- FinMin calls off EGX stamp tax increase. (Speed Round)

- UK-based Statsbomb acquires Egyptian sports data company ArqamFC. (Speed Round)

- FinMin gives update on fiscal performance as the IMF arrives in Cairo for final reform program review. (Speed Round)

- Fuel subsidies spending falls 28% in the first nine months of FY2018-19. (Speed Round)

- Egypt, World Bank ink final agreement for USD 200 mn facility to support SMEs. (Speed Round)

- No mosalsalat on YouTube as EMC enters TV streaming space with Watch iT app. (On Your Way Out)

- Amid ongoing selloff, traders are holding their collective breath ahead of a Friday deadline for a US-China trade pact. (What We’re Tracking Today)

- Mobius figures it will be “a year or two” before active investors look seriously at Saudi Arabia. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 8 May 2019

Ah, the joy of an early-Ramadan news slowdown…

TL;DR

What We’re Tracking Today

The Ramadan news slowdown continues this morning, ladies and gents. Enjoy it while it lasts — the pace will inevitably pick up.

Monthly inflation figures for April are due out tomorrow. Annual headline urban inflation eased slightly in March to 14.2%, down from 14.4% the previous month.

Amazon subsidiary Souq will rebrand in Egypt to become Amazon.eg next year, Al Mal reports. The e-commerce giant already rebadged as Amazon.ae in the UAE earlier this month.

Asian stocks are following US shares lower this morning after The Donald imposed a Friday deadline to reach a trade agreement. China’s chief trade negotiator is heading to the US for talks Thursday and Friday with the threat of bns in additional tariffs hanging in the air. Almost 90% of NYSE stocks closed down yesterdayin a selloff that “eclipsed the Christmas Eve rout” back in December. That has some traders in Europe and North America thinking it’s time to lock in their gains: “There is this little bit of fear that, OK, let’s take what we’ve got and not end up losing for the year, like everyone did at the end of the year last year,” one told Bloomberg. CNBC speculates that the sell-down could accelerate if there’s no trade pact by Friday and the Financial Times joins the rest of the global business press in the hand-wringing.

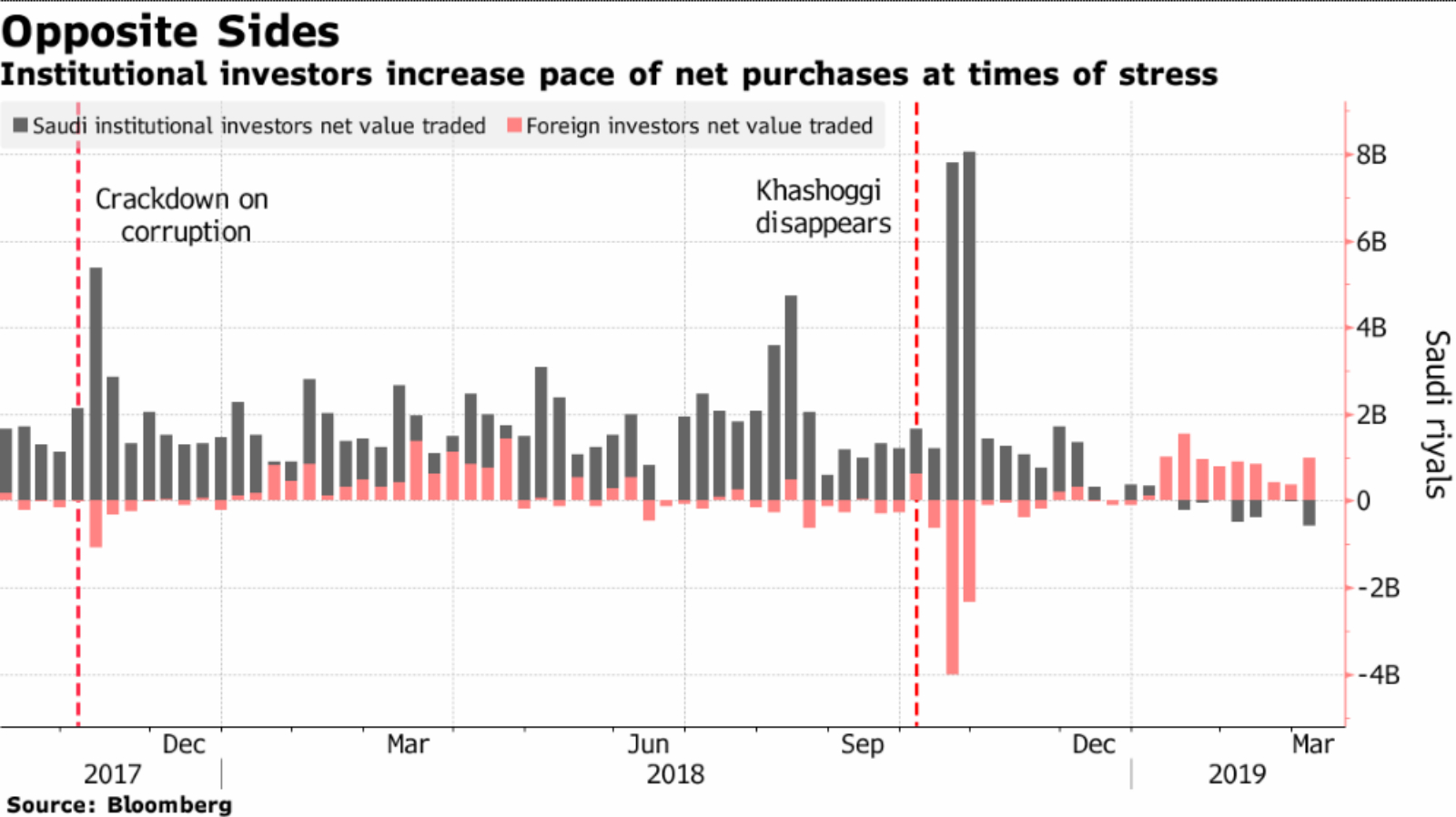

Investors including the guy who invented EM investing are concerned that Riyadh’s involvement in the Tadawul may mask underlying political risks, as FTSE Russell and MSCI prepare to include Saudi equities in their emerging-market indices, Bloomberg writes. The kingdom’s sovereign wealth fund is the biggest investor in the market, leading some to speculate that the government uses it to prop up equity prices during political turbulence. “Many people are concerned about the political environment,” Mark Mobius, founder of Mobius Capital Partners, told the business information service. “It’s going to take a year or two before people really begin to say that Saudi Arabia is a place we want to be.”

This is unlikely to stop a tide of inflows when the Tadawul joins EM indices: Arqaam Capital estimates that inflows into the Saudi market could reach USD 20 bn after FTSE and MSCI finish their inclusions.

EBRD’s success in Egypt and Turkey could propel it into sub-Saharan Africa. The European Bank for Reconstruction and Development’s plans to expand its lending operations to sub-Saharan Africa are partially propelled by its success in Egypt and Turkey, where it is “close to its share-of-portfolio limits,” the Financial Times says. EBRD President Sir Suma Chakrabarti says that doling out funding to the rest of Africa “would have to be based on evidence of where EBRD loans to the private sector could make a real difference.” The plan will go before the lender’s shareholders next year.

Wait, Mifid II wasn’t a panacea? “Helping small and medium companies access capital markets was at the heart of Mifid II but more than 16 months on, bankers and regulators are worrying that Europe’s flagship securities-industry overhaul has become more of a problem than a solution,” writes the FT. It’s part of a series of stories out yesterday looking at how Mifid “spoiled the business of matchmaking” between companies and investors and at how the regulation is changing finance in the US of A

Abraaj founder Arif Naqvi is still in the Clink, having failed to cough up the equivalent of USD 20 mn in bail that would secure his release from detention pending trial or extradition, Bloomberg reports. Naqvi was granted bail on Friday under conditions that “effectively amount to house arrest.” He was arrested last month on charges of fraud stemming from the meltdown of the once high-flying private equity firm.

Attention iSheep: Apple will be unveiling a host of updates to the operating systems of the iPhone, iPad, Mac, Apple Watch, and Apple TV at its annual developer conference on 3 June, Bloomberg reports. For once, Mark Gurman’s report adds little to what we know about Apple’s plans: Brazilian writer and software developer Guilherme Rambo has already broken what consumers can expect from the next editions of iOS as well as macOS and what’s in store at WWDC for developers.

Google, meanwhile, is out with a less-expensive alternative to its Pixel 3 smartphone. The Verge’s Dieter Bohn (one of our favorite gadget reviewers) says the budget-priced Pixel 3A is “competitive with more expensive phones in one very important way: the Pixel 3A has a great camera.” Read the review or compare specs between the Pixel 3a and Pixel 3.

What we’re tracking today, the Ramadan Edition:

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- Made by women, for women: Bloomberg talks to female business owners making healthier, more sustainable products targeted at the largest consumer demographic: Women.

- Struggling to give job advice to your kids? The Wall Street Journal has you covered.

- Stranger Things Lego and Polaroid cameras have the resident 11-year-old asking if she couldn’t perhaps have an Eid gift a little early. Too bad the Lego set hasn’t yet been released.

BONUS: The mystery of human uniqueness, a (reasonably) short and sweet piece that asks, “If you dropped a dozen human toddlers on a beautiful Polynesian island with shelter and enough to eat, but no computers, no cell phones, and no metal tools, would they grow up to be like humans we recognize or like other primates? Would they invent language? Without the magic sauce of culture and technology, would humans be that different from chimpanzees?”

RAMADAN PSA #1- Bank hours at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

RAMADAN PSA #2- Egypt could see lower temperatures and light rain starting today, Ahram Online reports. Here’s what the Japanese sing when it rains (watch, runtime: 02:10).

So, when can we eat? Maghrib is at 6:37pm CLT today in Cairo. You’ll have until 3:29am tomorrow morning to caffeinate / finish your sohour. Yes, the fasting day is getting longer by about 2 minutes each passing day.

Enterprise+: Last Night’s Talk Shows

Our talk shows roundup is on hiatus during Ramadan. Move along, ladies and gents.

Speed Round

Speed Round is presented in association with

FinMin calls off EGX stamp tax increase: The Finance Ministry will not increase the stamp tax on EGX transactions this year. The move is meant to ease the financial burden on traders, according to a ministry statement. The tax was scheduled to increase to 0.175% from 0.15% on 1 June. The ministry introduced the tax at 0.125% in 2017, and planned to increase it annually over a three-year period. We reported yesterday that EGX regulators were looking at ways to mitigate the impact of the tax hike.

EXCLUSIVE- UK-based Statsbomb acquires Egyptian sports data company ArqamFC: Sports data collection and analytics company ArqamFC announced yesterday it has been fully acquired by Statsbomb, a British football analytics provider with offices in Boston and Cairo, according to a statement (pdf). While the details of the transaction were not disclosed, ArqamFC’s management team will remain in place, a source close to the transaction tells Enterprise. The company’s digital content arm will also continue to operate under the ArqamFC brand, the statement says. ArqamFC, which launched in 2017, “has scaled quickly to over 100 employees in the last two years, with a focus on data collection technology and operations. ArqamFC collect event-data for over 25 competitions over the globe, with a strong focus on data design and quality.”

FinMin gives update on fiscal performance as the IMF arrives in Cairo: The budget deficit shrank to 5.3% of GDP in the first nine months of FY2018-19, compared to 6.2% in the same period a year earlier, Finance Minister Mohamed Maait announced in a press conference yesterday, according to a ministry statement (pdf). The primary budget surplus rose to EGP 35.5 bn (0.7% of GDP) during the period, up from EGP 7 bn (0.2%) a year earlier. Results bode well for ministry’s June-end target to reduce the debt-to-GDP ratio to 93%,Maait said. The ministry’s four-year debt control strategy aims to reduce the ratio to 80-85% of GDP by the end of FY2021-22.

Other key takeaways from the presser:

- Foreign holdings in Egyptian treasuries stood at USD 16.8 bn by the third week of April, up from USD 15.8 bn at the end of February.

- Inflation: The ministry is targeting an inflation level of no more than 10% in the coming fiscal year, and between 6 and 7% in FY 2020-21.

- Tax and non-tax state revenues continue to outgrow spending: Tax collections and other revenues grew at 20.3% to EGP 598.7 bn during the nine months, a rate faster than the 13.9% growth in state spending, which came at EGP 879 mn during the period.

The press conference came as an IMF delegation arrived in Cairo to conduct its final review of the economic reform program. The review will determine whether the fund disburses the sixth and final tranche of the USD 12 bn facility in July.

Fuel subsidies spending falls 28% in the first nine months of FY2018-19: Government spending on fuel subsidies fell to EGP 60.1 bn in the first nine months of FY2018-19, declining 28.45% y-o-y from EGP 84 bn during the same period a year earlier, Oil Minister Tarek El Molla told Reuters’ Arabic service. The government set aside EGP 89 bn for fuel subsidies in its FY2018-19 budget — and hopes to reduce the outlay to EGP 52.9 bn in the coming fiscal year, El Molla added. Egypt is expected to lift most fuel subsidies by the end of this fiscal year as part of the ongoing IMF-backed reform program. Subsidies on all products, except liquefied petroleum gas and fuel oil used for electricity and bakeries, are due to be eliminated in June.

BUDGET WATCH- Health Ministry follows Education Ministry’s lead in angling for better budget allocation: Health Minister Hala Zayed has asked the government to increase the budget allocation for the health sector to EGP 100 bn in the coming fiscal year, the local press reported. To implement the Universal Healthcare Act, the ministry requires an additional EGP 33 bn in the sector’s allocation in the state budget for FY2019-20, Zayed said. The ministry had apparently previously requested that the government earmark EGP 96 bn for healthcare during the next fiscal year, but the Finance Ministry has only approved EGP 73 bn. The news came after Education Minister Tarek Shawky earlier this week requested a higher budget.

LEGISLATION WATCH- Exec regs for temporary law to settle building code violations will be issued soon: The executive regulations for the temporary law to settle building code violations are nearly complete and will be issued soon, House Housing Committee member Mohamed El Akad said, according to Youm7. The House of Representatives had approved earlier this year the temporary bill, which permits authorities to negotiate settlements on structures that meet structural integrity requirements and that are not built on state-owned or agricultural land. The law will sunset after three months.

Egypt, World Bank ink final agreement for USD 200 mn SMEs loan: Investment Minister Sahar Nasr and World Bank President David Malpass have signed the final agreement of a USD 200 mn loan to support SMEs and entrepreneurs, according to a ministry statement (pdf). Non-banking financial institutions will receive USD 145 mn to fund primarily women and youth-led small businesses. The signing came as Malpass wrapped up his two-day visit to Egypt, during which he visited the Benban solar plant in Aswan and discussed infrastructure and investment with President Abdel Fattah El Sisi.

Correction: 08 May 2019.

An earlier version of this article incorrectly stated that the value of the loan was USD 200 bn.

Image of the Day

Visual data par excellence: Is there a better way of illustrating the growing power of developing economies in international trade than these amazing interactive graphics from Bloomberg? We suspect not. This series of infographics show how emerging-market trade in agricultural goods, minerals, oil, and electronics has skyrocketed over the past two decades.

Egypt in the News

Topping coverage of Egypt in the international press this morning is wire pickups of a court decision to uphold death sentences for 13 suspected terrorists. Reuters and the Times of Israel had the story.

Other headlines worth a moment of your time:

- Receiving official approval for mosalsalat production is becoming more complicated, impacting what we will see on our screens this Ramadan, RFI reports.

- Egypt and Iran are jostling to promote conflicting interests in Gaza, Yaakov Lappin argues in the Jewish News Syndicate.

- Al Mashhad is the latest news website to be blocked in Egypt after the Press and Media Act was passed, the Committee to Protect Journalism says.

On The Front Pages

Egypt’s show of support to Sudan by sending medical aid in military airplanes is the leading story in state-owned Al Ahram this morning, while Al Akhbar focuses on updates from Finance Minister Mohamed Maait on Egypt’s fiscal performance. We have chapter and verse on the latter in this morning’s Speed Round, above.

Worth Watching

There’s apparently something very Egyptian about hoarding useless clutter, or “karakib.” Most of us know someone who just can’t seem to let go of their karakib (or are that someone), but none outdo Hussein, an Egyptian journalist featured in a documentary by a television broadcaster based in a statelet that thinks we’re enemies. Hussein, who boasts a collection of 200 pens without ink and other trinkets that scream “karakib,” believes that Egyptians’ irrational attachment to their clutter is sometimes the result of poverty (watch, runtime 0:59).

Energy

Cabinet approves first phase of 1 GW Eni solar plant

Cabinet has approved the first 200 MW phase of Eni’s planned 1 GW solar plant, paving the way for the Electricity Ministry to start negotiating energy prices with the Italian company, sources at the Egyptian Electricity Transmission Company (EETC) told the domestic press. The cabinet and the EETC are reportedly open to maintaining a sale price of USD 0.027 per kWh, the same as the energy produced by the Kom Ombo plant. We previously reported in February that Eni was in talks with the ministry to invest USD 1 bn in a 1 GW solar facility.

Egypt’s gas consumption to increase to 7.3bn bcf/day in FY2010/21

Egypt’s gas consumption will increase to 7.3 bcf/d in FY2020-2021, a source at the Egyptian Natural Gas Holding Company (EGAS) told the domestic press. Connecting wells at the Zohr and North Alexandria fields to the national grid will support the growing market need, which will rise from a projected 6.5 bcf/d in FY2019-2020.

Tourism

Egypt signs tourism promotion agreement with CNN

Tourism Minister Rania Al Mashat signed yesterday a partnership agreement with CNN to launch a tourism promotion campaign for Egypt, Al Shorouk reports. The promotion strategy will zero in on specific destinations in Egypt, such as Aswan, Luxor, Sharm El Sheikh, and Marsa Alam, in addition to giving special focus to the Grand Egyptian Museum, which is set to be inaugurated next year.

Automotive + Transportation

Transport ministry talks potential maintenance contract with Bombardier

Transport Minister Kamel El Wazir met yesterday with a delegation from Bombardier to look into potentially contracting the Canadian company to maintain and repair Egypt’s locomotives, according to a ministry statement.

On Your Way Out

Egyptian Media Company has entered the TV streaming space with the launch of its new app, Watch iT, according to Arab News. The app will feature 15 Ramadan television series or mosalsalat, which will not be posted to YouTube as was previously customary. Monthly subscription fees have been set at EGP 99, while a full annual subscription will set you back EGP 999.

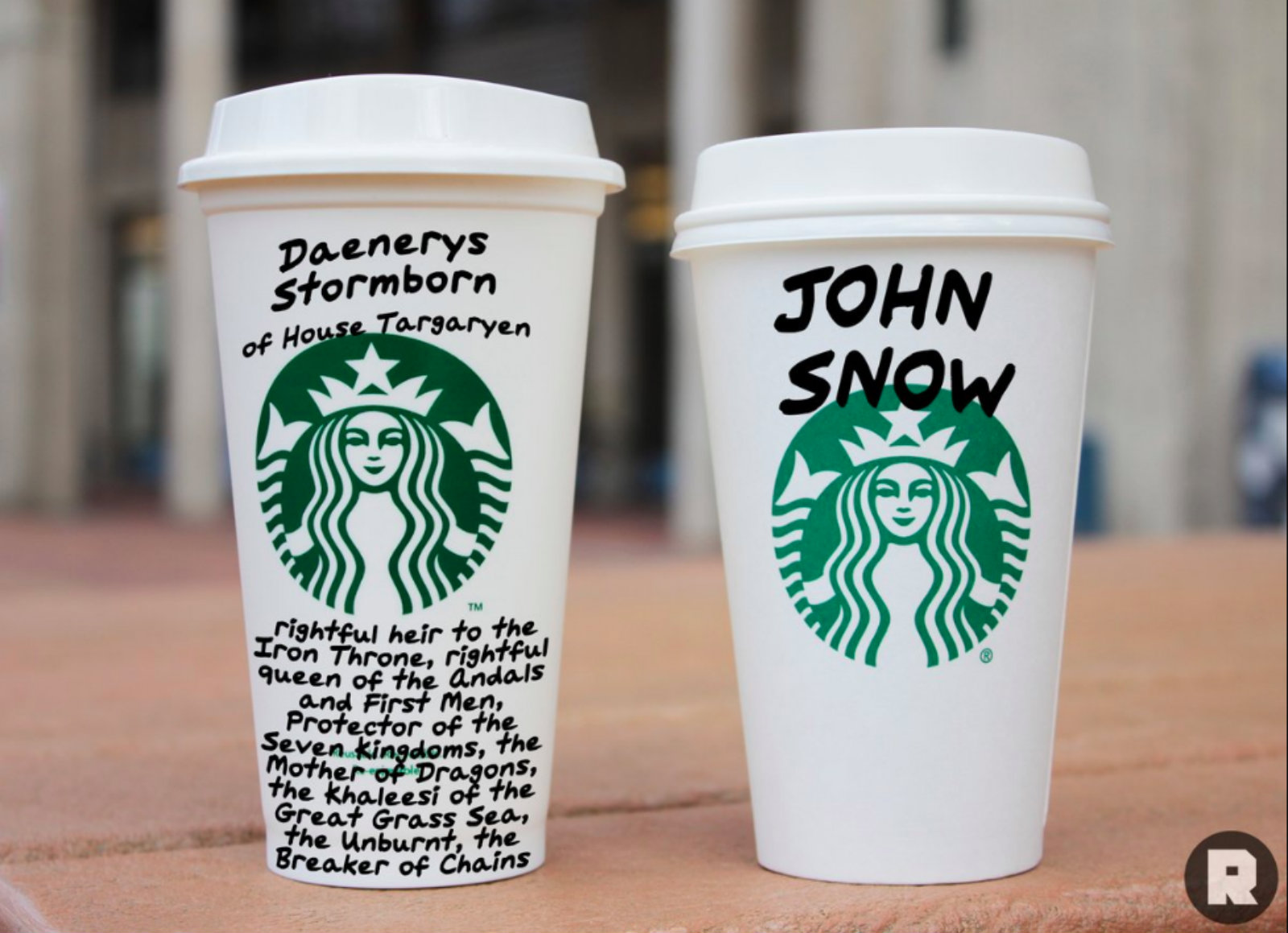

Starbucks opens new branch in Westeros: Unless you’re swordsmith or a horse breeder, most companies wouldn’t consider trying for product placement in the medieval universe of Game of Thrones. Starbucks managed the impossible in Sunday’s episode though, when a coffee cup appeared by mistake in front of one of the series’ main characters. Cue a large amount of free publicity for the coffee giant as viewers took to Twitter for social media banter. Starbucks’ response? “TBH we’re surprised she didn’t order a Dragon Drink.” The WSJ has more. The only catch: It wasn’t a Starbucks cup after all, just a standard item from craft services that happened to get Starbucks the equivalent of USD 2.3 bn in unpaid publicity, CNBC reports.

The Market Yesterday

EGP / USD CBE market average: Buy 17.10 | Sell 17.20

EGP / USD at CIB: Buy 17.08 | Sell 17.18

EGP / USD at NBE: Buy 17.10 | Sell 17.20

EGX30 (Tuesday): 14,390 (+1.3%)

Turnover: EGP 461 mn (45% below the 90-day average)

EGX 30 year-to-date: +10.4%S

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.3%. CIB, the index heaviest constituent ended up 3.3%. EGX30’s top performing constituents were CIB up 3.3%, and Orascom Development Egypt up 2.9%, and Oriental Weavers up 2.7%. Yesterday’s worst performing stocks were Arab Cotton Ginning down 3.1%, AMOC down 2.5% and Sarwa Capital Holding down 2.3%. The market turnover was EGP 461 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +61.2 mn

Regional: Net Short | EGP -74.7 mn

Domestic: Net Long | EGP +13.5 mn

Retail: 39.7% of total trades | 38.8% of buyers | 40.6% of sellers

Institutions: 60.3% of total trades | 61.2% of buyers | 59.4% of sellers

WTI: USD 61.60 (+0.33%)

Brent: USD 69.88 (-1.91%)

Natural Gas (Nymex, futures prices) USD 2.55 MMBtu, (+0.35%, Jun 2019)

Gold: USD 1,285.60 / troy ounce (0.00%)

TASI: 8,968.86 (-0.82%) (YTD: +14.59%)

ADX: 5,124.48 (-0.42%) (YTD: +4.26%)

DFM: 2,725.87 (-0.28%) (YTD: +7.75%)

KSE Premier Market: 6,309.91 (+1.93%)

QE: 10,251 (-0.44%) (YTD: -0.47%)

MSM: 3,901.13 (-0.11%) (YTD: -9.77%)

BB: 1,441.71 (+0.29%) (YTD: +7.81%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

14 May (Tuesday): Egyptian Private Equity Association annual sohour. Four Seasons Hotel, Cairo.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.