What we’re tracking on 08 May 2019

The Ramadan news slowdown continues this morning, ladies and gents. Enjoy it while it lasts — the pace will inevitably pick up.

Monthly inflation figures for April are due out tomorrow. Annual headline urban inflation eased slightly in March to 14.2%, down from 14.4% the previous month.

Amazon subsidiary Souq will rebrand in Egypt to become Amazon.eg next year, Al Mal reports. The e-commerce giant already rebadged as Amazon.ae in the UAE earlier this month.

Asian stocks are following US shares lower this morning after The Donald imposed a Friday deadline to reach a trade agreement. China’s chief trade negotiator is heading to the US for talks Thursday and Friday with the threat of bns in additional tariffs hanging in the air. Almost 90% of NYSE stocks closed down yesterdayin a selloff that “eclipsed the Christmas Eve rout” back in December. That has some traders in Europe and North America thinking it’s time to lock in their gains: “There is this little bit of fear that, OK, let’s take what we’ve got and not end up losing for the year, like everyone did at the end of the year last year,” one told Bloomberg. CNBC speculates that the sell-down could accelerate if there’s no trade pact by Friday and the Financial Times joins the rest of the global business press in the hand-wringing.

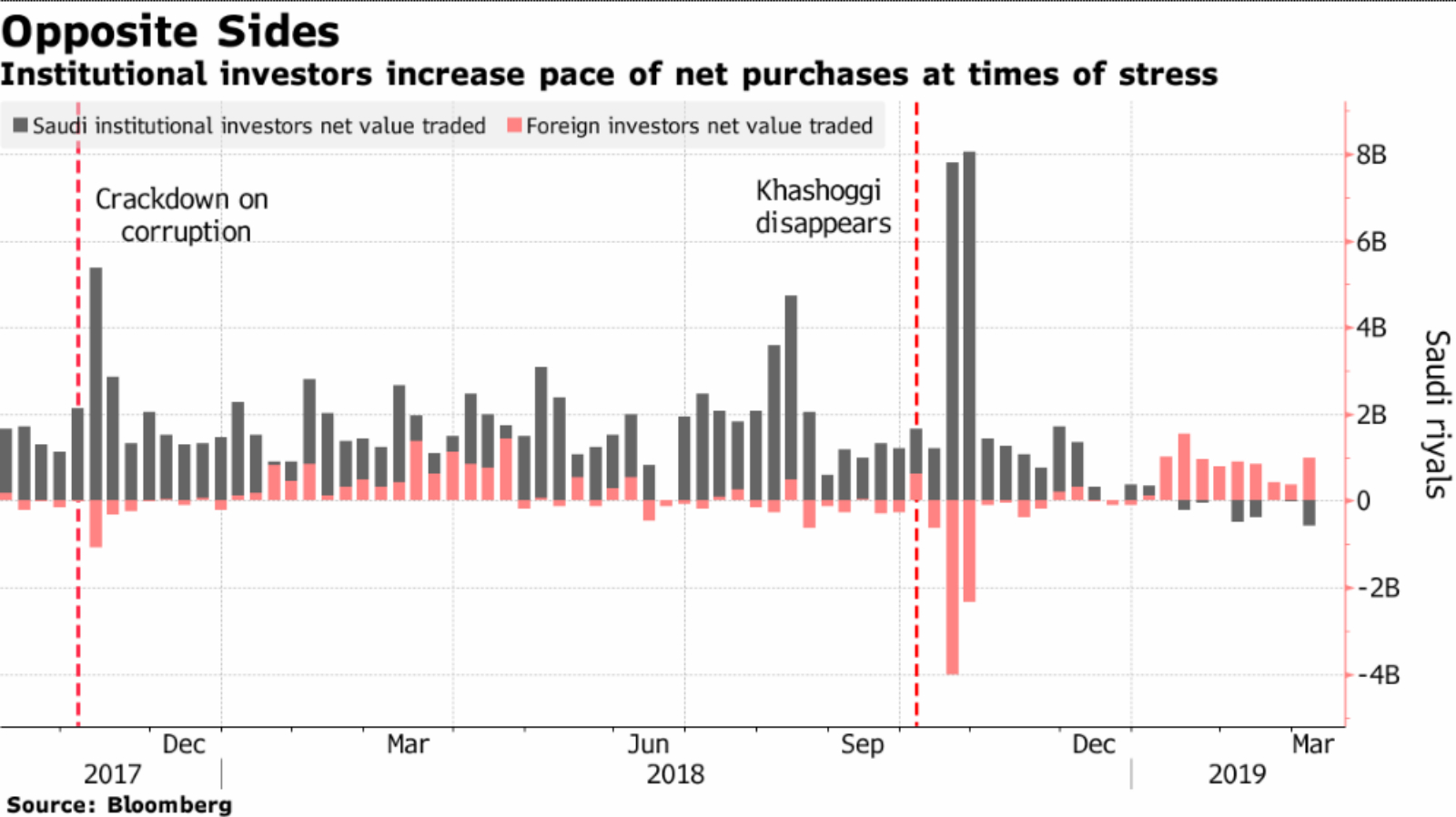

Investors including the guy who invented EM investing are concerned that Riyadh’s involvement in the Tadawul may mask underlying political risks, as FTSE Russell and MSCI prepare to include Saudi equities in their emerging-market indices, Bloomberg writes. The kingdom’s sovereign wealth fund is the biggest investor in the market, leading some to speculate that the government uses it to prop up equity prices during political turbulence. “Many people are concerned about the political environment,” Mark Mobius, founder of Mobius Capital Partners, told the business information service. “It’s going to take a year or two before people really begin to say that Saudi Arabia is a place we want to be.”

This is unlikely to stop a tide of inflows when the Tadawul joins EM indices: Arqaam Capital estimates that inflows into the Saudi market could reach USD 20 bn after FTSE and MSCI finish their inclusions.

EBRD’s success in Egypt and Turkey could propel it into sub-Saharan Africa. The European Bank for Reconstruction and Development’s plans to expand its lending operations to sub-Saharan Africa are partially propelled by its success in Egypt and Turkey, where it is “close to its share-of-portfolio limits,” the Financial Times says. EBRD President Sir Suma Chakrabarti says that doling out funding to the rest of Africa “would have to be based on evidence of where EBRD loans to the private sector could make a real difference.” The plan will go before the lender’s shareholders next year.

Wait, Mifid II wasn’t a panacea? “Helping small and medium companies access capital markets was at the heart of Mifid II but more than 16 months on, bankers and regulators are worrying that Europe’s flagship securities-industry overhaul has become more of a problem than a solution,” writes the FT. It’s part of a series of stories out yesterday looking at how Mifid “spoiled the business of matchmaking” between companies and investors and at how the regulation is changing finance in the US of A

Abraaj founder Arif Naqvi is still in the Clink, having failed to cough up the equivalent of USD 20 mn in bail that would secure his release from detention pending trial or extradition, Bloomberg reports. Naqvi was granted bail on Friday under conditions that “effectively amount to house arrest.” He was arrested last month on charges of fraud stemming from the meltdown of the once high-flying private equity firm.

Attention iSheep: Apple will be unveiling a host of updates to the operating systems of the iPhone, iPad, Mac, Apple Watch, and Apple TV at its annual developer conference on 3 June, Bloomberg reports. For once, Mark Gurman’s report adds little to what we know about Apple’s plans: Brazilian writer and software developer Guilherme Rambo has already broken what consumers can expect from the next editions of iOS as well as macOS and what’s in store at WWDC for developers.

Google, meanwhile, is out with a less-expensive alternative to its Pixel 3 smartphone. The Verge’s Dieter Bohn (one of our favorite gadget reviewers) says the budget-priced Pixel 3A is “competitive with more expensive phones in one very important way: the Pixel 3A has a great camera.” Read the review or compare specs between the Pixel 3a and Pixel 3.

What we’re tracking today, the Ramadan Edition:

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- Made by women, for women: Bloomberg talks to female business owners making healthier, more sustainable products targeted at the largest consumer demographic: Women.

- Struggling to give job advice to your kids? The Wall Street Journal has you covered.

- Stranger Things Lego and Polaroid cameras have the resident 11-year-old asking if she couldn’t perhaps have an Eid gift a little early. Too bad the Lego set hasn’t yet been released.

BONUS: The mystery of human uniqueness, a (reasonably) short and sweet piece that asks, “If you dropped a dozen human toddlers on a beautiful Polynesian island with shelter and enough to eat, but no computers, no cell phones, and no metal tools, would they grow up to be like humans we recognize or like other primates? Would they invent language? Without the magic sauce of culture and technology, would humans be that different from chimpanzees?”

RAMADAN PSA #1- Bank hours at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

RAMADAN PSA #2- Egypt could see lower temperatures and light rain starting today, Ahram Online reports. Here’s what the Japanese sing when it rains (watch, runtime: 02:10).

So, when can we eat? Maghrib is at 6:37pm CLT today in Cairo. You’ll have until 3:29am tomorrow morning to caffeinate / finish your sohour. Yes, the fasting day is getting longer by about 2 minutes each passing day.