- Elsewedy in EUR 55 mn agreement to acquire four Greek renewable energy outfits. (Speed Round)

- Is FrieslandCampina bidding for Arab Dairy, the darling of the 2015 M&A season? (Speed Round)

- Cleopatra said it will acquire one of Egypt’s largest IVF centers. (Speed Round)

- Enara plans new USD 600 mn solar plants. (Speed Round)

- Another proposal on the table for auto assemblers and manufacturers? (Speed Round)

- Egypt to pay Israel USD 500 mn settlement to end seven-year gas dispute. (Speed Round)

- Egypt FDI fell 8.2% in 2018 — but we’re still Africa’s #1 investment destination. (Speed Round)

- We have the second-highest renewable energy capacity in Africa, but we’re still not reaching our potential. (Worth Reading)

- The Market Yesterday

Monday, 17 June 2019

From healthcare to food and renewables, lots and lots of M&A

TL;DR

What We’re Tracking Today

We’re particularly happy to kick off this morning’s Speed Round with a run of investment and M&A news. Domestic and cross border, big ticket and small — there’s no better way to start your day.

It’s shaping up to be a tech-heavy week: Fintech and ecommerce conference Seamless North Africa gets underway this morning at the Nile Ritz-Carlton (continuing tomorrow), while Cairo Technology Week will kick off at the Hilton Heliopolis and wrap up Wednesday. Meanwhile, Minister of Communications and Information Technology Amr Talaat is headlining the IDC CIO Summit 2019 for the Middle East, Africa and Turkey. The one-day gathering takes place tomorrow at the Marriott Zamalek

The House general assembly is off this week, but will be back next week to debate the FY2019-2020 budget. Committee-level meetings and hearings continue in the meantime. The House is scrambling to wrap up this session before it goes on summer break some time after 1 July; it will be back in session by the first Thursday of October.

Also this week:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada on Wednesday;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs tomorrow through Friday;

- The African Cup of Nations kicks off in Cairo on Friday when the Pharaohs take on Zimbabwe in the opening match. Check out our guide to watching the matches and our special edition of Your Wealth, in association with our friends at CIB, which this month was all about Afcon.

It’s interest rate week in the US of A, with the US Federal Reserve widely seen as under pressure to get back on the easing train when its Federal Open Markets Committee concludes its two-day meeting on Wednesday. Pundits see the Fed leaving rates on hold now, but signaling that a rate cut could take place in July.

Central bankers will also be watching Sintra, Portugal, where the European Central Bank’s annual forum runs today through Wednesday. Tap or click here to visit the landing page for the gathering.

The Paris Air Show opens this morning. Just sayin’.

More demand for private equity as an asset class ≠ more fees for PE general partners. That’s the take-home message from the FT, which notes that limited partners are increasingly giving mainstream funds a pass in favor of hands-on direct investment in private companies or co-investing with fund managers. Among the draws: Being able to influence company strategy, a more stimulating environment for investors with a risk appetite, and zero fund management fees. Oh, and no exposure to bad actors such as Abraaj.

Factoid of the morning: Foreign investors now hold about 6.6% of all shares traded on Saudi Arabia’s Tadawul.

By far the biggest international story this morning are the ongoing protests in Hong Kong, which have continued to swell despite leader Carrie Lam’s u-turn on the contentious extradition bill. Protest leaders said that almost 2 mn people took to the streets yesterday to demand Lam’s resignation in what is becoming Hong Kong’s most serious political crisis since the UK handed the territory back to China in 1997. (Reuters | NYT | FT | CNBC | Bloomberg)

Other regional headlines worth knowing about this morning:

- Israel will attend the US-led gathering on Palestinian economic development set to take place in Bahrain next week. (The Hill)

- Military escorts in the Gulf? US Secretary of State Mike Pompeo has promised to protect shipping lanes in the Arabian Gulf, days after two tankers were attacked off the coast of Iran. (Bloomberg)

In miscellany this morning:

- Are we partying like it’s 1999 when it comes to the IPOs of loss-making startups? It’s complicated, argues Matthew Vincent in the Financial Times.

- Meet the man behind the video game that your kid (or younger sister) can’t get enough of. The Wall Street Journal has a great profile of Tim Sweeney, the founder of Epic Games — and publisher of Fortnight. Epic is a USD 7 bn company that Sweeney, 48, founded in his parents’ garage when he was 20.

- America is stepping up cyberattacks on Russia’s electricity grid, the New York Times reports, prompting The Donald to declare the story is simultaneously (a) false and (b) treason.

Oh, and speaking of power outages: The electricity went out yesterday across Argentina and large swathes of Uruguay and Paraguay, a development that has Argentina’s president, Mauricio Macri, scratching his head.

Another foldable phone just bit the dust. Huawei has postponed the launch of its Mate X foldable phone, following in the footsteps of Samsung and its ill-fated Galaxy Fold.

Two more father-related stories for you this morning: Toronto photographer William Lam takes his ethnic Chinese dad back to Vietnam 60 years later. It’s a touching little photo essay to which any of us with immigrant parents (or as immigrants ourselves) will be able to relate. Not a dad yet and pushing 50? Read Old enough to be your father: What it was like becoming a dad in my 50s, also in the Globe and Mail.

Enterprise+: Last Night’s Talk Shows

Gov’t keen on supporting real estate sector: Prime Minister Moustafa Madbouly’s speech at the Benaa Misr forum was the highlight of Al Hayah Al Youm with Khaled Abu Bakr (watch, runtime: 03:01). Madbouly said that the government is keen on supporting the real estate industry and urged developers to work on increasing the country’s export footprint. The minister also stressed the importance of the industry in creating jobs and boosting national income over the past five years.

New national projects have contributed to boosting the sector, the head of the Egyptian Federation For Construction & Building Contractors, Hassan Abdel Aziz, told Hona Al Asema’s Reham Ibrahim (watch, runtime: 04:31).

President Abdel Fattah El Sisi toured Cairo Stadium yesterday to ensure all was ready for Afcon, which kicks off this Friday when Egypt play Zimbabwe. El Hekaya’s Amr Adib had the story (watch, runtime: 02:54).

Finally, watch Adib have a fit over Egypt not celebrating Father’s Day (watch, runtime: 02:40).

Speed Round

Speed Round is presented in association with

M&A WATCH- Elsewedy Electric looking to acquire four Greek renewable energy outfits in EUR 55 mn transaction: Elsewedy Electric has entered into a EUR 55 mn agreement to acquire three wind assets and one hydroelectric company from Greece’s R.F. Energy. All four assets are in Greece, Elsewedy said in a statement (pdf) yesterday. The National Bank of Greece will fund up to 75% of the project via a ring-fenced project finance facility. Elsewedy Electric confirmed in May that it had received a EUR 42 mn loan from the NBG without stating what the funding would be used for. It is expected that the agreement will be completed by 28 June.

The move will make Elsewedy one of the top producers of renewable energy in Greece, CEO Ahmed Elsewedy said. The assets have a combined power generation capacity of 63.6 MW — enough to power 34k homes. They operate on fixed-tariff power-purchase agreements with 12-20 years left to run.

Background: The transaction, if completed, would mark Elsewedy’s second independent power producer project in the EMEA region after its USD 75 mn investment in a solar power facility in Benban. The company announced last year a partnership with Abu Dhabi’s Masdar and Japan’s Marubeni to invest USD 900 mn in wind parks in Egypt. In April, Siemens Gamesa selected the Elsewedy-Marubeni consortium to launch the first phase of a wind power project in Ras Ghareb.

M&A WATCH- FrieslandCampina to do due diligence on Arab Dairy ahead of bid: Egyptian cheese maker Arab Dairy will let Netherlands-based FrieslandCampina perform due diligence ahead of a potential bid for 100% of Arab Dairy’s, the company said in a bourse filing (pdf). The Panda cheese brand producer said it has received a letter of interest on Friday from the Dutch company asking to perform due diligence. Arab Dairy is 70%-owned by Pioneers Holding.

Background: Pioneers bought Arab Dairy in an EGP 257 mn transaction in 2015 after a bidding war that saw it beat out Lactalis (Europe’s largest dairy products company), Denmark’s Arla Foods, India’s Paras Dairy and Saudi’s Arrow Food Distribution. Arab Dairy had at the time a deep base of corporate clients including Hilton, Movenpick and InterContinental as well as mass-market restaurant brands Bon Appetit, Cook Door and La Poire and Saudi Arabia’s Arrow Food Distribution.

M&A WATCH- Cleopatra to acquire one of Egypt’s largest IVF centers: Cleopatra Hospitals Group (CHG) has entered into an agreement to acquire a majority stake in one of Egypt’s largest IVF centers, according to a press release (pdf). CHG did not provide the name of the target company or the size of the stake, but said that it expects to close the transaction later this year. “The acquisition not only sees CHG further strengthen its service offering in line with our expansion strategy, but sees us venture into a new, fast-growing and high margin segment reinforcing our position as leaders,” Cleopatra CEO Ahmed Ezzeldin said.

M&A WATCH- UK-based fund enters talks to acquire Euro Mena II’s majority stake in International Eye Hospital: An unnamed UK-based fund is in talks with the Euro Mena II private equity fund to acquire its 51% stake in Egyptian healthcare chain International Eye Hospital, according to unnamed sources speaking with the local press. The report suggests due diligence is yet to take place.

Euro Mena I, II, and III are separate funds owned by a Lebanese private equity firm, EuroMena Funds.

Why is it selling? The regional PE firm announced in 2017 a plan to exit investments in three Egyptian companies owned by Euro Mena I. The plan was reportedly part of a strategy to shift its focus to Lebanon, as well as to Africa-based companies with ties to the Lebanese diaspora.

Background: The local press reported in March that US private equity firm TPG was considering making a bid for the International Eye Hospital. Euro Mena II has reportedly rejected two informal offers: one from private equity fund Ezdehar Management and another from a group of physicians who are also shareholders in the target hospital. Euro Mena II tapped global advisory firm Lazard last year as financial advisor and Matouk Bassiouny as legal counsel on the potential transaction.

M&A WATCH- Media Production City to begin talks to acquire 55% stake in Arab Hotel Company: Egyptian Media Production City’s (EMPC) board has greenlit talks to acquire a 55% stake in Arab Hotel Company from Arab Contractors and its affiliates, EMPC said in a bourse filing (pdf).

INVESTMENT WATCH- Enara is planning to build solar plants at a cost of as much as USD 600 mn in El Wadi El Gedeed with a combined capacity of 600 MW, CEO Mohsen Ebeid said. The company has received land from the governorate and is expecting to complete the plants within 9-12 months of breaking ground. A number of petrochemical, ICT, agriculture, and education businesses have agreed with Enara to purchase power produced from the plants, which will be built under the independent power producer framework.

STARTUP WATCH- Eksab receives six-figure seed investment from 500 Startups: Egyptian sports startup Eksab has raised a six-figure seed investment from 500 Startups and plans to use the proceeds to fund regional expansion, the company said in a press release (pdf). Eksab is a daily fantasy sports platform allowing users to make predictions about live football games, earning points based on how accurate their predictions are, and being rewarded with prizes. It has processed over 5 mn predictions since its launch in November 2017 and aims to increase this to 100 mn in the coming year, using the seed funding from 500 Startups. California-based VC firm 500 Startups has an investment portfolio of over 2.2k companies in more than 74 countries. “We believe we can add significant support to Eksab with our investment,” partner Sharif El Badawi said.

EXCLUSIVE- We’re going to be discussing a new set of incentives for the automotive industry this fall. The finance and trade ministries are drafting new incentives to spur domestic manufacturing and assembly that will include large custom discounts on automotive components that peak at nearly 100%, two government sources told Enterprise. Amendments to the Customs Act are now on the drawing board after a series of meetings with representatives of global auto companies, the sources tell us. The amendments could slash the current 40% customs rate for factory-bound car parts according to a sliding scale based on how much local content is in the components.

Cui bono? The measure would benefit component manufacturers as well as both domestic car assemblers and manufacturers. If finalized, still require cabinet approval before being sent to the House of Representatives for debate.

So, what are we looking at?

- An effective customs rate of 28% on components for manufacturers using components that have 10-20% domestic content (representing a 30% customs break);

- A rate of 22.5% on components with 21-30% domestic content (good for a break of up to 50%);

- Customs of 17.6% on components with 31-40% local content (a break topping out at 60%);

- Customs of 8-16% on components with 40-60% local content (or a break of up to 80%);

- Manufacturers using more than 60% domestic content could pay just 5-7.5% customs on the parts under the proposal (good for an effective customs break of up to 95%).

A possible mix of subsidies plus large customs and tax breaks in auto zones? The program could also include significant subsidies for plants set up in dedicated automotive manufacturing zones, the sources said. This could mean 0% customs rate on select imports as well as tax breaks and, potentially, some form of cash subsidy with a sunset clause. The sources didn’t elaborate further.

By way of background: We were told last summer that, after scrapping the original incentive plan (the automotive directive), the government was looking at an alternative strategy that could borrow heavily from one adopted by successful regional players including Morocco and South Africa. The strategy involves a policy of supporting full-fledged auto manufacturing customs-exempt zones that would offer a range of as-yet unspecified tax and customs breaks.

Morocco also offers capex rebates, whereby the state effectively subsidizes the building of qualified plants and provides after-the-fact rebates.

Wait, haven’t we been here before? Yep. The industry has been told for years that successive governments have been working on a so-called automotive directive to provide incentives to assemblers to move further up the value chain into manufacturing. The automotive directive was a blanket policy for the industry, not based on specific zones or geographies. It set minimum production and export requirement to benefit from incentives, which would have included tax and customs breaks that varied by engine size and proportional to the percentage of domestic components used to assemble the vehicle.

A clean break with the past? The sources’ statements come as Trade and Industry Minister Amr Nassar issued a decree last night scrapping former minister Tarek Kabil’s domestic assembly order, according to Al Mal, which ran a copy of the order. Kabil’s policy mandated that 46% of the components of a domestically-assembled car be sourced locally. Assembly of a chassis and body plus painting on a domestic assembly line together qualified as 28% domestic content. The move was widely seen as a harbinger to the long-awaited automotive directive.

What does Nassar’s directive last night mean? (a) It could just simply be clearing the table for the newly formed policy we noted above; or (b) as the new policy itself appears to just be the automotive directive 2.0, last night’s move could just simply be part of the rebranding.

DISPUTE WATCH- Egypt to pay Israel USD 500 mn settlement to end seven-year gas dispute: Egypt has agreed to pay USD 500 mn over 8.5 years to the Israel Electric Corporation (IEC) as a settlement for halting natural gas shipments in 2012, the Egyptian General Petroleum Corporation (EGPC) and EGAS said yesterday in a statement picked up by Reuters. Egypt agreed to the reduced fine in exchange for the IEC dropping its other claims that arose from an arbitration decision in 2015, when the International Chamber of Commerce ordered Egypt to pay USD 1.76 bn.

Background: The IEC admitted in April that it was willing to accept a USD 500 mn settlement, amounting to a USD 1.3 bn write-off of the original USD 1.76 bn fine. Egypt had appealed against the International Chamber of Commerce’s ruling, and made reducing the settlement a key condition for accepting a gas agreement with Israel. The two countries signed a USD 15 bn gas pact last year, which will see Delek Drilling and its partner Noble Energy supplying the Alaa Arafa-led Dolphinus Holding with 7 bcm of natural gas from Israel’s Leviathan and Tamar gas fields. Delek’s deputy CEO Yossi Gvura said earlier this month commercial sales of natural gas to Egypt could begin by the end of June. The gas dispute originates from 2012 when terrorist attacks in the Sinai resulted in the Egyptian government suspending shipments of natural gas to Israel.

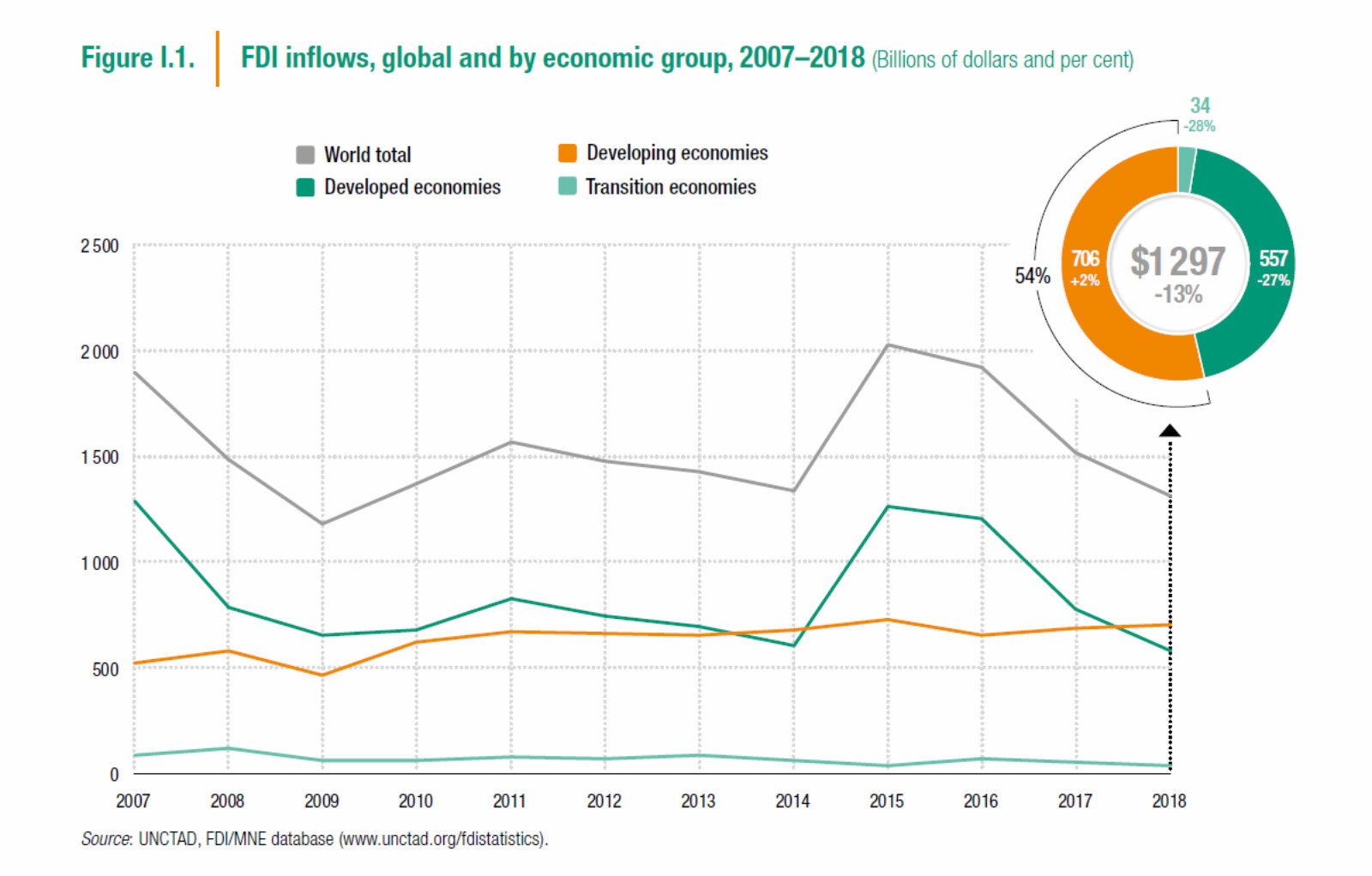

Foreign direct investment into Egypt fell 8.2% in 2018 amid global investment drop-off: Egypt retained its position as the largest recipient of foreign direct investment in Africa last year despite inflows falling 8.2% to USD 6.8 bn, according to UN figures. UNCTAD’s 2019 World Investment Report shows that inflows mostly went to the oil and gas sector, but large projects in other sectors — including Nibulon’s USD 2 bn grain infrastructure investment and Atraba’s USD 1 bn medical city — helped to diversify the country’s sources of foreign investment.

This is the second consecutive year FDI has declined. Investment rose to a peak of USD 8.1 bn in 2016, before falling to USD 7.4 bn in 2017. Outflows have been more sporadic over the past two years, slowing slightly from USD 207 mn in 2016 to USD 199 mn in 2017, but accelerating last year to USD 324 mn.

When will FDI growth return? Expectations differ: EFG Hermes’ Mohamed Abu Basha told us in April that Egypt could see a return to year-on-year growth in 2020 as inflation continues to fall and the CBE pushes ahead with its easing policy. Naeem Brokerage’s Allen Sandeep was less optimistic, telling us that we might have to wait until the economic reform program is 5-10 years-old before seeing annual growth in non-oil FDI.

Global inflows hit lowest level since the 2008 financial crisis: Global FDI declined for the third consecutive year in 2018, falling 13% to USD 1.3 tn. The report attributes a large part of this drop-off to the US tax reforms passed in 2017, which provided tax incentives to US multinationals to repatriate their foreign-held capital and invest it in the US economy.

Developed countries were hit hardest: FDI flows into developed countries plunged to 14-year lows last year as US companies pulled investment. Investment fell by 27% to USD 559 bn despite the value of cross-border M&A agreements rising by more than a fifth. This was driven largely by a halving of investment into European countries, but the US also saw a 9% drop-off. Australia meanwhile achieved a record USD 60 bn of inflows as foreign companies reinvested profits into the economy.

This might sound bad but…: The OECD’s analysis (pdf), which suggested in April that global FDI declined by a massive 27% last year, makes the latest UN figures look tame by comparison.

The rest of the world was less affected by Trump’s tax reforms: Given the relative lack of US investment outside of advanced economies, developing countries were largely unaffected by the repatriation of US capital — FDI into emerging markets actually rose 2% to USD 706 bn. The vast majority of this was concentrated in Asia, which accounted for USD 512 bn of all inflows into developing countries. Africa, while constituting only a small share of global investment, bucked the global trend as inflows rose 11% to USD 46 bn. This was driven in part by a huge rise in interest in South Africa, which more than doubled its FDI to USD 5.3 bn.

Is a “modest recovery” the best we can hope for? Unctad predicts that investment flows will improve slightly this year as the effects of the US tax reforms abate. Green shoots can be seen in the uptick of greenfield project announcements, which rose 41% last year. Unctad’s secretary-general, Mukhisa Kituyi, suggested though that is unlikely to be a dramatic pick-up in investment, particularly given the deteriorating trade situation, warning that “FDI continues to be trapped, confined to post-crisis lows.”

Want more stats? Read the full report here (pdf).

BUDGET WATCH- House budget committee to vote on draft budget this Wednesday: The House’s Budget and Planning Committee is expected to vote on the draft FY2019-2020 budget this Wednesday after completing its report, parliamentary sources said. That could set up a vote on the document as early as next week when the House general assembly returns from a one-week hiatus.

Egyptian company launches encrypted email service to allow blockchain crypto payments: Egyptian web firm Intelli Coders is aiming to make accessing online privacy tools and cryptocurrency exchanges in the Middle East easier with Dmail, which launched on 1 June in beta, Coindesk reports. Messages sent on Dmail include encrypted social and payment information, allowing bitcoiners easier access to the cryptocurrency.

How does Dmail work? Dmail users can directly send bitcoin to (or receive it from) a cryptocurrency wallet linked to a user’s online profile. Dmail’s messages are encrypted, and only the user can access any related data. Any recipient also has to consent to receive messages from another user.

Egypt’s relationship with cryptocurrency has been a rocky one, asthis excellent infograph demonstrates. And despite government scepticism over digital currencies, a recent CIGI/Ipsos survey found that more than half of Egyptians plans to use them over the coming year.

EARNINGS WATCH- Banque du Caire (BdC) net profits almost tripled year-on-year to EGP 1.21 bn in 1Q2019, up from EGP 407 mn in the same quarter last year, according to Al Ahram. The bank’s net interest income grew 58% y-o-y to EGP 2 bn during the quarter. “FY2019 came on the back of the positive results achieved in 2018, which was a turning point for the bank’s strategy,” CEO Tarek Fayed said. We noted last April that BdC is expecting to raise USD 300-400 mn when it sells a 20-30% stake on the EGX in a planned IPO as part of the state privatization program.

Egypt in the News

There’s nothing going on in Egypt that merits much attention in the foreign press this morning: A piece in The National looks at the Mohamed Salah-fronted ad campaigns currently sweeping the nation’s airwaves and filling social media feeds. But that’s it.

On The Front Pages

Egypt is committed to supporting the Gulf in its efforts against destabilizing attempts, President Abdel Fattah El Sisi said in a meeting with UAE Foreign Affairs Minister Sheikh Abdullah bin Zayed Al Nahyan, Al Ahram and Al Akhbar reported. The president also met with his government to discuss a fund to compensate martyrs and wounded soldiers, Al Gomhuria reported.

Worth Reading

Egypt has Africa’s second-highest renewable energy capacity, but we’re still not reaching our potential: Egypt ranks second in Africa in terms of renewable energy capacity, with statistics from the International Renewable Energy Association (IRENA) showing that power plants and other installations that use renewables can generate up to 4,813 MW of electricity per year, CNBC reports. But IRENA’s October 2018 Renewable Energy Outlook (pdf) stated that we could “realistically and cost-effectively” supply 53% of our electricity mix using renewables by 2030 — a far more ambitious target than the government’s aim for renewables to make up 42% of our electricity mix by 2035.

Egypt’s frameworks are stronger and projects are flourishing: Currently, Egypt’s total installed capacity of renewables includes 2.8 GW of hydropower and around 0.9 GW of solar and wind power. The USD 2.8 bn Benban complex is expected to generate as much as 1.8 GW of electricity, and its biggest contributor, Scatec Solar, has already started commercial operations on the third part of its 400 MW project, which is expected to be completed by the end of the year. In late 2018, Egypt’s renewable energy framework was named one of the three fastest-improving globally by the World Bank. And small businesses are leading the way in private sector job creation, with companies such as KarmSolar and the Solar Energy Development Association (SEDA) being responsible for 80% of private-sector jobs.

How can we reach, or even exceed, our renewable energy goals? IRENA’s recommendations include updating energy and power strategies, clarifying institutional roles and responsibilities for wind and solar development, bundling larger and smaller projects to help mitigate financial risk, and enhancing local manufacturing capabilities.

Diplomacy + Foreign Trade

El Sisi meets UAE FM Abdullah bin Zayed Al Nahyan: President Abdel Fattah El Sisi reaffirmed Egypt’s solidarity with the UAE in the face of “destabilizing attempts” in the Gulf in a meeting yesterday with UAE Foreign Affairs Minister Sheikh Abdullah bin Zayed Al Nahyan, according to an Ittihadiya statement.

Basic Materials + Commodities

Cotton-cultivated land shrinks by 36.8% this season

The size of agricultural lands cultivated with cotton fell this season by 36.8% compared to last year to about 193,000 feddans, local press reported, citing Agriculture Ministry officials. The fall is due to weather conditions and low selling prices last season which discouraged farmers from growing the crop.

Manufacturing

Novavera Sport to open factory producing FIFA-certified footballs in July

Novavera Sport will open its first football factory in the region, producing its first batch of FIFA-certified footballs before the start of the next season, according to the local press. The factory is set to open in early July in the 6 October industrial zone. It will have a production capacity of 1 mn balls in the first year, increasing to 5 mn within five years, according to Novavera’s GM. The project is being funded through a partnership between Al Assiouty Sport and Master Sports, comprising an investment of EGP 50 mn over three years.

Real Estate + Housing

Heliopolis Housing sells eight Sheraton plots for EGP 66.8 mn

Heliopolis Housing has sold eight plots of land in Sheraton for a total value of EGP 66.8 mn, the company said in an EGX disclosure (pdf) without specifying a timeframe. The Public Enterprises Ministry and the Holding Company for Construction and Development decided last week to hand the company’s management to a private investor.

NACCUD completes 70% of new capital infrastructure

The New Administrative Capital Company for Urban Development (NACCUD) has completed 70% of the infrastructure work for the new capital and is expected to finish the job within the coming year, NACCUD boss Ahmed Zaki Abdeen said, according to Al Mal. The next year will also see the completion of housing compounds as well as the government complex, Abdeen added during a tour yesterday that included 40 Saudi investors.

Egypt’s real estate exports at USD 500 mn from total of USD 70 bn in MENA

Egypt’s real estate exports are valued at only USD 500 mn from a total of USD 70 bn in the region, Prime Minister Moustafa Madbouly said yesterday on the sidelines of the opening of the Benaa Misr forum, according to Youm7. “The figure is smaller than modest considering Egypt’s capabilities and advantages,” Madoubly was quoted as saying. The minister reaffirmed the government’s support for the industry.

Telecoms + ICT

Telecom Egypt to expand in data centers in the coming two years

Government-owned carrier Telecom Egypt (TE) is planning to build four to five data centers in the coming two years in the new administrative capital, Alexandria, Smart Village and Suez, a company official told Masrawy. The company is also upgrading its existing data centers and is expecting to host Nokia’s Internet Of Things platform by the end of the year to serve Egypt and the region. TE is also working to meet the requirements to host Microsoft’s cloud network.

Banking + Finance

Banque Misr to provide letters of guarantee worth USD 162 mn for Orascom Construction and Arab Contractors

Banque Misr is set to provide letters of guarantee worth USD 162 mn for Orascom Construction and Arab Contractors for the water treatment plant project in Bahr Al Baqar, banking officials told Al Shorouk. The letters will be provided over two tranches with the first one worth 20% of the USD 739 mn estimated cost of the project, and the other worth 5%. The facility — set to be the biggest in Egypt — will treat around 5 mn cbm/d of water, which then will be used to irrigate agricultural land in Sinai. The OC-Arab Contractors JV will also be responsible for operating and maintaining the facility for five years.

Other Business News of Note

Military production ministry has EGP 15 bn construction backlog

The Military Production Ministry owns 20 companies and 17 factories involved in contracting and engineering consultation and has a backlog of projects worth as much as EGP 15 bn, all of it work on national projects, Minister Mohamed El Assar said, according to Youm7. The ministry, which hopes to expand regionally and internationally, is working with a joint venture between Elsewedy Electric and Arab Contractors to build a 2.1 GW dam and hydropower plant over Tanzania’s Rufiji River, El Assar said.

Sports

Egypt beat Guinea 3-1 in final Afcon warm-up game

Egypt ended their Afcon preparations on a high note last night, beating Guinea 3-1 at the Borg El Arab Stadium in Cairo, Ahram Online reports. Egypt’s Marwan Mohsen scored the opener after 11 minutes, and they held the lead until the 63rd minute when Sory Kaba pulled a goal back for the visitors. But the Pharaohs wrapped up the game soon after, courtesy of goals from Ahmed Ali and Omar Gaber. Afcon 2019 will begin on Friday, when Egypt play Zimbabwe in the opening game at Cairo’s International Stadium.

On Your Way Out

The Egyptian Museum is getting a facelift: The Egyptian Museum will be revamped as authorities prepare to move some of the country’s most treasured antiquities to the Grand Egyptian Museum in Giza, due to open by the end of next year. The EUR 3.1 mn project will see several galleries relocated to near the museum’s entrance and the Tanis Royal Tombs moved to the space that used to house the Tutankhamun collection. “The time has come to shed new light on the museum’s rich collection, upgrade its physical structure and improve its research and programming activities,” Antiquities Minister Khaled El Enany said yesterday. Reuters has the story.

The Market Yesterday

EGP / USD CBE market average: Buy 16.68 | Sell 16.80

EGP / USD at CIB: Buy 16.67 | Sell 16.77

EGP / USD at NBE: Buy 16.71 | Sell 16.81

EGX30 (Sunday): 14,210 (+0.2%)

Turnover: EGP 487 mn (37% below the 90-day average)

EGX 30 year-to-date: +9.0%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.2%. CIB, the index heaviest constituent ended up 0.5%. EGX30’s top performing constituents were Pioneers Holding up 5.3%, Kima up 4.7%, and AMOC up 1.8%. Yesterday’s worst performing stocks were Cairo investment & Real Estate Development down 4.4%, GB Auto down 2.4% and Madinet Nasr Housing down 1.6%. The market turnover was EGP 487 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -50.8 mn

Regional: Net Short | EGP -10.6 mn

Domestic: Net Long | EGP +61.4 mn

Retail: 55.5% of total trades | 57.2% of buyers | 53.9% of sellers

Institutions: 44.5% of total trades | 42.8% of buyers | 46.1% of sellers

WTI: USD 52.62 (+0.21%)

Brent: USD 62.17 (+0.26%)

Natural Gas (Nymex, futures prices) USD 2.40 MMBtu, (+0.59%, July 2019 contract)

Gold: USD 1,344.90/ troy ounce (+0.03%)

TASI: 8,886.84 (-0.61%) (YTD: +13.54%)

ADX: 4,955.26 (-0.17%) (YTD: +0.82%)

DFM: 2,614.03 (-0.72%) (YTD: +3.33%)

KSE Premier Market: 6,351.65 (+0.61%)

QE: 10,479.63 (-0.34%) (YTD: +1.75%)

MSM: 3,915.25 (-0.08%) (YTD: -9.45%)

BB: 1,449.85 (+0.07%) (YTD: +8.42%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

Mid-June: A delegation of Egyptian businessmen will head to Estonia and Latvia to explore investment prospects in the two eastern European nations.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-21 June (Tuesday-Friday): President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

18 June (Tuesday): IDC CIO Summit, Marriott Hotel Zamalek, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, GrEEk Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.