- Could Raya Holding break a decade-long dry spell in Egypt’s corporate bond market? (Speed Round)

- Residential electricity prices could increase by 30-60% after the next round of subsidy cuts. (Speed Round)

- Crypto is on the CBE’s list of online no-nos for banks as the regulator orders aggregators and payment facilitators to off guarantees to banks. (Speed Round)

- Government to require download sites to charge and remit VAT. (Speed Round)

- Canada’s Aton Resources looks to raise CAD 1.5 mn to fund gold exploration in Egypt. (Speed Round)

- S&P offers investors its two cents on Egypt’s post-IMF landscape. (Speed Round)

- The NYT takes a deep dive into everything Gen X. (What We’re Tracking Today)

- On “work creep” (not creeps at work) and how to be less busy. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 15 May 2019

Electricity rates are set to rise 30-60% in next wave of subsidy cuts

TL;DR

What We’re Tracking Today

Good morning, friends — take heart, it is nearly the weekend. Still, we have plenty of interesting news for you this morning, so there’s that.

Investors are still getting their collective head around the odds (and implications) of a protracted US-China trade war, the talking heads tell us. Wall Street recovered on Tuesday, but Asian shares are struggling near a nearly four-month low this morning on “lingering concerns over the economic impact” of the trade war. The EGX30 closed up 0.9% on an anemic EGP 372 mn in total turnover.

The key takeaway: Volatility is decidedly back on the menu, and anyone who tells you that the selloff in equities is deepening or that trade fears are miraculously “easing” hasn’t got a clue what he’s talking about. Or in slightly more mature terms: “It’s just too early to tell if this is a buy, on slightly oversold conditions, or if it’s the start of stabilization … we’re going to be in for a period of volatility for most the next month as we await the G-20 meeting,” as one Bloomberg analyst put it.

(That G-20 meeting? June 28 and 29 in Osaka, Japan.)

Keep an eye on: The Donald calling on the US Federal Reserve to throw its lot in with the trade war, the Financial Times suggests. Trump thinks America will win the trade war if the “US central bank matches stimulus moves in Beijing.” He is also expected this week to order that US companies stop using “telecommunications equipment made by firms posing a national security risk, paving the way for a ban on doing business with China’s Huawei,” Reuters adds.

SIGN OF THE TIMES: UAE’s Finablr has cut its IPO price amid weak investor demand, Reuters says. The payments platform had planned to list its shares on the London Stock Exchange at GBP 2.10-2.60 per share but has since priced at GBP 1.75 amid the ongoing market jitters — and that after it kicked back its closing day. The new share price gives the company an implied market value of around USD 1.59 bn. Our friends at EFG Hermes are serving as joint bookrunners on the transaction, which is being led by JPMorgan, Barclays and Goldman Sachs.

Also in the market right now: Arabian Centres, Saudi Arabia’s largest owner and operator of shopping malls, which was looking to raise some USD 1 bn in what was being billed as the second-largest IPO ever in the kingdom. The company now looks on track to raise about USD 747 mn after pricing at the bottom of the range on which it had guided, putting it on track to close as the third-largest IPO in Saudi. EFG Hermes is also doing JBR duties here.

Across the pond, workplace messaging app Slack is pushing ahead with plans to directly list on the New York Stock Exchange on 20 June. The direct listing, which will not see it offer new shares, is getting plenty of ink in the FT (here and here).

What the heck is happening in the GCC? Two Saudi oil pumping stations were hit by drone attacks yesterday, “heightening concerns about the security of the kingdom’s energy infrastructure 48 hours after two of its tankers were struck.” Houthi rebels backed by Iran claimed responsibility for the pipeline attack. Coming as it does amid heightened tensions between the US and Iran, the news has the FT channeling its inner Rodney King, calling for us all to just get along. See more in the FT, Reuters and Bloomberg (here and here) as you prefer.

The robots’ latest move: Taking jobs boxing orders at Amazon, according to reports in the US press that suggest the Everything Store could cut as many as 1,300 US jobs as it replaces workers with machines that can pack at 4-5x the rate of a human, wrapping items in custom-built boxes at a rate of 600-700 boxes per hour.

Apparently, we join the rest of the world in loving Netflix: Viewers in Egypt and the UAE are loving Netflix, and it shows in positive impressions of (and good word-of-mouth about) the brand, according to data analytics firm YouGov

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

Dive into the least-understood generation: Our TBR pile is now stuffed thanks to the New York Times’ awesome look at Generation X, the cohort of people sandwiched between the Boomers and the Millennials. The NYT’s Styles section argues that Xes “sold out, invented all things millennial, and caused everything else that’s great and awful.” Start there or with the package’s landing page, which argues that folks born 1965-1980 “set the precedent for today’s social justice warriors and capitalist super-soldiers.”

Did you, mid-way through reading this issue, stop to answer an email? Take a phone call? Reschedule a meeting? Work creep is real, and the proliferation of endless meetings and emails that serve hardly any purpose are two easy illustrations of the fact that we’ve become busier, running “on a treadmill of pointless activity,” according to this Economist piece. Instead of “leaning in” to this hectic pace, the “magazine” suggests leaning back. Take a leaf out of former GE boss Jack Welch’s book and spend an hour of “looking out of the window time.” Keep a “stop doing list,” à la Jim Collins, author of “Good to Great.” Protecting chunks of empty time in our day might be the secret to real productivity and, lest we sound as breathless as our peers across the pond, we must revive the practice “before we schedule ourselves to death.”

Read that alongside I trained myself to be less busy — and it dramatically improved my life, by a PhD psychologist writing for Vox’s First Person column. Easy fixes? No. But ideas worth exploring in our own lives nonetheless.

Take it to the next level with this CNBC piece on lessons learned from Yale’s “happiness class” — a class you can take without charge online, by the way.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

GARDEN VARIETY PSA- It’s going to be hot today in the capital city, with the mercury set to hit 40°C today before heading to 41°C tomorrow.

So, when do we eat? Maghrib is at 6:41pm CLT today in Cairo. You’ll have until 3:23am tomorrow morning to caffeinate / finish your sohour.

WANT TO HAVE IFTAR WITH US? Take our very short survey, in which we ask you which sector you would most like to see us explore in a dedicated weekly vertical. You can choose from the seven sectors we have included or name a sector yourself. We would also like to know what it is you enjoy and like about Enterprise and what it is you don’t. The survey will run all week.

We’ll be drawing the names of at least 10 survey takers and inviting them to join us for iftar on Wednesday, 29 May at the Four Seasons Cairo at the First Residence. Think of it as a chance to get to know some of you and discuss the survey questions, your views on Enterprise, the economy, life and the universe, so please mark the date. We’ll announce the winners on Tuesday, 21 May.

IF YOU WANT TO ENTER THE DRAW, you need to make sure to give us your name, company, phone number and email at the end of the survey.

Become a sponsor of an industry vertical: If you would like to be a sponsor of an Enterprise vertical, contact Fady Sherif on fsherif@inktankcommunications.com. We’ll talk about your interests and our editorial goals and see if we can’t do something amazing together.

Enterprise+: Last Night’s Talk Shows

Check back after Ramadan for our daily wrapup of last night’s talk shows.

Speed Round

Speed Round is presented in association with

Could Raya Holding break a decade-long dry spell in Egypt’s corporate bond market? Raya Holding is planning to issue EGP 500 mn worth of three-year bonds to finance its expansion without resorting to high-interest rates on bank loans, Al Mal reports. The issuance could take place before the end of the year. Raya has reportedly named EFG Hermes to manage the issuance. Middle East Ratings and Investors Service (Meris) is doing duties on the rating, while Norton Rose Fulbright is reportedly on board as legal counsel.

Egypt’s corporate bond market has been in stasis for years: The last significant issuance was by the then-Mobinil in 2009. Porto Group said in March that it was considering issuing corporate bonds and had reportedly hired Sarwa Capital to study the prospects.

Residential electricity prices could increase by 30-60% after the next round of subsidy cuts that will take place at the start of the next fiscal year in July, Electricity Ministry officials tell Al Mal. All households and businesses will face a price hike with the potential exception of businesses in the agriculture sector. Anyone else want to look into rooftop solar panels?

Prices will rise the least for households in the highest consumption brackets as they already receive no subsidies and purchase electricity at a price higher than that of the global market, the newspaper says. Those in the lower consumption tiers will bear the largest increases.

Details out soon: We cited local news reports on Monday that the ministry is expected to officially announce the new rates by the end of the month, but Al Mal’s sources say the announcement will be made in mid-June. We’re keeping our ears to the ground and will publish a breakdown when new details emerge.

Background: Egypt raised its average electricity prices for all tiers of industrial, residential, commercial consumers by an average of 26% last July as part of the plan to gradually phase out electricity and fuel subsidies. The plan began in FY2015-2016 with the launch of the IMF-sanctioned economic reform program and is now approaching its fifth, and penultimate round. Electricity subsidies were originally due to be fully lifted this coming fiscal year, but the period was extended to FY2020-21 to avoid placing too much pressure on household budgets.

REGULATION WATCH- Crypto is on the CBE’s list of online no-nos as the regulator orders aggregators and payment facilitators to off guarantees to banks. (Speed Round): Banks must hold guarantees from e-payment facilitators (or so-called PayFacs) and aggregators to ensure the two forms of intermediaries are able to cover 50% of the payments they collect on behalf of merchants, according to Central Bank of Egypt (CBE) guidelines for the e-payment industry seen by Al Mal. The banks, which are charged with overseeing the industry, must have an internal system in place giving them “full control” over authorizing and monitoring daily merchant collections on the basis of the guarantees held.

CBE blacklists cryptocurrency, websites that match would-be partners, crowdfunders: The new guidelines prohibit the industry from providing services to cryptocurrency sites, multi-level marketing companies, and companies that specialize in helping you find that special someone (sorry for the oblique language — the algorithms that govern our deliverability to your inboxes don’t like the standard term). Crowdfunding sites, file sharing and storage services, folks hawkin games of chance (again, sorry for the oblique language), and sites facilitating the buying and selling of financial securities and precious stones are also banned.

Protecting information: Banks must also ensure their information security policies cover e-payment processing, and are obliged to analyze the providers’financials, and conduct due diligence and risk assessment reports before entering into agreements. Any agreement involving a merchant whose annual sales exceeds EGP 3 mn must have a commercial bank as a party. This could mean a direct contract with a bank to act as the sole payment service provider or a trilateral agreement with the e-platform still on board.

What, exactly, are PayFacs? The contrast between e-payment aggregators and PayFacs is interesting. Aggregators can be seen as the more basic providers who sign up merchants under a merchant ID and do not own master accounts (i.e. Fawry). In other words, they “aggregate” merchants under a single ID and do not usually provide complementary services. PayFacs, meanwhile, provide merchants with separate IDs under their own master accounts and often provide access to gateway and authorization services (i.e. Amazon’s PayFort, which operates in Egypt). Merchants using PayFacs, unlike those using aggregators, can be referred to as sub-merchants.

LEGISLATION WATCH- Central Bank of Egypt Governor Tarek Amer presented to the Cabinet economic group yesterday an amended draft of the Banking Act, Al Mal reports. No further details were provided on the changes, but sources told the local press last month that a revised version of the bill would not include controversial term limits for bank managing directors or a surtax on bank profits to finance an industry development fund

Background: A first draft of the new Banking and Central Bank Act leaked in 2017 and was controversial within the sector for suggesting term limits on bank MDs as well as a tithe on industry profits to finance an industry development fund that would be managed by the central bank. The current draft has been with the Madbouly Cabinet for review since January. It remains unclear what the timeline on the bill could be. Once approved by cabinet, the bill will move to the House of Representatives for committee review and a vote in the general assembly.

EXCLUSIVE- Government to required download sites to charge and remit VAT: The Finance Ministry’s central value-added tax department is currently compiling a list of websites that charge for the download of books, movies, and songs, all of whom will be required to charge and remit VAT, VAT Department Head Sayed Saqr told Enterprise. The listing process is slow due to difficulties in finding accurate data on the size of these websites’ activities, but the government should be sending out tax claims soon, Saqr said.

In related news: Egypt-based digital marketers running social media advertising campaigns for overseas customers have started paying the government an 18% “estimated tax,” sources familiar with the matter told Al Mal. Social media companies will not receive any tax payments, the sources note. Although they don’t make an explicit link, the sources could have been referring to reports on Monday that Facebook will begin charging Egypt-based advertisers an 18% VAT. Facebook, Google and Twitter will only be responsible for calculating and collecting the non-VAT tax on behalf of the authority, the sources added. A Tax Authority official quoted by Al Mal also pointed out that “advertising activities on social media platforms are VAT-exempt under current legislation.” The Finance Ministry has been pushing to have ads on social media platforms subject to a 15-20% stamp tax, treating them basically on par with print ads.

Background: The government wants to add around 500k new VAT taxpayers by 2020 and raise VAT revenues to EGP 364.6 bn in the next fiscal year, from EGP 312 bn currently. An official told us last month that the Finance Ministry is developing plans to impose VAT on all e-commerce platforms. Companies including Amazon’s Souq, Jumia and OLX would be required to charge VAT on all online sales.

Canada’s Aton Resources looks to raise CAD 1.5 mn to fund gold exploration in Egypt: Egypt-focused Canadian miner Aton Resources is raising CAD 1.5 mn in a non-brokered private placement to fund exploration and development in its Abu Marawat concession in Egypt, according to a statement (pdf). The company is issuing 60 mn shares at par value of CAD 0.025 per share. The issuance will close on or around 28 May, the company said. Aton had announced earlier this year it was planning to raise CAD 5 mn, but President and CEO Mark Campbell says the company decided to revise its targets “to reflect demand from Egyptian and Gulf investors and because reform of the mineral exploration terms and conditions in Egypt is moving at a very brisk pace.” The company will instead raise a smaller amount for the time being “to reduce dilution, continue to work and wait for the new investor friendly reforms to be implemented.” Campbell had praised last year the long-awaited amendments to the Mineral Resources Act, saying the scrapping of the production sharing agreement and other changes would have significant effects on investment in exploration and mining.

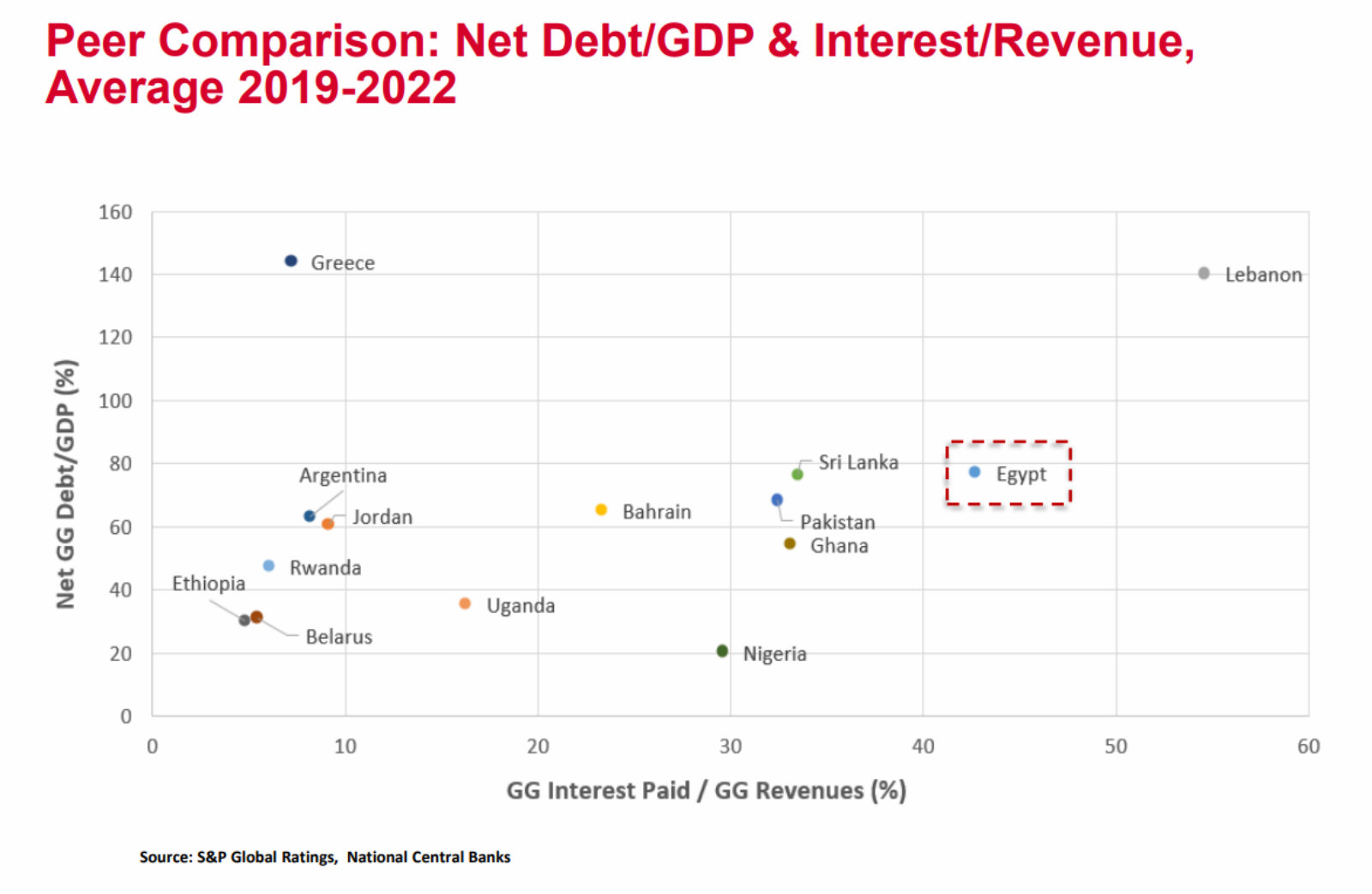

EXCLUSIVE- S&P’s two cents on Egypt’s post-IMF landscape: Egypt has begun to see the “small green shoots of recovery” but serious risks remain to the government’s fiscal stability, Zahabia Gupta, S&P Global’s associate director of sovereign ratings, said during a Q&A with investors this week. The situation in Egypt is “gradually improving” as it approaches the end of its IMF program, she said, citing the government’s falling current account deficit, rising gas production, a recovery in tourism, and stabilizing remittances. But the country’s fiscal position remains “very weak” and substantial debt service costs present challenges. Key takeaways from the Q&A:

Egypt is unlikely to receive more funding from the IMF because they would struggle to meet the tighter conditions on debt sustainability. Having said that, S&P does not see the need for Egypt to return to the fund for post-program funding given its improved liquidity position. Further IMF assistance is more likely to take the form of a policy coordination instrument — a non-financing tool designed to improve the government’s credibility in its commitment to reform. The IMF will also monitor the government’s progress twice a year after the end of the program.

“Real interest rates remain a risk to Egypt’s debt sustainability,” Gupta said, highlighting the fact that under the central bank’s current easing strategy, the interest cost will remain high for a significant period. Strong market demand for the country’s foreign currency-denominated debt helps it manage nominal interest, while at the same time raising its exposure to fluctuations in the exchange rate.

S&P believes Egypt’s current FX levels provide sufficient liquidity to cover around five and a half months of current account payments for the next two years. There remain risks that portfolio flows could rapidly leave the country, but the CBE’s ring-fenced foreign assets could mitigate some of the impact on the country’s reserves and exchange rate. The ratings agency expects reserves to dip only slightly over the coming three years.

Foreign direct investment into productive areas of the economy has “disappointed” despite the competitive exchange rate, Gupta said. FDI has over the past few years gone primarily into the energy sector, which creates few jobs for Egypt’s increasing population. The government is responding to the problem by increasing subsidies for exporters.

Remittances don’t pose a significant risk to Egypt’s balance of payments: Although some inflows may exit the country as interest rates slowly decline, the bulk of remittances come from Egyptians living abroad and will likely remain stable over the coming years.

What are the chances of a credit upgrade? Slim, in the near term. “We do not see the possibility of an upgrade in the near future,” Gupta said, citing the government’s weak fiscal position and the lengthy time period it takes to complete its structural overhaul of the public sector.

Foreign holdings of Egyptian treasuries rose to USD 14.6 bn in February (EGP 249.6 bn) , compared to USD 13.7 bn (EGP 233.8 bn) in January, according to the CBE’s March monthly statistical bulletin (pdf). Finance Minister Mohamed Maait said in March that foreign holdings of t-bills stood at USD 15.8 bn at the end of February. Total holdings of treasuries inched down to EGP 135.8 bn in February from EGP 137.1 bn in January.

BUDGET WATCH- The Finance Ministry has agreed to a EGP 2.5 bn increase in the Education Ministry’s FY2019-20 budget allocation to pay off “urgent” loans, House Planning and Budgeting Committee Chair Yasser Omar tells the local press. The two ministries will study making available EGP 8.5 bn for the ministry amid efforts to increase the sector’s allocation in the FY2019-20 draft budget. Earlier this month, the MP said the ministry was after an additional EGP 11 bn, which would bring the sector’s budget to EGP 110 bn the next fiscal year. A source had told us earlier this week that the government has placed a EGP 1.01 tn cap on public spending for the upcoming fiscal year.

EARNINGS WATCH- EFG Hermes net profits rise 51% y-o-y in 1Q2019 to EGP 374 mn, the company announced in a statement (pdf). Revenues rose 42% y-o-y to reach EGP 1.3 bn, up from EGP 945 mn in 1Q2018. Earnings growth was driven by a 58% y-o-y increase in commissions and fees earnings, which reached EGP 1 bn during the quarter.

Buy-side growth underpinned strong investment bank performance: Net profits at the company’s investment banking arm rose 48% y-o-y in 1Q, supported by a 199% y-o-y increase in buy-side revenues to EGP 348 mn. The sell-side business recorded revenues of EGP 322 mn, a 2% increase from 1Q2018.

Looking ahead: “This year will see us continue diversifying our product offering and expanding our geographical reach as we look to solidify our presence in existing markets and explore new, fast-growth opportunities in frontier emerging markets,” Group CEO Karim Awad said. The firm’s full earnings release is here (pdf).

EKH net profits jump 15% in 1Q2019 to USD 37.5 mn, the company said in its earnings release (pdf). Revenues rose 18.2% y-o-y to USD 140.2 mn during the quarter due to a “broad-based upsurge in performance across EKH’s business segments.” The company’s Energy & Energy Related segment saw particularly strong revenue growth, rising 33% y-o-y to USD 35.3 mn. “I am very pleased with our performance in the start of the year, with EKH delivering the strongest operational quarter in its history,” Chairman Moataz Al Alfi said. “We have kicked-off 2019 stronger than ever with all our businesses standing on firm ground and geared for growth,” he added.

State-owned Telecom Egypt reported 1Q2019 net profits of EGP 1.6 bn, a 109% increase compared to a year earlier, the company said in an earnings release (pdf). The surge in profits come on the back of the revaluation of USD debt facilities following the appreciation of EGP against the greenbacks. Revenues were up 27% y-o-y to EGP 6.1 bn as data services revenues rise. Mobile subscribers reached 4.2 mn at the end of the quarter.

Real estate developer Talaat Moustafa Group’s 1Q2019 net profit rose 17% y-o-y to EGP 361 mn, the company said in a bourse filing (pdf). Revenues came at EGP 2.2 bn, a 39% increase compared to last year.

Porto Group net profits increase 31% in 1Q2019: Porto Group 1Q2019 net income rose 31% y-o-y to EGP 59.6 mn, the company said in a bourse filing (pdf). Revenues came at EGP 417.8 mn during the quarter, compared to EGP 378.1 mn a year earlier.

Credit Agricole Egypt’s 1Q2019 profit rises 15.3%: Credit Agricole Egypt reported 1Q2019 profits of EGP 693.8 mn, a 15.3% increase compared to a year earlier, the lender said in a bourse filing (pdf).

Vodafone said service revenues from Egypt grew 14.7% y-o-y in 9Q2018-19 “supported by growing data usage and a price increase,” according to the company’s earnings release (pdf). The group’s total global revenues dropped 6.2% y-o-y to GBP 43.7 bn, down from GBP 46.6 bn during the same period last year.

CORRECTION- Yesterday we mistakenly wrote that Acwa Power had offered to sell electricity from its Kom Ombo solar facility at USD 0.275 per KwH. The correct price is actually USD 0.0275 per KwH. The story has been corrected on our website.

** WE’RE HIRING: We’re looking for a podcast producer with a strong track record with audio production. The ideal candidate will have experience and background in audio production and journalism. This includes familiarity with audio production software, such as Adobe Audition. A background in business / economics / finance, and/or entrepreneurship and technology is also preferred, but not a requirement. Check out the job posting here for more information. The producer should be highly fluent in the English language.

To apply, please submit 2-3 audio samples and a solid cover letter telling us a bit about who you are, why you’re a good fit and what interests you in Enterprise. A CV is nice, but we’re much more interested in your clips. Please direct your applications to jobs@enterprisemea.com.

Image of the Day

Camels have beauty pageants, too: The month-long Saudi camel parade that doubles as a camel beauty pageant culminated with a procession that was captured by a drone image displayed by National Geographic, with the owners and judges driving alongside the camels making their critiques.

Egypt in the News

It’s another blessedly quiet morning for Egypt in the foreign press. A handful of headlines making the rounds:

- Bye, Cairo: Ahead of the move out to the new administrative capital, ITV takes a quick look at the urban planning woes the government is trying to leave behind.

- Shubra church death: A civilian church guard shot and killed a priest on Monday following a personal dispute over money,AP reports.

- US diplomacy complicated by Ikhwan blacklisting: Designating the Ikhwan a foreign terrorist organization could impede intellectual debate and efforts to promote democratic change in the region, regional experts tell Voice of America.

- Classes to prevent divorce: A new government project aims to teach students about marriage to curb rising divorce rates, Reuters reports.

On The Front Pages

El Sisi reaffirms commitment to development in Africa, stability in Sudan: Egypt is committed to the reconstruction and development of Africa and is prepared to provide Sudan with whatever help it requires during its transitional phase, President Abdel Fattah El Sisi was quoted as saying on the front pages of the country’s three state-run dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Watching

Have we reached “peak Wall Street” — and will a crisis follow? Global financialization has peaked, and focusing more on markets than the real economy is likely to bring diminishing returns — and, potentially, a future crisis due to excessive corporate debt, argues Rana Foroohar in the Financial Times (watch, runtime: 2:00). Financialization — or a preference for all things finance at the expense of the real economy — has been a driving force in the global economy for decades. But Foroohar cites the growth of the corporate bond market, which has doubled in value to USD 13 tn since 2008, and massive increase in share buybacks as examples of its risks. With total financial assets now triple the size of the real economy it’s time for a correction, she predicts.

Diplomacy + Foreign Trade

Germany plans to lend Egypt USD 250 mn this year as part of a debt swap arrangement that was suspended in 2011, Germany’s ambassador in Cairo Georg Luy said, according to Amwal El Ghad. The financing is still pending approval from the Bundestag, Luy said, without providing further details on the agreement.

Energy

Egypt to export USD 2 bn worth of natural gas next fiscal year

Egypt is expected to export 12 mn tonnes of natural gas worth USD 2 bn in FY2019-20, EGPC official Ayman Othman told the House Energy Committee, according to Al Masry Al Youm. Egypt has exported 4 mn tonnes of gas worth a total USD 589 mn during the current fiscal year, according to Othman.

Basic Materials + Commodities

Egypt’s wheat imports to remain flat at 12.5 mn tonnes in FY2019-20

Egypt’s wheat imports will remain flat at 12.5 mn tonnes in FY2019-20, according to forecasts outlined in a report by the US Department of Agriculture (pdf). Production will increase slightly to 8.78 mn tonnes from 8.45 mn tonnes in the current fiscal year. This will compensate for a 300k-tonne increase in consumption to 20.4 mn tonnes.

Tourism

Jaz to inaugurate three new hotels in Egypt’s Hurghada, Marsa Alam this summer

Travco hospitality arm Jaz Hotel Group will inaugurate this summer two new hotels in Hurghada and a third in Marsa Alam at a cost of EGP 1 mn, Chairman Alaa Akel tells Al Mal. The hotels have a combined total of 700 rooms. Jaz is pushing ahead with plans to build eight new hotels in the two resort towns at a cost of EGP 4 bn, and intends to develop eight others in Marsa Alam over the next four to five years.

Egypt’s Albatros, Germany’s Phoenix to build new EGP 850 mn Hurghada hotel

Albatross Holding’s hotel management arm Pick Albatros has partnered with Germany-based travel agency Phoenix Reisen to build a five-star hotel in Hurghada at a cost of EGP 850 mn, company head Kamel Abu Ali told Al Mal. The 350-room hotel, “Blue Spa Resort Hurghada,” is set for inauguration during the summer in 2020 and will be financed jointly by the partners.

Banking + Finance

Naeem suspends operations at its Etihad Capital Brokerage

Naeem Holding has suspended its Etihad Capital Securities Brokerage due to what it said were poor market conditions, low trading volumes and rising costs, Al Mal reports, citing Naeem Brokerage Managing Director Tarek Abaza.

Legislation + Policy

Federation of Egyptian Chambers of Commerce requests changes to Mineral Resources Act amendments

The Federation of the Egyptian Chambers of Commerce’s quarries division presented to the House Industry Committee its requests for changes to make to the proposed amendments to the Mineral Resources Act yesterday, division head Ibrahim Ghaly tells the local press. The requests include reducing the punishment for extracting more material than their licenses allow from mines and quarries and extending the validity of mining licenses for value-added projects. The division also objected to two of the bill’s articles pertaining to the rent and royalty payments, which it said are discouraging to investments. The Madbouly Cabinet had approved earlier this week amendments to the bill, and was expected to send the bill to the House of Representatives.

Egypt Politics + Economics

Parliament approves EUR 4 mn grant to support Egyptian entrepreneurship

The House of Representatives approved yesterday a EUR 4 mn grant for the development of Egyptian entrepreneurship, funded by a multi-donor trust fund currently managed by the African Development Bank, according to Al Shorouk.

National Security

Egypt launches second locally-built small navy warship

The Egyptian navy launched its second locally-built Gowind class corvette on Sunday from the Alexandria Shipyard (ASY), Defence Web reports. The small coastal patrol warship, Al-Moez, contains French military technology, acquired from France’s Naval Group. Egypt ordered four Gowind vessels in 2014 as part of a EUR 1 bn contract which stipulated that three would be built in Egypt. The first locally produced Gowind corvette, Port Said, was launched in September 2018.

On Your Way Out

For your eyes only, 007 fans: Aston Martin has revealed the extra special (read: as geeky as Q himself) working spy gadgetry that will feature in the 25 cars being manufactured for Bond’s wealthiest fans, Bloomberg reports. The USD 3.5 mn continuation DB5s are based on the 1964 model Sean Connery drove in Goldfinger, and contain an array of gadgets worthy of any Bond vehicle. These include rotating number plates, rear smoke screens, oil slicks, a weapons tray, and twin machine guns (unfortunately not stocked with real bullets).

The Market Yesterday

EGP / USD CBE market average: Buy 17.03 | Sell 17.13

EGP / USD at CIB: Buy 17.02 | Sell 17.12

EGP / USD at NBE: Buy 17.03 | Sell 17.13

EGX30 (Tuesday): 14,024 (+0.9%)

Turnover: EGP 372 mn (54% below the 90-day average)

EGX 30 year-to-date: +7.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.9%. CIB, the index heaviest constituent ended up 1.1%. EGX30’s top performing constituents were Cairo Investment & Real Estate Development up 3.6%, Telecom Egypt up 2.0%, and Qalaa Holdings up 1.8%. Yesterday’s worst performing stocks were Egyptian Resorts down 1.6%, Pioneers Holding down 0.9% and TMG Holding down 0.5%. The market turnover was EGP 372 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -8.7 mn

Regional: Net Short | EGP -5.5 mn

Domestic: Net Long | EGP +14.2 mn

Retail: 41.4% of total trades | 41.6% of buyers | 41.3% of sellers

Institutions: 58.6% of total trades | 58.4% of buyers | 58.7% of sellers

WTI: USD 61.34 (+0.49%)

Brent: USD 70.96 (+1.04%)

Natural Gas (Nymex, futures prices) USD 2.65 MMBtu, (+1.22%, Jun 2019)

Gold: USD 1,297.50 / troy ounce (-0.33%)

TASI: 8,374.27 (+0.09%) (YTD: +7.00%)

ADX: 4,802.58 (-2.57%) (YTD: -2.29%)

DFM: 2,612.98 (+3.46%) (YTD: +3.29%)

KSE Premier Market: 5,998.60 (-1.32%)

QE: 9,798.74 (+0.60%) (YTD: -4.86%)

MSM: 3,828.05 (-0.32%) (YTD: -11.46%)

BB: 1,408.44 (-0.54%) (YTD: +5.32%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

14 May (Tuesday): Egyptian Private Equity Association annual sohour. Four Seasons Hotel, Cairo.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28 May (Tuesday): 30 Saudi stocks join the MSCI Emerging Markets Index at the end of the day’s trading session.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.