officials are reportedly discussing pushing the company’s listing on the Saudi exchange, originally slated for November, but have said they will wait for a full assessment of the damage from the attack before making a decision. While executives are expected to hold planned presentations and meetings, they are debating pushing the IPO itself until full production has resumed, sources said. There has been much speculation as to how the attacks will figure in any investor valuation, as they highlight the risk and vulnerability of Saudi’s oil infrastructure. Some advisers say the market may push for a discount of as much as USD 300 bn — bad news for Crown Prince Mohammed bin Salman, who was pushing for a valuation of USD 2 tn before the attacks, even as many advisers said USD 1.5 tn was more realistic.

Oil prices fell steeply on Tuesday, but general market uncertainty remains high: Brent crude prices fell from a high of just under USD 69/bbl to around USD 65/bbl towards the end of the day, and USD-denominated bonds issued by the Saudi government and Aramco also rebounded, following the Reuters report cited above, in a sign that investor concern might be abating. General market concerns, however, remain high. US consumers are being warned to expect higher energy prices in the short-term, and media outlets such as the Wall Street Journal are asking if consumers in Asia, heavily reliant on Saudi oil, will now need to look to Iran to supply their energy needs.

That’s still too close to call, as Egypt has based its fuel spending budget on an oil price of USD 68/bbl. Its hedging contracts with international banks are capped at that price.

MOVES- OPPO gets new MEA boss: Chinese electronics firm OPPO has appointed Ethan Xue as its new Middle East and Africa president, replacing Andy Shi, the company said in a press release (pdf). Xue previously lead the training division before heading marketing in China. OPPO’s regional office is in Dubai.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning is our continued spat with Ethiopia about the Grand Ethiopian Renaissance Dam (GERD): Ethiopia’s “summary rejection” of Egypt’s plan for filling and operating the dam is "unfair and inequitable," Foreign Ministry representatives said after talks earlier this week. Deutsche Welle and Reuters both have the story.

Other headlines worth noting in brief:

- Pictured above is an ancient Egyptian cow shoulder,one of many “beef mummies” excavated from tombs of high-born officials, courtesy of Atlas Obscura.

- Aswan’s Benban solar complex: Due to come online soon, the massive Aswan solar park is being noted by the Institute of Electrical and Electronics Engineers’ magazine IEEE Spectrum.

- The United Nations Human Rights Council should use its periodic review of Egypt’s human rights records to address repression,17 organizations — including Human Rights Watch — said in an open letter. Egypt’s review is coming up on 13 November and is a requirement for all UN member states.

Worth Watching

If Facebook’s domination is ending, what might replace it? Facebook may have had a monopoly over social media use for 15 years, with 2 bn active users, but the recent backlash against it has led to a rise in social media sites that want to offer users more control and privacy. Mastodon and Blockstack are two examples of sites that represent a radical break from Facebook’s centralized system, the Economist says (watch, runtime: 02:40). Mastodon is open-source, community-run, and crowdfunded, with no user tracking or targeted advertising. Blockstack relies of blockchain technology, so users own their data and can store it securely. Both are still a long way from posing a real threat to the social media behemoth, but they do offer a glimpse of where social media could be headed.

Diplomacy + Foreign Trade

Export council calls on gov’t to reach out to Libya to end new border fees: The Building Materials Export Council is calling on Prime Minister Moustafa Madbouly and the Trade and Industry Ministry to find a solution to a recent decision by authorities in the east of Libya to impose a EGP 8,800 entry and departure fees on Egyptian trucks entering Libyan borders, according to Al Mal. Libya’s imposition of fees was a response to Egypt increasing Libyan entry fees last year, reported in the Libya Observer.

The Textiles and Readymade Garments Export Council is targeting growing the value of the sector’s exports to EGP 4 bn by the end of the year, up from EGP 3 bn last year, council head Magdy Tolba said. The council is eyeing EGP 12 bn-worth of exports by 2025, with much of its strategy relying on participating in expositions at home and abroad to appeal to new markets, especially Japan, Tolba said.

Foreign Minister Sameh Shoukry met with his French counterpart, Jean-Yves Le Drian, in Cairo yesterday according to Foreign Ministry spokesperson Ahmed Hafez. The talks were aimed at boosting bilateral relations in various fields and to deepen cooperation and coordination on issues of mutual concern between Egypt and France.

Basic Materials + Commodities

China mulling Egyptian pomegranate imports

A Chinese agricultural quarantine delegation is visiting Cairo next week to scope out Egypt’s supervision procedures when it comes to packaging and exporting pomegranates and visit a number of farms, Agricultural Export Council head Abdel Hamid El Demerdash said. Egypt’s pomegranate season runs through December. Quarantine delegations from Brazil, the Philippines, South Africa, and New Zealand have already made similar visits to Egypt this year, El Demerdash said.

Egypt renews fees on fertilizer exports to ensure gov’t gets its orders

The Trade Ministry has renewed for one year a decision to impose a EGP 550-per-tonne fee on nitrogen fertilizer exports, according to a decision published in the Official Gazette. Fertilizer manufacturers have previously said they lose as much as EGP 250 per tonne when selling their output to the government, which then provides it to farmers at a subsidized price. This led them to direct most of their output towards exports and fall behind on their monthly deliveries. The fee, which was raised to EGP 500 last year from EGP 125 the previous year, is therefore meant to discourage the practice.

Manufacturing

Egypt’s Ghazl Al Mahalla to break ground next month on yarn factory

State-owned Misr Spinning and Weaving Company (Ghazl Al Mahalla) is planning to break ground at the beginning of next month on a new yarn factory that is expected to be the largest in the world, Chairman and CEO Ashraf Ezzat told the press. The 16-feddan facility, specialized in medium weight yarn, will have a production capacity of 15 tonnes per day.

Health + Education

Egypt could set up EUR 20 mn PPP factory to produce pharma raw materials

The government is currently looking into setting up a EUR 20 mn facility to manufacture raw materials for pharma products under a public-private partnership (PPP) framework, head of the Federation of Egyptian Industries’ pharma division Ahmed El Ezaby tells the local press. It remains unclear how much of the investment would come from the private sector. The Health Ministry would partner with an undetermined number of local private pharma players, in addition to Chinese and Indian raw material manufacturers for their know-how. According to El Ezaby, the two sides may break ground on the facility before the year is out.

Tourism

Luxor, Aswan Nile hotels see 60% occupancy this summer for first time since 2011

The occupancy rate at floating hotels in Luxor and Aswan reached 60% this summer for the first time since January 2011 amid a large number of visitors from Germany, Spain, China and Japan, Princess Cruise Line Chairman Ehab Abdel Aal said, according to Al Shorouk. Reservations during the winter season, which begins in October, at floating and other hotels is over 90%, Abdel Aal said, expecting full occupancy within the last 10 days of the month as Opera Aida kicks off in Luxor. Princess Cruise Line inaugurated this week a new floating hotel with EGP 70 mn in investments, Abdel Aal said.

Telecoms + ICT

TE to complete work on gov’t district in NAC by end of 1H2020

State-owned landline monopoly Telecom Egypt (TE) expects to complete telecommunication services for the new administrative capital’s government district by the end of 1H2020, CEO Adel Hamed said, according to Mubasher. TE began working last week on an EGP 40 bn (c. USD 2.4 bn) project to develop a telecommunications network in the new capital after signing an agreement with the New Administrative Capital Company for Urban Development (NACCUD). The company will build and operate the city’s tech and digital security infrastructure.

Other Business News of Note

Rebranded Egyptians Abroad Co Odin obtains investment fund license from FRA

Odin Investments has obtained a license from the Financial Regulatory Authority (FRA) to set up and manage investment funds, the company said in an EGX disclosure (pdf). Odin is planning to launch next year a logistics sector focused fund, we noted in June — back when the company was named the Egyptians Abroad Investment and Development. The FRA licensed the firm — which operates investment banking, private equity, asset management, and venture capital departments — under regulations passed in May last year. The regulations allowed banks and several types of non-banking financial service firms to set up any type of investment fund apart from real estate independently or with local, regional, or international partners.

Legislation + Policy

Egypt industry watchdog proposes law to limit informal sale of factory supplies

The Trade and Industry Ministry’s Industrial Control Authority has proposed a law to clamp down on the informal trade of factory supplies, authority head Ibrahim El Manasterly said. The proposed legislation, the details of which remain scant, would limit the sale of supplies to factories that are officially part of the formal economy, El Manasterly said.

Law

Two Shahid Law lawyers recognized by Who’s Who Legal Energy 2019

Who’s Who Legal Energy 2019 have recognized Shahid Law’s managing partner Girgis Abd El-Shahid and partner Donia El-Mazghouny as two of Egypt’s top recommended lawyers in the energy sector. Girgis Abd El-Shahid was also recognized for his skills in arbitration, both in the region and internationally, a statement from the firm says.

Sports

The Egyptian Weightlifting Federation banned from 2019 World Championships

The Egyptian Weightlifting Federation (EWF) has been banned from the 2019 World Championships by the Independent Member Federation Sanctions Panel (IMFSP), in response to a 2016 scandal in which seven members of the Egyptian weightlifting team were found to be doping, according to Al Shorouk. Measures are also being taken to remove Egypt’s weightlifters from the Tokyo Olympics in 2020. The EWF has 21 days to appeal the decision by the IMFSP to the Court of Arbitration for Sport. Reuters also has the story.

On Your Way Out

A clean-up campaign was launched to remove the so-called “garbage mountain,” a pile up of garbage in a 20 acres vacant downtown area in front of the Ismaili Social Club in Ismailia, according to Egyptian Streets. The campaign was part of a nationwide initiative launched by the Egyptian government.

The Market Yesterday

EGP / USD CBE market average: Buy 16.28 | Sell 16.40

EGP / USD at CIB: Buy 16.27 | Sell 16.37

EGP / USD at NBE: Buy 16.30 | Sell 16.40

EGX30 (Tuesday): 14,752 (-1.5%)

Turnover: EGP 961 mn (52% above the 90-day average)

EGX 30 year-to-date: +13.2%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 1.5%. CIB, the index’s heaviest constituent, ended down 0.8%. EGX30’s top performing constituents were Telecom Egypt up 1.8%, Cleopatra Hospital up 1.2%, and Ibnsina Pharma up 0.6%. Yesterday’s worst performing stocks were Qalaa Holdings down 6.0%, Palm Hills down 5.6% and Orascom Investment Holding down 5.4%. The market turnover was EGP 961 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +48.7 mn

Regional: Net Long | EGP +30.2 mn

Domestic: Net Short | EGP -78.9 mn

Retail: 60.6% of total trades | 55.9% of buyers | 65.3% of sellers

Institutions: 39.4% of total trades | 44.1% of buyers | 34.7% of sellers

WTI: USD 58.91 (-0.72%)

Brent: USD 64.55 (-6.48%)

Natural Gas (Nymex, futures prices) USD 2.66 MMBtu, (-0.22%, Oct 2019 contract)

Gold: USD 1,508.70 / troy ounce (-0.31%)

TASI: 7,770.55 (-0.72%) (YTD: -0.72%)

ADX: 5,170.66 (+0.19%) (YTD: +5.20%)

DFM: 2,849.67 (-0.99) (YTD: +12.65%)

KSE Premier Market: 6,069.89 (-0.5%)

QE: 10,470.83 (-0.39%) (YTD: +1.67%)

MSM: 4,001.48 (-0.19%) (YTD: -7.45%)

BB: 1,513.93 (-0.68%) (YTD: +13.21%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.