What we’re tracking on 18 September

Today we find out if the US Federal Reserve will decide to give markets the rate cut it so desperately needs. An announcement will come in the wee hours of Thursday morning CLT, so look for the results in Thursday morning’s issue. The decision comes during a very tough week for markets following heightened tensions in Saudi Arabia, when 5% of the global oil supply was temporarily taken out of commission following a Houthi attack. The resulting spike in oil prices and the prospect of rising inflation is adding confidence to those assuming the Fed will cut rates, according to CNBC. That said, markets are pricing a 34% chance that the Fed will stay put on rates.

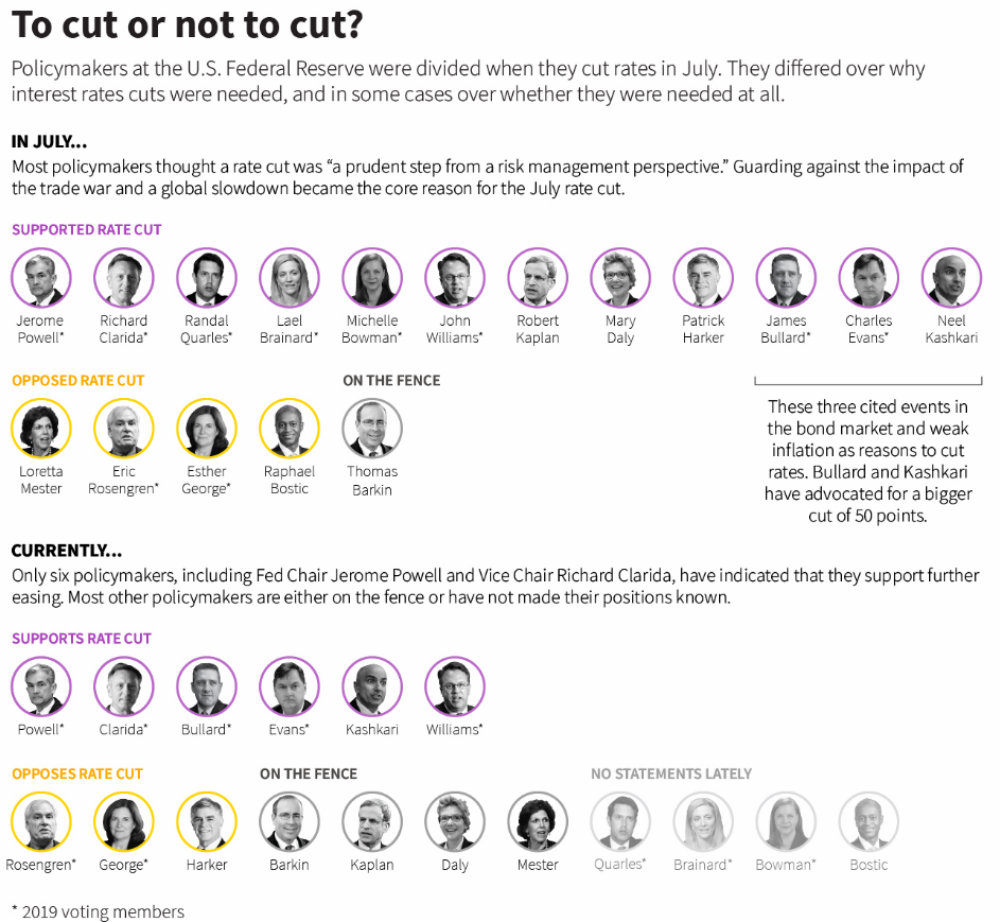

But not all of the Fed sees eye to eye on rate cuts. Reuters draws a very interesting picture of where Fed board members stand now versus where they stood when the Fed first started cutting rates in July. We see a much more divided Fed with more people on the fence and fewer board members seeing the need for a cut.

EMs want it: As we noted yesterday, the appetite for monetary easing has been prevalent across emerging markets. Bank of America expects Russia, Brazil, China and the Czech Republic, will likely cut rates further this year.

This is all making it likely that the central bank will move to cut rates when its Monetary Policy Committee meets next Thursday, 26 September. The primary driver given by analysts we’ve been speaking with is the low inflation. “We see inflationary pressures largely subsiding following the July subsidy cuts,” said HC Securities’ Monette Doss. “Yearly inflation dropped below 9% y-o-y, well within the CBE target of 9% (± 3%) in 4Q20, providing room for the CBE to proceed with monetary easing to stimulate economic growth and stock market activity,” she added. HC expects the CBE to cut rates by 100 bps.

One thing we haven’t seen discussion on is the impact of higher global oil prices on the CBE’s inflation targets. Brent crude crossed the USD 70/bbl market earlier this week following the attack on the Aramco facility, and reached a high of USD 68/bbl yesterday.

Conference season continues, with tech summits and competitions gaining the most traction in the local press.

Hala El Gohary, CEO of ITIDA, inaugurated the E-commerce Summit, focusing her opening speech on the growth of the e-commerce market in Egypt, and the country’s emergence as a regional leader in the field, according to a press release. She made note of the authority’s initiatives to stimulate the e-commerce sector such as an additional 5% subsidy for outsourcing firms.

On the competition side of things, cybersecurity solutions firm Trend Micro held the Egypt National Cybersecurity Competition (pdf). Three Egyptian teams were selected for the regional competition, which will be held in Cairo this month, before a winner goes off to compete in the global challenge in Tokyo in November.

Elsewhere, this year’s RiseUp Summit (which runs from 5-7 December) features the “Pitch by the Pyramids” competition, a multi-stage regional startup pitch contest involving countries from around the MENA region with the grand final event at the Great Pyramids of Giza. Local and international media heavyweights, renowned investors, and industry leaders will be present to see what the startups have to offer. More details on the competition’s format and the prizes offered are still to be announced.

Coming up on the events calendar are:

- The Egyptian Private Equity Association will host their venture capital event (pdf) later today at the Conrad Hotel.

- The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria.

- The Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

WeWork shelved its IPO on Monday after investors were seemingly unenthusiastic about the multi-bn USD listing, according to the Financial Times. The company had planned to launch a roadshow marketing the IPO as early as Monday morning, and to price and list its shares next week. This was not an unprovoked decision as SoftBank, WeWork’s biggest shareholder, has been opposing the IPO as of last week due to the slashing of the company’s valuation.

The end of founder worship? Investors had turned cold after concerns were raised about co-founder and CEO Adam Neumann’s outsized sway over the company as well as the increasing operating losses. The listing was expected to raise between USD 3-4 bn. WeWork has also lost out on a USD 6 bn loan from a consortium of banks, contingent on a successful IPO this year.

Israel’s national elections closed last night, and Netanyahu’s Likud party isn’t certain to come out on top. Exit polls following the election say “the result is too close to call,” according to the BBC. Incumbent Prime Minister Benjamin Netanyahu’s right-wing Likud had secured 28.42% of the ballots counted around an hour before dispatch time, while 25.40% were cast in favor of centrist former army chief Benny Gantz’s Blue and White Party, the Jerusalem Post reported.

Hong Kong leader Carrie Lam said she will begin an open dialogue with the community next week, but that suppressing the violence that has been taking place in three months of protests was still her priority, Reuters reports.